TIDMI3E

RNS Number : 4673Y

i3 Energy PLC

02 January 2020

2 January 2020

i3 Energy plc

("i3" or the "Company")

Corporate and Funding Update

i3 Energy plc, an independent oil and gas company with assets

and operations in the UK, is pleased to announce the following

update.

2020 planning and farm-out process underway

Following i3's 2019 drilling campaign at Serenity and Liberator,

the Company is now preparing for a mid-2020 appraisal programme to

delineate the fields which the Company believes could contain more

than 600 MMbbls P50 STOIIP.

Well and fluid data from the Serenity 13/23c-10 discovery well

encountered sweet, 31.5deg API crude in 11 feet of upper Captain

oil-bearing sands. The measured oil column on structure, observed

through pressure data, was 604 feet true vertical depth (TVD). If

the Serenity and neighbouring Tain oil field are in communication

as i3 expects, then this infers an oil column height of 1124 feet

TVD. On the basis of information recovered from the discovery well,

the Company retains its pre-drill estimate of 197 mmbbls P50 STOIIP

for Serenity. The Company expects the thickness of the upper

Captain sands package to increase, potentially substantially,

moving westward along structure, based upon a measured sand

thickness of 115 ft true vertical thickness (TVT) immediately west

of the Serenity accumulation in the 13/23a-7A well. The 13/23c-10

well has confirmed the strong commercial potential of the Serenity

area, and reservoir model simulations demonstrate potential

recovery factors above 60%.

Though Liberator wells 13/23c-9 and 13/23c-11 did not meet i3's

expectations, the latter confirmed a migration path for

hydrocarbons to move westward towards the "Minos High" where the

upper Captain sands package is estimated to have a thickness of

circa 200 ft TVT above the oil-water contact. Post-drill mapping of

the entire Liberator structure still shows potential in-place

resources above 400 MMbbls.

With the highly successful Serenity discovery and remaining

potential at Liberator, the Company has begun planning a mid-2020,

multi-well appraisal programme and is simultaneously conducting a

farm-down process of its licences to potentially fund the 2020

drilling campaign. The Company will continue working with its

senior lenders on a development facility for its assets. Future

drilling remains subject to funding and i3 will update the market

on these endeavours in due course as material progress is made.

GE UK warrants for services rendered

As part of an agreement announced 2 July 2019, i3 Energy has

issued a further 2,816,739 warrants to subscribe for Ordinary

Shares at an exercise price of 56.85 pence per Ordinary Share to GE

Oil & Gas UK Limited ("GE UK"), in addition to the 2,204,574

issued to GE UK and as announced on 29 October 2019. As previously

referenced in the Company's July announcement, these warrants

relate to deferred payments for Oilfield Service ("OFS") contracts

entered into between i3 and Baker Hughes. To 30 November 2019,

Baker Hughes had performed and invoiced i3 Energy for GBP3,000,000

worth of oilfield services. GE UK can exercise the warrants via

cash settlement or in exchange for payments due to Baker Hughes

under OFS contracts with the Company. Junior Noteholders will be

offered participation in warrants on the same terms as GE UK,

pro-rata to their ownership of i3 Energy on a fully-diluted basis,

and also pro-rata to the proportion of warrants issued to GE UK

under this arrangement. Any warrants subscribed to by Junior

Noteholders, in addition to 255,732 warrants remaining due to GE UK

for OFS rendered by Baker Hughes, will be subject to shareholder

approval at a General Meeting of the Company expected to occur

before mid-February.

In accordance with the provisions of the Disclosure Guidance and

Transparency Rules of the Financial Conduct Authority, the Company

confirms its issued ordinary share capital comprises 107,719,400

Ordinary Shares of GBP0.0001 each. All of the Ordinary Shares have

equal voting rights and none of the Ordinary Shares are held in

Treasury. The above figure may be used by shareholders as the

denominator for the calculations to determine if they are required

to notify their interests in, or change to their interest in, the

Company.

With the above issuance of warrants to GE UK, the Company now

has 9,503,798 warrants exercisable at 40p/share, notional GBP8

million warrants exercisable at 40.7p/share, notional GBP8 million

warrants exercisable at 48.1p/share, notional GBP8 million warrants

exercisable at 55.5p/share, and 5,021,313 warrants exercisable at

56.85p/share which, when fully exercised in aggregate, would

convert into 65,227,561 Ordinary Shares of GBP0.0001 each in the

Company.

Majid Shafiq, CEO of i3 Energy commented:

"The discovery of the Serenity oil field was a transformational

event in i3's history. We are very excited about the further

drilling operations we expect to conduct in 2020 and see this as

the lowest risk path to unlocking substantial shareholder value. We

believe our acreage, together with the data retrieved from our 2019

drilling campaign, will be very attractive to potential farminees

looking to add material barrels and near-term production to their

portfolios."

S

CONTACT DETAILS:

i3 Energy plc

Majid Shafiq (CEO) / Graham Heath c/o Camarco

(CFO) Tel: +44 (0) 203 781 8331

WH Ireland Limited (Nomad and Joint

Broker)

James Joyce, James Sinclair-Ford Tel: +44 (0) 207 220 1666

Canaccord Genuity Limited (Joint Tel: +44 (0) 207 523 8000

Broker)

Henry Fitzgerald- O'Connor, James

Asensio

Camarco

Jennifer Renwick, James Crothers Tel: +44 (0) 203 781 8331

Notes to Editors:

i3 is an oil and gas development company initially focused

on the North Sea. The Company's core asset is the Greater

Liberator Area, located in Blocks 13/23d and 13/23c, to which

i3's independent reserves auditor attributes 11 MMBO of 2P

Reserves, 22 MMBO of 2C Contingent Resources and 47 MMBO of

mid-case Prospective Resources. The Greater Liberator Area

consists of the Liberator oil field discovered by well 13/23d-8

and the Liberator West extension. The Greater Liberator Area,

along with the Company's Serenity Discovery located in the

northern half of Block 13/23c and for which it carries a STOIIP

of 197 MMbbls, are owned and operated on a 100% working interest

basis.

The Company's strategy is to acquire high quality, low risk

producing and development assets, to broaden its portfolio

and grow its reserves and production.

The information contained within this announcement is deemed

by the Company to constitute inside information under the

Market Abuse Regulation (EU) No. 596/2014.

Qualified Person's Statement:

In accordance with the AIM Note for Mining and Oil and Gas

Companies, i3 discloses that Mihai Butuc, i3's New Ventures

Manager, is the qualified person who has reviewed the technical

information contained in this document. He graduated as a

Diplomat Engineer, Geology and Geophysics from the University

of Bucharest in 1985 and is a member of the Society of Petroleum

Engineers. Mihai Butuc consents to the inclusion of the information

in the form and context in which it appears.

Glossary

"BCF" or "bscf" billion (10(9) ) standard cubic feet;

"Boe" barrels of oil equivalent. One barrel

of oil is approximately the energy

equivalent of 6,000 standard cubic

feet of natural gas;

"boepd" Barrels of oil equivalent per day;

"MMBO" or "MMbbls" millions (10(6) ) of barrels of oil;

"MMboe" millions (10(6) ) of barrels of oil

equivalent;

"MMcfd" or "MMscfd" millions (10(6) ) of standard cubic

feet per day;

"MMstb" millions (10(6) ) of stock tank barrels

of oil;

"Net Present Value" or the discounted value of an investment's

"NPV" cash inflows minus the discounted value

of its cash outflows;

"PRMS" The SPE/WPC/AAPG/SPEE Petroleum Resources

Management System for Reserves and

Resources Classification;

"standard cubic feet" standard cubic feet measured at 14.7

or "scf" pounds per square inch and 60 degrees

Fahrenheit;

Stock Tank Oil Initially a method of estimating how much oil

In Place or "STOIIP" in a reservoir can be economically

brought to the surface;

RESOURCES

"Contingent Resources" those quantities of petroleum estimated,

as of a given date, to be potentially

recoverable from known accumulations,

but the applied project(s) are not

yet considered mature enough for commercial

development due to one or more contingencies;

"Prospective Resources" those estimated volumes associated

with undiscovered accumulations. These

represent quantities of petroleum which

are estimated, as of a given date,

to be potentially recoverable from

oil and gas deposits identified on

the basis of indirect evidence but

which have not yet been drilled;

"P10 resource" reflects a volume estimate that, assuming

"High case resource" the accumulation is developed, there

is a 10% probability that the quantities

actually recovered will equal or exceed

the estimate. This is therefore a high

estimate of resource;

"P50 resource" reflects a volume estimate that, assuming

"Mid case resource" the accumulation is developed, there

is a 50% probability that the quantities

actually recovered will equal or exceed

the estimate. This is therefore a median

or best case estimate of resource;

"P90 resource" reflects a volume estimate that, assuming

"Low case resource" the accumulation is developed, there

is a 90% probability that the quantities

actually recovered will equal or exceed

the estimate. This is therefore a low

estimate of resource;

RESERVES

"Proved Reserves" those quantities of petroleum which,

by analysis of geological and engineering

data, can be estimated with reasonable

certainty to be commercially recoverable,

from a given date forward, from known

reservoirs and under current economic

conditions, operating methods and government

regulations. Proved reserves can be

categorised as developed or undeveloped.

If deterministic methods are used,

the term reasonable certainty is intended

to express a high degree of confidence

that the quantities will be recovered.

If probabilistic methods are used,

there should be at least a 90% probability

that the quantities actually recovered

will equal or exceed the estimate;

"Probable Reserves" those unproved reserves which analysis

of geological and engineering data

suggests are more likely than not to

be recoverable. In this context, when

probabilistic methods are used, there

should be at least a 50% probability

that the quantities actually recovered

will equal or exceed the sum of estimated

Proved plus Probable reserves;

"Possible Reserves" those additional reserves which analysis

of geological and engineering data

suggests are less likely to be recoverable

than Probable Reserves. In this context,

when probabilistic methods are used,

there should be at least a 10% probability

that the quantities actually recovered

will equal or exceed the sum of estimated

Proved plus Probable plus Possible

reserves;

"Reserves" those quantities of hydrocarbons which

are anticipated to be commercially

recovered from known accumulations;

"Justified for Development" implementation of the development project

is justified on the basis of reasonable

forecast commercial conditions at the

time of reporting, and there are reasonable

expectations that all necessary approvals/contracts

will be obtained;

"1P" the Proved Reserves;

"2P" the sum of Proved plus Probable Reserves;

"3P" the sum of Proved plus Probable plus

Possible Reserves.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

UPDSSDFUFESSEFF

(END) Dow Jones Newswires

January 02, 2020 02:00 ET (07:00 GMT)

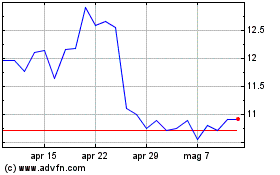

Grafico Azioni I3 Energy (LSE:I3E)

Storico

Da Mar 2024 a Apr 2024

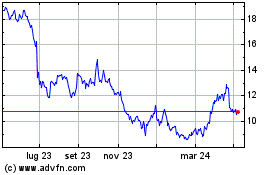

Grafico Azioni I3 Energy (LSE:I3E)

Storico

Da Apr 2023 a Apr 2024