TIDMIWG TIDMTTM

RNS Number : 2317S

IWG PLC

05 November 2019

THIRD QUARTER TRADING STATEMENT - 5 November 2019

IWG plc, the leading global operator of co-work and workspace

brands, today issues its trading update for the period ended 30

September 2019.

Continuing strong revenue growth, excellent franchising and

enterprise account momentum and strong financial position

Key Highlights(1)

-- Q3 Open centre revenue up 15.5%(2) (19.5% at actual rates),

all regions contributing strongly

-- Q3 Pre-20183 revenue up 3.3%(2) (7.0% at actual rates)

-- Q3 Pre-2018(3) occupancy up 2.2 percentage points to 76.4% from 74.2% in Q3 2018

-- Excellent franchising momentum; strategic partnerships signed

in Japan, Taiwan and Switzerland

-- 27 franchise partners across 22 countries, with a combined commitment of over 400 locations

-- Improving UK momentum, with positive Q3 Pre-2018(3) revenue

growth and strong occupancy gains

-- Continued strong growth in enterprise accounts

-- 66 new locations added in Q3, taking worldwide total to 3,348 locations

-- Cash flow(4) pre-growth to 30 September 2019 of GBP466.4m, 52.1p per share

-- Share repurchase programme commenced - 5.5m shares acquired in Q3 for GBP22.4m

-- Net debt(4) substantially reduced year-to-date to GBP301.2m; Net Debt to EBITDA of 0.8x

Third quarter performance(1)

Sales activity across the Group remains very buoyant and this

continues to drive our strong revenue growth trend. In the three

months ended 30 September 2019 revenue growth across all our open

centres increased 15.5% at constant currency (19.5% at actual

rates). Total revenue for the Group (including closed centres and

adjusted for discontinued activities) increased to GBP692.3m

compared with GBP611.6m in the same period last year, an increase

of 9.4% at constant currency (13.2% at actual rates). This

performance continues to be driven by the Americas and EMEA, our

two largest markets and very encouraging contributions from the

2018 and 2019 centre additions.

Revenue from ancillary services also continues to grow strongly.

Approximately 27% of Group revenue is currently derived from these

services. We believe that this provides a strong and unique

competitive advantage which underpins our profitable, cash

generative business model.

Pre-2018 revenue in the three months to 30 September increased

to GBP591.4m from GBP552.8m in the comparable quarter last year.

This represents a constant currency increase of 3.3% (7.0% at

actual rates). Encouragingly the UK has started to contribute to

the pre-2018 revenue growth and this provides an early indication

that the actions we have implemented are starting to have a

positive impact.

Pre-2018 occupancy improved year-on-year, up 2.2 percentage

points on a like-for-like basis to 76.4%, with particularly strong

performances in Brazil, China, India, North America, Spain,

Switzerland and the UK. This is the highest level of mature

occupancy since Q4 2016.

Year-to-date performance(1)

For the nine months to 30 September 2019, revenue growth across

all our open centres was strong at 15.4% at constant currency

(18.3% at actual rates). Total Group revenue increased to

GBP1,990.1m compared with GBP1,767.9m (adjusted for discontinued

operations) for the same period last year, an increase of 9.9% at

constant currency (12.6% at actual rates).

Pre-2018 revenue for the nine months to 30 September 2019

increased to GBP1,724.8m from GBP1,607.1m, an increase at constant

currency of 4.7%, (7.3% at actual rates). Pre-2018 occupancy

improved 3.1 percentage points on a like-for-like basis to

76.0%.

Network development

During the third quarter, we added 66 new organic locations and

2.2m sq. ft. of additional space to our global network, with net

growth capital investment5 of GBP64.4m. In the nine months ended 30

September 2019 the Group has added 180 new locations, approximately

one-third by partnering, and 5.2m sq. ft. of space, taking the

Group's total network at 30 September 2019 to 60.4m sq. ft. and

3,348 locations worldwide. This includes the opening of 82 new

Spaces locations and 3.5m sq. ft. of new space. Net growth capital

investment in the nine months to 30 September 2019 was

GBP249.9m.

In addition to the organic development of the network, we are

seeing increasing opportunities to grow the scale of the business

and further advance our multi-brand strategy through M&A. Where

it makes strategic sense, we are ready to use our strong financial

position to undertake such activity. Recently in the UK we acquired

Clubhouse, a multi-location meeting room and membership business,

from the administrator for a nominal sum. We expect to grow this

brand in the years to come.

This year we have been increasingly proactive and accelerated

the rationalisation of the network, where locations no longer fit

into our network or were unlikely to contribute to value creation.

We rationalised approximately 4% of the network in the nine months

to 30 September 2019. Although this impacts profitability in the

short term (by GBP27.9m for the year to date), it will deliver

improved returns and value creation in the future. This focus is

expected to continue in the fourth quarter and into the early part

of 2020.

At the end of October 2019, we had visibility on net growth

capital expenditure for the whole of 2019 of approximately GBP280m,

260 locations and 7.5m sq. ft. of new space.

Excellent franchising momentum

We continue to experience excellent momentum in our franchising

activities. Following the master franchise agreements in Japan,

Taiwan and Switzerland, in total we have 27 franchise partners

across 22 countries, with combined commitments of over 400 new

centre locations.

During the third quarter we entered into our second strategic

partnership with TKP with the divestment of our Taiwan business for

a gross consideration of GBP22.7m and related exclusive master

franchise agreement for that territory. This has been supplemented

with strong traction in our traditional franchise activities. In

the third quarter we added two new franchise partners, in Southern

Germany and the Cayman Islands. Together with Taiwan, these

franchises included commitments to open over 30 new locations. This

continuation of excellent momentum brings the year to date progress

to eight new franchisees and commitments for new centres to over

210.

As reported on 4 November 2019 we have entered into a strategic

partnership in Switzerland with the J. Safra Group and the P.

Peress Group. This transaction follows similar deals completed

earlier this year between IWG and TKP. IWG will receive gross

consideration of CHF120m for the entire issued share capital of

IWG's subsidiaries in Switzerland, which had 38 flexible co-working

locations as at 30 September 2019. We have also entered into a

long-term master franchise agreement which provides the franchise

partner with exclusive rights to the use of IWG's brands in

Switzerland. The partner will continue to operate the existing

centres under IWG's brands and operating platform and has committed

to a development plan which will add significantly to IWG's centre

network in Switzerland.

With the increasing interest in our partnering approach from a

diverse range of parties across our regions, we anticipate

reporting on further deals in the future to continue to unlock

value for our shareholders.

Strong financial position

The Group has substantially strengthened its financial position

in the nine months to 30 September 2019, reaching a relatively low

third quarter net debt to EBITDA leverage ratio of 0.8x. This has

been achieved by a combination of our strong trading performance,

excellent profit to cash conversion and pivot to franchising.

The net debt position at 30 September 2019, excluding the lease

liabilities under IFRS 16, was GBP301.2m, which represents a

substantial decrease on the 31 December 2018 position of GBP460.8m.

This reflects the receipt of the proceeds from the Japan and Taiwan

partnering transactions but not the recently announced partnering

transaction in Switzerland, where completion is expected to occur

at the end of November 2019.

During the third quarter we also acquired approximately 5.5m

shares for a total consideration of GBP22.4m under the recently

announced GBP100m share repurchase programme.

This strong and improved financial standing places the Group in

a position of strength to capitalise on opportunities that may

arise in the future to create further shareholder value.

Summary(1)

Strong sales activity has continued to drive good revenue

momentum. Open centre revenue, a good indicator of future

performance, increased by 15.5% in the third quarter and 15.4% for

the nine months to 30 September 2019, at constant currency. Growth

in the pre-2018 revenue for the nine months of 4.7% at constant

currency reflects a further improvement in occupancy in both the

centres opened in 2017 and those opened in earlier years. Occupancy

for the nine months to 30 September 2019 improved 3.1 percentage

points to 76.0%.

Also encouraging for future Group performance is the strong

development of the newer centres. Locations opened in 2018 are

developing strongly and those opened in the current year are

already exhibiting the potential to be even better than the 2018

cohort of openings.

The strong momentum of our enterprise accounts business has had

a beneficial impact on the average initial duration of our customer

contracts, which has strengthened our forward order book. We expect

to see the benefit of this in future quarters.

We have a very strong pipeline of franchising opportunities

across the globe, with excellent progress made in our pivot to a

franchising business model and we look forward to reporting on

further progress on this strategy.

We remain very confident in the structural, long-term growth in

the flexible workspace market and IWG's leading position within it,

which we continue to extend. We believe our transition to a

franchising model by partnering with a growing and diverse range of

third parties will deliver a quicker and more asset light approach

to growth, which benefits all stakeholders. We are making excellent

progress in shaping the business to benefit from this significant

growth opportunity. We continue to invest in our leading global

platform and management to support our strategy and look forward to

the rest of the year with confidence.

(1) Excluding the financial performance of Japan and Taiwan,

franchised during 2019 and now disclosed as discontinued operations

under IFRS accounting standards.

(2) At constant currency.

3Pre-2018 refers to the performance in the reported period for

all operations opened on or before 31 December 2017 and were open

throughout the period. Previously referred to as the mature

performance.

(4) Presented on a pre-IFRS 16 basis.

5Net capital expenditure in new locations equals gross capital

expenditure less any contributions received towards fit-out

costs.

Conference call details

IWG plc will be hosting a call for analysts and investors at

08.30 GMT this morning. Details are set out below:

Dial in number: +44 (0) 20 7192 8000

Conference ID: 1499033

There will also be a replay facility available until 1.30pm GMT

on 12 November 2019:

Dial in number: +44 (0) 33 3300 9785

Playback ID: 1499033

This announcement contains inside information.

For further information, please contact:

IWG plc Tel: + 41 (0) 41 723 2353 Brunswick Tel: + 44 (0)

Mark Dixon, Chief Executive Officer 20 7404 5959

Eric Hageman, Chief Financial Nick Cosgrove

Officer Oli Sherwood

Wayne Gerry, Group Investor Relations

Director

This trading update contains certain forward looking statements

with respect to the operations of IWG plc. These statements

and forecasts involve risk and uncertainty because they relate

to events and depend upon circumstances that may or may not

occur in the future. There are a number of factors that could

cause actual results or developments to differ materially from

those expressed or implied by these forward-looking statements

and forecasts. Nothing in this announcement should be construed

as a profit forecast.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTUGGUGGUPBPGC

(END) Dow Jones Newswires

November 05, 2019 02:00 ET (07:00 GMT)

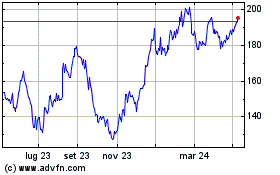

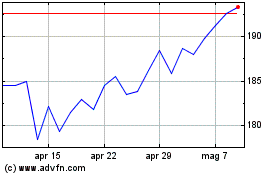

Grafico Azioni Iwg (LSE:IWG)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Iwg (LSE:IWG)

Storico

Da Apr 2023 a Apr 2024