Sony Goes All In With Deal For Game Show Network -- WSJ

19 Novembre 2019 - 9:02AM

Dow Jones News

By Benjamin Mullin

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (November 19, 2019).

Sony Corp.'s Sony Pictures Entertainment is buying AT&T

Inc.'s stake in Game Show Network for $380 million, a deal that

will make Sony the sole owner of the U.S. cable channel.

The purchase of AT&T's 42% stake implies a valuation of

about $905 million for Game Show Network, a cable channel that airs

quiz show staples like "Family Feud" and "Deal or No Deal"

alongside classics like "Match Game."

The network will continue to be carried by AT&T's DirecTV

service, according to a person familiar with the matter. Game Show

Network will continue to be operated by Sony Pictures Television,

which will add Game Show Network's catalog of shows to its library,

Sony said in a statement.

Game Show Network Chief Executive Mark Feldman will continue

running the channel.

Doubling down on a cable channel cuts against the grain in a

media environment where many consumers are ditching traditional pay

TV service in favor of online video streaming services like Netflix

and Amazon Prime Video. Other entertainment companies such as Walt

Disney Co. are focusing their investments on their own subscription

streaming services.

But Sony executives are confident that Game Show Network will

continue delivering profits well into the streaming era, according

to a person familiar with their thinking.

About 90% of Game Show Network's revenue comes from advertisers,

with only a small slice from the channel-carriage fees paid by pay

TV providers, the person said. That gives Game Show Network some

cushion in a media landscape where providers are trying to cut

programming costs, the person said.

The audience demographics for Game Show Network also make the

channel durable, despite cord-cutting, Sony said. The viewership

skews older and is more inclined to watch traditional TV, and

almost all of Game Show Network's audience watches live, which

makes the advertising more effective, the company said.

AT&T is receiving $500 million in cash in connection with

the deal, reflecting about $120 million in cash on the books of

Game Show Network that AT&T is keeping in addition to Sony's

$380 million payment.

Included in the deal is GSN Games, a division of Game Show

Network that produces casual games for mobile users. The division's

revenue comes mostly from players who make in-app purchases while

they're playing free games, according a person familiar with the

matter. Some games on offer correspond to shows on the Game Show

Network cable channel, including "Wheel of Fortune."

The deal comes as AT&T is selling assets the company deems

nonstrategic to help pay down debt from its 2018 purchase of Time

Warner for more than $80 billion. AT&T sold its 9.5% stake in

Hulu to Disney for $1.43 billion in April. In October, the telecom

giant agreed to sell its Puerto Rican and U.S. Virgin Islands

businesses to Liberty Latin America Ltd.

AT&T is pinning its ambitions in the video-streaming space

on HBO Max, a $14.99-a-month service that will launch in May and

will include programming from across the WarnerMedia empire.

AT&T is spending big to fill HBO Max with attractive shows. It

paid about $600 million for the rights to stream "South Park" for

five years and has lured directors such as J.J. Abrams with

big-ticket production deals.

Write to Benjamin Mullin at Benjamin.Mullin@wsj.com

(END) Dow Jones Newswires

November 19, 2019 02:47 ET (07:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

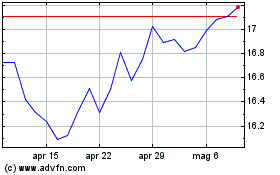

Grafico Azioni AT&T (NYSE:T)

Storico

Da Mar 2024 a Apr 2024

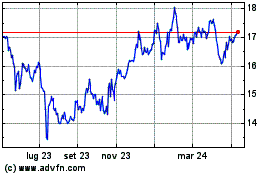

Grafico Azioni AT&T (NYSE:T)

Storico

Da Apr 2023 a Apr 2024