TIDMASPL

RNS Number : 7436W

Aseana Properties Limited

13 December 2019

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) 596/2014.

13 December 2019

Aseana Properties Limited

("Aseana" or the "Company")

Recommended Proposals regarding the future of the Company

Posting of Circular and Notice of General Meeting

Aseana Properties Limited (LSE: ASPL), a property developer in

Malaysia and Vietnam, listed on the Main Market of the London Stock

Exchange, announces that it has today posted to the Company's

shareholders ("Shareholders") a circular (the "Circular") putting

forward recommended Proposals regarding the future of the Company

to be considered at a General Meeting.

The General Meeting will be held at 12 Castle Street, St.

Helier, Jersey, JE2 3RT, Channel Islands on Monday, 30 December

2019 at 10.00 a.m. GMT.

The Circular will shortly be made available on the Company's

website: http://www.aseanaproperties.com/ and submitted to the

National Storage Mechanism to be made available for public

inspection at http://www.morningstar.co.uk/uk/nsm. Capitalised

terms used but not defined in this announcement have the meanings

set out in the Circular. Further details of the recommended

Proposals, extracted from the Circular, are set out below.

For further information:

Aseana Properties Limited Tel: 020 7920 3150

(via Tavistock)

Liberum Capital Tel: 020 3100 2000

Gillian Martin / Owen Matthews

Tavistock Tel: 020 7920 3150

Jeremy Carey / James Verstringhe

Set out below is a reproduction, without material adjustment, of

the key sections of the Chairman's letter to Shareholders which are

contained within the Circular:

RECOMMED PROPOSALS REGARDING THE FUTURE OF THE COMPANY

1 Introduction and background to the Proposals

When the Company was launched in 2007 the Board considered it

desirable that Shareholders should have an opportunity to review

the future of the Company at appropriate intervals. Accordingly, at

shareholder meetings held in 2015 and 2018, in accordance with the

Articles, the Board put forward a resolution to Shareholders to

determine if the Company should continue in existence.

At the 2015 AGM Shareholders voted for the Company to continue

in existence and, at the same time, approved the adoption of a

divestment investment policy to enable the controlled, orderly and

timely realisation of the Company's assets, with the objective of

achieving a balance between periodically returning cash to

Shareholders and maximising the realisation value of the Company's

investments (the "Divestment Investment Policy").

At a general meeting held on 23 April 2018, inter alia,

Shareholders again voted for the Company to continue in existence

and approved certain amendments to the Articles requiring a further

resolution for Shareholders to determine whether the Company should

continue to be proposed at a general meeting of the Company to be

held in December 2019 (the "2019 Discontinuation Resolution").

The notice of general meeting appended to this circular convenes

that general meeting and this letter seeks to provide you with some

further updates and information in relation to the Company to help

inform your decision on how to vote on the Resolutions to be

proposed at the General Meeting.

2 Company update

Restructuring of the management of the Company and changes to

the Board

As you will be aware, the Management Agreement between Ireka

Development Management Sdn Bhd ("IDM") and the Company was

terminated with effect from 30 June 2019. IDM is a wholly owned

subsidiary of Ireka Corporation Berhad ("Ireka") which holds 23.07

per cent. of the Company's total voting share capital and Legacy

Essence Limited, an affiliate of Ireka, together with its related

parties ("Legacy Essence") owns in aggregate 18.43 per cent. of the

Company's total voting share capital, which together total 41.50

per cent. of the Company's total voting share capital. IDM decided

not to continue acting as the development manager so as to avoid

any perception of conflict between IDM's role as development

manager and Ireka's position as a shareholder of the Company; IDM

had become aware through discussions with a significant shareholder

of the Company that some shareholders may have perceived there to

have been a misalignment between Ireka's interests in the

divestment of the Company's portfolio and that of other

Shareholders.

After careful consideration, in particular noting that the

Company is in divestment mode, the Board decided that the most

practical and expeditious next step in the best interests of

Shareholders and the Company as a whole was to internalise the

management of the Company.

As part of this process, the Board identified and appointed Mr

Chan Say Yeong as the Chief Executive Officer of the Company with

effect from 3 June 2019. It also sought to strengthen the

capability and capacity of the Board to achieve the Divestment

Investment Policy and enhance governance oversight through the

re-appointments of Mr Christopher Lovell and Mr Nicholas Paris to

the Board and the appointments of Ms Monica Lai, who is the Group

Deputy Managing Director of Ireka, and Ms Helen Siu Ming Wong, who

was named as the Divestment Director with a specific focus on

selling the Company's remaining assets.

With regards the day-to-day administration of the Company's

assets, a number of IDM employees have been seconded to assist with

the operation of the assets and this arrangement has enabled the

Company to avoid the need to hire alternative, additional employees

to fulfil these roles at short notice. This arrangement also gives

the Company the flexibility to reduce the number of employees as

assets are sold. The Company pays IDM a monthly fee, calculated at

cost, in respect of this secondment arrangement.

Divestment Investment Policy

The Company has realised gross proceeds of US$250 million since

June 2015 but there are still six assets yet to be sold. The

disposal of the remaining assets in the portfolio has been slower

than anticipated, reflecting increasingly competitive market

conditions in the locations and market sectors in which the Company

has assets.

To date, net sale proceeds from disposals have largely been used

to pay down project debts across the portfolio, to fund the

Company's working capital requirements and to finance the

construction of The RuMa Hotel and Residences, which is the

Company's final asset to have been developed. As a result of the

previous asset disposals, approximately US$10 million was also

returned to Shareholders via a share buyback conducted in January

2017.

The Board is aware that Shareholders are eager for a more

expeditious disposal programme and it is this which prompted the

restructuring of the Board and the Company's management

arrangements in recent months. With these new arrangements in

place, a new sales strategy has been adopted and the Board has

prioritised the divestment of the Company's assets as soon as

possible to ensure further capital can be returned to

Shareholders.

Since internalising the management and disposal process for the

remaining assets, the Board has revised all of the sale due

diligence processes and marketing documentation for each of the

Company's remaining assets, the result being that there is now

extensive information available in virtual data rooms for qualified

buyers interested in the assets in the portfolio. The Board has

also identified those assets which it deems to be of highest

priority to sell, on the basis of those properties being more

readily saleable and that the proceeds of those sales should be

capable of paying down the Company's most significant debt

facilities. The early settlement of those debt facilities would

then enable the Company to use the disposal proceeds of further

asset sales thereafter to return cash to Shareholders.

The new sales strategy for the Company's assets commenced

externally in mid-September and to date approximately 150

prospective investors have been approached and approximately 55

non-disclosure agreements have been signed with interested buyers

in respect of two of the Company's principal assets and active sale

discussions continue on them.

The Board is working to complete the next asset sales from Q1

2020 onwards and will be pragmatic in its approach. However, there

can be no guarantee that these sales will successfully conclude

within this timeframe. As a result, the Board is not currently able

to provide Shareholders with any indication as to when further

capital distributions can be expected from the Company, but

re-iterates that this is the Board's key objective.

The Board is keen to ensure that RNAV valuations of the

Company's assets are reflective of the current market environment

and a review of the value of all of the assets within the portfolio

is ongoing. The portfolio revaluation will be conducted using a

number of external valuers (each a specialist in the relevant

market of the relevant asset) and the Board may bring in certain

new valuation firms as part of that process. The review is expected

to be completed during the audit of the 2019 Accounts, which

themselves are expected to be completed when the accounts are

published in late April 2020.

Debt facilities

The Group currently has, in aggregate, approximately US$88

million of outstanding bank loans from seven different banks. Each

loan provides the relevant bank with security over certain of the

Group's assets and the Company has granted corporate guarantees in

respect of certain loans of its subsidiaries.

The Board is currently seeking to re-negotiate certain of the

Group's loan facilities in order to amend their scheduled repayment

dates to make them coincide with the expected sale dates of the

assets that they have financed. This process is ongoing.

3 2019 Discontinuation Resolution

Notwithstanding the obligation on the Board to propose the 2019

Discontinuation Resolution pursuant to the Existing Articles, the

Board firmly believes that placing the Company into liquidation

(which could be the result of passing the 2019 Discontinuation

Resolution) would have a significant adverse impact on Shareholder

value for the reasons set out below.

Possible breach of banking covenants

The Company believes that, in the event that the 2019

Discontinuation Resolution is passed, an event of default under the

lending covenants of certain of the Company's facility arrangements

could be triggered. If an event of default is triggered the

relevant loans would become immediately repayable and this could

result in security given to secure those loans being enforced. This

could lead to the banks foreclosing on the Group's loan facilities

and the Group's remaining assets being disposed of on behalf of the

banks rather than Shareholders at significantly lower prices than

anticipated. Further, this could force the Company to enter into

liquidation due to having insufficient liquid assets to repay the

facilities if proceeds from the security that has been enforced are

insufficient. The Group does not currently have sufficient

available cash to be able to repay the entirety of its loans in the

event they are accelerated.

The Company no longer being a "going concern"

If the 2019 Discontinuation Resolution is passed the Directors

may not be able conclude that the Company is a "going concern" and

accordingly be unable to prepare the 2019 Accounts other than on a

"break up" basis. This could lead certain of the Company's lenders

to consider that an event of default has occurred under the terms

of the Company's existing facilities and the banks could seek

immediate repayment of those loans.

It is also for this reason that the Board has determined that

the next discontinuation vote should take place in May 2021 in

order for the Board to conclude, at the date of the 2019 Accounts

to be published in April 2020, that the Company is a going concern.

For this purpose, the next discontinuation vote should be scheduled

for a date beyond 12 months from the date of the audit report.

Whilst the auditors are still expected to refer to the

discontinuation vote in the audit report, notwithstanding this, the

Board do expect the 2019 Accounts to be prepared on a going concern

basis. An earlier scheduled discontinuation vote would prevent this

going concern determination and could lead to an event of default

under the Company's banking arrangements.

Impact on asset sale values

The Company may not be able to achieve full value for the

Company's remaining assets if the 2019 Discontinuation Resolution

is passed as prospective buyers may seek a reduction to the prices

at which they are willing to acquire the assets in the knowledge

that (a) the Board would be under pressure to take steps to wind up

the Company as soon as practicable; and/or (b) if the passing of

the 2019 Discontinuation Resolution results in an event of default

under, and acceleration of, a loan secured by the Group's assets,

such security may be enforced and the assets may be realised at a

value lower than that which could be expected to be obtained if the

assets were sold/offered to the market in the Group's ordinary

course of business.

4 Proposals

In light of the severity of the possible consequences for

Shareholder value, the Directors are unanimously recommending that

you vote AGAINST the 2019 Discontinuation Resolution.

Instead, the Board recommends that Shareholders allow the

Company to continue in order to give the new divestment strategy

time to deliver results and to enable the Board and the Company's

auditors to conclude that the Company is a going concern for at

least 12 months from the date on which the 2019 Accounts are due to

be finalised, and thereby avoid the consequences described in

paragraph 3 above. The Board therefore proposes that the next

discontinuation vote take place at a general meeting to be held in

May 2021.

The Board is clear that enabling the Company to continue to

pursue the new divestment strategy, rather than placing the Company

into liquidation or seeking a "fire sale" of the Company's

portfolio at potentially significantly depressed prices, is in the

best interests of the Company and Shareholders as a whole.

In order to implement this proposal, the Existing Articles will

need to be amended. A blacklined version of the proposed amendment

to the Existing Articles is set out in the Appendix to this

circular. The Existing Articles and the Amended Articles (together

with a comparison document showing the changes between the two) are

available for inspection on the Company's website at

www.aseanaproperties.com and during normal business hours on any

weekday (public holidays excepted) at the registered office of the

Company at 12 Castle Street, St. Helier, Jersey JE2 3RT, and will

also be available for inspection at the General Meeting and for at

least 15 minutes prior to the General Meeting.

The Directors are unanimously recommending that you vote FOR the

resolution to amend the Existing Articles which will allow the

Company to continue until May 2021, which will be proposed as a

special resolution.

5 Additional considerations for Shareholders

In connection with the Proposals, Shareholders should be aware

of the following additional considerations:

-- there can be no guarantee that the result of implementing the

Proposals will provide the returns or realise the capital sought by

Shareholders. The Company's investments are illiquid. Accordingly,

they may be disposed of at a discount to their current valuations.

The eventual disposal price of the Company's remaining assets is

unknown and it is possible that the Company may not be able to

realise some investments at any value; and

-- returns of cash will be made at the Directors' sole

discretion, as and when they deem that the Company has sufficient

assets available to return cash to Shareholders, subject to

applicable Jersey law. Shareholders will therefore have little

certainty as to when their capital will be returned. Distributions

pursuant to the orderly realisation programme are subject, amongst

other things, to the Board being able to give the necessary

declaration(s) of solvency required by Jersey law. Distributions

under the orderly realisation programme are subject to the Board

continuing to be satisfied, on reasonable grounds, that the Company

will, at the time of distribution and for a period of 12 months

thereafter, in respect of each distribution, continue to satisfy

the statutory solvency test. Returns of cash may also in certain

circumstances be subject, amongst other things, to the Company

obtaining the consent of one or more lenders to the Group.

6 General Meeting

The implementation of the Proposals is conditional on the

outcome of the votes cast by Shareholders in connection with the

Resolutions to be proposed at the General Meeting. A notice

convening the General Meeting, which is to be held at 10.00 a.m. on

30 December 2019, is set out at the end of this document.

At the General Meeting, Resolution 1 (the 2019 Discontinuation

Resolution) will be proposed as an ordinary resolution and will

require a vote in favour by Shareholders holding a majority of the

Shares represented at the General Meeting, either in person or by

proxy, and voting on Resolution 1, to be validly passed. The

Directors are unanimously recommending that you vote AGAINST

Resolution 1.

Resolution 2 (the proposed amendment to the Existing Articles to

allow the Company to continue until May 2021) will be proposed,

conditional on the failure of Resolution 1 (the 2019

Discontinuation Resolution), as a special resolution and will

require a vote in favour by Shareholders holding not less than two

thirds of votes cast in order to be validly passed. The Directors

are unanimously recommending that you vote FOR Resolution 2.

Action to be taken by Shareholders

Whether or not you intend to be present at the General Meeting,

Shareholders are requested to complete and return the accompanying

Form of Proxy in accordance with the instructions printed thereon,

so as to be received as soon as possible, and in any event no later

than 10.00 a.m. on 27 December 2019. The completion and return of

the Form of Proxy will not preclude you from attending the General

Meeting and voting in person should you so wish.

7 Irrevocable voting undertakings from certain Shareholders

Ireka has been unable to vote its Shares on previous

discontinuation resolutions proposed at general meetings of the

Company because of commitments it had made to the Company not to

undertake any activities which would result in the Company ceasing

to be able to carry on its business independently of Ireka.

Now that Ireka has resigned its position as manager, those

commitments have ended and the Directors have concluded that votes

cast by Ireka in respect of its Shares on the Resolutions to be

proposed at the General Meeting will be accepted. Each of Ireka and

Legacy Essence, which in aggregate hold 41.50 per cent. of the

total voting rights of the Company as at the date of this circular,

has given its irrevocable undertaking to vote the Shares held in

its name at the time of the General Meeting against Resolution 1

and in favour of Resolution 2.

8 Directors' voting intentions and recommendation

The Directors consider that the Proposals are in the best

interests of the Company and Shareholders as a whole.

Accordingly, the Directors unanimously recommend that you vote

(1) AGAINST Resolution 1 (the 2019 Discontinuation Resolution) to

be proposed at the General Meeting and (2) FOR Resolution 2 (to

amend the Existing Articles).

Each of Gerald Ong Chong Keng and Christopher Lovell, the two

Directors who are also beneficial holders of Shares amounting to

1.08 per cent. of the total voting rights of the Company in

aggregate, has given an irrevocable undertaking to vote the Shares

held in his name at the time of the General Meeting

accordingly.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

NOGUUUBRKOAUAAA

(END) Dow Jones Newswires

December 13, 2019 02:00 ET (07:00 GMT)

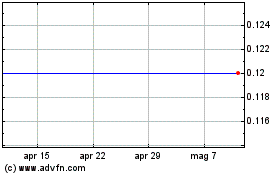

Grafico Azioni Aseana Properties (LSE:ASPL)

Storico

Da Mar 2024 a Apr 2024

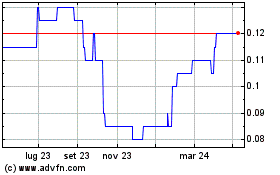

Grafico Azioni Aseana Properties (LSE:ASPL)

Storico

Da Apr 2023 a Apr 2024