TIDMARBB

RNS Number : 9937P

Arbuthnot Banking Group PLC

16 October 2019

16 October 2019

Arbuthnot Banking Group PLC

Third Quarter Trading Update

Arbuthnot Banking Group PLC ("Arbuthnot", "ABG" or "the Group")

today issues an update on trading for the three months to 30

September 2019.

Highlights

-- Continued good progress in developing and diversifying the

business, and also operationally as new investment is transforming

the efficiency and resiliency of the Group's operating

platforms.

-- Completion and smooth transition of two residential mortgage

portfolios at a 2.7% discount to par, adding GBP264.9m of mortgages

to the Group loan book.

-- Overall loan balances have grown 33% compared to the prior

year and have since exceeded GBP1.6bn.

-- Deposit balances have increased 17% compared to the prior

year and have since surpassed GBP2bn.

-- GBP85m of new deposits raised by Arbuthnot Direct since the

mortgage portfolio acquisitions leaving the Group with more than

GBP300m surplus liquidity in excess of the minimum regulatory

requirement.

-- New divisions continue to make strong progress:

o Renaissance Asset Finance ended the quarter with lending

balances of GBP101m, an increase of 22% compared to the prior

year.

o Arbuthnot Asset Based Lending has grown customer facilities to

GBP106m, an increase of 278% over the prior year.

-- Work has commenced on a major refurbishment and enhancement

of the Group's West End property.

Commenting on the third quarter trading, Sir Henry Angest,

Chairman and Chief Executive of Arbuthnot said:

"The Group remains well positioned to continue its strategy of

diversification of its lending and deposit raising capabilities and

the deployment of the surplus capital. Our ability to maintain high

levels of surplus liquidity has enabled us to take advantage of

opportunities that present themselves over time, such as the

acquisition of the mortgage portfolios. As a result of this and

notwithstanding the current geo-political uncertainties, we remain

confident of being able to continue to grow the businesses within

the Group."

Mortgage Portfolio Acquisition

In August the Group completed the purchase of the residential

mortgage portfolios which added GBP264.9m of mortgages acquired at

a discount of 2.7%. The transition of the portfolios took place

smoothly and the portfolios continue to perform better than

indicated by the models used as part of the transaction.

Arbuthnot Direct

As previously described, the Arbuthnot Direct deposit platform

was created, in part, to enable the bank to participate in

transactions such as the portfolio acquisition, giving the Group

the ability to build its liquidity resources quickly. Accordingly,

following the signing of the purchase agreement, Arbuthnot Direct

has raised GBP85m of new deposits and at the quarter end the

Group's surplus liquidity was in excess of GBP300m of the amount

required to be held in reserve. At the end of September our deposit

balances are 17% higher than the prior year and since the quarter

end the balances surpassed GBP2bn for the first time.

Core Loan Book

The core lending business continues to work on a number of new

business opportunities but has seen increasing uncertainty in the

macro economic outlook lead to a delay in the drawdown of these

loans. As a result, the underlying loan balances (excluding the

mortgage portfolio purchase) are behind where we anticipated, but

we believe this simply to be a timing issue, rather than a

fundamental change. Regardless of this, the Group continues to

maintain strong discipline in pricing lending risk, as it expects

the current heightened competition in the retail lending markets to

pass. Despite the wider economic uncertainty, lending balances are

33% higher than the same time in 2018 and since the quarter end

have surpassed GBP1.6bn.

Associated with the loan book the Group has a number of interest

rate derivatives that are hedging approximately GBP26m of fixed

rate loans. During the year these derivatives have generated a mark

to market loss of approximately GBP500k as a result of falling

interest rates in the LIBOR markets. If market conditions continue

at these levels, this mark to market loss will flow into the year

end results. However, over the full term of the derivative

contracts the overall economic effect will result in a net zero

impact to the profit and loss of the Group.

Though the performance of the underlying loan book remains

strong, we continue to work through a small number of longstanding

impaired loans. However, the resultant IFRS 9 provisions that arise

when the outlook for economic scenarios used in the stress testing

worsen, have seen a small increase. In addition there are now

provisions associated with the grossing up of interest, which were

not previously required.

Private Bank

The change in strategy to focus the Private Bank on identifying

and attracting new criteria clients is beginning to show results,

with the number of new clients that have joined in the first nine

months of 2019 averaging approximately 40 per month. As a result,

the net inflows of customer balances into the Investment Management

business have been positive for each of the three months in the

third quarter. However, assets under management remain below our

expectations, largely as a result of the poor stock market

conditions at the end of 2018 and also the slow conversion rate of

criteria clients in the first part of the year.

The Wealth Planning division will be loss making this year as a

result of a fundamental change in its business proposition and

hence its charging structure. In July the business ceased charging

clients for ongoing annual advice reviews and moved to an event

based model, where clients are charged wealth planning fees when

they need specific advice.

New Business Divisions

The Group's new business divisions continue to make good

progress.

Renaissance Asset Finance ended the quarter with lending

balances of GBP101m, an increase of 22% compared to the same time

in the prior year. This growth represents good progress, with the

business recording above average volumes in July and August. The

market has also seen a number of competitors withdraw from the

market, which we expect to aid us in the long term. However, the

business has experienced a small number of credit impairment events

which will temper the otherwise overall good performance of the

business.

The Arbuthnot Asset Based Lending business has continued to

source new lending opportunities and has increased its customer

facilities to GBP106m, an increase of 278% on the prior year.

The business also experienced its first potential credit event

as one of its customers suffered a downturn in its trading

performance. However, Arbuthnot's team managed to facilitate a

rescue of the business via a trade sale.

Arbuthnot Specialist Finance has only lent GBP1m as it remains

in a soft launch phase due to an aborted initial search for a

technology provider for its customer facing loans platform. A new

provider is now engaged and the platform should be fully

operational in 2020.

Operational Resilience and Efficiency

During the quarter, the Group agreed to implement the Salesforce

CRM System, which will transform the way in which the bank

interacts with clients. The implementation of this system is now

fully in train with the Group's technical partners and the first

phase is expected to be completed by Q1 2020.

At the same time, the Group has agreed to develop a new website

for Arbuthnot Latham, which will enable the business to establish a

digital marketing channel for the first time.

In conjunction with our partners at Oracle, the Group has been

developing the API (Application Programming Interface) connections

to the wider payment systems to be fully compliant with the Second

Payment Services Directive ("PSD2"). As a secondary benefit to

this, the Group will examine its payment clearing mechanisms, which

we expect will enable Arbuthnot Latham to offer extended clearing

services beyond its current payment cut off times. We expect this

to enable the bank to offer enhanced banking products to its

clients, which we expect will be implemented during 2020.

Investment Properties

The major tenant of the Group's West End property moved out at

the end of its lease at the end of September. Work has now

commenced to complete a major refurbishment and enhancement of the

building. Once completed, the office space is expected to be re-let

at a significantly higher rent and when market conditions permit,

the Group will look to sell the property.

The refurbishment of the property in Birmingham has largely been

completed and a tenant for one of the five floors have already been

found. Also, this property will now be reclassified as being "held

for sale" rather than as an investment property.

The Directors of the Company accept responsibility for the

contents of this announcement.

Enquiries:

Arbuthnot Banking Group

Sir Henry Angest, Chairman and Chief Executive

Andrew Salmon, Group Chief Operating Officer

James Cobb, Group Finance Director 0207 012 2400

Grant Thornton UK LLP (Nominated Adviser

and

NEX Exchange Corporate Advisor)

Colin Aaronson / Samantha Harrison / Niall

McDonald 0207 383 5100

Numis Securities Ltd (Joint Broker)

Stephen Westgate 0207 260 1000

Shore Capital Ltd (Joint Broker)

Hugh Morgan/ Daniel Bush 0207 408 4090

Maitland/AMO (Financial PR)

Neil Bennett / Jais Mehaji / Sam Cartwright 0207 379 5151

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTDELFFKBFBFBV

(END) Dow Jones Newswires

October 16, 2019 02:00 ET (06:00 GMT)

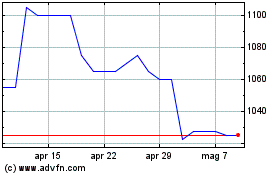

Grafico Azioni Arbuthnot Banking (LSE:ARBB)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Arbuthnot Banking (LSE:ARBB)

Storico

Da Apr 2023 a Apr 2024