TIDMTRY

RNS Number : 0684V

TR Property Investment Trust PLC

28 November 2019

The following amendment has been made to the "Half-year Report"

announcement released on 28/11/2019 at 7:00am under RNS No

9066U.

The original RNS stated in the Chairman's Statement that the

discount of the share price to the Net Asset Value reduced over the

period from 5.3% to 4.8%. This has now been corrected to 5.9% to

4.8%.

The following sentence has also been removed from the Chairman's

Statement: '*Share price discount to capital only NAV.'

All other details remain unchanged. The full amended

announcement is set out below.

This announcement and the information contained herein is not

for publication, distribution or release in, or into, directly or

indirectly, the United States, Canada, Australia or Japan.

TR PROPERTY INVESTMENT TRUST PLC

Financial Report for the half year ended 30 September 2019

28 November 2019

Financial Highlights and Performance

At 30 September At 31 March

2019

2019 (Audited) %

(Unaudited) Change

Balance Sheet

Net asset value per share 445.12p 418.54p +6.4

Shareholders' funds (GBP'000) 1,412,577 1,328,254 +6.4

Shares in issue at the end

of the period (m) 317.4 317.4 +0.0

Net debt(1) 11.4% 10.0%

Share Price

Share price 423.50p 394.00p +7.5

Market capitalisation GBP1,344m GBP1,250m +7.5

Half year Half year

ended ended

30 September 30 September

2019 (Unaudited) 2018 (Unaudited) %

Change

Revenue and dividends

Revenue earnings per share 9.96 p 9.25p +7.7

Interim dividend per share 5.20p 4.90p +6.1

Half year

ended

30 September Year ended

2019 (Unaudited)

31 March

2019

(Audited)

Performance: Assets and Benchmark

Net Asset Value total return(2) +8.5% +9.1%

Benchmark total return +6.7% +5.6%

Share price total return(3) +9.7% +6.2%

Ongoing Charges

Including performance fee +0.76% +1.10%

Excluding performance fee +0.61% +0.63%

Excluding performance fee

and direct property costs +0.59% +0.61%

1. Net debt is the total value of loan notes and loans

(including notional exposure to CFDs) less cash as a proportion of

net asset value.

2. The NAV Total Return for the year is calculated by

reinvesting the dividends in the assets of the Company from the

relevant ex-dividend date. Dividends are deemed to be reinvested on

the ex-dividend date as this is the protocol used by the Company's

benchmark and other indices.

3. The Share Price Total Return is calculated by reinvesting the

dividends in the shares of the Company from the relevant

ex-dividend date.

4. Ongoing Charges are calculated in accordance with the AIC

methodology. The ratio for 30 September 2019 is based on forecast

expenses and charges for the year ending 31 March 2020. The

performance fee included in the calculation above is the provision

at 30 September 2019 referred to in note 2 rather than an estimate

of the fee at the year end.

5. Considered to be an Alternative Performance Measure as

defined in the full Interim Report.

Dividend

An interim dividend of 5.20p (2018: 4.90p) will be paid on 7

January 2020 to shareholders on the register on 6 December 2019.

The shares will be quoted ex-dividend on 5 December 2019.

Chairman's Statement

Introduction

For the six months to 30th September, the Trust delivered a

robust NAV total return of 8.5% which was ahead of the benchmark

total return of 6.7%. The share price total return was larger at

9.7% as the Trust's shares traded close to, and occasionally at a

premium to, the net asset value.

This performance was achieved against a backdrop of weakening

confidence in the prospects for further growth in the current

global economic cycle. Importantly, central banks around the world

including the U.S. Federal Reserve, remain determined to offer

support through further easing in monetary policy. At the end of

October the Fed announced a further 25bp cut bringing the mid cycle

rate reduction to 75bps. In Europe, the European Central Bank cut

rates and announced a resumption of bond buying. Such activity

continues to help reduce the cost of borrowing and this in turn

supports asset values. In these circumstances real estate remains a

firm beneficiary.

Investors have had to wrestle with gauging the impact of the

political uncertainty in the UK and Europe. Capital expenditure and

investment decisions by corporates alongside spending by consumers

have all suffered from deferral. Unsurprisingly, demand for

logistics and warehousing remains very strong. Businesses continue

to stockpile and retail property continues to suffer from the

adversities of this consumption slowdown, combined with the

political uncertainty as well as the relentless move to online

shopping. The surprise has been the robust demand for office space

in London, although flexibility has become paramount. Meanwhile

Continental Europe's dominant cities are also in good health with

rental growth still evident.

Earnings from our companies have continued to show steady growth

and outside of the retail sector, management teams remain confident

of the return prospects for their businesses.

Revenue Results and Dividend

The half year earnings of 9.96p are 7.7% ahead of the earnings

at the prior year first half reflecting the growth referred to

above assisted marginally by currency and a lower tax charge.

The Board has announced an interim dividend of 5.20p just over

6% ahead of the prior year interim dividend of 4.90p.

Revenue Outlook

Although our manager is confident of the continued earnings

prospects for the companies we invest in, the uncertainties ahead

and in particular the potential impact on Sterling, make it

difficult to predict the full year outcome. The interim earnings

typically represent around 65% of our full year earnings, but it is

quite possible that significant currency fluctuations and changes

in the portfolio could still have a material impact on our revenue

for the full year.

Net Debt and Currencies

The level of gearing closed the half year at 11.4%. The gearing

increased from 10.0% reported at the March year end, to around

13.5% through July and August, and has been reduced again towards

the end of September. This reflects the sale of a directly owned

property close to the half year and also a tactical response to the

strong rally in UK names over the summer. Currency exposure in

respect of the capital account (as opposed to the income account

referred to above) is maintained in line with the benchmark.

Therefore, the valuation of a significant proportion of the

portfolio which is denominated in currencies other than Sterling,

will increase if Sterling weakens and vice versa if the currency

strengthens.

Discount and Share Repurchases

The discount of the share price to the Net Asset Value reduced

over the period from 5.9% to 4.8%. There were some fluctuations

over the period with the shares standing at a small premium at

times. There were no share repurchases in the half year period.

The website (www.trproperty.com) provides current and background

data on the Trust including an informative monthly fact sheet

prepared by the Manager alongside the Annual and Interim

Reports.

Board Changes

I am delighted to report the appointment of Kate Bolsover to the

Board with effect from 1st October. Kate brings a wealth of

experience, which has further strengthened the Board. She was

managing director of the mutual fund business at JP Morgan Cazenove

and more recently has held a range of board positions including

both chair and senior independent director of several investment

trusts.

Awards

The Trust recently won the Property category in the AJ Bell Fund

& Investment Trust Awards 2019.

Outlook

The themes of weakening global growth leading to central bank's

monetary stimulus are clear. It is somewhat less clear what the

outcomes will be to major geo-political and economic events such as

the US/China trade tensions, the recently announced UK General

Election and presumed subsequent withdrawal from the European

Union.

However, a decade of ultra low interest rates and a reluctance

of governments and corporates to drive capital investment has

resulted in strengthened balance sheets but left the world awash

with both capital (savings) seeking investment and income. We

therefore find ourselves in the peculiar situation with strong

demand for high quality commercial property even at record low

yields, but with banks remaining unwilling to finance speculative

development. The result has been steady asset values (outside of

retail) coupled with little evidence of over development.

Looking forward our managers remain ever vigilant about tenant

quality and credit risk so that we focus on secure and stable

earnings. Low (or even negative) interest rates will support asset

prices but, as we are seeing every day in the retail sector,

collapsing tenant demand, falling rents and corporate

restructurings quickly equates to dramatic valuation falls.

Businesses and consumers across Continental Europe and the UK

have endured three years of political uncertainty and referencing

that fact has been a staple part of this outlook over that period.

I offer no predictions of the political process or outcomes but I

would remind investors that TR Property is truly pan-European in

portfolio construction, currency exposure and its ability to seek

out real estate opportunities.

Hugh Seaborn

Chairman

27 November 2019

Directors' Responsibility Statement

The Directors acknowledge responsibility for the interim results

and approve this Half-Yearly Financial Report. The principal risks

facing the Company are substantially unchanged since the date of

the Annual Report for the year ended 31 March 2019 and continue to

be as set out in that report.

The Directors of TR Property Investment Trust plc confirm that

to the best of their knowledge:

(a) the Half-Yearly Financial Statements have been prepared in

accordance with IAS34 as adopted by the European Union and give a

true and fair view of the assets, liabilities, financial position

and profit for the period of the Group as required by the

Disclosure Guidance and Transparency Rules ('DTR') 4.2.4R;

(b) the Chairman's Statement together with the following

Manager's Report includes a fair review of the information required

by DTR 4.2.7R (indication of important events during the first six

months and description of principal risks and uncertainties for the

remaining six months of the year); and

(c) the report includes a fair review of the information required by DTR 4.2.8R.

Approved by the Board on 27 November 2019 and signed on its

behalf by Hugh Seaborn, Chairman

Manager's Report

Performance

The Net Asset Value total return for the six months was 8.5%,

ahead of the benchmark total return at 6.7%. Continental property

companies returned 5.4% (in local currency terms) again

outperforming their UK counterparts (+4.3%) but, unlike the last

four half year reporting periods, this time the difference was much

more marginal. However, when viewed in GBP, the Continental returns

were once again more substantial at 8.3% due to further GBP

weakness.

Whilst the overall property indices travelled in a tight band

over the period, at the sector and country level there were large

dispersions of returns. The slow 'car crash' of retail property

values continued to be evidenced in the interim results of

companies such as Hammerson, Intu and Capital & Regional. Share

prices have disconnected from underlying asset values given how

hard it is to assess value accurately. The twin evils of too much

leverage and weakening earnings continue to keep investors away.

The Trust has very modest exposure to UK retail (less than 3.5% of

NAV) and importantly nearly half of that is through Supermarket

Income REIT. This company was the only UK retail name to have

positive performance in the period and this helped drive our

relative outperformance in this sector. Post the half year the

company successfully raised capital and now trades at a premium to

its asset value.

German residential has been a mainstay of performance in the

fund for many years. In the Annual Report, I highlighted the

concerns around the risk of the State of Berlin seeking to impose

(in contradiction of federal practice) rent freezes and aggressive

restrictions on indexation. These new rules ('Mietendeckel') look

likely to become law in November, although the devil is always in

the detail. Investors also worry that there could be contagion of

this type of legislation to other regions. We do not agree with

that premise and have maintained our non-Berlin exposure. It is

important to note that our German-wide (ex Berlin) exposure

(through Vonovia and LEG) is far greater than our investment in

that one city.

Our loosely termed 'alternatives' group which includes student

accommodation, self-storage and healthcare, all performed well and

each sub-sector contributed strongly to performance - both absolute

and relative. I have highlighted in the past our index-linked, long

income exposure which overlaps with this group, particularly in

healthcare and we saw strong returns there as these businesses

benefited from the drop in the cost of long term financing.

This theme of 'lower for longer' debt cost resonated strongly in

Sweden. Swedish property companies, with just one exception, have

greater than average gearing coupled with higher proportions of

short term debt. The combination of a falling cost of debt

environment, coupled with rental growth at the asset level has led

to very strong performances from many of these companies.

Switzerland, a market where we see little organic growth,

benefited from being a safe haven in these volatile times. Swiss

investors also sought exposure to their domestic currency and

property names yielding 3% to 4% look attractive regardless of the

medium term fundamentals.

The industrial and logistics overweight remains a key theme in

the portfolio. Not only did we experience strong organic growth

from all our companies (particularly those with development

opportunities) but we benefited from corporate activity as well. In

May, Londonmetric announced the agreed takeover of A&J Mucklow,

the specialist Midlands industrial owner and developer. The Trust

owned 5% of Mucklow. We opted for shares (rather than cash) in

Londonmetric as we are firm advocates of the management team and

the opportunities afforded in the merged vehicle.

Office markets across Europe continue to see rental growth. Our

overweight to Paris (Gecina, Covivio) and Stockholm (Fabege,

Kungsladen) added to performance but our underweight to Madrid and

Barcelona proved costly. Whilst we are very positive about the

outlook for both Spanish cities we focused our exposure through

Arima, the new vehicle of the Axiara management team. Axiara was

sold to Colonial in 2018 and was a successful investment for the

Trust. We are confident that they have invested the proceeds of the

IPO well but it will take time for the returns to materialise.

Central London's solid performance remains a conundrum and is

reviewed later in this report. Our overweight to decentralised

South East offices versus our underweight to Central London proved

a poor decision. However, I am confident that that has more to do

with illiquidity in the smaller companies which provide us with

that exposure, McKay Securities and CLS Holdings, than the health

of the underlying markets. In fact their relative undervaluation

provides an ongoing investment opportunity.

Offices

The resilience of the London office market in terms of both

rents and capital value stability continues to surprise us. Demand

remains broad based, particularly across tech and media industries.

Companies are happy to pay for quality and the premium rents

achieved on Grade A (new and refurbished) space have persisted. In

fact, the drought of new space has driven pre-lets (advance

commitments) to record levels. Investment appetite is driven by

expectations of sustainable rents with future growth prospects. As

a consequence investors remain active buyers. The difference

between 2018 and 2019 has been the resurgence of domestic interest

particularly in the City. However, the Brexit 'drag' has pulled

investment volumes lower with Savills year to date estimates of

GBP4.9bn in the City and GBP2.8bn in the West End both c50% below

the five year average.

The rise of the flexible office provider remains a key topic,

not least because of the travails of WeWork. Our view is that the

flexible space market share (currently c5% of floorspace in Central

London) will continue to grow. Tenants want the convenience and

tenure flex and are prepared to pay for it. WeWork has led the

space absorption charge, doubling its footprint each year since

2016. They are not alone and the difficulty for market observers is

getting a handle on the underlying occupancy of these types of

operators. WeWork et al will quickly cease acquiring space if they

cannot fill or make money from their current estates. We remain

cautious.

The picture across the largest cities in Continental Europe has

been similar but with particular strength in Paris, Amsterdam,

Madrid and Barcelona. Paris has year to date capital growth of 15%

in core CBD and even higher figures in some peripheral markets.

Underlying this is year on year rental growth of 5% to 7% across

all the Paris sub-markets. In Spain, CBRE reported the fastest take

up in Q3 for over 12 years. Vacancy has fallen a full percent to

8.7% in a year and prime rents reached EUR35.5 per sq m/per month

(+7.6% year on year). Rents have been stable in the big six German

cities with Berlin again reporting best in class growth.

Investment volumes in Paris have been lower than last year (but

that period was buoyed by the Terreis EUR1.4bn transaction).

Germany, Spain and Scandinavia all continue to attract global

capital however the Netherlands (-34%) and Ireland (-17%) both saw

falls in investment volumes between H1 2018 and H1 2019 according

to CBRE.

Retail

Retail property of all types (with the exception of well let

supermarkets) across Europe continue to suffer value degradation to

varying degrees. Matters remain most acute in the UK. The period

saw a number of high profile CVAs (company voluntary arrangements)

including the long anticipated Debenhams and Arcadia. The CVAs

provided a 'stay of execution' for both retailers with store

closures and large rent reductions but neither retailer's future is

assured. The twin headwinds of the online challenge and high

property taxes (rates) continue to batter the profitability of all

but best in class retailers. Overall, vacancy in UK retail reached

13%, the correction towards sustainable rental levels remains work

in progress. With concerns over the quality and depth of cashflow,

investors have not returned. Shopping centre transaction volumes

will be lower in 2019 than they were in 2018 which itself was a

previous record. The largest transaction was the sale by Intu of

its Derby centre. However, the buyer receives a priority income

stream and, therefore, the vendor was left with significant capital

risk if the rental income falls. A desperate transaction from the

seller's point of view. We expect Intu will be forced to raise

capital as its balance sheet deteriorates.

Whilst we have seen a number of retailer failures across

Continental Europe, particularly in the Netherlands, compared to

the UK numbers these have been modest. European retail rents are

generally much closer to sustainable levels. Whilst we see weakness

in headline rents, it is not on the scale of the UK. The market

share of online purchases is currently far lower than the UK but

investors expect the trend to online to accelerate as next day

delivery becomes more standard. It is no surprise that retail

investment has fallen 22% between H1 2018 and H1 2019 according to

CBRE. Spain, which has seen strong employment and wage growth was

the only country where investment volumes rose.

Distribution and Industrial

Occupier demand has remained robust in the UK even in the face

of the supply chain uncertainty surrounding Brexit. The first nine

months of 2019 saw take up reach 19.7m sq ft, just 10% down on last

year. DTRE, predicts that full year lease up will match the five

year average of 28m sq ft. Whilst this may only be matching the

average, these are huge numbers and reflect the scale of growth in

this key market. The supply response has been forthcoming and we

predict little rental growth in certain regions such as the East

Midlands where new supply is more than matching demand. Much hinges

on the Brexit outcome for this type of real estate. We continue to

favour the smaller, urban and suburban markets as opposed to the

larger 'big boxes'. Yields have stopped falling for this latter

group. However, the medium term outlook remains positive with the

ONS reporting that online retail accounted for 18% of total retail

sales in 2018. Forrester's (a research and consulting group)

forecast that it will reach 25% by 2023.

Continental Europe is a different story with Western Europe

averaging 10.2% but just 5% in Spain and Italy. With a relatively

nascent big box market, yields have historically been much higher

than the UK. We are confident that yield compression will remain an

attractive feature of almost all these markets. CBRE estimate that

EUR32bn of capital flowed into this subsector in the year to June

2019, a sum only just eclipsed by the same period a year earlier.

This year will exceed the 10 year average and this figure excludes

the largest single property transaction, Logicor, which alone

accounts for EUR12.2bn of logistics assets across Europe. The money

is following the rental growth. Spain saw prime logistics rents

rise 4% in H1 2019. In Dublin, the figure was 5%. Vacancy stands at

less than 5% in Germany, Sweden, Ireland and the Czech

Republic.

Analysis by Savills assessed the attractiveness of 32 European

countries across 23 different metrics. One of the conclusions

identified was the tipping point for rapid growth in ecommerce

logistics. Once online retail sales exceeded 11% of all sales,

there was a step change in logistics demand.

Residential

The private rental sector continues to flourish with demand

continuing to outstrip supply. The risk is not economic but

political. As detailed earlier, Berlin is experiencing an extreme

form of state intervention. Our view remains that the unique

history of this city, coupled with the unusual political structure

where the city and the state of Berlin are effectively one, makes

the likelihood of contagion to other German residential markets

low.

However, the speed of market driven rental growth and the social

sensitivity of this particular sector means that we must have a

constant eye on the risk of state intervention across Europe. We

remain more attracted to markets where there are already state

restrictions as this ensures that book values remain below rebuild

cost. The key is to ensure that the rent restrictions allow for

indexation and this makes these income streams very attractive. We

continue to favour Germany (ex-Berlin), Ireland and Sweden,

although the Swedish residential names have become expensive and we

have recently reduced exposure to those.

Alternatives

As mentioned earlier this group is now a core part of the

portfolio. Unite's purchase of Liberty Living was welcomed by the

market (us included). In fact, the Trust had committed to being a

cornerstone investor when the previous owners had considered

floating the business in 2015. Given the investor demand for this

asset class, we would expect more portfolios to seek a listing.

Healthcare remains popular, particularly where investors are

comfortable with the underlying tenant risk, and we have seen

strong performance from Assura and PHP with their direct

relationships with state healthcare bodies in the UK and Ireland.

The elderly care providers have seen more modest returns due to

concerns over certain operators' financial strength but it was good

to see Target Healthcare (a stock we hold) raise GBP80m in May.

Self-storage has also been a strong performer and we see an

increase in the use of short-term storage by commercial users. The

weakening in the London housing market has also enabled both Big

Yellow and Safestore to acquire sites which might have previously

been outbid by residential operators.

Debt and Equity Capital Markets

Refinancing and securing record low costs of debt remains a

popular activity for CFOs across the listed property sector. EPRA

recorded GBP12.6bn of debt raised in the period under review and

GBP15.3bn in the calendar year to date. This is a slightly lower

run rate than previous years but that is to be expected given how

much debt has been refinanced at these very low levels over the

last few years. We do continue to see record low costs of debt

being secured. By way of example, in October,

Unibail-Rodamco-Westfield priced a EUR750m 12-year bond at a fixed

annual coupon of 0.875%.

There were no IPOs in the period, however, we saw GBP3.7bn of

follow on capital raisings. These were dominated by businesses

raising capital to make corporate acquisitions. These included

Vonovia raising EUR744m to aid its acquisition of Victoria Park in

Sweden and Unite (GBP290m) to aid the purchase of Liberty Living.

Aedifica, the healthcare operator raised EUR600m to acquire a UK

portfolio (GBP450m) and aid expansion.

Aroundtown, the aggressively expanding German commercial and

residential investor, was the most prolific issuer of debt, raising

a total of EUR3.0bn in a mix of straight bonds, senior unsecured

and perpetual subordinated notes.

Property Shares

Property equity markets moved broadly sideways until late July

when the background (rumbling) noise of the Brexit debacle once

again rose in volume and pitch, driving investors away from UK

domestic stocks. Property companies are a disproportionately large

component of UK domestic 'baskets' due to their high level of GBP

earnings. UK property names which had been weakening over the

summer fell by 7.5% in the first two weeks of August. What was

almost more surprising was the subsequent rally which ran from 15th

August to 30th September adding 12.4% as investors changed their

views entirely with the incoming Prime Minister appearing to be

more determined than ever to drive matters to a conclusion, albeit

an unknown one. Broader markets also saw a strong style rotation

from 'growth' to 'value' and property names - seen as value plays -

were a beneficiary.

Once again the central banks have played a leading role in

investor behaviour. ECB President Draghi delivered his parting

shot, another rate cut and a renewed bond buying programme. More QE

saw the 10-year Bund yield fall to -0.6% at the end of September.

Property values with their long duration income profiles benefit

from these further falls in the cost of long-term financing.

Against this benign backdrop of positive macro policies, there

was a broad dispersion of fundamental real estate factors driving

performance at the sector and company level. The issues surrounding

retail property require no introduction. I have highlighted in

previous reports the differential in characteristics between UK

retail property and its Continental counterparts. These differences

particularly around greater affordability across Europe continue to

dominate. The essence is that the UK has a triple whammy of higher

rents, much higher property taxes (rates) and greater online

penetration. This continued to be reflected in the performance of

the respective retail landlords. The worst performing Continental

business, Vastned Retail, returned -15.6% versus -58.4% for Intu

and -19.6% for Capital & Regional. Klepierre returned +3.5%

whilst Hammerson returned -11.3%. The pattern of performance is

clear.

As mentioned in the summary, German residential has been a

stalwart sector for many years, growing in importance through

capital increases and M&A driven by excellent returns. The

Berlin political situation - which remains unresolved - rocked

investor confidence. There are three listed companies with high

exposure to the Berlin residential market, the largest Deutsche

Wohnen returned -20.6% and the smallest, Phoenix Spree -16.6%. We

are exposed to both these businesses but not ADO Properties which

returned -23.9%. These figures are all very disappointing but it is

worth reminding investors that the vast bulk of our German

residential exposure is through LEG (-0.9%) and Vonovia (+3.8%).

The weak returns from these stalwarts, who own thousands of

apartments across the whole of Germany, points to investors'

concerns. Nevertheless, their relative outperformance of the Berlin

names illustrates how investors see little chance of contagion from

the Berlin political process.

Scandinavia and Sweden in particular were strong performers in

the period. Almost all Nordic property companies operate with

higher leverage and shorter duration debt structures than the

average pan European property company. The consequence of the

dovish response by the Riksbank (mirroring the ECB) was to

supercharge earnings expectations and total returns with the

Swedish element of the benchmark returning 20.2% in the six months.

Residential names performed particularly well with Balder +25.1%

and Kojamo of Finland returning a hugely impressive 40%. Not only

have the underlying residential letting markets remained strong but

corporate activity provided reinforcing datapoints. Vovonia

acquired 61% of Hembla in a EUR1.1bn transaction adding to this

giant residential investor's expansion outside of Germany.

The industrial/logistics markets across Europe remain top of

investors shopping lists with all of our companies in this

preferred sector beating the benchmark. Standout performances came

from Catena (+28.4%) and WDP (+22.0%). In the UK, we saw strong

performances on the back of corporate activity with Londonmetric

acquiring A&J Mucklow in a part paper/part cash GBP415m deal.

The Trust owned 5% of Mucklow and enjoyed a tremendous return of

27.5% in the period with the transaction completing at the end of

June. Londonmetric has been a key holding for many years and we

welcome the increased scale together with the opportunities offered

by Mucklow's West Midlands assets.

Swiss property stocks draw investors in volatile times. The

uncertainty surrounding the global outlook as well as the ongoing

local issues in Europe resulted in the Swiss property companies

collectively returning +15% (in CHF) in the six months to

September.

Investment Activity

Turnover (purchases and sales divided by two) totalled GBP157.8m

equating to 12.0% of the average net assets over the period. This

compares to GBP122.7m in the same period last year and GBP138.8m

for the previous year. The increase compared to previous periods

reflects, in part, the block disposals following the privatisations

of Telford Homes (acquired in July by Trammel Crow part of the CBRE

group) and Green REIT (acquired in September by US private equity

Henderson Park).

Corporate activity has been a strong feature of the period as

noted earlier. Much more commercial property is owned privately

than publicly and, if public markets are going to insist on valuing

companies significantly below asset value, then private capital

will step in. Green REIT is a case in point, where the stock traded

between EUR1.30 and EUR1.60 per share for 4 years prior to the

Board announcing their intention to sell the business. The eventual

sale price was EUR1.94 per share.

In the logistics space, I reduced exposure to the UK names

particularly those with the greatest 'big box' exposure as share

prices moved to premiums to net asset values. I remain positive

about the prospects for the sector, particularly those with

development programmes in densely populated markets. I increased

our Continental European positions (Argan, Catena, VIB, Montea,

WDP) where all our positions have significant landbanks and where

we anticipate further yield tightening (capital values rising) just

as we have experienced in the UK.

As noted earlier, the vast majority of our German residential

exposure is outside of Berlin and this will remain the case as we

continue to absorb the impact of this historic state intervention

freezing rents for five years. I have, though, increased our

exposure to German commercial property through adding to VIB

Vermoegen (industrial), Sirius and CLS (offices) and Aroundtown

(all sectors). The latter has just agreed non-binding terms to

acquire a smaller competitor, TLG. The twist in this particularly

opaque saga is that TLG had already bought / committed to acquire,

for cash, up to 15% of Aroundtown owned by the founder, Yakir

Gabay. This represents 2/3 of his holding and TLG paid a hefty

premium to the share price. Minority shareholders will need to be

able to rely on a strong supervisory board going forward. Not as

easy as it sounds.

Revenue and Revenue Outlook

Earnings for the first half of the year increased by 7.7% over

the prior year first half to 9.96p per share. This reflected the

underlying earnings growth we have seen from our portfolio with a

little help from weakening sterling and a lower tax charge. Some

modest successes in reclaiming withholding tax together with

beneficial withholding tax rates on some of the dividends received

in the first half maintained the effective tax rate to around

10.5%, in line with the prior year. The prior year tax charge had

benefitted from some more significant withholding tax reclaims and

we anticipate a slightly higher effective tax rate in the second

half.

The fortunes of sterling remain a significant unknown with the

potential for change in either direction. Although 68% of our

projected non-sterling income has already been collected, foreign

exchange movements could still have a significant impact on the

revenue account. Another material factor will be the positioning of

the portfolio through the second half as we take into account

political events. This may also lead to a change in the gearing

levels which will have an impact upon the revenue account.

Gearing and Debt

Gearing at the end of September was modestly higher than at the

year-end, although this disguises activity in-between. Corporate

transactions delivered cash just ahead of the year end and, as I

wrote the Annual Report in May, this had not been re-invested given

the uncertain political outlook. Net investment increased over the

early part of summer with gearing moving from 10.0% to around 13.5%

but then was pulled back again towards the end of the period in

response to the dramatic rally in UK names from mid-August.

Essentially, I have been taking profits in the UK larger cap names

and reduced London exposure as share prices return to

pre-Referendum levels and the gearing level has ended the period at

just over 11%.

At the time of writing, we have just entered into a new loan

agreement with ICBC for a facility of GBP20m. This addition

diversifies our borrowing relationships, which we are always keen

to do, and gives us the capacity to effect gearing towards the

upper limit of our guidelines if deemed advantageous.

Direct Physical Portfolio

The physical property portfolio produced a total return of 1.2%

for the 6 months comprising a capital return of -0.5% and an income

return of 1.7%.

At the end of the period, Field House, Harlow was sold for

GBP10.5m, 3% ahead of book cost after all fees and rental top ups.

The price reflected a net initial yield of 7.7% and a capital value

of GBP170 per sq. ft and comes at the end of an intensive period of

asset management. We successfully completed the rent review of Teva

(the principal tenant) together with the letting of the vacant 1st

floor suite at a new record rent for the building.

Over the summer at The Colonnades in Bayswater, we completed the

separation and refurbishment/extension for the old public house and

flat above. We have created a modern, fully furnished 3 bed, 3 bath

flat with its own direct access. Previously, redundant space has

been incorporated to provide a cinema room. The property is on the

market to sell with a new long lease and early interest has been

positive. These works also included the external recladding of the

pub and we hope to find a new operator shortly.

The planning application for the redevelopment of our industrial

estate in Wandsworth remains with the Council for determination but

we are informed that it will go to the planning committee before

the Christmas break. The length of time it has taken to reach this

point in the planning application process (over a year) reflects

not only the scheme's size and complexity, but also how stretched

local authority planning teams are.

Outlook

The ongoing Brexit saga continues to dominate the outlook.

However, the country does appear to be inching towards an outcome

after three years of negotiation and Parliamentary stalemate.

Clarity will result in the release of pent up investment decisions.

This will aid property values as both tenants and investors commit

to transactions. Beyond that potential short term bounce, we remain

focused on the longer-term sector-focused dynamics which are

broadly the same as they were six months or a year ago. Retail

property (particularly in the UK) remains of deep concern. The

flipside of that coin - logistics - the reverse. However, equity

markets are now up with events with deep discounts applied to

retail names and premiums for logistics businesses. The largest

city office markets across Europe are set fair with few exhibiting

over supply. The private residential sector is also robust with

wage growth ensuring affordability, although the pace of rental

growth is a growing concern and (further) direct intervention (as

seen in Berlin), whilst unlikely, cannot be ruled out. The reality

of the situation is the acute shortage of accommodation as these

key cities grow and more rural areas

depopulate.

Underpinning all this commentary at the sector level is the

response of the central banks. Inflation expectations in the

Eurozone, a metric closely watched by the ECB's governing council,

fell to an all-time low in early October. The 'five-year, five year

inflation forward' which measures how much annual inflation markets

are pricing in starting in five years' time sank below 1.1%. With

this low level of inflation expectation, interest rates will remain

lower for longer and the hunt for income and yield is set to

continue. Real assets remain a good source of that income. The key

is in the assessment of that income quality.

Marcus Phayre-Mudge

Fund Manager

27 November 2019

GROUP STATEMENT OF COMPREHENSIVE INCOME

for the half year ended 30 September 2019

(Unaudited) (Unaudited) (Audited)

Half year ended Half year ended Year ended

30 September 2019 30 September 2018 31 March 2019

Revenue Capital Revenue Capital Revenue Capital

Return Return Total Return Return Total Return Return Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Income

Investment

income 31,141 - 31,141 30,130 - 30,130 44,771 - 44,771

Other operating

income 13 - 13 11 - 11 674 - 674

Gross rental

income 1,763 - 1,763 1,789 - 1,789 3,659 - 3,659

Service charge

income 1,039 - 1,039 928 - 928 1,608 - 1,608

Gains on

investments

held at fair

value - 79,313 79,313 - 66,774 66,774 - 96,594 96,594

Net movement

on foreign

exchange;

investments

and loan

notes - 6,881 6,881 - 1,491 1,491 - (1,463) (1,463)

Net movement

on foreign

exchange;

cash and

cash equivalents - (41) (41) - 1,320 1,320 - (508) (508)

Net returns

on contracts

for difference 4,365 (2,174) 2,191 3,038 (2,812) 226 6,469 (18,380) (11,911)

_____ _____ _____ _____ _____ _____ _____ _____ _____

Total income 38,321 83,979 122,300 35,896 66,773 102,669 57,181 76,243 133,424

_____ _____ _____ _____ _____ _____ _____ _____ _____

Expenses

Management

and performance

fees (note

2) (769) (4,390) (5,159) (760) (4,650) (5,410) (1,514) (10,653) (12,167)

Direct property

expenses,

rent payable

and service

charge costs (1,168) - (1,168) (1,007) - (1, 007) (1,940) - (1,940)

Other administrative

expenses (625) (302) (927) (604) (275) (879) (1,271) (564) (1,835)

_____ _____ _____ _____ _____ _____ _____ _____ _____

Total operating

expenses (2,562) (4,692) (7,254) (2,371) (4,925) (7,296) (4,725) (11,217) (15,942)

_____ _____ _____ _____ _____ _____ _____ _____ _____

Operating

profit 35,759 79,287 115,046 33,525 61,848 95,373 52,456 65,026 117,482

Finance costs (412) (1,236) (1,648) (405) (1,215) (1, 620) (851) (2,554) (3,405)

_____ _____ _____ _____ _____ _____ _____ _____ _____

Profit from

operations

before tax 35,347 78,051 113,398 33,120 60,633 93,753 51,605 62,472 114,077

Taxation (3,737) 1,954 (1,783) (3,783) 1,962 (1,821) (5,351) 3,479 (1,872)

_____ _____ _____ _____ _____ _____ _____ _____ _____

Total comprehensive

income 31,610 80,005 111,615 29,337 62,595 91,932 46,254 65,951 112,205

_____ _____ _____ _____ _____ _____ _____ _____ _____

Earnings

per Ordinary

share

(note 3) 9.96p 25.21p 35.17p 9.25p 19.72p 28.97p 14.58p 20.78 35.36p

The total column of this statement represents the Group's

Statement of Comprehensive Income, prepared in accordance with

IFRS. The revenue return and capital return columns are

supplementary to this and are prepared under guidance published by

the Association of Investment Companies. All items in the above

statement derive from continuing operations.

The Group does not have any other income or expense that is not

included in the above statement, therefore 'Total Comprehensive

Income' is also the profit for the period.

All income is attributable to the shareholders of the parent

company.

The final Ordinary dividend of 8.60p (2018: 7.55p) in respect of

the year ended 31 March 2019 was declared on 30 May 2019 (2018: 31

May 2018) and was paid on 30 July 2019 (2018: 31 July 2018). This

can be found in the Group Statement of Changes in Equity for the

half year ended 30 September 2019.

The interim Ordinary dividend of 5.20p (2019: 4.90p) in respect

of the year ended 31 March 2020 was declared on 28 November 2019

(2019: 22 November 2018) and will be paid on 7 January 2020 (2019:

2 January 2019).

GROUP AND COMPANY STATEMENT OF CHANGES IN EQUITY

Share Share Capital Retained

Capital Premium Redemption Earnings

For the half year ended Ordinary Account Reserve Ordinary Total

30 September 2019 (Unaudited) GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 31 March 2019 79,338 43,162 43,971 1,161,783 1,328,254

Net profit for the half

year - - - 111,615 111,615

Dividends paid - - - (27,292) (27,292)

_ _ __ _ _ __ _ _ __ _ _ __ _ _ __

At 30 September 2019 79,338 43,162 43,971 1,246,106 1,412,577

_ _ __ _ _ __ _ _ __ _ _ __ _ _ __

Share Share Capital Retained

Capital Premium Redemption Earnings

For the half year ended Ordinary Account Reserve Ordinary Total

30 September 2018 (Unaudited) GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 31 March 2018 79,338 43,162 43,971 1,089,088 1,255,559

Net profit for the half

year - - - 91,932 91,932

Dividends paid - - - (23,960) (23,960)

_ _ __ _ _ __ _ _ __ _ _ __ _ _ __

At 30 September 2018 79,338 43,162 43,971 1,157,060 1,323,531

_ _ __ _ _ __ _ _ __ _ _ __ _ _ __

Share Share Capital Retained

Capital Premium Redemption Earnings

For the year ended 31 March Ordinary Account Reserve Ordinary Total

2019 (Audited) GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 31 March 2018 79,338 43,162 43,971 1,089,088 1,255,559

Net profit for the year - - - 112,205 112,205

Dividends paid - - - (39,510) (39,510)

_ _ __ _ _ __ _ _ __ _ _ __ _ _ __

At 31 March 2019 79,338 43,162 43,971 1,161,783 1,328,254

_ _ __ _ _ __ _ _ __ _ _ __ _ _ __

GROUP BALANCE SHEET

as at 30 September 2019

30 September 30 September 31 March

2019 2018 2019

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

Non-current assets

Investments held

at fair value 1,423,356 1,339,652 1,291,442

Deferred taxation

asset 74 243 243

_________ _________ _________

1,423,430 1,339,895 1,291,685

Current assets

Debtors 70,503 41,874 54,892

Cash and cash equivalents 40,503 9,637 52,282

_________ _________ _________

111,006 51,511 107,174

Current liabilities (62,625) (8,340) (12,520)

_________ _________ _________

Net current assets 48,381 43,171 94,654

Total assets less

current liabilities 1,471,811 1,383,066 1,386,339

Non-current liabilities (59,234) (59,535) (58,085)

_________ _________ _________

Net assets 1,412,577 1,323,531 1,328,254

_________ _________ _________

Capital and reserves

Called up share

capital 79,338 79,338 79,338

Share premium account 43,162 43,162 43,162

Capital redemption

reserve 43,971 43,971 43,971

Retained earnings

(note 7) 1,246,106 1,157,060 1,161,783

_________ _________ _________

Equity shareholders'

funds 1,412,577 1,323,531 1,328,254

_________ _________ _________

Net asset value

per:

Ordinary share 445.12p 417.06p 418.54p

GROUP CASH FLOW STATEMENT

For the half year ended 30 September 2019

Half year ended Half year ended Year ended

30 September 30 September 31 March

2019 2018 2019

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

Reconciliation of profit

from operations before

tax to net cash inflow

from operating activities

Profit from operations

before tax 113,398 93,753 114,077

Finance costs 1,648 1,620 3,405

Gains on investments

and derivatives held

at fair value through

profit or loss (77,139) (63,962) (78,214)

Net movement on foreign

exchange; cash and cash

equivalents and loan

notes 1,191 (659) (292)

Decrease/(increase) in

accrued income 1,745 1,079 (1,129)

Increase in other debtors (16,618) (10,419) (18,350)

Decrease in other creditors (2,628) (5,116) (3,711)

Net (purchases)/sales

of investments (58,374) 51,124 115,685

Decrease/(increase) in

sales settlement debtor 3,583 (500) (3,334)

(Decrease)/ increase

in purchase settlement

creditor (1,474) 148 1,474

Scrip dividends included

in investment income (3,310) (7,748) (8,226)

Scrip dividends included

in net returns on contracts

for difference (439) (779) (936)

_________ _________ _________

Net cash (outflow)/inflow

from operating activities

before interest and taxation (38,417) 58,541 120,449

Interest paid (1,777) (1,600) (3,391)

Taxation paid (1,252) (1,778) (1,872)

_________ _________ _________

Net cash (outflow)/inflow

from operating activities (41,446) 55,163 115,186

Financing activities

Equity dividends paid (27,292) (23,960) (39,510)

Drawdown/(repayment)

of loans 57,000 (41,000) (41,000)

_________ _________ _________

Net cash from/(used in)

financing activities 29,708 (64,960) (80,510)

_________ _________ _________

(Decrease) /increase

in cash (11,738) (9,797) 34,676

Cash and cash equivalents

at start of the period 52,282 18,114 18,114

Net movement on foreign

exchange; cash and cash

equivalents (41) 1,320 (508)

_________ _________ _________

Cash and cash equivalents

at end of the period 40,503 9,637 52,282

_________ _________ _________

Note

Dividends received 38,185 34,176 46,249

Interest received 14 8 669

NOTES TO THE FINANCIAL STATEMENTS

1 Basis of accounting

The accounting policies applied in these interim financial statements

are consistent with those applied in the Company's most recent annual

financial statements. The financial statements have been prepared on

a going concern basis and in accordance with International Accounting

Standard (IAS) 34 'Interim Financial Reporting'.

The financial statements have also been prepared in accordance with

the Statement of Recommended Practice (SORP), "Financial Statements

of Investment Trust Companies and Venture Capital Trusts," issued in

October 2019, to the extent that it is consistent with IFRS.

The financial statements are presented in Sterling and all values are

rounded to the nearest thousand pounds (GBP'000) except where otherwise

indicated.

In accordance with IFRS 10 the Company has been designated as an investment

entity on the basis that:

* It obtains funds from investors and provides those

investors with investment management services;

* It commits to its investors that its business purpose

is to invest solely for returns from capital

appreciation and investment income; and

* It measures and evaluates performance of

substantially all of its investments on a fair value

basis.

Each of the subsidiaries of the Company was established for the sole

purpose of operating or supporting the investment operations of the

Company (including raising additional financing), and is not itself

an investment entity. IFRS 10 sets out that in the case of controlled

entities that support the investment activity of the investment entity,

those entities should be consolidated rather than presented as investments

at fair value. Accordingly, the Company has consolidated the results

and financial positions of those subsidiaries.

Subsidiaries are consolidated from the date of their acquisition, being

the date on which the Company obtains control, and continue to be consolidated

until the date that such control ceases. The financial statements of

subsidiaries used in the preparation of the consolidated financial

statements are based on consistent accounting policies. All intra-group

balances and transactions, including unrealised profits arising therefrom,

are eliminated. This is consistent with the presentation in previous

periods.

All the subsidiaries of the Company have been consolidated in these

financial statements.

IFRS 16 - Leases, which was effective from 1 January 2019, has been

applied in the preparation of the interim financial statements. The

application of the standard has not had any material impact on the

interim financial statements and the Group's leases continue to be

classified as operating leases with the leased assets recognised in

the Balance Sheet.

2 Management fees

(Unaudited) (Unaudited) (Audited)

Half year ended Half year ended Year ended

30 September 2019 30 September 2018 31 March 2019

Revenue Capital Revenue Capital Revenue Capital

Return Return Total Return Return Total Return Return Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Management

fee 769 2,306 3,075 760 2,281 3,041 1,514 4,543 6,057

Performance

fee - 2,084 2,084 - 2,369 2,369 - 6,110 6,110

_____ _____ _____ _____ _____ _____ _____ _____ _____

769 4,390 5,159 760 4,650 5,410 1,514 10,653 12,167

_____ _____ _____ _____ _____ _____ _____ _____ _____

A provision has been made for a performance fee based on the net assets

at 30 September 2019. No payment is due until the full year performance

fee is calculated at 31 March 2020.

3 Earnings per share

The earnings per Ordinary share can be analysed between revenue and

capital, as below.

Half year ended Half year Year ended

ended

30 September 30 September 31 March

2019

(Unaudited) 2018 2019

GBP'000 (Unaudited) (Audited)

GBP'000 GBP'000

Net revenue profit 31,610 29,337 46,254

Net capital profit 80,005 62,595 65,951

_______ _______ _________

Net total profit 111,615 91,932 112,205

_______ _______ _________

Weighted average number of Ordinary

shares in issue during the period 317,350,980 317,350,980 317,350,980

pence pence pence

Revenue earnings per Ordinary

share 9.96 9.25 14.58

Capital earnings per Ordinary

share 25.21 19.72 20.78

_______ _______ _________

Earnings per Ordinary share 35.17 28.97 35.36

_______ _______ _________

4 Changes in share capital

During the half year and since 30 September 2019, no Ordinary shares

have been purchased and cancelled.

As at 30 September 2019 there were 317,350,980 Ordinary shares (30

September 2018: 317,350,980; 31 March 2019: 317,350,980 Ordinary shares)

of 25p in issue.

5 Going concern

The directors believe that it is appropriate to adopt the going concern

basis in preparing the financial statements. The assets of the Company

consist mainly of securities that are readily realisable and, accordingly,

the Company has adequate financial resources to meet its liabilities

as and when they fall due and continue in operational existence for

the foreseeable future.

6 Fair value of financial assets and financial liabilities

Financial assets and financial liabilities are carried in the Balance

Sheet either at their fair value (investments) or the balance sheet

amount is a reasonable approximation of fair value (due from brokers,

dividends and interest receivable, due to brokers, accruals and cash

at bank).

Fair value hierarchy disclosures

The table below sets out fair value measurements using IFRS 13 fair

value hierarchy.

Financial assets/(liabilities) at fair value through profit and loss

Level 1 Level 2 Level 3 Total

At 30 September 2019 GBP'000 GBP'000 GBP'000 GBP'000

Equity investments 1,332,042 - 377 1,332,419

Investment properties - - 90,937 90,937

Contracts for difference - 4,139 - 4,139

_______ _______ _______ _______

1,332,042 4,139 91,314 1,427,495

_______ _______ _______ _______

Level 1 Level 2 Level 3 Total

At 30 September 2018 GBP'000 GBP'000 GBP'000 GBP'000

Equity investments 1,241,068 - 258 1,241,326

Investment properties - - 98,326 98,326

Contracts for difference - (1,743) - (1,743)

Foreign exchange forward

contracts - (781) - (781)

_______ _______ _______ _______

1,241,068 (2,524) 98,584 1,337,128

_______ _______ _______ _______

Level 1 Level 2 Level 3 Total

At 31 March 2019 GBP'000 GBP'000 GBP'000 GBP'000

Equity investments 1,189,136 - 377 1,189,513

Investment properties - - 101,929 101,929

Contracts for difference - (3,210) - (3,210)

Foreign exchange forward

contracts - 1,969 - 1,969

_______ _______ _______ _______

1,189,136 (1,241) 102,306 1,290,201

_______ _______ _______ _______

Categorisation within the hierarchy has been determined on the basis

of the lowest level input that is significant to the fair value measurement

of the relevant asset as follows:

Level 1 - valued using quoted prices in an active market for identical

assets.

Level 2 - valued by reference to valuation techniques using observable

inputs other than quoted prices within level 1.

Level 3 - valued by reference to valuation techniques using inputs

that are not based on observable market data.

Contracts for Difference are synthetic equities and are valued by reference

to the investments' underlying market values.

Valuations of Investment Properties - Level 3

The Group carries its investment properties at fair value in accordance

with IFRS 13, revalued twice a year, with changes in fair values being

recognised in the Group Statement of Comprehensive Income. The Group

engaged Knight Frank LLP as independent valuation specialists to determine

fair value as at 30 September 2019.

Determination of the fair value of investment properties has been prepared

on the basis defined by the RICS Valuation Professional Standards,

Global & UK Edition, January 2014 (The Red Book) as follows:

"The estimated amount for which an asset or liability should exchange

on the valuation date between a willing buyer and a willing seller

in an arm's length transaction after proper marketing wherein the parties

had each acted knowledgeably, prudently and without compulsion."

The valuation takes into account future cash flow from assets (such

as lettings, tenants' profiles, future revenue streams, capital values

of fixtures and fittings, plant and machinery, any environmental matters

and the overall repair and condition of the property) and discount

rates applicable to those assets. These assumptions are based on local

market conditions existing at the balance sheet date.

In arriving at their estimates of fair values as at 30 September 2019,

the valuers have used their market knowledge and professional judgement

and have not only relied solely on historical transactional comparables.

Reconciliation of movements in Financial assets categorised as level

3

31 March Appreciation/ 30 September

At 30 September 2019 Purchases Sales (Depreciation) 2019

2019 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------ ---------- ------------------ ------------------- ---------------------

Unlisted equity

investments 377 - - - 377

_______ _______ _______ _______ _______

Investment properties

* Mixed use 54,962 334 (749) (867) 53,680

* Office & Industrial 46,967 232 (10,284) 342 37,257

_______ _______ _______ _______ _______

101,929 566 (11,033) (525) 90,937

_______ _______ _______ _______ _______

102,306 566 (11,033) (525) 91,314

================== ========== ================== =================== =====================

Transfers between hierarchy levels

There were no transfers between any levels during the period.

Sensitivity information

The significant unobservable inputs used in the fair value measurement

categorised within Level 3 of the fair value hierarchy of investment

properties are:

* Estimated rental value: GBP5 - GBP50 per sq ft

* Capitalisation rates: 3.20% - 6.50%

Significant increases (decreases) in estimated rental value and rent

growth in isolation would result in a significantly higher (lower)

fair value measurement. A significant increase (decrease) in capitalisation

rates in isolation would result in a significantly lower (higher) fair

value measurement.

Gains on investments held at fair value

Half year ended Half year ended Year ended

30 September 30 September 31 March

2019

(Unaudited) 2018 2019

GBP'000 (Unaudited) (Audited)

GBP'000 GBP'000

Gains on sale of investments 6,300 37,253 79,858

Movement in investment

holding gains 73,013 29,521 16,736

_______ _______ _______

Gains on investments held

at fair value 79,313 66,774 96,594

_______ _______ _______

The Group received GBP92,995,000 (30 September 2018: GBP118,318,000)

and (31 March 2019: GBP246,467,000) from investments sold in the period.

The book cost of these investments when they were purchased was GBP86,695,000

(30 September 2018: GBP81,065,000) and (31 March 2019: GBP166,609,000).

These investments have been revalued over time and until they were

sold, any unrealised gains/losses were included in the fair value of

the investments.

Loan Notes

On 10 February 2016, the Company issued 1.92% Unsecured Euro 50,000,000

Loan Notes and 3.59% Unsecured GBP 15,000,000 Loan Notes which are

due to be redeemed at par on 10 February 2026 and 10 February 2031

respectively.

The fair value of the 1.92% Euro Loan Notes at 30 September 2019 was

GBP44,429,000 (30 September 2018: GBP44,663,000) and (31 March 2019:

GBP43,255,000).

The fair value of the 3.59% GBP Loan Notes at 30 September 2019 was

GBP15,566,000 (30 September 2018: GBP15,154,000) and (31 March 2019:

GBP15,373,000).

Using the IFRS 13 fair value hierarchy the Loan Notes are deemed to

be categorised within Level 2.

The loan notes agreement requires compliance with a set of financial

covenants, including:

* Total Borrowings shall not exceed 33% of Adjusted Net

Asset Value;

* the Adjusted Total Assets shall at all times be

equivalent to a minimum of 300% of Total Borrowings;

and

* the Adjusted NAV shall not be less than

GBP260,000,000.

The Company and Group complied with the terms of the loan notes agreement

throughout the year.

Multi-currency revolving loan facilities

The Group also has unsecured, multi-currency, revolving short-term

loan facilities totalling GBP65,000,000 (30 September 2018: GBP65,000,000)

and (31 March 2019: GBP65,000,000). At 30 September 2019, GBP57,000,000

was drawn on these facilities (30 September 2018: GBPnil) and (31 March

2019: GBPnil). The fair value is considered to approximate the carrying

value and the interest is paid at a margin over LIBOR.

Subsequent to 30 September 2019 the Group has entered into a new loan

agreement for a facility of GBP20,000,000.

7 Retained Earnings

Half year ended Half year ended Year ended

30 September 30 September 31 March

2019

(Unaudited) 2018 2019

GBP'000 (Unaudited) (Audited)

GBP'000 GBP'000

Investment holding gains 479,787 432,057 402,635

Realised capital reserves 691,839 656,208 688,986

_______ _______ _______

1,171,626 1,088,265 1,091,621

Revenue reserve 74,480 68,795 70,162

_______ _______ _______

1,246,106 1,157,060 1,161,783

_______ _______ _______

8 Related Party Transactions

There have been no material related party transactions during the period

and no changes to related parties.

During the period Thames River Capital charged management fees as detailed

in Note 2.

The remuneration of the directors has been determined in accordance

with rates outlined in the Directors' Remuneration Report in the Annual

Financial Statements.

9 Comparative information

The financial information contained in this Half-Yearly Financial Report

does not constitute statutory accounts as defined in section 435(1)

of the Companies Act 2006. The financial information for the half year

periods ended 30 September 2019 and 30 September 2018 has not been

audited or reviewed by the Group auditors. The figures and financial

information for the year ended 31 March 2019 are an extract from the

latest published accounts and do not constitute statutory accounts

for that year. Those accounts have been delivered to the Registrar

of Companies and include the report of the auditors, which was unqualified

and did not contain a statement under either section 498(2) or 498(3)

of the Companies Act 2006.

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014). Upon the

publication of this announcement via Regulatory Information Service

this inside information is now considered to be in the public

domain.

Disclaimer

The loan notes have not been and will not be registered under

the U.S. Securities Act of 1933, as amended (the "Act") and may not

be offered or sold in the United States absent registration or an

applicable exemption from the registration requirements of the Act.

This notice is for information only, does not constitute an offer

to sell or the solicitation of an offer to buy any security and

shall not constitute an offer, solicitation or sale of any

securities in any jurisdiction in which such offer, solicitation or

sale would be unlawful.

This announcement and the information contained herein is not

for publication, distribution or release in, or into, directly or

indirectly, the United States, Canada, Australia or Japan and does

not constitute, or form part of, an offer of securities for sale in

or into the United States, Canada, Australia or Japan.

The securities referred to in this announcement have not been

and will not be registered under the U.S. Securities Act of 1933,

as amended (the "Securities Act") and may not be offered or sold in

the United States unless they are registered under the Securities

Act or pursuant to an available exemption therefrom. The Company

does not intend to register any portion of securities in the United

States or to conduct a public offering of the securities in the

United States. The Company will not be registered under the U.S.

Investment Companies Act of 1940, as amended, and investors will

not be entitled to the benefits of that Act.

This announcement does not constitute an offer to sell or the

solicitation of an offer to buy, nor shall there be any sale of the

securities referred to herein in any jurisdiction in which such

offer, solicitation or sale would be unlawful prior to

registration, exemption from registration or qualification under

the securities law of any such jurisdiction.

The contents of this announcement include statements that are,

or may be deemed to be "forward-looking statements". These

forward-looking statements can be identified by the use of

forward-looking terminology, including the terms "believes",

"estimates", "anticipates", "expects", "intends", "may", "will" or

"should". They include the statements regarding the target

aggregate dividend. By their nature, forward-looking statements

involve risks and uncertainties and readers are cautioned that any

such forward-looking statements are not guarantees of future

performance. The Company's actual results and performance may

differ materially from the impression created by the

forward-looking statements. The Company undertakes no obligation to

publicly update or revise forward-looking statements, except as may

be required by applicable law and regulation (including the Listing

Rules). No statement in this announcement is intended to be a

profit forecast.

For further information please contact:

Marcus Phayre-Mudge

Fund Manager

TR Property Investment Trust plc

Telephone: 020 7011 4711

Jo Elliott

Finance Manager and Investor Relations

TR Property Investment Trust plc

Telephone: 020 7011 4710

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR LLFEDLALTFIA

(END) Dow Jones Newswires

November 28, 2019 13:10 ET (18:10 GMT)

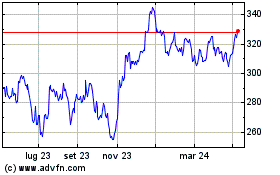

Grafico Azioni Tr Property Investment (LSE:TRY)

Storico

Da Mar 2024 a Apr 2024

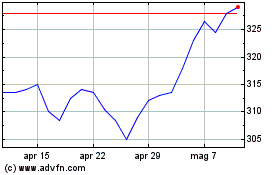

Grafico Azioni Tr Property Investment (LSE:TRY)

Storico

Da Apr 2023 a Apr 2024