TIDMJLP

RNS Number : 3997T

Jubilee Metals Group PLC

14 November 2019

Jubilee Metals Group Plc

Registration number (4459850)

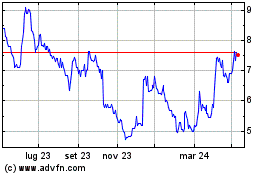

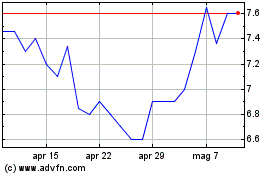

Altx share code: JBL

AIM share code: JLP

ISIN: GB0031852162

14 November 2019

Jubilee Metals Group Plc

("Jubilee" or the "Company")

Audited results for the year ended 30 June 2019

Notice of Annual General Meeting

Jubilee, the AIM and Altx traded metals processing company is

pleased to announce its audited results for the year ended 30 June

2019.

FINANCIAL HIGHLIGHTS

-- Group revenue for the year increased by a strong 66.83%, to

GBP 23.59 million (ZAR(1) 432.61 million) [2018: GBP 14.14 million

(ZAR 245.53 million)]

-- In 2019, the Group delivered positive earnings of GBP 7.00

million (ZAR 128.28 million) [(2018: loss of GBP 2.11 million (ZAR

36.72 million)] and a return on equity of 10.50%, compared to a

negative return of 3.67% in the previous year

-- In 2019, the Group delivered positive earnings per share of

0.48 pence per share (ZAR 8.75 cents) [(2018: loss of 0.18 pence

(ZAR 3.05 cents)]

-- Total project attributable earnings almost doubled to GBP

9.87 million (ZAR 181.03 million) [2018: GBP 5.03 million (ZAR

86.80 million)]

-- The Group posted an operating profit up significantly to GBP

4.87 million (ZAR 89.38 million) [2018: profit of GBP 0.06 million

(ZAR 1.04 million)], with an operating margin of 20.64%

-- The Group's balance sheet strengthened substantially, with

total assets increasing by 47%, to GBP102.04 million (ZAR1.82

billion)

-- Total equity increased to GBP 78.69 million (ZAR 1.40

billion), from GBP 58.80 million (ZAR 1.07 billion) a year earlier,

maintaining a strong equity ratio of 77.11% (2018: 84.64%)

-- The Group delivered strong cash flows from its operating

activities of GBP 4.76 million (ZAR 84.79 million) [(2018: positive

cash flow of GBP 0.96 million (ZAR 17.44 million)], with Cash and

cash equivalents tripling from the previous year, to GBP 18.9

million

-- Overall, the Group's gearing remains low with the positive

net debt position and current assets covering a comprehensive

126.74% (2018: 106.96%) of total short and long term

liabilities

1= for income statement purposes conversions are at the average

GBP: ZAR rates for the period under review and for balance sheet

purposes at the spot rate as at year end. All other conversions are

at rates at the time announced.

OPERATIONAL HIGHLIGHTS FOR THE PERIOD UNDER REVIEW

-- Inyoni PGM(2) Operations delivered a record production of 23

847 ounces (2018: 17 354 ounces) for the year, generating revenue

of GBP 14.90 million (ZAR 273.36 million) compared to GBP 9.52

million (ZAR 164.37 million) in the previous year

-- The newly acquired Windsor Chrome Operations delivered 149

272 tonnes of chrome concentrate since January 2019, generating

revenue of GBP 5.75 million (ZAR 105.48 million)

-- Windsor Chrome Operations was established by the execution of

a sale and purchase agreement through Jubilee's subsidiary Jubilee

Processing to acquire all of the chrome beneficiation assets

including plant, equipment, intellectual property and all rights to

the existing surface material estimated in excess of 1.8 million

tonnes owned by PlatCro and associated companies, for a combined

consideration of GBP 8.26 million (US$10.5 million). Jubilee's

subsidiary Windsor SA is the appointed operator of the Windsor

Chrome Operations.

-- DCM Fine Chrome Operations produced a total of 32 675 tonnes

of chrome concentrate (2018: 46 191 tonnes) for the year, with

additional revenue of GBP 2.09 million (ZAR 38.24 million) [(2018:

GBP 4.62 million (ZAR 80.05 million)]

-- Combined chrome performance of 181 947 tonnes of chrome

concentrate delivered generated revenue of GBP 7.84 million (ZAR

143.72 million) [(2018: GBP 4.62 million (ZAR 80.05 million)],

increasing the chrome operations contribution to one third of

Group's total revenues

2= 6 Element Platinum Group Metals (platinum, palladium,

rhodium, ruthenium, iridium + gold)

HIGHLIGHTS POST THE PERIOD UNDER REVIEW

-- The significant growth in earnings delivered during the

period under review continued on its steep growth trajectory

demonstrated by the jump in operational earnings to GBP 3.38

million delivered for the three month period July to September

2019, which equates to a 90% jump from the comparative period in

2018

-- This jump in earnings reflects only one full month of

production at the Windsor PGM Operations, which commenced

operations in late August 2019 and exceeded expectations by

delivering 5 337 PGM ounces for the month of September 2019 alone,

which is more than double that of the PGM ounces produced from the

Inyoni Operations

-- Jubilee has executed a share purchase agreement for the

acquisition of the Sable Zinc refinery in Kabwe Zambia. The

refinery is situated immediately adjacent to the large stock piles

of zinc, lead and vanadium that Jubilee has contracted from BMR

Group PLC. Jubilee executed the acquisition from two subsidiaries

of Glencore plc for a consideration of GBP 9.16 million (US$ 12

million) (ZAR 175.97 million)

-- Jubilee acquired 100% of the rights to PGM earnings from the

current and future tailings produced at Jubilee's Inyoni Operations

(previously Hernic) located in the Bushveld Complex, South Africa.

In addition to the current unprocessed 1.70 million tonnes of

historical tailings at the Hernic Operations and the 630 000 tonnes

of previously processed tailings, Jubilee has acquired the rights

to some 1.0 million tonnes of PGM rich material

-- Jubilee has acquired 100% of all further chrome rights to the

chrome contained in all of the historical tailings at Inyoni as

described above

CHIEF EXECUTIVE OFFICER'S OVERVIEW

Jubilee has continued on its positive growth trajectory,

delivering strong growth in earnings and operational performance

for the period under review. Group Revenue increased to GBP 23.59

million (ZAR 432.61 million), delivering positive Group earnings of

GBP 7.00 million (ZAR 128.28 million). Group operations produced

181 947 tonnes of chrome concentrate and 23 847 PGM ounces during

the period under review. This growth has been achieved as a result

of both the performance of the Company's flagship Inyoni Operations

(previously known as Hernic Operations) and the contributions from

new production facilities being brought on-line during the period

under review.

The Company's operations at the date of this announcement

expanded to include:

Period under review

-- Inyoni Operations (previously Hernic Operations) - a South

African based PGM and chrome beneficiation facility processing both

historical tailings, as well as on-going tailings produced by the

Hernic Operations (now owned by a subsidiary of one of the world's

largest ferrochrome producers). Inyoni holds a capacity to process

55 000 tonnes per month of feed material, producing both chrome and

PGM saleable concentrates. The transaction post the period under

review, has transformed the operation from a co-operation

processing agreement, to eventual full ownership, by Jubilee, of

all historical chrome and PGM tailings at Inyoni Operations.

-- Windsor Chrome Operations - a South African based chrome

beneficiation facility principally supplied by offtake agreements

with third party chrome ore suppliers. In addition, Windsor Chrome

has access to historical chrome tails produced under its previous

ownership. Windsor Chrome, which was acquired by Jubilee in January

2019, holds a capacity to process approximately 70 000 tonnes per

month of feed material.

-- Dilokong Chrome Mine Operations ("DCM") - a South African

based chrome beneficiation facility holding Jubilee's industry

leading fine chrome recovery process, with a design capacity to

process up to 30 000 tonnes per month of feed material. The project

was ramped up to commercial production levels in May 2019.

Post the period under review

-- Windsor PGM Operations - a South African based PGM recovery

joint venture ("JV"), with Northam Platinum's Eland Plant

operations. Under the JV, Windsor PGM has secured access to the PGM

recovery operations for the recovery of the PGMs contained in the

tailings produced by Windsor Chrome Operations. The JV has

significantly exceeded its target of processing 60 000 tonnes per

month of PGM containing feed since being brought on-line during

August 2019.

-- Integrated Kabwe Operations - a Zambian based multi metal

refining facility currently under construction, which includes

nearly 6.4 million tonnes of vanadium, zinc and lead containing

surface material and further supplemented by third party ore

supply.

-- Inyoni Operations - a South African based chrome and PGM

operation. As announced on 24 October and 5 November 2019, Jubilee

increased its scope at Inyoni through the acquisition of all PGM

and chrome rights contained in the historical tailings material.

Jubilee targets to accelerate the implementation of its successful

Fine Chrome solution at Inyoni to improve the chrome recovery. The

DCM Fine Chrome recovery plant has shown the potential to increase

chrome concentrate mass-yields by up to 21%. The combination of the

increased operational scope and the expanded chrome recovery

circuit, which now includes taking control of the feed supply to

our processing plant, offers Jubilee the opportunity to increase

both feed rates as well as improving chrome recoveries. This

combination holds the potential for Jubilee to increase its PGM

production to 2 700 PGM ounces per month while the expanded chrome

processing operation could produce up to a total of 500 000 tonnes

of recoverable chrome concentrate from the historical tailings

located at the Inyoni operation. The increased PGM ounce production

would equate to an approximate US$ 450 000 of additional revenue

per month with chrome offering a significant revenue boost to the

project with chrome concentrate CIF prices fluctuating over the

quarter between US$ 135 to US$ 157 per ton of chrome concentrate.

At current

operating margins, these additions to revenue have the potential

to add significantly to earnings.

Further projects in the pipeline include the DCM PGM Operations,

which targets the recovery the PGMs contained in the nearly 800 000

tonnes of tailings from the DCM Chrome Operations and the Tjate

Platinum Project, which is an underground PGM exploration asset

currently under review.

Jubilee has successfully expanded and diversified its earnings

base across metal groups and mining jurisdictions, targeting

surface material previously discarded or overlooked due to inherent

process inefficiencies in the mining industry. Jubilee has unlocked

significant value from these surface assets by leveraging its

in-house technical expertise and process development capabilities

to implement fit for purpose, cost effective, cutting edge process

solutions. Jubilee has incorporated a zero-effluent policy in its

processing designs, resulting in the natural rehabilitation of

these historical surface waste materials. The Company has a

distinct expansion plan aimed at utilising its team, diversifying

commodity and jurisdictional exposure to build cash flow and

maximise the international opportunity.

The increased global awareness and focus on mine tailings

globally continues to drive renewed interest from both governments

and corporates to decrease the global footprint of legacy mine

waste and reduce the environmental risk this poses. This creates

ideal opportunities for Jubilee to engage in mine waste reduction

through reprocessing, which meets local environmental obligations,

whilst also realising economic benefit.

The Company has successfully responded to the current challenges

and risks inherent to a metals processing business that also holds

an exploration asset and will continue to formulate preventative

risk management measures.

CHAIRMAN'S STATEMENT

Dear Shareholder,

This has been another fantastic period for Jubilee as we look to

build an industry leading international metal recovery business

focused on the treatment of surface tailings materials and primary

mineral ore generated from third party mining operations. Through

the successful implementation of a defined strategy, we have

significantly expanded Jubilee's operational, jurisdictional and

earnings footprint, which has resulted in a current portfolio of

five operations in South Africa and Zambia, a defined and valuable

metal inventory, exposure to a broad commodity basket that includes

PGMs, chrome, copper, lead, zinc, vanadium and cobalt and a sharp

swing from an operating loss to an operating profit to GBP 4.87

million.

We are a global leader with first mover advantage in a market

that is rapidly expanding due to the increasing awareness and

legislation, both from government and corporate mining entities,

driving the need to reduce mine waste exposure and the vast amount

of historic above ground material accumulated. With the

environmental obligations and the rising cost and difficulty of

mining, majors are, not only increasingly needing a waste treatment

solution, but viewing surface material as a potential source of

cash flow. However, they do not necessarily have the means nor

expertise to implement mine waste recovery projects; this is where

we step in. We turn potential waste liabilities into assets through

implementing our bespoke environmentally conscious metal recovery

solutions that ensure a zero-effluent policy. Importantly the

projects have defined reserves with the tonnage and a grade known

in advance, and don't have the expenses related to traditional

mining techniques. Our bespoke solutions have exceptionally low

capital intensity and operating costs which delivers robust

margins. The ability of our team is recognised, and we already have

a blue-chip industry partnership base including Mitsubishi,

Northam, Lonmin and Vedanta.

Drilling down on the operational front and underlining our

delivery capabilities, we continue to optimise and expand our

project portfolio. We now have inventory of GBP 1.66 million and

are actively looking to increase existing production and revenue

streams. Our South African chrome and PGM operations have seen

significant growth with a combination of productivity and

optimisation input and the addition of new operations. Importantly,

we were able to continue to produce an increase in earnings quarter

on quarter despite softer chrome prices.

In December 2018, we acquired a major chrome processing

operation, owned by PlatCro Minerals (Pty) Ltd (now Windsor SA

(Pty) Ltd) with an operational capacity to process up to 75 000

tonnes of chrome ore, offering the potential to boost our

operational cash flow. The acquisition, which included 1.8 million

tonnes of surface dump material containing chrome and platinum,

positions Jubilee in a pivotal position in the Western Bushveld,

South Africa, where it has easy access to material for treatment

from numerous nearby sources. Windsor SA is performing well and the

team has shown its ability to deliver strong results.

We are continually focused on innovation, which was clearly

demonstrated with the successful commissioning of the fine chrome

plant at our DCM Fine Chrome Operations. Through our conceptual

approach we targeted the recovery of fine chrome from existing mine

waste material, which had previously been considered to be

irrecoverable. Our fine chrome capability now has the potential to

be rolled out into the whole of the chrome industry and we expect

it to be applicable to other commodities where fine material has

been judged to be irrecoverable. The underlying test work, design

and implementation is an absolute credit to our research and

engineering team.

Underlining our ambition to expand, was taking our interest in

Kabwe up to 87.5%, which combined with a 29.01% shareholding gives

us a 91.13% beneficial interest and the commencement of discussions

to acquire the Sable Zinc Refinery, located near our tailings and

primary oxide ore. The acquisition of this plant will be beneficial

in many respects, including but not limited to: a reduced project

implementation time-line and project implementation risk, as well

as reduced capital expenditure against the acquisition of a major

refinery at a significant discount to new build. These events

represent transformational milestones in the Company's aspirations

and our plans in Zambia.

Market

During the initial part of the period under review chrome prices

were satisfactory and PGMs were somewhat depressed. However, at the

time of writing this report chrome prices retracted sharply but has

been offset by an improving PGM basket price buoyed in particular

by palladium and rhodium. These volatile metal prices show the

benefit of having a diversified commodity basket which has provided

us with considerable resilience in the face of varying

performances, ensuring that we continue to produce an overall

value.

Financial

Jubilee is now producing considerable cash, meeting its market

promises and delivering its development strategy. For the period we

reported earnings of 0.48 (2018: loss of 0.18) pence per ordinary

share. We delivered strong cash flows from operating activities of

GBP 4.76 million (2018: GBP 0.96 million), with cash and cash

equivalents tripling from year earlier, to GBP 18.9 million.

Outlook

This is a truly exciting time for Jubilee Metals. We are looking

at a number of acquisitions and cash accretive investments within

our portfolio, with a determination to continue the exceptional

growth shown during the financial year under review. We have a

robust project pipeline and acquisition opportunities to augment

our rapid growth strategy and believe our unique positioning,

technical knowhow and team will enable us to create significant

further value for shareholders.

We are mindful that growth and success can bring its own

problems and we review, on a routine basis, the risks against the

business. These risks are often outside our control and as such, we

are determined to position ourselves and work diligently on all

matters, which might not lead to an enhanced cash flow, but will

lead to security of tenure and community acceptance.

I conclude by thanking our Chief Executive, Leon Coetzer, who

has put in extreme effort over all fronts to achieve these results,

supported by an excellent team. I also welcome our newcomers in the

various disciplines, who I have no doubt will continue to drive

this Company onwards and upwards.

Colin Bird

Non-executive Chairman

GROUP ANNUAL FINANCIAL STATEMENTS FOR THE YEARED 30 JUNE

2019

GROUP STATEMENT OF FINANCIAL POSITION

as at 30 June 2019 Group

2019 2018

GBPs GBPs

-------------------------------- ------------ ---------

Assets

Non-current assets

10 364

Property, plant and equipment 17 901 768 239

44 385

Intangible assets 46 937 992 596

Investments in associates 1 895 477 2 760 966

Other financial assets 5 709 324 509 229

--------------------------------- ------------ ---------

58 020

72 444 561 030

-------------------------------- ------------ ---------

Current assets

Inventories 1 660 691 1 306 000

Other financial assets - 424 753

Current tax receivable - 15 870

Trade and other receivables 9 071 729 3 293 938

Cash and cash equivalents 18 865 288 6 376 153

--------------------------------- ------------ ---------

11 416

29 597 708 714

-------------------------------- ------------ ---------

69 436

Total assets 102 042 269 744

--------------------------------- ------------ ---------

Equity and liabilities

Equity attributable to equity

holders of parent

94 065

Share capital and share premium 105 820 411 073

21 432

Reserves 22 319 022 114

(59 057

Accumulated loss (51 842 702) 860)

--------------------------------- ------------ ---------

56 439

72 296 731 327

Non-controlling interest 2 393 081 2 363 401

--------------------------------- ------------ ---------

58 802

78 689 812 728

-------------------------------- ------------ ---------

Liabilities

Non-current liabilities

Other financial liabilities 10 396 736 1 622 026

Deferred tax liability 6 018 620 5 065 422

--------------------------------- ------------ ---------

16 415 356 6 687 448

-------------------------------- ------------ ---------

Current liabilities

Other financial liabilities 2 272 459 1 448 664

Trade and other payables 4 664 642 2 497 904

--------------------------------- ------------ ---------

6 937 101 3 946 568

-------------------------------- ------------ ---------

10 634

Total liabilities 23 352 457 016

--------------------------------- ------------ ---------

69 436

Total equity and liabilities 102 042 269 744

--------------------------------- ------------ ---------

The financial statements were authorised for issue and approved

by the Board on 14 November 2019 and signed on its behalf by:

Leon Coetzer

Chief Executive Officer

Company number: 04459850

GROUP STATEMENT OF COMPREHENSIVE INCOME

for the year ended 30 June 2019

Group

2019 2018

GBPs GBPs

-------------------------------------------- ----------- -----------

Continuing operations

Revenue 23 585 845 14 139 510

(10 709

Cost of sales 445) (8 672 325)

--------------------------------------------- ----------- -----------

Gross profit 12 876 400 5 467 185

Other income 385 000 9 227

Operating expenses (8 388 378) (5 416 827)

--------------------------------------------- ----------- -----------

Operating profit/(loss) 4 873 022 59 585

Investment revenue 30 058 25 586

Impairments 5 021 585 (804 357)

Finance costs (1 112 909) (1 375 732)

Share of loss from associates (895 489) (308 451)

--------------------------------------------- ----------- -----------

Profit/(loss) before taxation 7 946 267 (2 403 369)

Taxation (969 971) -

--------------------------------------------- ----------- -----------

Profit/(loss) for the year 6 976 296 (2 403 369)

Other comprehensive income:

Exchange differences on translating foreign

operations 679 636 (2 954 327)

--------------------------------------------- ----------- -----------

Total comprehensive income 7 655 932 (5 357 696)

--------------------------------------------- ----------- -----------

Basic loss for the year

Attributable to:

Owners of the parent 6 993 587 (2 114 713)

Non-controlling interest (17 291) (288 656)

--------------------------------------------- ----------- -----------

6 976 296 (2 403 369)

-------------------------------------------- ----------- -----------

Total comprehensive loss attributable to:

Owners of the parent 7 626 600 (4 892 637)

Non-controlling interest 29 332 (465 059)

--------------------------------------------- ----------- -----------

7 655 932 (5 357 696)

-------------------------------------------- ----------- -----------

Earnings/(loss) per share (pence) 0.48 (0.18)

--------------------------------------------- ----------- -----------

Diluted earnings/(loss) per share (pence) 0.47 (0.18)

--------------------------------------------- ----------- -----------

GROUP STATEMENT OF CHANGES IN EQUITY

for the year ended 30 June 2019

Total

Share Foreign Share- attributable

capital currency based Convertible to equity Non-

Figures in and share translation Merger payment instrument Total Accumulated holders controlling Total

Sterling premium reserve reserve reserve reserve reserves loss of the Group interest equity

-------------- ----------- ------------ ----------- ---------- ------------ ------------ ------------- ------------- ------------ -----------

Balance at 1

July 2017 87 674 940 (1 442 540) 23 184 000 1 336 583 - 23 078 043 (57 261 760) 53 491 223 2 867 039 56 358 262

Changes in

equity

Total

comprehensive

income

for the year - (2 777 924) - - - (2 777 924) (2 114 713) (4 892 637) (465 059) (5 357 696)

Issue of share

capital net

of costs 7 258 327 - - - - - - 7 258 327 - 7 258 327

Warrants

issued (868 194) - - 868 194 - 868 194 - - - -

Options issued - - - 263 801 - 263 801 - 263 801 - 263 801

Changes in

ownership

interest

- control not

lost - - - - - - 318 612 318 612 (38 578) 280 034

----------- ------------ ----------- ---------- ------------ ------------ ------------- ------------- ------------ -----------

Total changes 6 390 133 (2 777 924) - 1 131 995 - (1 645 929) (1 796 101) 2 948 103 (503 637) 2 444 466

----------- ------------ ----------- ---------- ------------ ------------ ------------- ------------- ------------ -----------

Balance at 30

June 2018 94 065 073 (4 220 464) 23 184 000 2 468 578 - 21 432 112 (59 057 860) 56 439 327 2 363 401 58 802 728

----------- ------------ ----------- ---------- ------------ ------------ ------------- ------------- ------------ -----------

Changes in

equity

Total

comprehensive

income

for the year - 633 013 - - - 633 013 6 993 587 7 626 600 29 332 7 655 932

Issue of share

capital net

of costs 11 765 355 - - - - - - 11 765 355 - 11 765 355

Share warrants

issued (10 017) - - 231 593 - 231 593 - 221 575 - 221 575

Share warrants

expired - - - (180 736) - (180 736) 180 736 - - -

Equity

component of

convertible

loan note 203 040 203 040 - 203 040 - 203 040

Changes in

fair value -

control

not lost - - - - - - 40 835 - - 40 835

Changes in

ownership

interest

- control not

lost - - - - - - - - 348 348

----------- ------------ ----------- ---------- ------------ ------------ ------------- ------------- ------------ -----------

Total changes 11 755 338 633 013 - 50 857 203 040 886 908 7 215 159 19 857 405 29 680 19 887 085

----------- ------------ ----------- ---------- ------------ ------------ ------------- ------------- ------------ -----------

Balance at 30 105 820 (51 842

June 2019 411 (3 587 451) 23 184 000 2 519 435 203 040 22 319 022 702) 76 296 731 2 393 081 78 689 812

----------- ------------ ----------- ---------- ------------ ------------ ------------- ------------- ------------ -----------

GROUP STATEMENT OF CASH FLOWS

for the year ended 30 June 2019

Group

2019 2018

GBPs GBPs

------------------------------------------ ----------- -----------

Cash flows from operating activities

Cash used in operations 5 514 036 1 406 936

Interest income 30 058 25 586

Finance costs (787 390) (469 548)

------------------------------------------- ----------- -----------

Net cash from operating activities 4 756 704 962 974

------------------------------------------- ----------- -----------

Cash flows from investing activities

Purchase of property, plant and

equipment (4 496 478) (195 208)

Sale of property, plant and equipment 17 060 9 056

Purchase of intangible assets (2 181 981) (191 743)

Business combinations (6 826 281) -

Investment in associate - (500 000)

(Repayment)/receipt of loans 49 368 (841 087)

(13 438

Net cash from investing activities 312) (1 718 982)

------------------------------------------- ----------- -----------

Cash flows from financing activities

Net proceeds on share issues 10 671 831 4 252 950

Repayment of other financial liabilities (630 693) (3 518 298)

Proceeds from other financial liabilities 10 933 550 1 920 000

------------------------------------------- ----------- -----------

Net cash from financing activities 20 974 688 2 654 652

------------------------------------------- ----------- -----------

Total cash movement for the year 12 293 080 1 898 644

Total cash at the beginning of

the year 6 376 153 4 635 636

Effect of exchange rate movement

on cash balances 195 055 (158 127)

------------------------------------------- ----------- -----------

Total cash at end of the year 18 865 288 6 376 153

------------------------------------------- ----------- -----------

NOTES TO THE FINANCIAL STATEMENTS

1. STATEMENT OF ACCOUNTING POLICIES

The Group and Company results for the year ended 30 June 2019

have been prepared using the accounting policies applied by the

Company in its 30 June 2018 annual report which are in accordance

with International Financial Reporting Standards (IFRS and IFRC

interpretations) issued by the International Accounting Standards

Board ("IASB") as adopted for use in the EU (IFRS, including the

SAICA financial reporting guides as issued by the Accounting

Practices Committee and the Companies Act 2006 (UK). They are

presented in Pound Sterling.

This financial report does not include all notes of the type

normally included in an annual financial report. Accordingly, this

report is to be read in conjunction with the annual report for the

year ended 30 June 2019 and any public announcements by Jubilee

after that date to the date of publication of these results.

All monetary information is presented in the functional currency

of the Company being Great British Pound. The Group's principal

accounting policies and assumptions have been applied consistently

over the current and prior comparative financial period. The

financial information for the year ended 30 June 2018 contained in

this report does not constitute statutory accounts as defined by

section 435 of the Companies Act 2006. A copy of the statutory

accounts for that year has been delivered to the Registrar of

Companies. The auditor's report on those accounts was unqualified

did not contain a statement under section 498(2)-(3) of the

Companies Act 2006.

2. FINANCIAL REVIEW

Jubilee delivers outstanding results for the period under

review. The Group reports revenue for the year of GBP 23.59

million, 66.81% up from the comparative period. Operating profit of

GBP 4.87 million compared to GBP 0.06 million for the comparative

period.

The Group achieved positive earnings per share of 0.48 pence per

share compared to a loss per share of 0.18 pence for the

comparative period. Return on equity reached 10.5% compared to a

negative return of 7.49% in the previous year. Total project

attributable earnings almost doubled to GBP 9.87 million.

The Group's balance sheet strengthened substantially, with total

assets increasing by 47%, to GBP102 million. Total equity increased

to GBP 78.60 million, from GBP 58.8 million a year earlier,

maintaining a strong equity ratio of 77.11% compared to 84.70% in

2018.

The Group delivered strong cash flows from operating activities

of GBP 4.76 million compared to GBP 0.96 million in the comparative

period.

3. DIVIDS

The Board did not declare any dividends for the period under

review. (2018: Nil)

4. AUDITOR'S REVIEW OPINION

These results have been audited by the Group's auditors, Saffery

Champness LLP and their report is available for inspection at the

Company's registered office. A copy of the report is also attached

to the back of this announcement as annexure 1.

5. BOARD

There were no changes to the Board during the period under

review.

6. SHARE CAPITAL AND SHARE PREMIUM

Group

2019 2018

GBPs GBPs

--------------------------------------------- ----------- -----------

Authorised

The share capital of the Company is divided

into an unlimited number of ordinary shares

of GBP0.01 each.

Issued share capital fully paid

Ordinary shares of GBP0.01 each 18 553 007 13 109 923

Share premium 87 267 404 80 955 150

----------- -----------

105 820

Total issued capital 411 94 065 073

----------- -----------

The Company issued the following shares during the period and up

to the date of this annual report:

Issue price

-

Date issued Number of shares pence Purpose

---------------------------- ---------------- ----------- -----------

Opening balance 1 310 992 791

14 December 2018 52 493 438 2.50 Acquisition

24 March 2019 491 814 444 2.25 Placing

Closing balance at year-end 1 855 300 673

----------------

The Company did not issue any shares after year-end to the date

of this report.

During the year cash transaction costs accounted for as a

deduction from the share premium account amounted to GBP 612 805

(2018: GBP 247 500).

WARRANTS

At year-end and at the last practicable date the Company had the

following warrants outstanding:

Share price

Issue at

Number price issue date

of warrants Issue date GBPs Expiry date Pence

------------ ---------- ------- ----------- -----------

27 777

780 2018-01-19 0.06120 2023-01-19 3.55

29 166

665 2018-01-19 0.06120 2023-01-19 3.55

5 555 555 2018-01-19 0.06120 2023-01-19 3.55

2 777 778 2018-01-19 0.06120 2023-01-19 3.55

19 417

476 2018-12-28 0.03863 2023-12-28 2.40

12 944

984 2018-12-28 0.03863 2023-12-28 2.40

1 473 055 2019-03-20 0.03380 2021-03-20 2.45

------------

99 113

293

------------

7. BUSINESS COMBINATIONS

Windsor Chrome Operations

On 10 December 2018 Jubilee announced that it has executed a

sale and purchase agreement to acquire all of the chrome

beneficiation assets including plant, equipment, intellectual

property and all rights to the existing surface material estimated

in excess of 1. 8 million tonnes ("Assets") owned by PlatCro

Minerals (Pty) Ltd ("PlatCro") and associated companies ("the

Target"), for a combined cost of GBP 8.26 million (US$10.5 million)

("the Acquisition"). The business was acquired free from any

historic liabilities.

The Assets acquired include:

-- Plant and equipment offering processing capacity in excess of

75 000 tonnes per month

-- All associated property including all rights to existing

surface material

-- All stock and materials accolated with operating the

business

The aggregate purchase price for the Acquisition was settled by

Jubilee on 7 January 2019. Jubilee took ownership and operational

control of the Target on 7 January 2019. The purchase price was

settled through a combination of own cash, debt and the issue of 52

493 438 new Jubilee shares ("Acquisition Shares") at a price of 2.5

pence per share. Of the total purchase price, a total of GBP 0.28

million is only payable upon completion of certain conditions

precedent to the Acquisition.

Fair value of the purchase consideration, net assets acquired

and gain on bargain purchase are as follows:

Group

2019

GBPs

Cash 6 826 281

Ordinary shares issued 1 183 202

Contingent consideration 280 001

8 289 484

The fair value of the 52 493 438 ordinary shares issued as part

of the consideration paid

was based on the published share price on 7 January 2019 of 2.5

pence per share. Issue

costs of GBP 59 175 directly attributable to the issue of the

shares have been netted against

the deemed proceeds.

The assets recognised as a result of the acquisition

are as follows:

Land 684 898

Buildings 637 954

Plant and machinery 3 678 512

Motor vehicles 574 565

----------------------------------------------------- ---------

Total property, plant and equipment 5 575 929

Intangible assets 1 441 709

Inventories 991 845

Net identifiable assets acquired

8 009 483

Contingent asset acquired(1) 280 001

Net assets acquired

8 289 484

1. The contingent asset acquired represents the purchase of the

issued shares of PlatCro for a consideration of GBP 280 001 which

is only payable upon the condition that PlatCro is able to

successfully renew its mining right with the DMR. At the date of

this report the mining right had not been renewed by the DMR.

There were no acquisitions in the previous period.

Revenue and profit contribution

The acquired assets contributed revenues of GBP 5.72 million and

attributable earnings of GBP 1.94 million to the Group for the

period from 7 January to 30 June 2019.

8. BUSINESS SEGMENTS

In the opinion of the Directors, the operations of the Group

companies comprise of four reporting segments being:

- the beneficiation of Platinum Group Metals ("PGMs"), chrome

and base metals and development of PGM smelters utilising exclusive

commercialisation rights of the ConRoast smelting process, located

in South Africa ("Base metals beneficiation");

- the evaluation of the reclamation and processing of sulphide

nickel tailings in Australia and the development and implementation

of process solutions, specifically targeting both liquid and solid

waste streams from mine processes ("Business Development");

- the exploration and mining of Platinum Group Metals ("PGMs") (Exploration and mining); and

- the parent company operates a head office based in the United Kingdom, which incurs certain administration and corporate costs. ("Corporate").

The Group's operations span six countries, South Africa,

Australia, Madagascar, Mauritius, Zambia and the United Kingdom.

There is no difference between the accounting policies applied in

the segment reporting and those applied in the Group financial

statements. Mauritius and Madagascar do not meet the qualitative

threshold under IFRS 8, consequently no separate reporting is

provided.

Segment report for the year ended 30 June 2019

Total

Base metals Business Exploration Continuing

beneficiation development and mining Corporate operations

GBPs GBPs GBPs GBPs GBPs

--------------------------- -------------- ------------ ------------ ------------- ---------------

Total revenues 23 585 846 - - - 23 585 846

(10 709

Cost of sales (10 709 444) - - - 444)

Forex losses (8 163) (6 711) - 246 226 231 352

Share of loss from

associate - - - (865 489) (865 489)

Interest received 21 802 - 207 8 050 30 059

Interest paid (933 307) - - (179 604) (1 112 911)

Loss before taxation 4 357 520 (229 145) (231 989) 4 049 881 7 946 266

Taxation ( 15 870) - - (954 101) (969 971)

Loss after taxation 4 341 649 (229 145) (231 989) 3 095 780 6 976 295

Depreciation, amortisation

and impairments (3 400 232) (70 359) (231 568) - (3 702 159)

-------------- ------------ ------------ ------------- -------------

(102 042

Total assets (43 389 556) (15 872 277) (25 885 711) (16 894 725) 269)

-------------- ------------ ------------ ------------- -------------

Total liabilities 15 602 932 3 343 970 1 398 627 3 006 927 23 352 457

-------------- ------------ ------------ ------------- -------------

Segment report for the year ended 30 June 2018

Total

Base metals Business Exploration Continuing

beneficiation development and mining Corporate operations

GBPs GBPs GBPs GBPs GBPs

--------------------------- --------------- ------------ ------------ ----------- --------------

Total revenues 14 139 570 - - - 14 139 570

(8 672

Cost of sales (8 672 325) - - - 325)

Forex losses (92 893) - - (27 500) (120 394)

Share of loss from

associate - - - (308 451) (308 451)

Interest received 22 526 - 263 2 797 25 586

(1 375

Interest paid (1 375 732) - - - 732)

(2 403

Loss before taxation (952 910) (348 840) (30 946) (1 070 671) 367)

Taxation - - - - -

(2 403

Loss after taxation (952 910) (348 840) (30 946) (1 070 671) 367)

Depreciation, amortisation (3 236

and impairments (2 898 310) (338 440) - - 750)

--------------- ------------ ------------ ----------- ------------

(25 555 (69 436

Total assets 593) (14 016 052) (25 325 043) (4 540 056) 744)

--------------- ------------ ------------ ----------- ------------

10 634

Total liabilities 5 393 954 3 305 224 1 376 573 558 265 016

--------------- ------------ ------------ ----------- ------------

9. GOING CONCERN

The financial position of the Group, its cash flows, liquidity

position are disclosed in the financial statements. Jubilee's

business strategy is based on three core business pillars:

1. Process business development

-- Consists of a combination of targeted process consulting and

business development, focused on the development and implementation

of process solutions, specifically targeting both liquid and solid

waste streams from mine processes.

-- Our business development includes existing pilot operations

as part of the process development cycle to provide mature

solutions which includes extractive-metallurgy, pyro-metallurgy and

hydro-metallurgy.

-- This process has led to many previously non-viable

environmental and metals recovery projects becoming commercially

viable. We have experienced a very strong demand in Africa.

2. Operations

Jubilee owns and operates recovery plants for the recovery of

metals and minerals, currently recovering precious metals including

PGMs and Chrome and targeting base metals including lead, zinc,

vanadium and copper.

3. Project Funding

Jubilee is able to provide funding to support its partners

within smaller or larger companies to implement the waste recovery

projects. The funding especially assists in instances where the

company holding the mineral right prefers to be a passive

investment partner.

Factors in support of the Group's treasury position are listed

below:

-- In March 2019 the Company successfully completed a placing of

491 814 444 new ordinary shares of 1 pence each in Jubilee at a

price of 2.25 pence (ZAR 43.22 cents) per share raising

approximately GBP 11.07 million before expenses (ZAR 212.57

million) (Conversion rates applicable on the date of the

announcement being 21 March 2019);

-- The Group's current operating projects are cash generative

and contributes to the treasury of the Group; and

-- The Group meets its day--to--day working capital requirements

through cash generated from operations. The Group's current

operational projects are all fully funded and self-sustaining.

The current global economic climate creates to some extent

uncertainty particularly over the trading price of metals and the

exchange rate fluctuation between the US$ and the ZAR and thus the

consequence for the cost of the company's raw materials as well as

the price at which the product can be sold. The Group's forecasts

and projections, taking account of reasonably possible changes in

trading performance, commodity prices and currency fluctuations,

indicates that the Group should be able to operate within the level

of its current cash flow earnings forecasted for the next twelve

months.

The Group is adequately funded and has access to further equity

placings, which together with contracts with a number of high

profile customers strengthens the Group's ability to meet its

day-to-day working capital requirements, including its capital

expenditure requirements. As a consequence, the directors believe

that the Group is suitably funded and placed to manage its business

risks successfully despite identified economic uncertainties.

The directors have a reasonable expectation that the Group has

adequate resources to continue in operational existence for the

foreseeable future, thus continuing to adopt the going concern

basis of accounting in preparing the annual financial

statements.

9. EVENTS AFTER THE REPORTING PERIOD

9.1 Acquisition of Sable Zinc Limited (Zambia)

As announced on 21 March 2019, Jubilee executed the acquisition

of 100% of the issued capital of Sable Zinc Kabwe Limited in Zambia

from two subsidiaries of Glencore plc "Glencore" for a

consideration of GBP 9.16 million (US$12 million) (ZAR 175.97

million) (the "Acquisition"). The Acquisition was funded through a

combination of debt and equity. Jubilee secured a convertible loan

note for GBP 6.11 million (US$ 8 million) (ZAR 117.31 million) with

ACAM LP and successfully completed a placing of 491 814 444 new

Jubilee shares at an issue price of 2.25 pence per share to raise

GBP 11.07 million (US$ 14.50 million) (ZAR 212.57 million) before

expenses.

On 23 August 2019 the Acquisition became unconditional ("Closing

Date"), Jubilee obtained control and commenced with the

implementation of a fully integrated multi-metal refinery in

Zambia.

The consideration for the Acquisition is payable in stages as

follows:

-- US$ 6 000 000 within 5 business days after fulfilment or

waiver of the conditions precedent to the share purchase agreement

("Closing Date");

-- US$ 3 000 000 on the earlier of the date falling 30 days

after the date of completion of the conversion of the Sable Zinc

Kabwe plant to a zinc processing plant and the date falling 6

months after the Closing Date ("Second Instalment"); and

-- US$ 3 000 000 on the earlier of the date falling 30 days

after the date of commencement of commercial production and the

date falling 6 months after the Second Instalment.

Jubilee's Kabwe Operations seeks to establish a fully integrated

metal recovery and refining operational footprint in Zambia. The

Project combines access to large surface material with the adjacent

multi-metal refining capability. The Kabwe Operations resource

comprises an estimated 6.4 million tonnes (3.2 million JORC

compliant) of surface assets containing 356 843 tonnes of zinc, 351

386 tonnes of lead and 1.26% equivalent vanadium pentoxide. This

excludes further third party sourced copper and zinc rich mined

material for further refining. The adjacent Sable Zinc Refinery

will be expanded to include a copper, zinc, vanadium and lead

refining circuit based on Jubilee's extensive process development

and optimisation works program. The Kabwe Operations will be

implemented over three phases as outlined below.

Phase 1: Upgrade and commissioning of the copper refining

circuit with a targeted capacity of 3 000

tonnes of refined copper per annum, targeting implementation

during Q4 2019;

Phase 2: Implementation of both the zinc and vanadium refinery

circuit with an initial targeted capacity of 8 000 tonnes per annum

of zinc contained in a high grade zinc concentrate suitable for

the

market and 1 500 tonnes per annum of vanadium pentoxide,

targeting commissioning of the

zinc and vanadium refinery circuit during Q2 2020; and

Phase 3: Implementation of the lead refining circuit with an

initial targeted capacity of 11 000 tonnes

per annum of lead contained in a high-grade concentrate during

Q2 2021.

The Kabwe Refinery process flowsheet offers flexibility with two

separated fully equipped electro-winning circuits able to produce

either high grade copper or zinc with only minor adjustments. The

Company can allocate this refining capacity either to both metals

individually or a combination of the two metals depending on the

prevailing market conditions to maximise returns. Prior to taking

ownership of the Sable Zinc Refinery, Jubilee actively pursued the

completion of the project design and initiating final equipment

selection to enable rapid implementation of the process

flowsheet.

9.2 Acquisition of signi-ficant tailings

Jubilee owns and operates a chrome and PGM processing facility

at Hernic with a processing capacity of 55 000 tonnes per month.

The facility currently produces up to 9 000 tonnes of saleable

chrome concentrate and 2 250 ounces of PGMs per month. Previously,

Jubilee had a Co-Operation Agreement ("Hernic Agreement") with

Hernic Ferrochrome (Pty) Ltd ("Hernic Ferrochrome"), whereby

Jubilee had the rights to all PGM earnings from the tailings at

Hernic until it secured a 30% return on investment, where after

Hernic secured the majority of earnings. Under the Hernic

Agreement, all of the chrome concentrate produced is returned to

Hernic Ferrochrome for its own use or sale to the market. As

announced on 24 October 2019, Jubilee has entered into a Framework

and Tailings Purchase Agreement ("Tailings Agreement") with

K2018239983 (SOUTH AFRICA) (PTY) LTD ("NewCo"), a subsidiary of one

of the world's largest ferrochrome producers to acquire 100% of the

rights to PGM earnings from the current and future tailings

produced at Jubilee's Inyoni Operations (previously Hernic) located

in the Bushveld Complex, South Africa. In addition to the current

unprocessed 1.70 million tonnes of historical tailings at the

Hernic Operations and the 630 000 tonnes of previously processed

tailings, Jubilee has acquired the rights to a further c. 1 million

tonnes of PGM rich material. The total consideration for all the

PGMs contained in the historical tailings is c. US$ 5.1 million and

will be settled from Jubilee's cash resources. Jubilee has also

entered into an exclusive agreement with NewCo whereby NewCo may

elect to include the sale of all further chrome rights to the

chrome contained in all of the current tailings at Hernic at a

predetermined value. The operations and assets of Hernic

Ferrochrome are being acquired by NewCo and following entering into

the Tailings Agreement with NewCo, the Hernic Agreement is

terminated with immediate effect.

As announced on 5 November 2019, NewCo has exercised its rights

in terms of the Exclusive Agreement announced on 24 October 2019,

to sell all further chrome rights to the chrome contained in all of

the historical tailings at Inyoni to Jubilee. Under the Exclusive

Agreement, Jubilee has acquired 100% of all further chrome rights

to the chrome contained in all of the historical tailings at

Inyoni. The total consideration for all the chrome contained in the

historical tailings is approximately US$ 16.39 million (at current

conversion rates), which will be majority funded from Jubilee's

existing cash and operating cash flows, together with project

funding as necessary. The total consideration will be settled in

three tranches, each 30 business days apart.

NOTICE OF ANNUAL GENERAL MEETING

The Company also hereby gives notice of its 2019 Annual General

Meeting, which will be held on 6 December 2019 at 11:00 am UK time

at Fladgate LLP, 16 Great Queen Street, London, WC2B 5DG to

transact the business as stated in the notice of Annual General

Meeting. The Group's Annual Report for the year ended 30 June 2019

has been posted to the website, www.jubileemetalsgroup.com, with

the notice of the Company's 2019 Annual General Meeting.

Shareholders are advised that the Notice of Annual General Meeting,

including a Form of Proxy, for the year ended 30 June 2019 has been

posted to Jubilee shareholders today, 14 November 2019.

*Ends*

14 November 2019

For further information visit www.jubileemetalsgroup.com, follow

Jubilee on Twitter (@Jubilee Metals) or contact:

Jubilee Metals Group PLC

Colin Bird/Leon Coetzer

Tel +44 (0) 20 7584 2155 / Tel +27 (0) 11 465 1913

Nominated Adviser - SPARK Advisory Partners Limited

Andrew Emmott/Vassil Kirtchev

Tel: +44 (0) 20 3368 3555

Broker - Shard Capital Partners LLP

Damon Heath/Erik Woolgar

Tel +44 (0) 20 7186 9900

Joint Broker - WHIreland

Harry Ansell/Katy Mitchell

Tel: +44 (0) 20 7220 1670/+44 (0) 113 394 6618

JSE Sponsor - Sasfin Capital (a member of the Sasfin group)

Sharon Owens

Tel +27 (0) 11 809 7500

PR & IR Adviser - St Brides Partners Limited

Catherine Leftley/ Beth Melluish

Tel +44 (0) 20 7236 1177

Annexure 1

Audit Opinion

We have audited the financial statements of Jubilee Metals Group

Plc for the year ended 30 June 2019 which comprise the Group and

Company Statements of Financial Position, the Group and Company

Statements of Comprehensive Income, the Group and Company

Statements of Changes in Equity, the Group and Company Statements

of Cash flows and notes to the financial statements, including a

summary of significant accounting policies. The financial reporting

framework that has been applied in their preparation is applicable

law and International Financial Reporting Standards (IFRSs) as

adopted by the European Union.

In our opinion, the financial statements:

-- give a true and fair view of the state of the group's and of

the parent company's affairs as at 30 June 2019 and of the group

and parent company's profit for the period then ended;

-- have been properly prepared in accordance with IFRSs as

adopted by the European Union; and

-- have been prepared in accordance with the requirements of the Companies Act 2006.

Basis for opinion

We conducted our audit in accordance with International

Standards on Auditing (UK) (ISAs (UK)) and applicable law. Our

responsibilities under those standards are further described in the

Auditor's responsibilities for the audit of the financial

statements section of our report. We are independent of the group

and the parent company in accordance with the ethical requirements

that are relevant to our audit of the financial statements in the

UK, including the FRC's Ethical Standard as applied to listed

entities, and we have fulfilled our other ethical responsibilities

in accordance with these requirements. We believe that the audit

evidence we have obtained is sufficient and appropriate to provide

a basis for our opinion.

Conclusions relating to going concern

We have nothing to report in respect of the following matters in

relation to which the ISAs (UK) require us to report to you

where:

-- the directors' use of the going concern basis of accounting

in the preparation of the financial statements is not appropriate;

or

-- the directors have not disclosed in the financial statements

any identified material uncertainties that may cast significant

doubt about the group's or the parent company's ability to continue

to adopt the going concern basis of accounting for a period of at

least twelve months from the date when the financial statements are

authorised for issue.

Key audit matters

Key audit matters are those matters that, in our professional

judgement, were of most significance in our audit of the financial

statements of the current period and include the most significant

assessed risks of material misstatement (whether or not due to

fraud) we identified, including those which had the greatest effect

on: the overall audit strategy, the allocation of resources in the

audit; and directing the efforts of the engagement team. These

matters were addressed in the context of our audit of the financial

statements as a whole, and in forming our opinion thereon, and we

do not provide a separate opinion on these matters.

Key Audit Matter How our audit addressed the key

audit matter

Carrying value of intangible

assets Our audit procedures included

The carrying value of the following:

intangible * Assessing whether the methodology used by the

assets included in the Group's Directors to calculate recoverable amounts complies

balance sheet at 30 June 2019 with IAS 36;

was stated as GBP46.9m,

contained

within 2 cash generating units * Assessing the viability of the platinum group

("CGUs"). elements ("PGE") exploration asset by analysing CGU

value in use cash flows and determining whether the

The Directors assess at each input assumptions are reasonable and supportable

reporting period end whether given the current macroeconomic climate;

there is any indication that

an asset may be impaired and

intangible assets with an * Performing sensitivity analysis on key assumptions

indefinite and testing the mathematical accuracy of models;

life must be tested for

impairment

on an annual basis. The * Challenging inputs to models including comparison

determination with external data sources;

of recoverable amount, being

the higher of value-in-use and

fair value less costs to * Reviewing correspondence and other sources for

dispose, evidence of impairment;

requires judgement on the part

of management in both

identifying * Reviewing the recoverability of intercompany loans

and then valuing the relevant within the parent company and indicators of

CGUs, especially for projects impairment in investments in subsidiaries;

where there is an uncertain

timeframe.

* Assessing the appropriateness and completeness of the

Deferred tax liabilities are related disclosures in note 9, intangible assets, of

recognised on certain the group financial statements; and

intangible

assets following business

combinations * Recalculating the deferred tax liability relating to

and these liabilities are specific intangible assets and assessing applicable

re-evaluated tax rates.

at each reporting period end.

Any impairment in these CGUs * Understanding the nature and basis of the recognition

could lead to consequent of new intangible assets relating to the Kabwe and

impairments Windsor operations.

of the parent company's

investments

in subsidiaries or

intercompany Based on our procedures, we noted

loans to these subsidiaries no material exceptions and considered

which at 30 June 2019 were management's key assumptions

carried to be within reasonable ranges.

at GBP36.9m and GBP52.4

respectively.

Due to the significance of the

intangible assets to the

consolidated

financial statements, the

significant

judgements involved in these

calculations and the potential

impact on parent company

investments

and intercompany loans, the

carrying value of intangible

assets is a key audit matter.

-------------------------------------------------------------------------

Revenue recognition

Revenue for the year was Our audit procedures included

GBP23.6m, the following:

representing a significant * Obtaining the Group's IFRS 15 impact assessment and

increase considering this in detail by reference to the

on 2018. 2019 saw the Group's underlying contracts with customers and

acquisition performance conditions set out therein;

of the Windsor Chrome project

which contributed new revenues

alongside Hernic and DCM. The * Evaluating the Group's revenue recognition policy and

revenue recognised is derived management's current year accounting assessment for

from platinum group metals the fair value of consideration receivable based on

("PGM") the contracts entered into;

concentrate and chromite

concentrate

sales. * Confirming the implementation of the Group's policy

to the Hernic, DCM and Windsor projects by performing

The Group also adopted IFRS tests to confirm our understanding of the process by

15 Revenue from Contracts with which revenue is calculated;

Customers for the first time.

Even though the Group

concluded * Confirming that fair value measurements are

that the implementation of determined in accordance with IFRS 13;

IFRS

15 resulted in no change to

the timing of revenue * Comparing foreign exchange rates used in management's

recognition, calculations;

this represents a change in

approach to the recognition

of revenue and required an * Substantive tests agreeing concentrates and

updated underlying calculations to independent sources; and

impact assessment by reference

to the Group's existing

contracts * Assessing the appropriateness of the related

and the performance conditions disclosures in notes 1.12 and 3, revenue recognition

placed on Jubilee within those accounting policy and revenue split by commodity, of

contracts. the group financial statements.

For the sale of chromite

concentrate

and PGM concentrate, the Based on our procedures, we noted

Group's no material exceptions and considered

revised revenue accounting management's key assumptions

policy to be within reasonable ranges.

is set out in note 1.12. We consider that revenue recognition

has been recognised appropriately

Due to the significance of and is in accordance with the

revenue Group's revenue recognition policy

to the consolidated financial and IFRS 15.

statements, the first year of

revenues from Windsor Chrome

and the judgement involved in

estimating consideration

receivable

and this being the first year

of adoption of IFRS 15,

revenue

recognition is a key audit

matter.

-------------------------------------------------------------------------

Accounting and disclosure of

convertible debt Our audit procedures included

During the year, Jubilee the following:

entered * Obtaining the funding agreement with ACAM LP to

into a funding agreement with determine the key features, terms and conditions;

ACAM LP for $8m to finance its

post balance sheet acquisition

of Sable Zinc as part of its * Reviewing management's proposed treatment and basis

development of the Kabwe for this;

Project.

Under the agreement, ACAM have * Challenging the Directors' assessment of the

the option to convert the loan applicable interest rate on an equivalent loan

and unpaid interest into without the conversion option and review of this by

convertible reference to external data and the Group's wider

loan notes with a fixed portfolio of funding arrangements;

conversion

price of 2.81p per share.

* Reworking and recalculating management's effective

Jubilee have the option to interest rate calculations based on contractual cash

repay flows and analysis of the relevant direct costs

early the loan which will associated with the loan;

trigger

the issue of warrants with a

value equal to 50% of the * Recalculating and agreeing with management the

amount resulting equity component and considering its

of the loan and accrued treatment within equity on the Statement of Financial

interest Position;

outstanding, divided by 2.81p.

Due to the significance of the * Ensuring that the necessary accounting adjustments

loan and the complexities in were reflected in the group financial statements;

assessing its treatment, the

accounting and disclosure of

the convertible loan is a key * Reviewing the application of exchange rates in the

audit matter. loan workings and assessing the appropriateness of

the loan treatment by reference to IAS 32;

* Reviewing the disclosure requirements to ensure

adequate disclosure was given in the financial

statements.

Based on our procedures, we noted

no material exceptions and considered

the accounting and disclosure

of the convertible loan, as amended,

to be reasonable.

-------------------------------------------------------------------------

Accounting and disclosure of

the Group's option over Enviro Our audit procedures included

Mining Limited the following:

* Discussing with management their view of the

During the year the Group appropriate accounting treatment of the overall

entered transaction;

into updated shareholder and

operator agreements with BMR

Group Plc in respect of the * Challenging management's assessment of whether the

operation of the Kabwe gaining of control of Kabwe Operations Limited

Project. represents a business combination;

These agreements took

Jubilee's * Reviewing the underlying updated operating and

interest in Kabwe Operations shareholder agreements to understand key terms;

Limited, the entity operating

the project, from 15% to

87.5%. * Understanding the assets held within Enviro Mining

Jubilee acquired the and Enviro Processing and the nature of the

additional small-scale mining licence held therein; and

interest in exchange for a

commitment

to execute the improved * Critically evaluating the cash flow model relating to

methodology the Kabwe Project used to value the shares of Enviro

for the exploitation of the Mining and challenging key assumptions including the

project as well as project discount rate applied, royalty rates, total forecast

funding. material processed and capital requirements;

A further feature of the

agreement * Understanding the rationale for an overall valuation

was to assign Jubilee an discount applied to reflect the pre-production stage

option of the project, the inherent uncertainties and the

to acquire, at no additional fact that the Sable Zinc refinery had not been

cost, 100% of the share acquired at the time the model was prepared;

capital

of Enviro Mining Limited, a

subsidiary of BMR Group Plc * Assessment of the appropriate deferred tax treatment

and which owns the share associated with the fair value uplift on the asset.

capital

of Enviro Processing Limited,

a company which holds rights

to access the material at Based on our procedures, we noted

Kabwe. no material exceptions and considered

the accounting and disclosure

If and when Jubilee exercise of the financial asset to be

that option, BMR Group plc appropriate.

will

pass its 12.5% interest in

Kabwe

Operations Limited to Jubilee

and will instead be entitled

to a 12.5% royalty from

project

earnings once Jubilee have

achieved

a 20% return from the project

and other conditions are met.

At the year-end Jubilee held

the option over Enviro Mining

Limited and therefore recorded

the option as a financial

asset

measured at fair value.

Deriving

that fair value required

significant

judgement and therefore the

recognition of this option was

considered a key audit matter.

-------------------------------------------------------------------------

Accounting and disclosure of

the acquisition of Windsor Our audit procedures included

Chrome the following:

trade and assets * Discussing with management their view of the

appropriate accounting treatment of the overall

During the year the Group transaction;

acquired

the trade and assets of an

existing * Obtaining and reviewing the underlying acquisition

trading operation at Windsor documents and identifying the key terms of the

Chrome. That acquisition was transaction;

treated as a business

combination

as the deal encompassed * Understanding the rationale for meeting the

operating definition of a business combination under IFRS 3 and

plant, land, stock, testing those assertions to the facts;

intellectual

property, other associated

assets * Obtaining management's register of assets acquired

as well as employees at the and their associated fair value assessment;

site.

The total consideration for * Physical verification of assets at the Windsor site;

the acquisition was set at

$10.5m

subject to various adjustment * Reviewing and recalculating the fair value of cash

mechanisms and was met through and shares issued in consideration;

the issue of new shares as

well

as cash. The cash element was * Reviewing external evidence available in respect of

met through a combination of the fair value of assets acquired;

existing funds and debt

funding.

* Considering any evidence of impairment by reference

The recognition of the to future cash flow models associated with the

transaction Windsor Chrome operation including in respect of

as a business combination volume of material processed and discount rates;

required

an assessment of the fair

values * Reviewing the disclosure requirements to ensure

of the assets acquired as well adequate disclosure was given in the financial

as the consideration issued. statements.

Due to the various judgement

areas involved we consider

this Based on our procedures, we noted

transaction to be a key audit no material exceptions and considered

matter. the accounting and disclosure

of the business combination to

be appropriate.

-------------------------------------------------------------------------

Our application of materiality

We apply the concept of materiality in planning and performing

our audit, in evaluating the effect of any identified misstatements

and in forming our audit opinion. Our overall objective as auditor

is to obtain reasonable assurance that the financial statements as

a whole are free from material misstatement, whether due to fraud

or error. We consider a misstatement to be material where it could

reasonably be expected to influence the economic decisions of the

users of the financial statements.

We have determined a materiality of GBP1,000,000 (2018:

GBP600,000) for both the Group and Company financial statements.

This is based on 1.5% of net assets per draft financial information

at the planning stage. We did not consider there to be any reason

to revise materiality during the audit.

An overview of the scope of our audit

We tailored the scope of our audit to ensure that we obtained

sufficient evidence to support our opinion on the financial

statements as a whole, taking into account the structure of the

Group and the Parent Company, the accounting processes and controls

and the industry in which the Group operates.

As Group auditors we carried out the audit of the Company

financial statements and, in accordance with ISA (UK) 600, obtained

sufficient evidence regarding the audit of seven subsidiaries

undertaken by component auditors in South Africa and Mauritius.

These seven subsidiaries were deemed to be significant to the Group

financial statements either due to their size or their risk

characteristics. The Group audit team directed, supervised and

reviewed the work of the component auditors in South Africa and

Mauritius, which involved issuing detailed instructions, holding

regular discussions with component audit teams, performing detailed

file reviews and visiting South Africa to attend local audit

meetings with management. Audit work in South Africa and Mauritius

was performed at materiality levels of GBP100,000, lower than Group

materiality.

We also reviewed the audit work performed by a component auditor

on one material associate whose results are equity accounted in the

financial statements. That associate has a different reporting

period to the Group and therefore we performed additional work to

gain comfort on the results of the associate for the relevant

period.

As part of designing our audit, we determined materiality and

assessed the risks of material misstatement in the financial

statements. In particular, we looked at where the Directors made

subjective judgements, for example in respect of significant

accounting estimates that involved making assumptions and

considering future events that are inherently uncertain. We also

addressed the risk of management override of internal controls,

including evaluating whether there was evidence of bias by the

Directors that represented a risk of material misstatement due to

fraud.

Other information

The directors are responsible for the other information. The

other information comprises the information included in the annual

report, other than the financial statements and our auditor's

report thereon. Our opinion on the financial statements does not

cover the other information and, except to the extent otherwise

explicitly stated in our report, we do not express any form of

assurance conclusion thereon.

In connection with our audit of the financial statements, our

responsibility is to read the other information and, in doing so,

consider whether the other information is materially inconsistent

with the financial statements or our knowledge obtained in the

audit or otherwise appears to be materially misstated. If we

identify such material inconsistencies or apparent material

misstatements, we are required to determine whether there is a

material misstatement in the financial statements or a material

misstatement of the other information. If, based on the work we

have performed, we conclude that there is a material misstatement

of this other information; we are required to report that fact.

We have nothing to report in this regard.

Opinions on other matters prescribed by the Companies Act

2006

In our opinion, based on the work undertaken in the course of

the audit:

-- the information given in the Strategic Report and the

Directors' Report for the financial year for which the financial

statements are prepared is consistent with the financial

statements; and

-- the Strategic Report and the Directors' Report have been

prepared in accordance with applicable legal requirements.

Matters on which we are required to report by exception

In the light of the knowledge and understanding of the group and

parent company and its environment obtained in the course of the

audit, we have not identified material misstatements in the

Strategic Report or the Directors' Report.

We have nothing to report in respect of the following matters in

relation to which the Companies Act 2006 requires us to report to

you if, in our opinion:

-- adequate accounting records have not been kept by the parent

company, or returns adequate for our audit have not been received

from branches not visited by us; or

-- the parent company financial statements are not in agreement

with the accounting records and returns; or

-- certain disclosures of directors' remuneration specified by law are not made; or

-- we have not received all the information and explanations we require for our audit.

Responsibilities of directors

The directors are responsible for the preparation of the

financial statements and for being satisfied that they give a true

and fair view, and for such internal control as the directors