TIDMSPDI

RNS Number : 3939Y

Secure Property Dev & Inv PLC

31 December 2019

31 December 2019

Secure Property Development & Investment PLC

('SPDI' or 'the Company')

Issue of New Ordinary Shares and Total Voting Rights

Secure Property Development & Investment PLC, the AIM-quoted

property company focused on Emerging Europe, announces that certain

executive and non-executive directors, senior management team

members and external advisers have elected to receive new Ordinary

shares in the Company in lieu of certain cash fees accrued.

Accordingly, the Company has issued, in aggregate, 1,920,961 new

Ordinary Shares to these individuals on the following basis:

Issue of new Ordinary Shares pursuant to closing of Stage 1 of

the transaction with Arcona Property Fund

1,219,000 new Ordinary Shares have been issued at a price of

GBP0.24 per new Ordinary Share to certain advisers in lieu of

certain cash fees for services offered to the Company during 2019

for assistance in closing Stage 1 of the transaction with Arcona

Property Fund, as well as to certain executives in lieu of a bonus

for the same reason. Michael Beys (the Chairman of the Company) and

Lambros Anagnostopoulos (a director of the Company and the CEO) are

among the recipients of 165,000 and 553,000 new Ordinary Shares,

respectively.

Issue of new Ordinary Shares to Non-Executive Directors in lieu

of accrued fees

261,100 new Ordinary Shares have been issued at a price of

GBP0.24 per new Ordinary Share to the Company's Non-Executive

directors who were in office in 2019 in lieu of cash fees accrued

in 2019.

The Company has also issued 176,576 new Ordinary Shares at a

price of GBP0.35 per new Ordinary Share to the Non-Executive

Directors at the time in lieu of outstanding liabilities of the

Company from relevant fees accrued during the period up to 2016.

Consequently all accrued past directors fees are now been paid.

Issue of new Ordinary Shares to adviser and senior management

team member for services

200,000 new Ordinary Shares have been issued at a price of

GBP0.24 per new Ordinary Share to SPDI's adviser, Emmanuel Blouin,

in lieu of cash fees for services offered to the Company in 2019,

as well as 64,285 new Ordinary Shares at a price of GBP0.24 per new

Ordinary Share to a member of its senior management team, George

Dopoulos, in lieu of compensation for services rendered in

2018.

Director Shareholdings, Admission to Trading and Total Voting

Rights

Pursuant to the above, a total of 1,920,961 new Ordinary Shares

have been issued, of which 553,000 have been allocated to the

Executive Director and 490,677 have been allocated to the

Non-Executive Directors of the Company currently in office, as set

out in the below table:

Name New Shares Previous Enlarged Enlarged

issued holding of holding of holding percentage

Ordinary Ordinary

Shares Shares

Lambros Anagnostopoulos 553,000 448,092 1,001,092 0.77%

----------- ------------ ------------ --------------------

Ian Domaille 95,013 719,975 814,988 0.63%

----------- ------------ ------------ --------------------

Harin Thaker 82,541 214,651 297,192 0.23%

----------- ------------ ------------ --------------------

Michael Petros

Beys 221,000 258,976 479,976 0.37%

----------- ------------ ------------ --------------------

Antonios Kaffas 92,123 251,709 343,832 0.27%

----------- ------------ ------------ --------------------

Total 1,043,677 1,893,403 2,937,080 2.27%

----------- ------------ ------------ --------------------

The new Ordinary Shares will be credited as fully paid and will

rank pari passu with the existing Ordinary Shares, including the

right to receive all dividends and other distributions declared in

respect of such shares after the date of their issue. Approval for

the issue of the new Ordinary Shares on a non-pre-emptive basis was

obtained at the Annual General Meeting of the Company's

shareholders held on 31 December 2018.

Application has been made for the 1,920,961 new Ordinary Shares

to be admitted to trading on AIM ("Admission") and it is expected

that Admission will become effective on 08 January 2020. Following

Admission, there will be a total of 129,191,442 Ordinary Shares in

issue. This figure may be used by shareholders as the denominator

for the calculations by which they will determine if they are

required to notify their interest in, or a change to their interest

in, the Company under the FCA's Disclosure and Transparency

Rules.

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014.

* * ENDS * *

For further information please visit www.secure-property.eu or

contact:

Lambros Anagnostopoulos SPDI Tel: +357 22 030783

Rory Murphy Strand Hanson Limited Tel: +44 (0) 20 7409

Ritchie Balmer 3494

Jack Botros

Jon Belliss Beaufort Securities Tel: +44 (0) 20 7382

Elliot Hance Limited 8300

Frank Buhagiar / Megan St Brides Partners Tel: +44 (0) 20 7236

Dennison Ltd 1177

Notes to Editors

Secure Property Development and Investment plc is an AIM listed

property development and investment company focused on the South

East European markets. The Company's strategy is focused on

generating healthy investment returns principally derived from: the

operation of income generating commercial properties and capital

appreciation through investment in high yield real estate assets.

The Company is focused primarily on commercial and industrial

property in populous locations with blue chip tenants on long term

rental contracts. The Company's senior management consists of a

team of executives that possess extensive experience in managing

real estate companies both in the private and the publicly listed

sector, in various European countries.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCEANAFDSKNFEF

(END) Dow Jones Newswires

December 31, 2019 05:30 ET (10:30 GMT)

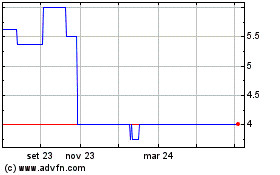

Grafico Azioni Secure Property Developm... (LSE:SPDI)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Secure Property Developm... (LSE:SPDI)

Storico

Da Apr 2023 a Apr 2024