Riverstone Energy Limited Sale of Gulf of Mexico Assets to Talos Energy Inc. (4808W)

11 Dicembre 2019 - 8:00AM

UK Regulatory

TIDMRSE

RNS Number : 4808W

Riverstone Energy Limited

11 December 2019

Riverstone Energy Limited

11 December 2019

Riverstone Energy Limited Announces Sale of Offshore Gulf of

Mexico Assets to Talos Energy Inc.

London, UK (11 December 2019). Riverstone International Limited,

the Manager of Riverstone Energy Limited ("REL"), together with

Riverstone Holdings ("Riverstone") have agreed to the sale of all

offshore Gulf of Mexico assets owned by affiliates of Castex Energy

2014, LLC ("Castex 2014") to Talos Energy Inc. ("Talos", NYSE:

TALO) (the "Castex 2014 Sale"). In addition, Riverstone agreed to

sell all of the undrilled primary term acreage and prospects of ILX

Holdings III ("ILX III") to Talos for non-material consideration

("ILX III Sale" and collectively with the Castex 2014 Sale, the

"Transaction" or "Sold Assets"). REL owns 25.1 per cent. of Castex

2014 and 33.3 per cent. of ILX III and has invested $52 million and

$155 million in the companies, respectively.

The net consideration at closing of the Castex 2014 Sale and ILX

III Sale is expected to be funded with the issuance of new Talos

shares and cash from existing sources of liquidity. The purchase is

subject to customary purchase price adjustments between the 1 July

2019 effective date and the closing date of the Transaction, which

is expected in the first quarter of 2020.

The Castex 2014 Sale represents a full realization of REL's

Castex 2014 investment and implies a 0.3x Gross MOIC, which is

consistent with REL's 3Q 2019 valuation. The ILX III Sale includes

only exploration prospects that ILX III did not intend to drill

within its current equity commitment and has no impact on REL's 3Q

2019 valuation of 1.2x Gross MOIC.

Talos is a technically driven independent exploration and

production company with operations in the United States Gulf of

Mexico and offshore Mexico. Talos leverages its geology, geophysics

and offshore operations expertise to pursue the acquisition,

exploration, exploitation and development of assets, with a focus

on safely and efficiently maximizing cash-flows and long-term

value.

Evercore Inc. and Latham & Watkins L.L.P. are serving as

financial and legal advisors to Riverstone, respectively.

Guggenheim Securities, LLC acted as lead financial advisor to Talos

and delivered a formal fairness opinion with respect to the

transaction. J.P. Morgan Securities LLC also provided financial

advice to Talos with respect to financing. Vinson & Elkins

L.L.P. acted as legal advisors to Talos.

About Riverstone Energy Limited:

REL is a closed-ended investment company that invests

exclusively in the global energy industry across all sectors. REL

aims to capitalise on the opportunities presented by Riverstone's

energy investment platform. REL's ordinary shares are listed on the

London Stock Exchange, trading under the symbol RSE. REL has 11

active investments spanning oil and gas, midstream, and energy

services in the Continental U.S., Western Canada, Gulf of Mexico,

Latin America and credit.

For further details, see www.RiverstoneREL.com

Neither the contents of Riverstone Energy Limited's website nor

the contents of any website accessible from hyperlinks on the

websites (or any other website) is incorporated into, or forms part

of, this announcement.

Media Contacts

For Riverstone Energy Limited:

Natasha Fowlie

Brian Potskowski

+44 20 3206 6300

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

DISTBBFTMBIBMIL

(END) Dow Jones Newswires

December 11, 2019 02:00 ET (07:00 GMT)

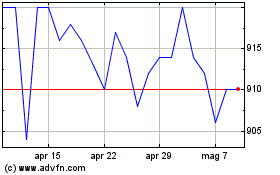

Grafico Azioni Riverstone Energy (LSE:RSE)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Riverstone Energy (LSE:RSE)

Storico

Da Apr 2023 a Apr 2024