Litigation Capital Management Ltd Case Investment Settlement Update (6210X)

20 Dicembre 2019 - 9:04AM

UK Regulatory

TIDMLIT

RNS Number : 6210X

Litigation Capital Management Ltd

20 December 2019

20 December 2019

Litigation Capital Management Limited

("LCM" or the "Company")

Case Investment Settlement Update

Litigation Capital Management Limited (AIM:LIT), a leading

international provider of litigation financing solutions, announces

the resolution of two single-case investments:

The first is the resolution of a claim which was pursued in the

Supreme Court of Queensland in Australia. The claim has been

resolved through negotiation. The resolution will generate revenue

to LCM this financial period of approximately A$6.45m, and

contribution to gross profit of approximately A$2m.

The second is the resolution of a claim which was pursued in the

Supreme Court of New South Wales in Australia. That claim also

resolved through negotiation. The resolution of that investment

will generate revenue of approximately A$4m, and contribution to

gross profit of not less than A$2.5m.

The funds from the above resolutions will be received during the

current financial year.

Patrick Moloney, CEO of LCM said: "We are pleased to update the

market with the resolution of these two single-case investments.

Single-case investments have been a fundamental part of our

stringent business model since LCM's inception and the settlement

of these respective disputes reinforces the ongoing opportunity and

demand for investment in such cases.

"Our robust investment strategy remains a core part of our model

and demonstrates the large and diverse investment opportunities

within the Company."

CONTACTS

Litigation Capital Management c/o Alma PR

Patrick Moloney, Chief Executive

Officer

Canaccord (Nomad and Joint Tel: 020 7523 8000

Broker)

Bobbie Hilliam

Investec Bank plc (Joint Broker) Tel: 020 7597 5970

David Anderson

Alma PR Tel: 020 3405 0205

Rebecca Sanders-Hewett LCM@almapr.co.uk

Justine James

Susie Hudson

Jessica Joynson

NOTES TO EDITORS

About LCM:

Litigation Capital Management ("LCM") is a leading international

provider of litigation financing solutions. This includes

single-case and portfolios across; class actions, commercial

claims, claims arising out of insolvency and international

arbitration. LCM has an unparalleled track record, driven by

effective project selection, active project management and robust

risk management.

Headquartered in Sydney, with offices in London, Singapore,

Brisbane and Melbourne, LCM listed on AIM in December 2018, trading

under the ticker LIT.

LCM Investment Strategies

LCM operates three principal investment strategies:

Single-case strategy - involves investing in single

disputes.

Acquisition strategy - involves the acquisition or taking an

assignment of causes of action. LCM pursues that strategy by

acquiring the dispute and pursues it as principal.

Portfolio funding - involves LCM providing a financing and risk

management solution to large and sophisticated corporate clients,

which will include a number of cases at any given time. Portfolio

funding is a relatively new strategy to the industry and LCM leads

the market in this space.

www.lcmfinance.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCFEESASFUSESE

(END) Dow Jones Newswires

December 20, 2019 03:04 ET (08:04 GMT)

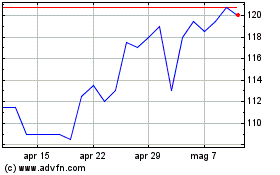

Grafico Azioni Litigation Capital Manag... (LSE:LIT)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Litigation Capital Manag... (LSE:LIT)

Storico

Da Apr 2023 a Apr 2024