TIDMSIHL

RNS Number : 5662T

Symphony International Holdings Ltd

15 November 2019

Not for distribution, directly or indirectly, in or into the

United States or any jurisdiction in which such distribution would

be unlawful.

Symphony International Holdings Limited ("Symphony")

15 November 2019

Update on Minor International PCL

Symphony International Holdings Limited (LSE: SIHL) is pleased

to announce that Minor International Pcl ("MINT"), Symphony's

largest portfolio investment, released its third quarter ("3Q19")

results for the 2019 financial year. MINT reported a 347% increase

in net profit in 3Q19 from the same period a year earlier as a

result of strong contributions from NH Hotel Group and MINT's

realized gain on sale of three Tivoli assets in Portugal.

MINT's announcement on 12 November 2019 is reproduced below.

MINOR INTERNATIONAL PCL

PRESS RELEASE - 12 November 2019 FOR IMMEDIATE RELEASE

MINT'S 3Q19 NET PROFIT SURGES 347% TO BAHT 4.6 BILLION

Minor International Public Company Limited ("MINT") reported net

profit of Baht 4,560 million in 3Q19, a 347% increase from Baht

1,020 million in 3Q18. This surge in net profit during the quarter

resulted from the strong contributions from NH Hotel Group and

MINT's realized gain on sale of three Tivoli assets in Portugal in

3Q19, undertaken as part of MINT's strategic asset rotation

strategy. Anantara Vacation Club also demonstrated significant

improvement in performance in 3Q19 compared to 3Q18. For the first

nine months of 2019, MINT reported net profit of Baht 6,929

million, a 76% increase from net profit of Baht 3,944 million in

the first nine months of 2018.

MINT's investment in NH Hotel Group, together with its sale and

leaseback of three Tivoli hotels in Portugal, validate MINT's

timely strategic initiatives of: (i) acquiring intrinsically strong

and growing business at a highly attractive price, and (ii)

simultaneously realizing MINT's tangible asset value through asset

rotation strategy, taking advantage of Europe's low interest rate

and high liquidity environment. Due to such strategic initiatives,

MINT was able to overcome external challenges, namely global

uncertainties arising from the US-China trade war, continued

appreciation of the Thai Baht and subdued domestic consumption

demand. As a result, MINT delivered third quarter financial

performance that surpassed its Thai and regional peer group.

Operationally, Minor Hotels achieved strong performance with 86%

core net profit growth to Baht 1,212 million in 3Q19 compared to

net profit of Baht 651 million in 3Q18, driven by strong

contribution from NH Hotel Group and significant improvement of

Anantara Vacation Club. Minor Hotels continues to strengthen its

global platform, which today spans from Australia, Asia, the Middle

East, Europe and the Americas. Minor Hotels' integration with NH

Hotel Group is well underway and is already delivering strong

benefits to the group. For example, the hotel portfolios in

Portugal and Brazil have been transferred to NH Hotel Group's

management since the third quarter of this year, in order to

capitalize on NH Hotel Group's strong European and Latin American

operating platform. Similarly, by drawing on NH Hotel Group's

strong relationships with property owners and investors across

Europe and marrying this with the strength of the Anantara brand,

Minor Hotels achieved the launch of the first Anantara in Spain in

July 2019 in Marbella and has recently announced plans for the

first Anantara in Dublin, Ireland.

Minor Food continued its recent soft performance, reporting core

net profit of Baht 207 million in 3Q19 compared to net profit of

Baht 350 million in 3Q18 on the back of negative same-store-sales

growth, primarily as a result of adverse asymmetric demand vs.

supply growth for the Thai restaurant sector. Notwithstanding this,

Minor Food is using the opportunity to refresh its food offerings,

invest in its infrastructure, and identify new growth opportunity

to take advantage of synergy from its current advantageous

economies of scale both in Thailand and internationally.

Overall, MINT reiterates its confidence in full-year 2019

performance and its long-term growth prospects, supported by its

business and geographical diversification. MINT and NH Hotel Group

continue to work together to realize further synergies between the

two businesses and believe that there remains huge untapped

potential to be unlocked in their collaboration. Thailand tourist

arrivals are already seeing signs of recovery, while Minor Hotels

expects to be able to recognize real estate sales in the fourth

quarter. With increasing focus on delivery, technology and new

growth opportunity, Minor Food sales should gradually

strengthen.

MINT further reiterates its commitment to strengthen its balance

sheet by taking advantage of highly liquid THB and USD debt capital

markets and MINT's strong issuer reputation, including: (i) the

refinancing of NH acquisition bridge loans, now with the lengthened

maturity of over 6 years, and (ii) continued support on MINT's

existing perpetual bonds, with recent favorable account treatment

being validated by The Federation of Accounting Professions for at

least until the end of 2022. In addition, MINT applied proceeds

from the sales-and-lease back of the three properties in Portugal

to repay a portion of its debt, while the gain on the transaction

has also increased its equity base, resulting in MINT's latest

debt-to-equity ratio of 1.35x as at end of 3Q19, now within the

band of MINT's internal policy target as MINT management team

previously guided to its stakeholders.

About Minor International: Minor International (MINT) is a

global company focused on three core businesses: hospitality,

restaurants and lifestyle brands distribution. MINT is a hotel

owner, operator and investor with a portfolio of 529 hotels under

the Anantara, AVANI, Oaks, Tivoli, NH Collection, NH Hotels, nhow,

Elewana, Marriott, Four Seasons, St. Regis, Radisson Blu and Minor

International brands in 55 countries across Asia Pacific, the

Middle East, Africa, the Indian Ocean, Europe, South and North

America. MINT is also one of Asia's largest restaurant companies

with over 2,200 outlets system-wide in 26 countries under The Pizza

Company, Swensen's, Sizzler, Dairy Queen, Burger King, Thai

Express, The Coffee Club, Riverside and Benihana brands. MINT is

one of Thailand's largest distributors of lifestyle brands and

contract manufacturers. Its brands include Anello, Bodum, Bossini,

Brooks Brothers, Charles & Keith, Esprit, Etam, Joseph Joseph,

OVS, Radley, Scomadi, Zwilling J.A. Henckels and Minor Smart Kids.

For more information, please visit www.minor.com

For further information:

Chaiyapat Paitoon / Jutatip Adulbhan +662 365 7500

Minor International Pcl

Symphony Asia Holdings Pte. Ltd. +65 6536 6177

Anil Thadani

Rajgopal Rajkumar

Dealing codes

The ISIN number of the Ordinary Shares is VGG548121059, the

SEDOL code is B231M63 and the TIDM is SIHL.

The LEI number of the Company is 254900MQE84GV5DS6F03.

About Symphony

Symphony International Holdings Limited (LSE:SIHL) is a London

listed strategic investment company that invests in consumer

related businesses, primarily in the healthcare, hospitality,

lifestyle (including branded real estate developments), logistics

and education sectors predominantly in Asia. It offers a way for

investors to gain exposure to rising disposable incomes and wealth

in fast growing economies. Symphony's objective is to provide

superior capital growth by investing in high quality companies and

form long-term business partnerships with talented entrepreneurs

and management teams. Symphony's investment team has a broad range

of expertise - many of its professionals have been working in Asia

for more than 30 years. For more information please visit our

website at www.symphonyasia.com.

No representation or warranty is made by the Company as to the

accuracy or completeness of the information contained in this

announcement and no liability will be accepted for any loss arising

from its use.

This announcement is for information purposes only and does not

constitute an invitation or offer to underwrite, subscribe for or

otherwise acquire or dispose of any securities of the Company in

any jurisdiction. All investments are subject to risk. Past

performance is no guarantee of future returns. Prospective

investors are advised to seek expert legal, financial, tax and

other professional advice before making any investment

decisions.

This announcement is not an offer of securities for sale into

the United States. The Company's securities have not been, and will

not be, registered under the United States Securities Act of 1933

and may not be offered or sold in the United States absent

registration or an exemption from registration. There will be no

public offer of securities in the United States.

The Company and the Investment Manager are not associated or

affiliated with any other fund managers whose names include

"Symphony", including, without limitation, Symphony Financial

Partners Co., Ltd.

End of Announcement

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

UPDUVSWRKWAAARA

(END) Dow Jones Newswires

November 15, 2019 03:53 ET (08:53 GMT)

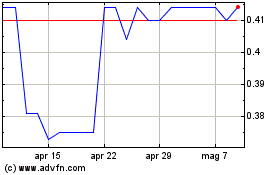

Grafico Azioni Symphony International H... (LSE:SIHL)

Storico

Da Mar 2024 a Apr 2024

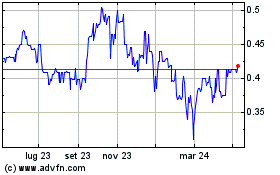

Grafico Azioni Symphony International H... (LSE:SIHL)

Storico

Da Apr 2023 a Apr 2024