TIDMSHG

RNS Number : 1288Q

Shanta Gold Limited

17 October 2019

17 October 2019

Shanta Gold Limited

("Shanta Gold", "Shanta" or the "Company")

Q3 2019 PRODUCTION & OPERATIONAL UPDATE

Shanta Gold (AIM: SHG), the East Africa-focused gold producer,

developer and explorer, announces its production and operational

results for the quarter ended 30 September 2019 (the "Quarter",

"Q3" or the "Period") for its New Luika Gold Mine ("NLGM" or "New

Luika"), in South Western Tanzania.

Q3 Highlights

-- Gold production of 22,726 ounces ("oz") in Q3 (Q2: 19,856 oz);

-- Year-to-date ("YTD") production of 64,956 oz;

-- The Company remains on track to meet annual guidance

reiterated for 2019 of 80,000-84,000 oz at All In Sustaining Costs

("AISC")(1) of US$740-780 /oz;

-- 126,787 oz of Inferred Resources grading 3.15 g/t was

converted into 83,543 oz of Indicated Resources grading 7.85

g/t;

-- Net debt decreased 23% to US$20.7 million ("m") (Q2: US$26.9 m);

-- Gross debt decreased 15% to US$25.7 m (Q2: US$30.1 m);

-- Forward sales reduced to 43,000 oz (Q2: 45,000 oz);

-- Adjusted EBITDA(2) of US$16.5 m (Q2: US$10.5 m);

-- AISC(1) of US$723 /oz (Q2: US$773 /oz);

-- Cash operating costs of US$474 /oz (Q2: US$564 /oz);

-- Cash, and available liquidity(3) of US$11.6 m (Q2: US$9.3 m); and,

-- Zero Lost Time Injuries ("LTI's"), with no LTI's since Q4 2017.

Operational

-- Gold production of 22,726 oz (Q2: 19,856 oz);

-- 174,132 t milled (Q2: 177,647 t); processing plant is

consistently performing at a premium to its nameplate capacity;

-- Average head grade of 4.5 g/t for the quarter (Q2: 3.9 g/t);

-- Run of Mine ("ROM") stockpile of 151,177 t of ore grading

1.67 g/t (Q2: 142,213 t grading 1.37 g/t); and,

-- Construction of infrastructure to connect to the state power

grid has commenced with completion expected by early 2020.

Exploration

-- 126,787 oz of Inferred Resources grading 3.15 g/t was

converted into 83,543 oz of Indicated Resources grading 7.85

g/t;

-- 58,553 oz of new Inferred Resources grading 4.79 g/t added to

the Mineral Resource at New Luika; and,

-- New orebodies discovered, including the high-potential

Bauhinia Creek ("BC") North and Elizabeth Hill ("EH") North

deposits.

Financial

-- Net debt excluding VAT receivable of US$20.7 m (Q2: US$26.9 m);

-- Gross debt of US$25.7 m (Q2: US$30.1 m);

-- Unrestricted cash balance of US$5.0 m (Q2: US$3.1 m);

-- Bullion available for sale at the end of the Period of US$4.1 m (Q2: US$3.3 m);

-- Liquidity available for draw down from Exim working capital

facility of US$2.5 m (Q2: US$2.5 m);

-- AISC(1) of US$723 /oz (Q2: US$773 /oz); and,

-- VAT receivable increased to US$27.4 m (Q2: US$25.3 m).

Ilunga

-- Commenced commercial production at Ilunga during the Period, on schedule and on budget; and,

-- Ilunga is now the third source of high-grade underground feed

at New Luika alongside BC and Luika underground deposits.

Singida Project (the "Project")

-- Singida Resources Plc ("Singida") entered into a non-binding

term sheet during the Period with a privately-held, East African,

multinational conglomerate, for an unsecured, non-recourse loan

facility of US$10 m;

-- The Project's Environmental Impact Assessment ("EIA")

Certificate has now been approved and received; and,

-- During the Quarter, the Singida IPO prospectus underwent its

second formal submission to the Capital Markets Securities Agency

("CMSA") with feedback expected in Q4.

Corporate Social Responsibility ("CSR")

-- Enrolment for sesame farming under the Company's alternative

livelihood programme has increased by 168% in 2019;

-- Preparations for the coming season are underway, including

the provision of financial management training for enrolled farmers

in collaboration with NMB Bank;

-- Two water boreholes were built during the Period, one of

which will service a recently resettled family with over 5,000

litres of water per day;

-- A second borehole, which is 80 metres deep, will provide a

new source of fresh water for Patamela village, situated in the

immediate vicinity of New Luika;

-- The Company purchased a Charcoal Briquette Plant for use in a

local project for youth groups in Songwe, targeting creation of new

employment opportunities in the region;

-- "Into-Africa Partnership" with Hazelwood School (charity

number 312081 in the UK) continues with the inauguration of a

maiden ICT laboratory in Q4 in the Songwe region; and,

-- Eton College donated over 500 kg of sports equipment to Shanta's communities.

Guidance

-- Annual guidance reiterated for 2019 of 80,000-84,000 oz at AISC(1) of US$740-780 /oz.

Post Period

-- Following a detailed review of the exploration portfolio, new

targets within the existing mining licences at NLGM were identified

including BC North and EH North;

-- Exploration drilling at these targets has intersected

encouraging mineralisation with sizeable widths, suggesting

significant potential for additional resources to add to the mine

plan;

-- Exploration drilling at these targets intersected

mineralisation with sizeable widths, including the following

encouraging results;

o 6.00 metres grading 8.62 g/t Au (BC North);

o 4.00 metres grading 8.38 g/t Au (BC North);

o 4.00 metres grading 8.94 g/t Au (BC North);

o 9.00 metres grading 6.62 g/t Au (EH North);

o 9.00 metres grading 5.56 g/t Au (EH North);

-- Strike lengths of the BC North and EH North mineralised

structures are estimated to be 150 metres and 350 metres

respectively and remain open at depth.Drilling is continuing at

depth and along strike at both targets, with additional results

expected in Q4 2019; and,

-- The results of this drilling campaign and the second drilling

campaign in Q4 2019 will be combined and analysed, with an updated

Mineral Resource Estimate and resultant life of mine extension

expected in the coming months.

Note: 1. Development costs at the BC, Luika and Ilunga

underground operations are not included in AISC.

Note: 2. EBITDA is earnings before interest, tax, depreciation

and amortisation which has been derived as operating profit

exclusive of pre-production revenue, depreciation/depletion of

tangible assets and amortisation of intangible assets. Adjusted

EBITDA has been derived as EBITDA before non-cash loss on unsettled

forward contracts.

Note: 3. Available liquidity has been derived as unrestricted

cash, restricted cash and the sale value of bullion available for

sale at the end of the Period (net of royalties and expected

selling costs).

Eric Zurrin, Chief Executive Officer, commented:

"As we rapidly pay down our debt and improve our financial

position, New Luika Gold Mine continues to perform operationally.

This quarter has seen us produce over 22,000 oz of gold and

positions the Company on track to again meet our guidance for the

year. Net debt at US$20.7 m is now the lowest it has been in over

six years and has decreased by over 50% since the same period two

years ago.

"Our recent exploration results are encouraging as we look to

add more ounces to the New Luika mine plan. Key to our current

exploration targets is the close proximity to both the existing

sources of high-grade ore and the processing plant. We plan to

announce a new resource update shortly which will highlight how we

can add low cost gold ounces to our future production and extend

the mine life of New Luika."

Analyst conference call and presentation

Shanta Gold will host an analyst conference call and

presentation today, 17 October 2019, at 10:00 BST. Participants can

access the call by dialling one of the following numbers below

approximately 10 minutes prior to the start of the call.

UK Toll-Free Number: 08003589473

UK Toll Number: +44 3333000804

PIN: 71803848#

The presentation will be available for download from the

Company's website: www.shantagold.com or by clicking on the link

below:

https://www.anywhereconference.com?Conference=301302161&PIN=71803848&UserAudioMode=DATA

A recording of the conference call will subsequently be

available on the Company's website.

Enquiries:

Shanta Gold Limited

+255 (0) 22 292

Eric Zurrin (CEO) 5148

Luke Leslie (CFO)

Nominated Adviser and Broker

Numis Securities Limited

+ 44 (0)20 7260

Paul Gillam / Alamgir Ahmed 0000

Financial Public Relations

Tavistock

Charles Vivian / Barnaby Hayward / +44 (0)20 7920

Gareth Tredway 3150

About Shanta Gold

Shanta Gold is an East Africa-focused gold producer, developer

and explorer. It currently has defined ore resources on the New

Luika project in Tanzania and holds exploration licenses covering

approximately 1,500km(2) in the country. Shanta's flagship New

Luika Gold Mine commenced production in 2012 and produced 81,872

ounces in 2018. The Company has been admitted to trading on

London's AIM and has approximately 787 m shares in issue. For

further information please visit: www.shantagold.com.

This announcement contains inside information for the purposes

of Article 7 of Regulation 596/2014.

Q3 2019 PRODUCTION & OPERATIONAL UPDATE

Safety, Health and Environment

There were no Lost Time Injuries during the Quarter and the

Company has now reached 3.4 million man-hours without Lost Time

Injury. Shanta maintains its track record of operating among the

safest gold mining operations of its peers and had a Total

Recordable Injury Frequency Rate ("TRIFR") (per 1 million hours

worked) of 0.00 for Q3 (Q2: 0.00), significantly below the industry

average.

Operational

Production Summary

Q3 2019 Q2 2019 Q1 2019 Q4 2018

Tonnes ore milled 174,132 177,647 172,644 172,902

-------- --------------------- ------------------- --------------

Grade (g/t) 4.54 3.91 4.49 4.74

-------- --------------------- ------------------- --------------

Recovery (%) 89.3 89.4 89.9 90.9

-------- --------------------- ------------------- --------------

Gold (oz)

-------- --------------------- ------------------- --------------

Production 22,726 19,856 22,374 23,942

-------- --------------------- ------------------- --------------

Sales 22,477 19,760 21,190 24,893

-------- --------------------- ------------------- --------------

Silver production (oz) 24,744 23,461 23,851 26,916

-------- --------------------- ------------------- --------------

Realised gold price

(US$/oz) 1,462 1,303 1,309 1,225

-------- --------------------- ------------------- --------------

Gold production during the period was 22,726 oz. Overall, a

total of 166,772 t of ore grading 5.31 g/t was mined in Q3 compared

with 155,779 t of ore grading 4.53 g/t in Q2. 174,132 t of ore was

milled during the period (Q2: 177,647 t). The ROM stockpile at the

end of Q3 was 151,177 t of ore grading 1.67 g/t (up from 142,213 t

grading 1.37 g/t at the end of Q2). Average recoveries of 89.3%

were achieved in the plant during the period (Q2: 89.4%).

Construction of infrastructure required to support a connection

to the low-cost state ("TANESCO") power grid began at New Luika

during the Period and is expected to be ready by early 2020. Once

the connection has been commissioned, an initial 10% of New Luika's

power requirement is expected to be drawn from the TANESCO grid,

with potential for this to increase to 25%. Power supply represents

one of the Company's most significant cost inputs and so presents

an opportunity to potentially access lower grade ounces by lowering

costs.

Exploration

In early Q3 the Company announced a Mine Resource Upgrade

following the drilling results from BC Central during the Period.

The drilling activities have converted 126,787 oz of Inferred

Resources grading 3.15 g/t into 83,543 oz of Indicated Resources

grading 7.85 g/t, a suitable level of confidence for these ounces

to be incorporated into the Mine Plan.

During the Period, the company continued exploration drilling at

selected high priority targets, BC North and EH North, that have

been identified on the mining licences at New Luika Gold Mine.

Encouraging drilling results were announced following the end of

the Quarter. A maiden resource estimate is expected at both targets

to a depth of only the first 70 metres below surface, and which

will continue to be upgraded through additional drilling which is

ongoing.

Financial

During the Quarter, a total of 22,477 oz of gold was sold at an

average price of US$1,462 /oz against the average spot price for

the quarter of US$1,474 /oz. As of 30 September 2019, the Company

had sold forward 43,000 oz to June 2020 at an average price of

US$1,235 /oz. The Company has the flexibility to defer settlement

of forward sales and, with the exception of delivering into forward

sales for 2,000 oz, had full exposure to the spot gold price during

the Quarter.

Cash operating costs and AISC for Q3 of US$474 /oz (Q2: US$564

/oz) and US$723 /oz (Q2: US$773 /oz), respectively, were achieved

in the Quarter. Of note, development costs at the BC, Luika and

Ilunga underground operations are not included in AISC.

Working capital in the Quarter increased by US$4.3 m, accounted

for by a decrease in trade and other payables (US$1.1 m), an

increase in inventories (US$1.2 m) and an increase in trade and

other receivables (US$2.0 m). The increase in inventories includes

ROM stockpile which increased by US$0.7m. The increase in trade and

other receivables includes the VAT receivable which increased by

US$2.1 m to US$27.4 m.

Capital expenditure was US$5.0 m (Q2: US$5.4 m) for the Quarter,

which was predominantly related to underground development.

As at 30 September 2019 the Company had an unrestricted cash

balance of US$5.0 m (Q2: US$3.1 m). This follows a 15% reduction in

gross debt from US$30.1 m to US$25.7 m at the end of the Quarter.

Net debt decreased by US$6.2 m to US$20.7 m (Q2: US$26.9 m), its

lowest in Shanta's producing history. This reduction in net debt

was predominantly driven by strong quarterly gold production,

prudent cost containment and a strong quarterly gold price.

Ilunga

The Company achieved commercial production at Ilunga during the

Period, on schedule and on budget. Commercial production was

achieved following gross pre-production capital investment of only

US$7.9 million (US$5.0 million after netting off pre-production

revenue) and less than 12 months after the underground portal blast

at Ilunga was carried out in August 2018.

Ilunga is now the third source of high-grade underground feed at

New Luika alongside the BC and Luika underground deposits.

Year to date, the Company has benefited from positive reserve

reconciliation at Bauhinia Creek of 3,745 oz which partly offset

negative reserve reconciliation at Ilunga of 6,617 oz. The average

orebody widths and gold grades at the Ilunga underground deposit in

the first three sublevels were lower than estimated in the ore

reserves. Year to date, reserve reconciliation of mined ore from

stopes and development at Bauhinia Creek and Ilunga is negative

2,872 ounces on a consolidated basis. An updated reserve and

resource statement is expected over the coming months following

ongoing grade control drilling.

Singida Project (the "Project")

In connection with the planned Initial Public Offering ("IPO")

on the Dar es Salaam Stock Exchange ("DSE") previously announced on

29 March 2019, Singida has entered into a non-binding term sheet

with a privately-held, East African, multinational conglomerate,

for an unsecured, non-recourse loan facility of US$10 m

("Facility"). The Facility is conditional on a minimum equity raise

of US$15 million at the IPO. The Facility will be repaid over a

period of three years from cash flows generated by the Project and

bears an annual interest rate of 10%.

The Project's EIA Certificate was received from the Minister of

State in the Vice President's Office for Union Affairs and

Environment during the Period, marking an important milestone for

the future construction and operation of the Project.

During the Quarter, the Singida IPO prospectus underwent its

second formal submission to the Capital Markets Securities Agency

("CMSA") which regulates the DSE. Feedback is expected in Q4 ahead

of the planned IPO in 2020.

Corporate Social Responsibility ("CSR")

The number of sesame farmers enrolled in the Company's

agricultural collaboration with ETG has now grown by 168% since

2018, in readiness for the forthcoming harvest season. During the

previous harvest participants generated US$0.5 m of income from

almost half a tonne of this crop and these figures are expected to

grow significantly.

The Company has been working to ensure that participants in the

scheme are suitably equipped with the skills required to continue

this work independently. This work has included a recent

collaboration with NMB Bank to provide training to enrolled farmers

on financial management.

Ensuring ready access to fresh water for the communities around

New Luika remains a core focus of the Company's CSR strategy. Two

new water boreholes were constructed during the Period, including

one in the nearby Patamela village which extends 80 metres below

ground level. This is in addition to a shallow borehole installed

in the Period for a family recently resettled from the Elizabeth

Hill area, which can produce over 5,000 litres of water per day to

ensure that the family's needs are met.

During the Period, the Company purchased a Charcoal Briquette

Plant for use in a local project for youth groups in Songwe. This

will be commissioned shortly and will assist the project in

creating new employment opportunities across the region.

During the Period, the Company completed construction of one of

the first ever primary school Information and Communication

Technology ("ICT") laboratories in the Songwe region, in

partnership with the primary school at Mbangala village. Teaching

professionals from the "Into Africa - Partners in Learning"

programme with UK-based Hazelwood School (charity number 312081)

will inaugurate the ICT laboratory in Q4, which marks a

transformational long-term outcome for the Company's stakeholders

in Mbangala village and Songwe region.

Post period

Exploration drilling at BC North and EH North has intersected

encouraging mineralisation with sizeable widths, suggesting

significant potential for additional resources to add to the mine

plan. Drilling is continuing at depth and along strike at both

targets and additional results are expected in Q4 2019.

The results of this drilling campaign and the second drilling

campaign in Q4 2019 will be combined and analysed, with an updated

Mineral Resource Estimate and resultant life of mine extension

expected by Q1 2020.

S

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

UPDUNASRKBARAAA

(END) Dow Jones Newswires

October 17, 2019 02:00 ET (06:00 GMT)

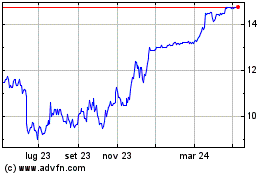

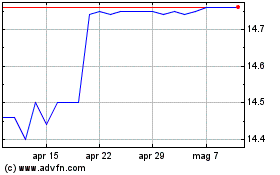

Grafico Azioni Shanta Gold (LSE:SHG)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Shanta Gold (LSE:SHG)

Storico

Da Apr 2023 a Apr 2024