TIDMATM

RNS Number : 1812V

AfriTin Mining Ltd

29 November 2019

AfriTin Mining Limited

("AfriTin" or the "Company" and with its subsidiaries the

"Group")

Unaudited Interim Results

for the six months ended 31 August 2019

Chief Executive Officer's Statement

Introduction

I am pleased to report another busy period for the company. The

first half of this financial year has been marked by the Company

reaching several key milestones that have successfully propelled

AfriTin from a tin-development business into a tin-producing

business with development assets. There has been significant work

on the ground at our flagship Uis tin mine in Namibia, and with the

initial construction phase achieved, our efforts are now focused on

the final commissioning of the mine ahead of the highly anticipated

first shipment of tin concentrate.

Review of the business

As we have communicated to shareholders, the main objective for

the AfriTin team for the financial year was centered around first

material through the Phase 1 Pilot Plant. Our efforts culminated in

the production of tin concentrate in August 2019, which marked the

first significant material produced since the closure of the mine

almost 30 years ago. This is a major milestone for the Company as

we are now operating a tin-producing mine, which is testament to

the skill and hard work of the entire AfriTin team. The Company's

focus now moves to the ramp-up phase, with the intention of

ultimately treating 500 000 tonnes of ore per annum which would

yield approximately 800 tonnes of tin concentrate annually. This

achievement would then provide a platform to focus on the

feasibility study for the larger Phase 2 expansion at Uis which is

anticipated to see annual production capacity increase to 5 000

tonnes of tin concentrate per annum.

Concurrent with the development of the Phase 1 Pilot Plant, the

Company embarked on a resource drilling programme at Uis. The

purpose of the drilling programme was to validate tonnages and

grades to be able to report a JORC-compliant mineral resource of

the V1/V2 pegmatite body. This drilling programme was completed in

May, and in October 2019, post period end, the Company was pleased

to publish a maiden Measured, Indicated and Inferred Mineral

Resource estimate, prepared in accordance with JORC (2012), of

71.54 million tonnes of ore at a grade of 0.134% tin for 95 539

tonnes of contained tin (see announcement of 16 September 2019).

This maiden resource estimate confirmed the historical data, with

the additional down-dip drilling confirming extension and

thickening of the orebody at depth, increasing the resource

historically stated by SRK (1989). Of particular interest is the

addition of tantalum and lithium to the estimate which could

provide additional revenue streams in the future.

We look forward to progressing these studies, further

understanding the economic viability, and updating the market in

due course.

In May 2019 the Company announced the conclusion of an

electrical power supply agreement for its mining and processing

facility at Uis. The agreement provides for the full on-site power

requirements of the Phase 1 mining and processing facility. The

conclusion of this agreement is an important step in the

progression of the Uis project and will provide reliable energy to

site, improve the planned cost structure, and further support the

economic viability of our mine.

To bring the plant into production, complete the drilling

programme, and provide further capital for the ramp-up phase, the

Company sourced additional funding during the period by way of

GBP3m equity financing and a ZAR30m standby working capital

facility with Bushveld Minerals. This standby working capital

facility was then amended to rather provide surety for a N$35

million (c. GBP2.4m) working capital facility received from Nedbank

Namibia. At the same time, the Company entered into an offtake

agreement with Thailand Smelting and Refining Co., Limited

("Thaisarco") enabling AfriTin to sell its tin concentrate and

secure revenue for 12 months with an option to extend the contract.

We believe this agreement, along with the funding secured from

Nedbank Namibia, signalled a vote of confidence in the long-term

development of Uis and the strategy of AfriTin as a whole. We are

grateful to our shareholders, our new offtake partner and Nedbank

for their support in this regard.

On 26 November 2019 (after the period end), AfriTin raised

GBP3.8m through the issuing of 38 convertible loan notes of

GBP100,000 each (the "Notes"). The Notes have a term of 18 months

and attract interest at a rate of 10% per annum which is payable on

the redemption or conversion of the Notes. The Notes, including the

total amount of accrued but unpaid interest, are convertible at the

conversion price of 4p per share. The Notes can be redeemed at any

time at the election of the Company, after 10 business days' notice

of such intention, in whole or in part, if not already converted by

the noteholder and subject to the application of an early

redemption premium of 10%.

Today, the Company will be making its first shipment of tin

concentrate to Thaisarco from the Uis tin mine. The first shipment

of product is an exciting stage as we demonstrate proof of concept

and move into a revenue-generating phase. We look forward to

upscaling the sizes of the shipments going forward as we ramp up

phase 1 production.

Outlook

After a successful six months, the Directors believe the Company

is well positioned for the next six months. The directors remain

committed to becoming the African tin champion on AIM through a

two-phased strategy: finalising the proof of concept while

expanding the size and scope of the existing portfolio; and

leveraging the production profile to expand the operations of the

business.

Anthony Viljoen, CEO

For further information, please visit www.afritinmining.com or

contact:

AfriTin Limited

Anthony Viljoen, CEO +27 (11) 268 6555

Nominated Adviser and Joint Broker

WH Ireland Limited

Katy Mitchell

Adrian Hadden

James Sinclair-Ford +44 (0) 207 220 1666

Corporate Advisor and Joint Broker

Hannam & Partners

Andrew Chubb

Jay Ashfield

Nilesh Patel +44 (0) 20 7907 8500

Joint Broker

NOVUM Securities Limited

Jon Belliss +44 (0)20 7399 9400

Financial PR (United Kingdom)

Tavistock

Jos Simson

Barney Hayward +44 (0) 207 920 3150

CONSOLIDATED STATEMENT OF COMPREHENSIVE Income

For the 6 months ended 31 August 2019

6 months 6 months 12 months

ended ended ended

31 August 31 August 28 February

2019 2018 2019

(unaudited) (unaudited) (audited)

Note GBP GBP GBP

Continuing operations

Revenue - 15 584 26 782

(1 097

Administrative expenses 5 (615 516) (447 505) 718)

-------------- ------------- ---------------------

(1 070

Operating loss (615 516) (431 921) 936)

Finance income 3 749 - 13 416

Finance charges (15 346) - -

-------------- -------------

(1 057

Loss before tax (627 113) (431 921) 520)

Income tax expense 6 - - -

-------------- ------------- ---------------------

(1 057

Loss for the period (627 113) (431 921) 520)

Other comprehensive income

Items that will or may be reclassified

to profit or loss:

Exchange differences on translation

of share-based payment reserve 222 - (1 577)

Exchange differences on translation

of foreign operations (31 697) (476 000) (421 827)

Exchange differences on non-controlling

interest (21) - 332

(1 480

Total comprehensive income for the period (658 609) (907 921) 592)

============== ============= =====================

Loss for the period attributable to:

(1 050

Owners of the parent (624 551) (428 951) 074)

Non-controlling interests (2 562) (2 970) (7 446)

-------------- -------------

(1 057

(627 113) (431 921) 520)

============== ============= =====================

Total comprehensive loss for the period

attributable to:

(1 473

Owners of the parent (656 027) (905 296) 478)

Non-controlling interests (2 582) (2 625) (7 114)

-------------- ------------- ---------------------

(1 480

(658 609) (907 921) 592)

============== ============= =====================

Loss per ordinary share

Basic and diluted loss per share (in

pence) (0.10) (0.11) (0.23)

Consolidated Statement of Financial Position

As at 31 August 2019

Company number: 63974

31 August 31 August 28 February

2019 2018 2019

(unaudited) (unaudited) (audited)

Note GBP GBP GBP

Assets

Non-current assets

Intangible assets: exploration 6 140 7 012

and evaluation 8 7 596 732 243 317

1 552 5 785

Property, plant and equipment 9 9 333 036 655 043

-----------

16 929 7 692 12 797

Total non-current assets 768 898 360

=========== ============ =============

Current assets

Inventories 26 441 - 25 221

Trade and other receivables 10 992 390 223 424 474 963

6 653 1 781

Cash and cash equivalents 130 635 229 335

-----------

6 876 2 281

Total current assets 1 149 465 653 519

=========== ============ =============

18 079 14 569 15 078

Total assets 234 551 879

=========== ============ =============

Equity and liabilities

Equity

20 223 16 533 17 337

Share capital 13 173 136 718

(1 962 (2 583

Accumulated deficit (3 210 518) 415) 538)

Warrant reserve 78 651 29 783 78 651

Share-based payment reserve 264 671 - 220 729

Foreign currency translation

reserve (453 523) (476 345) (421 827)

-----------

Equity attributable to the owners 16 902 14 124 14 631

of the parent 454 159 733

----------- ------------ -------------

Non-controlling interests (10 067) (2 995) (7 484)

----------- ------------ -------------

16 892 14 121 14 624

Total equity 387 164 249

=========== ============ =============

Non-current liabilities

Environmental rehabilitation

liability 14 75 600 - 75 180

Lease liability 262 475 - -

----------- ------------ -------------

Total non-current liabilities 338 075 - 75 180

=========== ============ =============

Current liabilities

Trade and other payables 12 763 307 448 387 379 450

Working capital facility 11 85 465

----------- ------------ -------------

Total current liabilities 848 772 448 387 379 450

=========== ============ =============

18 079 14 569 15 078

Total equity and liabilities 234 551 879

=========== ============ =============

The financial statements were authorised and approved for issue

by the Board of Directors and authorised for issue on 29 November

2019.

AR VILJOEN

Director

29 November 2019

Consolidated Statement of Changes in Equity

For the 6 months ended 31 August 2019

Foreign

Share-based currency

Share Accumulated Warrant payment translation Non-controlling Total

capital deficit reserve reserve reserve Total interests equity

GBP GBP GBP GBP GBP GBP GBP GBP

Total equity

at 28

February

2018 10 853 631 (1 533 464) 29 783 - - 9 349 950 (370) 9 349 580

Loss for the

year (1 050 074) - - - (1 050 074) (7 445) (1 057 519)

Other

comprehensive

income - - (1 577) (421 827) (423 404) 332 (423 072)

Transactions

with owners:

Warrants

granted in

period (48 868) - 48 868 - - - - -

Share-based

payments in

the period - - 222 306 - 222 306 - 222 306

Issue of

shares 6 858 813 - - - - 6 858 813 - 6 858 813

Share issue

costs (325 858) - - - - (325 858) - (325 858)

----------- --------------- ----------- ------------ ------------ --------------- ---------------- ---------------

Total equity

at 28

February 14 631 14 624

2019 17 337 718 (2 583 538) 78 651 220 729 (421 827) 733 (7 483) 250

----------- --------------- ----------- ------------ ------------ --------------- ---------------- ---------------

Effect of

adoption of

IFRS 16 - (2 482) - - - (2 482) -

----------- --------------- ----------- ------------ ------------ --------------- ---------------- ---------------

1 March 2019

as restated 17 337 718 (2 586 020) 78 651 220 729 (421 827) 14 629 251 (7 483) 14 621 768

----------- --------------- ----------- ------------ ------------ --------------- ---------------- ---------------

Loss for the

period - (624 551) - - - (624 551) (2 562) (627 113)

Prior year

IFRS 16

adjustment - (2 428) (2 428) (2 428)

Other

comprehensive

income - - - 222 (31 697) (31 475) (21) (31 496)

Transactions

with owners:

Share-based

payments in

the period - - - 43 720 - 43 720 43 720

Issue of

shares 2 988 392 - - - - 2 988 392 - 2 988 392

Share issue

costs (102 937) - - - - (102 937) - (102 937)

----------- --------------- ----------- ------------ ------------ --------------- ---------------- ---------------

Total equity

at 31 August 16 902 16 892

2019 20 223 173 (3 210 518) 78 651 264 671 (453 523) 454 (10 067) 387

=========== =============== =========== ============ ============ =============== ================ ===============

Consolidated Statement of Cash Flows

For the 6 months ended 31 August 2019

Period ended Period ended Period ended

31 August 31 August 28 February

2019 2018 2019

(unaudited) (unaudited) (audited)

Note GBP GBP GBP

Cash flows from operating activities

(1 057

Loss before taxation (627 112) (431 921) 520)

Adjustments for:

Depreciation property, plant and

equipment 9 61 126 1 965 22 824

Share-based payments 43 720 - 205 962

Finance income (3 749) - (13 416)

Changes in working capital:

(Increase) in receivables (519 580) (101 737) (379 245)

(Increase) in inventory (1 087) (67 720) (26 222)

Increase / (decrease) in payables 384 405 - (119 708)

------------ ------------ ------------

(1 367

Net cash used in operating activities (662 278) (599 413) 325)

------------ ------------ ------------

Cash flows from investing activities

Finance income 3 749 - 13 416

Purchase of exploration and evaluation

assets 8 (578 252) (90 629) (570 767)

Purchase of property, plant and (4 901

equipment 9 (3 346 592) (1 200 677) 993)

------------ ------------ ------------

(5 459

Net cash used in investing activities (3 921 095) (1 291 306) 344)

------------ ------------ ------------

Cash flows from financing activities

5 682

Net proceeds from issue of shares 2 885 455 5 679 505 954

------------ ------------ ------------

Net proceeds from drawdown on

working capital facility 85 465

------------ ------------ ------------

Net cash generated from financing 5 682

activities 2 970 920 5 679 505 954

------------ ------------ ------------

Net (decrease)increase in cash (1 143

and cash equivalents (1 612 453) 3 788 786 715)

Cash and cash equivalents at the beginning 2 904

of the period 1 781 335 2 904 767 767

Foreign exchange differences (38 247) (40 324) 20 283

------------ ------------

Cash and cash equivalents at the 1 781

end of the period 130 635 6 653 229 335

------------ ------------ ------------

Notes to the consolidated financial statements

For the 6 months ended 31 August 2019

1. Corporate information and principal activities

AfriTin Mining Limited ("AfriTin") was incorporated and

domiciled in Guernsey on 1 September 2017, and admitted to the AIM

market in London on 9 November 2017. The company's registered

office is 18-20 Le Pollet, St Peter Port, Guernsey, GY1 1WH.

These financial statements are for the 6-month period ended 31

August 2019 and the comparative figures for the 6-month period

ended 31 August 2018 and for the year ended 28 February 2019 are

shown.

The AfriTin Group comprises AfriTin Mining Limited and its

subsidiaries as noted below.

AfriTin Mining Limited ("AML") is an investment holding company

and holds 100% of Guernsey subsidiary, Greenhills Resources Limited

("GRL").

GRL is an investment holding company that holds investments in

resource-based tin and tantalum exploration companies in Namibia

and South Africa. The Namibian subsidiary is AfriTin Mining

(Namibia) Pty Limited ("AfriTin Namibia"), in which GRL holds 100%

equity interest. The South African subsidiaries are Mokopane Tin

Company Pty Limited "Mokopane" and Pamish Investments 71 Pty

Limited "Pamish 71", in which GRL holds 100% equity interest.

AfriTin Namibia owns an 85% equity interest in Uis Tin Mine

Company Pty Limited "Uis Tin Mine". The minority shareholder in Uis

Tin Mine is The Small Miners of Uis who own 15%.

Mokopane owns a 74% equity interest in Renetype Pty Limited

"Renetype" and a 50% equity interest in Jaxson 641 Pty Limited

"Jaxson".

The minority shareholders in Renetype are African Women

Enterprises Investments Pty Limited and Cannosia Trading 62 CC who

own 10% and 16% respectively.

The minority shareholder in Jaxson is Lerama Resources Pty

Limited who owns a 50% interest in Jaxson.

Pamish 71 owns a 74% interest in Zaaiplaats Mining Pty Limited

"Zaaiplaats". The minority shareholder in Zaaiplaats is Tamiforce

Pty Limited who owns 26%.

AML owns 100% of Tantalum Investment Pty Limited, a company

containing Namibian exploration licenses EPL5445 and EPL5670 for

the exploration of tin, tantalum and other associated minerals.

As at 31 August 2019, the AfriTin Group comprised:

Equity holding

and voting Country

Company rights of incorporation Nature of Activities

Ultimate Holding

AfriTin Mining Limited N/A Guernsey Company

Greenhills Resources Limited

(1) 100% Guernsey Holding Company

AfriTin Mining Pty Limited

(1) 100% South Africa Group support services

Tantalum Investment Pty Tin & Tantalum

Limited (1) 100% Namibia Exploration

AfriTin Mining (Namibia) Tin & Tantalum

Pty Limited (2) 100% Namibia Exploration

Uis Tin Mine Company Pty Tin & Tantalum

Limited (3) 85% Namibia Exploration

Mokopane Tin Company Pty

Limited (2) 100% South Africa Holding Company

Tin & Tantalum

Renetype Pty Limited (4) 74% South Africa Exploration

Tin & Tantalum

Jaxson 641 Pty Limited (4) 50% South Africa Exploration

Pamish Investments 71 Pty

Limited (2) 100% South Africa Holding Company

Zaaiplaats Mining Pty Limited

(5) 74% South Africa Property Owning

(1) Held directly by AfriTin Mining Limited

(2) Held by Greenhills Resources Limited

(3) Held by AfriTin Mining (Namibia) Pty Limited

(4) Held by Mokopane Tin Company Pty Limited

(5) Held by Pamish Investments 71 Pty Limited

These financial statements are presented in Pound Sterling (GBP)

because that is the currency in which the Group has raised funding

on the AIM market in the United Kingdom. Furthermore, Pound

Sterling (GBP) is the functional currency of the ultimate holding

company, AfriTin Mining Limited.

2. Significant accounting policies

Basis of accounting

The interim financial statements have been prepared using

measurement and recognition criteria based on International

Financial Reporting Standards (IFRS and IFRIC interpretations)

issued by the International Accounting Standards Board (IASB) as

adopted for use in the EU. The interim financial information has

been prepared using the accounting policies which will be applied

in the Group's statutory financial statements for the year ended 28

February 2020 and which were applied in the Group's statutory

financial statements for the year ended 28 February 2019.

The Group has adopted the standards, amendments and

interpretations effective for annual periods beginning on or after

1 March 2019. Apart from IFRS 16, the adoption of these standards

and amendments did not have a material effect on the financial

statements of the Group. See Note 3.

The interim financial information for the six months to 31

August 2019 is unaudited and does not constitute statutory

financial information. The statutory accounts for the year ended 28

February 2019 are available on the Company's website. The auditors'

report on those accounts was unqualified.

The consolidated financial statements have been prepared under

the historical cost convention. The preparation of financial

statements in conformity with IFRS requires the use of certain

critical accounting estimates. It also requires management to

exercise judgement in the process of applying the Group's

accounting policies. The areas involving a higher degree of

judgement or complexity and areas where assumptions and estimates

are significant to the consolidated financial statements are

discussed in further detail in this note.

Going concern

These financial statements have been prepared on the basis of

accounting principles applicable to a going concern which assumes

the Company will be able to continue in operation for the

foreseeable future and will be able to realize its assets and

discharge its liabilities in the normal course of operations.

The Company has incurred operating losses to date and currently

has no source of consistent revenues. The ability of the Company to

continue as a going concern is dependent on the ability to raise

additional capital to explore and develop its mineral properties.

However, should additional capital not be available, the Company

may be unable to continue as a going concern.

The directors are confident of raising additional capital based

on market conditions and previous experience to continue as a going

concern. No adjustments have been made relating to the

recoverability and classification of recorded asset amounts and

classification of liabilities that might be necessary should the

combined group not continue as a going concern.

Critical accounting estimates and judgements

In the application of the Group's accounting policies, the

Directors are required to make judgements, estimates and

assumptions about the carrying amounts of assets and liabilities

that are not readily apparent from other sources. The estimates and

associated assumptions are based on historical experience and other

factors that are considered to be relevant. Actual results may

differ from these estimates.

The estimates and assumptions that have a significant risk of

causing a material adjustment to the carrying amounts of the assets

and liabilities within the next financial year are addressed

below.

Impairment of exploration & evaluation assets

Determining whether an exploration and evaluation asset is

impaired requires an assessment of whether there are any indicators

of impairment, including by reference to specific impairment

indicators prescribed in IFRS 6 "Exploration for and Evaluation of

Mineral Resources". If there is any indication of potential

impairment, an impairment test is required based on value-in-use of

the asset. The valuation of intangible exploration assets is

dependent upon the discovery of economically recoverable deposits

which, in turn, is dependent on future tin prices, future capital

expenditures and environmental, regulatory restrictions and the

successful renewal of licenses. The directors have concluded that

there are no indications of impairment in respect of the carrying

value of intangible assets at 31 August 2019 based on planned

future development of the projects and current and forecast tin

prices. Exploration and evaluation assets are disclosed fully in

Note 8.

3. Adoption of new and revised standards

Certain new standards, amendments and interpretations to

existing standards have been published that are mandatory for the

Group's accounting periods beginning after 1 March 2019. The only

standard which is anticipated to be significant or relevant to the

Group is:

IFRS 16 Leases

IFRS 16 introduces a single lease accounting model. This

standard requires lessees to account for all leases under a single

on-balance sheet model. Under the new standard, a lessee is

required to recognise all lease assets and liabilities on the

balance sheet; recognise amortisation of leased assets and interest

on lease liabilities over the lease term; and separately present

the principal amount of cash paid and interest in the cash flow

statement. The requirements of IFRS 16 extend to certain service

contracts, such as mining contractors in which the contractor

provides services and the use of assets, which may impact the

Group. The Group has applied the modified retrospective approach

where the cumulative effect of initially applying IFRS 16 is

recognised at the date of initial application. Below is a summary

of the impact upon adoption of IFRS 16 leases.

A right-of-use asset amounting to GBP292 301 and corresponding

lease liability relating to the corporate office building was

raised. Depreciation relating to this right-of-use asset of GBP43

646 was charged during the period and finance charges of GBP15 346

were raised on the lease liability during the period.

4. Segmental reporting

The reporting segments are identified by the management steering

committee (who are considered to be the chief operating

decision-makers) by the way that the Group's operations are

organised. As at 31 August 2019, the Group operated within two

operating segments, tin exploration activities in Namibia and South

Africa.

Segment results

The following is an analysis of the Group's results by

reportable segment.

South Africa Namibia Total

GBP GBP GBP

Period ended 31 August 2019

Results

Other income - - -

Associated costs (6 755) (61 145) (67 900)

Segmental loss (6 755) (61 145) (67 900)

============ ======== =========

South Africa Namibia Total

GBP GBP GBP

Year ended 28 February 2019

Results

Other income 26 782 - 26 782

Associated costs (13 623) (93 711) (107 334)

Segmental profit / (loss) 13 159 (93 711) (80 552)

============ ======== ==========

The reconciliation of segmental gross loss to the Group's loss

before tax is as follows:

Period ended Year ended

31 August 2019 28 February 2019

GBP GBP

Segmental loss (67 900) (80 552)

Unallocated costs (547 616) (990 384)

Finance income 3 749 13 416

Finance charges (15 346) -

========== ==================

Loss before tax (627 113) (1 057 520)

========== ==================

Unallocated costs mainly comprise corporate overheads and costs

associated with being listed in London.

Other segmental information

South Africa Namibia Total

GBP GBP GBP

As at 31 August 2019

Intangible assets - exploration 7 596

and evaluation 3 232 101 4 364 631 732

9 966

Other reportable segmental assets 50 268 9 915 995 264

Other reportable segmental liabilities (70 419) (565 563) (635 982)

Unallocated net assets - - (34 627)

------------ ---------- ----------

13 715 16 892

Total consolidated net assets 3 211 950 064 387

============ ========== ==========

As at 28 February 2019

Intangible assets - exploration 7 012

and evaluation 3 214 042 3 798 275 317

6 150

Other reportable segmental assets 89 103 6 061 366 469

Other reportable segmental liabilities (70 203) (286 546) (356 749)

1 818

Unallocated net assets - - 211

14 624

Total consolidated net assets 3 232 942 9 573 095 248

============ ========== ==========

Unallocated net assets are mainly comprised of cash and cash

equivalents which are managed at a corporate level.

5. Expenses by nature

The loss for the period has been arrived at after charging:

Period

Period ended ended Year ended

31 August 31 August 28 February

2019 2018 2019

GBP GBP GBP

Staff costs 248 572 185 561 519 823

Depreciation of property, plant

& equipment 61 126 2 176 22 824

Operating lease expense - - 20 332

Professional fees 145 412 26 537 75 076

Travelling expenses 63 778 37 778 105 939

Other costs 96 628 186 484 313 724

Auditor's remuneration - 8 969 40 000

------------- -----------

1 097

615 516 447 505 718

============= =========== =============

6. Taxation

The tax expense represents the sum of the tax currently payable

and deferred tax.

Period ended Period ended Year ended

31 August 31 August 28 February

2019 2018 2019

GBP GBP GBP

Factors affecting tax for the period:

The tax assessed for the period

at the Guernsey corporation tax

charge rate of 0%, as explained

below:

(1 057

Loss before taxation (627 113) (431 921) 520)

------------ ------------ ------------

Loss before taxation multiplied

by the Guernsey corporation tax

charge rate of 0%

Effects of:

Non-deductible expenses

Tax for the period

Accumulated losses in the subsidiary undertakings for which

there is an unrecognised deferred tax asset are GBP1 271 578

(August 2018: GBP 556 281) (February 2019: GBP842 560).

7. Loss per share

From continuing operations

The calculation of a basic loss per share of 0.10 pence (August

2018: loss per share of 0.11 pence) (February 2019: loss per share

of 0.23 pence), is calculated using the total loss for the period

attributable to the owners of the Company of GBP624 551 (August

2018: GBP428 951) (February 2019: GBP1 050 074) and the weighted

average number of shares in issue during the period of 599 566 233

(August 2018: 391 593 793) (February 2019: 465 473 041).

Due to the loss for the period, the diluted loss per share is

the same as the basic loss per share. The number of potentially

dilutive ordinary shares, in respect of share options, warrants and

shares to be issued is 48 566 727 (August 2018: 24 397 922)

(February 2019: 48 566 727). These potentially dilutive ordinary

shares may have a dilutive effect on future earnings per share.

On 18 October 2019, 21 930 000 share options were awarded to

directors and certain key employees in the Group. Please refer to

Note 15 for more details.

8. Intangible assets

Exploration and Computer

evaluation assets Software Total

GBP GBP GBP

6 140

As at 31 August 2018 6 140 243 - 243

Additions for the period - other

expenditure 480 138 - 480 138

Additions for the period - acquisition

of Tantalum 850 000 - 850 000

Reclassification to property,

plant and equipment (488 891) - (488 891)

Foreign exchange difference 30 827 - 30 827

----------- ---------- ----------

7 012

As at 28 February 2019 7 012 317 - 317

=========== ========== ==========

Additions for the period - other

expenditure 506 203 72 049 578 252

Foreign exchange difference 6 749 (586) 6 163

----------- ---------- ----------

As at 31 August 2019 7 525 269 71 463 7 596 732

=========== ========== ==========

The Company's subsidiary, Greenhills Resources Limited has the

following:

i) a 74% interest in Renetype Pty Limited ("Renetype") which

holds an interest in Prospecting Right 2205.

ii) an 85% interest in Guinea Fowl Investments 27 Pty Limited

("Guinea Fowl") which holds an interest in mining rights, ML129,

ML133 and ML134.

iii) a 50% interest in Jaxson 641 Pty Limited ("Jaxson") which

holds an interest in Prospecting Right 428.

iv) a 74% interest in Zaaiplaats Mining Pty Limited

("Zaaiplaats") which holds an interest in Prospecting Right

183.

The Company has a 100% interest in Tantalum Investment Pty

Limited ("Tantalum") which holds an interest in Exclusive

Prospecting License 5445 and Exclusive Prospecting License

5670.

9. Property, plant and equipment

Right-of-use

Mining asset asset -

under De-commissioning office Computer

Land construction asset building equipment Furniture Vehicles Total

Cost

As at 31

August 2018 13 014 1 521 943 - - 17 425 2 559 - 1 554 941

Additions for

the period -

other

expenditure - 3 538 930 78 168 - 49 661 71 231 88 902 2 826 892

Transfer from

exploration

and

evaluation

asset - 488 891 - - - - - 488 891

Foreign

exchange

differences 425 (53 993) (2 988) - (888) (2 556) (3 398) (63 398)

As at 28

February 2019 13 439 5 495 771 75 180 - 66 198 71 234 85 504 6 099 627

Additions for

the period -

other

expenditure - 3 280 764 - 292 301 33 098 17 392 - 3 623 555

Foreign

exchange

differences 75 737 420 (2 379) 100 253 478 (315)

As at 31

August 2019 13 514 8 777 273 75 600 289 922 99 396 88 880 85 982 9 430 566

Accumulated

Depreciation

As at 31

August 2018 - - - - 2 101 184 - 2 285

Charge for the

period - - - - 9 354 4 096 7 409 20 859

Foreign

exchange

differences - - - - (415) (164) (282) (861)

As at 28

February 2019 - - - - 11 040 4 116 7 127 22 283

Charge for the

period - - - 43 646 13 422 7 637 10 836 75 541

Foreign

exchange

differences - - - (157) (46) (41) (48) (292)

As at 31

August 2019 - - - 43 488 24 417 11 712 17 915 97 532

Net Book Value

As at 31

August 2019 13 514 8 777 273 75 600 246 434 74 979 77 168 68 067 9 333 036

As at 31

August 2018 13 014 1 521 943 - - 15 324 2 375 - 1 552 656

As at 28

February 2019 13 439 5 495 771 75 180 - 55 158 67 118 78 377 5 785 043

10. Trade and other receivables

31 August 31 August 28 February

2019 2018 2019

GBP GBP GBP

Trade receivables 32 440 34 408 42 463

Other receivables 177 528 87 507 83 615

VAT receivables 782 422 101 509 348 885

---------- ---------- ------------

992 390 223 424 474 963

========== ========== ============

Post reporting period, GBP444 926 worth of VAT receivables in

the above balance had been refunded by the Namibian tax

authorities.

11. Loans and borrowings

31 August 31 August 28 February

2019 2018 2019

GBP GBP GBP

Working capital facility (85 465) - -

---------- ---------- ------------

On 16 August 2019, a working capital facility of N$35,000,000

(c. GBP2.0 million) and a VAT facility for N$8,000,000 (c.

GBP456,000) was entered into between the Company's subsidiary,

AfriTin Mining Namibia Proprietary Limited and Nedbank Namibia.

The VAT Facility is secured by assessed/audited VAT returns

(refunds) which have not been paid by Namibia Inland Revenue.

For the working capital facility, the loan is repayable in full

on the date being 12months from the date of execution and Interest

accrues on the loan at a rate of JIBAR plus 3.658% (being

approximately 10.7%).

Both AfriTin, as the parent company of AfriTin Mining Namibia

Proprietary Limited, and Bushveld Minerals Limited ("Bushveld"), a

shareholder holding approximately 8% of the Company, have offered

surety for the loan to Nedbank as collateral in the form of a joint

suretyship from AfriTin and Bushveld.

12. Trade and other payables

31 August 31 August 28 February

2019 2018 2019

GBP GBP GBP

Trade payables 616 505 388 621 266 184

Other payables 109 335 46 550 110 716

Accruals 37 467 13 216 2 550

---------- ---------- ------------

763 307 448 387 379 450

========== ========== ============

13. Share capital

Number of ordinary

shares of no par

value issued and

fully paid Share Capital

GBP

Balance at 31 August 2018 519 588 525 16 533 136

Reversal of Share issue costs - excluding

warrants - 3 450

Share issue costs - fair value of

warrants - (48 868)

"Tantalum" Acquisition 25 000 000 850 000

Balance at 28 February 2019 544 588 525 17 337 718

Capital Raise - 22 May 2019 99 613 074 2 988 392

Share issue costs (102 938)

Balance at 31 August 2019 644 201 599 20 223 173

Authorised:

966 302 399 ordinary shares of no par value

Allotted, issued and fully paid:

644 201 599 shares of no par value

On 22 May 2019, AfriTin Mining Limited completed an equity

fundraising by way of a direct subscription of 99 613 074 ordinary

shares of no par value in the Company at a price of 3 pence per

share.

14. Environmental rehabilitation liability

31 August 31 August 28 February

2019 2018 2019

GBP GBP GBP

Opening balance 75 180 - -

Provision for the period - - 78 168

Foreign exchange differences 420 - (2 988)

---------- ---------- ------------

Closing balance 75 600 - 75 180

========== ========== ============

Provision for future environmental rehabilitation and

decommissioning costs are made on a progressive basis. Estimates

are based on costs that are regularly reviewed and adjusted

appropriately for new circumstances.

The rehabilitation provision represents the present value of

decommissioning costs relating to the dismantling and sale of

mechanical equipment and steel structures related to the Phase 1

Pilot Plant, the demolishing of civil platforms and reshaping of

earthworks. The provision is based on management's estimates and

assumptions based on the current economic environment. Actual

rehabilitation and decommissioning costs will ultimately depend

upon future market prices for the necessary rehabilitation works

and timing of when the mine ceases operation.

15. Events after Balance Sheet Date

Awarding of options

On 18 October 2019, 21 930 000 share options over ordinary

shares in the capital of the Company were awarded to directors and

certain key employees in the Group. The income statement charge

calculated according to the Black Scholes method will be GBP556 338

over the period of the options.

Convertible loan note

On 26 November 2019, AfriTin Mining Limited entered into an

unsecured convertible loan note agreement for a total amount of

GBP3.8 million of GBP100,000 each (the "Notes"). The Notes have a

term of 18 months and attract interest at a rate of 10% per annum

which is payable on the redemption or conversion of the Notes. The

Notes, including the total amount of accrued but unpaid interest,

are convertible at the conversion price of 4p per share. The Notes

can be redeemed at any time at the election of the Company, having

given 10 Business Days' notice of such intention, in whole or in

part, if not already converted by the Noteholder and subject to

applying an early redemption premium of 10%.

16. Related-party transactions

Balances and transactions between the Company and its

subsidiaries, which are related parties, have been eliminated on

consolidation and are not disclosed in this note.

Bushveld Minerals Limited ("Bushveld") is a related party due to

Anthony Viljoen, Chief Executive Officer being a Non-Executive

Director on the Bushveld Board. During the period, Bushveld charged

the Group GBP33 794 (August 2018: GBPnil) (February 2019: GBP22

477) for rent. At year end, the Group owed Bushveld GBP77 970.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR LLFFFLRLAFIA

(END) Dow Jones Newswires

November 29, 2019 07:31 ET (12:31 GMT)

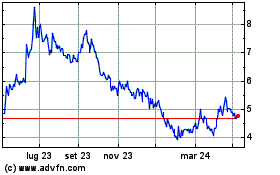

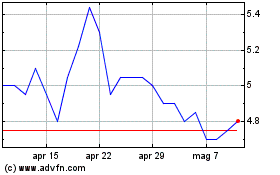

Grafico Azioni Andrada Mining (LSE:ATM)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Andrada Mining (LSE:ATM)

Storico

Da Apr 2023 a Apr 2024