Capital & Counties Properties Plc Business Update (2409V)

02 Dicembre 2019 - 8:00AM

UK Regulatory

TIDMCAPC

RNS Number : 2409V

Capital & Counties Properties Plc

02 December 2019

02 December 2019

CAPITAL & COUNTIES PROPERTIES PLC ("Capco" or "the

Company")

BUSINESS UPDATE

Following completion of the sale of Capco's interests in Earls

Court for GBP425 million, the Company is today providing an update

on the business:

-- Sale of Capco's interests in Earls Court completed

successfully with initial net proceeds of GBP156 million received

and GBP211 million to be received over the next two years

-- Capco is now positioned as a prime central London property

investment business and will convert to UK REIT status before the

end of 2019

-- Capco's strong balance sheet and significant financial

flexibility (approximately GBP900 million of cash and undrawn

facilities) positions it to capitalise on further investment

opportunities. Over GBP50 million invested recently through

targeted acquisitions at Covent Garden

-- Capco will target a progressive dividend policy over the

medium-term by driving rental growth and securing income.

Administration costs expected to be approximately GBP20 million on

a run rate basis from the end of 2020

Capco is now positioned as a prime central London property

investment business centred around Covent Garden. This is a

world-class estate based in the heart of London's West End in

concentrated ownership, which provides a differentiated offer,

delivering an attractive environment for retail and restaurant

brands, office occupiers, residents and consumers. Capco's creative

approach and emphasis on the consumer ensures the estate is

well-positioned to deliver further rental growth and capture its

reversionary income.

The West End offers greater insulation from the well-documented

wider retail challenges however it is not immune with certain

retailers taking a more conservative view, as a result of broader

political and macro-economic uncertainty and occupational cost

pressures. Nevertheless, trading performance on the estate remains

encouraging with footfall growth and average tenant sales

continuing to trend upwards.

Recent signings across the estate include Big Mamma on Henrietta

Street, L'Occitane in the Market Building, Pandora on James Street,

A.P.C. on Floral Street and Lulu Guinness on King Street. There has

been strong demand for office and residential space with high

occupancy and rates of renewal.

Capco continues to create unique customer experiences on the

estate. For the Christmas trading period, cosmetics brands Glossier

and Huda Beauty have launched pop up concepts on Floral Street and

the East Piazza, which is also hosting the Tiffany & Co.

ice-skating rink.

Acquisitions

Capco's strong balance sheet and access to substantial liquidity

provides significant financial flexibility. Over GBP50 million has

already been invested through the acquisition of two target

properties located on the southern side of the estate, which offer

significant value creation opportunities.

Capco has exchanged contracts to acquire the freehold interest

of 5-6 Henrietta Street for GBP34 million (before purchaser's

costs) with completion expected later this week. The multi-let

building produces an annual rental income of GBP1.2 million across

14,300 square feet which comprises 8,200 square feet of restaurant

space let to Din Tai Fung and four floors of office space which are

currently vacant.

In addition, on 19 November 2019, Capco acquired the freehold

interest of Sussex Mansions, 36-39 Maiden Lane for GBP17.8 million

(before purchaser's costs). The building comprises a restaurant let

to Franco Manca, as well as office and residential space. The

property generates an annual rental income of GBP0.6 million across

13,300 square feet.

Further information on the sale of Earls Court

Payments will be made to Capco on a phased basis, with 45 per

cent received on completion and the balance over two years. Net

proceeds from the initial payment were approximately GBP156 million

(adjusting for net debt, transaction-related costs and other

completion items). The balance of GBP211 million will be payable in

two equal instalments, 12 months and 24 months after completion.

The deferred payments receivable by Capco would be accelerated in

part to the extent that payments made by Capco to the London

Borough of Hammersmith and Fulham pursuant to the CLSA are refunded

to the Purchaser after completion. Refer to the announcement 'Sale

of Earls Court Interests for GBP425 million' released on 15

November 2019 for further information.

Enquiries

Capital & Counties Properties PLC

+44 (0)20 3214

Ian Hawksworth Chief Executive 9188

+44 (0)20 3214

Situl Jobanputra Chief Financial Officer 9183

+44 (0)20 3214

Sarah Corbett Head of Investor Relations 9165

Media enquiries

+44 (0)20 3214

Sarah Hagan Director of Communications 9185

+44 (0)20 7353

UK: Tulchan Jessica Reid 4200

+44 (0)20 7796

UK: Hudson Sandler Michael Sandler 4133

SA: Instinctif Frederic Cornet +27 (0)11 447 3030

Notes to Editors

About Capital & Counties Properties PLC (Capco)

Capital & Counties Properties PLC is one of the largest

listed property investment companies in central London and is a

constituent of the FTSE-250 Index. Capco's landmark estate at

Covent Garden was valued at GBP2.6 billion (as at 30 June 2019)

where its ownership comprises over 1.2 million square feet of

lettable space. The company is listed on the London Stock Exchange

and the Johannesburg Stock Exchange.

www.capitalandcounties.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCFSUEFFFUSELE

(END) Dow Jones Newswires

December 02, 2019 02:00 ET (07:00 GMT)

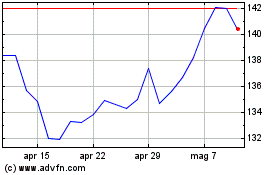

Grafico Azioni Shaftesbury Capital (LSE:SHC)

Storico

Da Mar 2024 a Apr 2024

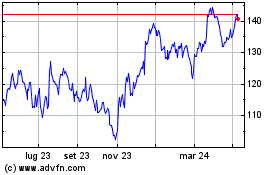

Grafico Azioni Shaftesbury Capital (LSE:SHC)

Storico

Da Apr 2023 a Apr 2024