Shell's 3Q Earnings Ahead of Expectations -- Earnings Review

31 Ottobre 2019 - 3:55PM

Dow Jones News

By Giulia Petroni

Royal Dutch Shell PLC (RDSB.LN) reported its third-quarter

results on Thursday. Here is how the results came in:

EARNINGS: Adjusted profit on a current cost-of-supplies basis--a

figure similar to the net income that U.S. oil companies report but

excluding certain items--came in at $4.77 billion. The result was

ahead of a consensus estimate compiled by Vara Research that had it

at $3.91 billion.

WHAT WE WATCHED:

- TRADING: Strong trading and optimization results in both

Shell's Integrated Gas and Downstream segments helped offset softer

energy prices and weaker refining and chemicals margins, analysts

say. Shell's gas business reported a 23% increase in earnings for

the period as production increased from fields in Australia,

Trinidad and Tobago.

- UPSTREAM PRODUCTION: Upstream missed by 17%, driven by weak

commodity prices, while production grew by 2% year-on-year

excluding portfolio impacts, according to Berenberg. Production was

2.60 million barrels of oil equivalent per day, in line with

company's expectations of between 2.60 million BOE a day and 2.65

million BOE per day.

- BUYBACK PROGRAM: Shell launched its share buyback-program last

year and has pledged to buy back $25 billion worth of shares by the

end of 2020. However, the company stressed that current

macroeconomic conditions could threaten the program's timeframe,

says Berenberg in a note.

Write to Giulia Petroni at giulia.petroni@wsj.com

(END) Dow Jones Newswires

October 31, 2019 10:40 ET (14:40 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

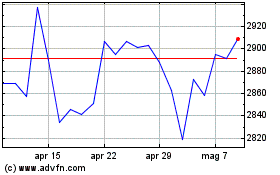

Grafico Azioni Shell (LSE:SHEL)

Storico

Da Mar 2024 a Apr 2024

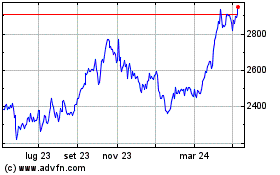

Grafico Azioni Shell (LSE:SHEL)

Storico

Da Apr 2023 a Apr 2024