Secure Property Dev & Inv PLC Transfer of Bulgarian Assets & Shareholder Call (0781W)

06 Dicembre 2019 - 1:15PM

UK Regulatory

TIDMSPDI

RNS Number : 0781W

Secure Property Dev & Inv PLC

06 December 2019

Secure Property Development & Invest PLC/ Index: AIM / Epic:

SPDI / Sector: Real Estate

6 December 2019

Secure Property Development & Investment PLC ('SPDI' or 'the

Company')

Transfer of Bulgarian property assets to Arcona Property Fund

N.V. and

Shareholder Call

Secure Property Development & Investment PLC (AIM: SPDI),

the AIM-quoted South Eastern European focused property company, is

pleased to announce the transfer of all of its Bulgarian assets

('the Boyana Assets') to Arcona Property Fund N.V. ('Arcona') in

exchange for the issue to SPDI of 315,591 new shares in Arcona and

77,201 warrants over shares in Arcona ('the Transfer'). Based on

the closing price of Arcona's shares on 05 December 2019, the

Transfer values the Boyana Assets at c.EUR1.9million (excluding the

issue of the warrants), while based on the current net asset value

per Arcona share, the Transfer values the Boyana Assets at EUR4.16

million (excluding the issue of the warrants).

The Boyana Assets, which comprise 34 apartments and two

neighbouring plots of land for development in the Boyana suburb of

Sofia, form part of Stage One of the previously announced transfer

to Arcona of SPDI's property portfolio, excluding its Greek

logistics properties, in exchange for new shares and warrants in

Arcona to create a larger Central and South Eastern European

focused investment vehicle ('the Arcona Transaction').

The Transfer represents the conditional closing of the second

tranche of Stage One of the Arcona Transaction. The shares and the

warrants issued to SPDI in relation to the Transfer are to be held

in escrow and will be released to SPDI upon agreement on the terms

of the extension of a loan associated with the Boyana Assets, which

is expected to occur by 31/12/2019.

As announced on 1 November, SPDI recently completed the transfer

of certain of its Ukrainian assets ('the Aisi Bella Assets') as

part of Stage One of the Arcona Transaction. In exchange for the

Aisi Bella Assets, SPDI received 277,943 new shares in Arcona and

67,063 warrants which, based on the closing price of Arcona's

shares on 31 October 2019, valued the Aisi Bella Assets at EUR1,76

million (excluding the issue of the warrants over new shares in

Arcona), while based on the current net asset value per Arcona

share, the Aisi Bella Assets are valued at EUR3.67million

(excluding the issue of warrants). The final tranche of assets to

be transferred as part of Stage One comprise SPDI's remaining

Ukrainian assets. A further announcement will be provided to the

market once this final Stage One tranche has been completed. For

further information on the Stage One assets, please see the

Company's announcement of 7 August 2019.

As previously announced, both parties intend to complete the

Arcona Transaction in three stages. Stages Two and Three of the

Arcona transaction are planned to progress to completion following

the execution of Stage One but this is now likely to be in Q1

2020.

Shareholder Call

The Company will be hosting a shareholder conference call on

Thursday 12 December 2019 at 13.30 (GMT) in line with its

commitment to maintaining positive engagement with its

shareholders. The call will be co-hosted by the Chairman of the

Board of Directors, Michael Beys, the CEO, Lambros Anagnostopoulos,

and a member of the Advisory Board, Emmanuel Blouin, as well as

Finance Director, Theofanis Antoniou, who together will provide an

update on the Company's strategy and, more specifically, on the

progress of the Arcona Transaction. Shareholders are invited to

submit questions via email in advance, which the hosts will aim to

respond to during the call. Questions should be sent to St Brides

Partners at shareholderenquiries@stbridespartners.co.uk. Details

for the conference call can be found at the end of the release.

Michael Beys, Chairman of the Board of Directors, said; "The

completion of the transfer of the Boyana Assets will bring the

total number of Arcona Shares issued to SPDI to 593k with a current

market value of EUR3. 7 million, which represents more than a third

of our current market capitalization. We have long said that the

Arcona Transaction was a value trigger event for SPDI shareholders.

With Stages Two and Three still to come, we are confident the

underlying value of our portfolio of prime real estate in South

Eastern European countries will soon be clear for all to see."

Conference Call Details

To participate in the conference call, please dial +44 (0) 20

3003 2701 and quote the pin 2651405# when prompted to do so. Please

note that all lines will be muted except for the hosts' line.

However, participants will be able to submit questions via a

messenger function during the call. To send questions through the

online messenger function, please use the link below and log in as

a participant. The event number is: 955 376 844 and the password

is: Event1

https://sbmf.webex.com/sbmf/onstage/g.php?MTID=e83005113b374408ee08149ad6c546c6c

On the right-hand side of the screen you will find an option to

submit questions during the call. The function will only be made

live once the call has commenced. The management team will strive

to answer as many questions as possible during the call. The

Company plans to make available a recording of the call on its

website shorty after.

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014.

* * ENDS * *

Lambros Anagnostopoulos SPDI Tel: +357 22 030783

Rory Murphy Strand Hanson Limited Tel: +44 (0) 20 7409 3494

Ritchie Balmer

Jack Botros

Jon Belliss Novum Securities Limited Tel: +44 (0) 207 399 9400

Frank Buhagiar St Brides Partners Ltd Tel: +44 (0) 20 7236 1177

Cosima Akerman

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCBDBDDCGGBGCL

(END) Dow Jones Newswires

December 06, 2019 07:15 ET (12:15 GMT)

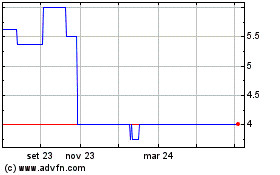

Grafico Azioni Secure Property Developm... (LSE:SPDI)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Secure Property Developm... (LSE:SPDI)

Storico

Da Apr 2023 a Apr 2024