IQE PLC 2019 Agm Ltip Resolution Voting And Proposed Actions

24 Dicembre 2019 - 8:00AM

UK Regulatory

TIDMIQE

IQE plc

("IQE", the "Company" or the "Group")

2019 AGM LTIP RESOLUTION VOTING AND PROPOSED ACTIONS

At the AGM on 25 June 2019, 42.9 percent of shareholders voted against

the resolution to approve the adoption of the 2019 IQE Long Term

Incentive Share Option Plan ("2019 LTIP").

In line with Provision 4 of the UK Corporate Governance Code 2018, this

announcement is intended to outline the Company's understanding of the

reasons behind the 2019 AGM LTIP resolution voting result and to provide

an update on the actions of the Remuneration Committee and Board as a

result of the vote.

The 2019 LTIP replaced the previous Executive Share Option Scheme

approved by shareholders at the AGM in July 2009 and was intended as a

natural update to the prior rules, which had not been the subject of any

representations from shareholders since it was approved by shareholders

in 2009. Accordingly, the Remuneration Committee did not anticipate any

significant dissent and therefore did not seek to engage shareholders in

advance of submitting the plan to an advisory vote at the 2019 AGM.

The Board was aware however that in advance of this year's AGM,

Institutional Shareholder Services ("ISS") issued a report in which it

recommended that shareholders vote against the resolution to approve the

2019 LTIP plan, citing two principal concerns:

1. That the dilution limits sought under the plan exceeded the

standard dilution limit expected by institutional investors of 10% in 10

years for all of the Company's share schemes; and,

2. That the plan permits the vesting of outstanding options to good

leavers without a pro-rata reduction to vesting based on performance and

the portion of the vesting period expired up to the time of the

termination of employment.

Prior to and following the AGM, the Board engaged with shareholders,

emphasising that as a global technology company with the majority of its

operations employing staff in Asia and the USA, share options are

considered an essential tool for the Company to attract and retain the

world-class talent required to sustain and grow our business. The

adoption of the 15% dilution limit in 10 years in 2009 was intended to

ensure that we would have sufficient flexibility to offer competitive

rewards to highly-sought after candidates in critical roles throughout

the entirety of the organisation, as all IQE employees are offered share

options as part of their compensation packages.

The Board would also state that since IQE's award levels are typically

denominated in percentage of salary terms, dilution is also a function

of the prevailing share price. With the current IQE share price notably

higher than over the period 2009-2016, it is considered significantly

less likely that the exceptional dilution limit set out in the 2019 LTIP

scheme will be utilised.

Notwithstanding the above and that the 2019 LTIP resolution was

ultimately approved at the AGM, the Board recognises that the

significant vote against is an indication of the strength of shareholder

sentiment in this area. The Board has therefore resolved to take the

following actions in response:

1. The Remuneration Committee will undertake a review of the Directors'

Remuneration Policy with a view to submitting a new Policy to

shareholders at the 2020 AGM. As part of this review, the Remuneration

Committee has undertaken an exercise to understand when IQE expects to be

able to comply with the standard 10% dilution limit. The result

demonstrated that, due to the number of share options currently

outstanding to all IQE employees, a reduction to the 10% dilution limit

is not currently feasible. However, the Board recognises the importance

of moving to a 10% dilution limit and is committed to doing so over time;

and,

2. The Board is taking steps to amend the LTIP plan rules to align the

leaver provisions for all employees to those set out for the Executive

Directors. This language will make clear that the maximum potential

entitlement for a good leaver will be a pro-rata vesting of outstanding

awards i.e. taking account of the time from grant to the time of

departure as a proportion of the full vesting period.

CONTACTS

IQE plc

+44 (0) 29 2083 9400

Drew Nelson

Tim Pullen

Peel Hunt LLP (Nomad and Joint Broker)

+44 (0) 20 7418 8900

Edward Knight

Nick Prowting

Christopher Golden

Citigroup Global Markets Limited (Joint Broker)

+44 (0) 20 7986 4000

Christopher Wren

Peter Catterall

Headland Consultancy (Financial PR)

+ 44 (0) 20 38054822

Andy Rivett-Carnac: +44 (0) 7968 997 365

Tom James: +44 (0)78 1859 4991

ABOUT IQE

https://www.globenewswire.com/Tracker?data=B-tsx-575oTDVktIEifpujfiyFQyzW3TVfCiiaUmEct1sMeY0KFPjbsdA5_CpeJIA16PD1YPGPxrTgcRNVCtUAUhktKxwqWqA_3YXT24BCZTba_HkQTp5lV_Y2Z1qXhiKwyw9_hbC7mP7pEAI9LJh7zYdj9BAHQZJzyRcRQiamMpF_PMt_h34ihHTdSsRB99TNV3ASMocTORdCpkAMDiBD9nIV21EiVJ1XqMxTB0ATRc3_BodfnTkbqhspkqdV3doIQg-CRtEUmaaQnFp3L29HtP0bC0fdj_tefPOj9CMzjp5RHT8KEPSc1qjelQy1f1TCK0rN9NG1M2ahExzr-ZSx3Ynf_kvYNOknJ2nkGShn7jcmdGh_uh5c1X1XofjfbjlohJ2HVhKVkWoRr_BYhdVjcsbCsx_tKktI9uuSx_1fA=

http://iqep.com

IQE is the leading global supplier of advanced compound semiconductor

wafers that enable a diverse range of applications across:

-- handset devices

-- global telecoms infrastructure

-- connected devices

-- 3D sensing

The macro trends of 5G and connected devices are expected to drive

significant growth for compound semiconductors over the coming years.

As a scaled global epitaxy wafer manufacturer, IQE is uniquely

positioned in this market which has high barriers to entry. IQE supplies

the whole market and is agnostic to the winners and losers at chip and

OEM level. By leveraging the Group's intellectual property portfolio

including know-how and patents, it produces epitaxy wafers of superior

quality, yield and unit economics.

IQE is headquartered in Cardiff UK, and is listed on the AIM stock

Exchange in London.

(END) Dow Jones Newswires

December 24, 2019 02:00 ET (07:00 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

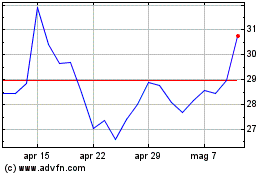

Grafico Azioni Iqe (LSE:IQE)

Storico

Da Mar 2024 a Apr 2024

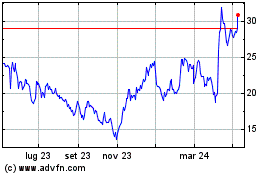

Grafico Azioni Iqe (LSE:IQE)

Storico

Da Apr 2023 a Apr 2024