TIDMSJH

RNS Number : 8270R

St James House PLC

31 October 2019

Dissemination of a Regulatory Announcement that contains inside

information according to REGULATION (EU) No 596/2014 (MAR).

St James House PLC

("SJH" or the "Company" or the "Group")

Half-Yearly Report for the period ended 31 July 2019 and Trading

Update

31 October 2019

Half-Yearly Report

For the half year to 31 July 2019 the Group incurred a loss

before tax of GBP1,296,000, all of which related to continuing

operations (H1 18: GBP668,000 loss) (year to 31 January 2019:

GBP2,755,000 loss).

The combined companies within the Payments Division have been

making progress in software development and roll out of new key

services.

The period to 31 July 2019 saw completion of IBAN account

software and testing with a small number of beta clients. The

process involved identifying suitable partners to work on both

regulatory and banking structures.

The period also saw the acquisition of Another Ops Limited

(subsequently renamed Market Access Limited), a prepaid card

issuing business and the integration of that business into the

merchant services business within our Payment Division.

The combined offering means the company can now provide merchant

services and settlement accounts to new and existing clients, as

well as offering those services as a stand-alone product set,

giving greater control and flexibility to our clients about how

they wish to receive and distribute receipts.

Underperformance in the foreign exchange space led to a

re-organisation, the departure of previous management with a

renewed focus on developing business in areas where our staff are

most experienced, in particular online gaming and other e-commerce

platforms.

The Group's lottery management business, Prize Provision

Services Limited ("PPSL") enjoyed a positive half year with the

addition of two well-known clients, Lincoln City Football Club and

Unite the Union, to the portfolio of managed lotteries.

In--- addition, in March 2019, the first scratch card client was

announced as the Bolton-based charity Families and Babies ordered

5,000 scratch cards.

Unite2Win, the lottery managed on behalf of the Unite the

Union's Benevolent Fund, resulted in total lines played increasing

by approximately one-third during the previous 12 months to

date.

During the six months to 31 July 2019, the Group announced a

number of organisational and structural changes which are detailed

at the end of the announcement.

Trading Update

In recent weeks we have seen a steady increase in cards issued,

despite the pre-paid card programme announced on 9 July 2019

remaining at zero cards in issue. The number of pre-paid cards

issued to date has fallen short of the figures mentioned in the

announcement of 17 September 2019 due to delays experienced by a

major client in commencing the project. No material level of cards

has been issued to this client to date, and the target date for the

full issue has been extended to the end of January. The uptake of

the new payment account service (as announced on 17 September 2019)

is promising, with a number of Euro accounts open and a handful of

beta clients about to begin testing U.K. format Sterling

accounts.

These accounts are linked via our technology to the An-Other

card, giving clients the opportunity to use them in a similar

fashion to a debit card, or to opt for fixed limits on balances

which require topping up as they run low.

While the Payment Division is making progress, it is much slower

than the Board had hoped. In particular, no merchant services are

currently being processed due to issues with the nature of traffic

from clients onboarded during July and August that remain in

progress. As a result, the Payment Division continues to be

lossmaking.

PPSL has continued to grow since the end of the half year and it

remains on course to deliver a positive contribution to the Group

during the second half of this financial year, however this is not

sufficient to offset the losses in the Payment Division.

The Board therefore does not currently expect an improvement on

the financial performance during the second half of the year and

the Group's working capital position remains constrained.

Roger Matthews

Chairman

For further information, contact:

St James House PLC 020 3655 5000

Roger Matthews, Chairman

Website www.sjhplc.com

Allenby Capital Limited (Nomad & Broker)

John Depasquale/Nick Harriss 020 3328 5656

Notes to editors:

St James House PLC (AIM: SJH) is an AIM quoted lottery,

software, gaming and leisure company.

SJH has a range of ecommerce products that suit all merchants'

and customers' needs enabling secure payments. The Company works

within both regulated frameworks and in regions where traditional

partners struggle to offer safe, secure services.

In addition, SJH operates the Weather Lottery, which has been in

operation since 2002 and the Company holds one of the limited

number of UK external lottery manager's licences. Over GBP5.4

million has been raised to date for good causes and the lottery has

paid over GBP4.9 million in prizes to winners.

SJH also has a joint venture agreement via Soccerdome Ltd

operating a five a side football complex in Nottingham.

CONDENSED CONSOLIDATED INCOME STATEMENT

6 month 6 month 12 month

Period ended Period ended Ended

31-Jul 31-Jul 31-Jan

2019 2018 2019

Notes (unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Continuing Operations:

Revenue 422 550 938

Cost of Sales (176) (124) (252)

--------------------------------- -------------------------------- -----------------------

Gross Profit 246 426 686

Administrative expenses (1,564) (1,093) (3,020)

Impairment of Intangible

assets - - (440)

Operating profit before exceptional

items (1,318) (666) (2,774)

(Finance expenses)/Interest

income 22 (2) 19

(Loss)/Profit before

taxation (1,296) (668) (2,755)

Taxation - - -

--------------------------------- -------------------------------- -----------------------

Profit for the period from

continuing operations (1,296) (668) (2,755)

Profit for the period from

discontinued operations 4 - 3,461 3,162

Revaluation of equity

investment - - (9)

Total comprehensive income (1,296) 2,793 398

--------------------------------- -------------------------------- -----------------------

PROFIT/(LOSS) PER SHARE

Basic (loss)/profit per

ordinary share 2 (0.42p) 1.05p 0.15p

--------------------------------- -------------------------------- -----------------------

Fully diluted (loss)/profit per

ordinary share (0.42p) 1.05p 0.15p

--------------------------------- -------------------------------- -----------------------

There are no recognised income or expenses other than the loss

for the period.

CONDENSED CONSOLIDATED BALANCE SHEET

As at As at As at

31-Jul 31-Jul 31-Jan

2019 2018 2019

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Notes

ASSETS

Non-current assets

Property, plant and

equipment 8 3 3

Goodwill 572 158 158

Intangible assets 1,174 1,762 1,009

10-year loan notes 1,725 2,000 1,722

------------------------------- ------------------------------- ---------------------

Investments in Equity

Instruments 213 222 213

------------------------------- ------------------------------- ---------------------

3,692 4,145 3,105

------------------------------- ------------------------------- ---------------------

Current assets

Trade and other

receivables 1,543 1,465 1,449

Cash and cash

equivalents 317 1,050 371

------------------------------- ------------------------------- ---------------------

1,860 2,515 1,820

------------------------------- ------------------------------- ---------------------

Total Assets 5,552 6,660 4,925

------------------------------- ------------------------------- ---------------------

LIABILITIES

Current liabilities

Trade and other

payables 2,891 1,212 1,858

Bank and other

borrowings 6 6 6

------------------------------- ------------------------------- ---------------------

2,897 1,218 1,864

Non-current

liabilities 590 - -

------------------------------- ------------------------------- ---------------------

3,487 1,218 1,864

------------------------------- ------------------------------- ---------------------

Total

Assets/(Liabilities) 2,065 5,442 3,061

------------------------------- ------------------------------- ---------------------

EQUITY

Capital and reserves attributable to equity holders

Called up share

capital 3 3,116 2,816 2,816

Share premium account 3,020 3,020 3,020

Merger reserve 999 999 999

Revaluation reserve 213 222 213

Retained earnings (5,283) (1,615) (3,987)

------------------------------- ------------------------------- ---------------------

Total equity 2,065 5,442 3,061

------------------------------- ------------------------------- ---------------------

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Share Share Merger Revaluation Retained

Capital Premium Reserve Reserve Earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1

February

2018 2,356 3,020 999 222 (4,408) 2,189

Issue of new

shares in

the

period 460 - - - - 460

Loss for the

period from

continuing

operations - - - - (668) (668)

Loss for the

period from

discontinued

operations - - - - (238) (238)

Exceptional

profit

on sale of

subsidiaries - - - - 3,699 3,699

---------------------------------- -------- -------- ------------ --------------------------------- ---------------------------------

Balance at

31

July 2018 2,816 3,020 999 222 (1,615) 5,442

Issue of new

shares in the - - - - -

period -

Share options

charge - - - - 14 14

Soccerdome -

revaluation - - (9) - (9)

Loss for the

period from - - - - -

continuing

operations -

Loss for the

period from - - - - -

discontinued

operations -

Balance at 31

January 2019 2,816 3,020 999 213 (3,987) 3,061

Issue of new

shares in

period 300 - - - - 300

Loss for the

period from

continuing

operations - - - - (1,296) (1,296)

Loss for the

period from - - -

discontinued

operations - - -

Balance at 31

July 2019 3,116 3,020 999 213 (5,283) 2,065

CONDENSED CONSOLIDATED CASH FLOW STATEMENT

6 month 6 month 12 month

Period ended Period ended ended

31-Jul 31-Jul 31-Jan

2019 2018 2019

Notes (unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Net cash generated

from/ (used in)

continuing

operations 6 (71) (249) (1,104)

Interest and

financing costs (4) - (3)

Tax paid - - -

-------------------------------- ----------------------------------- -----------------------

Net cash (used by)/generated

from operating activities (75) (249) (1,107)

Net cash (used

by)/generated from

discontinued

operating

activities 6 - (852) (430)

-------------------------------- ----------------------------------- -----------------------

Net cash (outflow) from

operating activities (75) (1,101) (1,537)

Cash flow from

investing

activities:

Acquisition of

property plant and

equipment (1) - (1)

Purchase of

intangible assets (25) - (90)

Net cash on

acquisition/(disposal) of

subsidiary 45 - (152)

-------------------------------- ----------------------------------- -----------------------

Net cash (used in) investing

activities 19 - (243)

-------------------------------- ----------------------------------- -----------------------

Net cash from

financing activities - - -

-------------------------------- ----------------------------------- -----------------------

(Decrease)/increase in cash

and cash equivalents:

(Decrease)/increase in cash

and cash equivalents (56) (1,101) (1,780)

Cash and cash equivalents

at beginning of period 371 2,151 2,151

Cash and cash equivalents at

end of period 316 1,050 371

-------------------------------- ----------------------------------- -----------------------

Comprising of:

Cash and cash equivalents per

the balance sheet 316 1,050 371

Less:

Bank overdraft - - -

-------------------------------- ----------------------------------- -----------------------

Cash and cash

equivalents for

cash flow statement

purposes 316 1,050 371

-------------------------------- ----------------------------------- -----------------------

NOTES TO THE INTERIM FINANCIAL REPORT

1. Accounting policies

Basis of Accounting and Preparation

These interim results for the six months ended 31 July 2019 have

been prepared using the historical cost and fair value conventions

on the basis of the accounting policies set out below. This interim

report has been prepared in accordance with International Financial

Reporting Standards as adopted by the EU ("Adopted IFRSs"), it is

not in accordance with IAS 34 and therefore is not fully compliant

with IFRS.

These interim results have been prepared under the historical

cost convention. Areas where other bases are applied are identified

in the accounting policies below.

The financial information set out in this interim report does

not constitute statutory accounts as defined in the Companies Act

2006. The Company's statutory financial statements for the year

ended 31 January 2019 have been filed with the Registrar of

Companies. The auditor's report on those financial statements was

unqualified with a material uncertainty relating to going

concern.

This announcement contains certain forward-looking statements

with respect to the operations, performance and financial position

of the Group. By their nature, these statements involve uncertainty

since future events and circumstances can cause results and

developments to differ materially from those anticipated. The

forward-looking statements reflect knowledge and information

available at the date of the preparation of this announcement and

the Company undertakes no obligation to update these

forward-looking statements. Nothing in this Interim Financial

Report should be construed as a profit forecast.

The results for the six months ended 31 July 2019 were approved

by the Board on 29 January 2019.

Basis of consolidation

The consolidated financial statements incorporate the financial

statements of the Company and entities controlled by the Company

(its subsidiaries) made up to 31 January and 31 July each year.

Control is achieved where the Company has the power to govern the

financial and operating policies so as to obtain benefits from its

activities.

The results of subsidiaries acquired or disposed of during the

year are included in the consolidated income statement from the

effective date of acquisition or up to the effective date of

disposal, as appropriate.

Where necessary, adjustments are made to the Financial

Statements of subsidiaries to bring the accounting policies used

into line with those used by the Group.

Business combinations

All business combinations are accounted for by applying the

acquisition method. Business combinations are accounted for using

the acquisition method as at the acquisition date, which is the

date on which control is transferred to the Group.

The Group measures goodwill at the acquisition date as:

the fair value of the consideration transferred; plus

the recognised amount of any non-controlling interests in the

acquiree; plus

the fair value of the existing equity interest in the acquiree;

less

the net recognised amount (generally fair value) of the

identifiable assets acquired and liabilities assumed.

When the excess is negative, a bargain purchase gain is

recognised immediately in profit or loss.

Costs related to the acquisition, other than those associated

with the issue of debt or equity securities, are expensed as

incurred.

Any contingent consideration payable is recognised at fair value

at the acquisition date. If the contingent consideration is

classified as equity, it is not remeasured and settlement is

accounted for within equity. Otherwise, subsequent changes to the

fair value of the contingent consideration are recognised in profit

or loss.

Where fair values are estimated on a provisional basis they are

finalised within 12 months of acquisition with consequent changes

to the amount of goodwill.

Intra-group balances and transactions, and any unrealised income

and expenses arising from intra-group transactions, are eliminated.

Unrealised gains arising from transactions with equity-accounted

investees are eliminated against the investment to the extent of

the Group's interest in the investee. Unrealised losses are

eliminated in the same way as unrealised gains, but only to the

extent that there is no evidence of impairment.

Intangible assets

Expenditure on research activities is recognised in the income

statement as an expense as incurred.

Expenditure on development activities is capitalised if the

product or process is technically and commercially feasible and the

Group intends to and has the technical ability and sufficient

resources to complete development, future economic benefits are

probable and if the Group can measure reliably the expenditure

attributable to the intangible asset during its development.

Development activities involve a plan or design for the production

of new or substantially improved products or processes. The

expenditure capitalised includes the cost of materials, direct

labour and an appropriate proportion of overheads and capitalised

borrowing costs. Other development expenditure is recognised in the

income statement as an expense as incurred. Capitalised development

expenditure is stated at cost less accumulated amortisation and

less accumulated impairment losses.

Expenditure on internally generated goodwill and brands is

recognised in the income statement as an expense as incurred.

Other intangible assets that are acquired by the Group are

stated at cost less accumulated amortisation and accumulated

impairment losses.

Amortisation is charged to the income statement on a

straight-line basis over the estimated useful lives of intangible

assets unless such lives are indefinite. Intangible assets with an

indefinite useful life and goodwill are systematically tested for

impairment at each balance sheet date. Other intangible assets are

amortised from the date they are available for use. The estimated

useful lives are as follows:

Licences, patents and trademarks 25 years

Software 3 to 10 years

Financial instruments

Financial assets and financial liabilities are recognised on the

Group's balance sheet when the Group becomes a party to the

contractual provisions of the instrument.

Goodwill

Goodwill arising on consolidation represents the excess cost of

acquisition over the Group's interest in the fair value of the

identifiable assets and liabilities of a subsidiary at the date of

acquisition. Goodwill is initially recognised as an asset and

reviewed for impairment at least annually. Any impairment is

recognised immediately in the income statement and is not

subsequently reviewed.

Goodwill is stated at cost less any accumulated impairment

losses. Goodwill is allocated to cash-generating units and is not

amortised but is tested annually for impairment. In respect of

equity accounted investees, the carrying amount of goodwill is

included in the carrying amount of the investment in the

investee.

Financial assets (including receivables)

In accordance with IFRS 9 impairment of financial assets is

based on an expected credit loss ('ECL') model. The ECL model

requires the Group to account for ECLs and changes in those ECLs at

each reporting date to reflect changes in credit risk since initial

recognition of the financial assets. Financial assets are impaired

where there is objective evidence that, as a result of one or more

events that occurred after the initial recognition of the financial

asset, the estimated future cash flows of the investment have been

affected, IFRS 9 also requires current and future events to be

considered when making an impairment assessment.

IFRS 9 requires the Group to measure the loss allowance for a

financial instrument at an amount equal to the lifetime ECLs if the

credit risk on that financial instrument has increased

significantly since initial recognition, or if the financial

instrument is a purchased or originated credit--impaired financial

asset.

However, if the credit risk on a financial instrument has not

increased significantly since initial recognition (except for a

purchased or originated credit--impaired financial asset), the

Group is required to measure the loss allowance for that financial

instrument at an amount equal to 12--months ECL. IFRS 9 also

requires a simplified approach for measuring the loss allowance at

an amount equal to lifetime ECL for trade receivables, contract

assets and lease receivables in certain circumstances.

The carrying amounts of the Group's non-financial assets, other

than investment property, inventories and deferred tax assets, are

reviewed at each reporting date to determine whether there is any

indication of impairment. If any such indication exists, then the

asset's recoverable amount is estimated. For goodwill, and

intangible assets that have indefinite useful lives or that are not

yet available for use, the recoverable amount is estimated each

year at the same time.

The recoverable amount of an asset or cash-generating unit is

the greater of its value in use and its fair value less costs to

sell. In assessing value in use, the estimated future cash flows

are discounted to their present value using a pre-tax discount rate

that reflects current market assessments of the time value of money

and the risks specific to the asset.

An impairment loss in respect of goodwill is not reversed. In

respect of other assets, impairment losses recognised in prior

periods are assessed at each reporting date for any indications

that the loss has decreased or no longer exists. An impairment loss

is reversed if there has been a change in the estimates used to

determine the recoverable amount. An impairment loss is reversed

only to the extent that the asset's carrying amount does not exceed

the carrying amount that would have been determined, net of

depreciation or amortisation, if no impairment loss had been

recognised.

Revenue recognition

Revenue is recognised when the performance obligations have been

met:

-- Lottery business revenue represents takings received for

entry into the lottery prize draws. Revenue is recognised on the

date that the draw takes place. Revenue in relation to performance

obligations that are delivered over the life of a contract are

recognised on a pro rata basis.

-- Payment processing revenue represents the consideration

received or receivable from the merchants for services provided.

Key revenue streams the Company reports are transaction service

charges that relate to services provided to process transactions

between the customer and an acquiring bank, which is a bank that

accepts card payments from the card-issuing banks. Revenue is

recognised when the transactions are successfully processed and is

recognised per transaction. Process fees are charged per

transaction for providing gateway services.

-- Payment solutions revenue is recognised at the point when a chargeable transaction occurs.

Taxation

Tax on the profit or loss for the year comprises current and

deferred tax. Tax is recognised in the income statement except to

the extent that it relates to items recognised directly in equity,

in which case it is recognised in equity.

Current tax is the expected tax payable or receivable on the

taxable income or loss for the year, using tax rates enacted or

substantively enacted at the balance sheet date, and any adjustment

to tax payable in respect of previous years.

Deferred tax is provided on temporary differences between the

carrying amounts of assets and liabilities for financial reporting

purposes and the amounts used for taxation purposes. The following

temporary differences are not provided for: the initial recognition

of goodwill; the initial recognition of assets or liabilities that

affect neither accounting nor taxable profit other than in a

business combination, and differences relating to investments in

subsidiaries to the extent that they will probably not reverse in

the foreseeable future. The amount of deferred tax provided is

based on the expected

manner of realisation or settlement of the carrying amount of

assets and liabilities, using tax rates enacted or substantively

enacted at the balance sheet date.

A deferred tax asset is recognised only to the extent that it is

probable that future taxable profits will be available against

which the temporary difference can be utilised.

Property, plant and equipment

Property, plant and equipment are stated at cost less

accumulated depreciation and any recognised accumulated impairment

losses. Useful lives are reviewed annually by the Directors.

Where parts of an item of property, plant and equipment have

different useful lives, they are accounted for as separate items of

property, plant and equipment.

Depreciation is charged to the income statement on a

straight-line basis over the estimated useful lives of each part of

an item of property, plant and equipment. The estimated useful

lives are as follows:

-- office equipment 4 years

-- vehicles 5 years

Depreciation methods, useful lives and residual values are

reviewed at each balance sheet date.

Leased assets

Payments made under operating leases are recognised in the

income statement on a straight-line basis over the term of the

lease. Lease incentives received are recognised in the income

statement as an integral part of the total lease expense.

Financing income and expenses

Financing expenses comprise interest payable and finance charges

recognised in profit or loss using the effective interest method,

unwinding of the discount on provisions, and net foreign exchange

losses that are recognised in the income statement (see foreign

currency accounting policy. Financing income comprise interest

receivable on funds invested, dividend income, and net foreign

exchange gains.

Interest income and interest payable is recognised in profit or

loss as it accrues, using the effective interest method. Dividend

income is recognised in the income statement on the date the

entity's right to receive payments is established. Foreign currency

gains and losses are reported on a net basis.

Impairment of tangible and intangible assets excluding

goodwill

The carrying amounts of the Group's non-financial assets, other

than investment property, inventories and deferred tax assets, are

reviewed at each reporting date to determine whether there is any

indication of impairment. If any such indication exists, then the

asset's recoverable amount is estimated. For goodwill, and

intangible assets that have indefinite useful lives or that are not

yet available for use, the recoverable amount is estimated each

year at the same time.

The recoverable amount of an asset or cash-generating unit is

the greater of its value in use and its fair value less costs to

sell. In assessing value in use, the estimated future cash flows

are discounted to their present value using a pre-tax discount rate

that reflects current market assessments of the time value of money

and the risks specific to the asset.

An impairment loss in respect of goodwill is not reversed. In

respect of other assets, impairment losses recognised in prior

periods are assessed at each reporting date for any indications

that the loss has decreased or no longer exists. An impairment loss

is reversed if there has been a change in the estimates used to

determine the recoverable amount. An impairment loss is reversed

only to the extent that the asset's carrying amount does not exceed

the carrying amount that would have been determined, net of

depreciation or amortisation, if no impairment loss had been

recognised.

Foreign currencies

The individual financial statements of each Group company are

prepared in the currency of the primary economic environment in

which it operates (its functional currency). For the purposes of

the consolidated financial statements, the results and financial

position of each Group company are expressed in Pounds Sterling,

which is the functional currency of the parent company, and the

presentational currency for the consolidated Financial

statements.

Transactions in foreign currencies are translated to the

respective functional currencies of Group entities at the foreign

exchange rate ruling at the date of the transaction. Monetary

assets and liabilities denominated in foreign currencies at the

balance sheet date are retranslated to the functional currency at

the foreign exchange rate ruling at that date. Foreign exchange

differences arising on translation are recognised in the income

statement. Non-monetary assets and liabilities that are measured in

terms of historical cost in a foreign currency are translated using

the exchange rate at the date of the transaction. Non-monetary

assets and liabilities denominated in foreign currencies that are

stated at fair value are retranslated to the functional currency at

foreign exchange rates ruling at the dates the fair value was

determined.

Share based payments

Share-based payment arrangements in which the Group receives

goods or services as consideration for its own equity instruments

are accounted for as equity-settled share-based payment

transactions, regardless of how the equity instruments are obtained

by the Group.

The grant date fair value of share-based payment awards granted

to employees is recognised as an employee expense, with a

corresponding increase in equity, over the period that the

employees become unconditionally entitled to the awards. The fair

value of the options granted is measured using an option valuation

model, taking into account the terms and conditions upon which the

options were granted. The amount recognised as an expense is

adjusted to reflect the actual number of awards for which the

related service and non-market vesting conditions are expected to

be met, such that the amount ultimately recognised as an expense is

based on the number of awards that do meet the related service and

non-market performance conditions at the vesting date. For

share-based payment awards with non-vesting conditions, the grant

date fair value of the share-based payment is measured to reflect

such conditions and there is no true-up for differences between

expected and actual outcomes.

Share-based payment transactions in which the Group receives

goods or services by incurring a liability to transfer cash or

other assets that is based on the price of the Group's equity

instruments are accounted for as cash-settled share-based payments.

The fair value of the amount payable to employees is recognised as

an expense, with a corresponding increase in liabilities, over the

period in which the employees become unconditionally entitled to

payment. The liability is remeasured at each balance sheet date and

at settlement date. Any changes in the fair value of the liability

are recognised as personnel expense in profit or loss.

Other than for business combinations, the only share based

payments of the Group are equity settled share options and certain

liability settlements. The Group has applied the requirements of

IFRS 2 - Share-based Payments.

For share options granted, an option pricing model is used to

estimate the fair value of each option at grant date. That fair

value is charged on a straight-line basis over the vesting period

as an expense in the income statement, with a corresponding

increase in equity.

For shares issued in settlement of fees and/or liabilities, the

Directors estimate the fair value of the shares at issue date and

that value is charged on a straight line basis as an expense in the

income statement (for fees) or reduction in the balance sheet

liability (for liabilities) with a corresponding increase in

equity.

Cash and cash equivalents

Cash and cash equivalents comprise cash balances and call

deposits. Bank overdrafts that are repayable on demand and form an

integral part of the Group's cash management are included as a

component of cash and cash equivalents for the purpose only of the

cash flow statement.

Trade receivables

Trade receivables are measured at initial recognition at fair

value, and are subsequently measured at amortised cost using the

effective interest rate method. Appropriate allowances for

estimated irrecoverable amounts are recognised in profit and loss

when there is objective evidence that the asset is impaired. The

allowance recognised is measured as the difference between the

asset's carrying amount and the present value of estimated future

cash flows discounted at the effective interest rate compound at

initial recognition.

Trade receivables are stated at their nominal value as reduced

by appropriate allowances for estimated irrecoverable amounts.

Investments in debt and equity securities

Investments in debt and equity securities held by the Group are

classified as either fair value through profit or loss (FVTPL) or

fair value through other comprehensive income (FVTOCI) and are

stated at fair value. Any resultant gain or loss is recognised in

the Statement of Profit and Loss or directly in equity

respectively, except for impairment losses and, in the case of

monetary items such as debt securities, foreign exchange gains and

losses. When these investments are derecognised, the cumulative

gain or loss previously recognised directly in equity is recognised

in profit or loss.

In the prior year investments in equity securities were

classified as being available-for-sale and are stated at fair

value, with any resultant gain or loss being recognised directly in

equity (in the revaluation reserve), except for impairment losses

and, in the case of monetary items such as debt securities, foreign

exchange gains and losses. When these investments and derecognised,

the cumulative gain or loss previously recognised directly in

equity is recognised in profit or loss.

The Company has taken the exemption available to it under IFRS 9

not to restate the prior period figures.

Financial instruments held for trading or designated upon

initial recognition are stated at fair value, with any resultant

gain or loss recognised in profit or loss.

Investments in debt and equity securities whose fair value

cannot be reliably measured are stated at amortised cost less

impairment.

Financial liability and equity

Financial liabilities are classified according to the substance

of the contractual agreements entered into. An equity instrument is

any contract that evidences a residual interest in the assets of

the Group after deducting all of its liabilities. Equity

instruments are recognised at the amount of proceeds received net

of costs directly attributable to the transaction. To the extent

that those proceeds exceed the par value of the shares issued they

are credited to a share premium account.

Trade payables

Trade and other payables are recognised initially at fair value.

Subsequent to initial recognition they are measured at amortised

cost using the effective interest method.

Provisions

A provision is recognised in the balance sheet when the Group

has a present legal or constructive obligation as a result of a

past event, that can be reliably measured and it is probable that

an outflow of economic benefits will be required to settle the

obligation. Provisions are determined by discounting the expected

future cash flows at a pre-tax rate that reflects risks specific to

the liability.

2. Earnings per ordinary share

The calculation of basic earnings per share and diluted earnings

per share is based on the results and weighted average number of

ordinary shares as follows:

6 month 6 month 12 month

Period ended Period ended ended

31-Jul 31-Jul 31-Jan

2019 2018 2019

(unaudited) (unaudited) (audited)

Attributable to

equity GBP000's (1,296) 2,793 407

--------------------------------- ------------------------------- ----------

Weighted average

number of

ordinary shares:

Basic 3,115,830 2,654,163 2,734,996

--------------------------------- ------------------------------- ----------

On 31 January 2016 the Company issued GBP1.6m of 0% unsecured,

undated, convertible loan stock which converted into 400,000,000

Ordinary Shares and were allotted to loan stock holders on 7 June

2016 and were admitted to trading on AIM on 15 June 2016. The

shares were consideration for the acquisition of Emex (UK) Group

Limited, and the associated company, Freepaymaster Limited

(collectively, "Emex").

On 10 April 2017, the Company acquired all of the ordinary

shares in Timegrand Limited for GBP1,000,000 satisfied in full by

the issue of 500,000,000 ordinary shares of 0.1p nominal each in

the Company with a consideration value of 0.2p per share.

On 23 April 2018 new shares totalling 410,000,000 Ordinary

Shares of 0.1 pence each ("Ordinary Shares") were issued in

settlement of amounts invoiced from key management personnel. In

addition, 60,000,000 share options were granted to Directors and

key management.

On 9 May 2018 new shares totalling 50,000,000 Ordinary Shares of

0.1 pence each were issued in settlement of invoices for

consultancy fees totalling GBP50,000 from Nineteen Twelve

Management Limited, a company controlled by James Rose.

At a general meeting held on 30 July 2018, shareholders approved

the sale of Emex. As part of the terms of the disposal, the MDC

Nominees Limited Shares were to be issued, but due to the

suspension of trading in shares on the AIM market of St James House

plc at the time, these were not issued at the time of the disposal.

The Board approved the issue and allotment of the MDC Nominees

Limited Shares (as published 30 January 2019) and an application

was made to admit the MDC Nominees Limited Shares to trading on AIM

with effect from 21 February 2019.

In addition, on 21 February 2019, new shares totalling

200,000,230 Ordinary Shares of 0.1 pence each ("Ordinary Shares")

were issued in settlement of amounts owed:

1. 30,000,000 Ordinary Shares at a price of 0.1 pence per share

in settlement of invoices for director and consultancy fees

totalling GBP30,000 from RT Associates, a partnership controlled by

Lord Tim Razzall, a director of the Company, in relation to his

contracted services as Executive Chairman of the Company.

2. 20,000,000 Ordinary Shares at a price of 0.1 pence per share

in settlement of invoices for consultancy fees totalling GBP20,000

from FS Business Limited, a company controlled by Andrew Flitcroft,

the company secretary and a former director of the Company, in

relation to his contracted services as Finance Director and company

secretary of the Company.

3. 50,000,000 Ordinary Shares at a price of 0.1 pence per share

in settlement of salaried amounts outstanding totalling GBP50,000

for Cath McCormick, a director of the Company, in relation to her

contracted employment with the Company.

4. The Board agreed contractual terms with John Botros t/a St.

James Street Chambers in relation to the legal work involved in the

issues surrounding Net World Ltd and its impact on the delayed

audit of the Company (as announced on 30 January 2019) for a total

consideration of GBP100,000.23 (the "Legal Services"). The Board

and Mr Botros agreed to the issue of 100,000,230 Ordinary Shares at

a price of 0.1 pence per share in settlement of the invoice for the

Legal Services. John Botros is a director of a Group company.

3. Share capital

As at As at As at

31-Jul 31-Jul 31-Jan

2019 2018 2019

GBP'000 GBP'000 GBP'000

Issued and fully paid: 3,116 2,816 2,816

---------------------- --------------------------- ------------------

Following discussion with the Company's financial adviser, the

Board proposed a share restructuring, which was approved by the

Board on 4 March 2019.

The share capital restructuring consisted of a sub-division of

each Ordinary Share followed by a consolidation at a ratio of

1:1,000.

Each Ordinary Share of the Company was sub-divided into one new

ordinary share of 0.001 pence each ("Interim Ordinary Shares") and

one deferred share of 0.099 pence each ("Deferred Shares"),

followed by a consolidation of every 1,000 Interim Ordinary Shares

into one consolidated new ordinary share of 1 pence each ("New

Ordinary Shares"). Therefore, the existing 3,115,830,000 Ordinary

Shares became 3,115,830 New Ordinary Shares and 3,115,830,000

Deferred Shares (the "Restructuring"). Fractional entitlements

arising from the Restructuring were aggregated and sold in the

market for the benefit of the Company.

Following the Restructuring, there were 3,115,830 New Ordinary

Shares in issue, each with one voting right per share.

The Deferred Shares have no right to vote, attend or speak at

general meetings of the Company and have no right to receive any

dividend or other distribution and have only limited rights to

participate in any return of capital on a winding-up or liquidation

of the Company. No application was made to the London Stock

Exchange for admission of the Deferred Shares to trading on AIM.

There were 3,115,830,000 immediately following the

Restructuring.

The outstanding options over 60,000,000 Ordinary Shares

exercisable at 0.1 pence per Ordinary Share (as announced 24 April

2018) will be adjusted for the Restructuring to become option over

60,000 New Ordinary Shares, exercisable at 100 pence per share. The

life of the options remains unchanged at 5 years from 23 April

2018.

4. Profit and loss of discontinued operations

Period ended Period ended Period ended

31-Jul 31-Jul 31-Jan

2019 2018 2019

GBP'000 GBP'000 GBP'000

Revenue - 119 104

-

Cost of Sales - -

-

Gross Profit - 119 104

Administrative expenses - (357) (447)

Operating profit before exceptional

items - (238) (343)

-

Finance expenses/(interest income) - - -

(Loss) before and after taxation - (238) (343)

Gain on sale of discontinued operations - 3,699 3,505

Profit for the period from discontinued

operations - 3,461 3,162

--------------- ------------------------------- --------------------

5. Assets and liabilities acquired

On 23 May 2019, St James House plc completed the acquisition of

Another Ops Limited, trading as "another", whose website is

https://an-other.co.uk/ ("Another"). Another Ops Limited offer

prepaid payment card and merchant solutions which provide a

complementary product to the merchant, international payment and

foreign exchange services provided by the Company's Market Access

division.

5.1 Assets acquired and liabilities recognised at the date of

acquisition

Total

GBP'000

Current assets

Cash and cash equivalents 45

Trade and other receivables 47

Non-current assets

Office Equipment 4

Unpaid share capital (210)

Current liabilities

Trade and other payables (233)

Long-term liabilities (380)

(727)

==========

5.2 Goodwill arising on acquisition

Total

GBP

Consideration Transferred 726

Less: fair value of intangible

assets acquired (312)

Goodwill arising on acquisition 414

========

5.3 Net cash inflow on acquisition

Total

GBP

Consideration paid in cash -

Plus: cash and cash equivalent

balances acquired 45

------

45

======

6. Cash used in continuing operations

Period ended Period ended Period ended

31-Jul 31-Jul 31-Jan

2019 2018 2019

GBP'000 GBP'000 GBP'000

Profit/(Loss)

attributable to

equity holders (1,296) (668) (2,775)

Finance costs 4 2 3

Finance income (22) - (22)

Depreciation,

amortisation and

impairment 172 86 490

Impairment - 440

Share options charge - - 14

Decrease/(increase)

in debtors (95) (2,179) (3,087)

(Decrease)/increase

in creditors 1,033 2,510 3,813

---------------------------------- -------------------------------- -------------------------

Cash generated from/

(used in) continuing

operations (204) (249) (1,104)

---------------------------------- -------------------------------- -------------------------

7. Cash used in discontinued operations

Profit/(Loss) attributable to equity

holders - 3,461 3,162

Finance costs - - -

Finance income - - -

Depreciation, amortisation and impairment - 8 8

Gain on disposal of subsidiaries (3,699) (3,505)

Tax credit - - -

Decrease/(increase) in debtors - 762 1,573

(Decrease)/increase in creditors - (1,384) (1,668)

---- --------------------------------- -----------------------

-

-

Cash generated from/ (used in) discontinued

operations - (852) (430)

---- --------------------------------- -----------------------

Cashflow figures include changes in debtors and creditors as a

result of disposal of assets and derecognition of liabilities on

the disposal of Emex to MDC Nominees Limited.

8. Transactions with related parties

The transactions set out below took place between the Group and

certain related parties.

Lord E T Razzall

Lord E T Razzall, a director, charged the Group GBP20,754 (six

months ended Jul 2018: GBP12,000; twelve months ended Jan 2019:

GBP24,000) in the period, for directorship services provided, via

an entity trading as R T Associates. At the period end R T

Associates was owed GBPnil (Jul 2018: GBP1,400; Jan 2019:

GBP38,400).

In Feb 2019 R T Associates was issued 30,000,000 Ordinary

shares, at par, in payment of amounts invoiced to the Group.

Andrew J A Flitcroft

Andrew Flitcroft, a director of St James House Plc until Feb

2019 and Group Company Secretary, charged the Group GBP13,500 (six

months ended Jul 2018 GBP16,500; twelve months ended Jan 2019:

GBP33,000) in the period, for his services as a director, company

secretarial and consultancy services provided, via an entity FS

Business Limited. At the period end FS Business Limited was owed

GBP59,750 (Jul 2018: GBP33,650; Jan 2019: GBP67,550).

In Feb 2019 FS Business Limited was issued 20,000,000 Ordinary

shares, at par, in payment of amounts invoiced to the Group.

In April 2018 FS Business Limited was issued 10,000,000 Ordinary

shares, at par, in payment of amounts invoiced to the Group.

John M Botros

John M Botros is a director of Timegrand Limited, Soccerdome

Limited, Barrington Lewis Limited, Market Access Ops Limited and

company Secretary of Prize Provision Services Limited. He was also

director of Market Access Limited until April 2018 and was director

of the Emex companies for the entire period to their disposal from

the Group.

John Botros charged the Group GBP18,000 (six months ended Jul

2018 GBP16,500; twelve months ended Jan 2019: GBP395,000) in the

period, for directorship and company secretarial services provided,

via an entity Bluedale Corporate Limited ("BCL"). John Botros also

charged the Group GBPnil (six months ended Jul 2018 GBPnil; twelve

months ended Jan 2019 GBP4,874) for expenses incurred on the

Group's behalf via an entity St James Chambers.

At the period end BCL was owed GBP100,000.23 (Jul 2018 and Jan

2019: GBP100,000 of shares as specified in the purchase agreement

between St James House plc and MDC Nominees Limited, a company

owned by Mr Botros, for the purchase of Emexconsult Limited, Emex

Technologies Limited and Emex (UK) Group Limited on 30 July

2018).

At the end of the period St James Chambers was owed GBPnil (Jul

2018: GBPnil; Jan 2019: GBP nil).

The shares owed to BCL at year end were issued on 21 February

2019.

In Feb 2019 BCL was issued 100,000,023 shares, at par, in

payment of amounts invoiced to the Group by BCL.

In April 2018 BCL was issued 160,000,000 shares, at par, in

payment of amounts invoiced to the Group by BCL.

In April 2018 John Botros was issued 100,000,000 shares, at par,

in payment of amounts invoiced to the Group by BCL.

During the six months to Jul 2019, year BCL charged GBPnil for

services provided by Market Access Limited (six months ended Jul

2018 GBPnil; twelve months ended Jan 2019 GBP18,690). Included in

other payables an amount of GBPnil (six months ended Jul 2018

GBPnil; twelve months ended Jan 2019 GBP35,598) owed to BCL by

Market Access Limited.

Phillite D UK Limited

Included in trade debtors is an amount of GBP1,234,452 (Jul

2018: GBP1,501,456 and Jan 2019: GBP1,241,100) and GBPnil (Jul

2018: GBP 1,620,000 and Jan 2019: GBPnil) in other receivables due

from Phillite D UK Limited ("PDU"), a company in which John Botros

is a director and Phil Jackson is the person with significant

control.

PDU performed regulated services on behalf of the Group between

December 2014 and November 2016, which gave the Group the

regulatory authorisation to perform payment processing. The revenue

recognised and costs associated with this processing was reflected

within the parent company. From November 2016, the services that

PDU had previously provided to the Group were instead undertaken

within the Group by Emex Technologies Limited which obtained the

necessary Financial Conduct Authority licences in May 2016. The

amount due as at the end of 31 January 2019 relates to processing

fees due on this processing less amounts repaid.

During 2017, the Company launched a high value transfer service

facilitating transactions in excess of EUR10,000,000 for corporate

and individual customers ("HVTS"). The development of HVTS involved

investment by a number of organisations within the industry and the

Group expected to generate future revenues from this product as

part of its longer-term strategy. As part of this investment, the

Group provided GBP1,600,000 of working capital to PDU, and this

amount was repayable by PDU in the normal course of business. It

did not attract interest and was repayable on demand and was

reported within Trade Receivables in the balance sheet along with

other amounts owed by PDU.

HVTS was a product offered by Emexconsult Limited and Emex

Technologies Limited, both of which were sold by the Group to MDC

Nominees Limited on 30 July 2018. Included within the assets and

liabilities disposed of in this transaction was the GBP1,600,000

balance owed by PDU.

Actual Limited

With effect from 1 September 2017, John Botros was a company

representative on the Board of Actual Limited, a tenant management

organisation for the businesses with office on the 7(th) floor of

39 St James Street, London. During his time as Director of Actual

Limited, Mr Botros received no remuneration and held no shares.

During the six months to Jul 2019, the Group was invoiced GBP7,881

(Jul 2018: GBP25,464 and Jan 2019: GBP84,421) by Actual Ltd, for

rent and associated office costs. At the period end Actual Ltd was

owed GBP4,924 (Jul 2018: GBP23,666 and Jan 2019: GBP14,403) by the

Group.

Clive Hyman

Clive Hyman, a Non-Executive director, charged the Group

GBP10,000 (six months ended Jul 2018: GBP10,000; twelve months

ended Jan 2019: GBP20,000) in the period, for directorship services

provided, via an entity trading as Hyman Capital Limited. At the

period end Hyman Capital Services Limited was owed GBPnil (Jul

2018: GBPnil; Jan 2019: GBP4,000).

In April 2018 Clive Hyman was issued 20,000,000 share options

exercisable immediately with an exercise price of 0.1p. The options

lapse after 5 years and none of these had been exercised at the

period end.

Cath McCormick

Cath McCormick was appointed as a Director of St James House Plc

on 30 January 2019, Market Access Ops Ltd between 8 July 2019 and

20 August 2019, Market Access Ltd on 12 June 2019, Another Ops

Limited on 26 June 2019, Boxhill Technologies Limited on 16 January

2019 and PPS Blockchain Limited on 8 March 2019.

Cath McCormick charged the Group GBP50,000 (six months ended Jul

2018 GBP42,500; twelve months ended Jan 2019: GBP141,250) in the

period, for directorship services. At the period end Cath McCormick

was owed GBP5,513 (Jul 2018 and Jan 2019: GBP50,000).

On 4 February 2019, 50,000,000 Ordinary Shares were issued to

Catherine McCormick at par.

On 23 April 2018 Catherine McCormick was issued 20,000,000 share

options exercisable immediately with an exercise price of 0.1p. The

options lapse after 5 years and none of these had been exercised at

the period end.

Arno Rudolf

Arno Rudolf, a director, charged the Group GBP10,000 (six months

ended Jul 2018 GBP16,500; twelve months ended Jan 2019: GBP33,000)

in the period, for directorship services. At the period end, Mr

Rudolf was owed GBP16,667 (six months ended Jul 2018 GBP16,500;

twelve months ended Jan 2019: GBP33,000).

On 23 April 2018 Arno Rudolf was issued 20,000,000 share options

exercisable immediately with an exercise

price of 0.1p. The options lapse after 5 years and none of these

had been exercised at the period end.

Graeme Paton

Graeme Paton, a director, charged the Group GBP27,000 (six

months ended Jul 2018 GBPnil; twelve months ended Jan 2019:

GBP27,000) in the period for directorship services provided. At the

period end Mr Paton was owed GBPnil (Jul 2018: GBPnil; Jan 2019:

GBPnil).

James Rose

James Rose is a director of Prize Provision Services Limited

("PPSL"), Market Access Limited, wholly owned subsidiaries of St

James House Plc. In addition, James Rose was a Director of Market

Access Ops Limited from between 8 July 2019 and 20 August 2019 and

was appointed a Director of PPS Blockchain Limited on 14 June 2019.

During the period James Rose charged PPSL GBP30,000 for consultancy

services via an entity 1912 Management Limited (six months ended

Jul 2018: GBP30,000; twelve months ended Jan 2019: GBP77,300). At

the period end 1912 Management Services Limited was owed GBP88,200

(Jul 2018: GBP88,200; Jan 2019: GBP85,200).

In May 2018 Nineteen Twelve Management Limited was issued

50,000,000 Ordinary shares, at par, in payment of amounts invoiced

to PPSL.

Mark Harris

Mark Harris was a Director of Market Access Ops Limited until 8

July 2019 and charged Market Access Ops Limited GBP37,586 (six

months ended Jul 2018 GBP16,500; twelve months ended Jan 2019:

GBP33,000) in the period, for directorship services provided, via

an entity MHC St James Limited. At the period end MHC St James

Limited was owed GBPnil (Jul 2018: GBP33,650; Jan 2019:

GBP67,550).

Phil Jackson

Phil Jackson charged the Group GBP73,518 (six months ended Jul

2018: GBP10,000; twelve months ended Jan 2019: GBP130,000) in the

period, for services provided, via Moorhen Limited. At the period

end the Group owed Moorhen Limited GBPnil (Jul 2018: GBPnil; Jan

2019: GBPnil).

In April 2018 Moorhen Limited was issued 140,000,000 shares, at

par, in payment for amounts invoiced to the Group in the early part

of the year to 31 January 2019 and previous years.

9. Organisational and Structural Changes During the six months to 31 July 2019

Change of Company Name

To reflect the change in ongoing strategy of the Group and the

significant changes that have occurred during the last year, the

Board believed that a change of the Company's name was appropriate.

Following General Meeting approval, Boxhill Technologies plc

changed its name to St James House plc on 4 March 2019.

Share Consolidation

The Board considered that having nearly three billion shares

issued created a negative perception of the Company and also

exposes Shareholders to undue volatility. Following discussion with

the Company's financial adviser, the Board proposed a share

restructuring, which was approved by the Board on 4 March 2019.

The share capital restructuring consisted of a sub-division of

each Ordinary Share followed by a consolidation at a ratio of

1:1,000.

Each Ordinary Share of the Company was sub-divided into one new

ordinary share of 0.001 pence each

("Interim Ordinary Shares") and one deferred share of 0.099

pence each ("Deferred Shares"), followed by a consolidation of

every 1,000 Interim Ordinary Shares into one consolidated new

ordinary share of 1 pence each ("New Ordinary Shares"). Therefore,

the existing 3,115,830,000 Ordinary Shares became 3,115,830 New

Ordinary Shares and 3,115,830,000 Deferred Shares (the

"Restructuring"). Fractional entitlements arising from the

Restructuring were aggregated and sold in the market for the

benefit of the Company. Following the Restructuring, there were

3,115,830 New Ordinary Shares in issue, each with one voting right

per share.

The Deferred Shares have no right to vote, attend or speak at

general meetings of the Company and have no right to receive any

dividend or other distribution and have only limited rights to

participate in any return of capital on a winding-up or liquidation

of the Company. No application will be made to the London Stock

Exchange for admission of the Deferred Shares to trading on AIM.

There will be 3,115,830,000 immediately following the

Restructuring.

The outstanding options over 60,000,000 Ordinary Shares

exercisable at 0.1 pence per Ordinary Share (as announced 24 April

2018), all held by Board members, will be adjusted for the

Restructuring to become options over 60,000 New Ordinary Shares,

exercisable at 100 pence per share. The life of the options remains

unchanged at 5 years from 23 April 2018. St James House plc

(formerly Boxhill Technologies plc)

Acquisition of Another Ops Ltd

On 23 May 2019, St James House plc completed the acquisition of

Another Ops Limited, trading as "another", whose website is

https://an-other.co.uk/ ("Another"). Another Ops Limited offer

prepaid payment card and merchant solutions which provide a

complementary product to the merchant, international payment and

foreign exchange services provided by the Company's Market Access

division.

New Lottery Joint Venture

On 8 March 2019, the Board of Directors of St James House PLC

announced it had agreed terms, subject to contract, to establish a

new lottery joint venture in Malta. The Company's partner in this

joint venture is ZeU Crypto Networks Limited ("ZeU"), a wholly

owned subsidiary of St-Georges Eco-Mining Corp. of Montreal, Canada

("SGEM"), whose shares are quoted on the Canadian Securities

Exchange (The "Lottery JV").

The Lottery JV will be established as a new company in Malta and

will combine the Company's expertise in regulated lottery

management and administration with ZeU's innovative

blockchain-based technology. The Group will hold a 45 per cent

equity interest in the Lottery JV and the other shareholders will

be Zeu with 19.9 per cent, SGEM with 19.9 per cent and the balance

with outside shareholders. All costs of the Lottery JV will be met

by ZeU and in return, ZeU will charge a service fee that will not

exceed 90% of the revenues from the Lottery JV. The remaining 10

per cent of the revenues of the Lottery JV will be distributed as a

dividend to the shareholders, i.e. the Group will receive 4.5 per

cent of the revenues of the Lottery JV by way of a dividend. St

James House PLC will appoint three directors to the Lottery JV and

ZeU will appoint one director. The Lottery JV will apply to the

Maltese authorities for the appropriate licence to operate a

lottery.

The Group's interest in the Lottery JV will be held by PPS

Blockchain Limited, a wholly owned subsidiary of SJH ("PPSB").

Change of Auditor

The Board has appointed MHA MacIntyre Hudson as auditors to the

Group in replacement of KPMG LLP. The Board believes MHA MacIntyre

Hudson to be more suited to the Group's size and business

activities.

Payment Division Restructuring

Following the acquisition of Another Ops Limited ("Another"),

the Group undertook a restructuring of its Payments division. All

regulated payment activities are now undertaken through the Group's

wholly owned subsidiary, Market Access Limited (previously Another

Ops Limited), trading as "Market Access" for business-to-business

activities and "another" for business-to-consumer activities.

Payment card processing activities are undertaken through the

Group's wholly owned subsidiary, Market Access Ops Limited

(previously Market Access Limited).

Change in Board Structure

Lord Razzall and Clive Hyman did not seek re-election as

directors at the Group AGM on 31 July 2019 and were replaced by

Roger Matthews and Kathy Cox. In addition, Jacques Leuba was

appointed as an additional Non-Executive Director on 4 September

2019.

As a result, the committee memberships have been updated to

reflect the Board member changes:

Committee: Chairman: Additional members:

Audit Committee Roger Matthews Arno Rudolf

--------------- ----------------------

Remunerations Committee Arno Rudolf Jacques Leuba

--------------- ----------------------

Nominations Committee Arno Rudolf Kathy Cox

Jacques Leuba

--------------- ----------------------

Compliance Committee Kathy Cox Roger Matthews

--------------- ----------------------

Operations Committee Graeme Paton No change to existing

members

--------------- ----------------------

10. Interim Financial Report

The unaudited interim financial report, which is the

responsibility of the directors and was approved by them on 31

October 2019, does not constitute statutory accounts within the

meaning of Section 435 of the Companies Act 2006.

This report is available on St James House PLC's website at

www.sjhplc.com. Copies are available from the Company at its

registered office:

30-35 Pall Mall, London, SW1Y 5LP, United Kingdom

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR FDWFFFFUSEDS

(END) Dow Jones Newswires

October 31, 2019 08:00 ET (12:00 GMT)

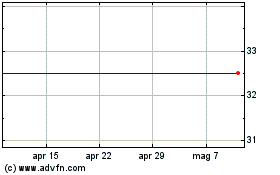

Grafico Azioni Tintra (LSE:TNT)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Tintra (LSE:TNT)

Storico

Da Apr 2023 a Apr 2024