TIDMLTI

RNS Number : 3481V

Lindsell Train Investment Trust PLC

02 December 2019

THE LINDSELL TRAIN INVESTMENT TRUST PLC

Half-year report for the six months ended 30 September 2019

Financial Highlights

Performance comparisons 1 April 2019 - 30 September Change

2019

Middle market share price per Ordinary Share* -4.7%

Net asset value per Ordinary Share* 23.4%

Benchmark 2.0%

MSCI World Index (Sterling) 10.6%

UK RPI Inflation (all items) 2.1%

The annual average running yield of the longest-dated UK

government fixed rate bond, currently UK Treasury 1(5) /(8) % 2071,

calculated using weekly data, plus a premium of 0.5%, subject to a

minimum yield of 4%.

Source: Bloomberg/Maitland Administration Services Limited

Investment Objective

The objective of the Company is to maximise long-term total

returns with a minimum objective to maintain the real purchasing

power of Sterling capital.

Investment Policy

The Investment Policy of the Company is to invest:

- in a wide range of financial assets including equities,

unquoted equities, bonds, funds, cash and other financial

investments globally with no limitations on the markets and sectors

in which investment may be made, although there may be a bias

towards Sterling assets consistent with a Sterling-dominated

investment objective. The Directors expect that the flexibility

implicit in these powers will assist in the achievement of the

absolute returns that the investment objective requires;

- in Lindsell Train managed fund products, subject to Board

approval, up to 25% of its gross assets; and

- in Lindsell Train Limited ("LTL") and to retain a holding,

currently 24.19%, in order to benefit from the growth of the

business of the Company's Investment Manager.

Diversification

The Company expects to invest in a concentrated portfolio of

securities with the number of equity investments averaging fifteen

companies. The Company will not make investments for the purpose of

exercising control or management and will not invest in securities

of or lend to any one company (or other members of its group) more

than 15% by value of its gross assets at the time of investment.

The Company will not invest more than 15% of gross assets in other

closed-ended investment funds.

Gearing

The Directors have discretion to permit borrowings up to 50% of

the Company's Net Asset Value. However, the Directors have decided

that it is in the Company's best interests not to use gearing. This

is in part a reflection of the increasing size and risk associated

with the Company's unquoted investment in LTL, but also in response

to the additional administrative burden required to adhere to the

full scope regime of the Alternative Investment Fund Managers

Directive ("AIFMD").

Dividends

The Directors' policy is to pay annual dividends consistent with

retaining the maximum permitted

earnings in accordance with investment trust regulations.

The composition of the portfolio as at 30 September 2019, which

may be changed at any time at the discretion of the Investment

Manager within the confines of the policy stated above, is shown

below.

Chairman's Statement

Over the six months to 30 September 2019 the Company's net asset

value ('NAV') performed well. Including the dividend paid in early

September, the NAV ended the six months up 23.4% which compared to

a rise in the benchmark of 2.0% and the good performance from world

stock markets (as measured by the MSCI World Index) of 10.6%. Set

against these positive changes the Company's share price declined

by 4.7%. This relatively modest decline masks a larger percentage

fall in the share price from its peak in late June. Having risen to

above GBP2,000 per share, a 100% premium to its then NAV, the share

price fell 35% in early July before settling at between GBP1,300

and GBP1,400 per share. The share price ended September at

GBP1,375, still a significant 28% premium to NAV.

The cause of the fall was not a sharp decline in markets nor

underperformance from Lindsell Train Limited's ('LTL') strategies,

which I had highlighted as key risks in previous reports. Instead

the trigger appeared to be the removal of LTL's two largest funds

from Hargreaves Lansdown's ('HL') Wealth 50 list of favoured funds.

It was made very clear by HL that this was not an investment-based

decision but that the action was taken to demonstrate HL's

independence as LTL, on behalf of its investors, owns 12% of HL's

equity. With HL's endorsement now removed it is possible that the

support for the two LTL funds by HL's customers will lessen in the

future, tempering fund inflows from that source. If nothing else it

was a ready reminder of the danger of buying shares in the Company

at an elevated premium to NAV, something that I continue to advise

against with the premium around 35%.

We suspect that the main reason for the elevated premium is the

belief on the part of some shareholders that the Board's valuation

of LTL is too conservative. The Board has considered the valuation

methodology of LTL and believes it to be appropriate and fair. This

is described in more detail in note 8. To remind you, the Board

believes it vitally important that the prospects for future growth

in funds under management and profitability should be balanced in

any valuation of LTL by the risks associated with reliance on key

individuals and with succession. LTL is not like some quoted fund

management companies with a long heritage and a history of managed

succession. LTL is still largely reliant on Nick and Michael but at

some juncture responsibility for managing LTL's core mandates and

the business will have to be handed to others. That process began

10 years ago with the recruitment of James Bullock, who is now a

portfolio manager. Madeline Wright, Alexander Windsor-Clive and

earlier this year Ben van Leeuwen have joined since, at two to

three year intervals. The Board has encouraged LTL to take measures

to build a successful and experienced team; in the meantime, while

uncertainty remains over how the future unfolds, the Board believes

it is appropriate to reflect that ongoing risk in LTL's current

valuation.

In the shadow of the fall in the share price the steady rise in

the NAV once again was largely attributable to the rise in the

valuation of LTL. This was up 39% (including the payment of the

interim dividend in June) from 31st March 2019 and captured the

strong increase in LTL funds under management from GBP18.4bn to

GBP22.0bn over the six months.

The Company's rising NAV also captured good performance from the

50% of the portfolio invested in quoted equities. The holding in

the London Stock Exchange ('LSE') in particular performed well, up

56%, helped by its proposed combination with Refinitiv and the

subsequent offer for the company from the Hong Kong Exchange, which

was then withdrawn with little detrimental effect on the share

price. The LSE has now risen from one of the Company's smallest

quoted holdings in 2006 to the largest at 8.5% of NAV thanks

entirely to its strong relative performance. The quoted portfolio

remained the same over the period, other than a small additional

investment in Laurent-Perrier.

Julian Cazalet

Chairman

2 December 2019

Investment Manager's Report

We are often asked why we rarely or never sell any of our

holdings. The questions get particularly pointed in relation to

investments that have done particularly well over the years.

Haven't such shares become expensive? Don't the big historic gains

make them more risky? Surely there must be better value

opportunities available elsewhere, especially in sectors that have

done poorly?

Our answer to such questions boils down to an appeal to one of

the oldest pieces of investment advice: RUN YOUR WINNERS.

As an investment principle running your winners is not

infallible, because nothing is infallible in investment. But

running winners brings some important benefits; benefits that, we

believe, tilt the odds of being successful slightly more in your

favour.

The thing about investing is that everything is so uncertain.

This is especially so, in our view, when it comes to valuation.

What makes an asset "cheap" or "expensive"? That's a problematic

question because the validation for whether something is dear or

good value depends on future developments that are by definition

more or less unknowable - because if they were known they would

already be in the price. What is abundantly clear is that not

everything that goes down in price has become "cheap" and not

everything that goes up becomes "expensive". And that acting on

signals of such opacity is not wise.

By contrast, running winners brings two advantages. First, by

resisting the temptation to trade in and out of holdings you

certainly avoid accruing transaction costs which are universally

acknowledged as a drag on investment performance. People are too

confident in their ability to predict the unknowable future and

this encourages them to trade more often than is good for their

financial health.

But second and far more important. If you have invested in a

winner - an asset that has appreciated meaningfully over a number

of years - you have not only been fortunate, you are also in

possession of a useful piece of information. This is that the

company you own part of has been able to generate positive

surprises over time, because it is only positive surprises that

make company shares go up. And although there is no certainty that

positive surprises will continue at least they have in the past -

and that is already something. Many industries and even more

individual companies most often just deliver serial

disappointments.

We have been lucky enough to have made a wonderful investment in

the London Stock Exchange for your company. We have held the stock

for 11 years and there is a current gain on book cost of 4.6-times.

Over the holding period there have been many times when LSE shares

have appeared "expensive" - or so has said the consensus. And there

have been many times when the shares have fallen or underperformed.

But holding on through these episodes has been rewarded, because

the LSE has been able to surprise its owners in a good way. These

surprises have resulted due to the persistence of the LSE's high

profitability, to the canny acquisitions it has made and to the

unique strategic position the company occupies in the world's

financial plumbing. That strategic position evidently more valuable

than ever, at least according to the price that the Hong Kong

Exchange was willing to place on it.

It is easy and disingenuous for investment managers to discuss

winners, like the LSE. But we don't table them to prove that what

we do works in any predictable way. We do so because they are an

illustration of the effects we are hoping to capture for

shareholders by approaching the investment challenge the way we do.

It has been a great example of running a winner. But we know not

everything we own has done or will do as well as the LSE.

So the question we ask ourselves is not so much why we continue

to hold companies that have performed well - AG Barr, Diageo,

Heineken, Mondelez, Paypal, RELX, Unilever. The answer is because

the companies enjoy structural advantages that mean they may be

able to surprise positively in the future. For instance, we think

about CEO Ivan Menezes' comment to us that Diageo speaks for only

4% of the world's beverage sales by value. Although Diageo appears

a "big" company to investors, because it is a top-ten FTSE 100

stock and "expensive", because it currently trades on over 20x

earnings - in fact Diageo is probably neither big nor expensive,

assuming it can grow its share of world beverage sales. Its brands,

its distribution and marketing skills and its cash flows mean that

the prospects for positive surprises remain good, we think.

No, we have to ask ourselves why we persevere with companies

that have proved persistently disappointing. Pearson is the obvious

example where we have allowed hope to triumph over experience. But

such disappointments are inevitable. All one can do is trust that a

lesson has been learned. And that the next decision taken in

respect of the company is the right one.

Nick Train

Lindsell Train Limited - Investment Manager

2 December 2019

Income Statement

Notes Revenue Six months ended Total

GBP'000 30 September GBP'000

2019

Unaudited

Gains on investments held Capital

at fair value GBP'000

through profit or loss - 39,463 39,463

Exchange gains on currency - (5) (5)

Income 2 6,275 - 6,275

Investment management fees 3 (645) (3,061) (3,706)

Other expenses 4 (247) (1) (248)

-------- ---------------- ---------

Net return before finance

costs and tax 5,383 36,396 41,779

Interest payable and similar - - -

charges

-------- ---------------- ---------

Return before tax 5,383 36,396 41,779

Tax 5 (42) - (42)

-------- ---------------- ---------

Return after tax for the

financial period 5,341 36,396 41,737

-------- ---------------- ---------

Return per Ordinary Share 6 GBP26.71 GBP181.98 GBP208.69

Six months ended

30 September 2018

Revenue Capital Total

GBP'000 GBP'000 GBP'000

Gains on investments held

at fair value through profit

or loss - 20,820 20,820

Exchange gains on currency - 5 5

Income 4,411 - 4,411

Investment management fees (476) (1,227) (1,703)

Other expenses (261) - (261)

Net return before finance

costs and tax 3,674 19,598 23,272

Interest payable and similar - - -

charges

Return before tax 3,674 19,598 23,272

Tax (24) - (24)

Return after tax for the

financial period 3,650 19,598 23,248

Return per Ordinary Share GBP18.25 GBP97.99 GBP116.24

Year ended 31 March 2019

Audited

Revenue Revenue Revenue

GBP'000 GBP'000 GBP'000

Gains on investments held - - -

at fair value through profit

or loss

Exchange gains on currency - - -

Income 8,680 8,680 8,680

Investment management fees (995) (995) (995)

Other expenses (464) (464) (464)

Net return before finance

costs and tax 7,221 7,221 7,221

Interest payable and similar - - -

charges

Return before tax 7,221 7,221 7,221

Tax (49) (49) (49)

Return after tax for the

financial period 7,172 7,172 7,172

Return per Ordinary Share GBP35.86 GBP35.86 GBP35.86

All revenue and capital items in the above statement derive from

continuing operations.

The total columns of this statement represent the profit and

loss accounts of the Company. The revenue and capital columns are

supplementary to this and are prepared under the guidance published

by the Association of Investment Companies.

The Company does not have any other recognised gains or losses.

The net return for the period disclosed above represents the

Company's total comprehensive income.

No operations were acquired or discontinued during the

period.

Statement of Changes in Equity

Share Special Capital Revenue Total

For the six months ended capital reserve reserve reserve GBP'000

30 September 2019 (unaudited) GBP'000 GBP'000 GBP'000 GBP'000

At 31 March 2019 150 19,850 148,035 11,150 179,185

Return after tax for the

financial period - - 36,396 5,341 41,737

Dividends paid - - - (5,900) (5,900)

----------------------------------- -------- -------- -------- -------- --------

At 30 September 2019 150 19,850 184,431 10,591 215,022

----------------------------------- -------- -------- -------- -------- --------

Share Special Capital Revenue Total

For the six months ended capital reserve reserve reserve GBP'000

30 September 2018 (unaudited) GBP'000 GBP'000 GBP'000 GBP'000

At 31 March 2018 150 19,850 121,078 8,338 149,416

Return after tax for the

financial period - - 19,598 3,650 23,248

Dividends paid - - - (4,360) (4,360)

----------------------------------- -------- -------- -------- -------- --------

At 30 September 2018 150 19,850 140,676 7,628 168,304

----------------------------------- -------- -------- -------- -------- --------

Share Special Capital Revenue

capital reserve reserve reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

For the year ended 31 March

2019 (audited)

At 31 March 2018 150 19,850 121,078 8,338 149,416

Return after tax for the

financial period - - 26,957 7,172 34,129

Dividends paid - - - (4,360) (4,360)

-------------------------------- -------- -------- -------- -------- --------

At 31 March 2019 150 19,850 148,035 11,150 179,185

-------------------------------- -------- -------- -------- -------- --------

Statement of Financial Position

Note 30 September 30 September 31 March

Fixed assets 2019 Unaudited 2018 2019 Audited

Investments held at fair value GBP'000 Unaudited GBP'000

through GBP'000

profit or loss 217,640 168,770 177,693

------------------ ------------ -------------------

Current assets

Other receivables 293 247 293

Cash at bank 335 651 3,782

------------------ ------------ -------------------

628 898 4,075

Creditors: amounts falling

due within one year

Other payables (3,246) (1,364) (2,583)

------------------ ------------ -------------------

(3,246) (1,364) (2,583)

Net current (liabilities)/assets (2,618) (466) 1,492

------------------ ------------ -------------------

Net assets 215,022 168,304 179,185

------------------ ------------ -------------------

Capital and reserves

Called up share capital 150 150 150

Special reserve 19,850 19,850 19,850

------------------ ------------ -------------------

20,000 20,000 20,000

Capital reserve 184,431 140,676 148,034

Revenue reserve 10,591 7,628 11,151

------------------ ------------ -------------------

Total shareholders' funds 215,022 168,304 179,185

------------------ ------------ -------------------

Net asset value per Ordinary 7 GBP1,075.11 GBP841.52 GBP895.93

Share

Cash Flow Statement

Six months Six months Year ended

ended 30 ended 30 September 31 March

September 2018 Unaudited 2019 Audited

2019 Unaudited GBP'000 GBP'000

Operating Activities GBP'000

Net return before finance costs

and tax 41,779 23,272 34,178

Gains on investments held at

fair value (39,463) (20,820) (29,414)

Gains on exchange movements 5 (5) 24

Decrease in other receivables 7 14 24

Decrease/(increase) in accrued

income (7) - (57)

(Decrease)/increase in other

payables 664 (1,596) (377)

Purchase of investments held

at fair value (527) - (4,414)

Sale of investments held at

fair value 43 1,003 5,088

--------------- -------------------- -----------------

Net cash inflow from operating

activities before interest and

taxation 2,501 1,868 5,052

Interest paid - - -

Taxation on investment income (43) (25) (49)

--------------- -------------------- -----------------

Net cash inflow from operating

activities 2,458 1,843 5,003

Financing activities

Equity dividends paid (5,900) (4,360) (4,360)

--------------- -------------------- -----------------

Net cash outflow from financing

activities (5,900) (4,360) (4,360)

(Decrease)/increase in cash

and cash equivalents (3,442) (2,517) 643

Cash and cash equivalents at

beginning of period 3,782 3,163 3,163

Gains on exchange movements (5) 5 (24)

--------------- -------------------- -----------------

Cash and cash equivalents at

end of period 335 651 3,782

--------------- -------------------- -----------------

Notes to the Financial Statements

1 Accounting policies

The financial statements of the Company have been prepared under

the historical cost convention modified to include the revaluation

of fixed assets in accordance with United Kingdom law and

Accounting Standards and with the Statement of Recommended Practice

("SORP") "Financial Statements of Investment Trust Companies and

Venture Capital Trusts", issued by the Association of Investment

Companies (issued November 2014 and updated in February 2018 with

consequential amendments) to comply with the revised reporting

standard.

The accounting policies and methods of computation followed in

this half-year report are consistent with the most recent annual

statements.

After considering a schedule of the Company's current financial

resources and liabilities for the next twelve months, and as the

majority of the net assets of the Company are securities which are

traded on recognised stock exchanges, the Directors have determined

that its resources are adequate for continuing in business for the

foreseeable future and that it is appropriate to prepare the

financial statements on a going concern basis. The Company does not

have a fixed life.

2 Income

Six months Six months Year ended

ended ended 31 March

30 September 30 September 2019

2019 2018 Audited

Unaudited Unaudited

GBP'000 GBP'000 GBP'000

Income from investments

Overseas dividends 366 211 434

UK dividends

- Lindsell Train Limited 5,005 3,392 7,099

- Other UK dividends 904 808 1,147

-------------- -------------- -----------

6,275 4,411 6,505

-------------- -------------- -----------

3 Investment management fees

Six months Six months Year ended

ended ended 31 March

30 September 30 September 2019

2019 2018 Audited

Unaudited Unaudited GBP'000

GBP'000 GBP'000

Investment Management

fee 665 518 1,066

Manager's performance

fee - charged to capital 3,061* 1,227* 2,433

Rebate of investment management

fee (20) (42) (71)

-------------- -------------- -----------

Total Management fee 3,706 1,703 3,428

*Accrued amount to 30

September 2019.

4 Other expenses

Six months Six months Year ended

ended ended 31 March

30 September 30 September 2019

2019 2018 Audited

Unaudited Unaudited GBP'000

GBP'000 GBP'000

Directors' emoluments 62 49 112

Administration fee 40 40 80

Auditor's remuneration

for:

- audit of the financial

statements of the Company 13 13 25

Tax Compliance fee 2 2 3

Provision for VAT written

off 21 24 36

Other* 109 133 208

-------------- -------------- -----------

247 261 464

Capital charges 1 - -

-------------- -------------- -----------

248 261 464

-------------- -------------- -----------

* Includes registrar's fees, printing fees, AIFM fees, marketing

fees, safe custody fees, London Stock Exchange/FCA fees, Key Man

and Directors' and Officers' liability insurance, Employer's

National Insurance and legal fees.

5 Effective rate of tax

The effective rate of tax reported in the revenue column of the

income statement for the six months

ended 30 September 2019 is 0.78% (year ended 31 March 2019:

0.68% and six months ended

30 September 2018: 0.65%), based on revenue profit before tax of

GBP5,383,000 (year ended

31 March 2019: GBP7,221,000 and six months ended 30 September

2018: GBP3,674,000). This differs from the standard rate of tax,

19% (year ended 31 March 2019 and six months ended 30 September

2018: 19%) as a result of revenue not taxable for Corporation Tax

purposes.

6 Return per Ordinary Share

Six months Six months

ended ended Year ended

30 September 30 September 31 March

2019 2018 2019

Unaudited Unaudited Audited

Return per Ordinary GBP41,737,000 GBP23,248,000 GBP34,129,000

Share

Weighted average number

of

Ordinary Shares in

issue during the period 200,000 200,000 200,000

---------------------- -------------- --------------

Return per Ordinary GBP208.69 GBP116.24 GBP170.65

Share

---------------------- -------------- --------------

The return per Ordinary Share detailed above can be further

analysed between revenue and capital, as below:

Revenue return per

Ordinary Share

Revenue return GBP5,341,000 GBP3,650,000 GBP7,172,000

Weighted average number

of Ordinary Shares

in issue during the

period 200,000 200,000 200,000

---------------------- -------------- --------------

Revenue return per

Ordinary Share GBP26.71 GBP18.25 GBP35.86

---------------------- -------------- --------------

Capital return per

Ordinary Share

Capital return GBP19,598,000 GBP19,598,000 GBP26,957,000

Weighted average number

of Ordinary Shares

in issue during the

period 200,000 200,000 200,000

---------------------- -------------- --------------

Capital return per

Ordinary Share GBP181.98 GBP97.99 GBP134.79

---------------------- -------------- --------------

7. Net asset value per Ordinary Share

Six months Six months Year ended

ended ended

30 September 30 September 31 March

2019 2018 2019

Unaudited Unaudited Audited

Net assets attributable GBP215,022,000 GBP168,304,000 GBP179,185,000

Ordinary Shares in issue

at the period end 200,000 200,000 200,000

Net asset value per Ordinary GBP1,075.11 GBP841.52 GBP895.93

Share

--------------- --------------- ---------------

8 Valuation of financial instruments

The Company's investments and derivative financial instruments

as disclosed in the Statement of

Financial Position are valued at fair value.

FRS 102 requires an entity to classify fair value measurements

using a fair value hierarchy that reflects the significance of the

inputs used in making the measurements. Categorisation within the

hierarchy has been determined on the basis of the lowest level

input that is significant to the fair value measurement of the

relevant asset as follows:

- Level 1 - The unadjusted quoted price in an active market for

identical assets or liabilities that the entity can access at the

measurement date.

- Level 2 - Inputs other than quoted prices included within

Level 1 that are observable (ie developed using market data) for

the asset or liability, either directly or indirectly.

- Level 3 - Inputs are unobservable (ie for which market data is

unavailable) for the asset or liability.

The tables below set out fair value measurements of financial

instruments as at the year end by the

level in the fair value hierarchy into which the fair value

measurement is categorised.

Financial assets/liabilities at fair value through profit or

loss

Level 1 Level 2 Level 3 Total

At 30 September 2019 GBP'000 GBP'000 GBP'000 GBP'000

Equity investments 108,248 - 109,392 217,640

------- ------- ------- -------

108,248 - 109,392 217,640

------- ------- ------- -------

Level 1 Level 2 Level 3 Total

At 30 September 2018 GBP'000 GBP'000 GBP'000 GBP'000

Equity investments 87,395 4,453 76,922 168,770

------- ------- ------- -------

87,395 4,453 76,922 168,770

------- ------- ------- -------

Level 1 Level 2 Level 3 Total

At 31 March 2019 GBP'000 GBP'000 GBP'000 GBP'000

Equity investments 95,333 - 82,360 177,693

------- ------- ------- -------

95,333 - 82,360 177,693

------- ------- ------- -------

Note: Within the above tables, the entirety of level 1 comprises

all the Company's ordinary investments, level 2 represents the

investment in Lindsell Train Global Equity LLC and level 3

represents the investment in LTL, including in 2018 the one share

in LTL against which an option was granted.

The valuation of the investment in LTL derives from a formula

created after taking advice from an expert in the sector and was

formally reviewed in March 2018 by professional advisors. The

formula uses a simple average of two different components:

- 1.5% of LTL's most recent funds under management; and

- LTL's net earnings (adjusted for a notional increase in staff

costs to 45% of revenues excluding performance fees) calculated on

a three month rolling basis, one month in arrears and annualised,

divided by the annual average running yield on the longest dated UK

government fixed rate bond, currently UK Treasury 1 (5) /(8) %

2071, calculated using weekly data, plus a premium of 0.5%, subject

to a minimum yield of 4% plus an equity risk premium of 4.5%.

The valuation of LT Global Equity LLC was based on the net asset

value of the Fund. The net asset value of LT Global Equity Fund LLC

was calculated on a monthly basis being the last New York (USA)

business day of each month. The NAV of the Fund was the mid-closing

price of its investment plus other assets held by the Fund less

operating expenses, accrued liabilities and the management fee.

The Board reserves the right to vary its valuation methodologies

at its discretion.

9. It is the intention of the Directors to conduct the affairs

of the Company so that the Company satisfies the conditions for

approval as an Investment Trust Company set out in Sections

1158/1159 of the Corporation Tax Act 2010.

Interim Management Report

The Directors are required to provide an Interim Management

Report in accordance with the UK Listing Authority's Disclosure and

Transparency Rules 4.2.3 to 4.2.11. They consider that the

Chairman's Statement and the Investment Manager's Report on pages 4

to 5 of this half-year report, the following statement on related

party transactions and the Directors' Responsibility Statement

below together constitute the Interim Management Report for the

Company for the six months ended 30 September 2019.

The Directors confirm that no related party transactions were

undertaken by the Company in the first six months of the current

financial year and that there have been no changes to the related

party disclosures set out in the Annual Report of the Company for

the year ended 31 March 2019.

The Directors do not expect the principal risks and

uncertainties as described in detail within the last Annual Report

and Accounts to change during the remaining six months of the

financial year.

The half-year report for the six months ended 30 September 2019

has not been reviewed by the Company's auditor,

PricewaterhouseCoopers LLP.

Directors' Responsibility Statement

The Directors listed at the back of this half-year report

confirm that to the best of their knowledge:

(a) the condensed set of Financial Statements, which has been

prepared in accordance with United Kingdom Generally Accepted

Accounting Practice, give a true and fair view of the assets,

liabilities, financial position and profit of the Company for the

period ended 30 September 2019;

(b) the Interim Management Report includes a fair review, as

required by Disclosure and Transparency Rule 4.2.7 R, of important

events that have occurred during the first six months of the

financial year, their impact on the condensed set of Financial

Statements and a description of the principal risks and

uncertainties for the remaining six months of the financial year;

and

(c) the Interim Management Report includes a fair review of the

information concerning related party

transactions as required by Disclosure and Transparency Rule

4.2.8 R.

The half-year report was approved by the Board on 2 December

2019 and the above Responsibility Statement was signed on its

behalf by:

Julian Cazalet

Chairman

Portfolio Holdings at 30 September 2019

(All ordinary shares unless otherwise stated)

Look-through

Fair % of basis:

value total % of

total

Holding Security GBP'000 assets assets

645 Lindsell Train Limited 109,392 50.87 50.87

246,500 London Stock Exchange 18,014 8.38 8.57

420,500 Diageo 14,015 6.52 6.70

41,000 Nintendo 12,311 5.73 5.94

222,000 Unilever 10,855 5.05 5.23

101,000 PayPal 8,490 3.95 3.95

1,263,393 Barr (AG) 7,315 3.40 3.43

161,552 Mondelez International 7,252 3.37 3.53

89,000 Heineken 7,193 3.35 3.44

363,000 RELX 7,013 3.26 3.45

Lindsell Train Japanese Equity

3,288,767 Fund - B 5,116 2.38 2.17

420,000 Finsbury Growth & Income Trust 3,957 1.84 0.78

74,400 eBay 2,354 1.09 1.09

300,000 Pearson 2,212 1.03 1.06

27,376 Laurent-Perrier 2,151 1.00 1.00

------- ------ ------------------

Total investments 217,640 101.22 101.21

Net current assets (2,618) (1.22) (1.21)

------- ------ ------------------

Total assets 215,022 100% 100.00

------- ------ ------------------

Look-through basis: This adjusts the percentages held in each

security upwards by the amount held in LTL managed funds and

adjusts the fund's holdings downwards to account for the overlap.

It provides Shareholders with a measure of stock specific risk by

amalgamating the direct holdings of the Company with the indirect

holdings held within the LTL funds.

Leverage

We detail below the balance sheet positions of the Funds managed

by LTL as at 30 September 2019:

Fund Net equity

exposure

Lindsell Train Japanese Equity Fund 94.84%

Finsbury Growth & Income Trust 100.53%

Analysis of Investment Portfolio at 30 September 2019

Breakdown by location of listing

(look-through basis)^

30 September 31 March

2019 2019

Japan 8% 8%

Europe 4% 5%

UK* 80% 77%

USA 9% 9%

Cash and equivalents (1%) 1%

------------ --------

100% 100%

------------ --------

Breakdown by location of underlying

company revenues (look-through basis)^

Japan 4% 4%

Europe 28% 27%

UK** 38% 36%

USA** 20% 20%

Emerging 11% 12%

Cash and equivalents (1%) 1%

------------ --------

100% 100%

------------ --------

Breakdown by sector

(look-through basis)^

Consumer staples 24% 29%

Communication services 7% 7%

Industrials 4% 4%

Financials* 60% 53%

Information Technology 4% 5%

Consumer Discretionary 1% 1%

Healthcare 1% -%

Cash and equivalents (1%) 1%

------------ --------

100% 100%

------------ --------

* LTL accounts for 51% and is not listed.

** LTL accounts for 28 percentage points of the UK figure, 18

percentage points of the Europe figure and 5 percentage points of

the USA figure.

^ Look-through basis: This adjusts the percentages held in each

asset class, country or currency by the amount held by LTL

managed funds. It provides Shareholders with a more accurate

measure of country and currency exposure by aggregating the direct

holdings of the Company with the indirect holdings held by the LTL

funds.

Appendix 1

Half year review of Lindsell Train Limited ('LTL')

The Manager of The Lindsell Train Investment Trust

Funds under Management Jul 2019 Jan 2019 Jul 2018

FUM by Strategy: GBPm GBPm GBPm

UK 10,691 8,311 8,368

Global 11,208 7,465 6,502

Japan 664 484 434

-------- -------- --------

Total 22,563 16,260 15,304

-------- -------- --------

Largest Client Accounts

Jul 2019 Jan 2019 Jul 2018

% of FUM % of FUM % of FUM

Largest Pooled Fund Account 39% 35% 37%

Largest Segregated Account 8% 9% 9%

Financials

Jul 2019 Jul 2018 %

Profit & Loss GBP GBP Change

Fee Revenue

Investment Management fee 50,506 35,251 43%

Performance Fee 2,436 2,827 (14%)

Bank Interest 220 76

-------- --------

53,162 38,154

Staff Remuneration * (17,583) (13,619) 29%

Fixed Overheads (1,623) (1,141) 42%

FX Currency Translation Gain 720 221

-------- --------

Operating profit 34,676 23,615 47%

Taxation (6,589) (4,487)

-------- --------

Net Profit 28,087 19,128 47%

Dividends (20,688) (13,996)

-------- --------

Retained profit 7,399 5,132

-------- --------

Capital & Reserves

Called up Share Capital 266 266

Profit & Loss Account 57,384 39,415

-------- --------

Shareholders' Funds 57,650 39,681

Balance Sheet

Fixed Assets 37 50

Current Assets (inc cash

at bank) 70,251 48,238

Liabilities (12,638) (8,607)

-------- --------

Net Assets 57,650 39,681

-------- --------

* No more than 25% of fees (other than LTIT fees) can be paid as

staff remuneration. Employer national insurance costs are excluded

from this limit.

Five Year History Jul 2019 Jul 2018 Jul 2017 Jul 2016 Jul 2015

Operating Profit Margin 65% 62% 58% 65% 57%

Earnings per share (GBP) 1,054 717 493 335 245

Dividends per share (GBP) 776 525 390 285 157

Total Staff Cost as %

of Revenue 33% 36% 38% 30% 38%

Opening FUM (GBPm) 15,304 11,326 8,045 5,758 3,897

Changes in FUM (GBPm) 7,259 3,978 3,281 2,287 1,861

- of market movement 4,568 2,044 1,530 979 1,053

- of net new fund inflows 2,691 1,934 1,751 1,308 808

Closing FUM (GBPm) 22,563 15,304 11,326 8,045 5,758

Open ended funds as %

of total 75% 72% 64% 57% 48%

Client Relationships

- Pooled funds 4 4 4 4 4

- Separate accounts 17 17 15 16 16

Ownership

Jul 2019* Jan 2019 Jul 2018

Michael Lindsell & spouse 9,650 967 967

Nick Train & spouse 9,650 967 967

Lindsell Train Investment

Trust plc 6,450 646 646

Other Directors/employee 910 86 86

--------- -------- -------- --------

26,660 2,666 2,666

* On February 1 2019, LTL undertook a share split, and each

share was subdivided into 10 shares of GBP10 each.

Board of Directors

Nick Train Chairman and Portfolio Manager

Michael Lindsell Chief Executive & Portfolio Manager

Michael Lim Chief Operating Officer

Jane Orr Head of Client Servicing & Marketing

James Alexandroff Non-Executive

Employees

July 2019 Jan 2019 July 2018

Investment Team ( inc. 3 Portfolio

Managers) 6 5 5

Client Servicing & Marketing 5 5 4

Operations & Administration 8 7 8

Non-Executive director 1 1 1

Total number of employees 20 18 18

======================================= ====== ============ =============

Appendix 2

LTIT Directors' Valuation of LTL (unaudited) Sept 2019 Sept 2018

GBP'000 GBP'000

Funds under Management excluding LTIT

holdings 21,643,251 15,344,509

---------- ----------

Value of LTL based on 1.5% of FUM

(A) 324,649 230,168

---------- ----------

Annualised revenue ex performance

fee * 115,232 81,555

Notional staff costs (45%) (51,854) (36,700)

Annualised interest income 431 183

Annual operating costs (3,280) (2,271)

Notional tax (11,501) (8,126)

---------- ----------

Notional post tax earnings 49,028 34,641

---------- ----------

Benchmark + 4.0% 4.0%

Equity risk premium 4.5% 4.5%

Total yield + premium (discount rate) 8.5% 8.5%

---------- ----------

Value of LTL based on earnings (B) 576,803 407,545

---------- ----------

Valuation of LTL (A+B)/2) (C) 450,726 318,856

---------- ----------

Shares in issue (D)(#) 26,660 2,666

---------- ----------

Valuation per share of LTL (C/D) GBP16,906 GBP11,960^

---------- ----------

* Annualised figures are previous three months' data.

+ The annual average running yield of the longest-dated UK

government fixed rate bond, currently UK treasury 1(5) /(8) % 2071,

calculated using weekly data, plus a premium of 0.5%, subject to a

minimum yield of 4%.

# On 1 February 2019, LTL undertook a share split, and each

share was subdivided into 10 shares of GBP10 each.

^ The valuation per share figure for September 2018 is

retrospectively changed based on 26,660 shares for ease of

comparison.

Company Information

Directors

Julian Cazalet (Chairman)

Nicholas Allan

Vivien Gould

Richard Hughes

Rory Landman

Michael Lindsell

Company Secretary and Registered Office

Maitland Administration Services Limited

Hamilton Centre

Rodney Way

Chelmsford

Essex

CM1 3BY

Tel: 01245 398950

www.maitlandgroup.com

email: cosec@maitlandgroup.co.uk

Solicitor

Stephenson Harwood LLP

1 Finsbury Circus

London

EC2M 7SH

Broker

JP Morgan Cazenove Ltd

25 Bank Street

Canary Wharf

London

E14 5JP

Investment Manager

Lindsell Train Limited

5th Floor

66 Buckingham Gate

London

SW1E 6AU

Tel: 020 7808 1210

(Authorised and Regulated by the

Financial Conduct Authority)

Registrar

Link Asset Services

The Registry

34 Beckenham Road

Beckenham

Kent

BR3 4TU

Tel: 0871 664 0300

Calls cost 10p per minute plus network extras

(from outside the UK: +44 208 639 3399)

Independent Auditors

PricewaterhouseCoopers LLP

Atria One, 144 Morrison Street

Edinburgh

EH3 8EX

Custodian

Northern Trust Company

50 Bank Street

Canary Wharf

London

E14 5NT

Shareholder relations

The Company's Ordinary share price is listed daily in the

Financial Times.

For further information visit: www.lindselltrain.com and follow

the links.

Individual Savings Account ("ISA")

The Company's shares are eligible to be held in an ISA account

subject to HM Revenue & Customs' limits.

Website

The Company's internet website is located at:

www.lindselltrain.com

Registered in England, No: 4119429

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR LLLFBKLFLFBX

(END) Dow Jones Newswires

December 02, 2019 07:25 ET (12:25 GMT)

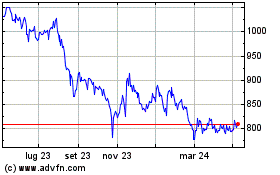

Grafico Azioni Lindsell Train Investment (LSE:LTI)

Storico

Da Mar 2024 a Apr 2024

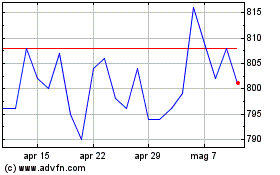

Grafico Azioni Lindsell Train Investment (LSE:LTI)

Storico

Da Apr 2023 a Apr 2024