Mining Giant Sends Shock Waves Through New Zealand's Stock Market

23 Ottobre 2019 - 9:02AM

Dow Jones News

By David Winning and Robb M. Stewart

The lights abruptly went out on New Zealand's long-running

stocks rally Wednesday. The reason: A global mining giant's threat

to pull the plug on the country's biggest buyer of electricity.

The NZX-50 index had been among the world's best-performing

stock benchmarks this year, notching a 26% gain through Tuesday.

But it fell 2.1%, close to a three-week low, after Rio Tinto PLC

said its Tiwai Point smelter is unprofitable, citing high energy

costs and historically low aluminum prices because of oversupply in

the market.

The selloff illustrates how small stock markets can be

especially vulnerable to big corporate decisions. Tiwai Point,

which employs roughly 1,000 people and has been in operation for

nearly half a century, is the single biggest user of electricity in

New Zealand, where it accounts for roughly 14% of energy

demand.

The possible closure risks creating a power-supply glut, which

could drive down electricity prices and industry profits.

Power generators bore the brunt of selling, with Meridian Energy

Ltd. falling 8.7% on the potential loss of a customer that takes

around 40% of its energy output. Meridian is New Zealand's largest

listed company by market value. Other power companies also have

contracts to supply Rio Tinto's smelter, including Contact Energy

Ltd. and Mercury NZ Ltd., which fell 9.7% and 8.4%,

respectively.

The NZX "isn't a huge exchange, and it can be thinly traded,"

said Michael McCarthy, chief market strategist at CMC Markets. "So

when you have stock-specific news on a day when there are negative

leads elsewhere, the reaction can be disproportionate."

Concerns about the future of Tiwai Point have long hung over the

sector. Six years ago, Meridian renegotiated its power-supply

contract with Rio Tinto's majority-owned New Zealand Aluminium

Smelters Ltd., or NZAS, to help the smelter to stay competitive.

The revised deal included a cut in the electricity price.

Investors who bought shares in Meridian when it was privatized

by the New Zealand government that same year were warned about the

risk of the Tiwai Point smelter closing. "In some circumstances the

impact on Meridian is likely to be severe," the listing prospectus

said.

On Wednesday, Rio Tinto said a review of the smelter's future

would be finished early next year. Other options include curtailing

production, it said.

Meridian Chief Executive Neil Barclay said the generator had

offered to overhaul its existing power-supply deal, and remained

open to negotiating with NZAS and its owners. Rio Tinto owns 79.36%

of the smelter, with the rest held by Japan's Sumitomo Chemical

Co.

Alf Barrios, head of Rio Tinto's aluminum business, said his

company is seeking talks with the government and other groups to

"find a solution that will ensure a profitable future for this

plant."

Write to David Winning at david.winning@wsj.com and Robb M.

Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

October 23, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

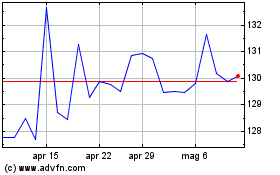

Grafico Azioni Rio Tinto (ASX:RIO)

Storico

Da Mar 2024 a Apr 2024

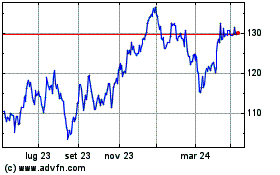

Grafico Azioni Rio Tinto (ASX:RIO)

Storico

Da Apr 2023 a Apr 2024