TIDMSRT

RNS Number : 8151T

SRT Marine Systems PLC

19 November 2019

The information communicated in this announcement contains

inside information for the purposes of Article 7 of the Market

Abuse Regulation (EU) No. 596/2014 and is disclosed in accordance

with the Company's obligations under Article 17 of those

Regulations.

SRT MARINE SYSTEMS PLC ("SRT" or the "Group")

HALF YEARLY REPORT FOR THE SIX MONTHSED 30 SEPTEMBER 2019

SRT, the AIM-quoted developer and supplier of maritime

surveillance, analytics and management systems and products

announces its unaudited interim results for the six months ended 30

September 2019 (the "Period").

Financial Highlights

-- Year on year period revenue increased by 9.8% to GBP3.5m (H118: GBP3.2m)

-- Gross profit margin of 38% (H118: 41%)

-- Gross cash of GBP1.7 million as at the period end (H118: GBP1.4m)

-- Active new systems contracts pipeline increased to approximately GBP580m

Operational Summary

-- Completion of first iteration of new fisheries monitoring transceiver (VMS-100)

-- Completion of first phase of new AIS transceiver development program

-- Significant functionality upgrade to GeoVS maritime domain awareness application

-- Growth of delivery, product management and development teams

Chairman's Statement

I am pleased to report that during the first half of our

financial year the Group performed operationally in line with our

plans and expectations and I look forward to reporting a busy and

productive second half and next financial year.

Revenues grew year on year by 9.8% to GBP3.5m generating a gross

profit margin of 38% and a loss before tax of GBP1.5m after

administration costs of GBP2.7m and net finance costs of GBP0.2m.

Cash balances as at 30 September 2019 were GBP1.7m, with trade and

other debtors of GBP14.3m.

The vast majority of revenues during the first half were

generated by our transceivers business with only a minimal

contribution from our MDA systems business as no performance

milestones were completed during this period. A significant cash

payment was received from a systems customer as scheduled,

counterbalanced by further significant purchases of equipment to

complete milestones scheduled for the second half. Subsequent to

the period end I can report that we have received a further GBP4.9m

as scheduled from a systems customer, which related to revenue

recognised on performance milestones completed during the previous

financial year.

Our raw overhead cash expenditure which excludes adjustments

such as exchange rate adjustments, depreciation, amortisation and

development capitalisation amounted to GBP4.2m compared to GBP2.8m

for the same period last year. This increase reflects a doubling of

product development investment from GBP0.7m to GBP1.4m and relates

to new transceivers and significant acceleration and expansion of

GeoVS software development as well as our investments in our

systems delivery and product management teams.

Our transceivers business enjoyed growing demand in both our OEM

and em-trak sub-divisions, driven primarily by the continuing

long-term adoption trend of AIS transceivers as standard equipment

on boats, both commercial and leisure, coupled with steady

expansion of our various OEM and em-trak sales channels.

Underpinned by our strategy of focusing on developing core

technology that delivers the best performance and so maximum AIS

data, and derivative products that are robust and reliable with

functionality that is practical and useful to the end user. All at

price points which are affordable to the majority of boat owners.

We have also started to generate new revenue streams from

customised versions of standard products such as specialist

ruggedized and encrypted AIS transceivers for coast guards and

emergency services applications.

During the period the first of a new range of products, the B900

series, were completed which will be exclusive to em-trak and will

launch in November 2019 and commence shipping from January 2020.

These new products deliver maximised AIS data and simultaneous

multi-device connectivity to meet the market demand for maximum

navigation functionality flexibility through an increasing use of

feature rich tablets, PCs, phones and wearables for navigation on

commercial and leisure boats. This development program, which

commenced in 2018, will yield further innovative AIS related

products during 2020 and 2021 for both our OEM and em-trak

sub-divisions all of which will leverage our internal core radio

communications technology development capabilities to produce

robust, high performance integrated products that are affordable

and desirable to the mass leisure and commercial marine markets. We

therefore see many exciting growth opportunities for our

transceivers business for the second half and beyond.

During the first half we have made significant progress with our

systems business, both in respect of existing contracts and pending

contract opportunities. This business delivers a turn-key

integrated maritime surveillance, monitoring and management system

(SRT-MDA System) which is configurable in scale and functionality

depending on the customer. The system is used by coast guards or

fishery authorities to enable them to detect and manage suspicious

and illegal activities such as drug smuggling, piracy and illegal

fishing.

Our systems delivery team has continued to make good progress

with our fisheries contract with the Philippine Government.

Extensive work has been completed by our Delivery team that

includes surveying and preparing over 100 sites, as well as

assembling large volumes of complex equipment shipped from our

warehouse in the UK ready for installation and commissioning at

these sites. We expect the monitoring system to start to come

online from January 2020 whereupon the customer will commence day

to day use of the system for fisheries management. This project

benefits from our new ruggedized VMS-100 fisheries monitoring

transceiver with electronic fish catch reporting interface which

will start being installed on 5,000 vessels from early 2020. In

validation trials, I am pleased to report that our system has

proven its ability to receive status reports from fishing boats of

any size once every 15 minutes. An exceptional performance level

not seen until now in fisheries monitoring made possible by core

technology innovation by the SRT transceiver development team.

On the development side, at the heart of the SRT-MDA system is

our GeoVS platform. This is a sophisticated professional integrated

software application which enables the fusion and processing of

large amounts of surveillance data from multiple terrestrial and

satellite sensor sources. It applies configurable real time and

historical analytics to identify and detect threats and illegal

activities along with advanced visualisation and integrated command

and control to enable customer operatives to have enhanced

situational awareness and manage appropriate action. During the

first half we have continued to expand and accelerate our GeoVS

development program and have made significant progress with the

development and implementation of additional functionality. Areas

of long-term focus include data fusion, data analytics, alert

management, fish catch reporting and auditing and command and

control. I am pleased to report that our considerable investments

in GeoVS over many years have resulted in it becoming a significant

asset for SRT and provides our systems offer with a differentiated

level of integrated functionality and ultimately delivering

enhanced maritime domain awareness for our customers.

As one of the pioneers of integrated maritime domain awareness

systems, SRT has built a global reputation as a reliable and

trusted supplier of such systems and as such given the continuing

growing strategic importance to countries of their marine domain,

we receive many inquiries and are engaged in many discussions with

multiple authorities around the world. Each opportunity has

different characteristics such as scale, budget, system

composition, implementation concept, timescales and processes as

dictated by the specific authority; however all have the same

fundamental operational requirements which we deliver with the

SRT-MDA system.

Most of our system discussions are confidential in nature and

usually have a long gestation period due to the nature of a

government turning a general idea into a real system with all the

necessary regulations, budgets and approvals. Over the last few

years, we have followed a very steep learning curve in respect of

understanding the realities of the intricacies and complexities of

the processes that each of these large contracts must complete

prior to SRT being contracted. Whilst predicting timescales remains

imperfect, this knowledge now enables us to more accurately

characterise system opportunities with regards to their status

within a customer's process and better understand the real time

window within which we would expect to be contracted and start

implementing an SRT-MDA system. We hope this will reflect in an

improving ability to provide market updates on the status of future

system contract opportunities.

In a world where maritime surveillance has become of strategic

importance to most countries, our daily challenge is to ensure that

we focus the majority of our sales resources on those opportunities

where we have verified that they have clarity on the system they

want, have taken the decision to implement a system and most

importantly have the budget, and therefore the route to a contract

is a matter of process and time. We call this our validated sales

pipeline (VSP) which is robustly reviewed and discussed by the

Board and senior company management on a regular basis. During the

first half the value of potential contracts in our VSP has

increased to approximately GBP580m. This is largely due to the

increase in value and scope of our opportunities in SE Asia. Each

opportunity within our VSP requires considerable engagement from

SRT across the business, including sales, product Management and

delivery in order to support the customer in their process to bring

the project to formal contract. This support will include

activities such as advising on the writing of supporting laws and

regulations, undertaking in country site surveys to determine the

exact equipment specifications required and any practical

challenges such as suitability of site power and connectivity and

if not, identifying the solution.

I am pleased to report we have made very good progress with all

our VSP opportunities, however, the precise status of each varies

in respect of how far they are from contracting. Of the overall

VSP, there are six specific projects in SE Asia and Middle East

with an aggregate value of approximately GBP300m which we are

confident are nearing the point of contract. These are of

particular focus for our teams and work on them has been intense

during the first half to support the customers final processes.

Typically, the final contracting process is an entirely internal

one to the customer and we are called upon as is necessary to

resolve any administrative issues or understandings amongst their

internal departments.

Each of our system contracts vary greatly in size and scope,

from GBP1m to GBP150m and initial system implementation periods of

anywhere between 6 months and 4 years. Each offers long term

recurring revenue opportunities through the provision of regular

customised satellite data feeds and/or system updates and expansion

after the initial phase. Our SRT-MDA system combines real time

coastal surveillance with long range satellite surveillance data to

provide an optimised gapless picture of their maritime domain.

Given the nature of large marine domains, we believe that the

provision of satellite data such as relaying transmissions from our

vessel transceivers, optical and Infrared imagery directly into the

monitoring systems we have delivered, offer a significant long-term

recurring revenue opportunity and as such we continue to

investigate ways in which we can maximise the opportunity that our

system contracts provide in this respect.

Looking to the second half I expect to see our transceivers

business benefitting from the increased sales channels and new

product launches during the seasonal buying period. I also expect

to see our systems business completing several major performance

milestones on our existing contracts and, subject to customer

processes and timings, the conversion and commencement of new

system contracts. As such, the Board remains comfortable with

achieving market expectations.

Kevin Finn

Chairman

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTHSED 30 SEPTEMBER 2019

Six months Six months Year

ended ended ended

30 Sep 30 Sep 31 Mar

2019 2018 2019

Unaudited Unaudited Audited

Notes GBP GBP GBP

--------------------------------- ------ -------------- --- -------------- ----------------

Revenue 3,541,039 3,223,804 20,559,699

Cost of sales (2,181,374) (1,915,550) (11,229,754)

--------------------------------- ------ -------------- --- -------------- ----------------

Gross profit 1,359,665 1,308,254 9,329,945

Administrative costs (2,673,611) (2,472,004) (5,877,445)

-------------- --- -------------- ----------------

Operating (loss) / profit (1,313,946) (1,163,750) 3,452,500

Finance expenditure 1 (231,833) (143,609) (275,195)

Finance income 803 224 363

--- ----------------

(Loss) / profit before income

tax (1,544,976) (1,307,135) 3,177,668

Income tax credit 3 160,434 113,829 230,703

--------------------------------- ------ -------------- --- -------------- ----------------

(Loss) / profit for the period (1,384,542) (1,193,306) 3,408,371

--------------------------------- ------ -------------- --- -------------- ----------------

Total comprehensive (loss)

/ profit for the period (1,384,542) (1,193,306) 3,408,371

--------------------------------- ------ -------------- --- -------------- ----------------

(Loss) / earnings per share:

Basic

Diluted 2 (0.90)p (0.88)p 2.43p

2 (0.90)p (0.88)p 2.36p

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 30 SEPTEMBER 2019

As at As at As at

30 Sep 30 Sep 31 Mar

2019 2018 2019

Unaudited Unaudited Audited

Notes GBP GBP GBP

------------------------------- ------ ------------ ------------ --------------

Assets

Non-current assets

Intangible assets 7,314,999 6,275,385 6,625,203

Property, plant and equipment 1 1,681,063 175,431 355,509

Deferred Tax 214,731 386,517 54,297

------------------------------- ------ ------------ ------------ --------------

Total non-current assets 9,210,793 6,837,333 7,035,009

Current assets

Inventories 4,304,690 3,353,330 2,234,378

Trade and other receivables 14,329,314 4,660,048 18,012,279

Cash and cash equivalents 1,747,439 1,426,402 3,942,167

------------------------------- ------ ------------ ------------ --------------

Total current assets 20,381,443 9,439,780 24,188,824

Liabilities

Current liabilities

Trade and other payables (4,855,621) (1,431,387) (6,318,987)

Financial liabilities 1 (214,473) (250,000) (18,055)

Total current liabilities (5,070,094) (1,681,387) (6,377,042)

Net current assets 15,311,349 7,758,393 17,851,782

Total assets less current

liabilities 24,522,142 14,595,726 24,886,791

Long term liabilities

Financial liabilities 1 (6,009,050) (3,150,000) (5,016,981)

Total long term liabilities (6,009,050) (3,150,000) (5,016,981)

Net assets 18,513,092 11,445,726 19,869,810

------------------------------- ------ ------------ ------------ --------------

Shareholders' equity

Share capital 4 154,794 139,743 153,223

Share premium account 11,543,989 7,738,311 11,510,773

Other reserves 6 5,490,596 5,490,596 5,490,596

Retained earnings / (loss) 1,323,713 (1,922,924) 2,715,218

Total shareholders' equity 18,513,092 11,445,726 19,869,810

------------------------------- ------ ------------ ------------ --------------

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE SIX MONTHSED 30 SEPTEMBER 2019

Six months Six months Year ended

ended ended

30 Sep 30 Sep 31 Mar

2019 2018 2019

Unaudited Unaudited Audited

Notes GBP GBP GBP

-------------------------------- --------- ------------- -------------- --------------

Cash used in operating

activities 5 (335,916) (1,635,351) (3,636,473)

Corporation tax received - - 449,094

------------------------------------- ---- ------------- -------------- --------------

Net cash used in operating

activities (335,916) (1,635,351) (3,187,379)

------------------------------------- ---- ------------- -------------- --------------

Investing activities

Expenditure on product

development (1,359,127) (711,324) (1,690,516)

Purchase of property, plant

and equipment (238,873) (42,737) (240,247)

Interest received 803 224 363

------------------------------------- ---- ------------- -------------- --------------

Net cash used in investing

activities (1,597,197) (753,837) (1,930,400)

------------------------------------- ---- ------------- -------------- --------------

Financing activities

Gross proceeds on issue

of shares 34,787 3,000,000 7,031,530

Costs of issue of shares - (155,238) (400,826)

Repayments on loan - (250,000) (500,000)

New loans issued - - 1,840,000

Finance lease repayment (64,569) - -

Interest paid (231,833) (143,609) (275,195)

------------------------------------- ---- ------------- -------------- --------------

Net cash (used in) / generated

from financing activities (261,615) 2,451,153 7,695,509

------------------------------------- ---- ------------- -------------- --------------

Net (decrease) / increase

in cash and cash equivalents (2,194,728) 61,965 2,577,730

------------------------------------- ---- ------------- -------------- --------------

Net cash and cash equivalents

at beginning of period 3,942,167 1,364,437 1,364,437

------------------------------------- ---- ------------- -------------- --------------

Net cash and cash equivalents

at end of period 1,747,439 1,426,402 3,942,167

------------------------------------- ---- ------------- -------------- --------------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHSED 30 SEPTEMBER 2019

Share Share Retained Other Reserves Total

Capital Premium Earnings

GBP GBP GBP GBP GBP

At 31 March 2018 127,743 4,905,549 (789,410) 5,490,596 9,734,478

Total comprehensive loss

for the period - - (1,193,306) - (1,193,306)

Share based payment charge - - 59,792 - 59,792

Issue of equity share

capital 12,000 2,988,000 - - 3,000,000

Costs of issue of equity

share capital - (155,238) - - (155,238)

At 30 September 2018 139,743 7,738,311 (1,922,924) 5,490,596 11,445,726

Total comprehensive income

for the period - - 4,601,677 - 4,601,677

Share based payment charge - - 36,465 - 36,465

Issue of equity share

capital 13,480 4,018,050 - - 4,031,530

Costs of issue of equity

share capital - (245,588) - - (245,588)

At 31 March 2019 153,223 11,510,773 2,715,218 5,490,596 19,869,810

Total comprehensive loss

for the period - - (1,384,542) - (1,384,542)

Share based payment credit - - (6,963) - (6,963)

Issue of equity share

capital 1,571 33,216 - - 34,787

At 30 September 2019 154,794 11,543,989 1,323,713 5,490,596 18,513,092

NOTES TO THE INTERIM FINANCIAL STATEMENTS

1. Accounting Policies

Basis of preparation

The interim financial information in this report has been

prepared using accounting policies consistent with International

Financial Reporting Standards (IFRS) as adopted by the European

Union. IFRS is subject to amendment and interpretation by the

International Accounting Standards Board (IASB) and the IFRS

Interpretations Committee and there is an ongoing process of review

and endorsement by the European Commission. The financial

information has been prepared on the basis of IFRS that the

Directors expect to be adopted by the European Union and applicable

as at 31 March 2020.

Non-statutory accounts

Financial information contained in this document does not

constitute statutory accounts within the meaning of section 434 of

the Companies Act 2006 ("the Act"). The statutory accounts for the

year ended 31 March 2019 have been filed with the Registrar of

Companies. The report of the auditors on those statutory accounts

was unqualified and did not contain a statement under section

498(2) or (3) of the Companies Act 2006. The audit report drew

attention by way of emphasis to the disclosure in the financial

statements surrounding the recoverability of debtors greater than

twenty-four months old which had not been provided as well as a

material uncertainty relating to going concern.

The financial information for the six months ended 30 September

2019 and 30 September 2018 is unaudited. The interim financial

statements will be available to download on the Company's website

www.srt-marine.com from 19 November 2019.

Accounting policies

The accounting policies as applied by the Group are the same as

those applied by the Group in the consolidated financial statements

for the year ended 31 March 2019, except for the adoption during

the period of IFRS 16 "Leases".

IFRS 16 has been adopted using the modified retrospective

approach and therefore the comparative information has not been

restated and continues to be reported under IAS 17.

The impact on the financial statements for the period ended 30

September 2019 has been to recognise a right of use asset within

property, plant and equipment of GBP1,216,897 and a finance lease

liability of GBP1,233,523, of which GBP214,473 is presented within

current financial liabilities and the remaining is presented within

long term financial liabilities. These leases were previously

reported as operating leases within administrative costs. Interest

charged on the finance leases for the period ended 30 September

2019 amounted to GBP31,531 and in included within finance

expenditure. Depreciation charged on the right of use assets

amounted to GBP84,302 for the period. Another significant change

due to the impact of this standard has been to the presentation of

cash flows, whereby finance lease repayments are now presented for

the capital element of the lease and interest now being charged is

presented within the same cash flow section. Depreciation has also

increased in the presentation of cash used in operating activities.

The impact on opening reserves was not material to these interim

financial statements and therefore a decision has been made to

present this in the statutory financial statements.

2. (Loss) / earnings per share

The basic loss per share have been calculated using the loss for

the period of GBP1,384,542 (six months ended 30 September 2018 -

loss of GBP1,193,306; year ended 31 March 2019 - profit of

GBP3,408,371) divided by the weighted average number of ordinary

shares in issue of 154,660,183 (six months ended 30 September 2018

- 135,807,993 and year ended 31 March 2019 - 140,059,460).

During the six months ended 30 September 2019 and 2018, the

Group has incurred losses for the periods and therefore there is no

impact of the share options granted on diluted earnings per share.

During the year ended 31 March 2019 the number of dilutive shares

under option was 4,237,894 and the weighted average number of

shares for the purposes of dilutive earnings per share was

144,297,354.

3. Income tax credit

During the period, the Group credited GBP160,434 of income tax

to the profit and loss account in respect of an increase in its

deferred tax asset. During the period ended 30 September 2018,

GBP113,829 was credited in respect of an increase in the Group's

deferred tax asset and during the year ended 31 March 2019

GBP230,703 was also credited due the receipt of an income tax

credit in respect of the Group's research and development

activities offset by a deferred tax charge.

4. Share capital

30 Sep 30 Sep 31 Mar

2019 2018 2019

Unaudited Unaudited Audited

GBP GBP GBP

-------------------------------- ---------- ---------- ----------

Allotted:

Ordinary shares of 0.1p each 154,794 139,743 152,223

--------------------------------- ---------- ---------- ----------

Reconciliation of movement Number of

in share capital shares

Shares outstanding at 31 March 2018 127,742,419

Placing of shares - May 2018 (a) 12,000,000

Shares outstanding at 30 September 2018 139,742,419

Placing of shares - January 2019 (b) 13,400,000

Exercise of share options (c) 80,000

Shares outstanding at 31 March 2019 153,222,419

Exercise of share options (d) 1,571,500

Shares outstanding at 30 September 2019 154,793,919

Notes:

a) The placing in May 2018 took place at 25p per share raising

gross proceeds of GBP3,000,000 before costs of GBP155,238;

b) The placing in January 2019 took place at 30p raising gross

proceeds of GBP4,020,000 before costs of GBP245,587;

c) 50,000 share options were exercised at a price of 23p in

December 2018 and 30,000 at a price of 0.1p in March 2019;

d) 35,000 share options were exercised at a price of 0.1p in

April 2019, followed by 1,375,000 at a price of 2.5p in April 2019,

152,500 at a price of 0.1p in June 2019 and 9,000 at a price of

2.5p in July 2019.

5. Cash used in operating activities

Six months Six months Year ended

ended ended

30 Sep 30 Sep 31 Mar

2019 2018 2019

Unaudited Unaudited Audited

GBP GBP GBP

------------------------------ -------------- -------------- ---------------

Operating (loss) / profit (1,313,946) (1,163,750) 3,452,500

Depreciation of property,

plant and equipment 166,376 44,785 107,253

Amortisation of intangible

fixed assets 669,330 658,758 1,288,132

Share-based payment (credit)

/ charge (6,963) 59,792 96,257

(Increase) / decrease in

inventories (2,070,312) 90,355 1,209,307

Decrease / (increase) in

trade and other receivables 3,682,965 (227,048) (13,579,279)

(Decrease) / increase in

trade and other liabilities (1,463,366) (1,098,243) 3,789,357

Net cash used in operating

activities (335,916) (1,635,351) (3,636,473)

------------------------------- -------------- -------------- ---------------

6. Other reserves

Other reserves consist of a capital redemption reserve of

GBP2,857 (six months ended 30 September 2018 - GBP2,857 and year

ended 31 March 2019 - GBP2,857), a warrant reserve of GBP62,400

(six month ended 30 September 2018 - GBP62,400 and year ended 31

March 2019 - GBP62,400) and a merger reserve of GBP5,425,339 (six

months ended 30 September 2018 - GBP5,425,339 and year ended 31

March 2019 - GBP5,425,339). There were no movements in these

reserves during the period.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR LLFFALVLTLIA

(END) Dow Jones Newswires

November 19, 2019 02:00 ET (07:00 GMT)

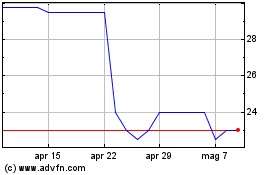

Grafico Azioni Srt Marine Systems (LSE:SRT)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Srt Marine Systems (LSE:SRT)

Storico

Da Apr 2023 a Apr 2024