TIDMIGP

RNS Number : 4268U

Intercede Group PLC

25 November 2019

25 November 2019

INTERCEDE GROUP plc

('Intercede', the 'Company' or the 'Group')

Interim Results for the Six Months Ended 30 September 2019

Intercede, the leading specialist in digital identity,

credential management and secure mobility, today announces its

interim results for the six months ended 30 September 2019.

The financial information in the following pages reflects the

impact of IFRS 16 Leases. IFRS 16 has been applied retrospectively

and the impact on each line of the Consolidated Financial

Statements is explained in Notes 1 and 6.

Financial Highlights

-- Revenues increased by 5% to GBP4.4m (2018: GBP4.2m)

reflecting a strong end to the half with orders received from both

new and existing customers.

-- Operating expenses reduced by 9% to GBP4.3m (2018: GBP4.8m),

which reflects staff cost savings and continued tight control of

overheads.

-- A return to operating profit of GBP25,000 (2018: GBP609,000

operating loss), the first time this has been achieved since the

corresponding period six years ago.

-- A profit for the period of GBP0.2m (2018: profit of GBP0.1m)

resulted in a basic profit per share of 0.4p and a fully diluted

profit per share of 0.3p (2018: basic and fully diluted profit per

share of 0.2p).

-- Cash balances of GBP5.2m at 30 September 2019 have increased

by GBP1.5m over the last 12 months, primarily driven by positive

cash generation from operations.

Operating Highlights

-- The sales team has been strengthened, including the hiring of

a new partner manager who is tasked with enhancing our partner

program. The establishment and further development of partner

relationships is critical for the Group's future growth

prospects.

-- Launch of the Innovation Hub, an internal team tasked with

guiding the future architecture and functionality of Intercede

products and improving how we develop and deliver software and

services.

-- Release of MyID Professional; a simplified version of MyID

targeting the large addressable market of mid-market enterprises to

enable them to step up to the strongest form of user authentication

with least cost and risk.

Chuck Pol, Chairman, said:

"The results we are announcing today do not represent the full

story of the progress that has been made to refocus the Group's

strategy towards sustainable revenue growth and profitability.

The return to a first half operating profit, the first time this

has been achieved for six years, is an important milestone. The

laser focus on our new strategy is evident, particularly in the

growth of our cash balances and our dedication to writing the best

code in the industry. The release of MyID Professional represents a

more scalable version of MyID that gives our customers and partners

the strongest form of user authentication in a simplified lower

cost format.

There remains further work to be done, but the direction of

travel and momentum in the business reflects the considerable

achievements of the Intercede Team to date - we remain on

track."

ENQUIRIES

Intercede Group plc Tel. +44 (0)1455 558 111

Klaas van der Leest, Chief Executive

Andrew Walker, Finance Director

finnCap Tel. +44 (0)20 7220 0500

Stuart Andrews, Corporate Finance

Simon Hicks, Corporate Finance

About Intercede

Intercede is a UK-headquartered, AIM listed (LSE:IGP)

cybersecurity company with a US office in Reston, VA.

Founded more than 20 years ago, Intercede has continued to

innovate its software platform. Today, MyID(R) credential

management software helps governments and enterprises around the

world issue and lifecycle manage millions of citizen and workforce

digital identities. Interoperable identity management software

facilitates strong multi-factor authentication across mobile

devices, smart cards, USB tokens and virtual smart cards.

It is our vision to safeguard the integrity of connected

workforces, supply-chains, citizens and industrial technologies for

the world's businesses and governments that will not compromise on

cybersecurity.

For more information visit: www.intercede.com

The information communicated in this announcement contains

inside information for the purposes of Article 7 of the Market

Abuse Regulation (EU) No. 596/2014.

INTERCEDE GROUP plc

('Intercede', 'the Company' or 'the Group')

Interim Results for the Six Months Ended 30 September 2019

Interim Management Review

Introduction

As noted in the Annual Report for the year ended 31 March 2019,

action has been taken by the new management team to refocus the

Group's strategy towards sustainable revenue growth and

profitability. Evidence of this turnaround has been visible inside

the business for some time and is now increasingly evident in the

financial performance. Revenues for the six months ended 30

September 2019 are 5% higher when compared to the same period last

year. There has been a 9% fall in operating expenses versus the

same period last year and it is pleasing to note that cash balances

have increased from GBP3.6m to GBP5.2m over the past year. The

return to a first half operating profit, the first time this has

been achieved in six years, is an important milestone and validates

the new strategy and its execution.

Strategy

In the 2019 Annual Report we also talked about an outlook that

focuses on organic growth through the execution of a strategy

centred around colleagues, customers, channels and cash. Actually,

this 4C strategy is missing a fifth 'C', which is 'code'. Intercede

takes great pride in having colleagues who are able to write the

best code in the industry to satisfy some of the most demanding

customers in the world, including industry majors as well as

governments, the military and banks.

1. Colleagues

Staff motivation remains a priority and an Employee Working

Group has been established to follow up on regular periodic

employee surveys and turn suggestions for improvement into actions.

We continue to provide support to colleagues wherever it is needed

to ensure a good work/life balance and to empower them to continue

to deliver strong results. We appreciate and continue to be

impressed by the considerable achievements of our colleagues.

Over the period, progress has been made in strengthening

specific areas of the business, particularly the sales team with

new additions in the UK and US offices. We are also pleased to

welcome Rob Chandhok back to the Intercede Board as an independent

Non-Executive Director. Rob served as a Non-Executive Director

between April 2015 and January 2017 and brings more than 20 years

of experience and expertise in software and embedded systems.

2. Customers

As outlined below in the Financial Results section, we have

received some significant follow on orders from existing customers,

which provides tangible evidence our secure credential management

software continues to deliver measurable business value.

We have sold three new deployments to the US Navy, US Airforce

and one of the largest US wireless network operators. All of these

deals were for our traditional smartcard solution although it

should also be noted that we are continuing to see orders, along

with strong interest and bid activity, for Derived PIV solutions.

Derived PIV is effectively mobile PIV and enables a cryptographic

credential to be passed into the secure area of a mobile device,

instead of a traditional smartcard. With Derived PIV, US Federal

government and military personnel have the flexibility to use their

mobile devices as an alternative factor of strong authentication in

a NIST SP800-157 and FIPS 201-2 compliant manner.

3. Channels

The establishment and further development of partner

relationships is critical for the Group's future growth prospects.

MyID is a Credential Management System (CMS) that forms part of a

wider identity ecosystem, so technology partnerships are crucial to

ensure that MyID works with the devices and technology our

customers want to use.

Intercede also utilises its global network of reseller partners

to provide the global footprint to locally deliver the cyber

security solutions our customers need. As part of the strengthening

of the sales function we have hired a new partner manager who is

tasked with enhancing our partner program. This will be designed to

engage, enable and reward partners for their commitment to

expanding our reach into targeted markets. It will include core

product training, joint marketing support and the establishment of

a partner portal (for online support) and a partner advisory board

to better inform the MyID product roadmap.

Good progress has been made in the past six months working

closely with technology as well as channel partners on new

opportunity generation in our chosen markets.

4. Code

Innovation is in Intercede's DNA and recently we launched the

Innovation Hub, an internal team tasked with two primary goals:

1. To guide the future architecture and functionality of Intercede products.

2. To improve how we develop and deliver software and services.

The prementioned US identification standards for Federal

employees and contractors (NIST SP800-157 and FIPS 201-2) are set

to evolve further with the forthcoming FIPS 201-3 update, which

proposes the expansion of Derived PIV credentials onto a wider

range of devices. FIPS 201 compliance has been of strategic

importance to Intercede since it was created and the Innovation Hub

team are looking at FIDO authentication, which is likely to be

included as an option under FIPS 201-3. The FIDO Alliance is made

up of hundreds of global technology leaders who are focused on

providing open and free authentication standards to help reduce the

world's reliance on passwords and SMS OTPs (one-time

passwords).

The Innovation Hub is also looking at changing MyID's

architecture to use REACT and REST to create a more intuitive web

user interface and enhance our mobile capabilities. This is

important for the future of large-scale mobile credential

opportunities, such as national ID deployments, as one of the

benefits REACT/REST will provide a faster more reliable credential

issuance process at high volumes.

In order to address the requirements for channels as well as end

users, MyID Professional has been developed and was recently

launched in September 2019 further underlining Intercede's ability

to innovate and deliver.

5. Cash

The Group's financial stability, control environment and

management information have been significantly improved since

action was taken to deliver sustainable revenue growth and

profitability. This improved operational performance is reflected

in the level of cash generated from operations totalling

GBP1,841,000 (2018: GBP739,000). Cash continues to be king; not

only in the sense that it is required to meet upcoming financial

obligations but also because it is required for strategic

investment in the other 4C's.

Financial Results

Revenue in the period totalled GBP4,364,000, a 5% increase

compared to the corresponding period last year. This reflects a

strong end to the half with second quarter total orders exceeding

first quarter total orders by a ratio of almost 4:1. This trend of

increasing orders over the period is promising and indeed some of

the second quarter orders will generate revenue over the next 12

months. It is also pleasing to note the longer-term trend of

Intercede's revenue. Revenue for the six months ended 30 September

2016 was GBP2,828,000 and the growth from this starting point

represents compound average growth of 16% over the three

corresponding periods to 30 September 2019.

Revenue highlights for the period include:

- Follow-on MyID license sales to an existing US Federal agency

customer, totalling 75,000 devices, spread across two different

deployments. One of these deployments will enable users to issue

Derived PIV credentials to a mobile device using their original PIV

card.

- The same US Federal agency customer has also ordered

professional and development services in excess of $0.5m, to

implement a 35,000 device deployment purchased in the corresponding

period last year.

- An additional 35,000 licenses sold to a government in the

Middle East operating an e-Government services portal.

- A follow-on MyID license sale for 20,000 devices to one of the

world's largest Aerospace & Defence contractors.

- A new MyID license sale to provide a traditional smartcard

deployment for one of the largest US wireless network

operators.

- A new MyID license sale to a US Navy force providing surveillance systems.

- A new MyID deployment sale to an existing US Airforce customer

for a forward deployment based in the Middle East.

All of these wins are expected to generate incremental revenue

over the next 12 months from a combination of support &

maintenance plus professional services, development and/or

follow-on license sales.

Compared to the corresponding period last year, operating

expenses have been reduced by 9% to GBP4,329,000 (2018:

GBP4,768,000). This reflects staff cost savings and continued tight

control over all areas of expenditure. Staff costs continue to

represent the main area of expense, representing 87% of total

operating costs (2018: 83%). Intercede had 82 employees and

contractors as at 30 September 2019 (30 September 2018: 85). The

average number of employees and contractors during the period was

82 (2018: 89). It should be noted that this 8% year on year

reduction in employees and contractors reflects efficiency

improvements in operational delivery and has not impacted upon

Intercede's ability to deliver MyID solutions or to implement the

5C strategy.

A GBP447,000 taxation credit for the period (2018: GBP993,000

taxation credit) primarily reflects the 2019 Research &

Development ("R&D") claim which results from the Group's

strategic investment activities. The Group is a beneficiary of the

UK Government's efforts to encourage innovation by allowing 130% of

qualifying R&D expenditure to be offset against taxable profits

and allowing 14.5% of the lower of R&D losses or taxable losses

to be paid as tax credits. In recent years, the tax credit has been

unrestricted due to taxable losses exceeding R&D losses,

although this was not the case for the 2019 claim. Had the 2019

claim been unrestricted, the amount claimed would have been

GBP717,000 which is a fairer reflection of the Group's continued

level of strategic investment activities.

The increase in revenue combined with the reduction in operating

expenses has resulted in a return to operating profit of GBP25,000

(2018: GBP609,000 operating loss), the first time this has been

achieved since the corresponding period six years ago. A profit for

the period of GBP184,000 (2018: GBP89,000) resulted in a basic

profit per share of 0.4p and a fully diluted profit per share of

0.3p (2018: basic and fully diluted profit per share of 0.2p).

Cash balances as at 30 September 2019 totalled GBP5,156,000

which compares with GBP3,623,000 as at 31 March 2019 and

GBP3,228,000 as at 30 September 2018. The increase in cash balances

is primarily driven by GBP1,841,000 of cash generated from

operations (2018: GBP739,000) and also reflects the benefit of

GBP422,000 proceeds from the disposal of a UK office (2018:

GBPnil). It is also worth noting that the 2019 R&D tax claim

totalling GBP460,000 was received shortly after the period end and

does not form part of the cash balances as at 30 September 2019

(2018: R&D claim totalling GBP993,000 received prior to period

end and included in the 30 September cash balances).

The Group adopted IFRS 16 Leases with effect from 1 April 2019

using the full retrospective method. This has resulted in the Group

recognising right of use assets and lease liabilities for all

contracts that are, or contain, a lease. Instead of recognising an

operating expense for its operating lease payments, the Group will

instead depreciate its right of use assets and recognise interest

on its lease liabilities. The impact on each line of the

Consolidated Financial Statements is explained in Notes 1 and

6.

Operational Review

Intercede is trusted by governments and large enterprises

throughout the world. Where protecting data really matters, you

will find MyID. The security, reliability and interoperability of

MyID software sets it apart and is why we are proud to help many

leading organisations around the world manage the secure digital

identities they issue to citizens and employees. In addition to

offering MyID as a market-leading credential management commercial

off-the-shelf product, Intercede supplies MyID as a platform

providing service providers with a range of software and service

tools enabling them to embed digital identity into their own

solutions.

For over 20 years Intercede has delivered solutions that truly

test the interoperability of MyID because governments and large

enterprises typically have complicated PKI (public key

infrastructure). But we recognise that there are enterprises who

are happy to follow best practice and just want a simple,

pre-configured solution that protects their networks, systems and

cloud-based resources with the most secure method of authenticating

employees. We are therefore pleased to announce the release of MyID

Professional, an easy to use and deploy software solution that

enables enterprises to replace insecure passwords with the

strongest form of multi-factor user authentication.

MYID PROFESSIONAL INCLUDES:

-- MyID Professional server software

-- Connectors to Microsoft Active Directory and Microsoft Certificate Services

-- Connectors with a wide range of leading smart cards and USB tokens

-- Connectors with hardware security modules, used to secure keys and sensitive data

-- Operator desktop for system administration and helpdesk operators

-- End-user client for simple self-service operations

-- Documentation covering installation, configuration and use

MYID PROFESSIONAL CAN BE USED TO:

-- Secure Windows and network logon

-- Secure VPN and remote access

-- Protect cloud resources such as Microsoft Office 365

-- Sign and encrypt emails, protecting against spear-phishing attacks

-- Deploy PKI credentials for strong two-factor authentication to smart cards and USB keys

-- Enable simple self-service credential management at the

user's own desktop, thereby reducing help desk costs

The establishment and further development of a simplified

version of MyID will be more scalable and is therefore important

for the Group's future growth prospects. By combining predefined

business processes and out-of-the-box integration with common

infrastructure components, MyID Professional will enable smaller

organisations to step up to the strongest form of user

authentication with least cost and risk. MyID Professional is

available on a subscription basis via Intercede channel

partners.

MyID is now available in three product lines, thereby reflecting

a growing product portfolio for an expanding addressable market

ie:

1) MyID Enterprise;

2) MyID PIV; and

3) MyID Professional.

Outlook

The actions taken to refocus the Group's strategy continue to

drive improvements throughout the business. As in previous years,

revenue is expected to be weighted towards the second half of the

year Whilst the nature of Intercede's business and customer profile

is such that the precise timing of orders is difficult to predict,

the current sales pipeline and levels of bid activity continue to

support management's revenue and profitability targets.

By order of the Board

Klaas van der Leest Andrew Walker

Chief Executive Officer Finance Director

25 November 2019 25 November 2019

Consolidated Statement of Comprehensive

Income

6 months ended 6 months ended Year ended

30 September 30 September 31 March

2019 2018 2019

Restated Restated

GBP'000 GBP'000 GBP'000

Continuing operations

Revenue 4,364 4,174 10,108

Cost of sales (10) (15) (24)

__________ __________ __________

Gross profit 4,354 4,159 10,084

Operating expenses (4,329) (4,768) (10,025)

__________ __________ __________

Operating profit/(loss) 25 (609) 59

Finance income 9 5 11

Finance costs (297) (300) (600)

__________ __________ __________

Loss before tax (263) (904) (530)

Taxation 447 993 979

__________ __________ __________

Profit for the period 184 89 449

__________ __________ __________

Total comprehensive income attributable

to owners of the parent company 184 89 449

__________ __________ __________

Profit per share (pence)

- basic 0.4p 0.2p 0.9p

- diluted 0.3p 0.2p 0.8p

__________ __________ __________

The Consolidated Statements of Comprehensive Income for the

periods ending 30 September 2018 and 31 March 2019 have been

restated to reflect the impact of IFRS 16 Leases (see Notes 1 and

6).

Consolidated Balance Sheet

As at As at As at

30 September 30 September 31 March

2019 2018 2019

Restated Restated

GBP'000 GBP'000 GBP'000

Non-current assets

Property, plant and equipment 151 207 154

Right of use assets 1,021 1,249 1,135

___________ ___________ __________

1,172 1,456 1,289

___________ ___________ __________

Current assets

Assets held for sale - 373 373

Trade and other receivables 3,188 2,355 4,797

Cash and cash equivalents 5,156 3,623 3,228

___________ ___________ __________

8,344 6,351 8,398

___________ ___________ __________

Total assets 9,516 7,807 9,687

___________ ___________ __________

Equity

Share capital 505 505 505

Share premium 673 673 673

Equity reserve 66 66 66

Merger reserve 1,508 1,508 1,508

Accumulated deficit (5,076) (5,905) (5,420)

___________ ___________ __________

Total equity (2,324) (3,153) (2,668)

___________ ___________ __________

Non-current liabilities

Convertible loan notes 4,790 4,708 4,747

Lease liabilities 1,301 1,531 1,404

Deferred revenue 311 221 166

___________ ___________ __________

6,402 6,460 6,317

___________ ___________ __________

Current liabilities

Lease liabilities 284 242 253

Trade and other payables 1,955 1,406 1,899

Deferred revenue 3,199 2,852 3,886

___________ ___________ __________

5,438 4,500 6,038

___________ ___________ __________

Total liabilities 11,840 10,960 12,355

___________ ___________ __________

Total equity and liabilities 9,516 7,807 9,687

___________ ___________ __________

The Consolidated Balance Sheets for the periods ending 30

September 2018 and 31 March 2019 have been restated to reflect the

impact of IFRS 16 Leases (see Notes 1 and 6).

Consolidated Statement of

Changes in Equity

Share Share Equity Merger Accumulated

capital premium reserve reserve deficit Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 April 2019 (Original) 505 673 66 1,508 (4,898) (2,146)

Change in accounting policy - - - - (522) (522)

______ _______ _______ _______ __________ _______

At 1 April 2019 (Restated) 505 673 66 1,508 (5,420) (2,668)

Proceeds from recycling

of own shares - - - - 17 17

Employee share option plan

charge - - - - 54 54

Employee share incentive

plan charge - - - - 89 89

Profit for the period and

total comprehensive income - - - - 184 184

________ ________ ________ ________ ______________ _______

At 30 September 2019 505 673 66 1,508 (5,076) (2,324)

At 1 April 2018 (Original) 505 673 66 1,508 (5,719) (2,967)

Change in accounting policy - - - - (443) (443)

______ _______ _______ _______ __________ _______

At 1 April 2018 (Restated) 505 673 66 1,508 (6,162) (3,410)

Proceeds from recycling

of own shares - - - - 12 12

Employee share option plan

credit - - - - (1) (1)

Employee share incentive

plan charge - - - - 157 157

Profit for the period and

total comprehensive income

(Restated) - - - - 89 89

________ ________ ________ ________ ___________ _______

At 30 September 2018 (Restated) 505 673 66 1,508 (5,905) (3,153)

At 1 April 2018 (Original) 505 673 66 1,508 (5,719) (2,967)

Change in accounting policy - - - - (443) (443)

______ _______ _______ _______ __________ _______

At 1 April 2018 (Restated) 505 673 66 1,508 (6,162) (3,410)

Proceeds from recycling

of own shares - - - - 27 27

Employee share option plan

charge - - - - 17 17

Employee share incentive

plan charge - - - - 249 249

Profit for the period and

total comprehensive income

(Restated) - - - - 449 449

________ ________ ________ ________ __________ _______

At 31 March 2019 (Restated) 505 673 66 1,508 (5,420) (2,668)

The Consolidated Statements of Changes in Equity for the periods

ending 30 September 2018 and 31 March 2019 have been restated to

reflect the impact of IFRS 16 Leases (see Notes 1 and 6).

Consolidated Cash Flow Statement

6 months ended 6 months ended Year ended

30 September 30 September 31 March

2019 2018 2019

Restated Restated

GBP'000 GBP'000 GBP'000

Cash flows from operating activities

Operating profit/(loss) 25 (609) 59

Depreciation 157 177 344

Profit on disposal of property, plant

and equipment (50) - -

Employee share option plan charge/(credit) 54 (1) 17

Employee share incentive plan charge 89 157 249

Employee unit incentive plan charge 14 6 5

Employee unit incentive plan payment - - (7)

Decrease/(increase) in trade and other

receivables 2,009 2,312 (131)

Increase/(decrease) in trade and other

payables 41 (460) 44

(Decrease)/increase in deferred revenue (542) (916) 63

Increase in lease liabilities 44 73 63

____________ ____________ __________

Cash generated from operations 1,841 739 706

Finance income 7 3 9

Finance costs on convertible loan

notes (199) (199) (400)

Finance costs on leases (54) (61) (122)

Taxation (13) 993 979

____________ ____________ __________

Net cash generated from operating

activities 1,582 1,475 1,172

____________ ____________ __________

Investing activities

Proceeds on disposal of property,

plant and equipment 422 - -

Purchases of property, plant and equipment (39) (75) (75)

____________ ____________ __________

Cash generated from/(used in) investing

activities 383 (75) (75)

____________ ____________ __________

Financing activities

Proceeds from recycling of own shares 17 12 27

Principal elements of lease payments (116) (106) (212)

____________ ____________ __________

Cash used in financing activities (99) (94) (185)

____________ ____________ __________

Net increase in cash and cash equivalents 1,866 1,306 912

Cash and cash equivalents at the beginning

of the period 3,228 2,272 2,272

Exchange gains on cash and cash equivalents 62 45 44

____________ ____________ __________

Cash and cash equivalents at the end

of the period 5,156 3,623 3,228

____________ ____________ __________

The Consolidated Cash Flow Statements for the periods ending 30

September 2018 and 31 March 2019 have been restated to reflect the

impact of IFRS 16 Leases (see Notes 1 and 6).

Notes to the Consolidated Accounts

For the period ended 30 September 2019

1 Preparation of the interim financial statements

These interim financial statements have been prepared under IFRS

as adopted by the European Union and on the basis of the accounting

policies set out in the Group's Annual Report for the year ended 31

March 2019.

The Group applies, for the first time, IFRS 16 Leases and the

nature and effect of this change is disclosed below. Several other

amendments and interpretations are effective for reporting periods

beginning on or after 1 January 2019. These have been applied but

do not have an impact on the interim consolidated financial

statements of the Group. The Group has not early adopted any other

standard, interpretation or amendment that has been issued but is

not effective.

These interim financial statements have not been audited and do

not constitute statutory accounts as defined in Section 434 of the

Companies Act 2006. Statutory accounts for the year ended 31 March

2018 have been delivered to the Registrar of Companies. The

Auditors' Report on those accounts was unqualified and did not

contain any statement under Section 498 (2) or (3) of the Companies

Act 2006.

The Interim Report will be mailed to shareholders within the

next few weeks and copies will be available on the website

(www.intercede.com) and at the registered office: Intercede Group

plc, Lutterworth Hall, St Mary's Road, Lutterworth, Leicestershire,

LE17 4PS.

Revised accounting policy for IFRS 16 (replacing 'Leased assets'

policy)

At the inception of a contract the Group assesses whether the

contract is, or contains, a lease. A lease is present where the

contract conveys, over a period of time, the right to control the

use of an identified asset in exchange for consideration. Where a

lease is identified the Group recognises a right of use asset and a

corresponding lease liability, except for short-term leases

(defined as leases with a lease term of 12 months or less) and

leases of low value assets.

The lease liability is initially measured at the present value

of the future lease payments, which are discounted at the Group's

incremental borrowing rate (8%). The lease liability is re-measured

for modifications to lease payments due to changes in an index or

rate or where the lease contract is modified and is not accounted

for as a separate lease. When the lease liability is re-measured an

equivalent adjustment is made to the right of use asset. Where the

lease liability is denominated in a foreign currency it is

retranslated at the Balance Sheet date and gains or losses are

included in the Statement of Comprehensive Income.

A right of use asset comprises the initial measurement of the

corresponding lease liability and is subsequently measured at cost

less accumulated depreciation. Right of use assets are depreciated

over the lease term.

2 Revenue

All of the Group's revenue, operating profits/(losses) and net

liabilities originate from operations in the UK. The Directors

consider that the activities of the Group constitute a single

business segment.

The split of revenue by geographical destination of the end

customer can be analysed as follows:

6 months ended 6 months ended Year ended

30 September 30 September 31 March

2019 2018 2019

GBP'000 GBP'000 GBP'000

UK 39 201 331

Rest of Europe 578 827 1,738

North America 3,041 2,814 6,981

Rest of World 706 332 1,058

___________ ___________ __________

4,364 4,174 10,108

___________ ____________ __________

3 Taxation

Taxation represents the net effect of amounts receivable from

HMRC in respect of R&D claims and US corporation tax

payable.

4 Earnings per share

The calculations of earnings per ordinary share are based on the

profit for the period and the weighted average number of ordinary

shares in issue during each period.

6 months ended 6 months ended Year ended

30 September 30 September 31 March

2019 2018 2019

Restated Restated

GBP'000 GBP'000 GBP'000

Profit for the period 184 89 449

___________ ___________ __________

Number Number Number

Weighted average number of shares

- basic 50,482,281 50,482,281 50,482,281

- diluted 60,552,436 58,562,299 59,214,607

___________ ___________ __________

Pence Pence Pence

Earnings per share

- basic 0.4p 0.2p 0.9p

- diluted 0.3p 0.2p 0.8p

___________ ___________ __________

4 Earnings per share (continued)

The weighted average number of shares used in the calculation of

basic and diluted earnings per share for each period were

calculated as follows:

6 months ended 6 months ended Year ended

30 September 30 September 31 March

2019 2018 2019

Number Number Number

Issued ordinary shares at start

of period 50,523,926 50,523,926 50,523,926

Effect of treasury shares (41,645) (41,645) (41,645)

___________ ___________ __________

Weighted average number of shares

- basic 50,482,281 50,482,281 50,482,281

___________ ___________ __________

Add back effect of treasury

shares 41,645 41,645 41,645

Effect of share options in issue 2,755,123 764,986 1,417,294

Effect of convertible loan notes

in issue 7,273,387 7,273,387 7,273,387

___________ ___________ __________

Weighted average number of shares

- diluted 60,552,436 58,562,299 59,214,607

___________ ___________ __________

5 Dividend

The Directors do not recommend the payment of a dividend.

6 IFRS 16 transition note

The Group has applied IFRS 16 retrospectively and the tables

below show the adjustments ("Adj") recognised for each line item at

30 September 2019, 30 September 2018 and 31 March 2019. Line items

that were not affected by the changes have not been included. As a

result, the sub-totals and totals disclosed cannot be recalculated

from the numbers provided.

Consolidated Statement of Comprehensive Income (extract)

6 months ended 30 6 months ended 30 Year ended 31 March

September 2019 September 2018 2019

Original Adj Restated Original Adj Restated Original Adj Restated

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Operating

expenses (4,341) 12 (4,329) (4,748) (20) (4,768) (10,068) 43 (10,025)

__________ __________ __________ __________ __________ __________ __________ __________ __________

Operating

profit/(loss) 13 12 25 (589) (20) (609) 16 43 59

Finance costs (243) (54) (297) (239) (61) (300) (478) (122) (600)

__________ __________ __________ __________ __________ __________ _________ __________ __________

Loss before

tax (221) (42) (263) (823) (81) (904) (451) (79) (530)

__________ __________ __________ __________ __________ __________ __________ __________ __________

6 IFRS 16 transition note (continued)

Consolidated Balance Sheet (extract)

As at 30 September As at 30 September As at 31 March 2019

2019 2018

Original Adj Restated Original Adj Restated Original Adj Restated

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Non-current

assets

Right of use

assets - 1,021 1,021 - 1,249 1,249 - 1,135 1,135

Total assets 8,495 1,021 9,516 6,558 1,249 7,807 8,552 1,135 9,687

__________ __________ __________ __________ __________ __________ __________ __________ __________

Equity

Accumulated

deficit (4,512) (564) (5,076) (5,381) (524) (5,905) (4,898) (522) (5,420)

__________ __________ __________ __________ __________ __________ __________ __________ __________

Total equity (1,760) (564) (2,324) (2,629) (524) (3,153) (2,146) (522) (2,668)

__________ __________ __________ __________ __________ __________ __________ __________ __________

Non-current

liabilities

Lease

liabilities - 1,301 1,301 - 1,531 1,531 - 1,404 1,404

Current

liabilities

Lease

liabilities - 284 284 - 242 242 - 253 253

__________ __________ __________ _________ __________ __________ __________ __________ __________

Total

liabilities 10,255 1,585 11,840 9,187 1,773 10,960 10,698 1,657 12,355

__________ __________ __________ __________ __________ __________ __________ __________ __________

Total equity

and

liabilities 8,495 1,021 9,516 6,558 1,249 7,807 8,552 1,135 9687

__________ __________ __________ __________ __________ __________ __________ __________ __________

Consolidated Cash Flow Statement (extract)

6 months ended 30 6 months ended 30 Year ended 31 March

September 2019 September 2018 2019

Original Adj Restated Original Adj Restated Original Adj Restated

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Operating

profit/(loss) 13 12 25 (589) (20) (609) 16 43 59

Depreciation 43 114 157 63 114 177 116 228 344

Increase in

lease

liabilities - 44 44 - 73 73 - 63 63

__________ __________ __________ __________ __________ __________ __________ __________ __________

Cash generated

from

operations 1,671 170 1,841 572 167 739 372 334 706

Finance costs

on leases - (54) (54) - (61) (61) - (122) (122)

__________ __________ __________ __________ __________ __________ __________ __________ __________

Net cash

generated

from operating

activities 1,466 116 1,582 1,369 106 1,475 960 212 1,172

__________ __________ __________ __________ __________ __________ __________ __________ __________

Principal

elements

of lease

payments - (116) (116) - (106) (106) - (212) (212)

__________ __________ __________ __________ __________ __________ __________ __________ __________

Cash generated

from/(used in)

financing

activities 17 (116) (99) 12 (106) (94) 27 (212) (185)

Net increase

in cash and

cash

equivalents 1,866 - 1,866 1,306 - 1,306 912 - 912

__________ __________ __________ __________ __________ __________ __________ __________ __________

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR QLLFLKFFFFBQ

(END) Dow Jones Newswires

November 25, 2019 02:00 ET (07:00 GMT)

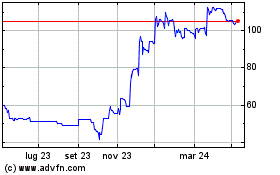

Grafico Azioni Intercede (LSE:IGP)

Storico

Da Mar 2024 a Apr 2024

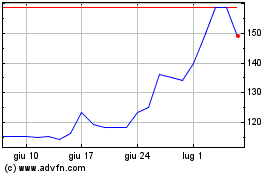

Grafico Azioni Intercede (LSE:IGP)

Storico

Da Apr 2023 a Apr 2024