Pound Firms As U.K. GDP Rebounds More Than Estimated

20 Dicembre 2019 - 8:10AM

RTTF2

The pound strengthened against its major opponents in the

European session on Friday, as the UK economy recovered at a

slightly faster than previously estimated pace in the third

quarter.

Data from the Office for National Statistics showed that gross

domestic product grew 0.4 percent sequentially, slightly faster

than the 0.3 percent growth estimated initially and in contrast to

the 0.2 percent decline seen in the second quarter.

On a yearly basis, economic growth was revised up to 1.1 percent

from 1 percent in the third quarter.

Separate data showed that U.K. budget deficit narrowed to GBP

5.6 billion in November from GBP 5.4 billion last year. In the

current financial year-to-date period, the budget deficit was GBP

50.9 billion, which was GBP 5.1 billion more than in the same

period last year.

On the Brexit front, U.K. Prime Minister Boris Johnson opened

the debate on the second reading of the withdrawal agreement

bill.

With a clear majority in parliament, Johnson is likely to win

the vote on the revised Brexit bill.

Meanwhile, Andrew Bailey is set to replace Mark Carney as head

of the Bank of England.

Bailey, is currently deputy governor of BoE and the chief

executive of the Financial Conduct Authority.

The currency has been trading higher against its key

counterparts in the previous session.

The pound advanced to 1.3048 against the dollar, from a low of

1.3006 hit at 5:45 pm ET. The pound is seen finding resistance

around the 1.32 level.

The U.K. currency rose to 0.8521 against the euro, after falling

as low as 0.8552 at 6:00 pm ET. The pound is likely to challenge

resistance around the 0.84 level.

Following a decline to 142.17 at 2:30 am ET, the pound climbed

to 142.66 against the yen. If the pound rises further, it may

locate resistance around the 144.00 level.

The pound gained to 1.2795 versus the franc, reversing from a

low of 1.2715 set at 5:15 pm ET. The next possible resistance for

the pound is seen around the 1.33 level.

Looking ahead, Canada retail sales for October and new housing

price index for November, U.S. GDP data for the third quarter,

personal income and spending data for November and University of

Michigan's final consumer sentiment index for December will be

featured in the New York session.

At 10.00 am ET, European Commission is slated to issue Eurozone

flash consumer confidence survey results for December.

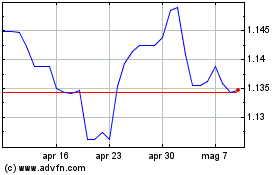

Grafico Cross Sterling vs CHF (FX:GBPCHF)

Da Mar 2024 a Apr 2024

Grafico Cross Sterling vs CHF (FX:GBPCHF)

Da Apr 2023 a Apr 2024