TIDMVLG

RNS Number : 4009X

Venture Life Group PLC

19 December 2019

RNS

19 December 2019

Venture Life Group plc

("Venture Life" or the "Group")

Acquisition and trading update

Earnings enhancing acquisition of PharmaSource BV, an

established Netherlands based development and distribution

business

Trading update

Venture Life Group plc (AIM: VLG), a leader in developing,

manufacturing and commercialising products for the international

self-care market, announces the acquisition of PharmaSource BV, a

Netherlands based development and distribution business, and

provides a trading update for the year ending 31 December 2019.

Acquisition of PharmaSource BV

Venture Life announces that it has agreed to acquire the entire

issued share capital of PharmaSource BV ("PharmaSource"), for an

initial consideration of EUR5.23 million, and deferred contingent

consideration of up to EUR1.27 million. These payments will be

funded entirely from the Company's existing cash resources, and the

acquisition is expected to be immediately earnings accretive. The

acquisition is also subject to conditions and price adjustment for

cash and debt.

PharmaSource owns a number of medical device products in key

therapeutic areas including fungal nail infections, wart removal

and women's health. These products are distributed both through

retail pharmacies in the Netherlands and through key international

distribution partners outside of the Netherlands, including the UK,

Germany, the Nordics, Belgium and France. Strategically, this

acquisition will enable the Company to broaden its product range

and extend its global reach by providing additional retailers and

distribution partners to its existing partner network.

PharmaSource is a growing business and revenues for the year

ending 31 December 2019 are expected to be in excess of EUR2.5

million (2018: EUR1.8 million), with Profit Before Tax in excess of

EUR0.9 million (2018: EUR0.5 million). It is expected to have gross

assets of around GBP0.6 million at completion. PharmaSource owns

various medical device registrations, for products marketed under

several different brand names. Once the post-completion integration

process gets underway, there are expected to be strong synergistic

benefits of the acquisition for the Venture Life Group going

forward, anticipated to enable the acquired business assets to

continue to grow both revenues and profitability under our

stewardship.

Completion of the acquisition is, among other matters,

conditional on the receipt of some regulatory documentation from

the Notified Body in relation to one of the PharmaSource products,

which is expected to be received shortly.

Trading update

The Company also announces that it expects its revenues for the

year ending 31 December 2019 to be at least GBP20 million and

adjusted EBITDA to be at least GBP3.2 million, before non-recurring

operating costs of approximately GBP0.2 million, principally

relating to the restructuring of the Company's finance team. As

mentioned in our half year results, our distribution partners in

China experienced some difficulties, which impacted sales in the

first half of 2019. Whilst the causes of this have been rectified,

it has not been possible to catch up on orders fully from those

partners in H2 2019, with a consequent knock-on effect to our

expected full year performance. However, we expect orders from our

Chinese distribution partners to grow in 2020. The Company already

has an overall order book in hand for the first quarter of 2020

that is more than EUR1 million (and more than 40%) ahead of the

same time last year. These factors, together with completion of the

PharmaSource acquisition on an earnings accretive basis, provide an

excellent platform for the Venture Life Group to continue to grow

into 2020 and beyond.

Jerry Randall, CEO of Venture Life Group, said: "We are

delighted to acquire this high quality, growing and profitable

business, which gives us our first European footprint directly into

the retailer market. Once completed, the acquisition should be

immediately earnings enhancing for Venture Life, is being funded

totally from our existing cash resources and will benefit from the

operational leverage we can bring. The acquisition brings an

excellent range of products and customer relationships to Venture

Life, which we expect to be able to leverage through our existing

products and relationships further. We see this as another

excellent add-on to our existing business, that we can further grow

and develop within our existing structure.

We expect to finish the year with revenues and profits ahead of

2018. Despite some one-off costs in the first half, we have been

pleased with the performance of the wider Group, which has

delivered good growth against a complex macro-economic backdrop.

This performance, when enhanced by completion of this excellent

acquisition opportunity on an earnings accretive basis in our

profit and loss account for 2020, provides us with confidence for

the year ahead, and makes us very well positioned for continued

growth."

THIS ANNOUNCEMENT, INCLUDING THE INFORMATION CONTAINED HEREIN IS

RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN

WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED

STATES OR ANY OTHER JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A

VIOLATION OF THE RELEVANT LAWS OR REGULATIONS OF THAT

JURISDICTION.

The information communicated within this announcement

constitutes inside information under the Market Abuse Regulation

(EU) No. 596/2014.

For further information, please contact:

+44 (0) 1344

Venture Life Group PLC 578004

Jerry Randall, Chief Executive Officer

+44 (0) 20 7397

Cenkos Securities Ltd (Nomad and Broker) 8900

Mark Connelly / Stephen Keys / Cameron MacRitchie

(Corporate Finance)

Russell Kerr / Michael Johnson (Sales)

Alma PR venturelife@almapr.co.uk or + 44 (0)

203 405 0208

Helena Bogle / Hilary Buchanan

/ Jessica Joynson

About Venture Life (www.venture-life.com)

Venture Life is an international consumer self-care company

focused on developing, manufacturing and commercialising products

for the global self-care market. With operations in both the UK and

Italy, the Group's product portfolio includes some key products

such as the UltraDEX and Dentyl oral care product ranges, food

supplements for maintaining brain function, medical devices for

women's intimate healthcare and proctology and dermo-cosmetics for

addressing the signs of ageing.

The products, which are typically recommended by pharmacists or

healthcare practitioners, are available primarily through

pharmacies and grocery multiples. In the UK these are supplied

direct by the company, outside of the UK they are supplied by the

Group's international distribution partners.

Through its Development & Manufacturing business in Italy,

Biokosmes, the Group also provides development and manufacturing

services to companies in the medical devices and cosmetic

sectors.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCGGGBWPUPBGBR

(END) Dow Jones Newswires

December 19, 2019 02:00 ET (07:00 GMT)

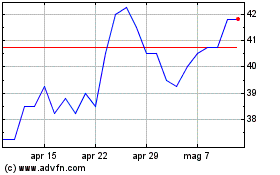

Grafico Azioni Venture Life (LSE:VLG)

Storico

Da Mar 2024 a Apr 2024

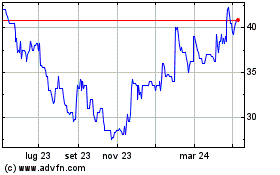

Grafico Azioni Venture Life (LSE:VLG)

Storico

Da Apr 2023 a Apr 2024