TIDMSVM

SVM UK EMERGING FUND PLC

(the "Fund")

HALF YEARLY REPORT

(FOR THE SIX MONTHS TO 30 SEPTEMBER 2019)

A copy of the Half Yearly Report will be available to download from the

Manager's website at www.svmonline.co.uk and a copy will shortly be available

for inspection at the National Storage Mechanism at www.morningstar.co.uk/uk/

nsm. Copies are also available at 7 Castle Street, Edinburgh EH2 3AH, the

registered office of the Fund.

HIGHLIGHTS

* Net asset value return of 1.3% compared to a 5.0% return in the IA UK All

Companies Sector Average Index and 4.6% return in the FTSE All-Share

Index. The share price rose 3.6%.

* Over the five years to 30 September 2019, net asset value gained 71% and

the share price 70.6%, against a benchmark return of 38.8%.

* At 31 October 2019, net asset value per share had risen to 112.5p.

* Positive contributions from JD Sports Fashion, 4Imprint Group, Unite Group

and GVC Holdings. Burford Capital was the main negative in the six months.

* Portfolio emphasises exposure to scalable businesses with a competitive

edge that can protect margins and deliver growth.

"Long term capital growth from investments in smaller UK companies. Its aim is

to outperform the IA UK All Companies Sector Average Index on a total return

basis"

Financial Highlights

Total Return 6 months 3 years 5 Years 10 Years

Performance to

30 September

2019

Net Asset Value +1.3% +30.5% +71.2% +79.4%

Share Price +3.6% +34.9% +70.6% +64.2%

Benchmark Index +5.0% +20.3% +37.1% +84.4%

*

* The benchmark index for the Fund was changed to the IA UK All Companies

Sector Average Index from 1 October 2013 prior to which the FTSE AIM Index was

used.

CHAIRMAN'S STATEMENT

In the period under review, medium sized and smaller companies lagged the FTSE

100 Index, providing a headwind for the portfolio. This pattern appeared to

reflect Brexit uncertainty. Over the six months to 30 September 2019, the

Company's net asset value gained 1.2% to 111.4p per share, compared to a return

of 4.9% in the benchmark, the IA UK All Companies Sector Average Index. Over

the six months, the share price rose 3.6%. Over the five years to 30 September

2019, net asset value has gained 71% and the share price 70.6%, against a

benchmark return of 38.8%. The Company's net asset value progressed since the

period under review to 112.5p at 31 October 2019.

The strongest contributions to performance over the six months were from JD

Sports Fashion, 4Imprint Group, Unite Group and GVC Holdings. The main

disappointment over the period was Burford Capital, which was sold to realise a

gain for the Fund. New investments were made in AJ Bell, Experian and new

issue, Trainline. Trainline has moved in recent years from a purely UK

ticketing platform to expand operations into Europe and the US. To fund these,

sales were made of Hargreaves Lansdown, Tui Travel, UDG Healthcare, ITV and

ASOS.

The six months showed no real progress on Brexit or US/China trade frictions.

International investors continued to reduce UK exposure, and the Pound was

weak. Outside the US and UK, a disinflationary pattern persists. The Woodford

fund liquidity problems and some other UK equity fund realisations have pushed

down a number of shares of medium sized and smaller companies. However, the UK

has seen increased bid activity, particularly from foreign buyers. The weaker

Pound has lifted inflation and also real wage growth. Many domestic service

sectors are helped by this improvement in UK consumer spending power.

The businesses that handle Brexit and trade frictions best are likely to be

those already winning against tough global competition. A number of mid-cap

companies stand out, with high value-added in supplying major global

customers. AB Dynamics, for example, designs and supplies advanced testing

products for the automotive industry, with a number of major manufacturers as

clients. These close relationships with auto groups should represent an entry

barrier. The UK has many listed businesses with global strengths in industrial

technologies. Those focusing on B2B strategies and high value-added services,

may be less exposed to trade friction than direct-to-consumer businesses.

Jeremy Harris joined the Board in August. Jeremy brings financial services,

legal and governance experience to the Board and on behalf of the Directors, I

welcome him. I would like also to thank Richard Bernstein, who has stepped

down as a non-executive Director of the Company, for his invaluable

contribution to the Company since its formation.

The UK stockmarket and the pound are still affected by considerable pessimism.

The Fund remains fully invested with some additional gearing, but has low

exposure to some more economically-sensitive sectors such as mining and

banking.

Peter Dicks

Chairman

8 November 2019

INVESTMENT OBJECTIVE and POLICY

The investment objective of SVM UK Emerging Fund plc (the "Fund" or the

"Company") is long term capital growth from investments in smaller UK

companies. Its aim is to outperform the IA UK All Companies Sector Average

Index on a total return basis

The Fund aims to achieve its objective and to diversify risk by investing in

shares and related instruments, controlled by a number of limits on exposures.

Appropriate guidelines for the management of the investments, gearing and

financial instruments have been established by the Board. This is an abridged

version of the Fund's investment policy. The full investment policy can be

found in the Strategic Report within the Fund's latest Annual Report &

Accounts.

DIRECTORS' RESPONSIBILITY STATEMENT

The Directors are responsible for preparing the Half Yearly Report in

accordance with applicable law and regulations.

The Directors confirm that to the best of their knowledge:

(i) the condensed set of financial statements have been prepared in

accordance with the Financial Reporting Council Statement 104 "Interim

Financial Reporting" on a going concern basis and give a true and fair view of

the assets, liabilities, financial position and profit or loss of the Fund;

(ii) the Half Yearly Report includes a fair review of the information

required by the Disclosure and Transparency Rules DTR 4.2.7R (indication of

important events during the first six months and description of principal risks

and uncertainties for the remaining six months of the year); and DTR 4.2.8R

(disclosure of related party transactions and changes therein).

(iii) During the first six months of the year, Peter Dicks, Chairman,

purchased 25,000 shares at a price of 86.5p per share. No other related party

transactions have taken place during the first six months of the year that have

materially affected the financial position of the Fund during the period and

there have been no changes in the related party transactions described in the

Annual Report & Accounts for the year end 31 March 2019 that could do so.

The Directors consider that the Half Yearly Report, taken as a whole, is fair,

balanced and understandable and provides the information necessary for

shareholders to assess the Fund's performance and strategy,

The Half Yearly Report has not been audited or reviewed by the Fund's auditors.

By Order of the Board

Peter Dicks

Chairman

8 November 2019

UNAUDITED ACCOUNTS

Income Statement

Six months to 30 September Six months to 30

2019 September 2018

Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Net gain on investments at - 73 73 - 950 950

fair value

Income 94 - 94 86 - 86

Investment management fees - (26) (26) - - -

Other expenses (45) - (45) (32) - (32)

Gain before finance costs and

taxation 49 47 96 54 950 1,004

Finance costs (11) - (11) (22) - (22)

Gain on ordinary activities

before taxation 38 47 85 32 950 982

Taxation - - - (2) - (2)

Gain attributable to ordinary

shareholders 38 47 85 30 950 980

Gain per Ordinary Share 0.63p 0.78p 1.41p 0.50p 15.82p 16.32p

Year ended 31 March 2019

(audited)

Revenue Capital Total

GBP'000 GBP'000 GBP'000

The Total column of

Net loss on investments at - (106) (106) this statement is the

fair value profit and loss

account of the Fund.

Income 143 - 143 All revenue and

capital items are

Investment management fees - (24) (24) derived from

continuing

Other expenses (104) - (104) operations. No

operations were

Gain/(loss) before finance 39 (130) (91) acquired or

costs and taxation discontinued in the

year. A Statement of

Finance costs (26) - (26) Comprehensive Income

is not required as all

Gain/(loss) on ordinary 13 (130) (117) gains and losses of

activities before taxation the Fund have been

reflected in the above

Taxation (3) - (3) statement.

Gain/(loss) attributable to 10 (130) (120)

ordinary shareholders

Gain per Ordinary Share 0.17p (2.17)p (2.00)p

Balance Sheet

As at As at As at

30 September 31 March 30 September

2019 2019 2018

(unaudited) (audited) (unaudited)

GBP'000 GBP'000 GBP'000

Fixed Assets

Investments at fair value through profit 6,668 6,437 7,435

or loss

Total Current Assets 138 306 376

Creditors: amounts falling due within (121) (134) (102)

one year

Net current assets 17 172 274

Total assets less current liabilities 6,685 6,609 7,709

Capital and Reserves 6,685 6,609 7,709

Equity shareholders' funds 6,685 6,609 7,709

Net asset value per Ordinary Share 111.51p 110.06p 128.38p

Statement of Changes in Equity

For the period to 30 September 2019

Share Share Special Capital Capital Revenue Total

capital premium reserve redemption reserve reserve

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

As at 1 April 2019 300 314 5,144 27 1,193 (369) 6,609

Ordinary shares

bought back during - - (9) - - -

the period and held (9)

in treasury

Gain attributable - - - - 47 38 85

to shareholders

As at 30 September 300 314 5,135 27 1,240 (331) 6,685

2019

For the year to 31 March 2019

Share Share Special Capital Capital Revenue Total

capital premium reserve redemption reserve reserve

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

As at 1 April 2018 300 314 5,144 27 1,323 (379) 6,729

(Loss)/gain - - - - (130) 10 (120)

attributable to

shareholders

As at 31 March 2019 300 314 5,144 27 1,193 (369) 6,609

For the period to 30 September 2018

Share Share Special Capital Capital Revenue Total

capital premium reserve redemption reserve reserve

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

As at 1 April 2018 300 314 5,144 27 1,323 (379) 6,729

Gain attributable - - - - 950 30 980

to shareholders

As at 30 September 300 314 5,144 27 2,273 (349) 7,709

2018

Investment Portfolio as at 30 September 2019

Market % of Net Sector analysis as at % of

Exposure 2019 Assets 30 September 2019 Gross

Stock GBP000 Exposure

Sector

1 4Imprint Group 362 5.4 Consumer Services 26.8

2 Unite Group 345 5.2 Financials 21.6

3 Fevertree Drinks 269 4.0 Technology 17.1

4 Learning Technologies * 248 3.7 Industrials 14.6

5 JD Sports Fashion * 238 3.6 Consumer Goods 11.3

6 Workspace Group 223 3.3 Healthcare 7.2

7 Hilton Food Group 217 3.2 Telecommunications 1.4

8 Rentokil Initial 210 3.1 Total 100.0

9 Johnson Service Group 200 3.0

10 GVC Holdings 199 3.0

Ten largest investments 2,511 37.5

11 Kerry Group 198 3.0

12 Beazley 195 2.9

13 GB Group * 194 2.9

14 DiscoverIE Group * 176 2.7

15 Dechra Pharmaceuticals 158 2.4

16 Manolete Partners 153 2.3

17 Ocado 152 2.3

18 Knights 150 2.2

19 Hutchison China Meditech 137 2.0

20 Experian 130 1.9

Twenty largest investments 4,154 62.1

21 Keystone Law Group 125 1.9

22 Aquis Exchange 125 1.9

23 Applegreen * 124 1.9

24 FDM Group 122 1.8

25 SSP Group 113 1.7

26 Blue Prism Group 110 1.6

27 Gamma Communications 109 1.6

28 Burford Capital 1.6

104

29 Cineworld Group 104 1.6

30 Whitbread * 94 1.4

Thirty largest investments 5,284 79.1 *Includes Contract for

Difference (CFD)

Other investments (41 2.594 38.7

holdings)

Market exposure for equity

Total investments 7,878 117.8 investments held is the same as

fair value and for CFDs held is

CFD positions exposure (1,397) (20.9) the market value of the

underlying shares to which the

CFD unrealised gains 187 2.8 portfolio is exposed via the

contract.

Net current assets 17 0.3

Net assets 6,685 100.0

Risks and Uncertainties

The principal risks facing the Fund relate to the investment in financial

instruments and include market, liquidity, credit and interest rate risk.

Additional risks faced by the Fund are investment strategy, share price

discount, accounting, legal and regulatory, operational, corporate governance

and shareholder relations, and financial. The Board seeks to mitigate and

manage these risks through continuous review, policy setting and enforcement of

contractual obligations. The Board receives both formal and informal reports

from the Managers and third party service providers addressing these risks. An

explanation of these risks and how they are mitigated is explained in the 2019

Annual Report, which is available on the Manager's website:

www.svmonline.co.uk. These principal risks and uncertainties have not changed

from those disclosed in the 2019 Annual Report.

Going Concern

The Board, having made appropriate enquiries, has a reasonable expectation that

the Fund has adequate resources to continue in operational existence for the

foreseeable future, a period of not less than 12 months from the date of this

report. Accordingly, it continues to adopt the going concern basis in preparing

the financial statements.

Notes

1. The Financial Statements have been prepared on a going concern basis

in accordance with FRS 102 "Financial Reporting Standard applicable in the UK

and Republic of Ireland", FRS 104 "Interim Financial Reporting" and under the

Association of Investment Companies Statement of Recommended Practice

"Financial Statement of Investment Trust Companies and Venture Capital Trusts"

issued in 2014, as were the interim financial statements for the period to 30

September 2018. The requirements have been met to qualify for the exemption to

prepare a Cash Flow Statement, this has therefore been removed. These

financial statements have been prepared in accordance with the accounting

policies used for the financial year ended 31 March 2019.

2. During the period 10,000 Ordinary Shares with a nominal value of GBP

500 and representing 0.17% of the issued share capital were bought back and

placed in treasury for an aggregate consideration of GBP8,650 (2018 - nil shares,

GBPnil).

The number of shares in issue at 30 September 2019 was 5,995,000

(2018 - 6,005,000).

Return per share is based on a weighted average of 6,004,672 (2018

- 6,005,000) ordinary shares in issue during the period.

Total return per share is based on the total gain for the period of

GBP85,000 (2018 - gain of GBP980,000). Capital return per share is based on the

capital gain for the period of GBP47,000 (2018 - gain of GBP950,000). Revenue

return per share is based on the revenue gain after taxation for the period of

GBP38,000 (2018 - gain of GBP30,000).

3. All investments are held at fair value. At 30 September 2019 no

unlisted investments were held with value attributed (31 March 2019: same; 30

September 2018: same).

Investments have been classified using the fair value hierarchy:

September March

2019 2019

GBP000 GBP000

Classification of financial instruments

Level 1 6,481 6,417

Level 2 187 20

Level 3 - 2 investments (March 2019 - 2) - -

Level 1 reflects financial instruments quoted in an active market.

Level 2 reflects financial instruments whose fair value is

evidenced by comparison with other observable current market transactions in

the same instrument or based on a valuation technique whose variables include

only data from observable markets. The CFD positions are the sole Level 2

investments at 30 September 2019 and 31 March 2019.

Level 3 reflects financial instruments whose fair value is

determined in whole or in part using a valuation technique based on assumptions

that are not supported by prices from observable market transactions in the

same instrument and not based on available observable market data.

4. The Board has granted the Manager a limited authority to invest in

CFDs to achieve some degree of gearing and/or hedging without incurring the

gross cost of the investment. The Board requires the Manager to operate within

certain risk limits, as detailed in the Annual Report. The following table

details the CFD positions:

Number of CFD holdings at 30 September 2019: 15 (31 March 2019: 17)

CFD positions September March

2019 2019

GBP000 GBP000

Gross exposure 1,397 1,332

Net exposure 1,397 1,332

Unrealised gains 187 20

Unrealised losses 61 58

The gearing ratio is 21.1% at 30 September 2019 (31 March 2019:

20.3%). The gearing figure indicates the extra amount by which the

shareholders' funds would change if total assets (including CFD position

exposure and netting off cash and cash equivalents) were to rise or fall. A

figure of zero per cent means that the Company has a nil geared

position.

5. SVM Asset Management Limited provides investment management and

secretarial services to the Fund. The Manager is entitled to a fee for these

services, payable quarterly in arrears, equivalent to 0.75% per annum of the

total assets of the Fund, less current liabilities. The Manager waived its

management fees for the six months to 30 September 2018. The Board made the

decision to re-instate the Investment Management Fee Agreement with effect from

1 October 2018.

6. The above figures do not constitute full or statutory accounts in

terms of Sections 434 and 435 of the Companies Act 2006. All information shown

for the six months to 30 September 2019 is unaudited. The accounts for the year

to 31 March 2019, on which the auditors issued an unqualified report, have been

lodged with the Registrar of Companies and did not contain a statement required

under Section 498 of the Companies Act 2006.

For further information, please contact:

Colin McLean SVM Asset Management 0131 226 6699

Roland Cross Four Broadgate 0207 726

6111

END

(END) Dow Jones Newswires

November 11, 2019 06:26 ET (11:26 GMT)

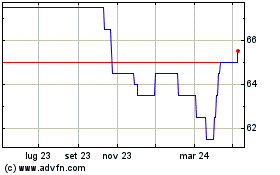

Grafico Azioni Svm Uk Emerging (LSE:SVM)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Svm Uk Emerging (LSE:SVM)

Storico

Da Apr 2023 a Apr 2024