Canadian Dollar Strengthens As Consumer Prices Rise Unexpectedly

18 Dicembre 2019 - 10:38AM

RTTF2

The Canadian dollar spiked up against its key counterparts in

the European session on Wednesday, after a data showed that the

nation's consumer price inflation unexpectedly improved in

November.

Data from the Statistics Canada showed that inflation rose 0.1

percent on a seasonally adjusted monthly basis in November,

following a 0.3 percent increase in October. Economists had

expected a 0.1 percent drop.

Core inflation came in flat on month, compared to a 0.2 percent

uptick in the previous month.

On year, inflation rose 2.2 percent in November, after a 1.9

percent rise in the previous month. The rate matched economists'

forecasts.

The loonie held steady against its major counterparts in the

Asian session, except the euro.

The loonie rose to a 2-day high of 1.3140 against the greenback

and near a 2-week high of 1.4605 against the euro, from its

previous lows of 1.3176 and 1.4681, respectively. The loonie is

seen finding resistance around 1.30 against the greenback and 1.44

against the euro.

Reversing from an early 2-day low of 83.06 against the yen, the

loonie climbed to a 2-day high of 83.39. The loonie is poised to

challenge resistance around the 85.00 mark.

The loonie climbed to near a 2-week high of 0.9002 versus the

aussie, off an early low of 0.9021. If the loonie strengthens

further, it is likely to test resistance around the 0.89

region.

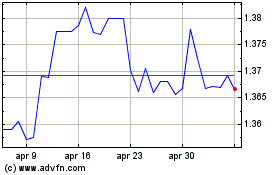

Grafico Cross US Dollar vs CAD (FX:USDCAD)

Da Mar 2024 a Apr 2024

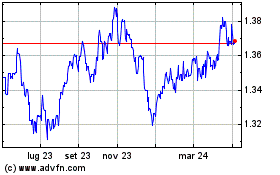

Grafico Cross US Dollar vs CAD (FX:USDCAD)

Da Apr 2023 a Apr 2024