TIDMTAM

RNS Number : 8806S

Tatton Asset Management PLC

11 November 2019

11 November 2019

Tatton Asset Management plc

Interim results for the six months ended 30 September 2019

"Continued good progress and reached GBP7.0bn AUM milestone"

Tatton Asset Management plc (the "Group") (AIM: TAM), the

on-platform discretionary fund management (DFM) and support

services business for independent financial advisers (IFAs), today

issues its interim results for the six-month period ended 30

September 2019.

FINANCIAL HIGHLIGHTS

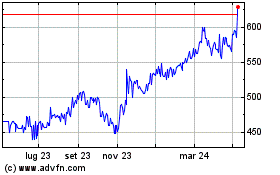

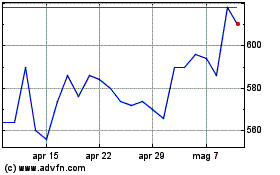

- Discretionary assets under management ("AUM")

increased 22.8% to GBP7.0bn (2018: GBP5.7bn)

- Average AUM inflows over GBP73.0m per month

- Group revenue increased 15.2% to GBP9.73m

(2018: GBP8.45m)

- Adjusted operating profit(*) up 23.2% to

GBP4.13m (2018: GBP3.35m)

- Profit before tax increased to GBP3.61m (2018:

GBP3.08m)

- Return on capital employed increased by 1.1%

to 25.2% (2018: 24.1%)

- Adjusted fully diluted EPS(*) increased 17.9%

to 5.39p (2018: 4.57p)

- Proposed interim dividend increased 14.3%

to 3.20p (2018: 2.80p)

- Strong financial position, with net cash

of GBP9.2m

OPERATIONAL HIGHLIGHTS

- Acquired Sinfonia Asset Management Limited,

five Funds with AUM of GBP135m for a consideration

of up to GBP2.7m

- Tatton Investment Management (Tatton) increased

its number of firms to 522 (2018: 405) and

number of accounts to 61,250 (2018: 53,500)

- Strong start to Tenet Partnership since June

announcement - 40 new firms and GBP24.5m

of AUM

- Paradigm Mortgages Services, the Group's

mortgage and protection distribution business,

performed strongly, with gross lending via

its channels during the period of GBP4.8bn

(2018: GBP4.0bn), an increase of 20.0% and

with 1,466 mortgage firms using its services

(2018: 1,290)

- Amalgamation of Consulting and Mortgages

creating a simplified IFA support services

business, allowing the Group to better meet

the needs of IFAs through an integrated approach

* Alternative performance measures are detailed in note 18 of

this interim report

Paul Hogarth, Chief Executive, commented: "It is particularly

pleasing to have reached the important milestone of GBP7bn of AUM

with monthly net flows continuing to perform well from both

existing and new IFAs despite an uncertain and volatile market. We

have also reorganised our IFA support services businesses under the

existing Paradigm brand but with one simplified operational and

management structure from which we expect to see improved

efficiencies and opportunities in the future. While we are mindful

of the current political and macro-economic factors, the Group

continues to trade in line with the Board's full year expectations

and the Board remains optimistic regarding the prospects of the

Group."

For further information please contact:

+44 (0) 161 486

Tatton Asset Management plc 3441

Paul Hogarth (Chief Executive

Officer)

Paul Edwards (Chief Financial

Officer)

Lothar Mentel (Chief Investment

Officer)

Roddi Vaughan-Thomas (Head of

Communications)

Nomad and Broker

+44 (0) 20 3829

Zeus Capital 5000

Martin Green (Corporate Finance)

Dan Bate (Corporate Finance and

QE)

Pippa Hamnett (Corporate Finance)

Media Enquiries

+44 (0) 20 7250

Powerscourt 1446

Justin Griffiths

For more information, please visit:

www.tattonassetmanagement.com

Analyst presentation

An analyst briefing is being held at 9.30am on 11 November 2019

at the offices of Zeus Capital, 10 Old Burlington St, London, W1S

3AG.

GROUP RESULTS

The Group has delivered a solid first half performance driven by

continued growth in Tatton Investment Management (Tatton). We

continue to deliver increasing assets under management (AUM) and

reached the GBP7.0bn milestone at the end of September 2019.

Group revenue for the period increased 15.2% to GBP9.73m (2018:

GBP8.45m). Adjusted operating profit* for the period increased

23.2% to GBP4.13m (2018: GBP3.35m) with adjusted operating profit

margin* increasing to 42.4% (2018: 39.7%).

Pre-tax profit after exceptional items and share-based payment

charges increased 17.1% to GBP3.61m (2018: GBP3.08m). Taxation

charges for the period were GBP0.67m (2018: GBP0.68m). This gives

an effective tax rate of 18.5% when measured against profit before

tax. Adjusting for exceptional costs and share-based payments the

effective tax rate is 19.7%.

The basic earnings per share was 5.26p (2018: 4.30p). When

adjusted for exceptional items and share-based payment charges,

earnings per share was 5.92p (2018: 4.97p) and earnings per share

fully diluted for the impact of share options was 5.39p (2018:

4.57p), an increase of 17.9%.

STRATEGIC PRIORITIES AND BUSINESS OBJECTIVES

TATTON INVESTMENT MANAGEMENT

Against a backdrop of a global economic slowdown and the rising

investor hesitance due to Brexit uncertainty, Tatton has made a

solid start to the financial year.

Tatton completed its first acquisition, Sinfonia Asset

Management Limited (SAM), for a consideration of up to GBP2.7m. SAM

contributed GBP135m of assets to the total AUM of GBP7.0bn (2018:

GBP5.7bn). This represents an increase in AUM of 22.8% on the prior

year (organic 21.1%) and 14.8% since the last full year results at

the end of March 2019. Increasing AUM through new and existing

adviser relationships remains at the core of Tatton's strategy,

both organically and through acquisition. We will continue to

develop our market leading managed portfolio service and enhance

our other products to ensure they remain at the cutting edge of

centralised investment propositions (CIP) for financial advisers.

We continue to make good progress in adding new firms and

associated clients with firm numbers increasing to 522 (2018: 405),

an increase of 28.9%, and clients increasing to 61,250 (2018:

53,500), an increase of 14.5%. We are very pleased with the

progress we are making with the Tenet Group following the signing

of the strategic partnership agreement in June this year. Results

are already very positive with 40 new firms (included in the 522

above) and GBP24.5m of associated AUM added in the period to

September 2019. We look forward to making further progress in the

year ahead.

Revenue for Tatton (excluding wrap income, as previously

presented) grew 35.2% to GBP5.45m (2018: GBP4.03m) and adjusted

operating profit* grew 42.0% to GBP2.91m (2018: GBP2.05m). Margins

increased to 53.3% (2018: 50.9%) reflecting the operational gearing

of the business. We anticipate that this will continue as the

business continues to grow.

PARADIGM MORTGAGES

Paradigm Mortgages started the year well and continues to

deliver good growth through increasing market share despite the

headwinds in the mortgage market. New members in the period

increased the number of firms by 13.6% to 1,466 (2018: 1,290).

Paradigm Mortgages' strategy remains to assist Financial

Advisers and intermediaries in benefiting from economies of scale

in lending and insurance provision through access to lenders

covering the whole of market, together with a full range of

mortgage-related support services. The increase in new members

helps to drive applications which is a key indicator for future

performance and also benefits the general drive towards increased

customer retention with intermediaries taking an increasing share

of the channel which feeds through to increased completions and

associated revenue.

Revenue for Paradigm Mortgages grew 11.4% to GBP1.42m (2018:

GBP1.28m) and adjusted operating profit grew 11.3% to GBP0.80m

(2018: GBP0.72m) with margins remaining strong at 56.1% (2018:

56.2%).

PARADIGM CONSULTING

The business continues to provide regulatory compliance support

and bespoke consultancy to IFAs and acts as a channel for

intelligence and insight into the IFA community for the wider

Group. The number of Paradigm Consulting firms slightly increased

to 385 (2018: 382), while the market experiences transactional

activity and continues to consolidate. Revenue in the period

reduced 9.3% to GBP2.83m (2018: GBP3.12m) and adjusted operating

profit* reduced 3.8% to GBP1.48m (2018: GBP1.54m).

REORGANISATION

Since the IPO in July 2017 we have operated three distinct

businesses, each with its own strategic goals and priorities. As

the Group has evolved over the last two years, we have continued to

develop our approach to how the Group businesses operate in their

respective markets. As such the decision has been made to simplify

the business units to better reflect their offerings of investment

management and adviser support services. Therefore, the two

existing Paradigm businesses will amalgamate to operate under a

single operational and reporting control structure, resulting in a

change to the operating segment reporting. They will continue to

deliver financial adviser support services, consulting, pooled

protection and the mortgage club under the existing Paradigm brand.

Further, all end client-related investment income to the Group will

now be presented under Tatton Investment Management (Tatton),

meaning the investment and wrap income of GBP1.6m including

associated costs of GBP0.3m, which were historically presented

under Paradigm Consulting, will now be presented under Tatton to

better reflect its nature and the operational activity which

supports it. A summary of the segmental results for the period

(together with prior period comparatives) for the Tatton and

Paradigm businesses, on both the new and old basis of presentation,

is set out in the Divisional Results section below and in Note 2.2

to these condensed financial statements.

As we look to the future, we will leverage the closer

relationship in the Paradigm businesses through improved

cross-fertilisation and co-operation and see this as a logical step

to a more cohesive proposition to the markets in which we operate.

We have shown both the new and historical presentation for clarity

and understanding on the following pages. Any additional costs

incurred in the second half of the year in relation to the

reorganisation will be separately disclosed in the income

statement.

DIVISIONAL RESULTS

The impact of the change in the Group's operating divisions as

detailed above is illustrated in note 2.6 of these condensed

financial statements.

HISTORICAL PRESENTATION

Tatton Paradigm Paradigm

Investment Consulting Mortgages Central Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

30 September 2019

Revenue 5,453 2,828 1,424 24 9,729

Adjusted operating

profit* 2,906 1,478 799 (1,057) 4,126

Adjusted operating

profit margin* 53.3% 52.3% 56.1% - 42.4%

30 September 2018

Revenue 4,025 3,118 1,278 24 8,445

Adjusted operating

profit* 2,050 1,537 718 (955) 3,350

Adjusted operating

profit margin* 50.9% 49.3% 56.2% - 39.7%

NEW PRESENTATION

Tatton Paradigm Central Total

GBP'000 GBP'000 GBP'000 GBP'000

30 September 2019

Revenue 7,102 2,603 24 9,729

Adjusted operating

profit* 4,273 910 (1,057) 4,126

Adjusted operating

profit margin* 60.2% 35.0% - 42.4%

30 September 2018

Revenue 5,987 2,434 24 8,445

Adjusted operating

profit* 3,482 823 (955) 3,350

Adjusted operating

profit margin* 58.2% 33.8% - 39.7%

ACQUISITION

A key part of the Group's strategy is to make acquisitions that

fit the business model and fulfil the key strategic aims of the

business. On 30 September 2019 the Group acquired the entire issued

share capital of Sinfonia Asset Management Limited (SAM), a wholly

owned subsidiary of the Tenet Group for a consideration of up to

GBP2.7m. SAM comprises five risk-targeted funds with a total AUM of

GBP135m. These five additional funds will complement Tatton's

existing fund range and expand the access IFAs' clients have to a

range of diversified investments portfolios on investment platforms

that cannot yet accommodate discretionary portfolio services.

Of the consideration of up to GBP2.7m, GBP2.0m was payable on

completion with the remaining balance becoming payable in two equal

instalments subject to meeting specific AUM targets at the end of

years one and two post completion as set out in note 16 to these

condensed financial statements.

EXCEPTIONAL ITEMS

The exceptional items totalling GBP0.1m in the period relate to

the acquisition of Sinfonia Asset Management Limited. Exceptional

items along with share-based payment charge are both reported

separately to give a better understanding of the Company's

underlying performance.

BALANCE SHEET

The balance sheet remains healthy with net assets at 30

September 2019 totalling GBP15.3m (2018: GBP13.9m) reflecting the

continued growth and profitability of the Group. Property, plant

and equipment has increased to GBP1.1m (2018: GBP0.3m), with

GBP0.6m of the increase relating to the recognition of right-of-use

assets following the adoption of IFRS 16 'Leases' from 1 April

2019. Lease liabilities of GBP0.7m have also been recognised at the

period end resulting in a net decrease to net assets of

GBP0.1m.

Intangible assets of GBP1.8m have been recognised (2018:

GBPnil), of which GBP1.5m relates to the preliminary valuation of

customer relationship intangibles recognised on the acquisition of

SAM. This business combination has also resulted in an increase to

goodwill of GBP1.1m.

CASH RESOURCES

The Group continues to generate strong cash flows. Net cash

generated from operations was GBP3.8m, GBP3.9m before exceptional

items (2018: GBP4.3m) and was 105% of operating profit. The Group

remains debt free with closing net cash at the end of the period of

GBP9.2m (2018: GBP11.6m or GBP9.4m excluding non-shareholder cash).

The cash resources are after the acquisition of Sinfonia of

GBP2.0m, corporation tax of GBP1.4m and dividend payments of

GBP3.1m relating to the final dividend for the year ended 31 March

2019.

DIVID

The Board is pleased to recommend an interim dividend of 3.2p

per share, an increase of 14.3% on the prior period interim

dividend. The interim dividend reflects both our cash performance

and our underlying confidence in the business. The interim dividend

of 3.2p per share, totalling GBP1.8m, will be paid on 13 December

2019 to shareholders on the register at close of business on 22

November 2019 and will have an ex-dividend date of 21 November

2019. In accordance with IFRS, the interim dividend has not been

included as a liability in this interim statement.

BUSINESS RISK

The Board identified principal risks and uncertainties which may

have a material impact on the Group's performance in the Group's

2019 Annual Report and Accounts (pages 24 to 25) and believes that

the nature of these risks remains largely unchanged at the half

year. The Board will continue to monitor and manage identified

principal risks throughout the second half of the year.

BREXIT

The Group has continued to review the implications of the result

of the UK referendum to leave the EU on our business model. As the

Group has no direct exposure to cross-border trading and has no

overseas operations, the direct impact of Brexit will be limited.

However, we remain mindful of the uncertainty Brexit has created

and its potential to impact markets and the wider consumer

sentiment. The Board will continue to assess the implications of

the changes as they emerge.

GOING CONCERN

As stated in note 2.2 of these condensed financial statements,

the Directors are satisfied that the Group has sufficient resources

to continue in operation for the foreseeable future, a period not

less than 12 months from the date of this report. Accordingly, they

continue to adopt the going concern basis in preparing these

condensed financial statements.

SUMMARY AND OUTLOOK

The Group continues to make good progress against its stated

strategy. We continue to see net new inflows supporting an

increasing AUM. The Group has delivered a solid first half

performance with increasing revenues, profit and margins. As in

prior periods we will continue to maintain a disciplined approach

to executing our strategy and we remain excited by the

opportunities that exist in the markets in which we operate. While

we are mindful of the current political and macro-economic factors,

the Group continues to trade in line with the Board's full year

expectations and the Board remains optimistic regarding the

prospects of the Group.

* Alternative performance measures are detailed in note 18 of

this interim report

FINANCIAL STATEMENTS

CONSOLIDATED STATEMENT OF TOTAL COMPREHENSIVE INCOME

FOR THE SIX MONTHSED 30 SEPTEMBER 2019

Unaudited Unaudited

six six Audited

months months year

ended ended ended

30-Sep 30-Sep 31-Mar

2019 2018 2019

Note (GBP'000) (GBP'000) (GBP'000)

Revenue 9,729 8,445 17,518

Administrative expenses (6,118) (5,473) (11,593)

================================ ==== ========= ========= =========

Operating profit 4 3,611 2,972 5,925

Share-based payment costs 5 413 365 874

Exceptional items 5 102 13 509

Adjusted operating profit

(before

========= ========= =========

separately disclosed items)(1) 4,126 3,350 7,308

=============================== ==== ========= ========= =========

Finance (costs)/income 6 (1) 112 187

=============================== ==== ========= --------- ---------

Profit before tax 3,610 3,084 6,112

Taxation charge 7 (667) (681) (1,255)

=============================== ==== ========= ========= =========

Profit attributable to

shareholders 2,943 2,403 4,857

=============================== ==== ========= ========= =========

Earnings per share - Basic 8 5.26p 4.30p 8.69p

Earnings per share - Diluted 8 4.79p 3.95p 7.92p

Adjusted earnings per share

- Basic(2) 8 5.92p 4.97p 10.99p

Adjusted earnings per share

- Diluted(2) 8 5.39p 4.57p 10.02p

1 Adjusted for exceptional items and share-based

payment costs. See note 18.

2 Adjusted for exceptional items and share-based

payment costs and the tax thereon. See note

18.

There were no other recognised gains or losses other than those

recorded above in the current or prior period and therefore a

statement of other comprehensive income has not been presented.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

FOR THE SIX MONTHSED 30 SEPTEMBER 2019

Unaudited Unaudited

six six Audited

months ended months ended year ended

31-Mar

30-Sep 2019 30-Sep 2018 2019

Note

============ ============ ==========

(GBP'000) (GBP'000) (GBP'000)

========================== ==== ============ ============ ==========

Non-current assets

Goodwill 10 6,060 4,917 4,917

Intangible assets 11 1,750 - 223

Property, plant

and equipment 12 1,094 310 349

Deferred income

tax asset 101 - 104

========================== ==== ============ ============ ==========

Total non-current

assets 9,005 5,227 5,593

========================== ==== ============ ============ ==========

Current assets

Trade and other

receivables 2,639 3,410 2,508

Corporation tax

asset 118 - -

Cash and cash equivalents 9,174 11,622 12,192

========================== ==== ============ ============ ==========

Total current assets 11,931 15,032 14,700

-------------------------- ---- ============ ============ ==========

Total assets 20,936 20,259 20,293

========================== ==== ============ ============ ==========

Current liabilities

Trade and other

payables (4,579) (5,775) (4,521)

Corporation tax - (600) (484)

========================== ==== ============ ============ ==========

Total current liabilities (4,579) (6,375) (5,005)

========================== ==== ------------ ------------ ----------

Non-current liabilities

Deferred tax liabilities - (15) -

Other payables (1,008) - -

========================== ==== ============ ============ ==========

Total non-current

liabilities (1,008) (15) -

-------------------------- ---- ============ ============ ==========

Total liabilities (5,587) (6,390) (5,005)

-------------------------- ---- ============ ============ ==========

Net assets 15,349 13,869 15,288

========================== ==== ============ ============ ==========

Equity attributable

to equity

holders of the entity

Share capital 11,182 11,182 11,182

Share premium account 8,718 8,718 8,718

Other reserve 2,041 2,041 2,041

Merger reserve (28,968) (28,968) (28,968)

Retained earnings 22,376 20,896 22,315

========================== ==== ============ ============ ==========

Total equity 15,349 13,869 15,288

========================== ==== ============ ============ ==========

The financial statements were approved by the Board of Directors

on 11 November 2019 and were signed on its behalf by:

PAUL EDWARDS

Director

Company registration number: 10634323

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHSED 30 SEPTEMBER 2019

Share Share Other Merger Retained Total

capital premium reserve reserve earnings equity

(GBP'000) (GBP'000) (GBP'000) (GBP'000) (GBP'000) (GBP'000)

At 1 April 2018 11,182 8,718 2,041 (28,968) 20,588 13,561

Profit and total

comprehensive

income - - - - 2,403 2,403

Dividends - - - - (2,460) (2,460)

Share-based payments - - - - 365 365

At 30 September

2018 11,182 8,718 2,041 (28,968) 20,896 13,869

Profit and total

comprehensive

income - - - - 2,454 2,454

Dividends - - - - (1,565) (1,565)

Share-based payments - - - - 400 400

Deferred tax on

share-based

payments - - - - 130 130

At 31 March 2019 11,182 8,718 2,041 (28,968) 22,315 15,288

Profit and total

comprehensive

income - - - - 2,943 2,943

Dividends - - - - (3,131) (3,131)

Share-based payments - - - - 379 379

Deferred tax on

share-based

payments - - - - (130) (130)

At 30 September

2019 11,182 8,718 2,041 (28,968) 22,376 15,349

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE SIX MONTHSED 30 SEPTEMBER 2019

Unaudited Unaudited

six months six months Audited

year

ended ended ended

30-Sep 30-Sep 31-Mar

2019 2018 2019

Note (GBP'000) (GBP'000) (GBP'000)

Operating activities

Profit for the period 2,943 2,403 4,857

Adjustments:

Income tax expense 7 667 681 1,255

Depreciation of property,

plant and equipment 12 145 46 91

Amortisation of intangible

assets 11 57 - 43

Share-based payment expense 15 413 365 874

Finance costs/(income) 6 1 (112) (187)

Changes in:

Trade & other receivables (79) (958) 78

Trade & other payables (357) 1,853 491

Exceptional costs 5 102 13 509

Cash generated from operations

before exceptional costs 3,892 4,291 8,011

Cash generated from operations 3,790 4,278 7,502

Income tax paid (1,396) (687) (1,366)

Net cash from operating

activities 2,394 3,591 6,136

Investing activities

Payment for the acquisition

of subsidiary, net of

cash acquired 16 (1,960) - -

Purchase of intangible assets (115) - (266)

Purchase of property, plant

and equipment (202) (251) (336)

Net cash used in investing

activities (2,277) (251) (602)

Financing activities

Interest received 10 112 53

Dividends paid (3,131) (2,460) (4,025)

Repayment of the lease liabilities (14) - -

Net cash used in financing

activities (3,135) (2,348) (3,972)

Net (decrease)/increase

in cash and cash equivalents (3,018) 992 1,562

Cash and cash equivalents

at beginning of period 12,192 10,630 10,630

Net cash and cash equivalents

at end of period 9,174 11,622 12,192

The accompanying notes are an integral part of the interim

financial statements.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

1 GENERAL INFORMATION

Tatton Asset Management plc ("the Company") is a public company

limited by shares. The address of the registered office is Paradigm

House, Brooke Court, Lower Meadow Road, Wilmslow, SK9 3ND, United

Kingdom. The registered number is 10634323.

The Group comprises the Company and its subsidiaries. The

Group's principal activities are discretionary fund management, the

provision of compliance and support services to independent

financial advisers (IFAs), the provision of mortgage adviser

support services and the marketing and promotion of the funds run

by the companies under Tatton Capital Limited.

The condensed consolidated interim financial statements for the

six months ended 30 September 2019 do not constitute statutory

accounts as defined under Section 434 of the Companies Act 2006.

The Annual Report and Financial Statements (the 'Financial

Statements') for the year ended 31 March 2019 were approved by the

Board on 3 June 2019 and have been delivered to the Registrar of

Companies. The Auditor, Deloitte LLP, reported on these financial

statements; its report was unqualified, did not contain an emphasis

of matter paragraph and did not contain statements under s498 (2)

or (3) of the Companies Act 2006.

News updates, regulatory news, and financial statements can be

viewed and downloaded from the Group's website,

www.tattonassetmanagement.com. Copies can also be requested from:

The Company Secretary, Tatton Asset Management plc, Paradigm House,

Brooke Court, Lower Meadow Road, Wilmslow, SK9 3ND.

2 ACCOUNTING POLICIES

The principal accounting policies applied in the presentation of

the interim financial statements are set out below.

2.1 BASIS OF PREPARATION

The unaudited condensed consolidated interim financial

statements for the six months ended 30 September 2019 have been

prepared in accordance with IAS 34 'Interim Financial Reporting' as

adopted by the European Union. The condensed consolidated interim

financial statements should be read in conjunction with the

Financial Statements for the year ended 31 March 2019, which have

been prepared in accordance with International Financial Reporting

Standards (IFRSs) as adopted by the European Union. The condensed

consolidated interim financial statements were approved for release

on 11 November 2019.

The condensed consolidated interim financial statements have

been prepared on a going concern basis and prepared on the

historical cost basis.

The condensed consolidated interim financial statements are

presented in sterling and have been rounded to the nearest thousand

(GBP'000). The functional currency of the Company is sterling.

The preparation of financial information in conformity with IFRS

requires management to make estimates and assumptions that affect

the reported amounts of assets and liabilities at the date of the

financial statements and the reported amounts of revenues and

expenses during the reporting period. Although these estimates are

based on management's best knowledge of the amount, event or

actions, actual events may ultimately differ from those

estimates.

The key accounting policies set out below have, unless otherwise

stated, been applied consistently to all periods presented in the

consolidated financial statements. The accounting policies adopted

by the Group in these interim financial statements are consistent

with those applied by the Group in its consolidated financial

statements for the year ended 31 March 2019, except for the

adoption of new standards effective as of 1 April 2019.

2.2 GOING CONCERN

These financial statements have been prepared on a going concern

basis. The Directors have prepared cash flow projections and are

satisfied that the Group has adequate resources to continue in

operational existence for the foreseeable future. The Group's

forecasts and projections, which take into account reasonably

possible changes in trading performance, show that the Group will

be able to operate within the level of its current facilities. The

Directors have considered the risks associated with Brexit,

including considering the effect on clients' wealth, attitude

towards savings and investment, and changes in government policy.

The Directors do not consider that the impact of Brexit will affect

the Group continuing as a going concern. Accordingly, the Directors

continue to adopt the going concern basis in preparing these

condensed consolidated interim financial statements.

2.3 BASIS OF CONSOLIDATION

On 23 February 2017 the Company was incorporated under the name

Tatton Asset Management Limited. On 19 June 2017 Tatton Asset

Management Limited acquired the entire share capital of Nadal Newco

Limited via a share for share exchange with the shareholders of

Nadal Newco Limited. On 19 June 2017 Tatton Asset Management

Limited was re-registered as a public company with the name Tatton

Asset Management plc. Following the share for share exchange

referred to above, Tatton Asset Management plc became the ultimate

legal parent of the Group.

2.4 STANDARDS IN ISSUE NOT YET EFFECTIVE

The following IFRS and IFRIC Interpretations have been issued

but have not been applied by the Group in preparing the historical

financial information, as they are not yet effective. The Group

intends to adopt these Standards and Interpretations when they

become effective, rather than adopt them early.

- Amendments to IFRS 3, IAS 1, IAS 8, IFRS 9, IAS 39 and IFRS 7

A number of IFRS and IFRIC interpretations are also currently in

issue which are not relevant for the Group's activities and which

have not therefore been adopted in preparing the interim financial

statements.

The Directors do not expect that the adoption of the Standards

listed above will have a material impact on the financial

statements of the Group in future periods.

2.5 LEASES

In the current period, the Group, for the first time, has

applied IFRS 16 Leases (as issued by the IASB in January 2016)

which became effective for accounting periods beginning on or after

1 January 2019. The date of initial application of IFRS 16 for the

Group was 1 April 2019.

IFRS 16 introduces new or amended requirements with respect to

lease accounting. It introduces significant changes to the lessee

accounting by removing the distinction between operating and

finance lease and requiring the recognition of a right-of-use asset

and a lease liability at commencement for all leases, except for

short-term leases and leases of low value assets. In contrast to

lessee accounting, the requirements for lessor accounting have

remained largely unchanged. The impact of the adoption of IFRS 16

on the Group's consolidated financial statements is described

below.

The Group has applied IFRS 16 using the modified retrospective

approach. Under this approach, comparative information is not

restated and the cumulative effect of internally applying IFRS 16

is recognised in retained earnings at the date of initial

application, however there is no impact on the net assets and

retained earnings of the Group at 1 April 2019.

Impact on the new definition of a lease

The Group has made use of the practical expedient available on

transition to IFRS 16 not to reassess whether a contract is or

contains a lease. Accordingly, the definition of a lease in

accordance with IAS 17 and IFRIC 4 will continue to be applied to

those leases entered or modified before 1 April 2019. The change in

definition of a lease mainly relates to the concept of control.

IFRS 16 determines whether a contract contains a lease on the basis

of whether the customer has the right to control the use of an

identified asset for a period of time in exchange for

consideration.

The Group applies the definition of a lease and related guidance

set out in IFRS 16 to all lease contracts entered into or modified

on or after 1 April 2019 (whether it is a lessor or a lessee in the

lease contract). In preparation for the first-time application of

IFRS 16, the Group has carried out an implementation project. The

project has shown that the new definition in IFRS 16 will not

change significantly the scope of contracts that meet the

definition of a lease for the Group.

Impact on Lessee Accounting

Former operating leases

IFRS 16 changes how the Group accounts for leases previously

classified as operating leases under IAS 17, which were off-balance

sheet.

Applying IFRS 16, for all leases (except as noted below), the

Group:

- recognises right-of-use assets and lease liabilities

in the Consolidated Statement of Financial

Position, initially measured at the present

value of the future lease payments;

- recognises depreciation of right-of-use assets

and interest on lease liabilities in the Consolidated

Statement of Total Comprehensive Income;

- separates the total amount of cash paid into

a principal portion (presented within financing

activities) and interest (presented within

operating activities) in the Consolidated

Statement of Total Comprehensive Income.

Lease incentives (e.g. rent-free period) are recognised as part

of the measurement of the right-of-use assets and lease liabilities

whereas under IAS 17 they resulted in the recognition of a lease

liability incentive, amortised as a reduction of rental expenses on

a straight-line basis.

Under IFRS 16, right-of-use assets will be tested for impairment

in accordance with IAS 36 Impairment of Assets. This replaces the

previous requirement to recognise a provision for onerous lease

contracts.

For short-term leases (lease term of 12 months or less) and

leases of low-value assets (such as personal computers and office

furniture), the Group has opted to recognise a lease expense on a

straight-line basis as permitted by IFRS 16. This expense is

presented within Other operating expenses in the Consolidated

Statement of Total Comprehensive Income.

Financial impact of initial application of IFRS 16

The tables below show the amount of adjustment for each

financial statement line item affected by the application of IFRS

16 for the current period.

Impact on profit or loss in the period GBP'000

======================================== =======

Increase in depreciation(1) (69)

Increase in finance costs(1) (11)

Decrease in other operating expenses(1) 77

Decrease in profit for the period (3)

Impact on earnings per share p

======================================== =======

Increase in earnings per share from

continuing operations

Basic 0.01p

Diluted 0.01p

As if IAS

17 still IFRS 16

Impact on assets, liabilities

and equity as at applied adjustments As presented

30 September 2019 GBP'000 GBP'000 GBP'000

================================ ========= =========== ============

Right-of-use asset(1) - 620 620

Net impact on total assets - 620 620

Trade and other payables (63) 63 -

Lease liabilities(1) - (686) (686)

Net impact on total liabilities (63) (623) (686)

Retained earnings (63) (3) (66)

1 The application of IFRS 16 to leases previously classified as

operating leases under IAS 17 resulted in the recognition of

right-of-use assets and lease liabilities. It resulted in a

decrease in Other operating expenses and an increase in

depreciation and interest expense.

GBP'000

Operating lease commitments disclosed

as at 31 March 2019 778

(Less): short-term leases recognised

on a straight-line basis as expense (28)

750

Lease liability recognised as at 1 April

2019 discounted using the lessee's

incremental borrowing rate at the date

of initial application 689

Of which are:

Current lease liabilities 40

Non-current lease liabilities 649

689

The application of IFRS 16 has an impact on the consolidated

cash flows of the Group. Under IFRS 16, lessees must present:

- short-term lease payments and payments for

leases of low-value assets as part of operating

activities (the Group has included these

payments as part of payments to suppliers

and employees);

- cash paid for the interest portion of lease

liability as either operating activities

or financing activities, as permitted by

IAS 7 (the Group has opted to include interest

paid as part of operating activities); and

- cash payments for the principal portion for

lease liability, as part of financing activities.

Under IAS 17, all lease payments on operating leases were

presented as part of cash flows from operating activities. At the

reporting date there is no impact on net cash generated by

operating activities as no payments have been made against the

relevant lease in the period. The adoption of IFRS 16 did not have

an impact on net cash flows.

The Group as lessee

The Group assesses whether a contract is or contains a lease, at

inception of the contract.

The Group recognises a right-of-use asset and a corresponding

lease liability with respect to all lease arrangements in which it

is the lessee, except for short-term leases (defined as leases with

a lease term of 12 months or less) and leases of low value assets.

For these leases, the Group recognises the lease payments as an

operating expense on a straight-line basis over the term of the

lease unless another systematic basis is more representative of the

time pattern in which economic benefits from the leased assets are

consumed.

The lease liability is initially measured at the present value

of the lease payments that are not paid at the commencement date,

discounted by using the rate implicit in the lease. If this rate

cannot be readily determined, the Group uses its incremental

borrowing rate.

Lease payments included in the measurement of the lease

liability comprise:

- fixed lease payments (including in substance

fixed payments), less any lease incentives;

- the amount expected to be payable by the lessee

under residual value guarantees;

- the exercise price of purchase options, if

the lessee is reasonably certain to exercise

the options; and

- payments of penalties for terminating the

lease, if the lease term reflects the exercise

of an option to terminate the lease.

The lease liability is presented within Trade and other payables

in the Consolidated Statement of Financial Position.

The lease liability is subsequently measured by increasing the

carrying amount to reflect interest on the lease liability (using

the effective interest method) and by reducing the carrying amount

to reflect the lease payments made.

The Group remeasures the lease liability (and makes a

corresponding adjustment to the related right-of-use asset)

whenever:

- the lease term has changed or there is a change

in the assessment of exercise of a purchase

option, in which case the lease liability

is remeasured by discounting the revised lease

payments using a revised discount rate;

- the lease payments change due to changes in

an index or rate or a change in expected payment

under a guaranteed residual value, in which

cases the lease liability is remeasured by

discounting the revised lease payments using

the initial discount rate (unless the lease

payments change is due to a change in a floating

interest rate, in which case a revised discount

rate is used); and

- a lease contract is modified and the lease

modification is not accounted for as a separate

lease, in which case the lease liability is

remeasured by discounting the revised lease

payments using a revised discount rate.

The Group did not make any such adjustments during the periods

presented.

The right-of-use assets comprise the initial measurement of the

corresponding lease liability, lease payments made at or before the

commencement day and any initial direct costs. They are

subsequently measured at cost less accumulated depreciation and

impairment losses.

Whenever the Group incurs an obligation for costs to dismantle

and remove a leased asset, restore the site on which it is located

or restore the underlying asset to the condition required by the

terms and conditions of the lease, a provision is recognised and

measured under IAS 37. The costs are included in the related

right-of-use asset, unless those costs are incurred to produce

inventories.

Right-of-use assets are depreciated over the shorter period of

lease term and useful life of the underlying asset. If a lease

transfers ownership of the underlying asset or the cost of the

right-of-use asset reflects that the Group expects to exercise a

purchase option, the related right-of-use asset is depreciated over

the useful life of the underlying asset. The depreciation starts at

the commencement date of the lease.

The right-of-use assets are within Property, plant and equipment

in the Consolidated Statement of Financial Position. The Group

applies IAS 36 Impairment of Assets to determine whether a

right-of-use asset is impaired and accounts for any identified

impairment loss as described in the Property, plant and equipment

policy.

As a practical expedient, IFRS 16 permits a lessee not to

separate non-lease components, and instead account for any lease

and associated non-lease components as a single arrangement. The

Group has not used this practical expedient.

2.6 OPERATING SEGMENTS

The Group comprises the following two operating segments which

are defined by trading activity:

- Tatton - investment management services

- Paradigm - the provision of compliance and support services to

IFAs and mortgage advisers

The Board is considered to be the chief operating decision

maker.

Following changes to the structure of the Group's internal

organisation, and subsequent changes to the way in which financial

and management information is presented to both the Board and the

Executive Committee, the composition of the Group's Reportable

Segments changed in the financial period ended 30 September

2019.

The change to the Group's organisation structure was the

establishment of the Paradigm division in order to bring together

the activities of Paradigm Consulting and Paradigm Mortgages under

single leadership. The change allows the needs of IFAs and

mortgages advisers to be better met through an integrated approach.

The services being provided to these customers include compliance

and support services. In addition, the Tatton division now includes

wrap-related revenue which was previously included in the Paradigm

Consulting division.

This change brings the management and responsibility for all

asset-related management and services into one division.

As a result of these changes, activities previously reported

under Paradigm Consulting have been split between Tatton and

Paradigm, with Paradigm Mortgages being reported under

Paradigm.

The Revenue by segment disclosure note for the period to

September 2018 and the year to March 2019 has been amended as

follows:

(i) Revenue by segment

Period ended 30 September

2018

As reported Adjustment Restated

GBP'000 GBP'000 GBP'000

Tatton 4,025 1,962 5,987

Paradigm - 2,434 2,434

Paradigm Consulting 3,118 (3,118) -

Paradigm Mortgages 1,278 (1,278) -

Central 24 - 24

Total 8,445 - 8,445

Year ended 31 March

2019

As reported Adjustment Restated

GBP'000 GBP'000 GBP'000

Tatton 8,732 3,789 12,521

Paradigm - 4,949 4,949

Paradigm Consulting 6,049 (6,049) -

Paradigm Mortgages 2,689 (2,689) -

Central 48 - 48

Total 17,518 - 17,518

(ii) Operating profit by

segment

Period ended 30 September

2018

As reported Adjustment Restated

GBP'000 GBP'000 GBP'000

Tatton 1,955 1,432 3,387

Paradigm - 810 810

Paradigm Consulting 1,524 (1,524) -

Paradigm Mortgages 718 (718) -

Central (1,225) - (1,225)

Total 2,972 - 2,972

Year ended 31 March

2019

As reported Adjustment Restated

GBP'000 GBP'000 GBP'000

Tatton 4,098 2,743 6,841

Paradigm - 1,805 1,805

Paradigm Consulting 2,983 (2,983) -

Paradigm Mortgages 1,565 (1,565) -

Central (2,721) - (2,721)

Total 5,925 - 5,925

(iii) Adjusted operating

profit* by segment

Period ended 30 September

2018

As reported Adjustment Restated

GBP'000 GBP'000 GBP'000

Tatton 2,050 1,432 3,482

Paradigm - 823 823

Paradigm Consulting 1,537 (1,537) -

Paradigm Mortgages 718 (718) -

Central (955) - (955)

Total 3,350 - 3,350

Year ended 31 March

2019

As reported Adjustment Restated

GBP'000 GBP'000 GBP'000

Tatton 4,628 2,743 7,371

Paradigm - 1,818 1,818

Paradigm Consulting 2,996 (2,996) -

Paradigm Mortgages 1,565 (1,565) -

Central (1,881) - (1,881)

Total 7,308 - 7,308

* Alternative performance measures are detailed in note 18 of

this interim report

2.7 SIGNIFICANT JUDGEMENTS, KEY ASSUMPTIONS AND ESTIMATES

In the process of applying the Group's accounting policies,

which are described above, management have made judgements and

estimations about the future that have the most significant effect

on the amounts recognised in the financial statements. The

estimates and underlying assumptions are reviewed on an ongoing

basis. Revisions to accounting estimates are recognised in the

period in which the estimate is revised if the revision affects

only that period. If the revision affects both current and future

periods, it is revised in the period of the revision and in future

periods. Changes for accounting estimates would be accounted for

prospectively under IAS 8.

Share-based payments

Given the significance of share-based payments as a form of

employee remuneration for the Group, share-based payments have been

included as a significant accounting estimate. The principal

estimations relate to:

- forfeitures (where awardees leave the Group as "bad" leavers

and therefore forfeit unvested awards); and

- the satisfaction of performance obligations attached to certain awards.

These estimates are reviewed regularly and the charge to the

income statement is adjusted appropriately (at the end of the

relevant scheme as a minimum). The sensitivity analysis carried out

shows that if it was considered that 100% of the options would

vest, the charge for the period would increase by GBP389,000.

Business combinations and acquisitions

Business combinations and acquisitions require a fair value

exercise to be undertaken to allocate the purchase price to the

fair value of the identifiable assets acquired and the liabilities

assumed. The determination of the fair value of the assets and

liabilities is based, to a considerable extent, on management's

judgement. The amount of goodwill initially recognised as a result

of a business combination is dependent on the allocation of this

purchase price to the identifiable assets and liabilities with any

unallocated portion being recorded as goodwill. Business

combinations are disclosed in note 16.

There are no other judgements or assumptions made about the

future, or any other major sources of estimation uncertainty at the

end of the reporting period, that have a significant risk of

resulting in a material adjustment to the carrying amounts of

assets and liabilities within the next financial year.

2.8 ALTERNATIVE PERFORMANCE MEASURES

In reporting financial information, the Group presents

alternative performance measures "APMs" which are not defined or

specified under the requirements of IFRS. The Group believes that

these APMs provide users with additional helpful information on the

performance of the business. The APMs are consistent with how the

business performance is planned and reported within the internal

management reporting to the Board. Some of these measures are also

used for the purpose of setting remuneration targets. Each of the

APMs used by the Group are set out in note 18 including

explanations of how they are calculated and how they can be

reconciled to a statutory measure where relevant.

3 SEGMENT REPORTING

Information reported to the Board of Directors as the chief

operating decision maker for the purposes of resource allocation

and assessment of segmental performance is focused on the type of

revenue. The principal types of revenue are discretionary fund

management and the marketing and promotion of the funds run by the

companies under Tatton Capital Limited ("Tatton") and the provision

of compliance and support services to independent financial

advisers and mortgage advisers ("Paradigm").

The Group's reportable segments under IFRS 8 are therefore

Tatton, Paradigm, and "Central" which contains the Group's central

overhead costs. The operating segments disclosed have changed

during the reporting period, see note 2.6.

The principal activity of Tatton is that of Discretionary Fund

Management ("DFM") of investments

on-platform and the provision of investment wrap services.

The principal activity of Paradigm is that of provision of

support services to IFAs and mortgage advisers.

For management purposes, the Group uses the same measurement

policies used in its financial statements.

The following is an analysis of the Group's revenue and results

by reportable segment:

Tatton Paradigm Central Group

Period ended 30 September

2019 (GBP'000) (GBP'000) (GBP'000) (GBP'000)

Revenue 7,102 2,603 24 9,729

Administrative expenses (2,956) (1,693) (1,469) (6,118)

Operating profit/(loss) 4,146 910 (1,445) 3,611

Share-based payments costs 25 - 388 413

Exceptional charges 102 - - 102

Adjusted operational profit/(loss)

(before

separately disclosed items)* 4,273 910 (1,057) 4,126

Finance (costs)/income (8) 8 (1) (1)

Profit/(loss) before tax 4,138 918 (1,446) 3,610

Tatton Paradigm Central Group

Period ended 30 September

2018 restated (note 2.6) (GBP'000) (GBP'000) (GBP'000) (GBP'000)

Revenue 5,987 2,434 24 8,445

Administrative expenses (2,600) (1,624) (1,249) (5,473)

Operating profit/(loss) 3,387 810 (1,225) 2,972

Share-based payments 95 - 270 365

Exceptional charges - 13 - 13

Adjusted operating profit/(loss)

(before separately

disclosed items)* 3,482 823 (955) 3,350

Finance income - 111 1 112

Profit/(loss) before tax 3,387 921 (1,224) 3,084

Tatton Paradigm Central Group

Year ended 31 March 2019

restated (note 2.6) (GBP'000) (GBP'000) (GBP'000) (GBP'000)

Revenue 12,521 4,949 48 17,518

Administrative expenses (5,680) (3,144) (2,769) (11,593)

Operating profit/(loss) 6,841 1,805 (2,721) 5,925

Share-based payments 34 - 840 874

Exceptional charges 496 13 - 509

Adjusted operating profit/(loss)

(before separately

disclosed items)* 7,371 1,818 (1,881) 7,308

Finance income - 185 2 187

Profit/(loss) before tax 6,841 1,990 (2,719) 6,112

All turnover arose in the United Kingdom.

* Alternative performance measures are detailed in note 18 of

this interim report

4 OPERATING PROFIT

The operating profit and the profit before taxation are stated

after:

30-Sep 30-Sep 31-Mar

2019 2018 2019

(GBP'000) (GBP'000) (GBP'000)

Amortisation of intangible

assets 57 - 43

Depreciation of property,

plant and equipment 76 46 91

Depreciation of right-of-use

assets 69 - -

Separately disclosed items

(note 5) 515 378 1,383

Services provided to the

Group's auditor

Audit of the statutory

consolidated and

Company financial statements

of Tatton Asset

Management plc 17 17 33

Audit of subsidiaries 21 20 40

Other fees payable to auditor:

Other taxation advisory

services - 20 38

Non-audit services 67 15 10

=============================== ========= ========= =========

5 SEPARATELY DISCLOSED

ITEMS

30-Sep 30-Sep 31-Mar

2019 2018 2019

(GBP'000) (GBP'000) (GBP'000)

IPO costs - 13 13

Project set-up costs related

to transferring

Authorised Corporate Director - - 293

New fund set-up costs - - 203

Acquisition-related expenses 102 - -

=============================== ========= ========= =========

Total exceptional items 102 13 509

=============================== ========= ========= =========

Share-based payments 413 365 874

=============================== ========= ========= =========

Total separately disclosed

items 515 378 1,383

=============================== ========= ========= =========

Separately disclosed items included within administrative

expenses reflect costs and income that do not relate to the Group's

normal business operations and are considered material

(individually or in aggregate if of a similar type) due to their

size or frequency.

On 30 September 2019 the Group acquired the share capital of

Sinfonia Asset Management Limited (see note 16) and incurred

acquisition related costs of GBP102,000. These costs are part of

separately disclosed items within administrative expenses in the

Consolidated Statement of Total Comprehensive Income.

During the financial year ended 31 March 2019, the Group

incurred exceptional one-off costs of GBP496,000 which related to

the funds in Tatton Investment Management Limited ("Tatton").

Tatton transferred its Authorised Corporate Director who acts on

behalf of the Company to administer the funds and this transfer

incurred significant project management charges. In addition,

Tatton launched new funds in the year and incurred material set-up

costs as part of the process; both are included within exceptional

items and separately disclosed items within administrative expenses

in the Consolidated Statement of Total Comprehensive Income.

Various legal and professional costs incurred in relation to the

IPO of the Group in July 2017 are shown as part of separately

disclosed items within administrative expenses in the Consolidated

Statement of Total Comprehensive Income in the prior year.

6 FINANCE (COSTS)/INCOME

30-Sep 30-Sep 31-Mar

2019 2018 2019

(GBP'000) (GBP'000) (GBP'000)

Bank interest income 2 2 2

Other interest income 8 124 214

Interest expense on lease

liabilities (11) - -

Bank charges - (14) (29)

=============================== ========= ========= =========

(1) 112 187

=============================== ========= ========= =========

7 TAXATION

30-Sep 30-Sep 31-Mar

2019 2018 2019

(GBP'000) (GBP'000) (GBP'000)

Current tax expense

Current tax on profits for

the period 779 681 1,318

Adjustment for under-provision

in prior periods - - (74)

=============================== ========= ========= =========

779 681 1,244

Deferred tax expense

Share-based payments (9) - (19)

Origination and reversal

of temporary differences 15 - 30

Adjustment for under-provision

in prior periods (118) - -

=============================== ========= ========= =========

(112) - 11

=============================== ========= ========= =========

Total tax expense 667 681 1,255

=============================== ========= ========= =========

The reasons for the difference between the actual tax charge for

the period and the standard rate of corporation tax in the UK

applied to profit for the period are as follows:

30-Sep 30-Sep 31-Mar

2019 2018 2019

(GBP'000) (GBP'000) (GBP'000)

Profit before taxation 3,610 3,084 6,112

Tax at UK corporation tax

rate of 19% (2018: 19%) 686 586 1,161

Expenses not deductible

for tax purposes 37 115 25

Capital allowances in excess

of deprecation - (20) -

Adjustments in respect of

previous years (117) - (74)

Differences in tax rates - - (2)

Share-based payments 61 - 145

============================= ========= ========= =========

Total tax expense 667 681 1,255

============================= ========= ========= =========

The UK corporation tax rate will reduce to 17% with effect from

1 April 2020. This will reduce the Company's future current tax

credit/charge accordingly. The deferred tax asset as at 30

September 2019 has been calculated based on a rate of 17% based on

when the Company expects the deferred tax liability to reverse.

8 EARNINGS PER SHARE AND DIVIDS

Basic earnings per share is calculated by dividing the earnings

attributable to ordinary shareholders by the weighted average

number of ordinary shares during the period.

For diluted earnings per share the weighted average number of

ordinary shares in issue is adjusted to assume conversion of all

dilutive potential ordinary shares. The dilutive shares are those

share options granted to employees where the exercise price is less

than the average market price of the Company's ordinary shares

during the period.

NUMBER OF SHARES

30-Sep 31-Mar

30-Sep 2019 2018 2019

Basic

Weighted average number

of shares in issue 55,907,513 55,907,513 55,907,513

Diluted

Share options 5,472,238 4,915,047 5,406,199

Weighted average number

of shares (diluted) 61,379,751 60,822,560 61,313,712

======================== =========== ========== ==========

30-Sep 30-Sep 31-Mar

2019 2018 2019

(GBP'000) (GBP'000) (GBP'000)

Earnings attributable

to ordinary shareholders

Basic and diluted profit

for the period 2,943 2,403 4,857

Share-based payments 413 365 874

Exceptional costs - see

note 5 102 13 509

Tax impact of adjustments (146) - (97)

=========================== ========= ========= =========

Adjusted basic and diluted

profits for the period

=========

and attributable earnings 3,312 2,781 6,143

=========================== ========= ========= =========

Earnings per share (pence)

(basic) 5.26 4.30 8.69

=========================== ========= ========= =========

Earnings per share (pence)

(diluted) 4.79 3.95 7.92

=========================== ========= ========= =========

Adjusted earnings per

share (pence) (basic) 5.92 4.97 10.99

=========================== ========= ========= =========

Adjusted earnings per

share (pence) (diluted) 5.39 4.57 10.02

=========================== ========= ========= =========

DIVIDS

The Directors consider the Group's capital structure and

dividend policy at least twice a year ahead of announcing results

and do so in the context of its ability to continue as a going

concern, to execute the strategy and to invest in opportunities to

grow the business and enhance shareholder value.

In July 2019, Tatton Asset Management plc paid the final

dividend related to the year ended 31 March 2019 of GBP3,131,000

representing a payment of 5.6p per share.

In the year ended 31 March 2019, Tatton Asset Management plc

paid the final dividend related to the year ended 31 March 2018 of

GBP2,460,000, representing a payment of 4.4p per share. In

addition, the Company paid an interim dividend of GBP1,565,000

(2018 GBP1,230,000) to its equity shareholders. This represents a

payment of 2.8p per share (2018: 2.2p per share).

At 30 September 2019 the Company's distributable reserves were

GBP22.4 million (2018: GBP20.9 million).

9 STAFF COSTS

KEY MANAGEMENT COMPENSATION

The remuneration of the statutory Directors who are the key

management of the Group is set out below in aggregate for each of

the key categories specified in IAS 24 Related Party

Disclosures.

30-Sep 30-Sep 31-Mar

2019 2018 2019

(GBP'000) (GBP'000) (GBP'000)

Short-term employee

benefits 515 493 884

Post-employment benefits - 13 14

Other long-term benefits - 1 3

Share-based payments 244 294 587

========================= ========= ========= =========

759 801 1,488

========================= ========= ========= =========

In addition to the remuneration above, the Non-Executive

Chairman and Non-Executive Directors have submitted invoices for

their fees as follows:

30-Sep 30-Sep 31-Mar

2019 2018 2019

(GBP'000) (GBP'000) (GBP'000)

Total fees 80 80 160

============================ ========== ========= =========

10 GOODWILL

Goodwill

(GBP'000)

Cost

Balance at 1 April 2018, 30 September

2018 and 31 March 2019 4,917

Additions 1,143

Balance at 30 September

2019 6,060

Carrying amount

Balance at 1 April 2018, 30 September

2018 and 31 March 2019 4,917

Balance at 30 September

2019 6,060

============================ ========== ========= =========

The goodwill of GBP4.9 million at 31 March 2019 relates to

GBP2.9m arising from the acquisition in 2014 of an interest in

Tatton Oak Limited by Tatton Capital Limited consisting of the

future synergies and forecast profits of the Tatton Oak business

and GBP2.0 million arising from the acquisition in 2017 of an

interest in Tatton Capital Group Limited.

On 30 September 2019 the Group acquired the share capital of

Sinfonia Asset Management Limited (note 16) which generated a

provisional goodwill value of GBP1.1 million. This goodwill

consists of future synergies and forecast profits of the Sinfonia

business.

None of the goodwill is expected to be deductible for income tax

purposes.

IMPAIRMENT LOSS AND SUBSEQUENT REVERSAL

Goodwill is subject to an annual impairment review based on an

assessment of the recoverable amount from future trading. Where, in

the opinion of the Directors, the recoverable amount from future

trading does not support the carrying value of the goodwill

relating to a subsidiary company an impairment charge is made. Such

impairment is charged to the Combined Statement of Total

Comprehensive Income.

IMPAIRMENT TESTING

For the purpose of impairment testing, goodwill is allocated to

the Group's operating companies which represents the lowest level

within the Group at which the goodwill is monitored for internal

management accounts purposes.

Goodwill acquired in a business combination is allocated, at

acquisition, to the cash-generating units (CGUs) or group of units

that are expected to benefit from that business combination. The

Directors test goodwill annually for impairment, or more frequently

if there are indicators that goodwill might be impaired. The

Directors have considered the carrying value of goodwill at 30

September 2019 and do not consider that it is impaired.

GROWTH RATES

The value in use is calculated from cash flow projections based

on the Group's forecasts for the year ending 31 March 2020 which

are extrapolated for a further four years. The Group's latest

financial forecasts, which cover a three-year period, are reviewed

by the Board.

DISCOUNT RATES

The pre-tax discount rate used to calculate value is 8.3% (2018:

8.3%). The discount rate is derived from a benchmark calculated

from a number of comparable businesses.

CASH FLOW ASSUMPTIONS

The key assumptions used for the value in use calculations are

those regarding discount rate, growth rates and expected changes in

margins. Changes in prices and direct costs are based on past

experience and expectations of future changes in the market. The

growth rate used in the calculation reflects the average growth

rate experienced by the Group for the industry.

The headroom compared to the carrying value of goodwill as at 30

September 2019 is GBP214 million. Increasing the discount rate to

171% and leaving all other factors the same would lead to the

recoverable amount being equal to the carrying value of the

goodwill attributed to the cash-generating unit.

11 INTANGIBLES

Customer Computer

relationships software Total

(GBP'000) (GBP'000) (GBP'000)

Cost

Balance at 1 April 2018

and 30 September 2018 - - -

Reclassifications from

property, plant and

equipment - 109 109

Additions - 157 157

Balance at 31 March 2019 - 266 266

Additions 1,469 115 1,584

Balance at 30 September

2019 1,469 381 1,850

========================= ============= ========= =========

Accumulated depreciation

and impairment

At 1 April 2018 and 30

September 2018 - - -

Reclassifications from

property, plant and

equipment (10) (10)

Charge for the period - (33) (33)

Balance at 31 March 2019 - (43) (43)

Charge for the period - (57) (57)

Balance at 30 September

2019 - (100) (100)

========================= ============= ========= =========

Carrying amount

As at 1 April 2018 and

30 September 2018 - - -

As at 31 March 2019 - 223 223

As at 30 September 2019 1,469 281 1,750

========================= ============= ========= =========

All amortisation charges are included within administrative

expenses in the Consolidated Statement of Total Comprehensive

Income.

The valuation of the customer relationships intangible asset is

provisional, see note 16.

12 PROPERTY, PLANT AND EQUIPMENT

Computer,

office Right-of-use

equipment Fixtures

and and assets -

motor vehicles fittings buildings Total

(GBP'000) (GBP'000) (GBP'000) (GBP'000)

Cost

Balance at 1 April

2018 435 214 - 649

Additions 133 119 - 252

Balance at 30 September

2018 568 333 - 901

Additions 48 144 - 192

Reclassifications

to intangible

assets (109) - - (109)

Balance at 31 March

2019 507 477 - 984

Additions 42 160 - 202

Increase attributable

to change in

accounting standards

(note 2.5) - - 689 689

Balance at 30 September

2019 549 637 689 1,875

========================= ============== ========= ============ =========

Accumulated depreciation

and impairment

Balance at 1 April

2018 (331) (214) - (545)

Charge for the

period (42) (4) - (46)

Balance at 30 September

2018 (373) (218) - (591)

Reclassifications

to intangible

assets 10 - - 10

Charge for the

period (34) (21) - (55)

Balance at 31 March

2019 (397) (239) - (636)

Charge for the

period (36) (40) (69) (145)

Balance at 30 September

2019 (433) (279) (69) (781)

========================= ============== ========= ============ =========

Carrying amount

As at 1 April 2018 104 - - 104

As at 30 September

2018 195 115 - 310

As at 31 March

2019 110 238 - 348

As at 30 September

2019 116 358 620 1,094

========================= ============== ========= ============ =========

All depreciation charges are included within administrative

expenses in the Consolidated Statement of Total Comprehensive

Income.

The Group leases buildings and IT equipment. The average lease

term is five years.

No leases have expired in the current financial period.

All depreciation charges are included within administrative

expenses in the Consolidated Statement of Total Comprehensive

Income.

RIGHT-OF-USE ASSETS

Unaudited six

months ended

30-Sep 2019

(GBP'000)

Amounts recognised in profit

and loss

Depreciation on right-of-use

assets (69)

Interest expense on lease liabilities (11)

Expense relating to short-term

leases (87)

Expense relating to low value

assets (3)

-------------------------------------- -------------

(170)

-------------------------------------- -------------

At 30 September 2019, the Group is committed to GBPnil for

short-term leases.

The total cash outflow for leases amounts to GBP104,000.

13 FINANCIAL INSTRUMENTS

The Group finances its operations through a combination of cash

resource and other borrowings. Short-term flexibility is satisfied

by overdraft facilities in Paradigm Partners Limited which are

repayable on demand.

Fair value estimation IFRS 7 requires disclosure of fair value

measurements of financial instruments by level of the following

fair value measurement hierarchy:

- Quoted prices (unadjusted) in active markets

for identical assets or liabilities (level

1).

- Inputs other than quoted prices included within

level 1 that are observable for the asset

or liability, either directly (that is, as

prices) or indirectly (that is, derived from

prices) (level 2).

- Inputs for the asset or liability that are

not based on observable market data (that

is, unobservable inputs) (level 3).

The Group holds loan notes due from Perspective Financial Group

Limited (see note 17). Due to the short-term nature of the Loan

notes, the carrying value is a reasonable approximation of their

fair value. The loan notes are repayable on demand, carry an

interest rate of 6%, and are classified as level 2.

INTEREST RATE RISK

The Group finances its operations through a combination of

retained profits and bank overdrafts. The Group has an exposure to

interest rate risk, as the overdraft facility is at an interest

rate of 3.2% above the base rate. At 30 September 2019 total

borrowings were GBPnil.

14 EQUITY

30-Sep 30-Sep 31-Mar

2019 2018 2019

(number) (number) (number)

Authorised, called

up and fully paid

GBP0.20 Ordinary shares 55,907,513 55,907,513 55,907,513

55,907,513 55,907,513 55,907,513

==========

15 SHARE-BASED PAYMENTS

During the period, a number of share-based payment schemes and

share options schemes have been utilised by the Company,

(A) SCHEMES

(i) Tatton Asset Management plc EMI Scheme ("TAM EMI

Scheme")

On 7 July 2017 the Group launched an EMI share option scheme

relating to shares in Tatton Asset Management plc to enable senior

management to participate in the equity of the Company. A total of

3,022,733 options with a weighted average exercise price of GBP1.89

were granted during the prior period, each exercisable in July

2020.

The scheme was extended on 8 August 2018 and a total of

1,720,138 zero cost options were granted during the year ended 31

March 2019, each exercisable in August 2021. The scheme was further

extended on 1 August 2019 and a total of 193,000 zero cost options

were granted, each exercisable in August 2022. A total of 4,800,768

options remain outstanding at 30 September 2019, none of which are

currently exercisable.

No options were exercised during the period. A total of 23,288

options were forfeited in the period (111,815 options were

forfeited in the prior year).

The options vest in July 2020, August 2021 or August 2022

provided certain performance conditions and targets, set prior to

grant, have been met. If the performance conditions are not met,

the options lapse.

Within the accounts of the Company, the fair value at grant date

is estimated using the appropriate models including both Black

Scholes and Monte Carlo modelling methodologies.

Number of Weighted

share options average

granted price

(number) (GBP)

Outstanding at 1 April 2018 3,022,733 1.89

Granted during the period 1,720,138 -

Forfeited during the period (111,815) 1.89

Outstanding at 30 September 2018 4,631,056 1.19

Exercisable at 30 September 2018 - -

========

Outstanding at 1 October 2018 4,631,056 1.19

Outstanding at 31 March 2019 4,631,056 1.19

Exercisable at 31 March 2019 - -

========

Outstanding at 1 April 2019 4,631,056 1.19

Granted during the period 193,000 -

Forfeited during the period (23,288) -

Outstanding at 30 September 2019 4,800,768 1.15

Exercisable at 30 September 2019 - -

========

(ii) Tatton Asset Management plc Sharesave Scheme ("TAM

Sharesave Scheme")

On 7 July 2017, 5 July 2018 and 3 July 2019 the Group launched

all employee Sharesave schemes for options over shares in Tatton

Asset Management plc, administered by Yorkshire Building Society.

Employees are able to save between GBP10 and GBP500 per month over

a three-year life of each scheme, at which point they each have the

option to either acquire shares in the Company, or receive the cash

saved.

Over the life of the 2017 Sharesave scheme it is estimated that,

based on current saving rates, 204,671 share options will be

exercisable at an exercise price of GBP1.70. Over the life of the

2018 Sharesave scheme it is estimated, based on current saving

rates, 48,695 share options will be exercisable at an exercise

price of GBP1.90. Over the life of the 2019 Sharesave scheme it is

estimated that, based on current savings rates, 87,687 share

options will be exercisable at an exercise price of GBP1.79. No

options have been exercised or expired in the period and 10,183

options have been forfeited in the period.

Within the accounts of the Company, the fair value at grant date

is estimated using the Black Scholes methodology for 100% of the

options. Share price volatility has been estimated using the

historical share price volatility of the Company, the expected

volatility of the Company's share price over the life of the

options and the average volatility applying to a comparable group

of listed companies. Key valuation assumptions and the costs

recognised in the accounts during the period are noted in (b) and

(c) overleaf respectively.

Number of Weighted

share options average

granted price

(number) (GBP)

Outstanding at 1 April 2018 63,344 1.70

Granted during the period 41,331 1.72

Forfeited during the period (8,353) 1.70

Outstanding at 30 September 2018 96,322 1.71