TIDMSYN

RNS Number : 3905R

Synnovia PLC

29 October 2019

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY IN, INTO OR FROM ANY JURISDICTION

WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR

REGULATIONS OF THAT JURISDICTION

RECOMMED CASH OFFER

FOR

SYNNOVIA PLC ("Synnovia" or the "Company")

BY

BPF1 LIMITED ("BIDCO"), A WHOLLY-OWNED SUBSIDIARY OF FUNDS

ADVISED BY CAMELOT CAPITAL PARTNERS LLC

CANCELLATION FROM TRADING ON AIM

Further to the announcement by Bidco made this morning

confirming that the Offer is now wholly unconditional following

Bidco's decision to waive the acceptance condition under the Offer,

Synnovia has informed the London Stock Exchange that it wishes to

cancel the admission to trading of the Synnovia Shares on AIM (the

"Cancellation"). Cancellation is expected to take effect from

7:00am on 26 November 2019, being 20 business days from the date of

this announcement. Following Cancellation, Bidco will seek to

re-register Synnovia as a private limited company.

The Cancellation and the re-registration of Synnovia as a

private limited company will significantly reduce the liquidity and

marketability of any Synnovia Shares in respect of which the Offer

has not been accepted at that time. Any remaining Synnovia

Shareholders would become minority shareholders in a majority

controlled private limited company and may therefore be unable to

sell their Synnovia Shares. There can be no certainty that such

minority Synnovia Shareholders would again be offered an

opportunity to sell their Synnovia Shares on terms which are

equivalent to or no less advantageous than those under the

Offer.

Capitalised terms used in this announcement, unless otherwise

defined, have the same meanings as set out in the offer document

issued by Synnovia on 23 September 2019 (the "Offer Document").

Actions to be taken

Shareholders who have not yet accepted the Offer are urged to do

so as soon as possible. If you hold your Synnovia Shares, or any of

them, in Certificated Form (that is, not in CREST), to accept the

Offer in respect of all or some of those Synnovia Shares, you must

follow the procedure set out in paragraph 14.1 of the letter from

Bidco included in the Offer Document. In particular, you must

complete the personalised Form of Acceptance in accordance with the

instructions printed on it and return the completed Form of

Acceptance (along with your original share certificate(s) and/or

other documents of title) by post or by hand (during normal

business hours only) to Link Asset Services, Corporate Actions, The

Registry, 34 Beckenham Road, Beckenham, Kent BR3 4TU as soon as

possible and, in any event, so as to be received by no later than

1.00 pm (London time) on 11 November 2019.

If you are posting in the UK, a reply-paid envelope has been

provided for your convenience. If you hold your Synnovia Shares, or

any of them, in Uncertificated Form (that is, in CREST), to accept

the Offer in respect of some or all of those Synnovia Shares, you

must follow the procedure set out in paragraph 14.2 of the letter

from Bidco so that the TTE Instruction settles as soon as possible

and, in any event, no later than 1.00 pm (London time) on 11

November 2019. If you hold your Synnovia Shares as a CREST

sponsored member, you should refer to your CREST Sponsor as only

your CREST Sponsor will be able to send the necessary TTE

Instruction to Euroclear.

If you require assistance in completing your Form of Acceptance

(or wish to obtain an additional Form of Acceptance), or have

questions in relation to this document, including making an

electronic acceptance, please contact the Receiving Agent, Link

Asset Services on 0371 664 0321. Calls are charged at the standard

geographic rate and will vary by provider. Calls outside the United

Kingdom will be charged at the applicable international rate. The

helpline is open between 9.00 am - 5.30 pm, Monday to Friday

excluding public holidays in England and Wales. Please note that

Link Asset Services cannot advise on the merits of the Offer nor

provide any financial, legal or tax advice and calls may be

recorded and monitored for security and training purposes. Calls

are charged at the standard geographic rate and will vary by

provider. The helpline is open between 9.00 am - 5.30 pm, Monday to

Friday excluding public holidays in England and Wales. Different

charges may apply to calls from mobile telephones and calls may be

recorded and randomly monitored for security and training

purposes.

Enquiries:

Synnovia

Nick Ball (Group Finance Director) Tel: 020 7978 0574

Numis Securities Limited (financial adviser Tel: 020 7260 1000

to Bidco)

Stuart Ord

George Fry

Jono Mawson

Cenkos Securities plc (financial adviser and

nominated adviser to Synnovia)

Stephen Keys Tel: 020 7397 8900

Callum Davidson

Important Information

Numis Securities Limited ("Numis"), which is authorised and

regulated in the United Kingdom by the Financial Conduct Authority,

is acting exclusively as financial adviser to Bidco and no one else

in connection with the Offer and other matters referred to in this

announcement. In connection with these matters, Numis, its

affiliates and their respective directors, officers, employees and

agents will not regard any other person as their client, nor will

they be responsible to anyone other than Bidco for providing the

protections afforded to the clients of Numis nor for providing

advice in relation to the matters referred to in this

announcement.

Cenkos Securities plc ("Cenkos"), which is authorised and

regulated in the United Kingdom by the Financial Conduct Authority,

is acting exclusively as financial adviser to Synnovia and no-one

else in connection with the Offer and other matters referred to in

this announcement. In connection with these matters, Cenkos, its

affiliates and their respective directors, officers, employees and

agents will not regard any other person as their client, nor will

they be responsible to anyone other than Synnovia for providing the

protections afforded to the clients of Cenkos nor for providing

advice in relation to the matters referred to in this

announcement.

Further information

This announcement is not intended to, and does not, constitute,

or form part of, any offer, invitation or the solicitation of an

offer to purchase, otherwise acquire, subscribe for, sell or

otherwise dispose of any securities, or the solicitation of any

vote or approval in any jurisdiction, pursuant to the Offer or

otherwise. The Offer is being made solely by means of the Offer

Document and the Form of Acceptance accompanying the Offer

Document, which contains the full terms of, and Conditions to, the

Offer, including details of how the Offer may be accepted. Any

response to the Offer should be made only on the basis of

information contained in the Offer Document. Synnovia Shareholders

are advised to read the formal documentation in relation to the

Offer carefully.

This announcement has been prepared for the purposes of

complying with English law, the AIM Rules and the Code and the

information disclosed may not be the same as that which would have

been disclosed if this announcement had been prepared in accordance

with the laws and regulations of any jurisdiction outside the

United Kingdom.

Overseas jurisdictions

The distribution of this announcement in jurisdictions other

than the United Kingdom and the ability of Synnovia Shareholders

who are not resident in the United Kingdom to participate in the

Offer may be affected by the laws of relevant jurisdictions.

Therefore any persons who are subject to the laws of any

jurisdiction other than the United Kingdom or Synnovia Shareholders

who are not resident in the United Kingdom will need to inform

themselves about, and observe, any applicable legal or regulatory

requirements. Any failure to comply with the applicable

restrictions may constitute a violation of the securities laws of

any such jurisdiction. Further details in relation to overseas

Synnovia Shareholders is contained in the Offer Document.

The Offer is not being, and will not be, made available,

directly or indirectly, in or into or by the use of the mails of,

or by any other means or instrumentality of interstate or foreign

commerce of, or any facility of a national state or other

securities exchange of, any Restricted Jurisdiction unless

conducted pursuant to an exemption from the applicable securities

laws of such Restricted Jurisdiction.

Accordingly, copies of this announcement and all documents

relating to the Offer are not being, and must not be, directly or

indirectly, mailed, transmitted or otherwise forwarded, distributed

or sent in, into or from any Restricted Jurisdiction except

pursuant to an exemption from the applicable securities laws of

such Restricted Jurisdiction and persons receiving this

announcement (including, without limitation, agents, nominees,

custodians and trustees) must not distribute, send or mail it in,

into or from such jurisdiction. Any person (including, without

limitation, any agent, nominee, custodian or trustee) who has a

contractual or legal obligation, or may otherwise intend, to

forward this announcement and/or the Offer Document and/or any

other related document to a jurisdiction outside the United Kingdom

should inform themselves of, and observe, any applicable legal or

regulatory requirements of their jurisdiction.

Publication on website

A copy of this announcement will be available, free of charge

(subject to any applicable restrictions relating to persons

resident in Restricted Jurisdictions), for inspection on Synnovia's

website at www.synnovia.com/investors by no later than 12 noon

(London time) on the Business Day following the publication of this

announcement and will continue to be made available until the end

of the Offer Period.

For the avoidance of doubt, neither the content of any website

referred to in this announcement nor the content of any website

accessible from hyperlinks is incorporated into or forms part of

this announcement.

Documents in hard copy form

Any person entitled to receive a copy of documents,

announcements and information relating to the Offer is entitled to

receive such documents and all information incorporated into such

documents by reference to another source in hard copy form. Unless

such a person makes such a request, a hard copy of this

announcement and the Offer Document and any such information

incorporated by reference in it will not be sent to that person.

Such person may request that all future documents, announcements

and information in relation to the Offer are sent to them in hard

copy form.

Copies of this announcement and the Offer Document (and any

information incorporated by reference in that document) and all

future documents, announcements and information required to be sent

to persons in relation to the Offer may be requested from the

Receiving Agent, Link Asset Services on 0371 664 0321. Calls are

charged at the standard geographic rate and will vary by provider.

Calls outside the United Kingdom will be charged at the applicable

international rate. The helpline is open between 9.00 am - 5.30 pm,

Monday to Friday excluding public holidays in England and Wales.

Please note that Link Asset Services cannot provide any financial,

legal or tax advice and calls may be recorded and monitored for

security and training purposes.

Information relating to Synnovia Shareholders

Please be aware that addresses, electronic addresses and certain

other information provided by Synnovia Shareholders, persons with

information rights and other relevant persons for the receipt of

communications from Synnovia may be provided to Bidco during the

Offer Period as required under Section 4 of Appendix 4 to the

Takeover Code.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCLLFFTIILTFIA

(END) Dow Jones Newswires

October 29, 2019 03:01 ET (07:01 GMT)

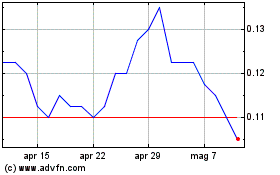

Grafico Azioni Synergia Energy (LSE:SYN)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Synergia Energy (LSE:SYN)

Storico

Da Apr 2023 a Apr 2024