Bank of America Adds 40 Model Portfolios to Merrill Lynch Investment Advisory Program

28 Ottobre 2019 - 1:00PM

Business Wire

New Investment Manager Model Portfolios Offer

Clients More Choice and Flexibility, With Guidance From the

Company’s Chief Investment Office

Bank of America today announced that it has added 40 new model

portfolios to its investment platform, providing clients and

advisors greater choice and flexibility when developing

personalized portfolios aligned to each client’s unique goals.

Available exclusively to Merrill Lynch Wealth Management clients,

the new model portfolios have been created and are managed by

BlackRock, JP Morgan, Franklin Templeton and Natixis Investment

Managers.

Since launching model portfolios under its Chief Investment

Office (CIO) in 2017, the company has expanded its suite of

offerings with CIO asset allocation guidance to more than 165

active, passive, hybrid and sustainable impact investing portfolios

– 125 of which are managed by its CIO team of investment

professionals.

“The focus of investing has begun to shift from product

selection to portfolio construction, with the true value of advice

for clients being the ability to customize unique paths toward

reaching their goals,” said Keith Banks, head of the Investment

Solutions Group at Bank of America. “Through the expansion of our

model portfolio offerings, we’re further integrating investment

managers into our strategy, while diversifying options and

viewpoints to the benefit of our clients.”

The new model portfolios introduced today are:

- Immediately available, giving clients and advisors access to 40

new model portfolios – 10 from each of the four investment

managers. These multi-asset, multi-manager, hybrid portfolios are

made up of a mix of mutual funds and exchange-traded funds, and are

available across investor profiles – from conservative to

aggressive – and tax approaches.

- Informed by the CIO strategic asset allocation as the policy

benchmark. Within the models, investment managers have the

flexibility to implement their own tactical views. These views may

be based on their market outlook and investment processes,

including potential changes to use passive and active investments

and by increasing, decreasing or using additional asset categories

within the equity or fixed income allocation. These variations

offer advisors more choice when selecting the appropriate portfolio

for clients.

- Exclusively available through the Merrill Lynch Investment

Advisory Program, with a minimum initial investment of

$50,000.

Platform and processes built around the value of

advice

Within its Investment Solutions Group, the CIO serves as a

differentiator for Bank of America Corporation, bringing together

120 investment professionals from across the organization to

provide a consistent, end-to-end, institutional-quality investing

process that includes investment viewpoints, guidance, portfolio

solutions, due diligence and insights. Within its flexible

framework, advisors and their clients can determine the level to

which they want to incorporate CIO views into their practice and

portfolios. CIO model portfolios and those provided by third

parties enable advisors to customize and personalize solutions for

clients at all wealth levels.

“Our advisors are at the center of the investing process, with

the value of their advice rooted in a deep understanding of what

their clients want and need,” said Keith Glenfield, head of

investment products for Bank of America. “Access to a wide range of

products and platforms, combined with our robust specialist

organization, gives our advisors a competitive advantage to develop

personalized approaches when helping clients pursue their

goals.”

Today, nine out of 10 Merrill advisors use at least one CIO

model portfolio, and 25 percent of them manage one-quarter or more

of the assets in their practice in CIO portfolios.

According to Bank of America Chief Investment Officer Chris

Hyzy, “By leveraging our CIO team as an extension of their

practice, advisors have the potential to deliver more consistent

outcomes and a better experience for clients, and to gain back time

to focus on aspects of wealth management that clients value

most.”

Bank of America Bank of America is one of the world’s leading

financial institutions, serving individual consumers, small and

middle-market businesses and large corporations with a full range

of banking, investing, asset management, and other financial and

risk management products and services. The company provides

unmatched convenience in the United States, serving approximately

66 million consumer and small business clients with approximately

4,300 retail financial centers, including approximately 2,400

lending centers, 2,600 financial centers with a Consumer Investment

Financial Solutions Advisor and 1,900 business centers;

approximately 16,600 ATMs; and award-winning digital banking with

nearly 38 million active users, including approximately 29 million

mobile users. Bank of America is a global leader in wealth

management, corporate and investment banking and trading across a

broad range of asset classes, serving corporations, governments,

institutions and individuals around the world. Bank of America

offers industry-leading support to approximately 3 million small

business owners through a suite of innovative, easy-to-use online

products and services. The company serves clients through

operations across the United States, its territories and

approximately 35 countries. Bank of America Corporation stock

(NYSE: BAC) is listed on the New York Stock Exchange.

For more Bank of America news, including dividend announcements

and other important information, visit the Bank of America

newsroom. Click here to register for news email alerts.

www.bankofamerica.com

Merrill Lynch, Pierce, Fenner & Smith Incorporated (also

referred to as “MLPF&S” or “Merrill”) makes available certain

investment products sponsored, managed, distributed or provided by

companies that are affiliates of Bank of America Corporation (“BofA

Corp.”). MLPF&S is a registered broker-dealer, registered

investment adviser, Member SIPC and a wholly owned subsidiary of

BofA Corp.

Investment products:

Are Not FDIC

Insured

Are Not Bank

Guaranteed

May Lose

Value

© 2019 Bank of America Corporation. All rights reserved.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20191028005054/en/

Reporters May Contact: Matt Card, Bank of America,

1.617.434.1388 matthew.card@bofa.com

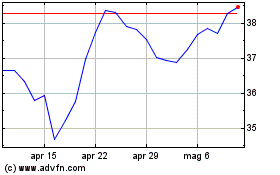

Grafico Azioni Bank of America (NYSE:BAC)

Storico

Da Mar 2024 a Apr 2024

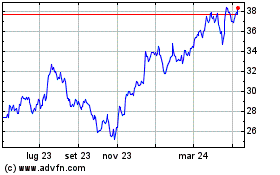

Grafico Azioni Bank of America (NYSE:BAC)

Storico

Da Apr 2023 a Apr 2024