Bank of America Merrill Lynch 2020 Market Outlook: Profits Rise, Economy Slows, Globalization Peaks, & Business-as-Usual Inve...

03 Dicembre 2019 - 5:30PM

Business Wire

Key drivers of this year’s late-cycle bull market gains are

expected to shift as the global markets enter the new year,

according to BofA Merrill Lynch Global Research, which was recently

named Institutional Investor’s top research firm in the world. In

its year-ahead outlook, the research team forecasts a bottoming of

economic growth in the spring as trade war tensions ease, and

relatively low recession risk.

Key highlights include:

- Stocks are expected to outperform bonds handily in 2020 as the

global economy bottoms out in the first quarter, while monetary

policy remains accommodative. The conventional idea of allocating

60 percent to equities and 40 percent to bonds is unlikely to

survive into the 2020s.

- An interim, skinny U.S.-China trade deal should temporarily

relieve trade concerns ahead of the U.S. presidential election and

pave the way for a midyear, mini-boost in global growth led by U.S.

rates and a weaker dollar.

- A rebound in U.S. corporate earnings should spur a long-awaited

uptick in capital spending and lift the S&P 500 to another

year-end high of 3300, or 6 percent above current levels. In a

reversal of trend, U.S. stock returns are expected to lag gains

forecast for Europe and emerging market stocks next year.

- The potential for 6 percent total returns on high-grade bonds

next year makes U.S. corporate credit particularly attractive in a

world facing $12 trillion of negative-yielding debt. Inflows from

foreign investors are expected to remain strong, supported by

favorable spreads, but today’s bond market “bubble” could become

the markets’ biggest vulnerability.

“The new year and decade begin near the tail end of the longest

bull market on record, and despite recent strong gains, investor

anxiety remains at a high level,” said Candace Browning, head of

BofA Merrill Lynch Global Research. “Many of the driving factors –

central bank policy, globalization, oil – have peaked, and new

economic paradigms are emerging in response to a different set of

challenges facing the world’s social, environment, political and

economic systems. Rather than focusing on the downside, we think

the opportunity for investors will be found in what happens

next.”

At the annual Bank of America Merrill Lynch Year Ahead Outlook

presentation today in New York City, the firm’s top strategists and

economists discussed the overarching themes that are transforming

economies and investing paradigms in the year ahead and throughout

the 2020s. Notable among these is the transition to stronger local

and regional economic ties, following three decades of economic

growth fueled by the benefits of globalization – an unchecked,

cross-border free flow of goods, people and capital that rewarded

cheap labor and low consumer prices. The shift from globalization

to localization and other global macro trends underpins much of

Bank of America Merrill Lynch’s outlook on the markets and economy

next year.

Key macro calls made for the markets and economy in the year

ahead are:

- Slowing global growth: Global GDP is forecast to slow

from 3.8 percent in 2018 to just over 3 percent in 2019 and 2020.

Europe should stabilize at around 1 percent, while a

below-consensus call on China assumes growth slowing from 6.1

percent to 5.6 percent. Inflation is likely to inch lower from 3.1

percent this year to 2.7 percent by 2021 while policy rates remain

flat and fiscal policy stays frozen.

- U.S. economic slowdown despite strong fundamentals: U.S.

GDP is expected to slow to trend, with growth averaging 1.7 percent

over the next two years. On the positive side, inflation should be

muted, with core PCE inflation at around 2 percent by the end of

2020. The Federal Reserve is not expected to take further rate

action for the foreseeable future, unless a material shift in

outlook triggers such a move. Given the Fed’s focus on avoiding a

recession, the risk of further cutting outweighs hikes.

- Modest gains in U.S. stocks, with greater upside outside

U.S.: S&P earnings per share are forecast to grow 8 percent

to $177 at year-end, and returns will likely be driven solely by

corporate earnings vs. price-to-earnings multiple expansions.

Emerging markets and Europe could offer more upside in 2020:

crowded positioning in the U.S. vs. the rest of the world, and

estimate revisions abroad outpacing those in the U.S. support a

rotation into global equities. Three significant tactical rotations

call for allocation shifts from growth to value, from large cap to

small cap, and from the U.S. to the rest of the world.

- Rates on pause as support from monetary policy wanes:

U.S. rates are expected to lead the way in 2020, with downside

risks somewhat diminished and higher repricing likely. Ten-year

rates are expected to move from 2 percent at the end of 2019 to 1.8

percent in 2020. The yield curve remains vulnerable to a paring

back of Fed easing expectations in the near term, while the swap

curve is expected to flatten. Fed actions freed other central banks

to ease, and with the exception of China, many are also expected to

put rate actions on hold next year.

- Credit cycle rolls on: Despite weaker global growth,

U.S. investment grade corporate earnings growth of 9 percent is

expected, up from 1 percent in 2019, with spreads tightening by 10

basis points and total returns of 4 to 6 percent. Gross issuance

will likely be down 4 percent to $1.137 trillion, with net issuance

declining 21 percent to $399 billion. In 2020, the 11-year

high-yield credit cycle is expected to keep on rolling, though

earnings will be the biggest risk. Default rates should stabilize

at 4 percent next year, as spreads gravitate to 450 basis points.

Key tactical rotations call for smaller over larger issuers, longer

over shorter spread duration, and more cyclical sectors.

- Emerging markets recovery contingent on trade: The

outcome of the U.S.-China trade war is crucial to the outlook for

emerging markets in 2020. Total emerging market returns of 7.1

percent in local debt are forecast, but only 2.6 percent for

external debt. Latin America is mounting a cyclical recovery,

likely led by Brazil and Andrean economies, while Argentina’s new

government faces extreme economic challenges. Idiosyncratic factors

will dominate in emerging EMEA, with Egyptian and Russian local

markets and Kenyan and Nigerian external debt favored.

- Weakening dollar: The U.S. dollar is expected to weaken

in 2020 with diminishing policy uncertainty. The euro and sterling

also should benefit from a resolution of Brexit uncertainty, with

EUR/USD and GBP/USD rising to 1.15 and 1.39 respectively. Stronger

global growth and a weaker dollar will help support emerging

markets. USD/JPY is expected to decline to 103, while AUD/JPY and

ASEAN FX should appreciate sharply on global reflation.

- Modest growth in commodities hedge inflation risks: A

positive roll yield should support modest commodity returns in

2020, with dispersion expected within energy, metals and

agricultural. Brent crude could hit $70 per barrel by midyear,

while diesel may near $100/bbl. Summer U.S. natural gas prices

could fall below $2/million British thermal units, as forward

balances continue to weaken after the winter. Cyclical raw

materials should benefit from a potential inventory restocking

cycle, easier Fed policy, and an interim China trade deal,

providing an attractive inflation hedge. While copper and nickel

are likely to rally in 2020, the outlook for gold and precious

metals is more cautious.

- Sector weights and rotations: Amid emerging signs of an

inflection in the manufacturing economy and interim trade deal, the

recommended sector weighting for industrials has moved to

overweight from marketweight. Given the likelihood that the trade

war re-escalates after the 2020 U.S. presidential election and

morphs from a trade war to a tech war, Information Technology moves

from overweight to marketweight. – Overweight: Financials, Consumer

Discretionary, Industrials, Utilities – Marketweight: Technology,

Communication Services, Health Care, Energy – Underweight: Real

Estate, Consumer Staples, Materials

Given macro trends impacting the markets, business-as-usual

investing is likely to come to an end. Localization, rather than

globalization, has major implications for global growth, and a rise

in moral capitalism is changing corporate behavior, shifting the

focus from shareholders to stakeholders. Investors should consider

several longer-term trends for 2020 and beyond: (1) from global to

local, (2) from trade war to tech war, (3) from bonds to stocks,

and (4) from short-term gains to long-term growth, where

environmental, social and governance (ESG) considerations can help

isolate the long-term growth stories.

To learn more about these major themes, please listen to a

podcast hosted by Candace Browning, “What the 2020s could bring for

the markets – and our financial lives.”

BofA Merrill Lynch Global Research The BofA Merrill Lynch Global

Research franchise covers more than 3,000 stocks and 1,250 credits

globally and ranks in the top tier in many external surveys. Most

recently, the group was named No. 1 Global Research Firm of 2019 by

Institutional Investor magazine; No. 1 in the 2019 Institutional

Investor Global Fixed-Income Research survey and Emerging EMEA

surveys; No. 2 in the 2019 Institutional Investor All-America

survey; and No. 4 in the 2019 Institutional Investor All-Asia and

All-Europe surveys. For more information about any awards cited,

visit https://go.bofa.com/awards.

Bank of America Bank of America is one of the world’s leading

financial institutions, serving individual consumers, small and

middle-market businesses and large corporations with a full range

of banking, investing, asset management, and other financial and

risk management products and services. The company provides

unmatched convenience in the United States, serving approximately

66 million consumer and small business clients with approximately

4,300 retail financial centers, including approximately 2,400

lending centers, 2,600 financial centers with a Consumer Investment

Financial Solutions Advisor and 1,900 business centers;

approximately 16,600 ATMs; and award-winning digital banking with

nearly 38 million active users, including approximately 29 million

mobile users. Bank of America is a global leader in wealth

management, corporate and investment banking and trading across a

broad range of asset classes, serving corporations, governments,

institutions and individuals around the world. Bank of America

offers industry-leading support to approximately 3 million small

business owners through a suite of innovative, easy-to-use online

products and services. The company serves clients through

operations across the United States, its territories and

approximately 35 countries. Bank of America Corporation stock

(NYSE: BAC) is listed on the New York Stock Exchange.

“Bank of America Merrill Lynch”, “Bank of America” and “BofA

Securities” are the marketing names used by the Global Banking and

Global Markets divisions of Bank of America Corporation. Lending,

other commercial banking activities, and trading in certain

financial instruments are performed globally by banking affiliates

of Bank of America Corporation, including Bank of America, N.A.,

Member FDIC. Trading in securities and financial instruments, and

strategic advisory, and other investment banking activities, are

performed globally by investment banking affiliates of Bank of

America Corporation (“Investment Banking Affiliates”), including,

in the United States, BofA Securities, Inc. and Merrill Lynch

Professional Clearing Corp., both of which are registered

broker-dealers and Members of SIPC, and, in other jurisdictions, by

locally registered entities. BofA Securities, Inc. and Merrill

Lynch Professional Clearing Corp. are registered as futures

commission merchants with the CFTC and are members of the NFA.

Investment products offered by Investment Banking Affiliates:

Are Not FDIC Insured * May Lose Value * Are Not Bank Guaranteed.

©2019 Bank of America Corporation.

For more Bank of America news, including dividend announcements

and other important information, visit the Bank of America newsroom

and register for news email alerts.

www.bankofamerica.com

View source

version on businesswire.com: https://www.businesswire.com/news/home/20191203005803/en/

Reporters May Contact: Melissa Anchan, Bank of America,

1.646.532.9241 melissa.anchan@bofa.com

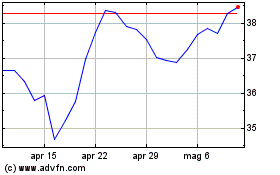

Grafico Azioni Bank of America (NYSE:BAC)

Storico

Da Mar 2024 a Apr 2024

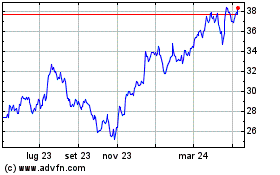

Grafico Azioni Bank of America (NYSE:BAC)

Storico

Da Apr 2023 a Apr 2024