Pound Falls On No-deal Brexit Fears

23 Dicembre 2019 - 9:25AM

RTTF2

The pound declined against its major counterparts in the

European session on Monday, as fears over a hard-Brexit intensified

after U.K. Parliament voted in favor of Boris Johnson's Brexit

Withdrawal Agreement last week.

The bill paves way for the U.K.'s departure from the bloc on

January 31 and remain in the single market and customs union until

December 31, 2020.

Johnson has set December 2020 as a hard deadline for a trade

deal to be reached with the EU, lifting odds of a no-deal exit.

The bill will now move to the House of Lords, where it is

expected to to passed with no hurdles.

European stocks were little changed after nearing a record high

in the previous session amid signs of progress on a phase-one deal

between the United States and China.

U.S. President Donald Trump on Saturday said the United States

and China would "very shortly" sign their so-called Phase One trade

pact.

The currency rose against its major counterparts in the previous

session.

The pound fell to a 3-week low of 0.8566 against the euro from

Friday's closing value of 0.8514. The pound is seen finding support

around the 0.88 level.

Data from Destatis showed that Germany's import prices declined

at a slower pace in November on weak energy prices.

On a yearly basis, import prices decreased by less-than-expected

2.1 percent, following a 3.5 percent fall in October. Prices were

expected to decline 2.3 percent.

The pound declined to 1.2928 against the greenback, its weakest

level since December 2. On the downside, 1.28 is likely seen as the

next support level for the pound.

The U.K. currency depreciated to near a 6-week low of 1.2683

against the franc from last week's closing quote of 1.2769. Next

possible support for the pound is seen around the 1.25 level.

The pound weakened to 141.26 against the yen for the first time

since December 4. The pound is likely to find support around the

137.00 level, if it drops further.

Data from the Ministry of Economy, Trade and Industry showed

that Japan's all industry activity dropped for the first time in

four months in October.

The all industry activity index fell 4.3 percent month-on-month

in October, after a 1.9 percent rise in September. This was the

first decrease since June and in line with economists'

expectations.

Looking ahead, Canada GDP data for October, U.S. durable goods

orders and new home sales for November are due out in the New York

session.

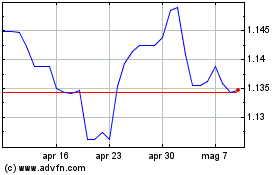

Grafico Cross Sterling vs CHF (FX:GBPCHF)

Da Mar 2024 a Apr 2024

Grafico Cross Sterling vs CHF (FX:GBPCHF)

Da Apr 2023 a Apr 2024