By Drew FitzGerald and Brent Kendall

An unusual merger trial starting Monday could have long-lasting

effects on the consumer wireless market and beyond by potentially

upending the federal government's dominant role in deciding whether

corporate rivals can join forces.

T-Mobile US Inc. and Sprint Corp., the country's third- and

fourth-largest carriers by cellphone subscribers, are defending

their $26 billion plan to merge into a nationwide heavyweight

rivaling Verizon Communications Inc. and AT&T Inc. The would-be

merger partners must defeat a coalition of 13 states and the

District of Columbia, all led by Democratic attorneys general, who

are suing to block the deal.

The lawsuit has flipped the script for corporate merger reviews

by standing in conflict with the views of the federal government.

Federal antitrust and telecom officials, appointed by President

Trump, approved the deal earlier this year, believing they

addressed the merger's shortcomings through concessions they

required from T-Mobile and Sprint.

Legal experts say it is unprecedented for the states to reject

such a settlement and sue to block a merger of this size and

national scope without the support or involvement of federal

authorities.

A victory for the carriers, which say the merger will allow them

to offer better services, could arm other companies with new

arguments for the benefits of consolidation. But a win for the

coalition could give states newfound power in antitrust enforcement

when they are also investigating U.S. tech giants.

If the states prevail, "companies will have to take them more

seriously, " said New York University law professor Harry First.

"They'll have to have really serious discussions with states like

California and New York."

"If we have another four years of the Trump administration, we

may see more of this," Mr. First said. The Justice Department

declined to comment.

Both sides will deliver opening arguments Monday before Judge

Victor Marrero in federal court in New York. The bench trial is

expected to last about three weeks with testimony from a colorful

cast of executives, including longtime T-Mobile boss John Legere,

Sprint Chairman Marcelo Claure and Dish Network Corp. Chairman

Charlie Ergen. T-Mobile in November said Mr. Legere will step down

as CEO next year, part of a long-planned transition that will hand

the top job to operating chief Mike Sievert.

Lawyers for the states and companies agreed last week to scrap a

potential last-minute meeting to discuss an out-of-court

settlement, an acknowledgment that past negotiations haven't borne

fruit, according to court filings. The two sides could still reach

a deal during the trial.

T-Mobile and Sprint announced their plan to join forces in April

2018. T-Mobile is controlled by Deutsche Telekom AG, and Sprint is

controlled by Japan's SoftBank Group Corp. Sprint abandoned an

earlier effort to combine in 2014 amid opposition from antitrust

officials in the Obama administration.

Federal Communications Commission Chairman Ajit Pai threw his

support behind the deal in May, backing the companies' argument

that their combined resources would fuel faster investment in

fifth-generation, or 5G, cellular service. The FCC declined to

comment.

But the Justice Department, which by law is tasked with

reviewing a merger's competitive effects, wasn't immediately

convinced, and pushed T-Mobile and Sprint to do more to address

consolidation that would remove another national wireless carrier

from the market.

A group of state antitrust enforcers led by New York and

California took advantage of the lag to sue the companies in

federal court. Their case makes a simple assertion: Putting

together two wireless companies with a record of aggressive

discounts would make cellphone plans more expensive than they would

be if the two rivals were kept apart.

The Justice Department reached a settlement with the companies

in July. The department's antitrust division said it would approve

the merger subject to commitments from the companies. They included

arming satellite-TV provider Dish with the building blocks for a

built-from-scratch cellphone network, which would preserve the

market's four-player structure.

Many state officials weren't satisfied, arguing in a pretrial

brief that the deal would create "a more staid market with prices

higher than they would otherwise be -- billions of dollars higher

in the aggregate -- and less innovation."

The companies argued their complementary assets, including

valuable radio spectrum licenses, would serve customers more

efficiently. "Without the merger, Sprint and T-Mobile will continue

to face competitive challenges and escalating costs," the companies

wrote, which would allow AT&T and Verizon to maintain their

dominant positions.

AT&T and Verizon serve about 100 million domestic customers

apiece. T-Mobile and Sprint would approach roughly the same number

by combining.

T-Mobile's shares have continued to climb as the company wins

more customers. Sprint's stock has slumped as subscribers depart

and the deal's outcome remains unresolved. Sprint traded at a

roughly 30% discount to the value of the all-stock deal Friday.

"There's definitely been investor fatigue with this one," said

Jennifer Fritzsche, a Wells Fargo Co. telecom analyst. "It's gone

on almost two years now."

Adding to the drama, the tally of states on either side of the

case has seesawed, amid growing tensions between the plaintiffs and

the Justice Department. California and New York recruited allies

from other states, only to see some defect.

Illinois, Oregon and Pennsylvania joined the states' lawsuit.

Colorado, Mississippi and Nevada switched sides after the companies

offered them commitments to improve coverage and protect rates.

Texas Attorney General Ken Paxton, a Republican, added political

gravity to the mostly Democratic state coalition by joining its

lawsuit in August, only to switch sides by settling with the

companies in November.

Write to Drew FitzGerald at andrew.fitzgerald@wsj.com and Brent

Kendall at brent.kendall@wsj.com

(END) Dow Jones Newswires

December 08, 2019 11:15 ET (16:15 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

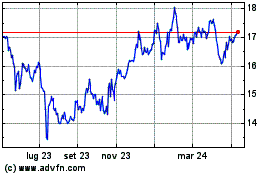

Grafico Azioni AT&T (NYSE:T)

Storico

Da Mar 2024 a Apr 2024

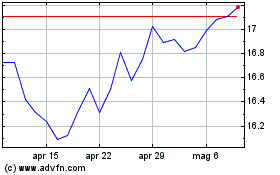

Grafico Azioni AT&T (NYSE:T)

Storico

Da Apr 2023 a Apr 2024