Adamas Finance Asia Limited Future Metal: Production Commenced and Update (0432Y)

27 Dicembre 2019 - 8:01AM

UK Regulatory

TIDMADAM

RNS Number : 0432Y

Adamas Finance Asia Limited

27 December 2019

27 December 2019

ADAMAS FINANCE ASIA LIMITED

("ADAM" or the "Company")

Future Metal Holdings Limited: Production Commenced and

Update

Adamas Finance Asia Limited (AIM: ADAM), the London quoted

company focused on providing shareholders with attractive

uncorrelated, risk adjusted returns from a diversified portfolio of

pan-Asian investments, is pleased to provide an update on its

investment in Future Metal Holdings Limited ("Future Metal"), which

was previously known as Hong Kong Mining Holdings. The Company has

an 85% shareholding in Future Metal, representing ADAM's largest

investment by value in the portfolio.

The quarry's processing line has now been installed and

commissioned and the initial run of the processing plant has been

successfully conducted. The equipment and transmission system are

working well with approximately 200 Tonnes of dolomite produced

during the initial run. Further ramping up of production commenced

in the third week of December and production is on track to achieve

the daily production target of 800 to 1,000 tonnes over the coming

quarter.

By mid-next year, the management team expects daily production

capacity to reach around 2,000 Tonnes due to increased operational

efficiency to be extracted from the current configuration of

equipment onsite. The actual level of output will be configured

based on contracts for sale of product which management will look

to secure in the 1(st) half of 2020.

Based on the successful initial production run, the Company is

constructing a steel structure to enclose its stockpile site,

installing dust removal equipment and commencing the process of

land hardening to comply with the local environmental requirements.

These initiatives remain on plan for delivery after the initial

production run and ramping up of daily production.

Future Metal entered its first sales contract on 30 November

2019 with a local construction company for an order of 1,000 Tonnes

of wall rock at a price of RMB48/Tonne (USD6.8/Tonne). Meanwhile,

the quarry has also been contacted by other potential buyers with

respect to the availability of its products now that initial

production has commenced.

The local management team intends to obtain a Work Safety Permit

and Discharge Permit, which, according to local regulations, can

only be applied for after production has commenced. These

initiatives are expected to complete in the first half of 2020.

John Croft, Chairman of Adamas Finance Asia Limited,

commented:

"We are pleased to have commenced production at the quarry and

begun initial sales of Future Metal's products before the year end

as planned. Full production is continuing to ramp up well with

strengthening levels of interest from potential buyers of the

quarry's products with prices in line with previous guidance given

by the Company. We look forward to updating shareholders in Q1 2020

as production ramps up and further sales contracts are agreed."

Further details on Future Metal including an updated photo and

video gallery of the site can be found on its website:

www.futuremetalholdings.com

For further information, please visit the Company's website at

http://adamasfinance.com and follow the Company on Twitter

(@AdamasFinance).

FOR FURTHER INFORMATION, PLEASE CONTACT:

Adamas Finance Asia Limited +44 (0) 1825 830587

John Croft

---------------------

WH Ireland Limited - Nominated Adviser +44 (0) 20 7220 1666

---------------------

James Joyce

---------------------

James Sinclair Ford

---------------------

Pello Capital Limited - Corporate

Broker +44 (0) 20 3700 2500

---------------------

Tim Sohal

---------------------

Maitland/AMO - Communications Advisor +44 (0) 20 7379 5151

---------------------

James Benjamin

---------------------

Peter Hamid

---------------------

The information contained within this announcement is deemed by

the Company to constitute inside information under the Market Abuse

Regulation (EU) No. 596/2014

About Adamas Finance Asia

Adamas Finance Asia Limited (ADAM) is quoted on the AIM Market

of the London Stock Exchange and is committed to providing

shareholders with attractive uncorrelated, risk adjusted long-term

returns from a combination of realising sustainable capital growth

and delivering dividend income.

The Company is focused on providing growth capital and financing

to emerging and established Small and Medium Enterprises (SME)

sector throughout Asia, well diversified by national geographies,

instruments and asset classes. This vital segment of the economy is

underserved by the traditional banking industry for regulatory and

structural reasons.

The Company's investment manager, Harmony Capital, seeks to

capitalise on its team's established investment expertise and broad

networks across Asia. Through rigorous diligence and disciplined

risk management, Harmony Capital is dedicated to delivering

attractive income and capital growth for shareholders with

significant downside protection through selectively investing in

assets and proactively managing them.

Harmony Capital is predominately sourcing private opportunities

and continues to create a strong pipeline of attractive income

generating assets from potential investments in growth sectors

across Asia, including healthcare, fintech, hospitality, IT and

property.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

UPDLQLLLKLFFFBL

(END) Dow Jones Newswires

December 27, 2019 02:01 ET (07:01 GMT)

Grafico Azioni Jade Road Investments (LSE:JADE)

Storico

Da Mar 2024 a Apr 2024

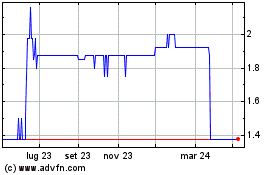

Grafico Azioni Jade Road Investments (LSE:JADE)

Storico

Da Apr 2023 a Apr 2024