TIDMAA4

RNS Number : 2704W

Amedeo Air Four Plus Limited

09 December 2019

AMEDEO AIR FOUR PLUS LIMITED (the "Company")

Legal Entity Identifier: 21380056PDNOTWERG107

HALF-YEARLY FINANCIAL REPORT

The Board of the Company is pleased to announce its results for

the period from 1 April 2019 to 30 September 2019.

To view the Company's half-yearly financial report please follow

the link below:

http://www.rns-pdf.londonstockexchange.com/rns/2704W_1-2019-12-9.pdf

The half-yearly financial report will also shortly be available

on the Company's website http://www.aa4plus.com.

In addition, to comply with DTR 6.3.5(1) please find below the

full text of the half yearly financial report.

For further information, please contact:

Administrative Enquiries:

JTC Fund Solutions (Guernsey) Limited

Tel: +44 (0) 1481 702400

Shareholder Enquiries:

Nimrod Capital LLP

Richard Bolchover

Marc Gordon

+44 (0) 207 382 4565

info@nimrodcapital.com

OF ANNOUNCEMENT

E&OE - in transmission

Amedeo Air Four Plus Limited

Consolidated

Half-Yearly Financial

Report (Unaudited)

From 1 April 2019 to 30 September 2019

Summary Information

----------------------------------------------------------------------------

Trading The Specialist Fund Segment of

the London Stock Exchange's Main

Market

-------------------------------------

Ticker AA4

-------------------------------------

SEDOL BWC53H4

ISIN GG00BWC53H48

LEI 21380056PDNOTWERG107

-------------------------------------

Reporting Currency British Pound

-------------------------------------

Launch Date / Share Price 13 May 2015 / 100p

-------------------------------------

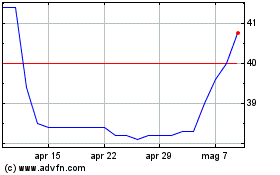

Share Price 83.5p (as at 30 September 2019)

78.5p (as at 6 December 2019)

-------------------------------------

Market Capitalisation GBP 504 million (as at 6 December

2019)

-------------------------------------

Target Dividend Current dividends are 2.0625p

per share per quarter (8.25p

per annum)

-------------------------------------

Dividend Payment Dates January, April, July, October

-------------------------------------

Year End 31 March

-------------------------------------

Stocks & Shares ISA Eligible

-------------------------------------

Aircraft Registration Numbers A6-EEY, A6-EOB, A6-EOM, A6-EOQ,

A6-EOV,

A6-EOX, A6-EPO, A6-EPQ, A6-API,

A6-APJ,

HS-THF, HS-THG, HS-THH, HS-THJ

-------------------------------------

Website www.aa4plus.com

-------------------------------------

Key Advisers and Contact Information

----------------------------------------------------------------------------

Directors Registered Office of the Company

Robin Hallam (Chairman) Ground Floor

David Gelber (Senior Independent Dorey Court

Director effective from 23 October Admiral Park

2019) St Peter Port

John Le Prevost Guernsey GY1 2HT

Laurence Barron

Telephone: +44 (0)1481 702400

-------------------------------------

Administrator and Secretary Corporate and Shareholder Adviser

JTC Fund Solutions (Guernsey) Nimrod Capital LLP

Limited 3 St Helen's Place

Ground Floor London

Dorey Court England EC3A 6AB

Admiral Park

St Peter Port

Guernsey GY1 2HT

Telephone: +44 (0)20 7382 4565

Telephone: +44 (0)1481 702400

-------------------------------------

Asset Manager Liaison and Administration Oversight

Amedeo Limited Agent

The Oval Amedeo Services (UK) Limited

Shelbourne Road 29-30 Cornhill

Ballsbridge London

Dublin England EC3V 3NF

Ireland D04 T8F2

-------------------------------------

Registrar, Paying Agent and Transfer UK Transfer Agent

Agent

Anson Registrars Limited Anson Registrars (UK) Limited

Ground Floor 3500 Parkway

Dorey Court Whiteley

Admiral Park Fareham

St Peter Port Hampshire

Guernsey GY1 2HT England PO15 7AL

Telephone: +44 (0)1481 702 400

-------------------------------------

Auditor Advocates to the Company (as

to Guernsey

KPMG law)

1 Harbourmaster Place Carey Olsen

IFSC Carey House

Dublin 1 Les Banques

DO1 F6F5 St Peter Port

Ireland Guernsey GY1 4BZ

-------------------------------------

Solicitors to the Company (as Solicitors to the Company (as

to English law) to asset acquisition, financing

and leasing documentation)

Herbert Smith Freehills LLP Clifford Chance LLP

Exchange House 10 Upper Bank Street

Primrose Street London

London England

England E14 5JJ

EC2A 2EG

Norton Rose Fulbright LLP

3 More London Riverside

London

England

SE1 2AQ

-------------------------------------

COMPANY OVERVIEW

Amedeo Air Four Plus Limited ("AA4" or the "Company") is a

Guernsey company incorporated on 16 January 2015. The Company

operates under The Companies (Guernsey) Law, 2008, as amended (the

"Law") and the Disclosure Guidance and Transparency Rules (the

"DGTRs") of the UK's Financial Conduct Authority (the "FCA").

The Company's shares were first admitted to trading on the

Specialist Fund Segment ("SFS") of the London Stock Exchange's Main

Market on 13 May 2015 upon the admission of 202,000,000 redeemable

ordinary shares ("Shares") at an issue price of 100 pence per

share. Subsequently, the Company has conducted six additional

placings, resulting in the issue and admission to trading on the

SFS of an additional 440,250,000 Shares at issue prices in the

range of 100 pence to 104 pence.

As at 6 December 2019, the last practicable date prior to the

publication of this report, the Company's total issued share

capital was 642,250,000 Shares trading at 78.5 pence per share.

Investment Objective and Policy

The Company's investment objective is to obtain income returns

and a capital return for its shareholders by acquiring, leasing and

then selling aircraft (each an "Asset" and together "Assets").

To pursue its investment objective, the Company seeks to use the

net proceeds of placings and/or other equity capital raisings,

together with debt facilities (or instruments), to acquire aircraft

which will be leased to one or more major airlines.

The Company's Articles of Incorporation (the "Articles") provide

that the Company may only acquire further aircraft with the

approval of the Company's shareholders by ordinary resolution in

relation to each proposed acquisition. Where such approval for a

new acquisition is obtained, it is the current intention of the

Board of directors of the Company (the "Board") to offer

shareholders the opportunity to participate in any equity financing

of such further acquisitions on a broadly pre-emptive basis,

although other approaches to the equity financing may also be

considered and pursued if the Board consider it appropriate to do

so in order to diversify the funding sources of the Company.

In accordance with the investment policy, it is the Board's

intention that, subject to finding suitable deals and obtaining

subsequent shareholder approval, the Company be grown into a larger

vehicle owning a range of aircraft leased to more airlines. The aim

of such a strategy is to diversify the risk profile of the

Company's portfolio of Assets and lease credits whilst maintaining

its target investor returns of a quarterly dividend of 2.0625 pence

per share and a double digit total return.

Amedeo Limited ("Amedeo" or the "Asset Manager") continues to

monitor the market for transactions to present to the Board that

would contribute positively to the Company's overall risk-return

profile.

Investment Portfolio

As at the financial reporting date the Company had sixteen

wholly-owned subsidiaries, see note 1 for further details. Together

the Company and its subsidiaries are known as the "Group".

The table below details the Assets held by the Group at the

reporting date:

Manufacturer Aircraft Manufacturer's Date of Acquisition Lessee* Initial Lease

Type Serial Number Duration

("MSN") and

Registration

Airbus A380-800 157 - A6-EEY 19-May-15 Emirates 12 years

---------- --------------- -------------------- --------- --------------

Airbus A380-800 164 - A6-EOB 19-May-15 Emirates 12 years

---------- --------------- -------------------- --------- --------------

Airbus A380-800 187 - A6-EOM 03-Aug-15 Emirates 12 years

---------- --------------- -------------------- --------- --------------

Airbus A380-800 201 - A6-EOQ 27-Nov-15 Emirates 12 years

---------- --------------- -------------------- --------- --------------

Airbus A380-800 206 - A6-EOV 19-Feb-16 Emirates 12 years

---------- --------------- -------------------- --------- --------------

Airbus A380-800 208 - A6-EOX 13-Apr-16 Emirates 12 years

---------- --------------- -------------------- --------- --------------

Boeing 777-300ER 42334 - A6-EPO 28-Jul-16 Emirates 12 years

---------- --------------- -------------------- --------- --------------

Boeing 777-300ER 42336 - A6-EPQ 19-Aug-16 Emirates 12 years

---------- --------------- -------------------- --------- --------------

Airbus A380-800 233 - A6-API 24-Mar-17 Etihad 12 years

---------- --------------- -------------------- --------- --------------

Airbus A380-800 237 - A6-APJ 24-May-17 Etihad 12 years

---------- --------------- -------------------- --------- --------------

Airbus A350-900 123 - HS-THF 13-Jul-17 Thai 12 years

---------- --------------- -------------------- --------- --------------

Airbus A350-900 130 - HS-THG 31-Aug-17 Thai 12 years

---------- --------------- -------------------- --------- --------------

Airbus A350-900 142 - HS-THH 22-Sep-17 Thai 12 years

---------- --------------- -------------------- --------- --------------

Airbus A350-900 177 - HS-THJ 26-Jan-18 Thai 12 years

---------- --------------- -------------------- --------- --------------

* "Emirates" means Emirates Airline;

"Etihad" means Etihad Airways PJSC;

"Thai" means Thai Airways International Public Company

Limited.

Distribution Policy

The Company aims to provide shareholders with an attractive

total return comprising income from distributions through the

period of the Group's ownership of the Assets and a capital gain

upon the sale, or other disposition of the Assets.

The Group receives income in the form of lease payments. Income

distributions are made to shareholders quarterly, subject to

compliance with applicable laws and regulations. The Company

currently targets and has achieved to date a distribution to

shareholders of 2.0625 pence per share per quarter.

There can be no guarantee that dividends will be paid to

shareholders and, if dividends are paid, as to the timing and

amount of any such dividend. There can also be no guarantee that

the Company will, at all times, satisfy the statutory solvency test

(the "Solvency Test") required to be satisfied pursuant to section

304 of the Law prior to any declaration of a dividend by the

Board.

In the event that the Company is wound-up, shareholders may also

receive a capital return from the net proceeds of a sale of the

Assets.

Performance Overview

All payments by the Lessees have to date been made in accordance

with the terms of the respective leases.

In accordance with the Distribution Policy, the Company declared

two dividends of 2.0625 pence per share during the period under

review and one dividend of 2.0625 pence per share was declared

after the end of the reporting period. Further details of dividends

declared and paid can be found on pages 32 and 33.

Return of Capital

Following the sale of an Asset the Board may, as it deems

appropriate at its absolute discretion, either return to

shareholders all or part of the net capital proceeds of such sale

(subject to satisfaction of the Solvency Test), or re-invest the

proceeds in accordance with the Company's investment policy,

subject to shareholder approval.

The Asset Manager regularly monitors the market valuations of

the Assets and, subject to any lease obligations, will consider the

most appropriate time for the sale of any one or more of the

Assets. The Board will consider any recommendation from the Asset

Manager as to the sale of any Asset and proceed as the Board

considers appropriate.

Liquidation Resolution

Although the Company does not have a fixed life, the Articles

require that the Board convenes a Liquidation Proposal Meeting in

2029 or such other date as shareholders may approve by ordinary

resolution.

CHAIRMAN'S STATEMENT

Whilst I am mindful of reporting a decline in the Company's

share price over the period and year-to-date, shareholders should

be reassured that the Company's Assets continue to be well utilised

and their lessees are meeting all financial obligations on-time and

in full. However, sentiment and recent news flow relating to the

A380 appears to be persisting as a headwind. As reported in my

statement accompanying the most recent annual financial report the

announcement by Airbus of the cessation of the A380 has no direct

impact on the Company's leases nor its ability to pay targeted

distributions. Moreover, the Company's first lease expiry does not

fall due until 2026 and the portfolio is complemented and

diversified by two additional aircraft models, namely the 777-300ER

and A350-900. Recent comments by Emirates with regard to the A380

continue to be supportive in many respects but, in the absence of

concrete evidence, the Company and its Asset Manager are somewhat

constrained in their ability to report more positive developments

at this time. The Board will carry out an impairment review for the

financial year ending 30 March 2020 on the basis that there is an

absence of a secondary market for the A380. Further details on

Emirates and the A380, along with the rest of the Company's

portfolio can be found in the Asset Manager's report. During the

period, and as targeted, the Company has continued to declare

quarterly dividends of 2.0625 pence per share, representing a

yearly distribution of 8.25 pence per share and your Board is

hopeful of continuing to pay such dividends for the foreseeable

future.

Your Board is also mindful of the increasing importance to

shareholders of Environment, Social and Governance ("ESG") factors

and is taking action to increase its reporting in this regard.

On 30 September 2019 the Company had 642,250,000 shares in issue

which, at the then market price of 83.5 pence equated to a market

capitalisation of approximately GBP536 million.

The Company's Asset Manager, Amedeo, continues to monitor the

leases and reports regularly to the Board. Nimrod Capital LLP

("Nimrod" or the "Corporate and Shareholder Adviser") continues to

liaise between the Board and shareholders.

I continue to encourage Amedeo to source potential future

transactions and to work with Nimrod in evaluating their

suitability for shareholders but remain conscious that we should be

patient and exercise discipline with regard to future growth. If,

in the view of the Board, it is in the interests of the Company to

acquire any further aircraft, taking into account the maintenance

of the Company's target income distributions, opportunities for

capital growth, the diversification of the Company's portfolio and

risk profile, the Board will seek shareholders' approval of those

proposed acquisitions.

Shareholders should note that, as per the most recent 2019

annual financial report, the subsidiaries of the Company

re-designated their functional currency to US Dollars with effect

from 1 April 2018. This is reflective of the most recent economic

environment of these subsidiaries, as their rental income and

sources of financing are primarily US Dollar based, and better

represent the Company's financial performance for comparative

periods going forward.

US Dollar lease rentals and loan repayments (with the exception

of the four Thai aircraft) are closely matched as to amount and

timing so that during the life of each lease the lease rentals

cover loan repayments as to interest and principal save for the

repayment of bullet repayments of principal due on the final

maturity of a loan. The Thai leases' floating lease rental payments

are in US Dollars and are matched to floating rate loan repayments

so as to closely match the loan interest and capital repayments

save for the bullet capital repayments due on the final maturity of

such loans. The Board monitors the foreign exchange exposure as

well as the interest rate risk resulting from the Thai aircraft and

may if it considers it appropriate undertake hedging

transactions.

Rental income receivable is credited evenly to the profit or

loss in the Consolidated Statement of Comprehensive Income over the

planned life of each lease. Conversely, the methodology for

accounting for interest costs means that the proportion of the loan

repayments which is treated as interest and is debited to the

Consolidated Statement of Comprehensive Income varies over the

course of the loan - so that the differential between rental income

and interest cost (as reported in the Consolidated Statement of

Comprehensive Income) reduces over the course of each twelve year

lease.

David Gelber, independent non-executive director of the Company,

has been appointed senior independent director ('SID') with effect

from 23 October 2019. The Board is pleased that Mr Gelber has

agreed to the appointment. Mr Gelber will provide a sounding board

to the Chairman and serve as an intermediary for the other

directors and shareholders. Mr Gelber will also lead on the

evaluation of the performance of the Chairman.

Finally, the Board is always keen to meet with shareholders and

welcomes their feedback. We welcome the opportunity to hear from

more shareholders in the future as your Board very much welcomes an

open dialogue. Please do not hesitate to contact Nimrod to request

a meeting.

On behalf of the Board, I would like to thank our service

providers for all their help and, most importantly, all

shareholders for their continuing support of the Company.

Robin Hallam

Chairman

Date: 9 December 2019

Asset Manager's Report

On the invitation of the Directors of the Company, the following

commentary has been provided by Amedeo as Asset Manager of the

Company and is provided without any warranty as to its accuracy and

without any liability incurred on the part of the Company, its

Directors and officers and service providers. The commentary is not

intended to constitute, and should not be construed as, investment

advice. Potential investors in the Company should seek their own

independent financial advice and may not rely on this communication

in evaluating the merits of an investment in the Company. The

commentary is provided as a source of information for shareholders

of the Company but is not attributable to the Company.

THE ASSETS

Lessee Model MSN REG Delivery Lease Expiry Flight Flight Cycles

Date Date Hours

------------- ------- ---------- -------------- -------------- ----------

Emirates A380-800 157 A6-EEY 19/05/2015 04/09/2026 21,474 3,421

A380-800 164 A6-EOB 19/05/2015 03/11/2026 21,335 3,435

A380-800 187 A6-EOM 03/08/2015 03/08/2027 21,653 1,996

A380-800 201 A6-EOQ 27/11/2015 27/11/2027 15,872 2,501

A380-800 206 A6-EOV 19/02/2016 19/02/2028 15,785 2,487

A380-800 208 A6-EOX 13/04/2016 13/04/2028 14,568 2,285

777-300ER 42334 A6-EPO 28/07/2016 28/07/2028 13,352 3,330

777-300ER 42336 A6-EPQ 19/08/2016 19/08/2028 14,365 3,239

-------------------------- ------- ---------- -------------- -------------- ---------- ---------------

Etihad A380-800 233 A6-API 24/03/2017 24/03/2029 13,410 1,446

A380-800 237 A6-APJ 24/05/2017 24/05/2029 12,459 1,305

-------------------------- ------- ---------- -------------- -------------- ---------- ---------------

Thai A350-900 123 HS-THF 13/07/2017 13/07/2029 10,390 1,776

A350-900 130 HS-THG 31/08/2017 31/08/2029 10,183 1,637

A350-900 142 HS-THH 22/09/2017 22/09/2029 9,889 1,644

A350-900 177 HS-THJ 26/01/2018 26/01/2030 8,376 1,399

-------------------------- ------- ---------- -------------- -------------- ---------- ---------------

As of 30 September 2019

Industry Update: Original Equipment Manufacturer ("OEM")

Production Dynamics and Related Effects

In an update to what was reported in Q3 2019, Boeing continues

to work towards re-certification of the 737 MAX aircraft. In

mid-September at a Morgan Stanley investor conference, Boeing

Chairman and CEO Dennis Muilenburg reiterated his projection that

the 737 MAX would be certified to return to service in November

2019. However, EASA continues to question Boeing's plan with regard

to Angle of Attack "integrity" issues, will send its own test

pilots, and has indicated that it may not fall in step with an FAA

approval timeline. Major operators are also hedging their bets with

their fleet planning. American Airlines has removed the MAX from

its schedule through December 3, 2019. Southwest Airlines has done

the same through January 5, 2020. We now think that recertification

may be a Q1 2020 event, but actual re-entry of the parked and

undelivered fleet will take all of 2020. The relevance of the 737

MAX issues raises questions as to how Boeing will handle the

production of other aircraft types, particularly the 777X. In

August, Boeing announced that it would delay the entry into service

of the -8 variant, which was previously slated for 2022. And in

September, the -9 variant suffered a setback when the static test

airframe failed at 1.48 times the expected maximum forces bending

the wings, nearly at the 1.5x target, but still a shortcoming that

will not inspire confidence at the FAA. In combination with still

unresolved GE-9X engine issues, the -9 entry into service will be

delayed. Boeing is still hoping to deliver the first aircraft to

Emirates in 2020, but does now say that there are risks to that

scenario. We think that the FAA, fresh off the 737 MAX controversy,

will be inclined to review the 777X certification project with a

more watchful eye. Our view is that the 777X will certainly be

delivered, but there is no visibility as to when, and that makes

forward fleet planning for airlines that ordered it, like Emirates,

a challenge. If any of these factors cause entry-into-service

delays, other widebody aircraft residuals may benefit and the

appraisal community should be more confident in regard to the

777-300ER. It also remains to be seen how the ongoing work with 737

MAX and 777X programs will affect Boeing's progress on the New

Midsized Aircraft ("NMA").

While its difficulties have received less attention, Airbus has

not escaped issues either. Reports indicate that Lufthansa and

British Airways have been blocking the last row(s) of their A320neo

aircraft as a result of recently discovered center-of-gravity

issues. Such actions obviously reduce the profitability of

operating these aircraft on an absolute basis, as well as relative

to the 737 family.

Emirates President Tim Clark recently skewered all the OEMs,

engine manufacturers included, for general reliability issues.

While he expressed complete confidence in aviation safety, he

bemoaned the reliability of the Rolls-Royce engine family and

criticized GE for the GE-9x engine issues mentioned above with

respect to the 777-9X.

Industry Update: Emissions Reduction Dynamics

With the increased focus on climate change and greenhouse gas

emissions, further focus has landed on the aviation industry and

its emissions profile. The Air Transit Action Group ("ATAG")

reports that aircraft flights produced an estimated 895 million

tons of carbon dioxide on an annual basis, or 2% of total

"human-induced" carbon dioxide emissions. Among transport sources

of carbon dioxide, aviation is responsible for just 12%, with road

emissions comprising the vast majority at 74%.

ATAG aims for net carbon emissions neutrality from 2020 onwards

and for net carbon emissions to be 50% of 2005 levels by the year

2050. Airframe and engine manufacturers can contribute

significantly to this effort.

Airbus offers the following claims with respect to its product

line:

1) A350 XWB - 25% fewer carbon dioxide emissions relative to

"the previous generation of aircraft";

2) A320neo - 20% fewer carbon dioxide emissions relative to the A320ceo;

3) A220 - 20% fewer carbon dioxide emissions relative to "aircraft...in their class";

4) A330neo - 14% fewer carbon dioxide emissions relative to the A330ceo; and

5) A380 - 33% fewer carbon dioxide emissions relative to "its nearest competitor".

Boeing, in turn reports:

1) 737 MAX - 20% reduction in carbon dioxide emissions relative

to original Next Generation 737;

2) 787 - 20 to 25% reduction in carbon dioxide emissions as compared to the 767-300ER;

3) 777X - 20% reduction in carbon dioxide emissions relative to the 777-300ER; and

4) 747-8 - 18% reduction in carbon dioxide emissions as compared to the 747-400.

These are impressive accomplishments, and when compounded by

better airline management, fleet utilization, and higher load

factors, jet aircraft are, according to ATAG, 80% more fuel

efficient per seat kilometre than they were at the advent of jet

engines.

We at Amedeo believe that aviation brings people together to

solve problems like climate change, and without bringing people

together we will fail in resolving this issue. Yes, there is an

environmental cost to aviation, but the benefits to humanity, now

and in the future, well outweigh the costs. This simple story has

not been sufficiently articulated by the industry's leadership.

IATA efforts to date have been laudable, but more visible

individual advocacy action, particularly by airline CEOs, is

needed.

IATA ECONOMIC ANALYSIS

Growth in industry-wide Revenue Passenger Kilometres ("RPKs")

continues to be positive for 2019 thus far, though somewhat below

long-term trend. RPKs have risen by 4.7% on a year-to-date basis

through the end of July. This increase represents a slower growth

pace relative to a long-run average pace of approximately 5.5% and

IATA 2019 estimates of 5%. July RPK growth was 3.6%, down from 5.1%

in June. This soft start to the peak travel period is additional

evidence of a trend toward slowing growth.

Available Seat Kilometres ("ASKs") grew by 4.1% on a

year-to-date basis through July, somewhat below RPK growth pace. As

a result, load factors hit monthly and all-time highs in July at

85.7%. Load factors stand at 82.6% over the first seven months of

2019. North American load factors lead the world at 85.2%

year-to-date through July, with Africa lagging behind at 71.4%. All

regions outside of Africa and the Middle East experienced all-time

high load factors during July.

European airlines continue to be the fastest growing overall

relative to their peers in other regions - year-to-date growth hit

5.6% through July. The Middle East region was the clear laggard of

the group, with year-to-date RPK growth of just 1.5%. Domestic

Brazilian RPKs fell 6.1% on a year-over-year basis in July, and are

down 0.4% year-to-date, reflecting the exit of Avianca Brasil. ASKs

decreased a commensurate 6.9% in July, as the passenger market

begins to recalibrate. Despite the Avianca Brasil failure, Latin

America RPKs are up 5.2% on a year-to-date basis.

International Air Transport Association, 2019. Air Passenger

Market Analysis (July 2019) (c) All Rights Reserved.

EMIRATES GROUP

Emirates fleet consisted of 268 aircraft as of September 2019,

including 110 A380s. 13 more A380s are yet to be delivered from

Airbus by 2021. Emirates also has an unfilled order for 6 777-300ER

aircraft and 150 777X aircraft. Of those 150, Cirium lists 35 as -8

variants. With the -8 variant delay announced by Boeing, unresolved

GE engine issues, and the previously mentioned 777X certification

challenges, it is unclear when the 777X will join the fleet,

perhaps in 2021.

In addition, Emirates agreed to acquire 40 A330-900 and 30 A350

aircraft from Airbus. We would expect clarity on the timing of the

A330 stream in the near future. Reading between the lines, matters

are delayed by the reliability issues Tim Clark has been vocal

about. The A330 fleet will allow Emirates to expand into markets

and airports too small for 777 or A380 operations.

Additionally, Emirates now has much greater cooperation and

connectivity with FlyDubai, a successful low cost carrier also

owned by the Government of Dubai. The regional focus of and narrow

body connectivity with FlyDubai will be accretive to the Emirates

long-haul network and it is in the space between the Emirates

business model and that of FlyDubai that the nexus exists for the

smaller widebodies that Emirates has on order, acting as route

expansion and route development aircraft for the future.

This FlyDubai cooperation and uncertainty about the timing of

new fleet additions provide the backdrop to the key question for

us: what are Emirates plans for its A380s, in particular those

leased by AA4?

Emirates has publicly stated that it will fly A380s well into

2030s, and we previously estimated that a fleet of about 100

aircraft will be the long-term hold. Emirates currently estimates

its A380 fleet will ultimately stabilise at 80 to 100 aircraft.

In the most recent Emirates World podcast

(https://cdn.ek.aero/downloads/ek/trailers/920191352-sir-tim-clark.mp3),

Tim Clark articulates a vision of an Emirates fleet with over 500

aircraft by 2030, including medium twin engine widebodies, not just

the largest aircraft.

Emirates is going through a review of which MSNs to keep long

term, complicated by the aforementioned fleet uncertainties

elsewhere, and we look forward to engaging with them on the future

of these aircraft once the review is completed.

With respect to fleet and network changes, Emirates announced

two daily flights from Dubai to Muscat, Oman with A380 aircraft in

early July. At approximately 340 kilometers, these are the shortest

A380 flights in the world. The flights last approximately 40

minutes. In addition, the airline announced resumption of service

to Khartoum and that it would launch daily service to Mexico City

via Barcelona in December 2019, using the 777-200LR.

Emirates also experienced a number of developments during the

quarter with respect to its passenger services. In mid-September,

the airline announced that its loyalty program, Emirates Skywards,

had passed the milestone of 25 million members. In addition,

Emirates announced that it has become the first airline outside of

the United States to receive approval for biometric boarding from

the U.S. Customs and Border Patrol. Customers at any of the

airline's 12 U.S. destinations can elect to use facial recognition

technology at its departure gates to complete identity

verification.

Finally, Emirates announced several new executive leadership

appointments during the quarter. Adel Al Redha was appointed Chief

Operating Officer, Adnan Kazim was appointed Chief Commercial

Officer and Sheikh Majid Al Mualla was appointed Divisional Senior

Vice President, International Affairs. Al Redha has been with the

airline for 31 years.

Emirates reports full financial data on a yearly basis. Further

financial analysis will accompany the November release of partial

half year data and then the release of the 2020 annual report.

The Emirates Group. (c) 2019 All Rights Reserved.

ETIHAD AIRWAYS

As of September 2019, Etihad had a majority widebody fleet of

109 aircraft in service, including 10 A380s and 19 aircraft in the

777 family. As per Boeing data at the end of August 2019, the

airline has a remaining orderbook of 37 787s and 25 777X aircraft

with Boeing. Cirium lists the 777X aircraft as being of the -8

variant. Boeing's delay in producing this variant leaves an open

question as to whether these aircraft will ultimately be delivered

or not. From Airbus, Etihad will take delivery of 17 incremental

A350-1000 aircraft and 26 A321neos.

With respect to fleet and network developments, Etihad announced

in early July that it would begin a daily service to Shanghai using

the 787-10 Dreamliner. Also in July, the airline announced that it

was adding a fourth daily, year-round flight to London Heathrow.

This flight will begin in October 2019.

In July 2019, Etihad took delivery of its second and third

A350-1000 aircraft from Airbus. These aircraft, in addition to an

incremental A350-1000 delivered in May, are currently in storage

and not in revenue service. As previously mentioned, 17 incremental

A350-1000s remain scheduled for delivery to the airline.

With respect to the passenger experience, Etihad announced two

developments. Beginning August 1st, the airline entered into a

rewards partnership with Booking.com. Etihad Guest members can now

earn Guest miles when booking accommodations through the new

co-branded website. Finally, in mid-September Etihad announced the

relaunch of its website, Etihad.com. The new website is designed to

be more accessible to mobile phone users as well as to make booking

flights easier.

Etihad Airways. (c) 2019 All Rights Reserved.

THAI AIRWAYS INTERNATIONAL

Thai Airways International's fleet comprised 103 in-service

aircraft as of the end of Q2 2019 (inclusive of Thai Smile units).

The airline currently has no firm orderbook with either Boeing or

Airbus but a 2019 - 2026 fleet acquisition plan calling for 38

aircraft has been approved by the airline's Board of Directors and

was approved by the Transport Minister in August. Of the 38

aircraft, 31 would be for replacement of the existing fleet, with

an incremental 7 growth aircraft. However, following the September

24th Board meeting, the airline was directed to revise its fleet

plan. Further, recent headlines suggest that the Transport Minister

may be considering replacing the airline's Board of Directors on

account of alleged underperformance. Both of these potential

developments are likely to have a significant impact, yet to be

determined, on the airline's fleet growth and renewal plan.

The group reported Q2 2019 headline loss of Bt6.878 billion,

more than double the Q2 2018 loss of Bt3.086 billion. Revenues

decreased 10.0% year-over-year, falling to Bt42.5 billion from

Bt47.2 billion in Q2 2018. The decrease in revenue was driven

primarily by a 6.1% decrease in passenger revenue, itself a result

of a 5.4% decline in RPKs and a 1.4% decrease in average passenger

yield. Passenger load factor decreased from 75.8% to 74.7%, and the

airline carried slightly fewer passengers during Q2 2019 than it

did during Q2 2018 - 5.72 million as compared to 5.90 million.

Freight revenue fell 18.8% year-over-year, though it represents

just a small portion of total revenue.

Total expenses decreased by Bt425 million, or 0.8%, from Bt50.0

billion to Bt49.6 billion. Fuel expenses were the largest

contributor to the decrease, declining 2.0% relative to Q2 2018.

Non-fuel operating expenses also declined slightly, falling 0.4%.

Net finance cost decreased by 0.9%. The airline recorded an

impairment of Bt172 million for the quarter, a 33.1% smaller

impairment than the Bt257 million recorded in Q2 2018. Finally, the

Q2 2019 bottom line was benefitted by Bt522 million in foreign

exchange gains, as compared to Bt431 million in foreign exchange

losses during Q2 2018.

The airline had 18 aircraft classified as held-for-sale at the

end of Q2 2019, and the airline sold 3 A330-300 aircraft during the

quarter. Long term liabilities decreased 4.3% during the first half

of 2019, with a total balance of Bt141.9 billion at June 30th. The

airline's reported leverage and coverage metrics showed meaningful

deterioration as measured at the end of H1 2019 relative to H1

2018.

Thai Airways continues to implement its business transformation

plan, the Montra Project. In 2019, the airline intends to continue

to sell decommissioned aircraft, increase ancillary revenue, and

increase network efficiencies between Thai Airways and Thai Smile,

the latter of which is set to become a Star Alliance connecting

partner by the end of 2019. The airline also expressed the

expectation that Thailand would receive a country upgrade to

Category 1 from the FAA by the end of 2019.

Thai Airways International Public Company Limited. Management's

Discussion and Analysis for three months ended June 30, 2019.

DIRECTORS

Robin Hallam (age 66) (Chairman) (independent non-executive)

Until 31 December 2015, Robin Hallam was a partner and co-head

of Asset Finance at international law firm Hogan Lovells LLP, where

he was a partner since 1995 specialising in aircraft finance,

particularly leasing, export credit and structured financing.

Between January and December 2016, Robin was a consultant at Hogan

Lovells LLP. He has represented financial institutions, operating

lessors, investors, airlines and export credit agencies. Robin

holds a degree in law from Trinity College, Cambridge, is a member

of International Society of Transport Aircraft Trading ("ISTAT")

and was ranked Band 1 for Asset Finance in Chambers UK 2015.

David Gelber (age 72) (Senior Independent non-executive)

David Gelber began his career with Citibank in London in 1974.

Over the course of the next twenty years he held a variety of

trading roles in foreign exchange, fixed income and derivatives at

Citibank, Chemical Bank and HSBC where he was Chief Operating

Officer of HSBC Global Markets. In 1994 he joined ICAP, an

inter-dealer broker, as COO and oversaw two mergers and a number of

acquisitions. He is currently the non-executive Chairman of Walker

Crips PLC, a stock broker and wealth manager; and a non-executive

director of IPGL, a holding company with investments in numerous

companies on several of which he serves as a director. He recently

joined the Board of Singapore Life Ltd, a newly formed online

insurance company. David holds a BSc in Statistics and Law from the

University of Jerusalem and an MSc in Computer Science from the

University of London.

John Le Prevost (age 68) (independent non-executive)

John Le Prevost is the Chief Executive Officer of Anson Group

Limited and Chairman of Anson Registrars Limited (the Company's

Registrar). He has spent over forty years working in offshore fund,

trust and investment businesses during which time he has been a

managing director of subsidiaries in Guernsey for County NatWest

Investment Management, The Royal Bank of Canada and for Republic

National Bank of New York. He is a Full Member of the Society of

Trust and Estate Practitioners. He is a director of a number of

other companies associated with Anson Group's business as well as

being a trustee of the Guernsey Sailing Trust. John is currently

also a non-executive director of Doric Nimrod Air One Limited,

Doric Nimrod Air Two Limited and Doric Nimrod Air Three Limited

(each of which is an aircraft leasing investment vehicle). He is

resident in Guernsey.

Laurence Barron (age 68) (independent non-executive)

Having begun his career as a commercial lawyer in Paris and then

in Tokyo, where he first became involved in aircraft financing

transactions, Laurence joined Airbus in 1982 as an in-house lawyer

specialising in aircraft finance. He subsequently moved to the

business side when, in 1984, he was appointed Sales Finance

Director North America, becoming Head of Sales Finance in 1985, and

then, in 1987, Vice President of Customer Finance. In 1994, he was

asked to set up the Asset Management Organisation within Airbus and

that year became Vice President and Head of Asset Management.

Airbus Asset Management has full responsibility for all used

aircraft transactions at Airbus and acts as an in-house leasing

company for the used Airbus aircraft owned or controlled by the

Airbus group of companies. In 2001 he was promoted to Senior Vice

President of Airbus before assuming the role of President of Airbus

China in 2004, with responsibility for Airbus' overall activities

in the People's Republic of China. In January, 2013, Laurence was

appointed Chairman of EADS China, now rebranded Airbus China.

Laurence retired from salaried Airbus employment at the end of

April 2016 and was non-executive Chairman of Airbus China until the

end of 2017. He holds an LLB from Bristol University Law

Faculty.

interim management report

A description of important events that have occurred during the

period under review, their impact on the financial statements and a

description of the principal risks and uncertainties facing the

Group, together with an indication of important events that have

occurred since the end of the period under review and are likely to

affect the Group's likely future development are included in the

Company Overview, the Chairman's Statement, the Asset Manager's

Report and the Notes to the consolidated financial statements

contained on pages 22 to 53 and are incorporated herein by

reference.

There were no events or changes in the related parties and

transactions with those parties during the period under review

which had or could have had a material impact on the financial

position and performance of the Group, other than those disclosed

in this consolidated half-yearly financial report.

Principal Risks and Uncertainties

The principal risks and uncertainties faced by the Group are

unchanged from those disclosed in the Group's annual financial

report for the year ended 31 March 2019.

Going Concern

The Group's principal activities are set out within the Company

Overview on pages 6 to 8. The financial position of the Group is

set out on page 19. In addition, note 17 to the consolidated

financial statements includes the Group's objectives, policies and

processes for managing its capital, its financial risk management

objectives and its exposures to credit risk and liquidity risk.

The rental income under the relevant operating leases should be

sufficient to repay the senior debts and provide surplus income to

pay for the Group's expenses and permit payment of dividends. The

bullet repayment of junior debt and senior debt as appropriate is

expected to be financed out of the disposal proceeds of the

relevant aircraft. The declaration of dividends may need to be

suspended if the Board considers that the Company will not be able

to repay the junior debt through the sale, refinancing or other

disposition of the Assets.

After making reasonable enquiries, and as described above the

Directors have a reasonable expectation that the Group has adequate

resources to continue in its operational existence for the

foreseeable future. Accordingly, they continue to adopt the going

concern basis of accounting in preparing the consolidated financial

statements.

Responsibility Statement

The Directors jointly and severally confirm that to the best of

their knowledge:

(a) the consolidated financial statements, prepared in

accordance with International Financial Reporting Standards, as

adopted by the European Union, give a true and fair view of the

assets, liabilities, financial position and profit or loss of the

Group; and

(b) this interim management report (including the information

incorporated by reference) includes a fair review of the

development and performance of the business and the position of the

Group, together with a description of the principal risks and

uncertainties that the Group faces.

Signed on behalf of the Board of directors of the Company on 9

December 2019.

John Le Prevost

Director

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the period from 1 April 2019 to 30 September 2019

1 Apr 2019 to 1 Apr 2018 to

30 Sep 2019 30 Sep 2018*

Notes GBP GBP

INCOME

US Dollar based rent income 4 109,536,552 102,996,829

British Pound based rent

income 4 22,758,325 22,733,781

Bank interest received 58,680 67,442

-------------- --------------

132,353,557 125,798,052

EXPENSES

Operating expenses 5 (3,502,169) (3,386,911)

Depreciation of Aircraft 9 (73,573,585) (77,440,734)

-------------- --------------

(77,075,754) (80,827,645)

Net profit for the period before

finance costs

and foreign exchange gains 55,277,803 44,970,407

FINANCE COSTS

Finance costs 10 (49,405,288) (21,467,078)

Foreign exchange gains 17b 22,329 1,587,152

Profit before tax 5,894,844 25,090,481

Income tax expense 23 (30,899) (32,810)

Profit for the period after

tax 5,863,945 25,057,671

-------------- --------------

OTHER COMPREHENSIVE INCOME

Translation adjustment on

foreign operations 2g 40,259,905 45,696,763

Total Comprehensive income

for the period 46,123,850 70,754,434

============== ==============

Pence Pence

Earnings per Share for the

period - Basic and Diluted 8 0.91 3.90

-------------- --------------

In arriving at the results for the financial period, all amounts

above relate to continuing operations.

*Restated, refer to note 2(g)

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at 30 September 2019

Notes 30 Sep 2019 31 Mar 2019

GBP GBP

NON-CURRENT ASSETS

Aircraft 9 2,308,434,300 2,247,415,403

Financial assets at fair value

through profit and loss 16 27,562 13,712,492

-------------- --------------

2,308,461,862 2,261,127,895

CURRENT ASSETS

Accrued income 24 14,520,768 13,589,107

Receivables 12 6,567,258 5,231,516

Cash and cash equivalents 19 110,814,899 91,070,150

-------------- --------------

131,902,925 109,890,773

TOTAL ASSETS 2,440,364,787 2,371,018,668

============== ==============

CURRENT LIABILITIES

Payables 13 186,055 179,449

Deferred income 24 40,277,540 37,972,435

Borrowings and Ijarah financing 14 128,267,282 118,654,871

-------------- --------------

168,730,877 156,806,755

NON-CURRENT LIABILITIES

Security deposits 20 14,301,130 13,482,669

Maintenance reserves 21 47,202,382 32,365,575

Borrowings and Ijarah financing 14 1,479,756,281 1,455,457,619

Deferred income 24 6,164,624 8,327,595

-------------- --------------

1,547,424,417 1,509,633,458

TOTAL LIABILITIES 1,716,155,294 1,666,440,213

============== ==============

TOTAL NET ASSETS 724,209,493 704,578,455

-------------- --------------

EQUITY

Share capital 15 647,638,697 647,638,697

Foreign currency translation

reserve 85,562,865 45,302,960

Retained earnings (8,992,069) 11,636,798

-------------- --------------

724,209,493 704,578,455

-------------- --------------

Pence Pence

-------------- --------------

Net Asset Value Per Share based

on 642,250,000 (31 March 2019:

642,250,000) shares in issue 112.76 109.70

-------------- --------------

The financial statements were approved by the Board and

authorised for issue on 9 December 2019 and are signed on its

behalf by:

John Le Prevost, Director

CONSOLIDATED STATEMENT OF CASH FLOWS

For the period from 1 April 2019 to 30 September 2019

1 Apr 2019 1 Apr 2018

to to

Notes 30 Sep 2019 30 Sep 2018*

GBP GBP

OPERATING ACTIVITIES

Profit for the period after tax 5,863,945 25,057,671

Decrease in accrued and deferred income (8,953,009) (3,945,671)

Interest received (58,680) (67,442)

Depreciation of Aircraft 9 73,573,585 77,440,734

Taxation expense 23 30,899 32,810

Loan and Ijarah financing interest

payable and fair value adjustments

on financial assets 10 48,356,236 20,476,745

Increase /(decrease) in payables 13 6,606 (10,197)

Maintenance reserves received 12,601,804 11,741,599

Decrease /(increase) in prepayments 12 1,385 (8,815)

Foreign exchange movement 17b (22,329) (1,587,152)

Amortisation of debt arrangement costs 10 1,049,052 990,333

NET CASH FROM OPERATING ACTIVITIES 132,449,494 130,120,615

-------------- --------------

INVESTING ACTIVITIES

Acquisition costs/purchase of Aircraft 9 - (11,195)

Interest received 58,680 67,442

NET CASH RECEIVED FROM INVESTING ACTIVITIES 58,680 56,247

-------------- --------------

FINANCING ACTIVITIES

Dividends paid 7 (26,492,812) (26,492,812)

Repayments of capital on senior loans

and Ijarah financing 22 (55,392,920) (56,092,363)

Payments of interest on senior loans

and Ijarah financing 22 (27,772,899) (27,347,153)

Payments of interest on junior loans 22 (6,241,552) (6,362,158)

Security trustee and agency fees 10 (143,642) (120,776)

NET CASH USED IN FINANCING ACTIVITIES (116,043,825) (116,415,262)

-------------- --------------

CASH AND CASH EQUIVALENTS AT BEGINNING

OF PERIOD 91,070,150 58,848,615

Increase in cash and cash equivalents 16,464,349 13,761,600

Exchange rate adjustment 3,280,400 3,622,483

CASH AND CASH EQUIVALENTS AT OF

PERIOD 19 110,814,899 76,232,698

-------------- --------------

*Restated, refer to note 2(g)

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the period from 1 April 2019 to 30 September 2019

Notes Share Capital Retained Foreign Total

Earnings Currency

Translation

Reserve

GBP GBP GBP GBP

Balance as at 1

April 2019 647,638,697 11,636,798 43,302,960 704,578,455

Total Comprehensive

income for the

period - 5,863,945 40,259,905 46,123,850

Dividends paid 7 - (26,492,812) - (26,492,812)

-------------- ------------- ------------- -------------

Balance as at 30

September 2019 647,638,697 (8,992,069) 85,562,865 724,209,493

-------------- ------------- ------------- -------------

Notes Share Capital Retained Foreign Total

Earnings Currency

Translation

Reserve

GBP GBP GBP GBP

Balance as at 1

April 2018 647,638,697 56,205,146 (96,119) 703,747,724

Total Comprehensive

Income for the

period* - 25,057,671 45,696,763 70,754,434

Dividends paid 7 - (26,492,812) - (26,492,812)

-------------- ------------- ------------- -------------

Balance as at 30

September 2018 647,638,697 54,770,005 45,600,644 748,009,346

-------------- ------------- ------------- -------------

*Restated, refer to note 2(g)

Notes to the Consolidated Financial Statements

For the period ended 30 September 2019

1. GENERAL INFORMATION

The consolidated financial information incorporates the results

of Amedeo Air Four Plus Limited (the "Company"), AA4P Alpha

Limited, AA4P Beta Limited, AA4P Gamma Limited, AA4P Delta Limited,

AA4P Epsilon Limited, AA4P Zeta Limited, AA4P Eta Limited, AA4P

Theta Limited, AA4P Iota Limited, AA4P Kappa Limited, AA4P Lambda

Limited, AA4P Mu Limited, AA4P Nu Limited, AA4P Leasing Ireland

Limited, AA4P Leasing Ireland 2 Limited and AA4P Xi Limited (each a

"Subsidiary" and together the "Subsidiaries") (together the Company

and the Subsidiaries are known as the "Group").

The Company was incorporated in Guernsey on 16 January 2015 with

registered number 59675. Its share capital consists of one class of

redeemable ordinary shares ("Shares"). The Shares are admitted to

trading on the SFS of the London Stock Exchange's Main Market.

The Company's investment objective is to obtain income returns

and a capital return for its Shareholders by acquiring, leasing and

then selling aircraft.

Since the completion of its initial public offering on 13 May

2015, the Company has acquired eight Airbus A380, two Boeing

777-300ER and four Airbus A350-900 aircraft. Eight of these

aircraft are leased to Emirates, two aircraft are leased to Etihad

and four aircraft are leased to Thai Airways. All aircraft are

leased for a period of 12 years from each respective delivery date.

In order to complete the purchase of these aircraft, subsidiaries

of the Company entered into debt financing arrangements which

together with the equity proceeds were used to finance the

acquisition of the fourteen aircraft.

Rental income received in US Dollars is used to pay loan

interest and regular capital repayments of debt (but excluding any

bullet or balloon repayment of principal), which are likewise

denominated in US Dollars. US Dollar lease rentals and loan

repayments, with the exception of the four Thai aircraft which

incorporate floating rate lease rentals, are furthermore fixed at

the outset of the Company's acquisition of an aircraft and are very

similar in amount and timing save for the repayment of bullet and

balloon repayments of principal due on the final maturity of a loan

to be paid out of the proceeds of the sale, refinancing or other

disposition of the relevant aircraft.

2. ACCOUNTING POLICIES

The significant accounting policies adopted by the Group are as

follows:

(a) Basis of preparation

The consolidated financial statements have been prepared in

conformity with the International Accounting Standard 34 Interim

Financial Reporting as adopted by the European Union ("EU"), and

applicable Guernsey law. The financial statements have been

prepared on a historical cost basis under International Financial

Reporting Standards.

This report is to be read in conjunction with the annual report

for the year ended 31 March 2019 which is prepared in accordance

with the International Financial Reporting Standards as adopted by

the EU and any public announcements made by the Company during the

interim reporting period.

The comparative period for the Consolidated Statement of

Comprehensive Income, Consolidated Statement of Cash Flows,

Consolidated Statement of Changes in Equity and the related notes

was from 1 April 2018 to 30 September 2018. The financial

information in the comparative period has been restated as

mentioned in 2(g). The accounting policies adopted are consistent

with those of the previous financial year, except for the adoption

of new and amended standards as set out overleaf:

Changes in accounting policies and disclosure

The following Standards or Interpretations have been adopted in

the current period. Their adoption has not had a material impact on

the amounts reported in these consolidated financial statements and

is not expected to have any impact on future financial periods

except where stated otherwise.

IFRS 16 Leases - specifies how an IFRS reporter will recognise,

measure, present and disclose leases. The standard provides a

single lessee accounting model, requiring lessees to recognise

assets and liabilities for all leases unless the lease term is 12

months or less or the underlying asset has a low value. Lessors

continue to classify leases as operating or finance, with IFRS 16's

approach to lessor accounting substantially unchanged from its

predecessor, IAS 17. This standard is effective for annual periods

beginning on or after 1 January 2019 and is endorsed by the EU.

IFRIC 23 Uncertainty over Income Tax Treatments - clarifies the

accounting for uncertainties in income taxes. This standard is

effective for annual periods beginning on or after 1 January 2019

and is endorsed by the EU. Guernsey has a 0% tax rate. The Irish

entities adopt commonly utilised tax structures which do not

contain inherent uncertainty.

At the date of approval of these financial statements there were

no standards and interpretations in issue but not yet effective,

which were considered to be material to the Group.

(b) Basis of consolidation

The consolidated financial information incorporates the results

of the Company and the Subsidiaries. The Company owns 100% of all

the shares in the Subsidiaries which grants it exposure to variable

returns from the entities and the power to affect those returns,

granting it control in accordance with IFRS 10.

Intra-group balances and transactions, and any unrealised income

and expenses arising from intra-group transactions, are eliminated

in preparing the consolidated financial information.

(c) Taxation

The Company and the Guernsey Subsidiaries have been assessed for

tax at the Guernsey standard rate of 0%. Since AA4P Leasing Ireland

Limited and AA4P Leasing Ireland 2 Limited are Irish tax resident

trading Companies, they will not be subject to Guernsey tax, but

their net lease rental income earned (after tax deductible

expenditure) will be taxable as trading income at 12.5% under Irish

tax regulations. Please refer to Note 23 for more information.

(d) Share capital

Shares are classified as equity. Incremental costs directly

attributable to the issue of Shares are recognised as a deduction

from equity.

(e) Expenses

All expenses, other than interest expenses are accounted for on

an accruals basis.

(f) Interest Income

Interest income and expenses are accounted for on an effective

interest rate basis.

(g) Foreign currency translation

The currency of the primary economic environment in which the

Group operates (the functional currency) is Great British Pounds

("GBP") which is also the presentation currency.

Transactions denominated in foreign currencies are translated

into GBP at the rate of exchange ruling at the date of the

transaction.

Monetary assets and liabilities denominated in foreign

currencies at the reporting date are translated into the functional

currency at the foreign exchange rate ruling at that date. Foreign

exchange differences arising on translation are recognised in the

Consolidated Statement of Comprehensive Income.

During the prior year, on 1 April 2018, the activities and

transactions of certain of the subsidiaries were reviewed by the

Board and were noted to be carried out substantially in USD. The

Board noted that the currency of the primary economic environment

of these entities was now more closely aligned with USD. As such,

the decision was made to re-designate the functional currency of

these entities to USD and to classify them as foreign

operations.

All assets and liabilities in the subsidiaries were translated

into the functional currency of USD using the USD/GBP exchange rate

prospectively from the date of change, being 1 April 2018. All

monetary assets and liabilities in the subsidiaries denominated in

currencies other than USD were translated to USD using the closing

exchange rate at 31 March 2019, with all items of income and

expenses in currencies other than USD in the subsidiaries to USD

using the exchange rate at the date of transaction. For

non-monetary items in the subsidiaries (including Aircraft assets),

the translated amount into USD at 1 April 2018 will be the item's

new historical cost.

As a result, the comparative information in the Consolidated

Statement of Comprehensive Income, Consolidated Statement of Cash

Flows, Consolidated Statement of Changes in Equity and the related

notes has been restated.

On consolidation the financial statements of foreign

subsidiaries whose functional currency is not GBP are translated

into GBP as follows: statement of financial position items are

translated into GBP at the period end exchange rate; statement of

income items are translated into GBP at the exchange rates

applicable at the transaction dates, as long as this is not

rendered inappropriate as a basis for translation by major

fluctuations in the exchange rate during the period; unrealized

gains and losses arising from the translation of the financial

statements of foreign subsidiaries are recorded under "Translation

adjustment on foreign operations" in other comprehensive income to

be recycled to income.

(h) Cash and cash equivalents

Cash at bank and short term deposits which are held to maturity

are carried at cost. Cash and cash equivalents are defined as call

deposits, short term deposits with a term of no more than three

months from the start of the deposit and highly liquid investments

readily convertible to known amounts of cash and subject to

insignificant risk of changes in value.

(i) Segmental reporting

The Directors are of the opinion that the Group is engaged in a

single segment of business, being acquiring, leasing and selling

aircraft (together the "Assets" and each an "Asset"). For more

information on segmental information please refer to note 26.

(j) Going concern

After making enquiries, the Directors have a reasonable

expectation that the Group has adequate resources to continue in

operational existence for the foreseeable future. While the Group

is in a current net liability position, the Group continues to make

profits as reflected and generate strong positive operating cash

flows. The Directors believe the Group is well placed to manage its

business risks successfully despite the current economic climate as

the loans have been largely fixed and the fixed rental income under

the operating leases means that the rents should be sufficient to

repay the debt and provide surplus income to pay for the Group's

expenses and permit payment of dividends. In addition the variable

rate loans are either hedged with an associated interest rate swap

contract issued by the lender to fix the loan interest over the

term of the loans, or are unhedged with related rentals which are

also floating rate to match. Accordingly, the Directors have

adopted the going concern basis in preparing the consolidated

financial information. The Board is not aware of any material

uncertainty that may cast significant doubt upon the Company's

ability to continue as a going concern.

(k) Leasing and rental income

The leases relating to the Assets have been classified as

operating leases as the terms of the leases do not transfer

substantially all the risks and rewards of ownership to the lessee.

The Assets are shown as non-current assets in the Consolidated

Statement of Financial Position. Further details of the leases are

given in Note 11.

Rental income and advance lease payments from operating leases

are recognised on a straight-line basis over the term of the

relevant lease. Initial direct costs incurred in negotiating and

arranging an operating lease are added to the carrying amount of

the leased Asset and amortised on a straight-line basis over the

lease term. The four A350-900 aircraft have variable lease rentals,

the variable portion of which is treated as contingent rent.

Contingent rent is recognised in the period in which it is

earned.

The deferred income liability represents the difference between

actual payments received in respect of the lease income (including

some received in full upfront) and the amount to be accounted for

in the accounting records on a straight line basis over the lease

terms. This liability will reduce over time as the leases continue

and approach the end of the lease terms. In addition to the timing

of receipt of the various rental income streams, the liability is

impacted by the USD/GBP exchange rate at the period end and any new

leases entered into from new aircraft acquisitions during the

period.

(l) Maintenance reserve and security deposits liabilities

In many aircraft operating lease contracts, the lessee has the

obligation to make periodic payments which are calculated with

reference to utilisation of airframes, engines and other major

life-limited components during the lease. In most lease contracts,

upon presentation by the lessee of the invoices evidencing the

completion of qualifying work on the aircraft, the Group reimburses

the lessee for the work, up to a maximum of the advances received

with respect to such work.

The Group records such amounts as maintenance advances.

Maintenance advances not expected to be utilised within one year

are classified as non-current liabilities. Amounts not refunded

during the lease are recorded as lease revenue at lease

termination. Further details are given in note 21.

Security deposits represent amounts paid by the lessee as

security in accordance with the lease agreements. The deposits are

repayable to the lessees on the expiration of the lease agreements

subject to satisfactory compliance of the lease agreements by the

lessees. Further details are given in note 20.

(m) Property, plant and equipment - Aircraft

In line with IAS 16 Property Plant and Equipment, each Asset is

initially recorded at cost, being the fair value of the

consideration paid. The cost of the Asset is made up of the

purchase price of the Assets plus any costs directly attributable

to bringing it into working condition for its intended use. Costs

incurred by the lessee in maintaining, repairing or enhancing the

aircraft are not recognised as they do not form part of the costs

to the Group. Accumulated depreciation and any recognised

impairment losses are deducted from cost to calculate the carrying

amount of the Asset.

Depreciation is recognised so as to write off the cost of each

Asset less the estimated residual value over the lease term of the

Asset of twelve years, using the straight line method. Residual

values have been arrived at by taking the average amount of three

independent external valuers and after taking into account

disposition fees. The Directors consider that the use of forecast

market values excluding inflation best approximates residual value

as required by IAS 16 Property, Plant and Equipment.

The depreciation method reflects the pattern of benefit

consumption. The residual value is reviewed annually in March and

is an estimate of the amount the entity would receive today if the

Asset were already of the age and condition they will be in at the

end of the lease.

Depreciation starts when the Asset is available for use.

At each audited reporting date, the Group reviews the carrying

amounts of its Assets to determine whether there is any indication

that those Assets have suffered an impairment loss. If any such

indication exists, the recoverable amount of the Asset is estimated

to determine the extent of the impairment loss (if any). Further

details are given in note 3.

Recoverable amount is the higher of fair value less costs to

sell and the value in use. In assessing value in use, the estimated

future cash flows are discounted to their present value using a

pre-tax discount rate that reflects current market assessments of

the time value of money and the risks specific to the Asset for

which the estimates of future cash flows have not been

adjusted.

If the recoverable amount of an Asset is estimated to be less

than its carrying amount, the carrying amount of the Asset is

reduced to its recoverable amount. An impairment loss is recognised

immediately in profit or loss. Where an impairment loss

subsequently reverses, the carrying amount of the Asset is

increased to the revised estimate of its recoverable amount, but so

that the increased carrying amount does not exceed the carrying

amount that would have been determined had no impairment loss been

recognised for the Asset in prior years. A reversal of an

impairment loss is recognised immediately in profit or loss.

(n) Financial assets and financial liabilities at fair value

through profit or loss

(a) Classification

The Group classifies its derivatives i.e. the interest rate

swaps, as financial assets or financial liabilities at fair value

through profit or loss. These financial assets and financial

liabilities are designated by the Board at fair value through

profit or loss at inception. The Group does not classify any

derivatives as hedges in a hedging relationship.

Trade and other receivables are classified as financials assets

at amortised cost. Financial assets measured at amortised cost are

initially recognised at fair value and are subsequently measured at

amortised cost using the effective interest rate methodology.

(b) Recognition/derecognition

Financial assets or liabilities are recognised on the trade date

- the date on which the Group commits to enter into the

transactions. Financial assets or liabilities are derecognised when

the rights to receive cash flows from the investments have expired

or the Group has transferred substantially all risks and rewards of

ownership.

(c) Measurement

Financial assets and financial liabilities at fair value through

profit or loss are initially recognised at fair value. Transaction

costs are expensed in profit or loss in the Consolidated Statement

of Comprehensive Income. Subsequent to initial recognition, all

financial assets and financial liabilities at fair value through

profit or loss are measured at fair value. Gains and losses arising

from changes in the fair value of the 'financial assets or

financial liabilities at fair value through profit or loss'

category are presented in the Consolidated Statement of

Comprehensive Income in profit or loss in the period in which they

arise.

(d) Impairment

The Group assesses on a forward looking basis the expected

credit losses associated with its receivables or accrued income

carried at amortised cost. The impairment methodology applied

depends on whether there has been a significant increase in credit

risk.

For trade and other receivables, the Group applies the

simplified approach permitted by IFRS 9, which requires expected

lifetime losses to be recognised from initial recognition of the

receivables.

(o) Non-derivative financial liabilities

Financial liabilities consist of security deposits, payables and

borrowings. The classification of financial liabilities at initial

recognition depends on the purpose for which the financial

liability was issued and its characteristics. All financial

liabilities are initially measured at fair value, net of

transaction costs. All financial liabilities are recorded on the

date on which the Group becomes party to the contractual

requirements of the financial liability.

Financial liabilities are subsequently measured at amortised

cost using the effective interest method, with interest expense

recognised on an effective yield basis.

The effective interest method is a method of calculating the

amortised cost of the financial liability and of allocating

interest expense over the relevant period. The effective interest

rate is the rate that exactly discounts estimated future cash

payments through the expected life of the financial liability, to

the net carrying amount on initial recognition.

Associated costs are subsequently amortised on an effective

interest rate basis over the life of the loan and are shown net on

the face of the Consolidated Statement of Financial Position over

the life of the lease.

The Group derecognises financial liabilities when, and only

when, the Group's obligations are discharged, cancelled or they

expire.

(p) Ijarah financing

Ijarah financing, a type of Islamic finance, where the Group has

substantially all the risks and rewards of ownership, are included

within Borrowings and Ijarah financing (Notes 14 and 22). The

Ijarah finance is capitalised at inception at the fair value of the

aircraft or, if lower, the present value of the minimum payments.

The corresponding rental obligations, net of finance charges, are

included in short-term and long-term borrowings and Ijarah

financing. Each payment is allocated between the liability and

finance cost. The finance cost is charged to the profit or loss

over the period so as to produce a constant periodic rate of

interest on the remaining balance of the liability for each period.

The Asset acquired under Ijarah financing is depreciated over the

Asset's useful life or over the shorter of the Asset's useful life

and the term if there is no reasonable certainty that the Group

will obtain ownership at the end of the finance term.

(q) Net Asset Value

In circumstances where the Directors are of the opinion that the

NAV or NAV per Share, as calculated under prevailing accounting

standards, is not appropriate or could give rise to a misleading

calculation, the Directors, in consultation with the Administrator

may determine, at their discretion, an alternative method for

calculating a more useful value of the Group and shares in the

capital of the Company, which they consider more accurately

reflects the value of the Group.

3. SIGNIFICANT JUDGEMENTS AND ESTIMATES

In the application of the Group's accounting policies, which are

described in Note 2, the Directors are required to make judgements,

estimates and assumptions about the carrying amounts of assets and

liabilities that are not readily apparent from other sources. The

estimates and associated assumptions are based on historical

experience and other factors that are considered to be relevant.

Actual results may differ from these estimates.

The estimates and underlying assumptions are reviewed on an

ongoing basis. Revisions to accounting estimates are recognised in

the period in which the estimate is revised if the revision affects

only that period or in the period of the revision and future

periods if the revision affects both current and future

periods.

Critical judgements in applying the Group's accounting

policies

The following are the critical judgements and estimates that the

Directors have made in the process of applying the Group's

accounting policies and that have the most significant effect on

the amounts recognised in the financial information.

KEY SOURCES OF ESTIMATION UNCERTAINTY

Residual value of Aircraft

As described in Note 2 (m), the Group depreciates the Assets on