TIDMRCN

RNS Number : 9170U

Redcentric PLC

28 November 2019

Redcentric plc

Half year results for the six months ended 30 September 2019

(unaudited)

Redcentric plc ("Redcentric", "the Company", or "the Group")

(AIM: RCN), a leading UK IT managed services provider, today

announces its unaudited results for the six months to 30 September

2019.

Financial measures Six months

to 30 Sept

Six months 2019 (H1-20) Six months

to 30 Sept pre-IFRS to 30 Sept

2019 (H1-20)(1) 16(1) 2018 (H1-19) Change(1)

-------------------------------------------- ----------------- -------------- --------------

Total revenue GBP43.2m GBP43.2m GBP47.5m -9%

Recurring monthly revenue (RMR) (2) GBP38.8m GBP38.8m GBP41.3m -6%

Adjusted EBITDA(2) GBP10.3m GBP8.8m GBP8.1m +8%

Adjusted operating profit(2) GBP5.5m GBP5.0m GBP4.1m +23%

Reported operating profit GBP1.9m GBP1.4m GBP0.5m +219%

Adjusted cash generated from operations(2) GBP10.2m GBP8.7m GBP9.2m -6%

Reported cash generated from operations GBP9.8m GBP8.2m GBP8.8m -6%

Net debt GBP(40.0)m GBP(16.5)m GBP(22.6)m -27%

Adjusted basic earnings per share(2) 2.41p 2.48p 1.89p +31%

Reported basic earnings per share 0.34p 0.41p (0.38)p +208%

Interim dividend per share 0.83p 0.83p 0.4p +108%

-------------- -------------- ----------

(1) The results for H1-20 are not directly comparable with the

prior year due to the adoption of IFRS 16 Leases. Further details

are provided in note 3 to the financial statements, and Appendix 1,

which sets out the impact of IFRS 16 Leases on the primary

statements. The % change figures reported above relate to H1-20 vs.

H1-19 pre any IFRS 16 Leases impact.

(2) For an explanation of the alternative performance measures

used in this report, please refer to Appendix 2.

Financial Highlights

-- Total revenue down by 9% to GBP43.2m, but good future

visibility with GBP38.8m recurring revenue representing 90% of

total revenue (H1-19: 87%).

-- Gross margins improved to 64.5% from 59.8%.

-- Adjusted (pre-IFRS 16) EBITDA up 8% to GBP8.8m (H1-19

GBP8.1m), with margin improving to 20.3% (H1-19 17.1%).

-- Adjusted (pre-IFRS 16) operating profit up 23% to GBP5.0m

(H1-19 GBP4.1m), with margin improving to 11.6% (H1-19 8.6%).

-- Continued strong cash flows with GBP8.7m of adjusted pre-IFRS

16 operating cash flow in the period (99% cash conversion).

-- Net debt, excluding the impact of IFRS 16, reduced by GBP1.1m

in the period to GBP16.5m, with GBP4.8m capital expenditure and

GBP1.5m of dividends paid in the period.

-- Interim dividend increased to 0.83p per share (H1-19 0.4p) , to be paid in January.

Operational Highlights

-- Q1-20 recurring revenues were flat on Q4-19 and Q2-20

recurring revenues were up on Q1-20, driven by both new logo wins

and effective cross-selling.

-- Operating margins continued to improve due the cost measures

undertaken in the second half of the last financial year.

-- GBP1.1m invested in our national network and a further

GBP1.5m invested in our infrastructure as a service (IaaS)

platform. We now have modern, resilient and scalable platforms and

networks from which we can service our current and future customer

base.

-- Product management and Development teams reorganised, with

managed firewall and SD WAN launched in Q3-20 and further

enhancement to our Collaboration and Security portfolios to be

launched in Q4-20.

-- Strategic review of our data centre and network portfolios

underway, with the expectation that this will result in annual

savings of at least GBP2.8m in FY21 onwards.

Ian Johnson, Non-Executive Chairman, commented:

"Visibility of future revenues remains strong with recurring

revenues reaching 90%. New customers were added in the period

which, together with effective cross selling, led to quarter on

quarter revenue growth. This revenue growth has been achieved

despite the ongoing FCA investigation, which continues to impact

the pace at which we win new business.

Management continues to improve the operational efficiency of

the business. The strategic data centre and network portfolios

review now underway is expected to lead to the realisation of

annual savings of at least GBP2.8m and further improvements in

operating margins.

Cash flow remains strong allowing significant investment into

our network and a further reduction to net debt in the period. The

Board is confident that the business will continue to generate

strong cash flows enabling it to return cash to shareholders by way

of dividend and further share purchases via the share buy-back

programme."

There will be a presentation for analysts held at 09:30hrs on 28

November 2019 at the offices of Tulchan Communications, 85 Fleet

Street, EC4 1AE. Please contact redcentric@tulchanCompany.com if

you would like to attend.

For further enquiries please contact:

Redcentric plc +44 (0)1423 850 000

Peter Brotherton, Chief Executive Officer

Dean Barber, Chief Financial Officer

Tulchan +44 (0)20 7353 4200

James Macey White / Matt Low / Sophie Duckworth

Numis Securities Limited - Nomad and Joint Broker +44 (0)20 7260 1000

Simon Willis / Oliver Hardy

FinnCap Ltd - Joint Broker +44 (0)20 7220 0500

Stuart Andrews / Rhys Williams

Chief Executive Officer's review

Overview

We have had another productive six months, with progress made

across all areas of the business. As well as continuing to extract

cost efficiencies, it is particularly pleasing to note that we have

stemmed the decline in recurring revenues. Whilst the half year

comparatives show a decrease in recurring revenue of 6%, this

reflects the opening run rate position. Indeed, our Q1 recurring

revenues were flat on Q4 and Q2 recurring revenues were up on Q1.

Encouragingly, this was driven by both new logo wins and effective

cross-selling.

Non-recurring revenues are less predictable by nature and have

been impacted in the period by the industry trend to move away from

on-premise to cloud solutions. Additionally, customers have delayed

their discretionary spending due to the economic uncertainty

surrounding the ongoing Brexit negotiations. This is reflected in

the half year numbers with non-recurring revenues down by GBP1.8m

(-29%) on the equivalent period last year.

Profitability and operating margins continue to improve as a

result of the cost reduction measures undertaken in the second half

of the last financial year. In addition to these measures, we have

recently commenced a strategic review of our network and data

centre portfolios, vacating third party data centres and

rationalising our legacy network connectivity contracts. This will

align our infrastructure better with our future strategy and

customer requirements. It will also yield significant savings,

outlined in more detail below, expected to be at least GBP2.8m in

FY21 onwards. The review will be complete by the time we announce

our full year results and full details will be provided at that

point.

The cash flows for the 6 months ended 30 September 2019 include

an acceleration of capital expenditure with GBP1.1m invested in our

national network which will shortly have a core capacity of 100Gb.

A further GBP1.5m has been invested in our infrastructure as a

service (IaaS) platform and GBP0.9m in our new internal ERP system.

With these investments, we now have modern, resilient and scalable

platforms and networks from which we can service our current and

future customer base. Going forward, we anticipate lower levels of

capital expenditure which will further enhance cash flow

performance.

Improved profitability and cash generation have enabled us to

declare an interim dividend of 0.83p per share (H1-19: 0.4p). In

addition to this, we have commenced a share buyback programme with

purchases of GBP0.3m made as at 30 September 2019.

Private sector

The private sector accounts for 85% of our recurring revenues.

Our focus on customer service has led to high levels of retention

during the period and we continue to receive additional orders from

existing customers. As highlighted in last year's Annual Report, we

believe that our margins are now reflective of the market and this

is evidenced by significantly lower levels of price erosion on

contracts renewed during the first half of the year.

Public Sector markets

Overview

Whilst the public sector accounted for just 15% of total

recurring revenues, we continue to see significant opportunity for

growth and anticipate that these revenues will represent an

increasing percentage of future total revenues.

Health and Social Care Networks (HSCN)

In the FY19 Annual Report we listed 7 HSCN contract wins with

annualised revenues of GBP3.1m. Contract variations and additions

in H1-20 have increased this figure to GBP3.4m.

The HSCN programme has added 66 new public sector logos to our

customer base and represent a significant opportunity for us to

cross sell additional products. In addition to the HSCN revenues, a

further GBP0.3m of annualised revenue from other products has been

added to date.

Whilst these wins have been significant, the progress in

implementing the contracts has been slower than expected, primarily

due to customer resource constraints, resulting in only GBP178k of

revenue being recognised in the first half of the year. As at 30

September 2019, the run rate of installed HSCN contracts amounted

to GBP648k per annum. We are working closely with both our

customers and NHS Digital to expedite these network rollouts.

Whilst the roll-out of the remaining revenue will continue in to

FY21, we expect that the bulk of these contracts will be live by

the end of this financial year.

Yorkshire and Humber Public Sector Networks (YHPSN)

YHPSN is the largest of the Public Sector framework contracts

won by Redcentric in the past 18 months. After a difficult start to

this framework award, we are starting to make some good progress.

70 organisations are part of the YHPSN framework and of these, 44

have placed orders with us.

To date the total value of orders received is GBP8.0m, which

equates to an annualised revenue of GBP1.6m.

As with the other HSCN orders, progress in installing new

circuits has been slower than anticipated but we are confident that

the bulk of the current order book will be installed by the end of

this financial year.

Our initial sales focus has been on selling HSCN circuits due to

the need for health organisations to move off the N3 network which

is scheduled to close in August 2020. Going forward we will

progress non-health opportunities and look to cross-sell additional

products into this new customer base.

Public sector hosting

In last year's Annual Report, we highlighted the significant

impact that the loss of public sector hosting contracts has had and

will continue to have on the business. In the six months to 30

September 2019, public sector hosting revenues amounted to GBP1.7m,

GBP0.9m down on the equivalent period last year.

As previously notified, we expect the whole of this revenue to

have migrated away from us by the end of the next financial

year.

Products, platforms and networks

National network upgrade and efficiencies

Our core network has been upgraded to enable 10Gb connections to

terminate on our network and we are in the process of expanding the

network to give a 100Gb core.

During the period we completed the decommissioning of a network

ring which originated from the historical inTechnology acquisition.

The closure of this ring has realised GBP0.5m annualised savings

effective 1 July 2019.

Infrastructure as a Service (IaaS) platform

We have commenced phase II of our IaaS platform upgrade which,

once fully implemented, will bring our cloud product offering fully

up to date. We expect that this will be live by the end of the

financial year.

New product launches

During the period we restructured the product management and

development teams yielding immediate results, with new managed

firewall and SD WAN products launched in Q3-20, and further

enhancement to our Collaboration and Security portfolios to be

launched in Q4-20

Data centre and network strategy review

We are now part-way through a strategic review of our network

and data centre portfolios. Our aim is to vacate third party data

centres and concentrate on our own managed facilities. This will

allow us to rationalise legacy network connectivity contracts. The

decisions taken to date will result in a GBP1.8m reduction to the

annual cost base in FY21, with GBP0.4m benefit from this in H2-20.

The review is ongoing and is expected to realise further savings of

at least GBP1.0m in FY21, in addition to the GBP1.8m already being

actioned. We expect to incur exceptional contract termination and

exit costs of approximately GBP1.8m in H2-20.

These efficiency measures will not impact the required capacity

to support future growth. By the end of the financial year the

business will have an upgraded single UK wide network, with all of

our customers located in Redcentric managed data centres and

third-party facilities only utilised for interconnectivity

purposes. No customer losses are expected as a result of this

rationalisation programme.

People

PLC Board

On 16 October 2019 Ian Johnson joined the Board as Non-Executive

Chairman replacing Chris Cole who resigned from the Board on the

same day. Ian Johnson is an experienced PLC chairman and we welcome

him to the Company. We thank Chris Cole for his considerable

contribution to the Company over a five-year period and wish him

well for the future.

Also, on 16 October 2019, Chris Rigg (Non-Executive Director)

announced his intention to step down from the Board with effect

from 31 December 2019 following his appointment as Chief Executive

Officer of Mandata Limited. Chris goes with our thanks and best

wishes for the future.

Dean Barber joined the business on 2 September 2019 as Chief

Financial Officer. Dean is a chartered accountant and joins us from

EMIS Group plc where he was Group Financial Controller.

Operating Board

We have continued to invest in our staff and to strengthen the

management teams in both the UK and India. Several key appointments

have been made in the first half of the financial year with the

Operating Board strengthened as a result. In addition, a new HR

Director will be joining the senior management team in

December.

The business currently has 465 employees all of whom are key to

the success of the business. The Board thanks them for their hard

work and loyalty.

FCA

The FCA investigation is still ongoing and continues to deflect

management's attention and to restrict the markets into which the

Company can sell. The FCA has not communicated how it intends to

proceed and what, if any, action it might bring against the

Company. The Company continues to cooperate fully with the FCA and

would like to bring the matter to a close as soon as possible.

Outlook and key areas of focus

We are cautiously optimistic for the future. The changes we have

made over recent periods are beginning to yield results in both the

private and public sector.

Whilst we are operating in very competitive markets, we expect

modest revenue growth in the second half and beyond.

We have invested significantly in our networks and platforms

over the last two years to position the business for the future.

Given this level of upfront investment we expect lower levels of

capital expenditure over the medium term. This, combined with the

cost efficiencies identified through the ongoing review of our data

centre and network portfolio, should lead to further strong cash

generation.

Our focus in the second half of the financial year will be

fivefold:

-- To continue to grow revenue both by new customer acquisition

and through cross selling of products to existing customers.

-- To expedite the delivery of public sector network wins.

-- To conclude the data centre and network strategy review

-- To enhance our product portfolio with new product launches

and further product enhancements.

-- To continue to deliver strong cash flows which will be

utilised to fund further share buy backs, pay dividends and reduce

debt.

We anticipate that our FY20 results will be in line with the

Board's expectations.

Financial Review

Overview

Total revenue in the period reduced by 9% to GBP43.2m (H1-19:

GBP47.5m). Recurring monthly revenue fell by 6% to GBP38.8m (H1-19:

GBP41.3m), representing 90% (H1-19: 87%) of the total revenue.

On a pre-IFRS 16 basis, both adjusted EBITDA (up GBP0.7m to

GBP8.8m) and adjusted operating profit (up GBP0.9m to GBP5.0m) were

higher than prior year, with an improvement to gross profit margin

and further reductions to the operating cost base in the

period.

On a post-IFRS 16 basis, adjusted EBITDA increased by GBP2.2m

and adjusted operating profit increased by GBP1.4m. The Company

recognised GBP1.1m of depreciation charges and GBP0.6m of interest

costs in respect of finance leases that would have previously been

recognised as a GBP1.6m operating lease expense. On transition to

IFRS 16 the Company recognised a right of use asset of GBP22.2m and

lease liabilities of GBP24.5m. Further disclosure is presented in

note 3 to the financial statements.

Revenue

Revenue is analysed into the following categories:

-- Recurring monthly revenue, lower at GBP38.8m (H1-19:

GBP41.3m), reflecting the closing Q4-19 run-rate position. In the

period, Q1-20 revenues were flat on Q4-19 with Q2-20 revenues up on

Q1-20.

-- Non-recurring product revenue, which was lower at GBP2.1m

(H1-19: GBP3.3m), impacted by the industry trend to move away from

on-premise to cloud solutions and by customers delaying

discretionary spending due to the economic uncertainty surrounding

the ongoing Brexit negotiations.

-- Non-recurring services revenue, which was slightly lower at GBP2.3m (H1-19: GBP2.8m).

Gross profit

Gross profit decreased by 2% (GBP0.5m) reflecting the Company's

lower revenue, with an improvement in gross margin to 64.5% (H1-19:

59.8%) driven by continued management of third-party operating

costs and the reduction in lower margin product revenues.

Operating costs

The Company's pre-IFRS 16 adjusted operating costs (operating

expenditure excluding depreciation, amortisation, exceptional items

and share-based payments) are set out in the table below:

H1-20 H1-19 Change

GBP'000 GBP'000 GBP'000 Change

%

------------------------------------------ -------- -------- -------- -------

UK staff costs 9,661 10,480 (819) -8%

Office and data centre costs 3,704 3,462 242 +7%

Network and equipment costs 3,603 3,708 (105) -3%

Other sales, general and administration

costs 983 1,463 (480) -33%

Offshore costs 1,123 1,140 (17) -1%

------------------------------------------ -------- -------- -------- -------

Total adjusted operating costs, pre-IFRS

16 19,074 20,253 (1,179) -6%

------------------------------------------ -------- -------- -------- -------

Adoption of IFRS 16 reduces operating costs by GBP1,571k to

GBP17,503k. A right of use asset of GBP21,079k is recognised at 30

September in relation to leases that were previously classified as

operating leases, with operating lease expenditure reduced by

GBP1,571k in the period but depreciation and interest expense

higher by GBP1,103k and GBP597k respectively.

Total adjusted operating costs for H1-20 were 6% (GBP1.2m) lower

than prior year, primarily driven by:

-- UK staff costs down GBP0.8m, driven by lower headcount. The

Company employed 318 UK staff at 30 September 2019 with an average

headcount over the period of 314 (H1-19: 337).

-- Other sales, general and administration costs down GBP0.5m,

with prior year including GBP0.5m of HSCN bid (consultancy)

costs.

Offshore costs were in line with prior year with the Company

employing 147 staff in India at 30 September 2019. Average Indian

headcount over the period was 150 (H1-19: 146).

Profitability and dividend

Excluding the impact of IFRS 16 adoption, adjusted EBITDA

(GBP8.8m) and adjusted operating profit (GBP5.0m) were up 8% and

23% respectively, with an EBITDA margin of 20.3% (H1-19: 17.1%) and

adjusted operating profit margin of 11.5% (H1-19: 8.6%).

After accounting for exceptional items of GBP0.2m (H1-19:

GBP0.2m) and share-based payment costs of GBP0.3m (H1-19: GBP0.2m),

reported operating profit was higher at GBP1.4m (H1-19: GBP0.5m).

On a post-IFRS 16 basis reported operating profit was GBP1.9m.

Net finance costs for the period were GBP1.1m (H1-19: GBP0.6m),

including GBP0.6m of IFRS 16 finance charges.

The tax charge for the period was GBP0.4m (H1-19: GBP0.5m),

comprising an income tax charge of GBP0.5m (H1-19: GBPnil), a

current year deferred tax credit of GBP0.3m (H1-19: GBP0.2m), and a

deferred tax charge in respect of prior years of GBP0.2m (H1-19:

GBP0.7m).

Adjusted basic and diluted earnings per share (EPS) increased by

28% and 27% to 2.41p and 2.38p respectively (H1-19: 1.89p and 1.88p

respectively). The reported basic and diluted EPS were also higher

at 0.34p (H1-19: (0.38)p loss per share).

In accordance with the dividend policy previously announced, an

interim dividend of 0.83p per share will be paid on 10 January 2020

to shareholders on the register at the close of business on 6

December 2019.

Cash flow and net debt

The principal movements in pre-IFRS 16 net debt are set out in

the table below.

H1-20, H1-19 FY 2019

pre-IFRS

16

GBP'000 GBP'000 GBP'000

----------------------------------------------- ---------- --------- ---------

Adjusted EBITDA, pre-IFRS 16 8,759 8,115 16,714

Working capital movements (82) 1,120 4,575

----------------------------------------------- ---------- --------- ---------

Adjusted cash generated from operations,

pre IFRS 16 8,677 9,235 21,289

Cash conversion 99% 114% 127%

Capital expenditure - cash purchases (2,267) (2,884) (5,229)

Capital expenditure - finance lease purchases (2,484) (185) (2,506)

Proceeds from sale and lease back of assets - - 1,181

Proceeds from sale of fixed assets - - 665

----------------------------------------------- ---------- --------- ---------

Net capital expenditure (4,751) (3,069) (5,889)

Corporation tax (248) (38) (1,873)

Interest paid (440) (545) (1,044)

Loan arrangement fees / fee amortisation (4) (34) (68)

Effect of exchange rates 18 (32) (8)

----------------------------------------------- ---------- --------- ---------

Other movements in net debt (674) (649) (2,993)

Normalised net debt movement 3,252 5,517 12,407

----------------------------------------------- ---------- --------- ---------

Cash cost of exceptional items (444) (431) (1,668)

Share buy-back (278) - -

Dividends (1,491) - (597)

(2,213) (431) (2,265)

Decrease in net debt 1,039 5,086 10,142

Net debt at the beginning of the period,

pre-IFRS 16 (17,565) (27,707) (27,707)

----------------------------------------------- ---------- --------- ---------

Net debt at the end of the period, pre-IFRS

16 (16,526) (22,621) (17,565)

----------------------------------------------- ---------- --------- ---------

Net debt (pre-IFRS 16) of GBP16.5m at the end of the period

consists of total borrowings of GBP12.7m plus finance leases of

GBP6.0m, less cash balances of GBP2.2m. Pre-IFRS 16 adjusted cash

generated from operations was GBP8.7m (H1-19: GBP9.2m), with the

reduction driven by timing differences in working capital against a

strong comparative period. Operating cash conversion was again high

at 99% (H1-19: 113.8%).

There was an acceleration of capital expenditure in the period,

with net capital expenditure of GBP4.8m (H1-19: GBP3.1m),

principally relating to investment in our national network and our

IaaS platform. GBP0.3m was spent on the share buy-back programme

and GBP1.5m on dividends. After finance costs, tax, and the cash

cost of exceptional items the Company ended the period with net

debt, excluding IFRS 16 lease liabilities, of GBP16.5m (30

September 2018: GBP22.6m; 31 March 2019: GBP17.6m). Including IFRS

16 lease liabilities of GBP26.9m the Company's net debt at 30

September 2019 was GBP40.0m.

A further GBP7.5m of unutilised bank facility was cancelled

during the period, leaving a total facility at 30 September 2019 of

GBP25.5m, compromising a revolving credit facility (RCF) of

GBP17.5m, an overdraft facility of GBP2.0m and a GBP6m asset

financing facility. In addition, the Company has access to a GBP20m

accordion facility. At 30 September 2019 GBP5.0m of the RCF and

GBP2.0m of the overdraft was undrawn.

The current facilities expire on 30 November 2020. Dialogue is

underway with lenders to determine the appropriate quantum and

facility required beyond this date.

Consolidated statement of comprehensive income for the six

months ended 30 September 2019

Six months Six months

ended 30 ended Year ended

September 30 September 31 March

2019 2018 2019

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

--------------------------------------------- ----- ----------- -------------- -------------

Revenue 8 43,152 47,452 93,260

Cost of sales (15,319) (19,084) (36,895)

--------------------------------------------- ----- ----------- -------------- -------------

Gross Profit 27,833 28,368 56,365

Operating expenditure (25,929) (27,918) (56,650)

--------------------------------------------- ----- ----------- -------------- -------------

Adjusted EBITDA 10,330 8,115 16,714

Depreciation (4,274) (3,493) (7,330)

Amortisation of intangibles (3,730) (3,689) (7,392)

Exceptional items 9 (169) (243) (1,911)

Share-based payments (253) (240) (366)

Operating profit / (loss) 1,904 450 (285)

Finance income 10 - 12 13

Finance costs 10 (1,017) (584) (1,091)

--------------------------------------------- ----- ----------- -------------- -------------

Profit / (loss) on ordinary activities

before taxation 887 (122) (1,363)

Income tax expense 11 (381) (449) (604)

--------------------------------------------- ----- ----------- -------------- -------------

Profit / (loss) for the period attributable

to owners of the parent 506 (571) (1,967)

--------------------------------------------- ----- ----------- -------------- -------------

Other comprehensive income

Items that may be classified to profit

or loss:

Currency translation differences 39 (28) 8

--------------------------------------------- ----- ----------- -------------- -------------

Total comprehensive income / (loss)

for the period 545 (599) (1,959)

--------------------------------------------- ----- ----------- -------------- -------------

Earnings per share

Basic earnings/(loss) per share 12 0.34p (0.38)p (1.32)p

Diluted earnings/(loss) per share 12 0.34p (0.38)p (1.32)p

--------------------------------------------- ----- ----------- -------------- -------------

Consolidated statement of financial position as at 30 September

2019

30 Sept 30 Sept 31 March

2019 2018 2019

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

------------------------------- ----- ----------- ----------- ---------

Non-Current Assets

Intangible assets 72,354 79,436 75,802

Property, plant and equipment 19,438 19,173 18,133

Right-of-use assets 14 21,079 - -

Deferred tax asset 307 - 142

113,178 98,609 94,077

------------------------------- ----- ----------- ----------- ---------

Current Assets

Inventories 302 443 357

Trade and other receivables 15 19,521 22,510 22,103

Cash and short-term deposits 2,183 6,282 7,206

------------------------------- ----- ----------- ----------- ---------

22,006 29,235 29,666

------------------------------- ----- ----------- ----------- ---------

Total assets 135,184 127,844 123,743

------------------------------- ----- ----------- ----------- ---------

Current Liabilities

Trade and other payables 16 (19,622) (19,617) (22,297)

Corporation tax payable (104) (836) -

Lease liabilities (4,512) - -

Borrowings 17 (127) (3,091) (3,056)

Provisions 18 (150) - (149)

------------------------------- ----- ----------- ----------- ---------

(24,515) (23,544) (25,502)

------------------------------- ----- ----------- ----------- ---------

Non-current liabilities

Deferred tax liability - (506) -

Lease liabilities (25,009) - -

Borrowings 17 (12,565) (25,812) (21,715)

Provisions 18 (893) (530) (881)

------------------------------- ----- ----------- ----------- ---------

(38,467) (26,848) (22,596)

------------------------------- ----- ----------- ----------- ---------

Total liabilities (62,982) (50,392) (48,098)

------------------------------- ----- ----------- ----------- ---------

Net assets 72,202 77,452 75,645

------------------------------- ----- ----------- ----------- ---------

Equity

Called up share capital 19 149 149 149

Share premium account 19 65,736 65,588 65,588

Capital redemption reserve (9,454) (9,454) (9,454)

Own shares held in treasury 19 (278) - -

Retained earnings 16,049 21,169 19,362

Total Equity 72,202 77,452 76,645

------------------------------- ----- ----------- ----------- ---------

Consolidated cash flow statement for the six months ended 30

September 2019

Six months Six months Year ended

to 30 Sept to 30 31 March

2019 Sept 2018 2019

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

----------------------------------------------- ------------ ----------- -----------

Operating profit 1,904 450 (285)

Adjustment for non-cash items

Depreciation and amortisation 8,004 7,182 14,722

Exceptional items 169 243 1,911

Share-based payments 253 240 366

----------------------------------------------- ------------ ----------- -----------

Operating cash flow before exceptional

items and movements in working capital 10,330 8,115 16,714

Loss on sale of fixed asset - - (42)

Exceptional items and NI on share-based

payments (444) (431) (1,668)

----------------------------------------------- ------------ ----------- -----------

Operating cash flow before changes in working

capital 9,886 7,684 15,004

Changes in working capital

Decrease in inventories 55 223 309

Decrease in trade and other receivables 2,254 1,364 5,775

Decrease in trade and other payables (2,391) (466) (1,467)

----------------------------------------------- ------------ ----------- -----------

Cash generated from operations 9,804 8,805 19,621

----------------------------------------------- ------------ ----------- -----------

Adjusted cash generated from operations(1) 10,248 9,236 21,289

Cash costs of exceptional items (444) (431) (1,668)

----------------------------------------------- ------------ ----------- -----------

Cash generated from operations 9,804 8,805 19,621

Tax paid (248) (38) (1,873)

----------------------------------------------- ------------ ----------- -----------

Net cash generated from operating activities 9,556 8,767 17,748

----------------------------------------------- ------------ ----------- -----------

Cash flows from investing activities

Proceeds from sale of property, plant and

equipment - - 665

Purchase of property, plant and equipment (2,081) (2,884) (4,665)

Purchase of intangible fixed assets (186) - (564)

----------------------------------------------- ------------ ----------- -----------

Net cash used in investing activities (2,267) (2,884) (4,564)

----------------------------------------------- ------------ ----------- -----------

Cash flows from financing activities

Dividends paid (1,491) - (597)

Share buy-back (278) - -

Interest paid (440) (545) (1,044)

Repayment of borrowings / finance leases (1,550) (1,613) (1,918)

Payment of IFRS 16 lease liabilities (1,571) - -

Repayment of revolving credit facility (7,000) (3,500) (8,500)

Net cash used in financing activities (12,330) (5,658) (12,059)

----------------------------------------------- ------------ ----------- -----------

Net increase in cash and cash equivalents (5,041) 225 1,125

Cash and cash equivalents at beginning

of period 7,206 6,089 6,089

Effect of exchange rates 18 (32) (8)

Cash and cash equivalents at end of the

period 2,183 6,282 7,206

----------------------------------------------- ------------ ----------- -----------

Consolidated statement of changes in equity

Share Capital Share Capital Own Shares Retained Total

Premium Redemption Held in Earnings Equity

Reserve Treasury

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------- -------------- --------- ------------ ----------- ---------- --------

Balance at 1 April 2018 149 65,588 (9,454) - 21,565 77,848

Loss for the period - - - - (571) (571)

Transactions with owners

Share-based payments - - - - 204 204

Other comprehensive income

Currency translation

differences - - - - (28) (28)

At 30 September 2018 149 65,588 (9,454) - 21,170 77,453

Loss for the period - - - - (1,396) (1,396)

Transactions with owners

Share-based payments - - - - 149 149

Dividends paid - - - - (597) (597)

Other comprehensive income

Currency translation

differences - - - - 36 36

---------------------------- -------------- --------- ------------ ----------- ---------- --------

At 31 March 2019 149 65,588 (9,454) - 19,362 75,645

Adjustment on initial

application of IFRS 16 - - - - (2,429) (2,429)

Profit for the period - - - - 506 506

Transactions with owners

Share-based payments - - - - 62 62

Share buyback (278) - (278)

Issue of new shares - 148 - - - 148

Dividends paid - - - - (1,491) (1,491)

Other comprehensive income

Currency translation

differences - - - - 39 39

---------------------------- -------------- --------- ------------ ----------- ---------- --------

At 30 September 2019 149 65,736 (9,454) (278) 16,049 72,202

---------------------------- -------------- --------- ------------ ----------- ---------- --------

Notes to the half year financial statements

1. General information

The financial statements for the six months ended 30 September

2019 and the six months ended 30 September 2018 do not constitute

statutory accounts within the meaning of Section 434 of the

Companies Act 2006. Statutory accounts for the year ended 31 March

2019 were approved by the Board of Directors on 25 June 2019 and

delivered to the Registrar of Companies. The auditor's report on

those accounts was unqualified, did not contain an emphasis of

matter paragraph and did not contain any statement under Section

498 (2) or (3) of the Companies Act 2006.

These condensed half year financial statements were approved for

issue by the Board of Directors on 27 November 2019.

Redcentric plc ('the Company') is a company domiciled in England

and Wales. These condensed half year financial statements comprise

the Company and its subsidiaries (together referred to as 'the

Company' or 'the Group'). The principal activity of the Company is

the supply of IT managed services.

2. Basis of preparation

These condensed half year financial statements for the half year

ended 30 September 2019 have been prepared in accordance with the

AIM Rules for Companies, comply with IAS 34 Interim Financial

Reporting as adopted by the European Union and should be read in

conjunction with the annual financial statements for the year ended

31 March 2019, which have been prepared in accordance with

International Financial Reporting Standards (IFRS) as adopted by

the European Union.

The directors have reviewed a detailed trading and cash flow

forecast for a period which covers at least 12 months after the

date of approval of these condensed half year financial statements.

There is a high and continuing level of recurring revenue and high

cash conversion is anticipated for the foreseeable future.

As at 30 September 2019 the Company had committed a revolving

credit facility (RCF) of GBP17.5m, an overdraft facility of GBP2.0m

and a GBP6m asset financing facility. In addition, the Company has

access to a GBP20m accordion facility. At 30 September 2019 GBP5.0m

of the RCF and GBP2.0m of the overdraft was undrawn. During the

period, the continuing strength of operating cash flows enabled the

Company to cancel GBP7.5m of unused RCF facility. These current

facilities expire on 30 November 2020, with dialogue underway with

the lenders to determine the appropriate quantum and facility

required beyond this date. The Directors are not aware of any facts

or circumstances that would prevent this refinancing process from

being successful.

After careful enquiry and review of available financial

information, the directors have formed the conclusion that the

Company has adequate resources to continue to operate for the

foreseeable future and that it is therefore appropriate to continue

to adopt the going concern basis of accounting in the preparation

of these half year financial statements.

The financial information is presented in sterling, which is the

functional currency of the Company. All financial information

presented has been rounded to the nearest thousand.

3. Accounting policies

Except for the adoption of IFRS 16 Leases, detailed below, the

accounting policies applied in these interim financial statements

are the same as those applied in the Company's annual report and

accounts for the year ended 31 March 2019. Following the adoption

of IFRS 16, non-current assets now include the category of

right-of-use assets, with depreciation provided on these on a

straight-line basis over the shorter of the lease term and its

useful life. For property, plant and equipment funded through

finance leases, where there is reasonable certainty that the

Company obtains ownership by the end of the lease term,

depreciation is provided on a straight line basis over the useful

life, otherwise it's provided over the shorter of the useful life

and the lease term.

IFRS 16 Leases

The Company has adopted IFRS 16 Leases from 1 April 2019,

replacing IAS 17, using the modified retrospective approach. The

cumulative effect of initial application is recognised in retained

earnings at 1 April 2019 and accordingly comparative information

presented has not been restated.

IFRS 16 has introduced a single on-balance sheet accounting

model for lessees. As a result, the Company, as a lessee, has

recognised right-of-use assets representing its rights to use the

underlying assets, and lease liabilities representing its

obligation to make lease payments. The Company has presented its

right-of-use assets and lease liabilities on the face of the

balance sheet. The table below summarises the impact on transition,

the Company recognising an adjustment of GBP2,429,000 to opening

retained earnings.

1 April

2019

GBP'000

---------------------------------------------------------------------- ---------

Right-of-use assets 22,182

Trade and other receivables (deferred lease incentives derecognised) (132)

Current lease liabilities (1,989)

Non-current lease liabilities (22,490)

Retained earnings (2,429)

---------------------------------------------------------------------- ---------

In relation to those leases under IFRS 16, the Company now

recognises depreciation and interest costs, instead of an operating

lease expense. During the six months ended 30 September 2019, this

amounted to GBP1.1m of depreciation charges and GBP0.6m of interest

costs from these leases.

The impact of IFRS 16 on the consolidated income statement,

consolidated statement of financial position, and consolidated cash

flow statement for the six months ended 30 September 2019 is set

out in Appendix 1.

At transition, for leases classified as operating leases under

IAS 17, lease liabilities were measured at the present value of the

remaining lease payments, discounted at an incremental borrowing

rate which reflects the characteristics of the underlying lease, at

1 April 2019. The weighted average incremental borrowing rate

applied is 5.1%.

Right-of-use assets are measured at either:

-- their carrying amount as if IFRS 16 had been applied since

the lease commencement date, discounted by the Company's

incremental borrowing rate as at 1 April 2019. The Company has

applied this methodology to the majority of its property leases

where the required historical information is available; or

-- an amount equal to the lease liability, adjusted for prepaid

/ accrued lease payments. This method has been applied to the small

number of non-property leases.

The Company has applied the following practical expedients on

transition:

-- leases for underlying assets that have a low value (less than

GBP5,000) or where the remaining lease term on transition was less

than 12 months have been excluded;

-- a single discount rate applied to its small portfolio of car leases; and

-- reliance on previous assessments on whether leases are

onerous instead of performing impairment reviews under IAS 36

The table below reconciles the Company's operating lease

commitment at 31 March 2019, under IAS 17, to the lease liability

now being recognised under IFRS 16.

1 April

2019

GBP'000

--------------------------------------------------------- -------

Operating lease commitment at 31 March 2019 as disclosed

in the Company's consolidated financial statements 32,665

Discounted using the incremental borrowing rate at

1 April 2019 24,513

Recognition exemption for leases of low value assets (31)

Recognition exemption for leases with less than twelve

months of lease term at transition (3)

Lease liabilities recognised as at 1 April 2019 24,479

--------------------------------------------------------- -------

4. Critical accounting judgements and key sources of estimation uncertainty

The key source of estimation uncertainty that carries a

significant risk of material change to the carrying value of assets

liabilities within the next year is with regard to credit note

provisioning, where provision is made for the value of credit notes

that the Company expects to subsequently issue to correct for

estimated inaccurate invoices issued to date. The basis for this

estimation is unchanged from the 2019 annual report and

accounts.

The Company has adopted IFRS 16 for the first time in these

financial statements, with GBP23.5m of IFRS 16 lease liabilities,

principally property leases, recognised at 30 September 2019.

Judgement has been applied in determining whether a contract

contains a lease and the anticipated tenure length on these leases

(whether or not break clauses will be exercised has been determined

based on our historical experience and expectations for future

trading and capacity requirements). Estimations have been made with

regard to discount rates applied.

The FCA investigation is still ongoing and has not yet reached

its conclusion. Until such stage as the FCA's intention becomes

clearer, the Directors are not able to judge whether a fine will be

likely, and accordingly, consistent with the treatment in the 2019

annual report and accounts, no provision has been made.

5. Principal risks and uncertainties

The 2019 annual report and accounts describes the principal

risks and uncertainties that could impact the Group's performance.

These relate to reliance on key personnel and management, market

and economic conditions, technology advancement and security,

infrastructure failure, and the ongoing FCA investigation. These

remain unchanged since the annual report was published and are not

expected to change for the remaining six months of the financial

year. Identifying, evaluating and managing the principal risks and

uncertainties facing the Group is an integral part of the way

Redcentric operates.

It is not anticipated that Brexit will have a material direct

effect on the Group as it is not a significant exporter or importer

of goods or services. There are potential indirect effects,

including exchange rate volatility affecting the value of sterling,

and delays in customers discretionary spending, which could have a

negative impact on the Group's prospects, but the scale and timing

of these is far from certain. The Group will continue to monitor

the progress of the negotiations of the terms under which the UK

will leave the EU.

6. Forward-looking statements

Certain statements in this half year report are forward-looking.

Although the Company believes that the expectations reflected in

these forward-looking statements are reasonable, it can give no

assurance that these expectations will prove to have been correct.

Because these statements involve risks and uncertainties, actual

results may differ materially from those expressed or implied by

these forward-looking statements.

7. Segmental reporting

IFRS 8 requires operating segments to be identified based on

internal financial information reported to the chief operating

decision-maker for decision-making purposes. The Group considers

that this role is performed by the main Board. The Board believes

that the Group continues to comprise a single reporting segment,

being the provision of managed services to customers.

8. Revenue analysis

Revenue is analysed as follows:

Year ended

Six months Six months 31 March

to 30 Sept to 30 Sept 2019

2019 Unaudited 2018 Unaudited Audited

GBP'000 GBP'000 GBP'000

------------------- ---------------- ---------------- -----------

Recurring revenue 38,810 41,322 80,544

Product revenue 2,079 3,328 5,810

Services revenue 2,263 2,802 6,906

Total revenue 43,152 47,452 93,260

------------------- ---------------- ---------------- -----------

9. Exceptional items

Six months Six months Year ended

to 30 to 30 31 March

Sept 2019 Sept 2018 2019

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

--------------------------------------------- ----------- ----------- -----------

Professional fees associated with Financial

Conduct Authority investigation 67 243 554

Staff restructuring 102 - 804

Vacant property provisions - - 553

169 243 1,911

--------------------------------------------- ----------- ----------- -----------

10. Finance income and costs

Six months Six months Year ended

to 30 to 30 31 March

Sept 2019 Sept 2018 2019

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

----------------------------------------------- ----------- ----------- -----------

Finance income

Other interest receivable - 12 13

- 12 13

----------------------------------------------- ----------- ----------- -----------

Finance costs

Interest payable on bank loans and overdrafts (308) (509) (947)

Interest payable on finance leases (666) (41) (93)

Amortisation of loan arrangement fees (43) (34) (51)

----------------------------------------------- ----------- ----------- -----------

(1,017) (584) (1,091)

----------------------------------------------- ----------- ----------- -----------

For the six months to 30 September 2019 interest payable on

finance leases includes GBP597,000 of IFRS 16 interest expense.

11. Income tax expense

The tax expense recognised reflects management estimates of the

tax charge for the period and has been calculated using the

estimated average tax rate of UK corporation tax for the financial

year of 19.0% (H1-19: 19.0%)

12. Earnings per share (EPS)

The calculation of basic and diluted EPS is based on the

following earnings and number of shares.

Six months Six months Year ended

to 30 Sept to 30 Sept 31 March

2019 Unaudited 2018 Unaudited 2019 Audited

Earnings GBP'000 GBP'000 GBP'000

--------------------------------------- ---------------- ---------------- --------------

Statutory earnings 506 (571) (1,967)

Tax charge 381 449 604

Amortisation of acquired intangibles 3,126 3,126 6,252

Share-based payments 253 240 366

Exceptional items 169 243 1,911

Adjusted earnings before tax 4,435 3,487 7,166

Notional tax charge at standard rate (843) (662) (1,362)

--------------------------------------- ---------------- ---------------- --------------

Adjusted earnings 3,592 2,825 5,804

--------------------------------------- ---------------- ---------------- --------------

Weighted average number of ordinary Number Number Number

shares '000 '000 '000

--------------------------------------- ---------------- ---------------- --------------

Total shares in issue 149,311 149,135 149,135

Shares held in treasury (327) - -

--------------------------------------- ---------------- ---------------- --------------

For basic EPS calculations 148,984 149,135 149,135

Effect of potentially dilutive share

options 1,915 1,455 1,141

--------------------------------------- ---------------- ---------------- --------------

For diluted EPS calculations 150,899 150,590 150,276

--------------------------------------- ---------------- ---------------- --------------

EPS Pence Pence Pence

--------------------------------------- ---------------- ---------------- --------------

Basic 0.34p (0.38)p (1.32)p

Adjusted 2.41p 1.89p 3.89p

Basic diluted 0.34p (0.38)p (1.32)p

Adjusted diluted 2.38p 1.88p 3.86p

--------------------------------------- ---------------- ---------------- --------------

13. Dividends

In relation to the 2019 financial year an interim dividend of

0.4p was paid on 21 December 2018 amounting to GBP597,000 followed

by a final dividend of 1p on 6 September 2019 amounting to

GBP1,491,000. For the 2020 financial year, the Directors have

approved an interim dividend of 0.83p, which will be payable on 10

January 2020, to shareholders on the register at the close of

business on 6 December 2019. This interim dividend, which will

amount to approximately GBP1,237,000, has not been recognised as a

liability in these financial statements.

14. Right-of-use assets

Vehicles

Leasehold & computer

property equipment Total

GBP000 GBP000 GBP000

---------------------------------------- ------------ ------------ --------

Cost

At 1 April 2018, 30 September 2018 and - - -

31 March 2019

Effect of initial application of IFRS

16 29,423 657 30,080

At 30 September 2019 29,423 657 30,080

---------------------------------------- ------------ ------------ --------

Accumulated depreciation

At 1 April 2018, 30 September 2018 and - - -

31 March 2019

Effect of initial application of IFRS

16 7,898 - 7,898

Charged in period 1,005 98 1,103

---------------------------------------- ------------ ------------ --------

At 30 September 2019 8,903 98 9,001

---------------------------------------- ------------ ------------ --------

Net book value

At 30 September 2019 20,520 559 21,079

At 1 April 2018, 30 September 2018 and - - -

31 March 2019

---------------------------------------- ------------ ------------ --------

15. Trade and other receivables

Six months Six months Year ended

to 30 to 30 31 March

Sept 2019 Sept 2018 2019

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

----------------------------- ----------- ----------- -----------

Trade Receivables 10,345 11,242 13,112

Less: credit note provision (1,356) (1,057) (1,521)

----------------------------- ----------- ----------- -----------

Trade receivables - net 8,989 10,185 11,591

Other receivables 233 270 194

Prepayments 5,814 8,170 6,133

Commission contract asset 2,438 - 2,040

Accrued income 2,047 3,885 1,949

Corporation tax - - 196

----------------------------- ----------- ----------- -----------

Total 19,521 22,510 22,103

----------------------------- ----------- ----------- -----------

Trade debtor days were 40 at 30 September 2019 (30 September

2018: 44). The ageing of trade receivables is shown below:

Six months Six months Year ended

to 30 to 30 31 March

Sept 2019 Sept 2018 2019

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

------------------------ ----------- ----------- -----------

Current 7,484 7,946 9,074

1 to 30 days overdue 1,777 1,112 2,628

31 to 60 days overdue 586 1,150 505

61 to 90 days overdue 217 182 99

91 to 180 days overdue 138 470 390

> 180 days overdue 143 382 416

------------------------ ----------- ----------- -----------

Gross trade debtors 10,345 11,242 13,112

Credit note provision (1,356) (1,057) (1,521)

Net trade debtors 8,989 10,185 11,591

------------------------ ----------- ----------- -----------

16. Trade and other payables

Six months Six months Year ended

to 30 to 30 31 March

Sept 2019 Sept 2018 2019 Audited

Unaudited Unaudited

GBP'000 GBP'000 GBP'000

------------------------------ ----------- ----------- --------------

Trade Payables 5,989 6,524 6,603

Other Payables 391 233 275

Taxation and Social Security 2,281 2,142 3,249

Accruals 2,849 2,959 3,028

Deferred Income 8,112 7,759 9,142

Total 19,622 19,617 22,297

------------------------------ ----------- ----------- --------------

Trade creditor days were 44 at 30 September 2019 (30 September

2018: 31).

17. Borrowings

Six months Six months Year ended

to 30 to 30 31 March

Sept 2019 Sept 2018 2019 Audited

Unaudited Unaudited

GBP'000 GBP'000 GBP'000

----------------------------------- ----------- ----------- --------------

Current

Finance Leases - 3,091 2,762

Term Loans 187 - 294

Unamortised loan arrangement fees (60) - -

----------------------------------- ----------- ----------- --------------

Total 127 3,091 3,056

----------------------------------- ----------- ----------- --------------

Non-current

Bank Loan 12,500 24,500 19,500

Finance leases - 1,414 2,214

Term loans 69 - 69

Unamortised loan arrangement fees (4) (102) (68)

----------------------------------- ----------- ----------- --------------

Total 12,565 25,812 21,715

----------------------------------- ----------- ----------- --------------

Following the adoption of IFRS 16, for the six months to 30

September 2019 current finance lease liabilities of GBP2,554,000,

and non-current finance lease liabilities of GBP3,462,000, have

been presented as lease liabilities on the face of the consolidated

statement of financial position.

18. Provisions

Vacant

Dilapidations property

provision provision Total provision

GBP'000 GBP'000 GBP'000

------------------------------------------ ---------------- ----------- ------------------

At 1 April 2018 376 - 376

Additional provisions created during the

period 154 - 154

At 30 September 2018 530 - 530

Additional provisions created during the

period (34) 538 504

Utilised during the period - (4) (4)

------------------------------------------ ---------------- ----------- ------------------

At 31 March 2019 496 534 1,030

Additional provisions created during the

period 60 - 60

Utilised during the period - (47) (47)

------------------------------------------ ---------------- ----------- ------------------

At 30 September 2019 556 487 1,043

------------------------------------------ ---------------- ----------- ------------------

Analysed as:

Current - 150 150

Non-current 556 337 893

------------------------------------------ ---------------- ----------- ------------------

556 487 1,043

19. Share capital and share premium

Ordinary shares

of 0.1p each Share premium

----------------------

Number GBP'000 GBP'000

---------------------------------------- ------------ -------- --------------

At 1 April 2018, 30 September 2018 and

31 March 2019 149,135,316 149 65,588

New shares issued 175,397 - 148

---------------------------------------- ------------ -------- --------------

At 30 September 2019 149,310,713 149 65,736

During the period the Company purchased, and held in treasury,

326,905 of its ordinary share capital for total proceeds of

GBP278,000. The total shares held in treasury at 30 September 2019

was 326,905 (30 September 2018: Nil; 31 March 2019: Nil)

Appendix 1: Impact of IFRS 16

Consolidated statement of comprehensive income

Six months Six months

to 30 Sept Impact to 30 Sept Six months

2019 pre of IFRS 2019 as to 30

IFRS 16 16 reported Sept 2018

GBP'000 GBP'000 GBP'000 GBP'000

--------------------------------------------- ------------ --------- ------------ -----------

Revenue 43,152 - 43,152 47,452

Cost of sales (15,319) - (15,319) (19,084)

--------------------------------------------- ------------ --------- ------------ -----------

Gross Profit 27,833 - 27,833 28,368

Operating expenditure (26,397) 468 (25,929) (27,918)

Adjusted EBITDA 8,759 1,571 10,330 8,115

Depreciation (3,171) (1,103) (4,274) (3,493)

Amortisation of intangibles (3,730) - (3,730) (3,689)

Exceptional items (169) - (169) (243)

Share-based payments (253) - (253) (240)

--------------------------------------------- ------------ --------- ------------ -----------

Operating profit / (loss) 1,436 468 1,904 450

Finance income - - - 12

Finance costs (420) (597) (1,017) (584)

--------------------------------------------- ------------ --------- ------------ -----------

Profit / (loss) on ordinary activities

before taxation 1,016 (129) 887 (122)

Income tax expense (406) 25 (381) (449)

--------------------------------------------- ------------ --------- ------------ -----------

Profit / (loss) for the period attributable

to owners of the parent 610 (104) 506 (571)

--------------------------------------------- ------------ --------- ------------ -----------

Other comprehensive income

Items that may be classified to

profit or loss:

Currency translation differences 39 - 39 (28)

--------------------------------------------- ------------ --------- ------------ -----------

Total comprehensive income / (loss)

for the period 649 (104) 545 (599)

--------------------------------------------- ------------ --------- ------------ -----------

Earnings per share

Basic earnings/(loss) per share 0.41p (0.07)p 0.34p (0.38)p

Diluted earnings/(loss) per share 0.40p (0.06)p 0.34p (0.38)p

--------------------------------------------- ------------ --------- ------------ -----------

Consolidated statement of financial position

30 Sept

2019 Impact 30 Sept

pre IFRS of IFRS 2019 30 September

16 16 as reported 2018

GBP'000 GBP'000 GBP'000

------------------------------- ---------- --------- ------------- -------------

Non-Current Assets

Intangible assets 72,354 - 72,354 79,436

Property, plant and equipment 19,438 - 19,438 19,173

Right-of-use assets - 21,079 21,079 -

Deferred tax asset 307 - 307 -

92,099 21,079 113,178 98,609

------------------------------- ---------- --------- ------------- -------------

Current Assets

Inventories 302 - 302 443

Trade and other receivables 19,653 (132) 19,521 22,510

Cash and short-term deposits 2,183 2,183 6,282

------------------------------- ---------- --------- ------------- -------------

22,138 (132) 22,006 29,235

------------------------------- ---------- --------- ------------- -------------

Total assets 114,237 20,947 135,184 127,844

------------------------------- ---------- --------- ------------- -------------

Current Liabilities

Trade and other payables (19,622) - (19,622) (19,617)

Corporation tax payable (129) 25 (104) (836)

Lease liabilities - (4,512) (4,512) -

Borrowings (2,681) 2,554 (127) (3,091)

Provisions (150) - (150) -

------------------------------- ---------- --------- ------------- -------------

(22,582) (1,933) (24,515) (23,544)

------------------------------- ---------- --------- ------------- -------------

Non-current liabilities

Deferred tax liability - - - (506)

Lease liabilities - (25,009) (25,009) -

Borrowings (16,027) 3,462 (12,565) (25,812)

Provisions (893) - (893) (530)

------------------------------- ---------- --------- ------------- -------------

(16,920) (21,547) (38,467) (26,848)

------------------------------- ---------- --------- ------------- -------------

Total liabilities (39,502) (23,481) (62,982) (50,392)

------------------------------- ---------- --------- ------------- -------------

Net assets 74,735 (2,533) 72,202 77,452

------------------------------- ---------- --------- ------------- -------------

Equity

Called up share capital 149 - 149 149

Share premium account 65,736 - 65,736 65,588

Capital redemption reserve (9,454) - (9,454) (9,454)

Own shares held in treasury (278) - (278)

Retained earnings 18,582 (2,533) 16,049 21,169

Total Equity 74,735 (2,533) 72,202 77,452

------------------------------- ---------- --------- ------------- -------------

The impact of IFRS 16 on current lease liabilities of

GBP4,512,000 comprises GBP1,958,000 of lease liabilities arising

from the adoption of IFRS 16 and GBP2,554,000 of existing IAS 17

finance leases re-presented from current borrowings.

The impact of IFRS 16 on non-current lease liabilities of

GBP25,009,000 comprises GBP21,547,000 of lease liabilities arising

from the adoption of IFRS 16 and GBP3,462,000 of existing IAS 17

finance leases re-presented from non-current borrowings.

Consolidated cash flow statement

Six months

to 30 Sept Six months

2019 to 30 Sept Six months

pre IFRS Impact of 2019 to 30 Sept

16 IFRS 16 as reported 2018

GBP'000 GBP'000 GBP'000

----------------------------------------- ------------ ---------- ------------- ------------

Operating profit 1,436 468 1,904 450

Adjustment for non-cash items

Depreciation and amortisation 6,901 1,103 8,004 7,182

Exceptional items 169 - 169 243

Share-based payments 253 - 253 240

----------------------------------------- ------------ ---------- ------------- ------------

Operating cash flow before exceptional

items and movements in working

capital 8,759 1,571 10,330 8,115

Loss on sale of fixed asset - - - -

Exceptional items and NI on share-based

payments (444) - (444) (431)

----------------------------------------- ------------ ---------- ------------- ------------

Operating cash flow before changes

in working capital 8,315 1,571 9,886 7,684

Changes in working capital

Decrease in inventories 55 - 55 223

Decrease in trade and other receivables 2,254 - 2,254 1,364

Decrease in trade and other payables (2,391) - (2,391) (466)

----------------------------------------- ------------ ---------- ------------- ------------

Cash generated from operations 8,233 1,571 9,804 8,805

----------------------------------------- ------------ ---------- ------------- ------------

Adjusted cash generated from

operations 8,677 1,571 10,248 9,236

Cash costs of exceptional items (444) - (444) (431)

----------------------------------------- ------------ ---------- ------------- ------------

Cash generated from operations 8,233 1,571 9,804 8,805

Tax paid (248) - (248) (38)

----------------------------------------- ------------ ---------- ------------- ------------

Net cash generated from operating

activities 7,985 1,571 9,556 8,767

----------------------------------------- ------------ ---------- ------------- ------------

Cash flows from investing activities

Proceeds from sale of property, - - - -

plant and equipment

Purchase of property, plant and

equipment (2,081) - (2,081) (2,884)

Purchase of intangible fixed

assets (186) - (186) -

----------------------------------------- ------------ ---------- ------------- ------------

Net cash used in investing activities (2,267) - (2,267) (2,884)

----------------------------------------- ------------ ---------- ------------- ------------

Cash flows from financing activities

Dividends paid (1,491) - (1,491) -

Share buy-back (278) - (278) -

Interest paid (440) - (440) (545)

Repayment of borrowings / finance

leases (1,550) - (1,550) (1,613)

Payment of IFRS 16 lease liabilities - (1,571) (1,571) -

Repayment of revolving credit

facility (7,000) - (7,000) (3,500)

Net cash used in financing activities (10,759) (1,571) (12,330) (5,658)

----------------------------------------- ------------ ---------- ------------- ------------

Net increase in cash and cash

equivalents (5,041) - (5,041) 225

Cash and cash equivalents at

beginning of period 7,206 - 7,206 6,089

Effect of exchange rates 18 - 18 (32)

Cash and cash equivalents at

end of the period 2,183 - 2,183 6,282

----------------------------------------- ------------ ---------- ------------- ------------

Appendix 2: Alternative performance measures (APMs)

This report contains certain financial measures (APMs) that are

not defined or recognised under IFRS but are presented to provide

readers with additional financial information that is evaluated by

management and investors in assessing the performance of the

Group.

This additional information presented is not uniformly defined

by all companies and may not be comparable with similarly titled

measures and disclosures by other companies. These measures are

unaudited and should not be viewed in isolation or as an

alternative to those measures that are derived in accordance with

IFRS.

Recurring monthly revenue

Recurring revenue is the revenue that annually repeats either

under contractual arrangement or by predictable customer habit. It

highlights how much of the Group's total revenue is secured and

anticipated to repeat in future periods, providing a measure of the

financial strength of the business. It is a measure that is well

understood by the Group's investor and analyst community and is

used for internal performance reporting.

Year ended

Six months Six months 31 March

to 30 Sept to 30 Sept 2019

2019 Unaudited 2018 Unaudited Audited

GBP'000 GBP'000 GBP'000

----------------------- ---------------- ---------------- -----------

Reported revenue 43,152 47,452 93,260

Non-recurring revenue (4,342) (6,130) (12,716)

----------------------- ---------------- ---------------- -----------

Recurring revenue 38,810 41,322 80,544

----------------------- ---------------- ---------------- -----------

Adjusted EBITDA and adjusted EBITDA margin

Adjusted EBITDA is EBITDA excluding exceptional items (as set

out in note 9) and share-based payments. The same adjustments are

also made in determining the adjusted EBITDA margin. Items are only

classified as exceptional due to their nature or size, and the

Board considers that this metric provides the best measure of

assessing underlying trading performance.

Year ended

Six months Six months 31 March

to 30 Sept to 30 Sept 2019

2019 Unaudited 2018 Unaudited Audited

GBP'000 GBP'000 GBP'000

------------------------------------------- ---------------- ---------------- -----------

Reported operating profit 1,904 450 (285)

Amortisation of intangible assets arising

on business combinations 3,126 3,126 6,252

Amortisation of other intangible assets 604 563 1,140

Depreciation 4,274 3,493 7,330

EBITDA 9,908 7,632 14,437

Exceptional items 169 243 1,911

Share-based payments 253 240 366

------------------------------------------- ---------------- ---------------- -----------

Adjusted EBITDA 10,330 8,115 16,714

------------------------------------------- ---------------- ---------------- -----------

Adjusted operating profit, adjusted operating profit margin and

adjusted earnings per share

Adjusted operating profit is operating profit excluding

amortisation on acquired intangibles, exceptional items and

share-based payments. The same adjustments are also made in

determining the adjusted operating profit margin and in determining

adjusted earnings per share (EPS). The Board considers this

adjusted measure of operating profit to provide the best metric of

assessing underlying performance as it excludes exceptional items

and the amortisation of acquired intangibles arising from business

combinations which varies year on year dependent on the timing and

size of any acquisitions.

Year ended

Six months Six months 31 March

to 30 Sept to 30 Sept 2019

2019 Unaudited 2018 Unaudited Audited

GBP'000 GBP'000 GBP'000

------------------------------------------- ---------------- ---------------- -----------

Reported operating profit 1,904 450 (285)

Amortisation of intangible assets arising

on business combinations 3,126 3,126 6,252

Exceptional items 169 243 1,911

Share-based payments 253 240 366

Adjusted operating profit 5,452 4,059 8,244

------------------------------------------- ---------------- ---------------- -----------

The EPS calculation further adjusts for the tax impact of the

operating profit adjustments, presented in note 12.

Adjusted operating costs

Adjusted operating costs are operating costs less depreciation,

amortisation, exceptional items and share-based payments.

Year ended

Six months Six months 31 March

to 30 Sept to 30 Sept 2019

2019 Unaudited 2018 Unaudited Audited

GBP'000 GBP'000 GBP'000

-------------------------------- ---------------- ---------------- -----------

Reported operating expenditure 25,929 27,918 56,650

Depreciation (4,274) (3,493) (7,330)

Amortisation of intangibles (3,730) (3,689) (7,392)

Exceptional items (169) (243) (1,911)

Share-based payments (253) (240) (366)

Adjusted operating expenditure 17,503 20,253 39,651

-------------------------------- ---------------- ---------------- -----------

Adjusted cash generated from operations and adjusted operating

cash conversion

Adjusted cash generated from operations adjusts for the cash

costs of exceptional items, consistent with the adjusted EBITDA and

operating profit measures. The same adjustments are also made in

determining the adjusted cash conversion percentage.

Year ended

Six months Six months 31 March

to 30 Sept to 30 Sept 2019

2019 Unaudited 2018 Unaudited Audited

GBP'000 GBP'000 GBP'000

----------------------------------------- ---------------- ---------------- -----------

Reported cash generated from operations 9,794 8,805 19,621

Share-based payments 444 431 1,668

Adjusted cash generated from operations 10,238 9,236 21,289

----------------------------------------- ---------------- ---------------- -----------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR UBVRRKSAAUUA

(END) Dow Jones Newswires

November 28, 2019 02:00 ET (07:00 GMT)

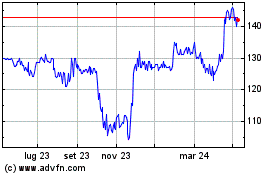

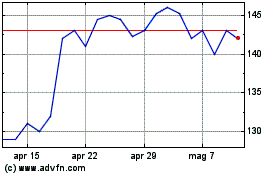

Grafico Azioni Redcentric (LSE:RCN)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Redcentric (LSE:RCN)

Storico

Da Apr 2023 a Apr 2024