TIDMFFWD

RNS Number : 4319W

FastForward Innovations Limited

11 December 2019

FastForward Innovations Ltd / AIM: FFWD / Sector: Closed End

Investments

11 December 2019

FastForward Innovations Ltd

("FastForward", "FFWD" or the "Company")

Interim Results

FastForward Innovations Ltd, the AIM listed closed end

investment fund with a focus on disruptive, high growth technology

and life sciences businesses, is pleased to announce its interim

results for the six months ended 30 September 2019.

Highlights from Investments

-- Progress across diverse portfolio of disruptive, high growth

technology and life sciences businesses

-- EMMAC Life Sciences Ltd. raised GBP15 million via the

successful issue of convertible loan notes, as announced post

period end, on 15 October 2019

-- Factom launched minable network of stablecoins, PegNet, as

announced post period end, on 15 October 2019

-- Successful closure of Juvenescence's Series B funding round

at the targeted $100 million, as announced on 19 August 2019

-- Investment in Portage Biotech Inc. in exchange for previous holding in Intensity Therapeutics

-- Leap Gaming partnered with established online betting and

gaming platform Mansion Casino, as announced on 27 September

2019

Chairman's Statement

This has been a positive period for FastForward as the value of

its investments in fast-growing, industry leading businesses,

specifically in the life science, health and technology arenas,

become apparent.

Our aim is to give investors exposure to disruptive growth

opportunities which they would otherwise be unable to access. To

this end, we currently have nine investments of varying size and

spanning several sectors, which we believe have the near-term

potential to re-rate and thus significantly impact our NAV.

Notably, FastForward does not charge management fees or take a fee

on success; the intention is to either re-invest the capital

generated or ultimately return value to investors by way of

dividends, share-buybacks or other distributions.

During the period, several investee companies have been active.

Our second investment in the medical cannabis sector, EMMAC Life

Sciences Ltd. ("EMMAC"), raised GBP15 million via the issue of

convertible loan notes. As Europe's leading independent cannabis

company, I am delighted with the response to EMMAC's fundraise,

which reflects the continuing attraction of EMMAC and its business

plan to investors, despite the regulatory difficulties facing the

sector.

Our investments within the technology sector are also showing

promise. Post period end in October 2019, we announced that

blockchain solutions provider, Factom, launched PegNet, an open,

distributed, autonomous and minable stablecoin network for an asset

backed payment cryptocurrency, that enables users to store value in

any of the listed fiat currencies, precious metals or

cryptocurrencies. Juvenescence, a biopharmaceutical company focused

on therapeutic assets to target aging, regeneration and the

diseases of aging, also made headway having raised $100 million

through a Series B financing round. Further details of investee

news can be found in the Investee Company Review section below.

On the corporate side, I have taken on the role of interim

Chairman, in addition to my role as CEO, replacing Jim Mellon who

resigned in August 2019 to focus on his other business activities,

particularly Juvenescence in which we continue to be invested. I'd

like to thank Jim for his service and assistance over the years and

look forward to continuing to work with him at Juvenescence.

As our financial statements highlight, there is a disparity

between the 30 September 2019 market cap of circa GBP11 million and

the NAV of circa GBP20.4 million. It should be noted that whilst we

have enjoyed gains on the back of foreign exchange rates between

the Dollar and the Pound Sterling given the number of US

investments, the NAV is liable to fluctuate in response to the

effects on the exchange rate from the uncertainties of the US /

China trade discussions. At home in the UK, the stock market is

also experiencing uncertainties. We are hopeful that once there is

more clarity politically and economically investors will follow the

lead of foreign investors, who continue to see the value of London

listed companies, and that our share price will respond

accordingly.

Looking ahead, this is an exciting time for FastForward as our

investee companies make notable progress towards building

revenue/profits and becoming leaders in their niche markets, which

we hope will ultimately lead to a liquidity event. In tandem, we

continue to evaluate other exciting and innovative opportunities

within the medical cannabis, wellness and technology fields where

we believe value can be generated. I look forward to updating

shareholders as our investment portfolio advances and

strengthens.

Lorne Abony

Chairman

11 December 2019

Investee Company Review

Juvenescence Ltd (investment position: c.12.5% of NAV) is a

biopharmaceutical company with a pipeline of therapeutic assets

that target aging, regeneration and the diseases of aging. It

actively works with scientists and leading research institutions to

create joint ventures combining their IP and its own resources.

Juvenescence has raised USD $165 million to-date and its last

fundraising was at a valuation of $400 million; it hopes to IPO in

2020. During the period, Juvenescence announced the successful

closure of its Series B financing round at the targeted $100

million, providing it with sufficient working capital to progress

many of its programmes to their initial inflection points.

EMMAC Life Sciences Plc (investment position: c.12% of NAV) is

Europe's largest medical cannabis company by territory. It brings

together cutting-edge scientific research with the latest

innovations in cannabis cultivation, extraction and production and

has plans for an IPO in the future. Post period end in October

2019, it was announced by the Company that EMMAC may have an

implied value of greater than GBP150 million based on the

conversion price of the GBP15 million convertible loan notes

issued.

Portage Biotech Inc. (investment position: c.5.5% of NAV) is a

biotechnology company focused on developing best-in-class or

first-in-class therapeutics. To this end, it provides funding and

advice to a portfolio of nine subsidiary companies; projects under

development include research and treatments for various cancers,

eye disease and acute kidney injury. This was a new investment for

the Company during this period, where we took a stake in Portage in

exchange for our previous holding in Intensity Therapeutics. Whilst

there have been some issues (notably the suspension of trading of

Portage stock on the Canadian Securities Exchange ("CSE") due to

late filing of accounts), we understand from a recent announcement

dated 27 November 2019 that the CSE have granted Portage an

extension to remedy the issue and lift the suspension. Portage

therefore expects that this will be resolved in the near future and

importantly, there is no impairment to the carrying value of the

investment in the meantime. We are excited to watch the development

of both Portage and its underlying therapeutic companies.

Leap Gaming (investment position: 28% of NAV) is a B2B developer

of high-end virtual reality ('VR') gaming applications whose games

are already offered by leading global online and retail gaming

operators generating tens of thousands of engagement points with

end-users. It has a strategic partnership with global media giant,

IMG, which is also one of the large investors, to drive the

development of the business. In September 2019, Leap Gaming signed

a new partnership with the established online betting and gaming

platform Mansion Casino around distribution of Leap Gaming's game

portfolio across Mansion's footprint.

Yooya (investment position: c.8% of NAV) is currently a

content-driven e-commerce platform focused on Asia, however,

proposals are under review, which may result in it being converted

to a CBD sales and marketing platform.

Vemo Education (investment position: c.1.5% of NAV) is one of

the leading US providers of income share agreement programmes,

which enable students to defer some of their costs to a US college

or university in exchange for a fixed percentage of their

post-graduation income for a fixed period. This increases

transparency around student experiences, helping schools improve,

compete, succeed and fundamentally change the relationship they

have with students. Vemo recently raised additional capital and is

in a strong position to continue to develop the business over the

coming years.

Factom (investment position: c.26.5% of NAV) is a recognised

leader in providing blockchain solutions that preserve, ensure and

validate digital assets. The commercial potential of its three

divisions is beginning to be realised, having recently signed

several large corporate and government clients that are likely to

deliver significant recurring revenues. It is looking to secure

bridge funding of up to US$4 million in Q1 2020, if successful this

will aid in supporting company development and prove its business

case ahead of a Series B funding round.

Cryptologic (investment position: c.2% of NAV) is a Canadian

listed company currently involved in cryptocurrency mining, but

which is seeking to pivot into the Canadian Cannabis Industry by

way of a proposed acquisition of assets from Wayland Group and the

sale of its mining business. The specifics of the proposed deal

would preclude FastForward's continued involvement in the company

due to UK regulatory constraints and is not in line with its

investment mandate. As such, FastForward is in the process of

selling its investment in Cryptologic, which is by way of market

traded, convertible debentures; the sale of any outstanding

debentures held by FastForward will in some ways be contingent upon

the proposed Wayland transaction and liquidity in the debenture

market.

Interim Financial Statements

FASTFORWARD INNOVATIONS LIMITED

UNAUDITED CONDENSED HALF-YEARLY REPORT AND FINANCIAL

STATEMENTS

FOR THE SIX MONTHSED 30 SEPTEMBER 2019

INVESTING POLICY

The Company's Investing Policy is to invest in and/or acquire

companies which have significant intellectual property rights which

they are seeking to exploit, principally within the technology

sector (including digital and content focused businesses) and the

life sciences sectors (including biotech and pharmaceuticals).

Initially the geographical focus will be North America and Europe

but investments may also be considered in other regions to the

extent that the Board considers that valuable opportunities exist

and positive returns can be achieved.

In selecting investment opportunities, the Board will focus on

businesses, assets and/or projects that are available at attractive

valuations and hold opportunities to unlock embedded value. Where

appropriate, the Board may seek to invest in businesses where it

may influence the business at a board level, add its expertise to

the management of the business, and utilize its industry

relationships and access to finance; as such investments are likely

to be actively managed.

The Company's interest in a proposed investment and/or

acquisition may range from a minority position to full ownership

and may comprise one investment or multiple investments. The

proposed investments may be in either quoted or unquoted companies;

are likely to be made by direct acquisitions or through an

immediate investment; and may be in companies, partnerships,

earn-in joint ventures, debt or other loan structures. The Board

may focus on investments where intrinsic value can be achieved from

the restructuring of investments or merger of complementary

businesses.

The Board expects that investments will typically be held for

the medium to long term, although short term disposal of assets

cannot be ruled out if there is an opportunity to generate an

attractive return for Shareholders. The Board will place no minimum

or maximum limit on the length of time that any investment may be

held.

There is no limit on the number of projects into which the

Company may invest and the Company's financial resources may be

invested in a number of propositions or in just one investment,

which may be deemed to be a reverse takeover under the AIM Rules.

The Directors intend to mitigate risk by appropriate due diligence

and transaction analysis. Any transaction constituting a reverse

takeover under the AIM Rules will also require Shareholder

approval. The Board considers that as investments are made, and new

promising investment opportunities arise, further funding of the

Company may also be required.

Where the Company builds a portfolio of related assets it is

possible that there may be cross holdings between such assets. The

Company does not currently intend to fund any investments with debt

or other borrowings but may do so if appropriate. Investments are

expected to be mainly in the form of equity, with debt potentially

being raised later to fund the development of such assets.

Investments in later stage assets are more likely to include an

element of debt to equity gearing. The Board may also offer new

Ordinary Shares by way of consideration as well as or in lieu of

cash, thereby helping to preserve the Company's cash for working

capital and as a reserve against unforeseen contingencies

including, for example, delays in collecting accounts receivable,

unexpected changes in the economic environment and operational

problems.

The Board will conduct initial due diligence appraisals of

potential businesses or projects and, where it believes that

further investigation is warranted, it intends to appoint

appropriately qualified persons to assist. The Board believes it

has a broad range of contacts through which it is likely to

identify various opportunities which may prove suitable. The Board

believes its expertise will enable it to determine quickly which

opportunities could be viable and so progress quickly to formal due

diligence. The Company will not have a separate investment manager.

The Board proposes to carry out a comprehensive and thorough

project review process in which all material aspects of a potential

project or business will be subject to rigorous due diligence, as

appropriate. Due to the nature of the sector in which the Company

is focused it is unlikely that cash returns will be made in the

short to medium term; rather the Company expects a focus on capital

returns over the medium to long term.

CHAIRMAN'S STATEMENT

I am pleased to present the report and financial statements of

FastForward Innovations Limited (the "Company" or "FastForward")

for the six months ended 30 September 2019.

This has been a positive period for FastForward as the value of

its investments in fast-growing, industry leading businesses,

specifically in the life science, health and technology arenas,

become apparent.

Our aim is to give investors exposure to disruptive growth

opportunities which they would otherwise be unable to access. To

this end, we currently have nine investments of varying size and

spanning several sectors, which we believe have the near-term

potential to re-rate and thus significantly impact our NAV.

Notably, FastForward does not charge management fees or take a fee

on success; the intention is to either re-invest the capital

generated or ultimately return value to investors by way of

dividends, share-buybacks or other distributions.

During the period, several investee companies have been active.

Our second investment in the medical cannabis sector, EMMAC Life

Sciences Ltd. ("EMMAC"), raised GBP15 million via the issue of

convertible loan notes. As Europe's leading independent cannabis

company, I am delighted with the response to EMMAC's fundraise,

which reflects the continuing attraction of EMMAC and its business

plan to investors, despite the regulatory difficulties facing the

sector.

Our investments within the technology sector are also showing

promise. Post period end in October 2019, we announced that

blockchain solutions provider, Factom, launched PegNet, an open,

distributed, autonomous and minable stablecoin network for an asset

backed payment cryptocurrency, that enables users to store value in

any of the listed fiat currencies, precious metals or

cryptocurrencies. Juvenescence, a biopharmaceutical company focused

on therapeutic assets to target aging, regeneration and the

diseases of aging, also made headway having raised $100 million

through a Series B financing round. Further details of investee

news can be found in the Investee Company Review section below.

On the corporate side, I have taken on the role of interim

Chairman, in addition to my role as CEO, replacing Jim Mellon who

resigned in August 2019 to focus on his other business activities,

particularly Juvenescence in which we continue to be invested. I'd

like to thank Jim for his service and assistance over the years and

look forward to continuing to work with him at Juvenescence.

As our financial statements highlight, there is a disparity

between the 30 September 2019 market cap of circa GBP11 million and

the NAV of circa GBP20.4 million. It should be noted that whilst we

have enjoyed gains on the back of foreign exchange rates between

the Dollar and the Pound Sterling given the number of US

investments, the NAV is liable to fluctuate in response to the

effects on the exchange rate from the uncertainties of the US /

China trade discussions. At home in the UK, the stock market is

also experiencing uncertainties. We are hopeful that once there is

more clarity politically and economically investors will follow the

lead of foreign investors, who continue to see the value of London

listed companies, and that our share price will respond

accordingly.

Looking ahead, this is an exciting time for FastForward as our

investee companies make notable progress towards building

revenue/profits and becoming leaders in their niche markets, which

we hope will ultimately lead to a liquidity event. In tandem, we

continue to evaluate other exciting and innovative opportunities

within the medical cannabis, wellness and technology fields where

we believe value can be generated. I look forward to updating

shareholders as our investment portfolio advances and

strengthens.

Results

The net assets of the Company at 30 September 2019 were

GBP20,401,000 (31 March 2019: GBP19,072,000), equal to net assets

of 12.63p per Ordinary Share (31 March 2019: 11.81p per Ordinary

Share).

Lorne Abony

Chairman

10 December 2019

INVESTEE COMPANY REVIEW

Performance and valuation

The Company's Net Asset Value ("NAV") per share stands at 12.63p

per share compared to 11.81p at 31 March 2019. Our share price

moved from 9.79p per share at 31 March 2019 to 6.85p per share at

30 September 2019.

Portfolio

The table below lists the Company's holdings as at 30 September

2019.

Holding Share Category Country Number Valuation

Class of Incorporation of Shares at

Held at

30 September

2019

30

September

2019

(GBP'000)

Juvenescence Biotech /

Limited Ordinary Healthcare BVI 128,205 2,576

EMMAC Life

Sciences Biotech /

Ltd Ordinary Healthcare England 6,666,667 2,500

Series Blockchain

Factom, Inc. Seed Tech USA 400,000 581

Blockchain

Factom, Inc. SAFE note Tech USA N/A 4,880

Leap Gaming

(Fralis

LLC) Units Gaming Nevis 1,512 5,710

Series

Yooya Media Seed Media and

(EDA) Preferred Content BVI 27,255 1,586

Portage Biotech /

Biotech Inc. Ordinary Healthcare BVI 12,980,061 1,119

Vemo

Education Pref Series

Inc. Seed 2 Edtech USA 1,000,000 264

Convertible

Cryptologic Debentures Blockchain

Corp & Warrants Tech Canada N/A 386

Diabetic Boot Ordinary Biotech / England 25,978 -

Company Healthcare

-------------- ------------- ------------ ------------------ ------------------------------------- -----------------------------------

Total Investment

Value 19,602

Cash and other net

current assets 799

-----------------------------------

Net Asset Value 20,401

===================================

Juvenescence Ltd (investment position: c.12.5% of NAV) is a

biopharmaceutical company with a pipeline of therapeutic assets

that target aging, regeneration and the diseases of aging. It

actively works with scientists and leading research institutions to

create joint ventures combining their IP and its own resources.

Juvenescence has raised USD $165 million to-date and its last

fundraising was at a valuation of $400 million; it hopes to IPO in

2020. During the period, Juvenescence announced the successful

closure of its Series B financing round at the targeted $100

million, providing it with sufficient working capital to progress

many of its programmes to their initial inflection points.

INVESTEE COMPANY REVIEW (continued)

EMMAC Life Sciences Plc (investment position: c.12% of NAV) is

Europe's largest medical cannabis company by territory. It brings

together cutting-edge scientific research with the latest

innovations in cannabis cultivation, extraction and production and

has plans for an IPO in the future. Post period end in October

2019, it was announced by the Company that EMMAC may have an

implied value of greater than GBP150 million based on the

conversion price of the GBP15 million convertible loan notes

issued.

Portage Biotech Inc. (investment position: c.5.5% of NAV) is a

biotechnology company focused on developing best-in-class or

first-in-class therapeutics. To this end, it provides funding and

advice to a portfolio of nine subsidiary companies; projects under

development include research and treatments for various cancers,

eye disease and acute kidney injury. This was a new investment for

the Company during this period, where we took a stake in Portage in

exchange for our previous holding in Intensity Therapeutics. Whilst

there have been some issues (notably the suspension of trading of

Portage stock on the Canadian Securities Exchange ("CSE") due to

late filing of accounts), we understand from a recent announcement

dated 27 November 2019 that the CSE have granted Portage an

extension to remedy the issue and lift the suspension. Portage

therefore expects that this will be resolved in the near future and

importantly, there is no impairment to the carrying value of the

investment in the meantime. We are excited to watch the development

of both Portage and its underlying therapeutic companies.

Leap Gaming (investment position: 28% of NAV) is a B2B developer

of high-end virtual reality ('VR') gaming applications whose games

are already offered by leading global online and retail gaming

operators generating tens of thousands of engagement points with

end-users. It has a strategic partnership with global media giant,

IMG, which is also one of the large investors, to drive the

development of the business. In September 2019, Leap Gaming signed

a new partnership with the established online betting and gaming

platform Mansion Casino around distribution of Leap Gaming's game

portfolio across Mansion's footprint.

Yooya (investment position: c.8% of NAV) is currently a

content-driven e-commerce platform focused on Asia, however,

proposals are under review, which may result in it being converted

to a CBD sales and marketing platform.

Vemo Education (investment position: c.1.5% of NAV) is one of

the leading US providers of income share agreement programmes,

which enable students to defer some of their costs to a US college

or university in exchange for a fixed percentage of their

post-graduation income for a fixed period. This increases

transparency around student experiences, helping schools improve,

compete, succeed and fundamentally change the relationship they

have with students. Vemo recently raised additional capital and is

in a strong position to continue to develop the business over the

coming years.

Factom (investment position: c.26.5% of NAV) is a recognised

leader in providing blockchain solutions that preserve, ensure and

validate digital assets. The commercial potential of its three

divisions is beginning to be realised, having recently signed

several large corporate and government clients that are likely to

deliver significant recurring revenues. It is looking to secure

bridge funding of up to US$4 million in Q1 2020, if successful this

will aid in supporting company development and prove its business

case ahead of a Series B funding round.

INVESTEE COMPANY REVIEW (continued)

Cryptologic (investment position: c.2% of NAV) is a Canadian

listed company currently involved in cryptocurrency mining, but

which is seeking to pivot into the Canadian Cannabis Industry by

way of a proposed acquisition of assets from Wayland Group and the

sale of its mining business. The specifics of the proposed deal

would preclude FastForward's continued involvement in the company

due to UK regulatory constraints and is not in line with its

investment mandate. As such, FastForward is in the process of

selling its investment in Cryptologic, which is by way of market

traded, convertible debentures; the sale of any outstanding

debentures held by FastForward will in some ways be contingent upon

the proposed Wayland transaction and liquidity in the debenture

market.

DIRECTORS' RESPONSIBILITIES STATEMENT

The Directors are responsible for preparing these unaudited

condensed half-yearly financial statements, which have not been

reviewed or audited by the Company's independent auditors, and are

required to:

-- prepare the unaudited half-yearly financial statements in

accordance with International Accounting Standard 34: Interim

Financial Reporting;

-- include a fair review of important events that have occurred

during the period, and their impact on the unaudited half-yearly

financial statements, together with a description of the principle

risks and uncertainties of the Company for the remaining six months

of the financial year as detailed in the Chairman's Statement and

Investee Company Review; and

-- include a fair review of related party transactions that have

taken place during the six month period which have had a material

effect on the financial position or performance of the Company,

together with disclosure of any changes in related party

transactions from the last annual financial statements which have

had a material effect on the financial position of the Company in

the current period.

The Directors confirm that the unaudited condensed half-yearly

financial statements comply with the above requirements and are

signed on behalf of the Board of Directors by:

Lance De Jersey Ian Burns

Director Director

10 December 10 December

2019 2019

CONDENSED HALF-YEARLY STATEMENT OF COMPREHENSIVE INCOME

for the six months ended 30 September 2019

1 April 2019 1 April 2018

to to

30 September 30 September

2019 2018

(unaudited) (unaudited)

Note GBP'000 GBP'000

Investment gains and losses

Realised gain/(loss) on investments at

fair value through profit and loss 5 528 (418)

Unrealised gain on investments at fair

value through profit and loss 5 1,156 1,686

Interest income on investments at fair

value through profit and loss 58 33

------------- -------------

Total investment gains 1,742 1,301

Income

Bank interest income 11 2

Total income 11 2

Expenses

Legal and professional fees (109) (90)

Adviser and broker's fees (36) (63)

Administration fees (55) (40)

Other expenses (30) (99)

4,

Recognition of Directors share based expense 12 (85) (78)

Directors' remuneration and expenses 12 (225) (127)

Total expenses (540) (497)

Net profit from operating activities before

gains and losses on foreign currency exchange 1,213 806

------------- -------------

Net foreign currency exchange gain 31 69

Total comprehensive profit for the period 1,244 875

============= =============

Profit per Ordinary Share - basic and

diluted 7 0.77p 0.62p

All the items in the above statement are derived from continuing

operations.

The accompanying notes on pages 10 to 17 form an integral part

of these unaudited condensed half-yearly financial statements.

CONDENSED STATEMENT OF FINANCIAL POSITION

as at 30 September 2019

30 September 31 March

2019 2019

(unaudited) (audited)

Note GBP'000 GBP'000

Non-current assets

Financial assets designated at fair value

through profit or loss 5 19,602 18,604

------------- ----------

Current assets

Other receivables 58 112

Cash and cash equivalents 999 504

1,057 616

Total assets 20,659 19,220

------------- ----------

Current liabilities

Payables and accruals (258) (148)

Total liabilities (258) (148)

Net assets 20,401 19,072

============= ==========

Capital and reserves attributable to equity

holders of the Company

Share capital 11 1,614 1,614

Deferred share reserve 11 630 630

Employee stock option reserve 1,318 1,233

Other reserve 2,293 2,293

Distributable reserves 14,546 13,302

Total equity shareholders' funds 20,401 19,072

============= ==========

Net assets per Ordinary Share - basic

and diluted 10 12.63p 11.81p

The accompanying notes on pages 10 to 17 form an integral part

of these unaudited condensed half-yearly financial statements.

CONDENSED HALF-YEARLY STATEMENT OF CHANGES IN EQUITY

for the six months ended 30 September 2019 (unaudited)

Employee

Deferred stock

Share shares Other option Distributable

capital reserve reserve reserve reserves Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 31 March

2019 1,614 630 2,293 1,233 13,302 19,072

Total comprehensive

profit for the period - - - - 1,244 1,244

Transactions with

shareholders

Employee share scheme

- value of employee

services - - - 85 - 85

Balance at 30 September

2019 1,614 630 2,293 1,318 14,546 20,401

================== ========= ========= ========= ============== ========

Employee

Deferred stock

Share shares Other option Distributable

capital reserve reserve reserve reserves Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 31 March

2018 1,306 630 2,293 1,086 8,219 13,534

Total comprehensive

profit for the period - - - - 875 875

Transactions with

shareholders

Issue of Ordinary

shares 308 - - - 3,618 3,926

Employee share scheme

- value of employee

services - - - 83 - 83

Balance at 30 September

2018 1,614 630 2,293 1,169 12,712 18,418

================== ========= ========= ========= ============== ========

The accompanying notes on pages 10 to 17 form an integral part

of these unaudited condensed half-yearly financial statements.

CONDENSED HALF-YEARLY STATEMENT OF CASH FLOWS

for the six months ended 30 September 2019

1 April 2019 1 April

to 2018 to

30 September 30 September

2019 2018

(unaudited) (unaudited)

GBP'000 GBP'000

Cash flows from operating activities

Bank interest received 6 2

Other Income 3 -

Nominated Adviser and broker's fees paid (75) (116)

Legal and professional fees paid (124) (105)

Administration fees paid (51) (29)

Other expenses paid (35) (50)

Directors' remuneration paid (65) (71)

Net cash outflow from operating activities (341) (369)

-------------- --------------

Cash flows from investing activities

Cash flows from investing activities

Purchase of investments - (9,007)

Sale of investments 805 8,307

-------------- --------------

Net cash inflow/(outflow) from investing

activities 805 (700)

-------------- --------------

Cash flows from financing activities

Proceeds from issue of Ordinary Shares - 3,926

Net cash inflow from financing activities - 3,926

(Decrease)/increase in cash and cash

equivalents 464 2,857

============== ==============

Cash and cash equivalents brought forward 504 72

(Decrease)/Increase in cash and cash

equivalents 464 2,857

Foreign exchange movement 31 69

Cash and cash equivalents carried forward 999 2,998

============== ==============

The accompanying notes on pages 10 to 17 form an integral part

of these unaudited condensed half-yearly financial statements.

NOTES TO THE CONDENSED HALF-YEARLY FINANCIAL STATEMENTS

for the six months ended 30 September 2019

1. General Information

FastForward Innovations Limited ("The Company") is a

closed-ended investment company. The Company is domiciled and

incorporated as a limited liability company in Guernsey. The

registered office of the Company is 11 New Street, St Peter Port,

Guernsey, GY1 2PF.

With effect from 3 May 2018 the Company has been authorised as a

Closed-ended investment scheme by the Guernsey Financial Services

Commission (the "GFSC") under Section 8 of the Protection of

Investors (Bailiwick of Guernsey) Law, 1987 and the Authorised

Closed-Ended Investment Schemes Rules.

The Company's Ordinary Shares are traded on AIM, a market

operated by the London Stock Exchange.

2. Statement of Compliance

These condensed half-yearly financial statements, which have not

been independently reviewed or audited by the Company auditors,

have been prepared in accordance with International Accounting

Standard 34: Interim Financial Reporting. They do not include all

of the information required for full annual financial statements

and should be read in conjunction with the audited financial

statements for the year ended 31 March 2019.

The unaudited condensed half-yearly financial statements were

approved by the Board of Directors on 10 December 2019.

3. Significant Accounting Policies

These unaudited condensed half-yearly financial statements have

adopted the same accounting policies as the last audited financial

statements, which were prepared in accordance with International

Financial Reporting Standards ("IFRS"), issued by the International

Accounting Standards Board, interpretations issued by the IFRS

Interpretations Committee and applicable legal and regulatory

requirements of Guernsey Law and reflect the accounting policies as

disclosed in the Company's last audited financial statements, which

have been adopted and applied consistently.

The Company has adopted all revisions and amendments to IFRS

issued by the IASB, which may be relevant to and effective for the

Company's financial statements for the annual period beginning 1

April 2019. No new standards or interpretations adopted during the

period had an impact on the reported financial position or

performance of the Company.

4. Critical Accounting Estimates and Judgments

The preparation of financial statements in conformity with IFRS

requires management to make judgments, estimates and assumptions

that affect the application of accounting policies and the reported

amounts of assets and liabilities, income and expenses. The

estimates and associated assumptions are based on historical

experience and various other factors that are believed to be

reasonable under the circumstances, the results of which form the

basis of making the judgments about carrying values of assets and

liabilities that are not readily apparent from other sources.

Actual results may differ from these estimates.

Management makes estimates and assumptions concerning the future

of the Company. The resulting accounting estimates will, by

definition, seldom equal the related actual results. Management

believe that the underlying assumptions are appropriate and that

the financial statements are fairly presented. The estimates and

assumptions that have a significant risk of causing a material

adjustment to the carrying amounts of assets and liabilities within

the next financial year are outlined below:

NOTES TO THE CONDENSED HALF-YEARLY FINANCIAL STATEMENTS

(continued)

for the six months ended 30 September 2019

4. Critical Accounting Estimates and Judgments (continued)

Judgments Going concern

After making reasonable enquiries, and assessing all data relating

to the Company's liquidity, the directors have a reasonable expectation

that the Company has adequate resources to continue in operational

existence for the foreseeable future and do not consider there

to be any threat to the going concern status of the Company. For

this reason, they continue to adopt the going concern basis in

preparing the financial statements.

Estimates and assumptions

Fair Value of financial instruments

The fair values of securities that are not quoted in an active

market are determined by using valuation techniques as explained

in the IPEV Guidelines, primarily earnings multiples, discounted

cash flows and recent comparable transactions. The models used

to determine fair values are validated and periodically reviewed

by the Company. In some instances, the cost of an investment is

the best measure of fair value in the absence of further information.

The inputs in the earnings multiple's models include observable

data, such as the earnings multiples of comparable companies to

the relevant portfolio company, and unobservable data, such as

forecast earnings for the portfolio company. In discounted cash

flow models, unobservable inputs are the projected cash flows of

the relevant portfolio company and the risk premium for liquidity

and credit risk that are incorporated into the discount rate. However,

the discount rates used for valuing equity securities are determined

based on historic equity returns for other entities operating in

the same industry for which market returns are observable. Management

uses models to adjust the observed equity returns to reflect the

actual equity financing structure of the valued equity investment.

Models are calibrated by back-testing to actual results/exit prices

achieved to ensure that outputs are reliable, where possible.

Valuation of Options

The fair values of the Options are measured using the Black-Scholes

model, for those options with non-market vesting conditions, and

a Monte Carlo Simulation model for those Options with market related

vesting conditions.

The key estimates and assumptions which are used as inputs in these

valuation models are as follows;

-- any market vesting conditions;

-- the expected vesting period;

-- the term of the options;

-- the expected volatility of the company's share price as at grant

date;

-- the risk-free rate of return available at grant date;

-- the company's share price at grant date;

-- the expected dividends on the company's shares over the expected

term of the options; and

-- the exercise (strike) price of the options.

For those Options which did not vest immediately on issue, non-

market vesting conditions, the expected vesting period of the options

is estimated to be 5 years from the grant date. 5 years is deemed

to be a realistic timeframe in which the performance conditions

can be expected to be achieved. However, the options can be exercised

at any point after vesting and prior to the Option expiry date.

NOTES TO THE CONDENSED HALF-YEARLY FINANCIAL STATEMENTS (continued)

for the six months ended 30 September 2019

5. Investments designated at fair value through profit or loss

A reconciliation of the opening and closing balances of assets

designated at fair value through profit or loss classified as Level

3 is as follows:

30 September 31 March

2019 2019

GBP'000 GBP'000

Opening valuation 18,110 5,682

Purchases - 9,837

Disposal proceeds (1,374) -

Realised gains 562 (1,377)

Net unrealised change in fair value of financial

assets 800 3,968

18,098 18,110

============= ===================

A reconciliation of the opening and closing balances of assets

designated at fair value through profit or loss classified as Level

1 is shown below:

30 September 31 March

2019 2019

GBP'000 GBP'000

Opening valuation 494 6,728

Purchases 1,033 1,304

Disposal proceeds (345) (7,286)

Realised losses (34) (418)

Net unrealised change in fair value of financial

assets 356 166

1,504 494

-------------- ----------------------

Total value of investments at fair value

through profit or loss 19,602 18,604

============== ======================

There were no transfers between fair value hierarchy levels

during the period (31 March 2019: None).

During the period, the Company swapped 288,458 in Intensity

Therapeutics Incs with Portage Biotech Inc. for a consideration of

$1,298,061 represented by 12,980,610 ordinary shares.

The valuations used to determine fair values are validated and

periodically reviewed by experienced personnel and are in

accordance with the International Private Equity and Venture

Capital Valuation Guidelines. The valuations, when relevant, are

based on a mixture of:

-- third party financing (if available);

-- cost, where the investment has been made during the year and

no further information has been available to indicate that cost is

not an appropriate valuation;

-- proposed sale price;

-- discount to NAV calculations;

-- discount to last traded price; and

-- discounted cash flow.

NOTES TO THE CONDENSED HALF-YEARLY FINANCIAL STATEMENTS

(continued)

for the six months ended 30 September 2019

6. Segmental Information

In accordance with International Financial Reporting Standard 8:

Operating Segments, it is mandatory for the Company to present and

disclose segmental information based on the internal reports that

are regularly reviewed by the Board in order to assess each

segment's performance and to allocate resources to them.

Management information for the Company is provided internally to

the management for decision-making purposes. The management's asset

allocation decisions are based on an integrated investment strategy

and the Company's performance is evaluated on an overall basis. The

single segment is investments in companies which have significant

intellectual property rights which they are seeking to exploit,

principally within the technology sector (including digital

technology, gaming and content focused businesses) and the life

sciences sectors (including biotech and pharmaceuticals). Initially

the geographical focus will be North America and Europe but

investments may also be considered in other regions to the extent

that the Board considers that valuable opportunities exist and

positive returns can be achieved.

Segment assets

The internal reporting provided to the Board for the Company's

assets, liabilities and performance is prepared on a consistent

basis with the measurement and recognition principles of IFRS.

Segment assets are measured in the same way as in the financial

statements. These assets are allocated based on the operations of

the segment and the physical location of the asset. At 30 September

2019 the cross section of segment assets between geographical focus

and economic sectors were as follows:

Geographical Focus Technology Life sciences Total

sector sector

Private equity investments GBP'000 GBP'000 GBP'000

- North America 5,725 - 5,725

- Europe - 2,500 6,195

- Other 7,682 3,695 7,682

Total segment assets 13,407 6,195 19,602

=========== ============== ========

Segment liabilities

Segment liabilities are measured in the same way as in the

financial statements. These liabilities are allocated based on the

operations of the segment. At 30 September 2019 there were no

segmented liabilities.

Other profit and loss disclosures

At 30 September 2019 the cross section of the realised losses,

unrealised gains and interest income generated from private equity

investments between geographical focus and economic sectors were as

follows:

Geographical Focus Technology Life sciences Total

sector sector

Private equity investments GBP'000 GBP'000 GBP'000

- North America 350 41 391

- Europe - 500 744

- Other 607 244 607

Total gains on investments 957 785 1,742

=========== ============== ========

NOTES TO THE CONDENSED HALF-YEARLY FINANCIAL STATEMENTS

(continued)

for the six months ended 30 September 2019

6. Segmental Information (continued)

All the Company's investment portfolio income was derived from

its investments whose business focus is in the sectors as described

above. The only other revenue generated by the Company during the

period was interest of GBP11,000 (30 September 2018: GBP2,000),

arising from cash and cash equivalents, which was generated in

Guernsey. The Company is domiciled in Guernsey.

7. Profit per Ordinary Share - basic and diluted

The profit per Ordinary Share of 0.77p (30 September 2018:

0.62p) is based on the profit for the period of GBP1,244,000 (30

September 2018: GBP875,000) and on a weighted average number of

161,500,105 Ordinary Shares in issue during the period (30

September 2018: 140,651,009 Ordinary Shares).

The share price of the Ordinary Shares throughout the period,

and as at 30 September 2019, was below the lowest exercise price of

the Options (lowest exercise price of 19.00 pence). Therefore, at

no point during the period, or as at 30 September 2019, did the

Options have any dilutive effect.

8. Dividends

The Directors do not propose an interim dividend for the period

ended 30 September 2019 (30 September 2018: GBPNil).

9. Tax Effects of Other Comprehensive

Income

There were no tax effects arising from income disclosed in the Statement

of Comprehensive Income (30 September 2018: GBPNil).

10. Net Assets per Ordinary Share

Basic and diluted

The basic net assets value per Ordinary Share is based on the net

assets attributable to equity shareholders of GBP20,401,000 (31

March 2019: GBP19,072,000) and on 161,500,105 Ordinary Shares in

issue at the end of the period (31 March 2019: 161,500,105 Ordinary

Shares).

The share price of the Ordinary Shares throughout the period and

as at 30 September 2019 was below the lowest exercise price of the

Options (lowest exercise price of 19.00 pence). Therefore, at no

point during the period, or as at 30 September 2019, did the Options

have any dilutive effect.

11. Share Capital and Options

30 September 31 March

2019 2019

GBP'000 GBP'000

Authorised:

1,910,000,000 Ordinary Shares of 1p 19,100 19,100

100,000,000 Deferred Shares of 0.9p 900 900

20,000 20,000

================ ==============

Allotted, called up and fully paid:

161,500,104 Ordinary Shares of 1p 1,614 1,614

70,700,709 Deferred Shares of 0.9p 630 630

---------------- --------------

2,244 2,244

================ ==============

Options:

Share options 15,647,992 15,647,992

NOTES TO THE CONDENSED HALF-YEARLY FINANCIAL STATEMENTS

(continued)

for the six months ended 30 September 2019

11. Share Capital and Options (continued)

Ordinary Shares

There were no issue of shares during the period ended 30

September 2019 (31 March 2019: 30,769,230 Ordinary shares at a

price of 13p per share).

Deferred Shares

In aggregate (not per share), the holders of Deferred Shares

shall be entitled to receive up to GBP1 only as a preferred

dividend or distribution. The Deferred Shares have zero economic

value. The holders of Deferred Shares, in respect of their holdings

of Deferred Shares, shall not have the right to received notice of

any general meeting of the Company, nor the right to attend, speak

or vote at any such general meeting. The Company has the right to

transfer the Deferred Shares to such persons as it wishes, without

the consent of the holders of the Deferred Shares, and to cancel

Deferred Shares with the consent of such transferee. No movement in

deferred shares has occurred in the period.

Options

No issue of Options has occurred during the current period.

Directors' Authority to Allot Shares

The Directors are generally and unconditionally authorised to

exercise all the powers of the Company to allot relevant

securities. As approved at the Company Annual General Meeting on 9

October 2019 the Directors may determine up to a maximum aggregate

nominal amount of 10% of the issued share capital during the period

until the following Annual General Meeting. The Guernsey Companies

Law does not limit the power of Directors to issue shares or impose

any pre-emption rights on the issue of new shares.

Shares held in Treasury

As a result of share repurchases in prior years, at period end

the Company has a total of 5,413,623 ordinary shares held as

Treasury shares (31 March 2019: 5,413,623). No shares were

repurchased during the period (31 March 2019: Nil).

12. Related Parties

Mr Mellon

Mr Mellon, a director of FastForward until 21 August 2019, is a

life tenant of a trust which owns Galloway Limited ("Galloway"),

which held 10,425,992 (31 March 2019: 10,425,991) Ordinary Shares

in the Company as at 30 September 2019 and at the date of signing

this report. Mr Mellon also holds 5,857,730 (31 March 2019:

5,857,730) shares directly in his own name as at 30 September 2019.

Total direct or indirect holding was 16,283,822 shares (31 March

2019: 16,283,822).

At 30 September 2019 FastForward held 25,978 (31 March 2019:

25,978) Ordinary Shares in The Diabetic Boot Company Ltd ("DBC").

Galloway also holds shares in DBC. The combined shareholding in DBC

is in excess of 30%.

Mr Mellon holds 20,500,000 (31 March 2019: 20,500,000) shares in

EMMAC Life Sciences Limited ("EMMAC"), which equates to 7.1% of the

shares in issue.

Mr Mellon also holds an interest in 3,783,199 shares of

Juvenescence Limited, equating to 17.75% of the issued shares.

Mr Mellon was entitled to an annual salary of GBP30,000, payable

quarterly in arrears.

NOTES TO THE CONDENSED HALF-YEARLY FINANCIAL STATEMENTS

(continued)

for the six months ended 30 September 2019

12. Related Parties (continued)

Mr Burns

Mr Burns, a director of the company, is the legal and beneficial

owner of Smoke Rise Holdings Limited ("Smoke"), which held

1,374,024 (31 March 2019: 1,374,024) Ordinary Shares in the Company

at 30 September 2019 and at the date of signing this report.

Regent Mercantile Holdings Limited ("Regent"), a company in

which Mr Ian Burns is a Director, is a shareholder of Juvenescence.

Regent hold 0.34% of Juvenescence (31 March 2019: 0.34%) (on a

fully diluted basis).

Mr Burns is entitled to an annual salary of GBP24,000, payable

quarterly in arrears.

Mr Abony

Mr Abony, a director of the company, held 14,843,211 (31 March

2019: 14,843,211) Ordinary Shares in the Company at 30 September

2019 and at the date of signing this report.

As at 30 September 2019 FastForward held no non-assessable

series-1 preferred stocks (31 March 2019: 2,527,059) and 1,000,000

(31 March 2019: 1,000,000) non-assessable series-2 preferred stocks

in Vemo Education. Inc ("Vemo"), a company related by virtue of

common shareholdings with Mr Abony. On 13 May 2019, FastForward

sold the 2,527,059 non-assessable series-1 preferred stocks.

Mr Abony holds US$1m ordinary shares of Juvenescence Limited on

the same terms as the Company.

Mr Abony holds 20,833,333 shares in EMMAC, which equates to 7.2%

of the shares in issue. On 19 November 2019, Mr Abony was appointed

as Chairman of the Board of Directors of EMMAC.

Mr Abony is entitled to an annual salary of GBP250,000, payable

monthly in arrears.

Mr McDermott

Mr McDermott was until December 2018 a part of the corporate

finance team at Optiva Securities Limited, the Company's Broker. A

total of GBP7,472 was incurred by the Company in respect of Broker

fees to Optiva Securities Limited during the period (31 March 2019:

GBP117,000).

Mr McDermott was a co-founder of, and is an executive director

of, EMMAC Life Sciences Limited ("EMMAC"). Mr McDermott owns

11,250,000 (31 March 2019: 11,250,000) shares in EMMAC, which

equates to 3.9% of the shares in issue.

Mr McDermott is entitled to an annual salary of GBP40,000,

payable quarterly in arrears.

Mr De Jersey

During the period Mr De Jersey purchased 400,000 ordinary shares

in the Company. Following the purchase his holding represents 0.25%

of the Company's issued share capital.

Lance De Jersey is entitled to an annual salary of GBP80,000 per

annum.

NOTES TO THE CONDENSED HALF-YEARLY FINANCIAL STATEMENTS

(continued)

for the six months ended 30 September 2019

12. Related Parties (continued)

30 September 2019

Directors' Recognition Total

Remuneration of share based

expense

GBP'000 GBP'000 GBP'000

Ian Burns 12 - 12

Jim Mellon 12 8 20

Lorne Abony 146 61 207

Ed McDermott 20 16 36

Lance De Jersey 35 - 35

225 85 310

======================= ======================== ================

30 September 2018

Recognition

Directors' of share based

Remuneration expense Total

GBP'000 GBP'000 GBP'000

Ian Burns 22 - 22

Jim Mellon 3 7 10

Lorne Abony 82 61 143

Ed McDermott 20 10 30

127 78 205

============== ================ ========

No pension contributions were paid or were payable on behalf of

the Directors.

13. Events after the financial reporting date

Mr Lorne Abony (Chairman of Fastforward) was appointed as

Chairman of EMMAC (Investee of the Company) on 19 December

2019.

14. Capital management policy and procedures

The Company does not ordinarily intend to fund any investments

through debt or other borrowings but may do so if appropriate.

Investments in early stage assets are expected to be mainly in the

form of equity, with debt potentially being raised later to fund

the development of such assets. Investments in later stage assets

are more likely to include an element of debt to equity gearing.

The Company may also offer new Ordinary Shares by way of

consideration as well as cash, thereby helping to preserve the

Company's cash for working capital and as a reserve against

unforeseen contingencies including, for example, delays in

collecting accounts receivable, unexpected changes in the economic

environment and operational problems.

The Board monitors and reviews the structure of the Company's

capital on an ad hoc basis. This review includes:

-- The need to obtain funds for new investments, as and when

they arise.

-- The current and future levels of gearing.

-- The need to buy back Ordinary Shares for cancellation or to

be held in treasury, which takes account of the difference between

the net asset value per Ordinary Share and the Ordinary Share

price.

-- The current and future dividend policy; and

-- The current and future return of capital policy.

The Company is not subject to any externally imposed capital

requirements.

DIRECTORS

Jim Mellon - resigned 21 August 2019

Ian Burns (Non- Executive Director)

Lorne Abony (Chief Executive Officer and Chairman)

Edward McDermott (Non Executive Director)

Lance De iersey(Finance Director)

Lance De Jersey (Finance Director)

ADVISERS

Administrator, Secretary and Registered Office Nominated Adviser

Vistra Fund Services (Guernsey) Limited Beaumont Cornish Limited

11 New Street 10(th) Floor

St Peter Port 30 Crown Place

Guernsey EC2A 4EB

GY1 2PF London

Registrar Independent Auditor

Link Market Services Limited PricewaterhouseCoopers CI LLP

PO Box 627 Royal Bank Place

Bulwer Avenue 1 Glategny Esplanade

St Sampsons St Peter Port

Guernsey Guernsey

GY2 4LH GY1 4ND

Brokers Guernsey Legal Adviser to the Company

Optiva Securities Limited Collas Crill

2 Mill Street Glategny Esplanade

London St Peter Port

W1S 2AT Guernsey

GY1 1WN

Investor Relations English Legal Adviser to the Company

St Brides Partners Ltd Hill Dickinson LLP

51 Eastcheap The Broadgate Tower

London 20 Primrose Street

London EC2A 2EW

EC3M 1JP London EC2A 2EW

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) 596/2014.

Cautionary Statement

The AIM Market of London Stock Exchange plc does not accept

responsibility for the adequacy or accuracy of this release. No

stock exchange, securities commission or other regulatory authority

has approved or disapproved the information contained herein. All

statements, other than statements of historical fact, in this news

release are forward-looking statements that involve various risks

and uncertainties, including, without limitation, statements

regarding potential values, the future plans and objectives of

FastForward Innovations Ltd. There can be no assurance that such

statements will prove to be accurate, achievable or recognizable in

the near term.

Actual results and future events could differ materially from

those anticipated in such statements. These and all subsequent

written and oral forward-looking statements are based on the

estimates and opinions of management on the dates they are made and

are expressly qualified in their entirety by this notice.

FastForward Innovations assumes no obligation to update

forward-looking statements should circumstances or management's

estimates or opinions change.

ENDS

For further information on the Company please visit

www.fstfwd.co or contact:

Ed McDermott FastForward Innovations Email: info@fstfwd.co

Lance de Jersey Ltd

James Biddle Beaumont Cornish Limited Tel: +44 (0) 20 7628

Roland Cornish Nomad 3396

-------------------------- ----------------------

Graham Dickson Optiva Securities Limited Tel: +44 (0) 203

Broker 411 1881

-------------------------- ----------------------

Beth Melluish St Brides Partners Ltd Tel: +44 (0)20 7236

Financial PR 1177

-------------------------- ----------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR VBLFFKLFZFBE

(END) Dow Jones Newswires

December 11, 2019 02:00 ET (07:00 GMT)

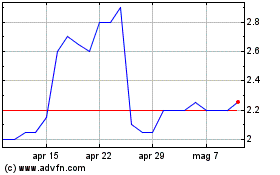

Grafico Azioni Seed Innovations (LSE:SEED)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Seed Innovations (LSE:SEED)

Storico

Da Apr 2023 a Apr 2024