AEW UK REIT plc: NAV Update and Dividend Declaration (891873)

18 Ottobre 2019 - 8:00AM

UK Regulatory

AEW UK REIT plc (AEWU)

AEW UK REIT plc: NAV Update and Dividend Declaration

18-Oct-2019 / 07:00 GMT/BST

Dissemination of a Regulatory Announcement, transmitted by EQS Group.

The issuer is solely responsible for the content of this announcement.

18 October 2019

NAV Update and Dividend Declaration for the three months to 30 September

2019

AEW UK REIT plc (LSE: AEWU) ("the Company"), which, as at 18 October 2019,

directly owns a diversified portfolio of 35 regional UK commercial property

assets, announces its unaudited Net Asset Value ("NAV") and interim dividend

for the three month period ended 30 September 2019.

Highlights

· At 30 September 2019, the fair value independent valuation of the

property portfolio was GBP196.05 million (30 June 2019: GBP196.56 million). On

a like-for-like basis the valuation of the property portfolio decreased by

GBP0.51 million (0.26%) over the quarter (30 June 2019: decrease of GBP1.05

million and 0.53%).

· NAV of GBP147.55 million or 97.36 pence per share (30 June 2019: GBP148.33

million or 97.87 pence per share).

· EPRA earnings per share ("EPRA EPS") for the quarter of 2.13 pence per

share (30 June 2019: 2.25 pence per share).

· The Company today announces an interim dividend of 2.00 pence per share

for the three months ended 30 September 2019, in line with the targeted

annual dividend of 8.00 pence per share.

· NAV total return of 1.52% for the three months ended 30 September 2019

(three months ended 30 June 2019: 1.28%).

· The Company remains conservatively geared with a gross loan to value

ratio of 25.50% (30 June 2019: 25.44%).

Alex Short, Portfolio Manager, AEW UK REIT, commented:

"Despite the backdrop of ongoing political uncertainty, the Company remains

confident in its ability to deliver on its objectives. The value of our

assets has remained robust to date, particularly in the office and

industrial sectors, where assets have either been acquired at conservative

levels or provide exciting value-add opportunities. There has been some loss

of value in retail assets, in line with the structural changes that we are

seeing across the retail sector, however, this has been mitigated by the

portfolio's light exposure to the sector at 14.2% and also by value gains in

other parts of the portfolio. EPRA Earnings cover of the quarterly 2 pence

per share dividend remains healthy, at 106% this quarter.

The portfolio, now increasingly mature, is offering us numerous

opportunities to undertake asset management initiatives which provide

various potential routes to add value. Over the past quarter this has

included the settlement of an industrial rent review in Bradford at an

increase of 14% above the level of our valuer's ERV. In addition, post

quarter-end, we have completed a lease extension on an industrial unit in

Basingstoke, which has been achieved at 46% above the previous passing rent

due to its short term.

Despite our positive outlook for the portfolio, we are conscious of the

opportunity to limit downside risk in an uncertain macro environment and,

with this in mind, we have recently taken a number of steps to reduce risk

associated with the Company's debt facility. In October 2018, we documented

the extension of the loan's term, pushing expiry from October 2020 to

October 2023. In addition, earlier this month we completed an amendment to

the loan agreement with RBSi, which increases the loan to NAV covenant from

45% to 55%, subject to certain conditions. Neither of these changes have

increased the current ongoing cost of the facility, other than incurring

up-front fees. Our aim is to continue to keep gearing at a conservative

level in accordance with the Company's stated policy."

The like-for-like valuation decrease for the quarter of GBP0.51 million

(0.26%) is detailed as follows by sector:

Sector Valuation 30 Valuation Valuation

September 2019 movement for the movement for the

quarter quarter

GBP million GBP million %

Industrial 93.93 0.05 0.05

Office 44.35 1.14 2.65

Other 30.02 0.00 0.00

Retail 27.75 (1.70) (5.77)

Total 196.05 (0.51) (0.26)

Net Asset Value

The Company's unaudited NAV as at 30 September 2019 was GBP147.55 million, or

97.36 pence per share. This reflects a decrease of 0.53% compared with the

NAV as at 30 June 2019. The Company's NAV total return, which includes the

interim dividend for the period from 1 April 2019 to 30 June 2019 of 2.00

pence per share, is 1.52% for the three-month period ended 30 September

2019. As at 30 September 2019, the Company owned investment properties with

a fair value of GBP196.05 million.

Pence per share GBP million

NAV at 1 July 2019 97.87 148.33

Capital expenditure (0.06) (0.09)

Valuation change in property (0.54) (0.82)

portfolio

Valuation change in derivatives (0.04) (0.06)

Income earned for the period 2.87 4.34

Expenses and net finance costs for (0.74) (1.12)

the period

Interim dividend paid (2.00) (3.03)

NAV at 30 September 2019 97.36 147.55

The NAV attributable to the ordinary shares has been calculated under

International Financial Reporting Standards and incorporates the independent

portfolio valuation as at 30 September 2019 and income for the period, but

does not include a provision for the interim dividend for the three month

period to 30 September 2019.

Dividend

The Company today announces an interim dividend of 2.00 pence per share for

the period from 1 July 2019 to 30 September 2019. The dividend payment will

be made on 29 November 2019 to shareholders on the register as at 1 November

2019. The ex-dividend date will be 31 October 2019.

The dividend of 2.00 pence per share will be designated 2.00 pence per share

as an interim property income distribution ("PID").

The EPRA EPS for the three-month period to 30 September 2019 was 2.13 pence

(30 June 2019: 2.25 pence).

The Directors will declare dividends taking into account the level of the

Company's net income and the Directors' view on the outlook for sustainable

recurring earnings. As such, the level of dividends paid may increase or

decrease from the current annual dividend of 8.00 pence per share. Based on

current market conditions, the Company expects to pay an annualised dividend

of 8.00 pence per share in respect of the financial period ending 31 March

2020.

Investors should note that this target is for illustrative purposes only,

based on current market conditions and is not intended to be, and should not

be taken as, a profit forecast or estimate. Actual returns cannot be

predicted and may differ materially from this illustrative figure. There can

be no assurance that the target will be met or that any dividend or total

return will be achieved.

Financing

Equity

The Company's issued share capital consists of 151,558,251 Ordinary Shares

and there was no movement during the quarter.

Debt

The Company's borrowings remained at GBP50.00 million throughout the quarter

and at 30 September 2019, the Company was geared at a gross loan to value of

25.50% and a net loan to value of 24.48%.

The loan continues to attract interest at LIBOR + 1.4%. To mitigate the

interest rate risk that arises as a result of entering into a variable rate

linked loan, the Company has entered into interest rate caps on GBP36.51

million of the total value of the loan (GBP26.51 million at 2.5% cap rate and

GBP10.00 million at 2.0% cap rate) up to October 2020, resulting in the loan

being 73% hedged.

Earlier this month, the Company announced that it had completed an amendment

to its existing loan agreement which increases the facility's loan to NAV

covenant from 45% to 55% (subject to certain conditions). There will be no

changes to the margin charged at the current level of gearing as a result of

this amendment.

The loan term runs to October 2023 and the Company has entered into

additional interest rate caps covering the period from October 2020 to

October 2023, capping a notional value of GBP46.51 million at LIBOR of 2.0%

per annum, which represents 93% of the current GBP50.00 million loan balance.

The Investment Manager and the Company will keep the levels of gearing and

hedging under review.

Portfolio activity and asset management

Knowles Lane, Bradford

A rent review dated September 2018 has been settled at an industrial unit in

Bradford. The review documents a new passing rent of GBP182,500, representing

a 14% increase on the previous rent, which is also ahead of the valuer's

ERV. The back-dated increase in rent from September 2018 up to the date of

the settlement of the review has been recognised as income in the quarter to

September 2019.

Bessemer Road, Basingstoke

A lease extension for a term of six months has been completed with HFC

Prestige Manufacturing in Basingstoke. Due to the short extension period, a

rental level has been agreed 46% ahead of the previous passing rent.

Enquiries

AEW UK

Alex Short alex.short@eu.aew.com

+44(0) 20 7016 4848

Nicki Gladstone nicki.gladstone-ext@eu.aew.com

+44(0) 7711 401 021

Company Secretary

Link Company Matters Limited aewu.cosec@linkgroup.co.uk

+44(0) 1392 477 500

TB Cardew AEW@tbcardew.com

Ed Orlebar +44 (0) 20 7002 1482

Lucas Bramwell +44 (0) 7789 374 663

Liberum Capital

Gillian Martin/Owen Matthews +44 (0) 20 3100 2000

Notes to Editors

About AEW UK REIT

AEW UK REIT plc (LSE: AEWU) aims to deliver an attractive total return to

shareholders by investing predominantly in smaller commercial properties

(typically less than GBP15 million), on shorter occupational leases in strong

commercial locations across the United Kingdom. The Company was listed on

the Official List of the UK Listing Authority and admitted to trading on the

Main Market of the London Stock Exchange on 12 May 2015, raising GBP100.5m.

Since IPO it has raised a further GBP51m.

The Company is currently invested in office, retail, industrial and leisure

assets, with a focus on active asset management, repositioning the

properties and improving the quality of the income stream.

AEWU is currently paying an annualised dividend of 8p per share.

www.aewukreit.com [1] [2]

About AEW UK Investment Management LLP

AEW UK Investment Management LLP employs a well-resourced team comprising 26

individuals covering investment, asset management, operations and strategy.

It is part of AEW Group, one of the world's largest real estate managers,

with EUR68.2bn of assets under management as at 30 June 2019. AEW Group

comprises AEW SA and AEW Capital Management L.P., a U.S. registered

investment manager and their respective subsidiaries. In Europe, as at 30

June 2019, AEW Group managed EUR31.9bn of real estate assets on behalf of a

number of funds and separate accounts with over 400 staff located in 9

offices. The Investment Manager is a 50:50 joint venture between the

principals of the Investment Manager and AEW. In May 2019, AEW UK Investment

Management LLP was awarded Property Manager of the Year at the Pensions and

Investment Provider Awards.

www.aewuk.co.uk [3]

ISIN: GB00BWD24154

Category Code: MSCM

TIDM: AEWU

LEI Code: 21380073LDXHV2LP5K50

OAM Categories: 3.1. Additional regulated information required to be

disclosed under the laws of a Member State

Sequence No.: 23812

EQS News ID: 891873

End of Announcement EQS News Service

1: https://link.cockpit.eqs.com/cgi-bin/fncls.ssp?fn=redirect&url=c9b6404682d7efd026577394ecbedab5&application_id=891873&site_id=vwd&application_name=news

2: https://link.cockpit.eqs.com/cgi-bin/fncls.ssp?fn=redirect&url=9220892e63355ca6947a3a3423a3bac8&application_id=891873&site_id=vwd&application_name=news

3: https://link.cockpit.eqs.com/cgi-bin/fncls.ssp?fn=redirect&url=c3ab986d9b746ee23c3523d74649f8db&application_id=891873&site_id=vwd&application_name=news

(END) Dow Jones Newswires

October 18, 2019 02:00 ET (06:00 GMT)

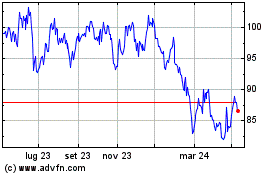

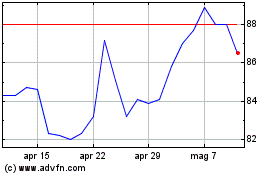

Grafico Azioni Aew Uk Reit (LSE:AEWU)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Aew Uk Reit (LSE:AEWU)

Storico

Da Apr 2023 a Apr 2024