Pound Higher As Brexit Worries Ease

30 Dicembre 2019 - 10:03AM

RTTF2

The pound appreciated against its major counterparts in the

European session on Monday, as fears over Brexit reduced following

last week's remarks from European Commission chief Ursula Von der

Leyen signaling extension of the transition period to strike a new

trading deal with the European Union.

The new head of the EU told Les Echos and Der Speigel in

separate interviews that the U.K. should reconsider the 11-month

timeframe available for negotiating a trade deal with the EU after

Brexit.

The EU chief expressed concern about the issues that "need to be

negotiated" and emphasized the necessity to extend the deadline for

talks.

"It seems to me that on both sides we should seriously ask

ourselves if all these negotiations are possible in such a short

time. I think it would be reasonable to take stock mid-year and, if

necessary, to agree on an extension of the transition period", Von

der Leyen said.

The pound was trading in a mixed note in the previous session.

While it fell against the franc and the yen, it rose against the

greenback. Versus the euro, it was steady.

The pound climbed to 143.43 against the yen, from a low of

142.86 seen at 3:45 am ET. The pound is seen finding resistance

around the 145.00 level.

After dropping to 0.8557 against the euro at 3:45 am ET, the

pound edged up to 0.8517. If the pound strengthens further, 0.84 is

likely seen as its next resistance level.

Extending early rally, the pound firmed to near a 2-week high of

1.3136 versus the dollar. At Friday's close, the pair was worth

1.3080. The pound may challenge resistance around the 1.33

mark.

The pound was trading at 1.2744 against the franc, after having

recovered from a low of 1.2727 set earlier in the Asian session.

The pound may test resistance around the 1.29 region, should it

rallies again.

Data from the KOF Swiss Economic Institute showed that

Switzerland's economic outlook is set to brighten at the start of

next year, yet remain subdued.

The KOF Economic Barometer rose to 96.4 from 92.6 in November,

which was revised from 93. Economists had expected a score of

94.5.

Looking ahead, U.S. pending home sales for November are

scheduled for release in the New York session.

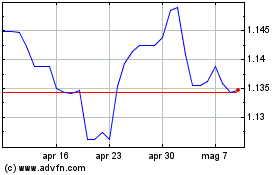

Grafico Cross Sterling vs CHF (FX:GBPCHF)

Da Mar 2024 a Apr 2024

Grafico Cross Sterling vs CHF (FX:GBPCHF)

Da Apr 2023 a Apr 2024