TIDMSUH

RNS Number : 5635V

Sutton Harbour Group PLC

04 December 2019

04 December 2019

Sutton Harbour Group plc (formerly Sutton Harbour Holdings

plc)

("The Company", "Sutton Harbour")

Sutton Harbour Group plc, the AIM-listed marine and waterfront

regeneration specialist, announces its interim results for the

six-month period to 30 September 2019.

Financial Highlights

-- Profit before taxation GBP0.281m 6 months to 30 September 2018: GBP0.110m)

-- Net assets GBP46.013m (31 March 2019: GBP45.732)

-- Net debt GBP22.861m (31 March 2019: GBP21.373m)

-- Gearing 49.7% (31 March 2019: 46.7%)

Company Highlights

-- Finalising pre-construction preparations for consented

schemes at Harbour Arch Quay and Sugar Quay

-- Installation of new Plymouth Fisheries fuel and power servery

underway and due to be complete by end of 2019

-- Work underway to increase marinas berthing space and

accommodation for a greater number of larger leisure vessels

-- Appointment of Corey Beinhaker as Executive Director and Chief Operating Officer

-- New 4 year long facility agreement with existing company bankers, NatWest, put in place

"With longer term banking facilities in place the Company is

advancing confidently with its objective to self-deliver real

estate projects and to continue targeted investment into the asset

base to achieve medium term returns and value growth to

shareholders."

Philip Beinhaker, Executive Chairman

For further information, please contact:

Sutton Harbour Group plc 01752 204186

Philip Beinhaker - Executive Chairman

Corey Beinhaker - Chief Operating Officer

Natasha Gadsdon - Finance Director

Arden Partners 020 7614 5900

Paul Shackleton

Benjamin Cryer

Executive Chairman's Statement

For the six-month period to 30 September 2019

Results and Financial position

Profit before taxation for the six-month period to 30 September

2019 was GBP0.281m, up GBP0.171m from GBP0.110m for the comparative

period to 30 September 2018.

As at 30 September 2019, net assets were GBP46.013m compared to

GBP45.732m, as last reported as at 31 March 2019. There has been no

re-valuation of assets during the reporting period, with the next

external independent valuation due to be undertaken early in

2020.

Net debt has increased to GBP22.861m, up by GBP1.488m from

GBP21.373m as at 31 March 2019. This budgeted movement reflects the

lower point in the annual cash cycle (as rents and annual berthing

fee receipts peak between January and April) and expenditure on

pre-construction costs in connection with consented schemes at

Harbour Arch Quay and Sugar Quay, infrastructure improvements

notably including the new fuel and utility dispensary system at

Plymouth Fisheries and works to other premises to facilitate new

tenancies and to maintain the quality of the estate. This has

resulted in a rise in gearing to 49.7% as at 30 September 2019 from

46.7% as at 31 March 2019.

To ensure continuity of financing the Company has just entered

into a new 4 year facility agreement with its incumbent bank on

equivalent terms to the previous agreement. Funding for consented

projects will be funded by separate development financing.

Board Composition Update

In October 2019 the Company announced Corey Beinhaker's

appointment as Chief Operating Officer. This brings the board to a

total of five Directors including Executive Chairman, Philip

Beinhaker.

Trading Report

The Company's business activities traded successfully during the

first half year, with the marinas and car parks both achieving

strong revenue growth ahead of price inflation. Marketing of the

marinas for the 2020 season was launched at Southampton Boat Show

from our newly designed interactive stand which attracted an

encouraging level of interest. Fisheries' trading remained on par

with the same period last year and rental incomes from recent

lettings added to income of this business sector. Further new

lettings are expected to complete in the second half year.

Regeneration

Finalisation of pre-construction preparations for the planning

consented residential led developments at Harbour Arch Quay and

Sugar Quay, both at Sutton Harbour, has been the priority in recent

months. These works have required submission of some amendments to

the Local Planning Authority, selection of the construction and

sub-contractor teams and finalisation of detailed drawings. It is

expected that subject to completion of finance and planning

amendments that both the smaller 14 apartment scheme at Harbour

Arch Quay and larger 170 apartment building at Sugar Quay will

start on site during 2020, along with the marketing of the

units.

The planning consented two storey extension to Harbour Car Park

has been put back to follow the Mayflower 400 celebrations which

take place throughout 2020, to avoid parking disruption during the

events season at the largest car park around Sutton Harbour.

Infrastructure improvements

The Company is currently in the process of commissioning a new

fuel and utility dispensary system at Plymouth Fisheries. The part

grant funded GBP800,000 project, updates the current 25 year old

system with modern fuel and energy delivery technology. It is the

latest phase of a 5 year plan to overhaul key fisheries

infrastructure which has also included GBP2m investment in ice

making equipment, chilled stores, energy efficient lighting and

boilers, hygienic wall cladding, enhanced CCTV and lock barrel

walkways.

During the winter months part of the marina at Sutton Harbour

will be re-configured to meet requirements of prospective

berth-holders for larger berths and new pontoon equipment will be

installed to meet the increasing demand for berthing space at King

Point Marina. To improve facilities for public participation and

entertainment in the harbour, the Company will be investing in new

floating 'event-size' pontoons which can be located in various

shallow water areas of Sutton Harbour together with an access

pontoon.

Summary

Our financial year to date has been a productive period in which

we have been preparing for major development projects which are now

close to the delivery phase. Profitability of the trading

businesses is improving following investment in marketing,

facilities' presentation and increased use of time saving

technologies in each area. The Company is working in partnership

with the City Council and other groups to support hosting of events

to commemorate the 400th anniversary of the departure of the

Pilgrim Fathers to America. Visitors numbers are expected to peak

in Summer 2020 centred around the Mayflower Steps located on

southern the side of Sutton Harbour

With longer term banking facilities in place the Company is

advancing confidently with its objective to self-deliver real

estate projects and to continue targeted investment into the asset

base to achieve medium term returns and value growth to

shareholders.

Philip Beinhaker

EXECUTIVE CHAIRMAN

Consolidated Statement of Comprehensive Income

6 months 6 months Year Ended

to to

30 September 30 September 31 March

2019 2018 2019

(unaudited) (unaudited) (audited)

GBP000 GBP000 GBP000

-------------- -------------- -----------

Revenue 3,820 3,717 6,893

Cost of Sales (2,379) (2,390) (4,686)

Gross Profit 1,441 1,327 2,207

-------------- -------------- -----------

Fair value adjustment on fixed assets

and investment property (26) (8) 1,444

Administrative expenses (672) (711) (1,234)

Operating profit from continuing operations 743 608 2,417

Financial income - - 1

Financial expense (462) (498) (902)

Net financing costs (462) (498) (901)

Profit before tax from continuing

operations 281 110 1,516

Taxation credit on profit from continuing

operations - - 315

Profit from continuing operations 281 110 1,831

============== ============== ===========

Basic profit/earnings per share 0.02p 0.01p 1.68p

Diluted profit/earnings per share 0.02p 0.01p 1.68p

6 months 6 months Year Ended

to to

30 September 30 September 31 March

2019 2018 2019

(unaudited) (unaudited) (audited)

GBP000 GBP000 GBP000

-------------- -------------- -----------

Profit from continuing operations 281 110 1,831

Other comprehensive income/(expenses)

Continuing operations:

Revaluation of property, plant and

equipment - - 1,640

Deferred taxation on income and expenses

recognised directly in the consolidated

statement of comprehensive income

Effective portion of changes in fair

value of cash flow hedges - - 6

Total other comprehensive income - - 1,646

-------------- -------------- -----------

Total comprehensive income for the

period attributable to equity shareholders 281 110 3,477

============== ============== ===========

Consolidated Balance Sheet

As at As at As at

30 September 30 September 31 March

2019 2018 2019

(unaudited) (unaudited) (audited)

GBP000 GBP000 GBP000

-------------- -------------- -----------

Non-current assets

Property, plant and equipment 26,855 23,899 26,632

Investment property 19,571 19,055 19,425

Inventories 12,610 - 12,448

-------------- -------------- -----------

59,036 42,954 58,505

-------------- -------------- -----------

Current assets

Inventories 11,552 22,250 11,119

Trade and other receivables 2,104 2,122 2,283

Cash and cash equivalents 244 1,859 1,296

Tax recoverable - - (5)

-------------- -------------- -----------

13,900 26,231 14,693

-------------- -------------- -----------

Total assets 72,936 69,185 73,198

-------------- -------------- -----------

Current liabilities

Trade and other payables 1,053 1,308 1,496

Finance lease liabilities 65 96 122

Deferred income 936 883 1,398

Provisions 75 69 70

2,129 2,356 3,086

-------------- -------------- -----------

Non-current liabilities

Other interest-bearing loans and

borrowings 23,000 25,000 22,500

Finance lease liabilities 40 232 47

Deferred government grants 646 646 646

Deferred tax liabilities 1,023 1,338 1,023

Provisions 85 168 164

24,794 27,384 24,380

-------------- -------------- -----------

Total liabilities 26,923 29,740 27,466

-------------- -------------- -----------

Net assets 46,013 39,445 45,732

============== ============== ===========

Issued capital and reserves attributable

to owners of the parent

Share capital 16,266 16,162 16,266

Share premium 10,695 7,872 10,695

Other reserves 11,696 10,055 11,696

Retained earnings 7,356 5,356 7,075

-------------- -------------- -----------

Total equity 46,013 39,445 45,732

============== ============== ===========

Consolidated Statement of Changes in Equity

Share Share Revaluation Merger Hedging Retained TOTAL

capital premium reserve reserve reserve earnings

----------Other Reserves----------

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

--------- --------- ------------- --------- --------- ---------- --------

Balance at 1 April 2019 16,266 10,695 7,825 3,871 - 7,075 45,732

Comprehensive

income/(expense)

Profit for the period - - - - - 281 281

Total comprehensive

income/(expense)

6 month period ended 30

September 2019 - - - - - 281 281

--------- --------- ------------- --------- --------- ---------- --------

Balance at 30 September

2019 16,266 10,695 7,825 3,871 - 7,356 46,013

--------- --------- ------------- --------- --------- ---------- --------

Balance at 1 April 2018 16,162 7,782 6,183 3,871 (6) 5,246 39,328

Comprehensive

income/(expense)

Profit for the period - - - - - 110 110

Other comprehensive

income/(expense)

Revaluation of property,

plant and equipment - - - - 7 - 7

Effective portion of changes

in fair value of cash

flow hedges

--------- --------- ------------- --------- --------- ---------- --------

Total other comprehensive

income/(expense) 6 month

period ended 30 September

2018 - - - - 7 - 7

--------- --------- ------------- --------- --------- ---------- --------

Total comprehensive

income/(expense)

6 month period ended 30

September 2018 - - - - 7 110 7

--------- --------- ------------- --------- --------- ---------- --------

Balance at 30 September

2018 16,162 7,782 6,183 3,871 1 5,356 39,445

--------- --------- ------------- --------- --------- ---------- --------

Balance at 1 October 2018 16,162 7,872 6,183 3,871 1 5,356 39,445

Comprehensive

income/(expense)

Profit for the period - - - - - 1,719 1,719

Other comprehensive

income/(expense)

Revaluation of property,

plant and equipment - - 1,642 - - - 1,642

Effective portion of changes

in fair value of cash

flow hedges - - - - (1) - (1)

--------- --------- ------------- --------- --------- ---------- --------

Total other comprehensive

income/(expense) 6 month

period ended 31 March

2019 - - 1,642 - (1) - 1,641

--------- --------- ------------- --------- --------- ---------- --------

Total comprehensive

income/(expense)

6 month period ended 31

March 2019 - - 1,642 - (1) 1,719 3,360

--------- --------- ------------- --------- --------- ---------- --------

Transactions with owners

of the parent

Issue of shares 104 2,823 - - - - 2,927

--------- --------- ------------- --------- --------- ---------- --------

Balance at 31 March 2019 16,266 10,695 7,825 3,871 - 7,075 45,732

--------- --------- ------------- --------- --------- ---------- --------

Consolidated Cash Flow Statement

6 months 6 months Year Ended

to to

30 September 30 September 31 March

2019 2018 2019

(unaudited) (unaudited) (audited)

GBP000 GBP000 GBP000

---- -------------- -------------- -----------

Cash generated from total operating

activities (481) (916) (1,181)

-------------- -------------- -----------

Cash flows from investing activities

Net expenditure on investment

property - - (60)

Expenditure on property, plant

and equipment (609) (100) (243)

Proceeds from sale of plant - - -

and equipment

-------------- -------------- -----------

Net cash used in investing activities (609) (100) (303)

-------------- -------------- -----------

Cash flows from financing activities

Proceeds from sale of shares - - 3,000

Expenses of share issuance - - (73)

Interest paid (462) (498) (958)

Loan drawdowns/(repayment of

borrowings) 500 650 (1,850)

Net finance lease (payments)/receipts - (43) (106)

Net cash generated from financing

activities 38 109 13

-------------- -------------- -----------

Net increase/(decrease) in cash

and cash equivalents (1,052) (907) (1,471)

Cash and cash equivalents at

beginning of period 1,296 2,766 2,767

Cash and cash equivalents at

end of period 244 1,859 1,296

============== ============== ===========

Notes to Interim Report

General information

This consolidated interim financial information does not

comprise statutory accounts within the meaning of section 434 of

the Companies Act 2006. Statutory accounts for the year ended 31

March 2019 were approved by the Board of Directors on 10 July 2019

and delivered to the Registrar of Companies. The report of the

auditors on those accounts was unqualified and did not contain any

statement under section 498 of the Companies Act 2006.

Copies of the Group's financial statements are available from

the Company's registered office, Sutton Harbour Office, Guy's Quay,

Sutton Harbour, Plymouth, PL4 0ES and on the Company's website

www.sutton-harbour.co.uk.

This consolidated interim financial information has not been

audited.

Basis of preparation

The consolidated interim financial information should be read in

conjunction with the annual financial statements for the year ended

31 March 2019, which have been prepared in accordance with

International Financial Reporting Standards (IFRS) and

International Financial Reporting Interpretation Committee (IFRIC)

interpretations as endorsed by the European Union, and those parts

of the Companies Acts 2006 as applicable to companies reporting

under IFRS.

Accounting policies

Except as described below, the accounting policies applied are

consistent with those of the annual financial statements for the

year ended 31 March 2019, as described in those annual financial

statements.

Adoption of new International Financial Reporting Standards

The following new standards, amendments to standards or

interpretations have been issued, but are not effective for the

financial year beginning 1 April 2018 and have not been adopted

early:

IFRS 15 Revenue from Contracts with Customers: *1 January

2018

IFRS 9 Financial Instruments: * 1 January 2018

* mandatory effective date is periods commencing on or after

Accounting estimates and judgements

The preparation of financial statements in conformity with IFRS

requires management to make judgements, estimates and assumptions

that affect the application of policies and reported amounts of

assets and liabilities, income and expenses. The estimates and

associated assumptions are based on historical experience and

various other factors that are believed to be reasonable under the

circumstances, the results of which form the basis of making

judgements that are not readily apparent from other sources. Actual

results may differ from these estimates.

The estimates and underlying assumptions are reviewed on an

ongoing basis. Revisions to accounting estimates are recognised in

the period in which the estimate is revised, if the revision

affects only that period, or in the period of the revision and

future periods, if the revision affects both current and future

periods.

Segment information

Management has determined the operating segments based on the

reports reviewed by the Board of Directors that are used to make

strategic decisions.

The Board of Directors considers the business from an

operational perspective as having only one geographical segment,

with all operations being carried out in the United Kingdom.

The Board of Directors considers the performance of the

operating segments using operating profit. The segment information

provided to the Board of Directors for the reportable segments for

the period ended 30 September 2019 is as follows:

6 months to

30 September

2019 Marine Real Estate Car Parking Regeneration Total

GBP000 GBP000 GBP000 GBP000 GBP000

Revenue 2,662 762 396 - 3,820

Gross profit

prior to non-recurring

items 637 534 269 - 1,440

Segmental Operating

Profit before

Fair value adjustment

and unallocated

expenses 637 534 269 - 1,440

Fair value adjustment

on fixed assets

and investment

property assets - - - - -

Unallocated:

Administrative

expenses (697)

Operating profit

from continuing

operations 743

Financial income

Financial expense (462)

-------

Profit before

tax from continuing

operations 281

Taxation -

-------

Profit for the

year from continuing

operations 281

=======

Depreciation

charge

Marine 150

Car Parking 14

Administration 5

-------

169

=======

Segment Information (continued)

6 months to

30 September

2018 Marine Real Estate Car Parking Regeneration Total

GBP000 GBP000 GBP000 GBP000 GBP000

Revenue 2,665 747 305 - 3,717

Gross profit

prior to non-recurring

items 629 486 213 (57) 1,271

Segmental Operating

Profit before

Fair value adjustment

and unallocated

expenses 629 486 213 (57) 1,271

Fair value adjustment

on fixed assets

and investment

property assets - - - - -

Unallocated:

Administrative

expenses (662)

Operating profit

from continuing

operations 609

Financial income

Financial expense (499)

-------

Loss before

tax from continuing

operations 110

Taxation -

-------

Loss for the

year from continuing

operations 110

=======

Depreciation

charge

Marine 152

Car Parking 16

Administration 7

-------

175

=======

Segment Information (continued)

Year ended 31

March 2019 Marine Real Estate Car Parking Regeneration Total

GBP000 GBP000 GBP000 GBP000 GBP000

Revenue 4,896 1,474 523 - 6,893

Gross profit

prior to non-recurring

items 1,057 941 350 (141) 2,207

Segmental Operating

Profit before

Fair value adjustment

and unallocated

expenses 1,057 941 350 (141) 2,207

Fair value adjustment

on fixed assets

and investment

property assets 1,134 310 - - 1,444)

3,651

Unallocated:

Administrative

expenses (1,234)

Operating profit

from continuing

operations 2,417

Financial income 1

Financial expense (902)

--------

Profit before

tax from continuing

operations 1,516

Taxation 315

--------

Profit for the

year from continuing

operations 1,831

========

Depreciation

charge

Marine 314

Car Parking 33

Administration 11

--------

358

========

30 September 30 September 31 March

2019 2018 2019

GBP000 GBP000 GBP000

Segment assets:

Marine 23,731 20,580 23,514

Real estate 19,815 19,704 19,952

Car Parking 4,423 4,196 4,456

Regeneration 24,267 22,335 23,577

Total segment assets 72,236 66,815 71,499

Unallocated assets:

Property, plant and equipment 87 72 61

Trade & other receivables 368 439 361

Cash & cash equivalents 245 1,859 1,277

Total assets 72,936 69,185 73,198

============= ============= =========

Segment Information (continued)

30 September 30 September 31 March

2019 2018 2019

GBP000 GBP000 GBP000

Segment liabilities:

Marine 1,196 1,134 1,897

Real estate 417 607 575

Car Parking 72 79 130

Regeneration 951 996 1,085

------------- ------------- ---------

Total segment liabilities 2,636 2,816 3,687

Unallocated liabilities:

Bank overdraft & borrowings 23,105 25,232 22,652

Trade & other payables 157 354 102

Financial Derivatives - (2) -

Tax payable 1 - 1

Deferred tax liabilities 1,024 1,340 1,024

------------- ------------- ---------

Total liabilities 26,923 29,740 27,466

============= ============= =========

Unallocated assets included in total assets and unallocated

liabilities included in total liabilities are not split between

segments as these items are centrally managed.

Taxation

The Company has applied an effective tax rate of 19% (2018: 19%)

based on management's best estimate of the tax rate expected for

the full financial year and is reflected in a movement in deferred

tax.

Dividends

The Board of Directors do not propose an interim dividend (2018:

nil).

Earnings per share

6 months to 6 months Year Ended

to

30 September 30 September 31 March

2019 2018 2019

(unaudited) (unaudited) (audited)

pence pence pence

-------------- -------------- -----------

Continuing operations

Basic earnings per share 0.02p 0.01p 1.68p

Diluted earnings per share* 0.02p 0.01p 1.68p

Basic Earnings per Share:

Basic earnings per share have been calculated using the profit

for the period of GBP281,000 (2018: profit GBP110,000, year ended

31 March 2019 profit GBP1,831,000). The average number of ordinary

shares in issue, excluding those options granted under the SAYE

scheme, of 115,944,071 (2018: 98,320,272; year ended 31 March 2019:

115,944,071) has been used in our calculation.

Diluted Earnings per Share:

Diluted earnings per share uses an average number of 115,944,071

(2018: 98,320,272; year ended 31 March 2019 108,982,966) ordinary

shares in issue, and takes account of the outstanding options under

the SAYE scheme in accordance with IAS 33 'Earnings per share'.

There are no outstanding options under expire SAYE schemes.

Property valuation

Freehold land and buildings and investment property have been

independently valued by Jones Lang LaSalle as at 31 January 2019,

in accordance with the Practice Statements in the Valuations

Standards (The Red Book) published by the Royal Institution of

Chartered Surveyors.

A further valuation will be commissioned for the year ending 31

March 2020, as in previous years.

Cash and cash equivalents

As at As at As at

30 September 30 September 31 March

2019 2018 2019

(unaudited) (unaudited) (audited)

GBP000 GBP000 GBP000

------------- ------------- ----------

Cash and cash equivalents per

balance sheet and cash flow

statement 244 1,859 1,296

============= ============= ==========

Provisions

Onerous leases Total

GBP000 GBP000

-------------- ------

Balance at 1 April 2018 239 239

Provisions utilised (2) (2)

Balance at 30 September

2018 237 237

============== ======

Provisions made - -

Provisions utilised (3) (3)

-------------- ------

Balance at 31 March 2019 243 243

============== ======

Provisions made

Provisions utilised (83) (83)

-------------- ------

Balance at 30 September

2019 160 160

============== ======

Current 75 75

Non-current 85 85

160 160

============== ======

Cash flow statements

6 months to 6 months to Year Ended

30 September 30 September 31 March

2019 2018 2019

(unaudited) (unaudited) (audited)

GBP000 GBP000 GBP000

-------------- -------------- -----------

Cash flows from operating

activities

Profit/(loss) for the period 281 110 1,831

Adjustments for:

Taxation - - (315)

Financial income - - -

Financial expense 442 498 901

Fair value adjustment on fixed

assets and investment property - - (1,443)

Depreciation 169 175 358

Amortisation of grants - - -

Profit/loss on sale of property,

plant and equipment 7 (16) -

Cash generated from operations

before changes in working

capital and provisions 899 767 1,332

Increase in inventories (635) (959) (2,236)

Decrease/(increase) in trade

and other receivables 251 57 (113)

(Decrease)/increase in trade

and other payables (366) (229) (124)

Decrease in deferred income (556) (551) (35)

(Decrease)/increase in provisions (74) (1) (5)

Cash generated from operations (481) (916) (1,181)

============== ============== ===========

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR LLFFDFALVIIA

(END) Dow Jones Newswires

December 04, 2019 02:00 ET (07:00 GMT)

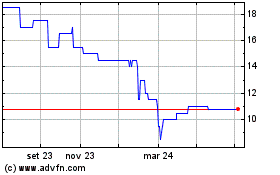

Grafico Azioni Sutton Harbour (LSE:SUH)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Sutton Harbour (LSE:SUH)

Storico

Da Apr 2023 a Apr 2024