Coty Weighs Beauty Shake-Up With Possible Sale of Wella, Clairol -- WSJ

22 Ottobre 2019 - 9:02AM

Dow Jones News

By Sharon Terlep and Patrick Thomas

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (October 22, 2019).

Cosmetics maker Coty Inc. is looking to sell its hair-care and

professional beauty businesses, a collection of brands that account

for nearly a third of its annual revenue.

The makeup and fragrance seller, controlled by European

investment firm JAB Ltd., said Monday it is exploring strategic

alternatives for more than a dozen brands including Wella and

Clairol hair products, and OPI nail polish. Coty also will look to

sell its Brazil unit.

The businesses are expected to generate revenues of about $2.7

billion in 2019. Several of the brands were acquired in 2016 when

Coty bought much of Procter & Gamble Co.'s beauty business.

Coty reported total revenue fell 8% to $8.65 billion for the fiscal

year ended June 30.

The move comes less than a year after Chief Executive Officer

Pierre Laubies replaced CEO Camillo Pane, architect of the $12

billion deal with P&G that doubled Coty's size. Since the deal,

Coty has struggled with falling sales and integration issues.

Mr. Laubies has said Coty was overly focused on meeting

quarterly targets and didn't take the steps needed to shore up the

business after the P&G deal proved more problematic than

expected. The deal included aging consumer beauty brands such as

CoverGirl and MaxFactor, which have fallen out of favor as shoppers

switch to higher-end and niche brands.

Selling the businesses won't address the bigger issues facing

Coty, Wells Fargo analyst Joe Lachky said. While calling the move a

good one on Coty's part, Mr. Lachky said the company has yet to

reverse the decline of consumer beauty brands that account for

roughly half Coty's business.

Coty said earlier this year it would restructure its operations

and take a $3 billion write-down on the roughly 40 brands acquired

from P&G. In August, Coty cut ties with Younique, a

social-media-driven cosmetics company it took control of in

2017.

Coty said the proceeds from any potential deal would be used to

pay down its debt and return cash to shareholders.

Shares of the company were up about 14% to $11.54 in Monday

afternoon trading. Before Monday's announcement, Coty shares had

lost half their value since the P&G deal closed.

Write to Sharon Terlep at sharon.terlep@wsj.com and Patrick

Thomas at Patrick.Thomas@wsj.com

(END) Dow Jones Newswires

October 22, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

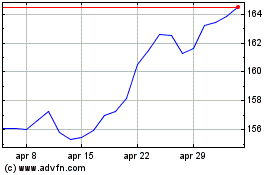

Grafico Azioni Procter and Gamble (NYSE:PG)

Storico

Da Mar 2024 a Apr 2024

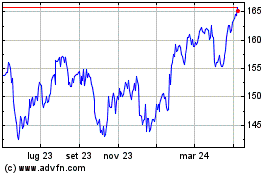

Grafico Azioni Procter and Gamble (NYSE:PG)

Storico

Da Apr 2023 a Apr 2024