Aberdeen Standard Eur Lgstc Inc PLC Acquisition of New Warehouse in The Netherlands (9698W)

16 Dicembre 2019 - 10:08AM

UK Regulatory

TIDMASLI

RNS Number : 9698W

Aberdeen Standard Eur Lgstc Inc PLC

16 December 2019

Aberdeen Standard European Logistics Income PLC (LSE: ASLI) (the

"Company" or "ASLI")

LEI: 213800I9IYIKKNRT3G50

16 December 2019

ACQUISITION OF LOGISTICS ASSET LOCATED IN DEN HOORN, THE

NETHERLANDS, FOR EUR49.9 MILLION

Purchase agreement

The Company is pleased to announce that it has signed an

agreement to acquire a logistics warehouse in Den Hoorn, the

Netherlands, for a value of EUR49.9 million in a share-deal,

providing a net initial yield of 4.5% at SPV level. The transaction

is expected to close in January 2020.

This is a newly built facility on a perpetual leasehold with

option to purchase the freehold from the local municipality and

provides a high quality warehouse, office and mezzanine space with

36 loading bays covering over 43,000 square metres. The building

has modern specifications such as twelve metre eaves, a floor load

capacity of 5 tons per square metre, LED lighting and will have

solar panels installed on the roof making this a very sustainable

investment.

The warehouse has an attractive income profile and will be fully

leased to logistics operator A.G. van der Helm Vastgoed Moerdijk

B.V. on a ten year CPI indexed lease. This property will be the

headquarters for the company which has a long 25 year history in

the area.

The asset is centrally located within the Randstad region, the

most densely populated area in the Netherlands, close to the cities

of the Hague and Rotterdam with access to the A4 connecting Den

Hoorn with the port of Rotterdam and Schiphol airport. Thanks to

its urban location the site has attracted strong demand from

third-party logistics and last-mile delivery operators such as

PostNL and DHL.

Evert Castelein, the Company's Fund Manager, commented:

"The logistics sector remains a compelling asset class thanks to

strong market fundamentals, especially in the most liquid part of

the market where we have positioned the portfolio.

Strong demand from investors continues and the lack of modern

facilities for logistics companies should support values and

capital growth, especially with greater planning restrictions over

new developments, as is the case in the Netherlands.

Completion of this latest property purchase will bring the

portfolio to thirteen assets in total spread across five countries

and I am very happy to have been able to add this brand new build

to the portfolio. The Netherlands, where we will have exposure for

almost 50% of the portfolio, is seen as the gateway to the Western

European market thanks to its strategic location in Europe with the

port of Rotterdam, the largest port in Europe, and Schiphol airport

playing an important role in serving cross-border and domestic

supply chains.

With the quality of our real estate and its locations, combined

with the longer indexed leases and size of the investments, we

believe that we have positioned the portfolio firmly in the most

liquid part of the logistics market and these characteristics give

us confidence for generating a durable income stream and value

accretion for our shareholders.

Investment demand in the logistics sector remains strong. Based

on healthy fundamentals, we believe that the medium to long term

outlook for the sector remains very favourable. Despite some

headwinds from economic output in certain areas, the structural

shifts in consumption patterns and overall demand drivers remain

supportive, while construction levels are relatively low. We

continue to see a healthy pipeline of deal flow which we apply our

stringent quality criteria against and hope to announce a further

agreement to purchase an asset in Spain shortly."

For further information:

Aberdeen Standard Fund Managers Limited

0207 463 6000

Luke Mason

Gary Jones

Investec Bank plc

0207 597 4000

Will Barnett

Neil Brierley

Alice Douglas

Dominic Waters

Denis Flanagan

David Yovichic

Notes to Editors

Aberdeen Standard European Logistics Income PLC is a UK

investment trust with a premium listing on the Main Market of the

London Stock Exchange. The Company invests in European logistics

real estate to achieve its objective of providing its shareholders

with a regular and attractive level of income return together with

the potential for long term income and capital growth. The Company

aims to invest in a portfolio of assets diversified by both

geography and tenant throughout Europe, predominantly targeting

well-located assets at established distribution hubs and within

population centres.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

ACQGGGCUPUPBUBQ

(END) Dow Jones Newswires

December 16, 2019 04:08 ET (09:08 GMT)

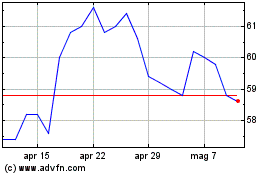

Grafico Azioni Abrdn European Logistics... (LSE:ASLI)

Storico

Da Mar 2024 a Apr 2024

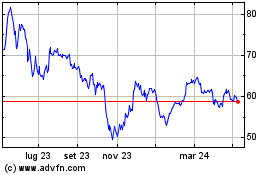

Grafico Azioni Abrdn European Logistics... (LSE:ASLI)

Storico

Da Apr 2023 a Apr 2024