By Alexandra Wexler

ORAPA, Botswana -- De Beers is facing up to a tough reality: The

world's diamond deposits won't last forever.

The mining behemoth, a unit of Anglo American PLC, is rewriting

its century-old playbook as discoveries of new diamond troves grow

scarce and its aging mines become more costly to operate. Global

diamond production is falling, companies and analysts say, pushing

De Beers to make investments and strategic changes that were almost

unthinkable a few years ago.

The former monopoly famed for secrecy is developing a

traceability system to verify a diamond's provenance, a bid to

attract more socially conscious buyers. De Beers also stunned the

industry last year with plans to sell its first synthetic diamonds

through a new subsidiary. The synthetic stones are identical to

natural stones in composition but are made in labs rather than

mined from the earth.

De Beers Chief Executive Bruce Cleaver said in a recent

interview that those changes and a new marketing push are necessary

to ensure diamonds remain a coveted purchase for Asia's expanding

middle class and American millennials reaching new life

milestones.

"We are standing on the cusp of a new diamond world," Mr.

Cleaver said. "It is a world...of considerable opportunity, if we

make the right choices."

De Beers, founded by a group including colonialist pioneer Cecil

John Rhodes in 1888, weathered the mothballing of its mines during

the Great Depression and the destruction of its London trading

offices in the Blitz during World War II.

As recently as the 1980s, De Beers controlled more than 80% of

the world's diamond supply. In 2012, Anglo American paid the

Oppenheimer family $5.1 billion for its 40% stake in the company,

which last year contributed about a quarter of global diamond

production.

That global industry is changing fast. During the most recent of

the regular diamond sales that De Beers conducts for buyers, the

company sold $390 million of rough diamonds, down 12% from the same

sale in 2018. Earnings before interest, taxes, depreciation and

amortization in the first half of this year dropped to $518

million, down 27% compared with the same period in 2018. Sales have

been hurt by a slowing global economy, the U.S.-China trade war,

protests in Hong Kong and tighter lending in India, where most

diamonds are cut and polished.

De Beers is ramping up an old standby, marketing, to help combat

the trends. The company is spending $180 million on marketing this

year, the most in a decade.

Another plank of De Beers' strategy is to boost supply chain

transparency by communicating the provenance and authenticity of

its diamonds, which are typically mixed together and sold to buyers

in bulk lots, effectively eliminating the ability to trace them

back to their origin.

"Consumers have been asking for proof of sustainable and ethical

sourcing," said Jim Duffy, chief executive of Tracr, a platform

that provides a diamond's provenance and traces it all the way

through the supply chain.

Using artificial intelligence and blockchain technology,

retailers will be able to show consumers that their diamond was dug

up in the sun-baked mining town of Orapa, in central Botswana,

where warthogs laze about the parking lots. Information on the

platform could explain whether proceeds from that stone funded a

particular road, school or hospital project. It could become as

granular as giving a consumer the back story of the specific person

who cut and polished the diamond, Mr. Duffy said.

Tracr goes beyond the Kimberley Process, the industrywide effort

to prevent insurgent groups from trafficking in rough diamonds by

certifying that stones are conflict-free. Tracr, initially an

in-house project at De Beers, is being spun out to the wider

diamond industry and is expected to launch commercially early next

year. It already has more than 30 participants, including De Beers

and Russia's PAO Alrosa, the world's largest diamond producer by

volume, and Chow Tai Fook Jewellery Group Ltd. of Hong Kong, the

world's second-largest jeweler.

"Increasing supply chain transparency is the industry's lowest

hanging fruit," said Paul Zimnisky, an independent diamond analyst

in New York.

De Beers has also staked a claim in the lab-grown diamond

market. That appears to have been a shrewd move. Since DeBeers said

it would sell synthetic stones under a brand called Lightbox, the

wholesale price for a 1-carat lab-grown stone has dropped from

near-parity with mined stones in some cases to about 60% below that

level. De Beers said they want consumers to see lab-made diamonds

as less precious than stones dug from the earth.

"There's no rarity: It's fashion, it's fun, it's lighthearted,"

Mr. Cleaver said.

Analysts expect natural diamond prices to stabilize following

their recent drop as global production continues to fall. Output is

projected to fall through at least 2021 as older mines are depleted

and new deposits aren't developed to replace them.

De Beers has sold several mines in recent years but is investing

heavily in those that remain.

In South Africa, De Beers is spending $2 billion to extend the

life of its single remaining mine there, Venetia, into the 2040s by

moving production from an open pit to underground.

And the company said in March it would spend another $2 billion,

together with the government of Botswana, to expand its largest

mine there. The investment should extend the life of that mine,

Jwaneng, to at least 2035.

Write to Alexandra Wexler at alexandra.wexler@wsj.com

(END) Dow Jones Newswires

November 30, 2019 05:44 ET (10:44 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

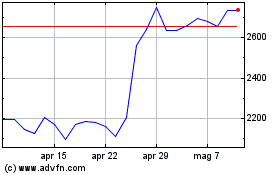

Grafico Azioni Anglo American (LSE:AAL)

Storico

Da Mar 2024 a Apr 2024

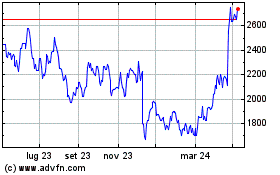

Grafico Azioni Anglo American (LSE:AAL)

Storico

Da Apr 2023 a Apr 2024