Severn Trent PLC PR19 Final Determination Update - SVT and HD (9602W)

16 Dicembre 2019 - 9:40AM

UK Regulatory

TIDMSVT

RNS Number : 9602W

Severn Trent PLC

16 December 2019

Severn Trent Plc

PR19 Final Determination Update for Severn Trent Water and

Hafren Dyfrdwy

Ofwat has today published its final determination on the PR19

plans for both Severn Trent Water and Hafren Dyfrdwy.

We are pleased Ofwat has approached the final determination 'in

the round'.

In respect of Severn Trent Water, our Totex allowance increased

by a further GBP91m over the next five years (in addition to the

GBP100m increase we received in the updated cost modelling in July)

in part reflecting a reduction in the annual shift in the frontier

efficiency target from 1.5% to 1.1%.

The benefit of this has been offset by a number of other

adjustments including notably the reduction in wholesale WACC of

16bps (reducing revenue by c.GBP75m over the next five years) and a

reduction to the RCV run-off(1) (worth c.GBP40m over AMP7 but value

neutral in the long term, as seen by an increase in our AMP7 RCV

growth to 3.8%).

We estimate the changes since July 2019 mean an overall

reduction of c.GBP50m in total revenue for AMP7.

We welcome the positive adjustments Ofwat has made to the

targets for our Supply Interruptions, CRI(2) and Mains Repairs

customer ODI measures for AMP7. In combination these changes will

have the effect of de-risking our plan, as reflected in the

movement on our P10/P90 ranges(3) from

-3.9%/+1.7% to -2.83%/+1.9%.

On Hafren Dyfrdwy, we are pleased to note that revenue will

increase by GBP3.6m across the next five years, and we will benefit

from a number of positive customer ODI adjustments including those

above.

We have until 15(th) February 2020 to consider the final

determinations in full and respond to Ofwat.

(1) RCV run-off is a measure of the annual depreciation of the

RCV to reflect the long-term nature of the benefit to customers of

the previous investment a company has made in its assets

(2) CRI - Customer ODI based on the DWI Compliance Risk Index

(CRI) is a measure designed to illustrate the risk arising from

treated water compliance failures

(3) The P90 and P10 are points on a risk distribution. The P90

points means there is only a 10% expected chance that the outturn

RoRE will be above the threshold provided

Enquiries

Investors & Analysts

Richard Eadie Severn Trent Plc +44 (0) 7889 806578

Head of Investor Relations

Rachel Martin Severn Trent Plc +44 (0) 7824 624011

Investor Relations Manager

Media

Press Office Severn Trent Plc +44 (0) 247 771 5640

Jonathan Sibun Tulchan Communications +44 (0) 207 353 4200

Cautionary statement regarding forward-looking statements

This document contains statements that are, or may be deemed to

be, 'forward-looking statements' with respect to Severn Trent's

financial condition, results of operations and business and certain

of Severn Trent's plans and objectives with respect to these

items.

Forward-looking statements are sometimes, but not always,

identified by their use of a date in the future or such words as

'anticipates', 'aims', 'due', 'could', 'may', 'will', 'would',

'should', 'expects', 'believes', 'intends', 'plans', 'projects',

'potential', 'reasonably possible', 'targets', 'goal', 'estimates'

or words with a similar meaning, and, in each case, their negative

or other variations or comparable terminology. Any forward-looking

statements in this document are based on Severn Trent's current

expectations and, by their very nature, forward-looking statements

are inherently unpredictable, speculative and involve risk and

uncertainty because they relate to events and depend on

circumstances that may or may not occur in the future.

Forward-looking statements are not guarantees of future

performance and no assurances can be given that the forward-looking

statements in this document will be realised. There are a number of

factors, many of which are beyond Severn Trent's control that could

cause actual results, performance and developments to differ

materially from those expressed or implied by these forward-looking

statements. These factors include, but are not limited to: the

Principal Risks disclosed in our latest Annual Report and Accounts

(which have not been updated since the date of its publication);

changes in the economies and markets in which the group operates;

changes in the regulatory and competition frameworks in which the

group operates; the impact of legal or other proceedings against or

which affect the group; and changes in interest and exchange

rates.

All written or verbal forward-looking statements, made in this

document or made subsequently, which are attributable to Severn

Trent or any other member of the group or persons acting on their

behalf are expressly qualified in their entirety by the factors

referred to above. No assurances can be given that the

forward-looking statements in this document will be realised. This

document speaks as at the date of publication. Save as required by

applicable laws and regulations, Severn Trent does not intend to

update any forward-looking statements and does not undertake any

obligation to do so. Past performance of securities of Severn Trent

Plc cannot be relied upon as a guide to the future performance of

securities of Severn Trent Plc.

Nothing in this document should be regarded as a profits

forecast.

This document is not an offer to sell, exchange or transfer any

securities of Severn Trent Plc or any of its subsidiaries and is

not soliciting an offer to purchase, exchange or transfer such

securities in any jurisdiction. Securities may not be offered, sold

or transferred in the United States absent registration or an

applicable exemption from the registration requirements of the US

Securities Act of 1933 (as amended).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

RSPTFBPTMBJBMIL

(END) Dow Jones Newswires

December 16, 2019 03:40 ET (08:40 GMT)

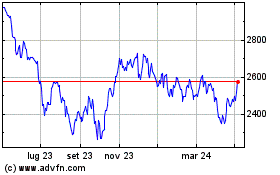

Grafico Azioni Severn Trent (LSE:SVT)

Storico

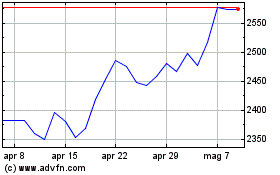

Da Mar 2024 a Apr 2024

Grafico Azioni Severn Trent (LSE:SVT)

Storico

Da Apr 2023 a Apr 2024