TIDMSOLG

RNS Number : 8268Q

SolGold PLC

23 October 2019

23 October 2019

SolGold plc

("SolGold" or the "Company")

Large New Copper-Gold-Silver-Molybdenum Porphyry System

Discovered in the Cisne-Loja Project

The Board of SolGold (LSE & TSX code: SOLG) is pleased to

provide an update from the Company's regional exploration

activities from its Cisne Loja Project in southern Ecuador, held by

wholly owned subsidiary Green Rock Resources S.A.

Highlights

Ø New mineralised outcrops discovered at the Celen Prospect

indicate a large new copper gold rich polymetallic porphyry

system - 100% owned by SolGold.

Ø Extensive outcrops of porphyry style quartz-magnetite-chalcopyrite

veining along with disseminated magnetite-chalcopyrite.

Ø Consistently rich copper, gold, silver and molybdenum

mineralisation is present in outcrop over a large area

2km by 1km.

Ø Strong magnetic anomalism in mineralised zones. Magnetics

identifies additional targets.

Ø Significantly, the porphyry style veins have 1:1 values

of copper, gold with proportionate silver and molybdenum

diagnostic of a strong Andean porphyry copper gold system.

Ø Proximal fracture hosted mineralisation is rich in diagnostic

copper oxide and carbonate minerals, neotocite, malachite

and azurite returning extremely high copper values.

Ø Significant rock chip mineralisation including:

-- R03001325 4.32% Cu, 4.51g/t Au, 20.8g/t Ag,

9.99ppm Mo

-- R03001342 .90% Cu, 0.21g/t Au, >100g/t Ag, 76.1ppm

Mo

-- R03001304 2.54% Cu, 3.04g/t Au, 15.4g/t Ag,

185.5ppm Mo

-- R03001347 2.52% Cu, 3.11g/t Au, 12.5g/t Ag,

13.4ppm Mo

-- R03001303 2.46% Cu, 0.10g/t Au, 54.5g/t Ag,

54.9ppm Mo

Ø 60/72 (83%) of samples >0.6% Cu and 0.6g/t Au.

Ø Initial gridded copper-gold soil anomalies confirms

Celen as an extensive mineralised porphyry target

Ø Centre of the Celen Prospect is located 7km from SolGold's

mineralised Cuenca Loma gold-silver epithermal prospect,

representing a mineralised gold and silver epithermal

vein field.

References to figures and tables relate to the version visible

in PDF format by clicking the link below:

http://www.rns-pdf.londonstockexchange.com/rns/8268Q_1-2019-10-23.pdf

Commenting on the results, Jason Ward, SolGold's Exploration

& Country Manager said:

"The recent discovery of this large copper gold target at Celen,

which outcrops over an area of 2km x 1km and exhibits all of the

geochemical and geophysical hallmarks of a large porphyry system,

underscores the prospectivity and unexplored nature of the area and

brings the number of SolGold priority projects from 12 to 13. The

Celen copper gold target is located just 5km south of an epithermal

gold field we discovered at Cisne Loja which outcrops over an area

of 2.5km x 1.5 km, and we are optimistic about the discovery of

both gold and copper ore bodies at Cisne Loja."

Introduction

Ecuador is located on the copper-gold rich and under-explored

northern section of the Andean Copper Belt. The well explored

southern portion is renowned as the production base for nearly half

of the world's copper (Figure 1). SolGold's strategy to become a

tier 1 copper and gold producer through systematic exploration

continues to yield exciting results. Follow up exploration has

focussed on 13 priority projects identified across SolGold's 75

granted regional concessions.

With 13 priority projects now recognised, ongoing exploration by

SolGold technical teams is focussed on advancing these priority

projects with a view to progress to drill testing as soon as

possible. SolGold's high success rate has been achieved by

operating multiple field teams comprising 42 Ecuadorean geologists

in regional exploration, led by highly experienced national

geologists and applying the exploration discovery and appraisal

blueprint developed over the last 4 years at Alpala.

Further Information

Cisne 2C

Coherent area of copper mineralisation over 1km x 2km

Continued mapping and sampling by Green Rock Resources field

teams at the Cisne Loja Project across three granted tenements (El

Cisne 2A,2B,2C) covering 2km(2) has located outcrops with strong

porphyry style copper, gold, silver and molybdenum mineralisation

in the Celen prospect located in the El Cisne 2C concession.

(Figure 2 & 3). Porphyry style mineralised outcrops occur in an

extensive 2km by 1km area indicating a large poly metallic

mineralised system located less than 7km south from the previously

identified gold-silver epithermal field in El Cisne 2A.

The copper mineralization is best developed within

magnetite-chalcopyrite porphyry veins in quartz diorite and

microdiorite units with associated disseminated chalcopyrite

mineralisation (Figures 4 & 5). Zones of high grade copper and

gold mineralisation are also developed proximal to the porpyhry

style veins with fractures containing diagnostic copper oxide and

carbonate minerals, neotocite, malachite and azurite.

Diagnostic magnetic signatures

Strongly anomalous magnetic signatures characterise the copper

mineralisation, and additional target areas west of Cuenca Loja and

between Celen and Cueca Loja are still to be sampled (Figure 2)

Outcrops are characterised by pervasive magnetite mineralisation

to 3% of the rock with associated chlorite and epidote alteration.

The main orientation of veins and fractures are north east trending

with a secondary north west trending structural orientation.

Weathered mineralised intrusive units are present in volcanic units

to the north of the main zone of mineralisation containing

quartz-hematite-goethite veining. There are numerous tourmaline

breccias outcropping south of the mineralised zone (Figure 5)

Of the 72 rock chip samples taken at the Celen prospect, 60

samples (83%) have returned grades greater than 0.6% Cueq with the

average molybdenum results for all 72 samples of 51.95ppm Mo

(Figure 3, Table 1). Best rock chip results from recent sampling

include;

-- R03001325 4.32% Cu, 4.51g/t Au, 20.8g/t Ag, 9.99ppm

Mo

-- R03001342 3.90% Cu, 0.21g/t Au, >100g/t Ag, 76.1ppm

Mo

-- R03001304 2.54% Cu, 3.04g/t Au, 15.4g/t Ag, 185.5ppm

Mo

-- R03001347 2.52% Cu, 3.11g/t Au, 12.5g/t Ag, 13.4ppm

Mo

-- R03001303 2.46% Cu, 0.10g/t Au, 54.5g/t Ag, 54.9ppm

Mo

-- R03001330 1.99% Cu, 2.38g/t Au, 28.1g/t Ag, 8.69ppm

Mo

-- R03001333 1.77% Cu, 0.12g/t Au, 35.9g/t Ag, 5.1ppm Mo

-- R03001328 1.63% Cu, 1.44g/t Au, 12.75g/t Ag, 31.3ppm

Mo

Previously announced rock chip sample results include;

-- R03001218 5.28% Cu, 0.66 g/t Au, 91.4 g/t Ag

-- R03001221 5.08% Cu, 1.10 g/t Au, 25.8 g/t Ag

-- R03001204 4.92% Cu, 3.90 g/t Au, 55.7 g/t Ag

-- R03001215 3.65% Cu, 0.02 g/t Au, 95.5 g/t Ag

-- R03001214 3.43% Cu, 0.09 g/t Au, 73.8 g/t Ag

-- R03001206 2.06% Cu, 0.24 g/t Au, 28.7 g/t Ag

-- R03001211 1.63% Cu, 0.30 g/t Au, 39.8 g/t Ag

-- R03001213 1.45% Cu, 0.02 g/t Au, 36.6 g/t Ag

-- R03001207 1.39% Cu, 0.15 g/t Au, 24.6 g/t Ag

-- R03001217 1.33% Cu, 0.08 g/t Au, 27.6 g/t Ag

-- R03001218 5.28% Cu, 0.66 g/t Au, 91.4 g/t Ag

-- R03001221 5.08% Cu, 1.10 g/t Au, 25.8 g/t Ag

-- R03001204 4.92% Cu, 3.90 g/t Au, 55.7 g/t Ag

-- R03001215 3.65% Cu, 0.02 g/t Au, 95.5 g/t Ag

-- R03001214 3.43% Cu, 0.09 g/t Au, 73.8 g/t Ag

Initial gridded soil anomalies confirm the extensive mineralised

area identified by mapping and rock chip sampling. Large coherent

copper and gold soil anomalies show a positive correlation to

identified mineralisation and delineate additional areas for follow

up exploration (Figure 6 & 7). The copper anomaly comprises

extremely high copper in soil values up to 0.1% Cu. Soil anomalies

remain open to the north and south and the gridded soil program

will be extended to define the surface limits of the Celen porphyry

target.

Figure 1: Location plan of the Cisne Loja Project in southern

Ecuador.

Figure 2: Copper results in rock chips over aeromagnetic RTP

data.

Figure 3: Celen geology with copper rock chip values.

Figure 4: Rock chip samples from the Celen Prospect

Figure 5: Celen prospect rock chip samples of peripheral

intrusive units and tourmaline breccias .

Figure 6: Copper in soil values with copper geochemical anomaly

and RTP magnetic data

Figure 7: Gold in soil values with gold geochemical anomaly and

RTP magnetic data

Sample Easting Northing RL Cu_ppm Au_ppm Ag_ppm Mo_ppm

ID

R03001218 677734 9575087 1830 52790 0,661 91,4 165

-------- --------- ----- ------- ------- ------- -------

R03001221 677751 9575045 1803 50820 1,1 25,8 69,9

-------- --------- ----- ------- ------- ------- -------

R03001204 677712 9575009 1803 49180 3,9 55,7 86

-------- --------- ----- ------- ------- ------- -------

R03001325 677867 9574396 1686 43220 4,51 20,8 9,99

-------- --------- ----- ------- ------- ------- -------

R03001342 678118 9575961 2014 39010 0,212 100 76,1

-------- --------- ----- ------- ------- ------- -------

R03001215 677543 9575623 2052 36530 0,025 95,5 542

-------- --------- ----- ------- ------- ------- -------

R03001214 677578 9575610 2027 34330 0,098 73,8 75,6

-------- --------- ----- ------- ------- ------- -------

R03001224 677777 9575588 1893 28240 0,026 60,1 18,8

-------- --------- ----- ------- ------- ------- -------

R03001224 677777 9575588 1893 28240 0,026 60,1 18,8

-------- --------- ----- ------- ------- ------- -------

R03001223 677854 9575431 1724 28120 0,019 61,3 41,7

-------- --------- ----- ------- ------- ------- -------

R03001304 678406 9577825 2109 25420 3,04 15,4 185,5

-------- --------- ----- ------- ------- ------- -------

R03001347 678078 9575036 1899 25220 3,11 12,5 13,4

-------- --------- ----- ------- ------- ------- -------

R03001303 678323 9577776 2131 24580 0,103 54,5 54,9

-------- --------- ----- ------- ------- ------- -------

R03001282 678240 9576306 1954 22330 0,092 96 431

-------- --------- ----- ------- ------- ------- -------

R03001206 677674 9575028 1843 20610 0,243 28,7 31,6

-------- --------- ----- ------- ------- ------- -------

R03001330 678008 9575057 1824 19880 2,38 28,1 8,69

-------- --------- ----- ------- ------- ------- -------

R03001333 678081 9575068 1896 17700 0,116 35,9 5,1

-------- --------- ----- ------- ------- ------- -------

R03001328 677865 9574357 1700 16300 1,44 12,75 31,3

-------- --------- ----- ------- ------- ------- -------

R03001211 677659 9575345 1919 16270 0,304 39,8 11,95

-------- --------- ----- ------- ------- ------- -------

R03001296 678500 9577553 2063 16230 0,263 100 214

-------- --------- ----- ------- ------- ------- -------

R03001213 677448 9575344 2012 14500 0,028 36,6 38,8

-------- --------- ----- ------- ------- ------- -------

R03001207 677694 9575034 1821 13910 0,154 24,6 6,19

-------- --------- ----- ------- ------- ------- -------

R03001217 677701 9575175 1858 13330 0,084 27,6 14,55

-------- --------- ----- ------- ------- ------- -------

R03000313 677908 9575150 1726 12150 1.535 11,3 3,51

-------- --------- ----- ------- ------- ------- -------

R03000312 677905 9575139 1726 10670 0,839 11,55 10,6

R03000314 677902 9575144 1726 8900 0,758 6,61 6,65

R03001209 677496 9575155 1947 7840 0,32 7,69 12,5

-------- --------- ----- ------- ------- ------- -------

R03001012 677765 9574993 1764 7250 0,038 2,64 15,1

-------- --------- ----- ------- ------- ------- -------

R03001205 677707 9575017 1817 6820 0,064 6,02 1,93

-------- --------- ----- ------- ------- ------- -------

R03001335 678077 9575060 1886 6710 0,024 5,41 1,61

-------- --------- ----- ------- ------- ------- -------

R03001016 677927 9575161 1707 6590 0,944 3,5 5

-------- --------- ----- ------- ------- ------- -------

R03001015 677952 9575124 1742 6370 1,9 21,8 2,14

-------- --------- ----- ------- ------- ------- -------

R03001208 677824 9575316 1760 6270 0,186 5,38 34,4

-------- --------- ----- ------- ------- ------- -------

R03001348 678055 9575364 1795 6120 0,548 6,98 2,63

-------- --------- ----- ------- ------- ------- -------

R03001212 677607 9575660 2022 6100 0,031 10,65 34,6

-------- --------- ----- ------- ------- ------- -------

R03001216 677361 9575196 2011 6050 0,028 9,89 18,75

-------- --------- ----- ------- ------- ------- -------

R03001013 677745 9574995 1760 5890 0,097 5,11 145,5

-------- --------- ----- ------- ------- ------- -------

R03001332 678036 9575103 1825 5700 0,071 11,35 1,66

-------- --------- ----- ------- ------- ------- -------

R03001222 677753 9575018 1788 5590 0,05 2,73 6,64

-------- --------- ----- ------- ------- ------- -------

R03001337 677708 9575010 1824 5550 0,608 8,9 92,9

-------- --------- ----- ------- ------- ------- -------

R03001329 678046 9574473 1776 5410 0,05 21,9 1,5

-------- --------- ----- ------- ------- ------- -------

R03001338 677962 9575158 1754 5300 0,054 24,7 69,6

-------- --------- ----- ------- ------- ------- -------

R03001285 678426 9575339 1867 4710 0,602 8,41 20,2

-------- --------- ----- ------- ------- ------- -------

R03001340 677923 9575045 1761 3400 0,213 0,62 1,15

-------- --------- ----- ------- ------- ------- -------

Table 1: Significant results table

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of the

Regulation (EU) No 596/2014 until the release of this

announcement.

Qualified Person:

Information in this report relating to the exploration results

is based on data reviewed by Mr Jason Ward ((CP) B.Sc. Geol.), the

Chief Geologist of the Company. Mr Ward is a Fellow of the

Australasian Institute of Mining and Metallurgy, holds the

designation FAusIMM (CP), and has in excess of 20 years' experience

in mineral exploration and is a Qualified Person for the purposes

of the relevant LSE and TSX Rules. Mr Ward consents to the

inclusion of the information in the form and context in which it

appears.

By order of the Board

Karl Schlobohm

Company Secretary

CONTACTS

Nicholas Mather Tel: +61 (0) 7 3303 0665

SolGold Plc (Chief Executive Officer) +61 (0) 417 880 448

nmather@solgold.com.au

Karl Schlobohm

SolGold Plc (Company Secretary) Tel: +61 (0) 7 3303 0661

kschlobohm@solgold.com.au

Anna Legge

SolGold Plc (Corporate Communications) Tel: +44 (0) 20 3823 2131

alegge@solgold.com.au

Gordon Poole / Nick Hennis

Camarco (Financial PR / IR) Tel: +44 (0) 20 3757 4997

solgold@camarco.co.uk

Andrew Chubb Tel: +44 (0) 20 7907 8500

Hannam & Partners (Joint Broker and Financial

Advisor)

solgold@hannam.partners

Ross Allister / David McKeown Tel: +44 (0)20 7418 8900

Peel Hunt (Joint Broker and Financial

Advisor)

solgold@peelhunt.com

James Kofman / Darren Wallace Tel: +1 416 943 6411

Cormark Securities Inc. (Financial Advisor)

dwallace@cormark.com

Follow us on twitter @SolGold_plc

ABOUT SOLGOLD

SolGold is a leading exploration company focussed on the

discovery and definition of world-class copper and gold deposits.

In 2018 SolGold's management team was recognised by the "Mines and

Money" Forum as an example of excellence in the industry, and

continues to strive to deliver objectives efficiently and in the

interests of shareholders. SolGold is the largest and most active

concession holder in Ecuador and is aggressively exploring the

length and breadth of this highly prospective and gold-rich section

of the Andean Copper Belt.

The Company operates with transparency and in accordance with

international best practices. SolGold is committed to delivering

value to its shareholders, while simultaneously providing economic

and social benefits to impacted communities, fostering a healthy

and safe workplace and minimizing the environmental impact.

Dedicated stakeholders

SolGold employs a staff of over 560 and at least 98% are

Ecuadorean. This is expected to grow as the operations at Alpala,

and in Ecuador generally, expand. SolGold focusses its operations

to be safe, reliable and environmentally responsible and maintains

close relationships with its local communities. SolGold has engaged

an increasingly skilled and experienced team of geoscientists using

state of the art geophysical and geochemical modelling applied to

an extensive data base to enable the delivery of ore grade

intersections from nearly every drill hole at Alpala. SolGold has

86 geologists, of which 11% are female, on the ground in Ecuador

looking for copper and gold.

About Cascabel and Alpala

The Alpala deposit is the main target in the Cascabel

concession, located on the northern section of the heavily endowed

Andean Copper Belt, the entirety of which is renowned as the base

for nearly half of the world's copper production. The project area

hosts mineralisation of Eocene age, the same age as numerous Tier 1

deposits along the Andean Copper Belt in Chile and Peru to the

south. The project base is located at Rocafuerte within the

Cascabel concession in northern Ecuador, an approximately three

hour drive on sealed highway north of Quito, close to water, power

supply and Pacific ports (Figure 1).

Having fulfilled its earn-in requirements, SolGold is a

registered shareholder with an unencumbered legal and beneficial

85% interest in ENSA (Exploraciones Novomining S.A.) which holds

100% of the Cascabel concession covering approximately 50km(2) .

The junior equity owner in ENSA is required to repay 15% of costs

since SolGold's earn in was completed, from 90% of its share of

distribution of earnings or dividends from ENSA or the Cascabel

concession. It is also required to contribute to development or be

diluted, and if its interest falls below 10%, it shall reduce to a

0.5% NSR royalty which SolGold may acquire for US$3.5m.

Over 226,328m of diamond drilling has been completed on the

project. With numerous rigs currently active on the project,

SolGold produces up to approximately 10,000m of core every month.

The Cascabel drill program is currently focussed on extending and

upgrading the status of the Alpala Resource, as well as further

drill testing of the rapidly evolving Aguinaga prospect. Drill

testing of the Trivinio target has commenced, whilst the numerous

other untested targets, namely at Moran, Cristal, Tandayama-America

and Chinambicito, are flagged for drill testing as overall program

demands allow.

The November 2018 Alpala MRE update, dated 15 November 2018, was

estimated from 68,173 assays. Drill core samples were obtained from

total of 133,576m of drilling comprising 128 diamond drill holes,

including 75 drill holes comprising, 34 daughter holes, 8 redrills,

and 11 over-runs, and represents full assay data from holes 1-67

and partial assay data received from holes 68 to 75. In contrast,

the Dec 2017 Maiden MRE was estimated from 26,814 assays obtained

from 53,616m of drilling comprising 45 drill holes, including 10

daughter holes and 5 redrills.

The November 2018 Alpala updated Mineral Resource Estimate (MRE)

totals a current:

o 2,050 Mt @ 0.60% CuEq (at 0.2% CuEq cut-off) in the Indicated

category, and 900 Mt @ 0.35% CuEq (at 0.2% CuEq cut-off)

in the Inferred category.

o Contained metal content of 8.4 Mt Cu and 19.4 Moz Au in

the Indicated category.

o Contained metal content of 2.5 Mt Cu and 3.8 Moz Au in

the Inferred category.

Investors should consult the technical report dated 3 January

2019 for a detailed account of the assumptions on which the

estimates were based as well as any known legal, political,

environmental and other risks that could materially affect the

development of the resources.

Getting Alpala advanced towards development

The resource at the Alpala deposit boasts a high grade core

which, in the event of the construction of a mine, is targeted to

facilitate early cashflows and an accelerated payback of initial

capital. SolGold is currently investigating development and

financing options available to the company for the development of

Cascabel on reaching feasibility.

The results of the PEA were published on 20 May 2019,

highlighting the following key aspects:

Ø Net Present Value ("NPV") estimates range from US$4.1Bn

to US$4.5Bn (Real, post-tax, @ 8% discount rate, US$3.3/lb

copper price, US$1,300/oz gold price and US$16/oz silver

price) depending on production rate scenario.

Ø Internal Rate of Return ("IRR") estimates range from 24.8%

to 26.5% (Real, post-tax, US$3.3/lb copper price, US$1,300/oz

gold price and US$16/oz silver price) depending on production

rate scenario.

Ø Pre-production Capex estimated at approx. US$2.4B to US$2.8B,

and total Capex including life of mine sustaining Capex

of US$10.1B to US$10.5B depending on production rate scenario.

Ø Payback Period on initial start-up capital - Range from

3.5 to 3.8 years after commencement of production depending

on production rate scenario.

Ø Preferred Mining Method - Underground low-cost mass mining

using Block Cave methods applied over several caves designed

on two vertically extensive Lifts.

Full results and all details of the PEA are available in the

Company's market release of 20 May 2019.

SolGold's regional push

SolGold is using its successful and cost efficient blueprint

established at Alpala, and Cascabel generally, to explore for

additional world class copper and gold projects across Ecuador.

SolGold is the largest and most active concessionaire in

Ecuador.

The Company wholly owns four other subsidiaries active

throughout the country that are now focussed on thirteen high

priority gold and copper resource targets, several of which the

Company believes have the potential, subject to resource definition

and feasibility, to be developed in close succession or even on a

more accelerated basis from Alpala.

SolGold is listed on the London Stock Exchange and Toronto Stock

Exchange (LSE/TSX: SOLG). SolGold is listed on the London Stock

Exchange and Toronto Stock Exchange (LSE/TSX: SOLG). The Company

has on issue a total of 1,846,321,033 fully-paid ordinary shares;

139,012,000 share options exercisable at 60p and 21,250,000 share

options exercisable at 40p.

Figure 1: Location of Cascabel project in Imbabura Province,

northern Ecuador, highlighting the significant capital advantages

held by the project, with proximity to ports, road infrastructure,

hydro-electric power stations and the trans-continental power

grid.

See www.solgold.com.au for more information. Follow us on

twitter @SolGold_plc

CAUTIONARY NOTICE

News releases, presentations and public commentary made by

SolGold plc (the "Company") and its Officers may contain certain

statements and expressions of belief, expectation or opinion which

are forward looking statements, and which relate, inter alia, to

interpretations of exploration results to date and the Company's

proposed strategy, plans and objectives or to the expectations or

intentions of the Company's Directors. Such forward-looking and

interpretative statements involve known and unknown risks,

uncertainties and other important factors beyond the control of the

Company that could cause the actual performance or achievements of

the Company to be materially different from such interpretations

and forward-looking statements.

Accordingly, the reader should not rely on any interpretations

or forward-looking statements; and save as required by the exchange

rules of the TSX and LSE or by applicable laws, the Company does

not accept any obligation to disseminate any updates or revisions

to such interpretations or forward-looking statements. The Company

may reinterpret results to date as the status of its assets and

projects changes with time expenditure, metals prices and other

affecting circumstances.

This release may contain "forward--looking information" within

the meaning of applicable Canadian securities legislation.

Forward--looking information includes, but is not limited to,

statements regarding the Company's plans for developing its

properties. Generally, forward--looking information can be

identified by the use of forward-looking terminology such as

"plans", "expects" or "does not expect", "is expected", "budget",

"scheduled", "estimates", "forecasts", "intends", "anticipates" or

"does not anticipate", or "believes", or variations of such words

and phrases or state that certain actions, events or results "may",

"could", "would", "might" or "will be taken", "occur" or "be

achieved".

Forward--looking information is subject to known and unknown

risks, uncertainties and other factors that may cause the actual

results, level of activity, performance or achievements of the

Company to be materially different from those expressed or implied

by such forward--looking information, including but not limited to:

transaction risks; general business, economic, competitive,

political and social uncertainties; future prices of mineral

prices; accidents, labour disputes and shortages and other risks of

the mining industry. Although the Company has attempted to identify

important factors that could cause actual results to differ

materially from those contained in forward-looking information,

there may be other factors that cause results not to be as

anticipated, estimated or intended. There can be no assurance that

such information will prove to be accurate, as actual results and

future events could differ materially from those anticipated in

such statements. Accordingly, readers should not place undue

reliance on forward--looking information. The Company does not

undertake to update any forward-looking information, except in

accordance with applicable securities laws.

The Company and its officers do not endorse, or reject or

otherwise comment on the conclusions, interpretations or views

expressed in press articles or third-party analysis, and where

possible aims to circulate all available material on its

website.

The Company recognises that the term "World Class" is subjective

and for the purpose of the Company's projects the Company considers

the drilling results at the growing Alpala Porphyry Copper Gold

Deposit at its Cascabel Project to represent intersections of a

"World Class" deposit. The Company considers that "World Class"

deposits are rare, very large, long life, low cost, and are

responsible for approximately half of total global metals

production.

"World Class" deposits are generally accepted as deposits of a

size and quality that create multiple expansion opportunities, and

have or are likely to demonstrate robust economics that ensure

development irrespective of position within the global commodity

cycles, or whether or not the deposit has been fully drilled out,

or a feasibility study completed.

Standards drawn from industry experts (1) Singer and Menzie,

2010; (2) Schodde, 2006; (3) Schodde and Hronsky, 2006; (4) Singer,

1995; (5) Laznicka, 2010) have characterised "World Class" deposits

at prevailing commodity prices. The relevant criteria for "World

Class" deposits, adjusted to current long run commodity prices, are

considered to be those holding or likely to hold more than 5

million tonnes of copper and/or more than 6 million ounces of gold

with a modelled net present value of greater than USD 1

Billion.

The Company and its external consultants prepared an initial

mineral resource estimate at the Cascabel Project in December 2017.

Results are summarised in Table B attached.

The Mineral Resource Estimate was completed from 53,616m of

drilling, approximately 84% of 63,500m metres drilled as of

mid-December 2017, the cut-off date for the maiden resource

calculation. There remains strong potential for further growth from

more recent drilling results, and continue rapid growth of the

deposit.

Any development or mining potential for the project remains

speculative.

Drill hole intercepts have been updated to reflect current

commodity prices, using a data aggregation method, defined by

copper equivalent cut-off grades and reported with up to 10m

internal dilution, excluding bridging to a single sample. Copper

equivalent grades are calculated using a gold conversion factor of

0.63, determined using an updated copper price of USD3.00/pound and

an updated gold price of USD1300/ounce. True widths of down hole

intersections are estimated to be approximately 25-70%.

On the basis of the drilling results to date and the results of

the Alpala Maiden Mineral Resource Estimate, the reference to the

Cascabel Project as "World Class" (or "Tier 1") is considered to be

appropriate. Examples of global copper and gold discoveries since

2006 that are generally considered to be "World Class" are

summarised in Table A.

References cited in the text:

1. Singer, D.A. and Menzie, W.D., 2010. Quantitative Mineral

Resource Assessments: An Integrated Approach. Oxford University

Press Inc.

2. Schodde, R., 2006. What do we mean by a world class deposit?

And why are they special. Presentation. AMEC Conference,

Perth.

3. Schodde, R and Hronsky, J.M.A, 2006. The Role of World-Class

Mines in Wealth Creation. Special Publications of the Society

of Economic Geologists Volume 12.

4. Singer, D.A., 1995, World-class base and precious metal

deposits-a quantitative analysis: Economic Geology, v.

90, no.1, p. 88-104.

5. Laznicka, P., 2010. Giant Metallic Deposits: Future Sources

of Industrial Metal, Second Edition. Springer-Verlag Heidelberg.

Deposit Discovery Major Country Current Status Mining Inventory

Name Year Metals Style

LA COLOSA 2006 Au, Cu Colombia Feasibility Open Pit (1) 469Mt

- New Project @ 0.95g/t

Au; 14.3Moz

Au

============= =========== ============ ========================= =============== ===============

LOS SULFATOS 2007 Cu, Mo Chile Advanced Exploration Underground (2) 1.2Bt

@1.46% Cu

& 0.02% Mo;

17.5Mt Cu

============= =========== ============ ========================= =============== ===============

BRUCEJACK 2008 Au Canada Development/Construction Open Pit (3) 15.6Mt

@ 16.1 g/t

Au; 8.1Moz

Au

============= =========== ============ ========================= =============== ===============

KAMOA-KAKULA 2008 Cu, Co, Congo Feasibility Open Pit (4) 1.3Bt

Zn (DRC) - New Project & Underground @ 2.72% Cu;

36.5 Mt Cu

============= =========== ============ ========================= =============== ===============

GOLPU 2009 Cu, Au PNG Feasibility Underground (5) 820Mt

- New Project @ 1.0% Cu,

0.70g/t Au;

8.2Mt Cu,

18.5Moz Au

============= =========== ============ ========================= =============== ===============

COTE 2010 Au, Cu Canada Feasibility Open Pit (6) 289Mt

Study @ 0.90 g/t

Au; 8.4Moz

Au

============= =========== ============ ========================= =============== ===============

HAIYU 2011 Au China Development/Construction Underground (7) 15Moz

Au

============= =========== ============ ========================= =============== ===============

RED HILL-GOLD 2011 Au United Feasibility Open Pit (8) 47.6Mt

RUSH States Study & Underground @ 4.56 g/t

Au; 7.0Moz

Au

============= =========== ============ ========================= =============== ===============

XILING 2016 Au China Advanced Exploration Underground (9) 383Mt

@ 4.52g/t

Au; 55.7Moz

Au

============= =========== ============ ========================= =============== ===============

Source: after MinEx Consulting, May 2017

(1) Source: http://www.mining--technology.com/projects/la--colosa

(2) Source: http://www.angloamerican.com/media/press--releases/2009

(3) Source: http://www.pretivm.com/projects/brucejack/overview/

(4) Source: https://www.ivanhoemines.com/projects/kamoa--kakula--project/

(5) Source:

http://www.newcrest.com.au/media/resource_reserves/2016/December_2016_Resources_and_Reserves_Statement.pdf

(6) Source: http://www.canadianminingjournal.com/news/gold--iamgold--files--cote--project--pea/

(7) Source: http://www.zhaojin.com.cn/upload/2015--05--31/580601981.pdf

(8) Source: https://mrdata.usgs.gov/sedau/show--sedau.php?rec_id=103

(9) Source: http://www.chinadaily.com.cn/business/2017--03/29/content_28719822.htm

Table A: Tier 1 global copper and gold discoveries since 2006.

This table does not purport to be exhaustive exclusive or

definitive.

Grade Resource Tonnage Grade Contained Metal

Category Category (Mt)

======================

Cu (%) Au (g/t) CuEq Cu (Mt) Au (Moz) CuEq

(%) (Mt)

====== ======== ==== ======= ======== =====

Total >0.2%

CuEq Indicated 2,050 0.41 0.29 0.60 8.4 19.4 12.2

============ ========== ======= ====== ======== ==== ======= ======== =====

Inferred 900 0.27 0.13 0.35 2.5 3.8 3.2

======================= ======= ====== ======== ==== ======= ======== =====

Table B: Alpala Mineral Resource Estimate updated effective 16

November 2018.

Notes:

-- Mr. Martin Pittuck, MSc, CEng, MIMMM, is responsible for

this Mineral Resource estimate and is an "independent qualified

person" as such term is defined in NI 43-101.

-- The Mineral Resource is reported using a cut-off grade

of 0.3% copper equivalent calculated using [copper grade

(%)] + [gold grade (g/t) x 0.6] based on a copper price

of US$2.8/lb and gold price of US$1,160/oz.

-- The Mineral Resource is considered to have reasonable potential

for eventual economic extraction by underground mass mining

such as block caving.

-- Mineral Resources are not Mineral Reserves and do not have

demonstrated economic viability.

-- The statement uses the terminology, definitions and guidelines

given in the CIM Standards on Mineral Resources and Mineral

Reserves (May 2014).

-- The MRE is reported on 100 percent basis.

-- Values given in the table have been rounded, apparent calculation

errors resulting from this are not considered to be material.

-- The effective date for the Mineral Resource statement is

16 November 2018.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

UPDPGGCGUUPBUQW

(END) Dow Jones Newswires

October 23, 2019 02:17 ET (06:17 GMT)

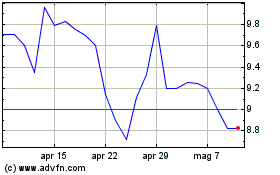

Grafico Azioni Solgold (LSE:SOLG)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Solgold (LSE:SOLG)

Storico

Da Apr 2023 a Apr 2024