TIDMBOO

RNS Number : 7176V

Zeus Capital Ltd

04 December 2019

For Immediate Release 04 December 2019

THIS ANNOUNCEMENT IS NOT FOR RELEASE, DISTRIBUTION OR

PUBLICATION, IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN, INTO

OR WITHIN AUSTRALIA, CANADA, JAPAN, JERSEY, THE REPUBLIC OF SOUTH

AFRICA, NEW ZEALAND OR THE UNITED STATES OR IN TO ANY OTHER

JURISDICTION WHERE SUCH AN ANNOUNCEMENT WOULD BE UNLAWFUL. FURTHER,

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND SHALL NOT

CONSTITUTE AN OFFER TO SELL, OR THE SOLICITATION OF AN OFFER TO

BUY, SUBSCRIBE FOR OR OTHERWISE ACQUIRE, ANY SHARES OR OTHER

SECURITIES OF BOOHOO GROUP PLC IN JERSEY OR ANY JURISDICTION IN

WHICH ANY SUCH OFFER OR SOLICITATION WOULD BE UNLAWFUL. PLEASE SEE

THE IMPORTANT NOTICE AT THE END OF THIS ANNOUNCEMENT.

Proposed secondary placing of ordinary shares in boohoo group

plc

Zeus Capital Limited ("Zeus Capital") and Jefferies

International Limited ("Jefferies") (together, the "Joint Global

Co-Ordinators") announce that they have been advised by Mahmud

Kamani and Carol Kane (the "Selling Shareholders") that they intend

to sell up to 35,000,000 and 15,000,000 ordinary shares

respectively (the "Placing Shares") in boohoo group plc ("boohoo",

or the "Company") (AIM: BOO). Mahmud Kamani is the Group Co-Founder

and Group Executive Chairman of boohoo, and Carol Kane is the Group

Co-Founder and Executive Director of boohoo. The Placing Shares

will be sold via an accelerated bookbuild placing to institutional

investors (the "Placing").

Zeus Capital and Jefferies, each acting as joint global

co-ordinator and bookrunner, have entered into a block trade

agreement ("Block Trade Agreement") with the Selling Shareholders.

Boohoo is not a party to the Block Trade Agreement and will not

receive any proceeds from the Placing.

The Placing Shares represent up to c. 4.3 per cent. of the

issued share capital of boohoo.

Assuming that all of the Placing Shares are sold, the Selling

Shareholders would continue to have an interest (in aggregate) in

184,010,301 ordinary shares in the Company, representing

approximately 15.8 per cent. of the Company's issued share capital,

as per the table below:

Selling Shareholder Shares currently Max. Placing Min. Shares Min. holding

held Shares to be held after % after the

sold the Placing Placing

Mahmud Kamani 187,679,880 35,000,000 152,679,880 13.1%

----------------- -------------- ------------- -------------

Carol Kane 46,330,421 15,000,000 31,330,421 2.7%

----------------- -------------- ------------- -------------

Total 234,010,301 50,000,000 184,010,301 15.8%

----------------- -------------- ------------- -------------

The final number of Placing Shares to be placed and the price at

which the Placing Shares are to be placed will be agreed by Zeus

Capital, Jefferies and the Selling Shareholders at the close of the

bookbuild process, and the results of the Placing will be announced

as soon as practicable thereafter. The timing for the close of the

bookbuild process will be at the absolute discretion of the Joint

Global Co-ordinators.

Assuming the Placing Shares are in aggregate 50 million ordinary

shares, the Selling Shareholders have agreed that, following

completion of the Placing, they will not, without the Company's and

Joint Global Co-ordinators' prior written consent, dispose of

further ordinary shares in the Company for a period of 18 months

(subject to certain customary exceptions).

The books for the Placing will open with immediate effect.

This announcement contains inside information as defined in

Article 7 of the Market Abuse Regulation No. 596/2014 ("MAR"). Upon

the publication of this announcement, this inside information is

now considered to be in the public domain.

Enquiries

Zeus Capital

Joint Global Co-Ordinator and Bookrunner

Nick Cowles/Andrew Jones (Corporate Tel: +44 (0)161 831 1512

Finance)

John Goold/Benjamin Robertson (Corporate Tel: +44 (0)20 3829 5000

Broking)

Jefferies

Joint Global Co-Ordinator and Bookrunner

Philip Noblet/Max Jones Tel: +44 (0)20 7029 8000

Luca Erpici/Lee Morton/Oliver Berwin Tel: +44 (0)20 7029 8415

Important information

This announcement is for information purposes only and does not

itself constitute an offer or invitation to underwrite, subscribe

for or otherwise acquire or dispose of any securities in the

Company and does not constitute investment advice.

Neither this announcement nor any copy of it may be taken or

transmitted, published or distributed, directly or indirectly, in

or into the United States of America, its territories and

possessions, any state of the United States and the District of

Columbia (the "United States"), Australia, Canada, Japan, Jersey or

South Africa or to any persons in any of those jurisdictions or any

other jurisdiction where to do so would constitute a violation of

the relevant securities laws of such jurisdiction. Any failure to

comply with this restriction may constitute a violation of United

States, Australian, Canadian, Japanese, Jersey or South African

securities laws. The distribution of this announcement in other

jurisdictions may be restricted by law and persons into whose

possession this announcement comes should inform themselves about,

and observe any such restrictions.

This announcement is not an offer of securities for sale into

the United States. The securities referred to herein have not been,

and will not be, registered under the U.S. Securities Act of 1933,

as amended, or applicable state securities laws, and may not be

offered or sold into the United States, except pursuant to an

applicable exemption from such registration requirements. No public

offering is being made in the United States.

The Placing is a private placing involving a limited number of

institutional and other investors. Accordingly, no prospectus will

be issued by the Selling Shareholders within the meaning of the

Companies (Jersey) Law 1991, as amended, and the consent of the

Jersey Registrar of Companies will not be sought or obtained, in

connection with the Placing.

Any failure to comply with these restrictions may constitute a

violation of the securities laws of any such jurisdiction. Neither

this announcement, nor any part of it, nor the fact of its

distribution, shall form the basis of, or be relied on in

connection with, or act as an inducement to enter into, any

contract or commitment whatsoever.

Zeus Capital and Jefferies are each authorised and regulated by

the FCA. Each of the Joint Global Co-ordinators is acting for the

Selling Shareholders only in connection with the Placing and no one

else, and will not be responsible to anyone other than the Selling

Shareholders for providing the protections offered to clients of

the Joint Global Co-ordinators nor for providing advice in relation

to the Placing Shares or the Placing, the contents of this

announcement or any transaction, arrangement or other matter

referred to in this announcement.

This announcement has been issued by the Joint Global

Co-ordinators on behalf of the Selling Shareholders and is the sole

responsibility of the Selling Shareholders apart from the

responsibilities and liabilities, if any, that may be imposed on

Zeus Capital or Jefferies by the Financial Services and Markets Act

2000. Neither Zeus Capital nor Jefferies accepts any responsibility

whatsoever and makes no representation or warranty, express or

implied, for the contents of this announcement, including its

accuracy, completeness or verification or for any other statement

made or purported to be made by the Selling Shareholders or on the

Selling Shareholders' behalf or on Zeus Capital's or Jefferies'

behalf, in connection with the Selling Shareholders or the Placing,

and nothing in this announcement is or shall be relied upon as a

promise or representation in this respect, whether as to the past

or the future. Each of Zeus Capital and Jefferies accordingly

disclaims to the fullest extent permitted by law all and any

responsibility and liability, whether arising in tort, contract or

otherwise, which it might otherwise have in respect of this

announcement and any such statement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCCKQDQABDDKBK

(END) Dow Jones Newswires

December 04, 2019 11:46 ET (16:46 GMT)

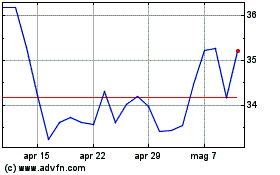

Grafico Azioni Boohoo (LSE:BOO)

Storico

Da Mar 2024 a Apr 2024

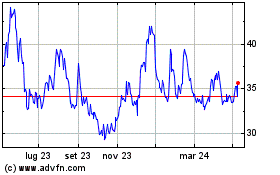

Grafico Azioni Boohoo (LSE:BOO)

Storico

Da Apr 2023 a Apr 2024