TIDMSMJ

RNS Number : 0218R

Smart(J.)&Co(Contractors) PLC

24 October 2019

J SMART & CO (CONTRACTORS) PLC AND SUBSIDIARY COMPANIES

ACCOUNTS FOR THE YEARED 31st JULY 2019

PRELIMINARY STATEMENT

ACCOUNTS

Headline Group profit for the year before tax, including an

unrealised surplus in revalued property and a minor deficit in

revalued available for sale financial assets, was GBP6,643,000

compared with GBP5,357,000 last year after accounting for the prior

year adjustment resulting from implementation of IFRS 9.

Underlying profit before tax for the year of GBP2,600,000 was

unexpectedly marginally more than last year's figure of

GBP2,392,000 (including GBP460,000 profit from property sales in a

joint venture company and a prior year adjustment increasing the

profit by GBP104,000). As before, our view is that discounting the

increase in the revaluation of the commercial property portfolio

and adjusting for the revaluation movement on available for sale

financial assets provides a truer reflection of Group

performance.

The Board is recommending a Final Dividend of 2.24p making a

total of 3.19p which compares with 3.16p for the previous year.

After waivers by members holding almost 60% of the shares, the

Final Dividend will cost the Company no more than GBP390,000.

TRADING ACTIVITIES

Group construction activities including private residential

sales on continuing operations increased by 56%. Own work

capitalised decreased by 92% and headline Group profit on

continuing operations increased by 25%. Underlying Group profit on

continuing operations increased by 13%.

As reported in post balance sheet events in the last Annual

Report and in my Statement in the last Interim Report, due to a

substantial loss in that financial year and losses in previous

years, the decision was taken to cease trading in the subsidiary

company, Concrete Products (Kirkcaldy) Limited, based at Hayfield

Industrial Estate, Kirkcaldy. Trading has now ceased and the

majority of the company assets have now been sold. The demolition

of the production buildings has now commenced and post demolition

the property assets will be transferred to our commercial property

subsidiary company, C. & W. Assets Limited. The remaining

property and yard space will be used by other group companies,

mainly for storage purposes. The loss for Concrete Products

(Kirkcaldy) Limited stated in these accounts reflects the majority

of the final cost of cessation.

Turnover in contracting was more than last year but the loss was

increased. The build contract for the Affordable Housing at the

mixed development at West Bowling Green Street continues and will

be finished prior to the end of 2019. The social housing build

contract at Ferrymuir is progressing and is due to complete after

the end of the current financial year.

The first private residential sales completed in the year under

review at West Bowling Green Street. Sales will continue in the

current financial year with the overall development due to complete

prior to the end of the current financial year.

Interest in the commercial property units at West Bowling Green

Street is positive, with potential sales due this financial

year.

Occupancy levels in our industrial and office portfolio have

improved. The total rent roll from our commercial property

portfolio has increased by 15% since the last financial year

end.

Interest in our industrial estates remains robust, with

continued rental growth through lettings of new stock and

re-lettings/rent review settlements of existing stock.

The first unit at Gartcosh through our joint venture company,

Gartcosh Estates LLP, has now been completed and interest is

promising. Due to the strong performance of the first two phases at

our industrial development at West Edinburgh Business Park, South

Gyle we commenced the third and final phase of development, after

the end of the last financial year. Similarly at Inchwood Park,

Bathgate the third and final phase of this development may commence

this financial year. The first unit at our industrial development

at Bellshill has now been successfully let.

Lettings of the office stock were encouraging this year.

Bridgeside House in Edinburgh is now 100% let after lying mainly

vacant for a number of years. A public sector related tenant let

the majority of this building. Our office building at Links Place,

Leith, Edinburgh has seen a number of lettings with occupancy up to

just over 80% by the end of the financial year. As this building

was sitting at less than 50% occupied only a few years ago, tribute

must be paid to the staff involved with this successful

turnaround.

FUTURE PROSPECTS

Work in hand in contracting is less than last year. Potential

site acquisitions and tender work in the Housing Association sector

continue to be progressed, but there will probably be no new

contracting work this financial year. This will influence the year

end figures due to reduced turnover, which will impact on the

recovery of fixed overhead costs.

As mentioned above, private housing sales will continue this

financial year at West Bowling Green Street and reservations to

date have remained steady. In relation to site acquisitions/future

development we currently have either legal agreements in place on

potential sites or sites within our control that would provide a

total of approximately 200 private residential sale units. Due to

the, frequently prolonged, planning and building control processes,

it is unlikely that development will commence on any of these sites

in the current financial year.

Property valuation levels have improved again and we expect

lettings to continue this financial year. It remains to be seen how

the continuing political uncertainty will affect the confidence of

house purchasers and commercial property occupiers.

At this stage it is difficult to make an informed forecast for

the outcome of the current year. However, due to the lull in

contracting work and new private housing work this financial year,

it seems unlikely that the underlying profit will improve.

DAVID W. SMART

Chairman

CONSOLIDATED INCOME STATEMENT

for the year ended 31st JULY 2019

2019 2018

Unaudited Audited

Restated

(Note 1

& 2)

Note GBP000 GBP000

CONTINUING OPERATIONS

Group construction activities 16,182 10,402

Less: Own construction work capitalised (147) (1,847)

---------- ---------

REVENUE 16,035 8,555

Cost of sales (14,416) (6,209)

---------- ---------

GROSS PROFIT 1,619 2,346

Other operating income 7,560 6,344

Net operating expenses (6,264) (6,521)

---------- ---------

OPERATING PROFIT BEFORE NET SURPLUS ON VALUATION

OF INVESTMENT PROPERTIES 2,915 2,169

Net surplus on valuation of investment properties 4,052 2,859

OPERATING PROFIT 6,967 5,028

Share of profits in Joint Ventures 48 463

Income from available for sale financial assets 53 43

Profit on sale of available for sale financial

assets 26 2

Net (deficit)/surplus on valuation of available

for sale financial assets (9) 106

Finance income 185 180

PROFIT BEFORE TAX 7,270 5,822

Taxation (529) (500)

PROFIT FOR THE YEAR FROM CONTINUING OPERATIONS 6,741 5,322

DISCONTINUED OPERATIONS

Loss for the year from discontinued operations 2 (505) (380)

---------- ---------

PROFIT FOR YEAR ATTRIBUTABLE TO EQUITY SHAREHOLDERS 6,236 4,942

---------- ---------

EARNINGS/(LOSS) PER SHARE

From continuing operations - basic and diluted 15.47p 11.96p

---------- ---------

From discontinued operations - basic and diluted (1.16)p (0.85)p

---------- ---------

From continuing and discontinued operations

- basic and diluted 14.31p 11.11p

---------- ---------

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

for the year ended 31st JULY 2019

2019 2018

Unaudited Audited

Restated

(Note

1)

GBP000 GBP000

PROFIT FOR THE YEAR 6,236 4,942

OTHER COMPREHENSIVE (LOSS)/INCOME

Items that will not be subsequently reclassified

to the Income Statement:

Actuarial (loss)/gain recognised in defined benefit

pension scheme (1,118) 111

Deferred taxation on actuarial loss/(gain) 190 (19)

---------- ---------

TOTAL ITEMS THAT WILL NOT BE SUBSEQUENTLY RECLASSIFIED

TO INCOME STATEMENT (928) 92

---------- ---------

TOTAL OTHER COMPREHENSIVE (LOSS)/INCOME (928) 92

---------- ---------

TOTAL COMPREHENSIVE INCOME FOR THE YEAR, NET OF

TAX 5,308 5,034

---------- ---------

ATTRIBUTABLE TO EQUITY SHAREHOLDERS 5,308 5,034

---------- ---------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

as at 31st July 2019

Capital

Share Redemption Retained

Capital Reserve Earnings Total

GBP000 GBP000 GBP000 GBP000

At 1st August 2017 (audited)

(Restated Note 1) 896 112 92,850 93,858

Profit for the year - - 4,942 4,942

Other comprehensive income - - 92 92

TOTAL COMPREHENSIVE INCOME

FOR THE YEAR - - 5,034 5,034

--------- ------------ ---------- --------

TRANSACTIONS WITH OWNERS, RECORDED DIRECTLY IN EQUITY

Shares purchased and cancelled (16) - (892) (908)

Transfer to capital redemption

reserve - 16 (16) -

Dividends - - (1,391) (1,391)

--------- ------------ ---------- --------

TOTAL TRANSACTIONS WITH OWNERS (16) 16 (2,299) (2,299)

--------- ------------ ---------- --------

At 31st July 2018 (audited)

(Restated Note 1) 880 128 95,585 96,593

--------- ------------ ---------- --------

Profit for the year - - 6,236 6,236

Other comprehensive loss - - (928) (928)

TOTAL COMPREHENSIVE INCOME

FOR THE YEAR - - 5,308 5,308

--------- ------------ ---------- --------

TRANSACTIONS WITH OWNERS, RECORDED DIRECTLY IN EQUITY

Shares purchased and cancelled (14) - (792) (806)

Transfer to capital redemption

reserve - 14 (14) -

Dividends - - (813) (813)

--------- ------------ ---------- --------

TOTAL TRANSACTIONS WITH OWNERS (14) 14 (1,619) (1,619)

At 31st July 2019 (unaudited) 866 142 99,274 100,282

--------- ------------ ---------- --------

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

as at 31st JULY 2019

2019 2018

Unaudited Audited

Restated

(Note 1)

GBP000 GBP000

NON-CURRENT ASSETS

Property, plant and equipment 1,304 1,308

Investment properties 73,874 69,532

Investments in Joint Ventures 57 68

Available for sale financial assets 1,309 1,099

Trade and other receivables 1,107 857

Retirement benefit surplus 2,899 4,205

Deferred tax asset 101 94

---------- ----------

80,651 77,163

---------- ----------

CURRENT ASSETS

Inventories 8,643 8,807

Contract assets 549 770

Trade and other receivables 2,835 3,770

Monies held on deposit 48 48

Cash and cash equivalents 25,699 23,586

---------- ----------

37,774 36,981

---------- ----------

TOTAL ASSETS 118,425 114,144

---------- ----------

NON-CURRENT LIABILITIES

Deferred tax liabilities 1,735 1,995

---------- ----------

CURRENT LIABILITIES

Trade and other payables 3,394 3,580

Current tax liability 154 118

Bank overdraft 12,860 11,858

16,408 15,556

TOTAL LIABILITIES 18,143 17,551

---------- ----------

NET ASSETS 100,282 96,593

---------- ----------

EQUITY

Called up share capital 866 880

Capital redemption reserve 142 128

Retained earnings 99,274 95,585

---------- ----------

TOTAL EQUITY 100,282 96,593

---------- ----------

CONSOLIDATED STATEMENT OF CASH FLOWS

for the year ended 31st JULY 2019

2019 2018

Unaudited Audited

Restated

(Note

1)

GBP000 GBP000

Profit before tax 6,643 5,357

Share of profits from Joint Ventures (48) (463)

Depreciation 376 427

Impairment of assets - 116

Unrealised valuation surplus on investment properties (4,052) (2,859)

Unrealised valuation deficit/(surplus) on available

for sale financial assets 9 (106)

Profit on sale of property, plant and equipment (141) (59)

Profit on sale of available for sale financial

assets (26) (2)

Change in retirement benefits 188 (232)

Interest received (71) (80)

Change in inventories 164 (5,926)

Change in contract assets 221 86

Change in receivables - non-current (250) (857)

Change in receivables - current 935 1,097

Change in payables (186) (805)

---------- ---------

3,762 (4,306)

Tax paid (448) (442)

---------- ---------

NET CASH FLOWS FROM OPERATING ACTIVITIES 3,314 (4,748)

---------- ---------

CASH FLOWS FROM INVESTING ACTIVITIES

Additions to property, plant and equipment (424) (454)

Additions to investment properties (143) (27)

Expenditure on own work capitalised - investment

properties (147) (1,847)

Sale of property, plant and equipment 193 93

Purchase of available for sale financial assets (380) -

Proceeds of sale of available for sale financial

assets 187 9

Decrease on monies held on deposit - 2,488

Interest received 71 80

Dividend from Joint Ventures 59 700

NET CASH FLOWS FROM INVESTING ACTIVITIES (584) 1,042

---------- ---------

CASH FLOWS FROM FINANCING ACTIVITIES

Purchase of own shares (806) (908)

Dividends paid (813) (1,391)

---------- ---------

NET CASH FLOWS FROM FINANCING ACTIVITIES (1,619) (2,299)

---------- ---------

INCREASE/(DECREASE) IN CASH AND CASH EQUIVALENTS 1,111 (6,005)

---------- ---------

CASH AND CASH EQUIVALENTS AT BEGINNING OF YEAR 11,728 17,733

---------- ---------

CASH AND CASH EQUIVALENTS AT OF YEAR 12,839 11,728

---------- ---------

NOTES TO THE PRELIMINARY STATEMENT

1. BASIS OF PREPARATION

The financial information set out in this unaudited preliminary

statement does not constitute the Group's statutory financial

statements. The financial statements for the year to 31st July 2019

have not yet been filed with the Registrar of Companies and have

not yet been reported on by the Company's auditor.

The unaudited financial information included in this preliminary

statement does not include all of the disclosures required by

International Financial Reporting Standards (IFRS) or the Companies

Act 2006 and accordingly does not itself comply with IFRS or the

Companies Act 2006.

The Group prepares its annual consolidated financial statements

in accordance with IFRS and its interpretations issued by the

International Accounting Standards Board as adopted by the European

Union. There are no differences in the accounting policies applied

in the preparation of the unaudited consolidated financial

statements for the year to 31st July 2019 and the unaudited

financial information included in this preliminary statement and

the accounting policies disclosed in the 2018 Annual Report and

Statement of Accounts, with the exception of the policy regarding

revenue recognition resulting from the application of IFRS 15:

Revenue from Contracts with Customers and IFRS 9: Financial

Instruments relating to the accounting of revaluation surpluses or

deficits on the Group's available for sale financial assets. The

impact of these standards is detailed below.

The following standards, amendments to standards and

interpretations became mandatory for the first time for the

financial year to 31st July 2019:

-- IFRS 9: Financial Instruments

-- IFRS 15: Revenue from Contracts with Customers

-- IAS 40 (amended): Investment Properties

These standards had no material impact on the financial

statements but the application on IFRS 9: Financial Instruments

resulted in the restatement of prior year figures as detailed

below.

IFRS 9: Financial Instruments became effective as from 1st

August 2018. This standard changes the accounting for revaluation

surpluses or deficits on available for sale financial assets.

Previously these surpluses or deficits were accounted for in the

Consolidated Statement of Comprehensive Income together with the

taxation impact of these surpluses or deficits. Under IFRS 9 these

surpluses or deficits are accounted for in the Consolidated Income

Statement together with taxation impact. There is no impact on the

valuation of the available for sale financial assets or the

deferred tax provision in relation to their valuation in the

Consolidated Statement of Financial Position. Within the Equity

section of the Consolidated Statement of Financial Position the

Fair value reserve no longer exists as the fair value movement is

included in Retained earnings.

The application of IFRS 9: Financial Instruments has been

applied retrospectively and accordingly the comparative figures

have been restated for the year to 31st July 2018.

The table below details the impact of the application of IFRS 9:

Financial Instruments on the Consolidated Income Statement and the

Consolidated Statement of Comprehensive Income for the year to 31st

July 2018:

CONSOLIDATED INCOME STATEMENT

GBP000

PROFIT BEFORE TAX (as previously reported) 5,253

Impact of net surplus on valuation of available

for sale financial assets 104

---------

5,357

---------

TAX (as previously reported) (402)

Impact of deferred tax adjustment

on fair value reserve (13)

---------

(415)

---------

PROFIT ATTRIBUTABLE TO EQUITY SHAREHOLDERS - REVISED 4,942

---------

Impact on profit attributable to equity shareholders 91

---------

TOTAL COMPREHENSIVE INCOME FOR THE PERIOD (as previously

reported) 5,034

Impact on profit for the period -

increase (as above) 91

--------

5,125

Other comprehensive income relating to fair value

of available for sale financial assets - no longer

accounted for in Statement of Comprehensive Income (91)

TOTAL COMPREHENSIVE INCOME FOR THE PERIOD 5,034

--------

PROFIT ATTRIBUTABLE TO EQUITY SHAREHOLDERS 5,034

--------

IFRS 15: Revenue from Contracts with Customers became effective

from 1st August 2018. It replaces IAS 11: Construction Contracts

and IAS 18: Revenue and sets out the criteria for revenue

recognition with regards to performance obligations. As stated in

the Group's 2018 Annual Report and Statement of Accounts the

implementation of this standard has not had a material impact on

the revenue or cash flows reported by the Group for the year to

31st July 2019. In respect of construction contracts this standard

has no impact on revenue from customers. The standard allows for

the recognition of revenue over time for the performance obligation

based on stage of completion of the contracts which is in line with

the Group's policy. The recognition of revenue from private house

sales or sales of land was not impacted by the new standard as this

revenue is recognised on completion of the performance obligation

of the supply of the housing or the land. This standard does not

apply to rental income from our investment properties but does

apply to service charge income and other property related income

and income from sale of investment properties. The new standard

does not impact on the Group's current policy of recognition of

these income types.

IAS 40 (amended): Investment Properties became effective from

1st August 2018. The amendment to this standard relating to the

transfer of properties to and from Investment Properties has no

impact on the Group's financial statements for the year.

The unaudited consolidated financial statements are prepared on

a going concern basis and under the historical cost convention

except where the measurement of balances at fair value is required

for investment properties, available for sale financial assets and

assets held by the defined benefit pension scheme.

The financial information for the year to 31st July 2018 is

derived from the statutory accounts for that year which were

submitted to the Registrar of Companies and upon which the

Company's auditor provided an unqualified audit report. The audit

report did not include a reference to any matters to which the

auditor drew attention by way of emphasis without qualifying its

report and did not contain a statement under S498 (2) or S498 (3)

of the Companies Act 2006.

2. DISCONTINUED OPERATIONS

On 9th November 2018 the Group Directors took the decision that

the subsidiary company, Concrete Products (Kirkcaldy) Limited

should cease trading.

The results of the discontinued operation, which have been

included in the profit for the year, were as follows:

2019 2018

GBP000 GBP000

Unaudited Audited

Revenue 645 2,100

Cost of sales (817) (1,909)

---------- --------

Gross (Loss)/Profit (172) 191

Other operating income 6 8

Net operating expenses (461) (664)

---------- --------

Loss before tax (627) (465)

Taxation 122 85

---------- --------

Net loss attributable to discontinued operations

(attributable to owners of the Company) (505) (380)

---------- --------

3. DIVIDENDS

Ordinary dividends

2017 Final dividend of 2.17p per share - 968

2018 Interim dividend of 0.95p per share - 423

2018 Final dividend of 2.21p per share, after 402 -

waivers

2019 Interim dividend of 0.95p per share 411 -

---- ------

813 1,391

---- ------

The Company is proposing a final dividend of 2.24p per share for

the year to 31st July 2019 which, after waivers, will cost the

Company no more than GBP390,000.

The dividend if approved will be paid on 30th December 2019 to

shareholders on the Register at the close of business on 6th

December 2019.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR USAKRKWARURA

(END) Dow Jones Newswires

October 24, 2019 05:22 ET (09:22 GMT)

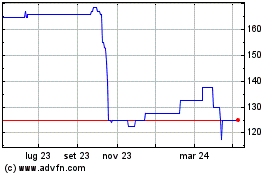

Grafico Azioni Smart (j.) & Co. (contra... (LSE:SMJ)

Storico

Da Mar 2024 a Apr 2024

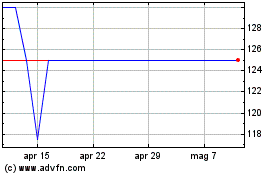

Grafico Azioni Smart (j.) & Co. (contra... (LSE:SMJ)

Storico

Da Apr 2023 a Apr 2024