TIDMLVCG

RNS Number : 9028W

Live Company Group PLC

16 December 2019

16 December 2019

LIVE COMPANY GROUP PLC

("LVCG", the "Company" or the "Group")

UPDATE REGARDING BRICKLIVE THEMED TOURS AND FINANCING

Live Company Group plc (AIM: LVCG) is pleased to provide the

following update regarding its business and financing.

Introduction

Since the acquisition of Bright Bricks in 2018, the Board

believes that the Group has made significant commercial and

operational progress and now has 16 BRICKLIVE themed tours in

circulation. In addition, the Group has secured international

contracts with global partners, including IP partners such as

Nickelodeon, part of Viacom International, and Penguin Books

Limited.

Given the demand for BRICKLIVE's events and tours, the Group

intends to accelerate its build programme for 2020, with the aim to

build up to 14 BRICKLIVE themed tours, with a number of new tours

including the global roll out of the Nickelodeon themed BRICKLIVE

tours (excluding the United States of America and Puerto Rico), the

BRICKLIVE Zoo and BRICKLIVE touring programmes. The Group is also

in discussions with other IP partners to create new themed touring

shows and looks forward to keeping shareholders updated in this

regard.

In order to ensure that the Group has the appropriate financial

resources in place to fund its build programme to meet demand, the

Company has agreed with YA II PN, Ltd. ("YA II") and RiverFort

Global Opportunities PCC Limited (formerly Cuart Investments PCC

Limited) (together the "Investors") to extend the maturity date of

the existing loan facility, of which approximately GBP0.7 million

remains outstanding, (the "Existing Facility") from December 2019

to December 2020. In addition, the Company has also entered into a

further loan facility with the Investors for up to GBP1.0 million

(the "New Facility"), and the Company has drawn down GBP0.3 million

(before costs). The New Facility enables the Company to place

orders, before the end of the year, with specialist steel and brick

suppliers which have an 8-16 weeks lead time, to enable the Group

to build up to 14 new themed tours in 2020.

In addition to the New Facility, the Company has entered into a

subscription agreement with the Investors (the "Subscription

Agreement"), whereby the Investors have agreed to make an equity

investment of GBP2.0 million, before expenses (the "Subscription

Amount"),through the subscription for, and issue to them of

6,666,667 new ordinary shares of 1 pence each in the capital of the

Company ("Ordinary Shares") (the "Subscription Shares") at a price

of 30p per share (the "Subscription Price") (the "Subscription").

Under an equity sharing agreement also entered into by the Company

with the Investors (the "ESA"), an amount equal to the gross

proceeds of the Subscription following its completion, will then be

returned by the Company to the Investors (the "ESA Payment"), with

the Company to receive back the ESA Payment, subject to certain

pricing adjustments (as detailed below), on a pro rata monthly

basis over the next 12 months pursuant to the ESA.

The Company is also pleased to confirm it has engaged finnCap

Group plc to advise the Group on securing debt funding to support

the Group's growth plans and the Group confirms that it has already

engaged a number of financial institutions to assess their appetite

to provide debt financing. Further announcements will be made as

appropriate.

Further details on BRICKLIVE's themed tours, the extension to

the Existing Facility, the New Facility and the Subscription and

ESA are set out below.

David Ciclitira, Chairman LVCG commented: "I'm delighted to

report that we have agreed a new funding facility with the

Investors which will assist the business to fast track its growth

programme of new tours in 2020 and beyond.

The BRICKLIVE Zoo and BRICKLIVE touring divisions continue to

perform strongly, and to meet the demand the Group will need to

build new touring shows. The New Facility will enable the Group to

draw down GBP0.3 million in December 2019, with the option to

drawdown up to a further GBP0.7 million in 2020. The initial GBP0.3

million, will be used to place orders for long lead time items such

as the specialist brick and steel suppliers before Christmas 2019,

to allow for launch dates at the end of Q1 and Q2 2020.

The Subscription and ESA, will provide the Company with funding

to settle the Existing Facility and New Facility and will also

enable the Company to benefit from any uplift in the Company's

share price. Under the terms of the ESA, the Investors are not able

to short the Company's shares and I will personally be subject to a

lock-in agreement until the Existing and New Facilities are

repaid.

The Company continues to review alternative debt facility

options and we are in active discussions with finnCap.

I believe the real growth story of the Company Group will be

realised in 2020 and 2021, when we begin the international rollout

of our Nickelodeon themed BRICKLIVE tours in Q1 2020, develop new

tours for the BRICKLIVE Zoo and BRICKLIVE touring divisions, and

secure contracts with international partners, including new IP

partners. Accordingly, I anticipate 2020 will be a strong year for

the Group."

Finally, the Company will be hosting a Shareholder event on

Friday 17th January 2020 at 9.30 a.m. at Wembley Stadium, Wembley

Park, London. Shareholders and non-shareholders wishing to attend

the event should register their interest by email

(info@livecompanygroup.com). In order to be able to attend the

event, you will need to have registered in advance with the Company

and present photo ID.

BRICKLIVE Themed Tours

The Group is seeking to build up to 14 new themed tours in 2020,

bringing the Group's total number of tours to 30 by the end of

2020. The New Facility will enable the Company to create new

touring shows across the following divisions:

1. BRICKLIVE IP Programme: On 22 November 2019, the Company

announced it had secured an international partnership with Viacom

International Media Networks, owner of the Nickelodeon brand, to

exhibit Nickelodeon and Nick Jr. themed BRICKLIVE tours globally

(excluding United States of America, and Puerto Rico) up to 31

December 2024.

The Group will begin the rollout of the Nickelodeon BRICKLIVE

themed tours internationally and the Group is in discussions with

international partners regarding the launch of the first

Nickelodeon BRICKLIVE tour in 2020.

In addition, the Company is in discussions with other IP

partners to produce BRICKLIVE themed tours and further

announcements will be made as appropriate. Funding from the New

Facility will assist with the creation of new tours.

2. BRICKLIVE Zoo programme: The BRICKLIVE Zoo programme

continues to perform very strongly and the Group has announced

contracts with zoos in North America and Europe in 2019 and 2020.

The pipeline of enquires continues to grow and with our existing

tours already leased in 2020 and 2021, the Group plans to create

new tours in 2020 to meet this growing demand.

3. BRICKLIVE Touring Shows: Since the acquisition of Bright

Bricks in October 2018, BRICKLIVE has exhibited tours in Business

Improvement Districts ("BID") areas (including shopping and town

centres in BIDs) across the UK. The Group has identified this as a

key opportunity area, specialising in delivering experience-based

events that attract footfall and create destination areas in BID

areas.

Financing update

Existing and New Facilities

Further to the Company's announcements of 17 October 2018, 29

November 2019 and 5 December 2019, the Company is pleased to

announce that it has agreed with the Investors to extend the

maturity date of the Existing Facility from December 2019 to

December 2020 (the "Extension"). As at the date of this

announcement, approximately GBP0.7 million remains outstanding

under the Existing Facility (the "Balance"). Pursuant to the

Extension, the Balance will incur interest at 9% per annum on the

full Balance, and the Balance and interest will be repayable in

nine equal monthly instalments, with the first payment being in

April 2020 and with the final payment being due in December 2020.

In the event the Existing Facility is repaid within three months of

the date of this announcement, the Company shall benefit from a

reduction in the interest. As detailed in the announcements of 17

October 2018 and 29 November 2019, the Existing Facility can be

converted into new Ordinary Shares in certain circumstances.

The Company and Investors have also entered into the New

Facility for up GBP1.0 million. The Company has drawn down GBP0.3

million of the New Facility (the "Drawdown") to enable the Group to

accelerate its build programme and to place orders with steel and

specialist brick suppliers, which have a typical lead in time of

8-16 weeks. The Company has the option to draw down a further

GBP0.7 million subject to the Investors' approval in 2020, should

this be required by the Group.

Amounts drawn down under the New Facility will incur an interest

charge of 9% and an implementation fee of 7% and the Drawdown of

GBP0.3 million, along with applicable interest and fees, will be

repayable in nine equal monthly instalments, with the first payment

being in April 2020 and with the final payment being due in

December 2020. The New Facility does not have any conversion rights

into Ordinary Shares.

The Existing Facility and New Facility are to be secured over

the assets of the Group. The Investors agree that the security

created shall be subordinated to any security granted by a bank or

financial institution to the Company after the date of this

announcement. The Company's subsidiary, Brick Live International

Limited, has agreed to guarantee the Company's obligations under

the Existing Facility and the New Facility.

Pursuant to the Extension, the 356,923 existing and unexercised

warrants issued in connection with the Existing Facility, have been

repriced, such that their exercise price is now 38.79p and the

exercise period has been extended to be four years from the date of

issue.

In connection with the Drawdown, the Investors will be issued

with 232,018 new warrants, with each warrant having the right to

acquire one new Ordinary Share. If further funds are drawn down

under the New Facility, the number of warrants to be issued will be

in proportion to the amount drawn down. The new warrants issued in

connection with the New Facility have an exercise price of 38.79p

and will be exercisable for a period of four years from the date of

issue.

Subscription and ESA

The Company and Investors have entered into a subscription

agreement (the "Subscription Agreement"), whereby the Investors

have agreed to make a GBP2.0 million (before expenses) equity

investment by subscribing for, and being allotted and issued,

6,666,667 Subscription Shares at a price of 30p per share. The

Subscription is condition, inter alia, on admission of the

Subscription Shares to trading on AIM ("Admission"). The

Subscription Shares will represent 8.39% of the Company's enlarged

issued share capital on Admission.

In addition to the Subscription, the Company and Investors have

entered into the ESA, pursuant to which the Subscription Amount

will be returned by the Company to the Investors (the "ESA

Payment"). Pursuant to the ESA, the Company will then receive back

the ESA Payment, subject to a pricing adjustment and deduction of a

5% commission, on a pro rata monthly basis over the next 12 months,

with the first payment being received in January 2020. The exact

monthly proceeds received by the Company are subject to adjustment,

upwards or downwards, depending on the Company's share price at the

time of such instalment payment, as explained in more detail

below.

The key elements of the Subscription and ESA are as follows:

-- The Investors receive their subscription monies back from the

Company then repay that GBP2.0 million to the Company in 12 monthly

instalments, subject to adjustment based on the Company's share

price, commission and other fees.

-- The structure is designed to remove any incentive on the

Investors to lower the price per Ordinary Share. Essentially, the

Investors are "long" of the Company's Ordinary Shares and will sell

them in order to return the proceeds to the Company, while, subject

to the benchmark price being above the Subscription Price, making a

return.

-- It fixes the number of Ordinary Shares being issued, thereby

providing certainty as to the number of Ordinary Shares to be

issued and the dilutive impact of the overall financing

structure.

-- The structure is designed such that the Company and Investors

benefit from an increasing share price.

-- There are selling restrictions and volume limits on any share

sales by the Investors and they are contractually precluded from

short selling the Company's Ordinary Shares.

The ESA provides the opportunity for the Company and Investors

to benefit from a positive future share performance. However,

should the Company's share price not perform positively, then the

Company will receive less than the amount it has returned to the

Investors (subject to pricing adjustment) and, if its share price

falls substantially, the Company may not receive any further monies

under the ESA. In no event will fluctuations in the Company's share

price result in any increase in the number of Subscription Shares

issued by the Company or received by the Investors.

Under the terms of the ESA, the Company will set off any amounts

owed by the relevant Investor to the Company towards repayment of

any amount of principal, or interest or other amount owed by the

Company to the Investor pursuant to the Existing Facility and New

Facility.

The ESA provides for a monthly payment over the next 12 months,

made by the Investors to the Company, being the Subscription Amount

divided by 12 (the "Monthly Settlement"). The Monthly Settlement

may be adjusted downwards each month depending on the Company's

share price performance with reference to the average of the ten

lowest daily volume weighed average price ("VWAP") of the Ordinary

Shares during the relevant month (the "Market Price") against a

benchmark price of 34.2 pence (the "Benchmark Price"), being equal

to 114% of the Subscription Price. The Monthly Settlement will

principally be used to repay the monies due under the Existing and

New Facilities.

The Monthly Settlement is then calculated as follows:

-- If the Market Price is equal to the Benchmark Price, the

Investors shall pay the Company the Monthly Settlements

-- If the Market Price is above the Benchmark Price, the

Investor shall pay the Company an increased amount based on the

following calculation:

- Monthly Settlement + (555,556 Ordinary Shares x (Market Price

- Benchmark Price) x Applicable Percentage))

The "Applicable Percentage" is 60% whilst the Company has only

drawn down GBP300,000 under the New Facility, In the event further

funds are drawn down under the New Facility, the Applicable

Percentage will be 50%.

-- If the Market Price is below the Benchmark Price, the

Investor will pay the Company a reduced amount based on the

following calculation:

- Monthly Settlement - (555,556 Ordinary Shares x (Benchmark

Price - Market Price))

The final Monthly Settlement will be calculated based on 555,551

Ordinary Shares.

Under the terms of the ESA, the Investors will not sell more

than 20% of the volume traded in the Company Shares in any

particular month, however this may increase to 25% of the volume

traded if trading liquidity is low and it does not allow for full

monthly exit.

In addition, the Group may, at its sole discretion, elect to

either buy back and/or procure the sale of the Subscription Shares

held by the Investors at any given time, subject to certain

pricing/discount limitations.

As part of the overall financing package, David Ciclitira and

those persons connected with him; have agreed with the Investors

that they will not to deal in their Ordinary Shares, totalling

27,397,373, until such time as the Existing Facility and the New

Facility are repaid in full, subject to certain exceptions.

AIM Application, Total Voting Rights

Application will be made for the Admission of the 6,666,667

Subscription Shares, with dealings expected to commence at 8.00

a.m. on 20 December 2019.

Following Admission, the enlarged share capital of the Company

("ESC") will comprise 79,500,419 Ordinary Shares with voting

rights. There are no Ordinary Shares held in treasury. Following

Admission, the above figure may be used by LVCG shareholders as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change to their

interest in, the share capital of the Company under the Financial

Conduct Authority's Disclosure Guidance and Transparency Rules.

Following Admission, David Ciclitira and his concert party, will

continue to be interested in 27,397,373 Ordinary Shares,

representing 34.46% of the Company's then ESC. Simon Horgan, Ed

Diment and Duncan Titmarsh will each continue to be interested in

3,152,330, 3,778,031 and 3,778,031 Ordinary Shares respectively,

represent 3.97%, 4.75% and 4.75% of the Company's then ESC

respectively.

Enquiries

Live Company Group Plc Tel: 020 7225 2000

David Ciclitira, Chairman Live Company Group

Ruth Cunningham, Chief Operating Officer

Strand Hanson Limited (Nominated Adviser) Tel: 020 7409 3494

Stuart Faulkner / Richard Tulloch / Georgia Langoulant

Shard Capital Partners LLP (Broker) Tel: 020 7186 9952

Damon Heath

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) No 596/2014.

LIVE COMPANY GROUP

Live Company Group plc ("LVCG", the "Company" or the "Group") is

a live events and entertainment Company, founded by David Ciclitira

in December 2017. The Company was admitted to trading on AIM in

December 2017, following the reverse acquisition of Brick Live

Group and Parallel Live Group by LVCG.

The Group is a network of partner-driven fan-based shows using

BRICKLIVE created content worldwide. The Company owns the rights to

BRICKLIVE - an interactive experience built around the creative

ethos of the world's most popular construction toy bricks.

BRICKLIVE, which is fast becoming a leading children's education

and entertainment brand, actively encourages all to learn, build

and play, and provides inspirational events and shows where

like-minded fans can push the boundaries of their creativity.

Bright Bricks is the Group's production centre for building brick

based models. The Group is an independent producer of BRICKLIVE and

is not associated with the LEGO Group.

Website: www.livecompanygroup.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCCKPDQDBDDFBD

(END) Dow Jones Newswires

December 16, 2019 02:00 ET (07:00 GMT)

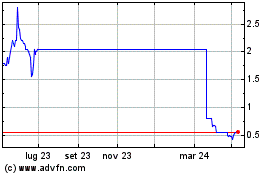

Grafico Azioni Live (LSE:LVCG)

Storico

Da Mar 2024 a Apr 2024

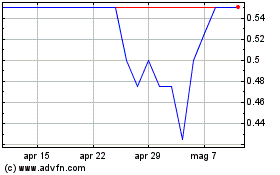

Grafico Azioni Live (LSE:LVCG)

Storico

Da Apr 2023 a Apr 2024