TIDMTSI

RNS Number : 3951R

Two Shields Investments PLC

29 October 2019

29 October 2019

Two Shields Investments plc

("TSI", "Two Shields" or the "Company")

Placing and proposed Investments in BrandShield and WeShop

Two Shields Investments plc, the AIM quoted investment company

with a revised strategy focused on building a portfolio of

investments in fast growing disruptive markets including technology

metals, cyber security, e-commerce and technology enabled

businesses, is pleased to announce that it has raised GBP1,000,000

(gross) via an oversubscribed placing (the "Placing") with existing

and new investors of 1,000,000,000 new ordinary shares in the

Company (the "Placing Shares") at a price of 0.1p pence per Placing

Share ("the Placing Price") and 1 warrant for every 2 Placing

Shares subscribed exercisable at 0.2p for a period of twelve months

("the Placing Warrants") from 1 November 2019. The Placing was

undertaken by the Company's broker, Turner Pope Investments Ltd

("Turner Pope").

Overview

-- GBP1,000,000 (gross) raised via a placing of 1,000,000,000

new ordinary shares at 0.1p per share & issue of 500,000,000

warrants exercisable for twelve months from 1 November 2019 at 0.2p

per share

-- Investment from existing and new shareholders, including

entrepreneur Doug Barrowman and Hawk Investments

-- Placing proceeds will support the development of current

portfolio companies, including up to GBP400,000 to fund further

investment in BrandShield, an anti-counterfeiting, anti-phishing

and online brand protection solution and up to GBP400,000 in to

WeShop which is an innovative, digital social network platform

focused on the rapidly growing and highly valuable social

e-commerce sector.

The oversubscribed Placing has been undertaken with both

existing and new shareholders, including experienced investor Mr

Doug Barrowman, who has subscribed for 250,000,000 Shares which

will represent approximately 5.6% of the enlarged share capital of

the Company and Hawk Investments, which has also subscribed for

250,000,000 shares, which will also represent approximately 5.6% of

the enlarged issued share capital. The proceeds of the

oversubscribed Placing will be invested in line with the Company's

revised strategy to build a portfolio of investments in digital and

technology enabled assets and disruptive technologies. Of net

proceeds, the Company expects to invest up to:

i) GBP400,000 in BrandShield, an anti-counterfeiting,

anti-phishing and online brand protection solution; in which TSI

currently has a 11.34% shareholding and has also invested a further

US$300,000 in BrandShield by way of a convertible loan; and

ii) GBP400,000 into WeShop which is an innovative, digital

social network platform focused on the rapidly growing and highly

valuable social e-commerce sector, in which TSI currently has a

6.7% shareholding.

As was announced to the market on 4 March 2019, the Company

completed its investment of US$300,000 in BrandShield via a

convertible loan ("Convertible Loan"), which was entered into

between the Company and BrandShield on 29 March 2019 ("Closing

Date"). The Convertible Loan will convert in to equity on the

Maturity Date, that being the second anniversary of the Closing

Date unless an accelerated conversion event occurs on an earlier

date ("Accelerated Conversion Event"), and has a 2.5% coupon. An

Accelerated Conversion Event, shall include, inter alia, an IPO or

sale of BrandShield or BrandShield undertaking a qualified

fundraising round.

Pursuant to the Convertible Loan the Company had the right to

make a further investment of US$500,000 in BrandShield within a

period of 180 days from the Closing Date under the same terms of

the Convertible Loan.

The Company has negotiated with BrandShield for it to accept the

investment (pursuant to the terms of the Convertible Loan) of

GBP400,000 from TSI even though the 180-day period from the Closing

Date had expired. Furthermore, the Company has entered into an

option agreement with BrandShield ("the BrandShield Option")

whereby TSI will have the option to invest a further amount of up

to US$1,000,000 in BrandShield on the same terms as the Convertible

Loan. The BrandShield Option is valid for 9 months from signing of

any share purchase agreement. TSI will continue to seek to build

its stake in BrandShield and will continue to advise BrandShield on

strategic growth opportunities, including the preferred option to

achieve a listing on the AIM market of the London Stock Exchange in

early 2020.

The Company proposes to invest a further approximately

GBP400,000 in to WeShop by way of an equity investment. Following

the positive investor update from WeShop as announced by the

Company on 9 July 2019, the Board feels it is very much in the

interests of shareholders to continue to support this exciting

business as it approaches what we believe will be a highly

expansive period. The approximately GBP400,000 investment will take

our holding in WeShop from 6.7% to 8.24%.

About BrandShield

BrandShield was established by brand protection industry

professionals with a goal to develop cutting-edge technology that

will provide organisations a powerful solution to manage and

protect their brand online. Backed by Israel's Innovation Authority

and with an R&D centre based in Israel, the company is

committed to a continuous development of a solution that meets the

needs of all sizes of entities from small companies to large

enterprises.

In calendar year 2018 BrandShield increased its Annual Recurring

Revenue ("ARR") by 112%. This growth trend continues in 2019 with a

year to date performance of approximately 50% ARR growth. Average

revenue per client increased significantly in 2018 as a result of

the introduction of BrandShield's new online threat hunting and

social anti-phishing solutions, with 13% of the new business coming

from existing customers' expansion. BrandShield has continued to

win a number of high-profile global customers in 2019.

About WeShop

WeShop is an innovative, digital social network platform focused

on the rapidly growing and highly valuable social e-commerce sector

forecast to become a US$350 billion market over the mid-term.

WeShop's digital platform enhances online shopping experiences by

combining social media's assets of reviews, likes, and shares with

an engaging retail e-commerce offering, specifically tailored to

the individual user. Users benefit from gaining access to thousands

of brands and millions of products on one platform plus a two-way

sharing of ideas with friends to participate in a rewards system;

brands/retailers benefit from increased sales and awareness.

Led by highly experienced and proven technology and retail

professionals James Sowerby, who previously led Global New Business

Development at Avon Cosmetics, the oldest and one of the most

successful global social selling networks, and non-executive

Chairman Matthew Hammond, who is Group Managing Director and CFO of

mail.ru, one of the largest internet companies in the Russian

speaking market.

WeShop recently delivered an investor update and the Board feels

it is in the interests of TSI shareholders to continue to support

this exciting business as it approaches what we believe will be a

highly expansive period.

WeShop has also launched phase 1 of its new rewards programme,

designed to drive ongoing engagement and retention of users by

enabling them to earn WeCoins(TM) for creation and distribution of

quality content, shopping through WeShop verified merchants, and

browsing. The WeCoins(TM) can be redeemed with over 100+ redemption

partners, including Uber, Spotify, Just Eat, Amazon, Starbucks and

many others. Phase 1 allows users to redeem their WeCoins(TM) for a

digital voucher. Phase 2 will allow users to redeem their live

WeCoin(TM) balance against products on WeShop, in combination with

cash. This creates a true ecosystem where WeCoins(TM) are earned

and redeemed within the platform.

Chairman of Two Shields, Andrew Lawley, said:

"I would like to welcome our new Investors and thank existing

investors for their continued support as Two Shields continues its

journey and transition into the next phase of development. I have

spent a considerable amount of time with both BrandShield and

WeShop and I am very excited about prospects and growth trajectory.

We look forward to further developments and I expect BrandShield

and WeShop to become the significant drivers of value within

TSI."

Admission and Total Voting Rights

The Shares were allotted on 28 October 2019. Application will be

made for the admission of the new Ordinary Shares to trading on AIM

("Admission"), with Admission expected to take place on or around 1

November 2019.

Following Admission, the Company's issued share capital will

comprise 4,445,172,896 Ordinary Shares, each with voting rights.

The above figure of 4,445,172,896 Ordinary Shares may be used by

shareholders in the Company as the denominator for the calculations

by which they will determine if they are required to notify their

interest in, or a change in their interest in, the share capital of

the Company under the Disclosure Guidance and Transparency

Rules.

This announcement contains inside information for the purposes

of article 7 of the Market Abuse Regulation (eu) 596/2014

-Ends-

For further information please visit https://twoshields.co.uk/

or contact:

Two Shields Investments +44 (0)20 3143

Andrew Lawley plc 8300

Spark Advisory Partners

Limited +44 (0) 20 3368

Neil Baldwin / Andrew Emmott (Nominated Adviser) 3554

Turner Pope Investments

Ltd +44 (0) 20 3657

Andy Thacker / Zoe Alexander (Broker) 0050

Notes to Editors:

Two Shields Investments plc, the AIM quoted investment company

with a strategy to build a portfolio of high-quality investments in

fast growing, scalable digital and technology enabled businesses,

including those in the cyber security, e-commerce services and

consumer sectors. The Company has appointed an experienced Board of

Directors with a proven pedigree in the origination, acquisition,

development & sale of projects and creating value for

shareholders. The investment mandate covers unquoted and quoted

businesses, as well as direct project investment. Where appropriate

the Board will apply its extensive combined experience to directly

support investee businesses achieve their growth potential.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCEAFEPALFNFAF

(END) Dow Jones Newswires

October 29, 2019 03:00 ET (07:00 GMT)

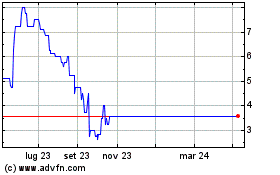

Grafico Azioni Brandshield Systems (LSE:BRSD)

Storico

Da Mar 2024 a Apr 2024

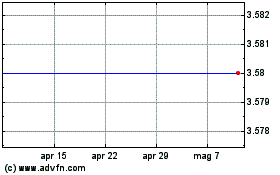

Grafico Azioni Brandshield Systems (LSE:BRSD)

Storico

Da Apr 2023 a Apr 2024