Canadian Dollar Drops On Downbeat Retail Sales Data

20 Dicembre 2019 - 10:28AM

RTTF2

The Canadian dollar depreciated against its major counterparts

in the European session on Friday, as a data showed that the

nation's retail sales fell unexpectedly in October.

Data from Statistics Canada showed that retail sales fell

sharply in October, driven by lower sales at motor vehicle and

parts dealers and at building material and garden equipment and

supplies dealers.

Retail sales declined 1.2 percent in October, following a

decline of 0.1 percent in the previous month. Economists had

expected a 0.5 percent rise.

Core retail sales, excluding motor vehicle and parts dealers,

declined 0.5 percent, in contrast to forecasts for a 0.3 percent

increase.

This follows a 0.1 percent drop in September.

The loonie declined against its most major counterparts in the

previous session on falling oil prices.

The loonie depreciated to a 3-day low of 1.3181 against the

greenback, from a high of 1.3119 seen at 5:00 pm ET. The next

possible support for the loonie is seen around the 1.33 level.

After rising to 0.9030 against the aussie at 5:00 pm ET, the

loonie reversed direction, touching a 1-week low of 0.9085. If the

loonie slides further, it may find support around the 0.92

level.

The loonie declined to a 4-day low of 82.93 against the yen,

after having climbed to 83.36 at 7:00 pm ET. The loonie is seen

locating support around the 80.00 level.

Data from the Ministry of Internal Affairs showed that Japan's

consumer price inflation accelerated in November after the sales

tax hike but remained well below the central bank target.

Core inflation that excludes fresh food rose to 0.5 percent in

November from 0.4 percent in October. The rate came in line with

expectations.

The loonie weakened to 1.4615 against the euro, following a

decline to 1.4568 at 6:15 am ET. On the downside, 1.48 is possibly

found as the next support level for the loonie.

Data from the European Central Bank showed that the euro area

current account surplus increased in October driven by trade

surplus and primary income.

The current account surplus advanced to EUR 32 billion from EUR

28 billion in the previous month.

Looking ahead, U.S. personal income and spending data for

November and University of Michigan's final consumer sentiment

index for December will be featured at 10.00 am ET.

At the same time, European Commission is slated to issue

Eurozone flash consumer confidence survey results for December.

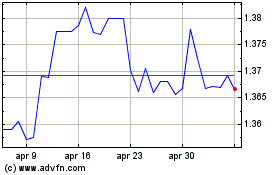

Grafico Cross US Dollar vs CAD (FX:USDCAD)

Da Mar 2024 a Apr 2024

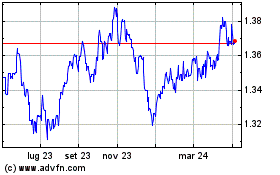

Grafico Cross US Dollar vs CAD (FX:USDCAD)

Da Apr 2023 a Apr 2024