Secure Trust Bank PLC 3rd Quarter Trading Update (9873P)

16 Ottobre 2019 - 8:00AM

UK Regulatory

TIDMSTB

RNS Number : 9873P

Secure Trust Bank PLC

16 October 2019

PRESS RELEASE

Secure Trust Bank PLC

LEI: 213800CXIBLC2TMIGI76

16 October 2019

For immediate release

SECURE TRUST BANK PLC

Q3 2019 Trading Update

Secure Trust Bank PLC and its subsidiaries ("Secure Trust Bank",

"STB" or the "Group") provide a trading update in relation to the

third quarter ended 30 September 2019.

The Group has traded well during the third quarter with business

trends consistent with those highlighted in the interim report. The

overall results for the period are in line with management

expectations.

Whilst demand for the Group's lending products remained healthy,

the Group saw a general slowing in demand in September. This

appears consistent with the recent economic data and is considered

by the Group to be a function of consumers and businesses becoming

more cautious ahead of the 31st October 2019 Brexit date. Given the

strong performance over the first three quarters of 2019, the Group

remains comfortable with its guidance in respect of the outlook for

the full year, although political developments in the coming weeks

could impact the UK economy and the Group's results in the final

quarter. The Group remains well capitalised and funded.

The introduction of ISAs to the deposit product offering has

also introduced further diversity into the deposit base at a lower

cost to non ISA deposit products.

On 15 October 2019 the Financial Conduct Authority (FCA)

announced plans to ban the way in which some car retailers, and

other brokers in the motor finance sector, receive commission. The

Group has reviewed the consultation paper issued by the FCA in this

respect and does not expect any negative impact on the Group's

motor finance business arising from the FCA's planned changes.

The Group considers that its lending portfolio is appropriately

positioned for current economic conditions and the short duration

nature of the asset portfolio means that the Group can react

quickly to both market opportunities and threats. The Group remains

selective in respect of new lending activities which are biased

towards shorter duration lower risk lending in attractive market

segments. This continues to drive profit growth and improve the

credit quality of new customer loan originations.

Enquiries:

Secure Trust Bank PLC

Paul Lynam, Chief Executive Officer

Neeraj Kapur, Chief Financial Officer

Tel: 0121 693 9100

Stifel Nicolaus Europe Limited (Joint Broker)

Robin Mann

Gareth Hunt

Tel: 020 7710 7600

Canaccord Genuity Limited (Joint Broker)

David Tyrell

Tel: 020 7523 8000

Forward looking statements

This document contains forward looking statements with respect

to the business, strategy and plans of Secure Trust Bank PLC

("Secure Trust Bank", "STB" or the "Group") and its current goals

and expectations relating to its future financial condition and

performance. Statements that are not historical facts, including

statements about Secure Trust Bank or management's beliefs and

expectations, are forward looking statements. By their nature,

forward looking statements involve risk and uncertainty because

they relate to events and depend on circumstances that will occur

in the future. Secure Trust Bank's actual future results may differ

materially from the results expressed or implied in these forward

looking statements as a result of a variety of factors. These

include UK domestic and global economic and business conditions,

risks concerning borrower credit quality, market related risks

including interest rate risk, inherent risks regarding market

conditions and similar contingencies outside Secure Trust Bank's

control, any adverse experience in inherent operational risks, any

unexpected developments in regulation or regulatory and other

factors. The forward looking statements contained in this document

are made as of the date hereof, and Secure Trust Bank undertakes no

obligation to update any of its forward looking statements.

About the Company:

Secure Trust Bank is an established, well--funded and

capitalised UK retail bank with a 67 year trading track record.

Secure

Trust Bank operates principally from its head office in

Solihull, West Midlands, and had 956 employees (full-- time

equivalent) as at 30 June 2019. The Group's diversified lending

portfolio currently focuses on two sectors:

(i) Business Finance through its Real Estate Finance, Asset

Finance and Commercial Finance divisions,

(ii) Consumer Finance through its Motor Finance, Retail Finance

and Debt Management divisions

As at 30 June 2019 the Group's loans and advances to customers

totalled GBP2,278.3 million, customer deposits totalled

GBP2,001.5million and the Group's total customer base was well

over 1.4 million.

Secure Trust Bank PLC is authorised by the Prudential Regulation

Authority and regulated by the Financial Conduct

Authority and the Prudential Regulation Authority.

Secure Trust Bank, PLC, One Arleston Way, Solihull, B90 4LH.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTKMMMGKKLGLZM

(END) Dow Jones Newswires

October 16, 2019 02:00 ET (06:00 GMT)

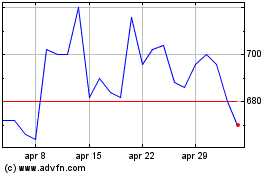

Grafico Azioni Secure Trust Bank (LSE:STB)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Secure Trust Bank (LSE:STB)

Storico

Da Apr 2023 a Apr 2024